Stuffed Animal and Plush Toys Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432191 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Stuffed Animal and Plush Toys Market Size

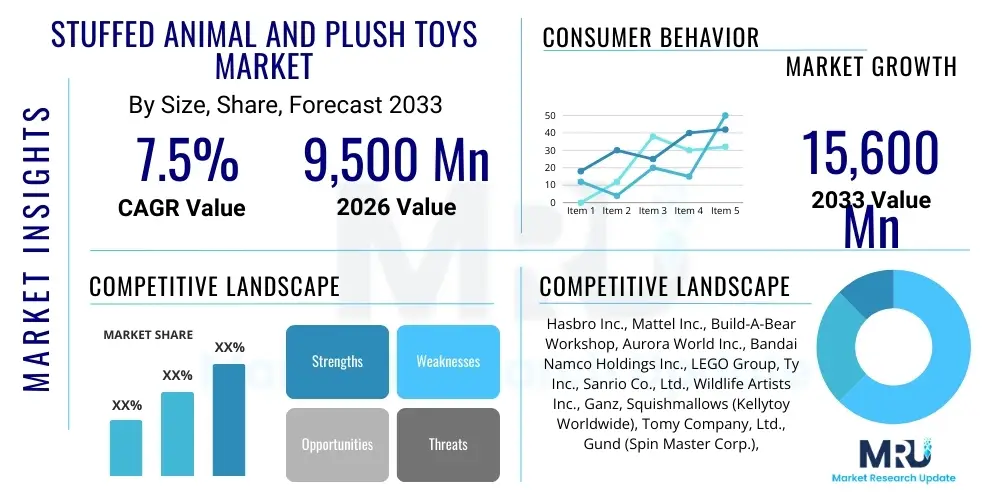

The Stuffed Animal and Plush Toys Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at $9,500 Million in 2026 and is projected to reach $15,600 Million by the end of the forecast period in 2033. This robust expansion is fueled by increasing consumer spending on toys, rising demand for licensed characters, and the growing trend of purchasing plush items as collectible and emotional support objects across all age demographics.

Stuffed Animal and Plush Toys Market introduction

The Stuffed Animal and Plush Toys Market encompasses the manufacturing, distribution, and sale of soft toys, typically made from textile materials and stuffed with flexible materials such as cotton, synthetic fibers, or beans. These products span a wide variety, including traditional teddy bears, licensed cartoon characters, animals, and novelty items designed for comfort, play, and decoration. Historically rooted in traditional craftsmanship, the market has rapidly evolved, incorporating sophisticated designs, sustainable materials, and digital integration to appeal to modern consumers. The primary product description centers on their tactile and emotional appeal, serving as companions for children and nostalgic items for adults, often categorized by size, material, and intellectual property (IP) tie-ins.

Major applications of plush toys include developmental tools for infants and toddlers, gifts for special occasions, collector items for hobbyists, and therapeutic or emotional support aids. The market benefits significantly from its universal appeal and high replacement rate. Key driving factors include strong global birth rates, increasing disposable income in developing regions, effective IP licensing agreements that generate highly demanded character toys (e.g., video game and movie franchises), and the strategic expansion of e-commerce channels which provide wider market access and niche product availability. Furthermore, rising awareness regarding the developmental benefits of tactile play contributes substantially to market momentum.

The market landscape is characterized by intense competition, with manufacturers focusing on innovation in texture, durability, and customization. Product differentiation is achieved through unique fabrics like organic cotton or recycled polyester, incorporation of sensory features (e.g., weighted toys, musical elements), and limited-edition releases targeting the lucrative adult collector segment. This diversification ensures sustained relevance across varying consumer needs, ranging from affordable mass-market items to premium, artisanal plush goods, positioning the sector as resilient against broader economic fluctuations due to its strong emotional value proposition.

