Stuffed & Plush Toys Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435607 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Stuffed & Plush Toys Market Size

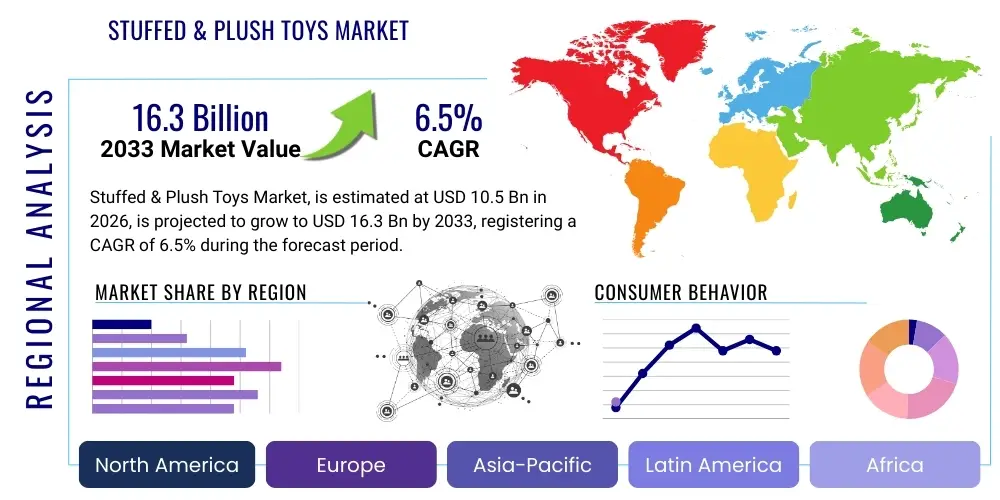

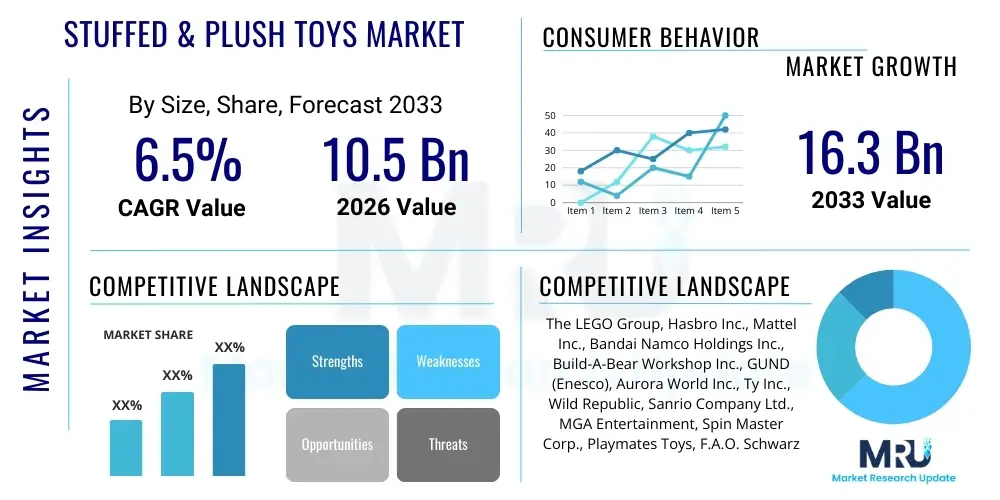

The Stuffed & Plush Toys Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 10.5 Billion in 2026 and is projected to reach USD 16.3 Billion by the end of the forecast period in 2033.

Stuffed & Plush Toys Market introduction

The Stuffed & Plush Toys Market encompasses the global production, distribution, and sale of toys constructed from soft materials such as cotton, plush fabric, or synthetic fibers, designed to resemble animals, characters, objects, or abstract forms. These products are primarily utilized for play, decoration, collecting, and emotional comfort across various age groups, though children remain the core consumer base. The market benefits significantly from high birth rates in developing economies, coupled with increased consumer spending on premium and branded entertainment products, making it a cornerstone of the global toy industry. Innovation in materials, specifically the shift toward sustainable and hypoallergenic fillings and fabrics, is a key focus area for manufacturers seeking to meet evolving consumer safety and environmental standards.

The product spectrum includes traditional teddy bears, licensed characters derived from popular media franchises (movies, video games, streaming series), and interactive plush toys equipped with electronics for sound, movement, or educational functions. Major applications span residential use (gifting, play, comfort), commercial use (promotional items, collectibles), and therapeutic settings (comfort toys). The essential appeal of plush toys lies in their tactile stimulation and capacity to foster emotional attachment and imaginative play, distinguishing them from hard plastic or electronic counterparts. Furthermore, the proliferation of specialized plush items targeting adult collectors, such as limited-edition designer toys and nostalgic characters, broadens the market scope beyond typical children's demographics.