Stuffed Animal and Plush Toys Market Executive Summary

The Stuffed Animal and Plush Toys Market is experiencing significant upward momentum driven by strong consumer affinity for nostalgia, the exponential growth of licensed merchandise tied to global entertainment franchises, and increasing adult consumer engagement in collecting niche plush items. Key business trends include a pivot toward sustainable manufacturing practices, with many leading companies adopting recycled materials and transparent sourcing strategies to meet ethical consumer demand. Furthermore, the convergence of physical plush toys with digital platforms, such as augmented reality experiences or blockchain-based authentication for limited editions, represents a crucial innovation path, enhancing perceived value and collector engagement. Strategic mergers and acquisitions are common as large players seek to consolidate IP rights and expand their global distribution networks, focusing particularly on high-growth areas in Asia Pacific.

Regional trends indicate that the Asia Pacific (APAC) region is poised for the fastest growth, largely due to rapidly expanding middle classes, burgeoning birth rates in countries like India and China, and the region’s established cultural appreciation for cute (kawaii) aesthetics, driving high demand for character plushies. North America and Europe, while mature, maintain high per capita spending on licensed and premium plush items, with robust e-commerce infrastructures supporting direct-to-consumer sales and catering to niche collecting communities. Latin America and MEA show potential, propelled by urbanization and improving retail infrastructure, but remain sensitive to macroeconomic volatility and import costs, necessitating localized product strategies.

Segment trends highlight the dominance of the traditional animal plush category, though licensed character plush is the fastest-growing segment due to effective marketing and cross-promotion across media. The material segmentation shows increasing adoption of eco-friendly and organic materials, particularly within the premium and specialty retail sectors, reflecting a broader consumer movement toward ethical consumption. In terms of distribution, online retail channels continue to outperform traditional brick-and-mortar stores, offering extensive product catalogs and facilitating the sale of personalized and custom-made plush items, thus driving overall market accessibility and diversity.

AI Impact Analysis on Stuffed Animal and Plush Toys Market

User queries regarding the impact of Artificial Intelligence on the Stuffed Animal and Plush Toys Market primarily center on three areas: personalized manufacturing, supply chain efficiency, and integrating AI into the product itself. Consumers and industry stakeholders are keen to understand how AI-driven design tools can rapidly prototype new plush designs based on trending aesthetics or customized customer inputs, speeding up time-to-market. Additionally, there is significant interest in how machine learning algorithms can optimize complex global supply chains, forecasting demand accurately to minimize inventory waste—a critical concern given the market's seasonal nature and the volatility of character popularity. Finally, users explore the concept of ‘smart plush,’ expecting AI to enable subtle interactivity, such as personalized responses or learning capabilities, transforming a passive toy into an active companion, thereby enhancing play value and justifying premium pricing. The overarching expectation is that AI will drive efficiency in production and personalization in consumption.

AI's application extends deeply into consumer insights and market segmentation. By analyzing vast datasets derived from social media sentiment, purchase history, and demographic shifts, AI systems can pinpoint emerging trends (e.g., specific aesthetics, color palettes, or niche character preferences) far faster than traditional market research. This foresight allows manufacturers to initiate production cycles for highly relevant products, reducing the risk of obsolescence and maximizing the return on investment for new lines. Furthermore, AI tools are crucial in optimizing digital marketing campaigns, personalizing product recommendations to individual shoppers browsing e-commerce platforms, significantly improving conversion rates and customer lifetime value within the highly competitive online retail space for toys.

In terms of production, AI is already transforming factory floors through advanced robotics and quality control systems. Computer vision systems powered by AI are employed to inspect stitching quality, material integrity, and conformity to safety standards at high speeds, ensuring consistent product quality and compliance across large production batches. This integration reduces manual labor dependency for repetitive tasks, allowing human workers to focus on higher-value activities such as complex assembly or specialized finishing touches. Consequently, the incorporation of AI into both the front-end design process and the back-end manufacturing workflow promises a future market defined by hyper-personalization, operational precision, and significantly higher product safety standards.

- AI-driven trend forecasting minimizes product failure rates by predicting consumer demand for specific plush designs and aesthetics.

- Machine learning optimizes supply chain logistics, reducing lead times and minimizing inventory costs through precise demand forecasting.

- Customization platforms leverage AI to generate unique plush designs based on user input, supporting the growing personalized product market.