Key benefits driving market expansion include the proven psychological comfort plush toys offer, making them popular gifts for infants, toddlers, and even adults during holidays or commemorative occasions. The market is also heavily influenced by continuous media consumption, where successful entertainment launches directly translate into demand for corresponding licensed plush merchandise. Driving factors include the globalization of major toy brands, effective digital marketing strategies targeting both children and parents, and the rising availability of customized or personalized plush offerings through e-commerce platforms. Additionally, the growing focus on early childhood development and the recognized role of soft toys in sensory exploration continue to solidify the market's fundamental stability and growth trajectory.

- Product Description: Soft toys made from textiles like plush, cotton, or polyester, ranging from traditional animal shapes to complex licensed characters.

- Major Applications: Gifting, personal comfort, play, room decoration, collecting, and therapeutic aids.

- Key Benefits: Emotional security, promotion of imaginative play, tactile development, and collectible value.

- Driving Factors: Strong licensing partnerships, increasing consumer disposable income, effective e-commerce penetration, and robust marketing during holiday seasons.

Stuffed & Plush Toys Market Executive Summary

The Stuffed & Plush Toys Market is characterized by a strong interplay between traditional manufacturing and modern digital licensing models, exhibiting resilient growth driven primarily by emotional gifting patterns and the powerful influence of intellectual property (IP). Business trends indicate a marked shift towards sustainable sourcing, with major manufacturers investing in recycled polyester fibers and organic cotton to appeal to environmentally conscious millennials and Gen Z parents. Furthermore, strategic consolidation among mid-sized players and vertical integration, particularly in managing raw material supply chains and accelerating time-to-market for trendy licensed products, are defining competitive strategies. The successful integration of technology, such as robotics and app-enabled functionalities into plush toys, introduces a premium segment that significantly bolsters average selling prices (ASPs) and overall market valuation.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market segment, fueled by rising disposable incomes in economies such as China and India, coupled with high birth rates and increasing Westernization of consumer habits favoring branded toys. North America and Europe remain mature markets but demonstrate stable growth, primarily through the luxury segment, adult collecting, and robust demand for highly sought-after licensed characters from major studios. Emerging markets in Latin America and the Middle East and Africa (MEA) are also showing promising potential, albeit constrained by fragmented distribution channels and sensitivity to product pricing. The strategic focus in these regions is on localizing product offerings and optimizing cost-effective sourcing to maximize penetration across diverse socioeconomic groups.

Segmentation trends reveal that the Animal Figures segment, particularly traditional teddy bears and popular wild animal plushies, maintains the largest market share due to its timeless appeal and applicability across all age groups. However, the Licensed Character segment is the fastest growing, driven by the rapid turnover of blockbuster media content and the effectiveness of cross-platform promotional campaigns. In terms of material, synthetic plush remains dominant owing to its durability and cost-effectiveness, but the segment focusing on natural and organic materials is experiencing disproportionately high growth rates. The distribution landscape is dominated by mass retailers and specialty toy stores, but the e-commerce channel is rapidly gaining ground, offering superior reach for specialized, limited-edition collector items and personalized plush toys, thereby reshaping traditional purchasing dynamics.

AI Impact Analysis on Stuffed & Plush Toys Market

User queries regarding AI's influence in the plush toys sector primarily revolve around manufacturing efficiency, product innovation (smart toys), and consumer personalization. Key themes include concerns about whether AI-driven manufacturing automation will reduce labor costs and lead to job displacement, expectations for highly interactive plush toys that learn user behaviors, and the ethical implications of collecting children's data through AI-enabled smart plush products. Users also frequently ask how AI can predict licensing trends and consumer demand to minimize inventory risk and streamline product design cycles. This confluence of manufacturing optimization, enhanced interactivity, and predictive analytics forms the core user focus regarding AI implementation in the Stuffed & Plush Toys Market.

The most immediate impact of Artificial Intelligence is seen in the optimization of the supply chain and manufacturing process. AI algorithms can analyze complex sales data, seasonal trends, and social media sentiment to provide hyper-accurate demand forecasts, allowing manufacturers to adjust production volumes of specific characters or product types, drastically reducing overstocking and waste. Furthermore, integrating AI into textile cutting and stuffing machinery enhances precision and speed, particularly beneficial for complex, detailed character designs. This operational efficiency is crucial for responding quickly to viral trends and capitalizing on short-lived media hype.

From a product standpoint, AI facilitates the development of the next generation of smart plush toys. These toys move beyond simple sound recordings to incorporate natural language processing (NLP) and machine learning, allowing them to engage in meaningful conversations, adapt personality traits based on interaction patterns, and provide personalized educational content. For example, an AI-enabled plush toy can recognize a child’s voice, recall previous interactions, and offer tailored bedtime stories or educational games, thereby increasing the perceived value and longevity of the product. This transformation moves plush toys from passive objects to interactive companions, opening up significant premium market opportunities.

- Optimization of production schedules through predictive analytics and demand forecasting.

- Enhanced personalization of plush toys via generative design and customized features.

- Development of smart plush with Natural Language Processing (NLP) for interactive, educational play.

- Automation of quality control and textile cutting processes, reducing material waste and improving precision.

- Improved supply chain logistics by AI-driven routing and inventory management for licensed merchandise.

- Data collection and analysis on children's play patterns (for smart toys) to inform future product innovation.