- AI-enhanced visual inspection systems improve manufacturing quality control and adherence to stringent international safety standards.

- Integration of AI (e.g., natural language processing, responsive sensors) into 'smart plush' toys enhances interactive play and educational value.

- Predictive analytics supports targeted marketing, ensuring promotional content reaches the most relevant consumer demographics, including adult collectors.

- AI assists in dynamic pricing strategies for limited-edition or high-demand licensed plush products.

DRO & Impact Forces Of Stuffed Animal and Plush Toys Market

The Stuffed Animal and Plush Toys Market is profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively exerting significant impact forces on strategic decision-making and overall growth trajectory. Key drivers include the powerful global influence of licensed entertainment content, where movie and gaming franchises directly translate into high-volume plush sales, alongside the continuous psychological demand for comfort items across all age groups, increasingly including young adults and adolescents seeking emotional support objects. The primary restraints involve fluctuating raw material costs, particularly polyester fiber and specialized fabrics, coupled with persistent safety and regulatory compliance hurdles, especially concerning materials used in infant toys, which necessitate expensive testing and certification processes. Opportunities are vast, driven by the expansion into non-traditional retail spaces like subscription box services, the growth of personalized product offerings facilitated by digital printing and customization technologies, and the untapped potential of therapeutic plush toys used in healthcare and special education settings.

The impact forces currently shaping the market are largely centered on digital transformation and sustainability pressures. The force of digitalization is revolutionizing distribution through e-commerce, offering manufacturers direct access to global consumers and bypassing traditional retail gatekeepers, which intensifies competition but simultaneously lowers market entry barriers for specialized brands. Simultaneously, the rising environmental consciousness among consumers acts as a significant force, compelling industry players to invest heavily in circular economy models—using recycled plastics, sustainable packaging, and transparent ethical sourcing—which, while initially raising production costs, ultimately strengthens brand loyalty and long-term viability. Geopolitical factors, particularly trade tariffs and complex global logistics networks, also exert substantial impact, often dictating production locations and influencing final product pricing in major consumer markets.

In addition to these external factors, internal market forces like product innovation and consumer sentiment management are critical. Manufacturers are constantly under pressure to refresh product lines and differentiate offerings through sensory input (weighted features, varied textures), technological integration (LEDs, sound chips), and creative collaborations with artists or designers. Failure to innovate rapidly can lead to market stagnation, while successful viral trends (often originating on social media platforms like TikTok) can instantly transform niche products into global bestsellers. Therefore, maintaining a responsive, agile manufacturing base capable of scaling production quickly in response to ephemeral trends is a paramount competitive necessity and a major impact force governing market success.

Segmentation Analysis

The Stuffed Animal and Plush Toys Market is comprehensively segmented based on product type, material, distribution channel, and end-user, offering a granular view of consumer behavior and market structure. Product type segmentation typically divides the market into standard animal plush, cartoon/character plush (licensed), dolls, and interactive/novelty plush, reflecting varying consumer needs and price sensitivities. Material classification ranges from traditional cotton and wool to synthetic polyester and specialized, sustainable alternatives like organic cotton and recycled PET fibers, driven by quality perception and environmental preferences. Distribution channels are categorized into online retail, specialty toy stores, department stores, and mass merchandise retailers, crucial for understanding sales velocity and geographical reach. Finally, the end-user segmentation differentiates between infant/toddler, children (3-8 years), pre-teens/adolescents, and the increasingly important adult collector demographic, each requiring distinct marketing and product safety approaches.

Analyzing these segments reveals crucial strategic insights. The character plush segment consistently demonstrates the highest growth potential, directly correlated with the global box office success of animated films and the popularity of video game intellectual properties (IPs). This segment benefits from high brand recognition and often commands premium pricing, justifying significant investment in licensing fees. Conversely, the traditional animal plush segment, while mature, offers resilience and stability, largely driven by gifting occasions and its evergreen appeal, often serving as the entry point for smaller, independent manufacturers focusing on artisanal quality and unique textures. The continuous evolution of interactive plush, which incorporates elements of technology like sensors and app connectivity, blurs the line between traditional toys and electronic gadgets, attracting tech-savvy parents and older children seeking enhanced play value.

Furthermore, segmentation by distribution channel highlights the critical shift toward e-commerce. Online platforms not only provide unlimited shelf space for a highly diversified product catalog, including highly customized and limited-run collector items, but also enable sophisticated data analysis regarding purchasing patterns and geographical demand hotspots. This digitalization allows manufacturers to streamline inventory management and execute highly targeted promotions, significantly improving market efficiency. The increasing preference for sustainable materials, especially within the high-end specialty retail segment, indicates a strong correlation between premium pricing, perceived quality, and ethical sourcing, influencing material innovation strategies across the entire industry supply chain.

- By Product Type:

- Traditional Animal Plush (Teddy Bears, Dogs, Cats)

- Licensed Cartoon and Character Plush (Media IP Tie-ins)

- Dolls and Figurines (Soft Body)

- Interactive and Novelty Plush (Sensory, Musical, Weighted)

- By Material:

- Natural Fibers (Cotton, Wool)

- Synthetic Materials (Polyester, Acrylic)

- Sustainable and Recycled Materials (Organic Cotton, Recycled PET)

- By Distribution Channel:

- Online Retail (E-commerce Platforms, Direct-to-Consumer Websites)

- Specialty and Toy Stores

- Mass Merchandise Retailers (Supermarkets, Hypermarkets)

- Departmental Stores

- By End-User:

- Infants and Toddlers (0-3 Years)

- Children (3-8 Years)

- Adolescents and Pre-teens (9-14 Years)

- Adults (Collectors, Gifting, Emotional Support)

Value Chain Analysis For Stuffed Animal and Plush Toys Market

The value chain of the Stuffed Animal and Plush Toys Market begins with upstream activities focused on raw material sourcing and design innovation. Upstream analysis involves the procurement of key textiles (plush fabrics, fleece, velvet), stuffing materials (polyester fibers, cotton, foam), and ancillary components (eyes, noses, sound chips). Manufacturers increasingly prioritize resilient and diversified sourcing strategies to mitigate risks associated with geopolitical instabilities and volatile commodity prices. Crucially, this stage includes research and development (R&D) and product design, where creativity, material science expertise, and market trend analysis converge to finalize product specifications and structural designs. Securing necessary intellectual property (IP) licenses for character plush is also a fundamental upstream activity that dictates product viability and market appeal.

Midstream activities encompass the core manufacturing processes, which involve cutting, stitching, stuffing, finishing, and rigorous quality control testing to meet stringent child safety standards (e.g., ASTM F963 in the US, EN 71 in Europe). These operations are highly labor-intensive, though automation is increasing in areas like cutting and quality assurance. Once manufactured, the downstream segment focuses on logistics, warehousing, inventory management, and distribution. The distribution channel analysis is critical, differentiating between direct and indirect sales pathways. Direct channels include brand-owned e-commerce sites and flagship stores, offering higher margins and control over the brand experience. Indirect channels involve wholesalers, distributors, and major retailers (both physical and online), which provide necessary scale and market penetration but require managing complex retailer relationships and margin expectations.

The effectiveness of the value chain relies heavily on streamlined coordination between sourcing, production, and market deployment. The shift towards omnichannel retailing means that the distinction between direct and indirect distribution is often blurred, with major retailers acting as crucial partners in both physical and digital sales environments. Successful market players prioritize traceability and ethical compliance throughout the chain, moving beyond mere regulatory compliance to incorporate factors like fair labor practices and environmentally friendly packaging, adding significant intangible value to the final product and securing consumer trust, which is a key differentiator in a high-volume, competitive market.

Stuffed Animal and Plush Toys Market Potential Customers

The Stuffed Animal and Plush Toys Market serves a remarkably broad spectrum of potential customers, extending far beyond the traditional demographic of young children. Primary potential customers are parents and guardians purchasing products for infants and children (0-14 years), driven by developmental needs, celebratory gifting, and emotional comfort provision. This segment focuses heavily on safety certifications, durability, washability, and age-appropriate design. Products targeting this group often feature bright colors, soft textures, and simple, recognizable animal or character shapes, adhering to strict non-toxic material requirements. Marketing strategies for this segment emphasize the developmental benefits and the role of plush toys in imaginative play and emotional regulation.

A rapidly expanding customer base includes adolescents and young adults (15-25 years), who purchase plush items for emotional support (known as comfort culture), decoration (room aesthetics), and connection to popular media culture (e.g., collectible plushies associated with specific anime, gaming, or streaming content). This segment prioritizes brand uniqueness, aesthetic design, and viral popularity, often interacting directly with manufacturers via social media. The items purchased are frequently niche, highly stylized, or collaboration-based, distinguishing them from mass-market children's toys and demonstrating a willingness to pay a premium for limited availability or high artistic value.

The third major group consists of adult collectors and gift-givers. Adult collectors (often 30+ years) seek out high-quality, limited-edition, or vintage plush items, focusing on material quality, craftsmanship, and potential investment value. Gifting customers, including businesses and corporations, utilize plush toys for promotional purposes, corporate gifts, and seasonal occasions (e.g., Valentine's Day, Christmas). For this group, potential customers value premium packaging, customization options, and the ability to associate the plush item with a deeper emotional or brand narrative, ensuring sustained demand for high-end and personalized products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $9,500 Million |

| Market Forecast in 2033 | $15,600 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hasbro Inc., Mattel Inc., Build-A-Bear Workshop, Aurora World Inc., Bandai Namco Holdings Inc., LEGO Group, Ty Inc., Sanrio Co., Ltd., Wildlife Artists Inc., Ganz, Squishmallows (Kellytoy Worldwide), Tomy Company, Ltd., Gund (Spin Master Corp.), Playmates Toys, Simba Dickie Group, Fiesta Toy, Vermont Teddy Bear Co., Posh Paws International, Russ Berrie, MGA Entertainment. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Stuffed Animal and Plush Toys Market Key Technology Landscape

The Stuffed Animal and Plush Toys Market, traditionally low-tech, is increasingly integrating advanced manufacturing and digital technologies to enhance product features, streamline production, and improve consumer engagement. Key technological innovations center on material science, production automation, and connectivity. In manufacturing, computer-aided design (CAD) and 3D modeling are crucial for rapid prototyping and generating precise cutting patterns, minimizing material waste and speeding up the design-to-production cycle. Automated stitching and stuffing machines are being adopted to handle high-volume, standardized production, ensuring consistency and efficiency, although highly detailed or intricate plush items still rely on skilled manual labor for finishing touches. Furthermore, the adoption of specialized non-allergenic and flame-retardant synthetic fibers, alongside sustainable material processing technologies (e.g., recycling plastic bottles into plush stuffing), represents a critical advancement in meeting both safety and ethical market demands.

The most transformative technology is the integration of ‘smart’ features. Interactive plush toys now frequently incorporate Bluetooth connectivity, low-power microcontrollers, and embedded sensors (touch, sound) that allow them to interface with dedicated mobile applications or respond contextually to environmental stimuli. This technology enables features like personalized audio playback, guided meditation routines, educational games, and remote parent monitoring. The challenge remains balancing technological complexity with simplicity of use, durability, and maintaining strict safety standards related to embedded electronics and battery compartments. Successful technological integration focuses on creating a seamless, engaging experience that justifies the higher cost associated with smart plush devices compared to traditional options.

Digitalization also plays a pivotal role in the supply chain and consumer interface. Technologies like Radio Frequency Identification (RFID) tags and blockchain are being explored to improve inventory tracking, combat counterfeiting (especially for high-value collector editions), and provide consumers with verifiable information regarding product authenticity and ethical sourcing origins. E-commerce platforms leverage sophisticated recommendation engines and virtual try-on tools (using augmented reality) to enhance the online shopping experience. These technologies collectively support mass customization, faster fulfillment, and a higher degree of traceability, creating a modern, resilient supply chain capable of handling global demand fluctuations and meeting the stringent demands of the digital-first consumer.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing region, characterized by high manufacturing capacity, expanding middle-class disposable incomes, and a cultural affinity for soft toys, particularly in East Asian nations like Japan, South Korea, and China (driven by 'cute' culture aesthetics). The market here is highly fragmented but dominated by locally licensed characters and rapid consumer adoption of e-commerce, creating robust demand for both mass-market and specialized plush goods.

- North America: North America represents a mature, high-value market dominated by major global brands and characterized by high consumer spending on licensed IP products (e.g., Disney, Marvel, video games). E-commerce penetration is extremely high, and the adult collector segment is substantial, driving demand for premium, limited-edition plush and subscription services. Compliance with strict consumer product safety laws, such as those mandated by the CPSC, is a significant operational focus.

- Europe: The European market demonstrates strong demand across Western economies (Germany, UK, France), balanced between educational/developmental toys and popular licensed merchandise. There is a particularly strong consumer preference for sustainably and ethically produced plush toys, pushing manufacturers toward organic materials and transparent supply chains. Stringent CE marking and EN 71 standards govern all toy imports and sales, necessitating high compliance investment.

- Latin America (LATAM): LATAM is an emerging market with significant potential, fueled by urbanization and demographic growth. Market growth is sensitive to economic stability and exchange rate fluctuations, which affect import costs. Brazil and Mexico are the primary hubs, where local manufacturers compete with global brands, focusing mainly on affordability and accessible distribution through mass retail channels.

- Middle East and Africa (MEA): This region is characterized by varying levels of market maturity. The GCC countries show high demand for high-end, branded plush due to substantial purchasing power, primarily through luxury malls and established retail chains. Sub-Saharan Africa remains highly price-sensitive, with demand concentrated on affordable, durable, and culturally relevant products, often distributed via informal or local marketplaces.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Stuffed Animal and Plush Toys Market.- Hasbro Inc.

- Mattel Inc.

- Build-A-Bear Workshop

- Aurora World Inc.

- Bandai Namco Holdings Inc.

- LEGO Group

- Ty Inc.

- Sanrio Co., Ltd.

- Wildlife Artists Inc.

- Ganz

- Squishmallows (Kellytoy Worldwide)

- Tomy Company, Ltd.

- Gund (Spin Master Corp.)

- Playmates Toys

- Simba Dickie Group

- Fiesta Toy

- Vermont Teddy Bear Co.

- Posh Paws International

- Russ Berrie

- MGA Entertainment

Frequently Asked Questions

Analyze common user questions about the Stuffed Animal and Plush Toys market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current market growth for stuffed animals and plush toys?

The primary drivers include the massive global success of licensed media characters (movies, games), which generates high demand for character plush, coupled with the rising trend of adults purchasing plush items for collecting, comfort, and emotional support, significantly expanding the addressable market beyond traditional children’s demographics.

Which geographical region holds the largest market share in the plush toy industry?

The Asia Pacific (APAC) region currently dominates the market share due to its large population base, increasing disposable income, robust manufacturing infrastructure, and strong consumer cultural preferences for character-based plush goods and aesthetics like 'kawaii'.

How is sustainability impacting the manufacturing of stuffed animals?

Sustainability is a crucial factor, driving manufacturers to shift production towards eco-friendly materials such as recycled polyester (RPET) and organic cotton. This move addresses growing consumer ethical concerns and regulatory pressures, enhancing brand reputation, particularly in high-spending Western markets.

What role does e-commerce play in the distribution of plush toys?

E-commerce is the fastest-growing distribution channel, providing manufacturers with direct access to global consumers, enabling the sale of personalized, niche, and limited-edition collector items, and offering highly efficient inventory management capabilities that traditional retail cannot match.

What are the main segments of the stuffed animal and plush toys market?

The market is segmented primarily by product type (traditional animal, licensed character, interactive), material (synthetic, natural, sustainable), distribution channel (online, specialty retail), and end-user demographics (infants, children, and the growing segment of adult collectors).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager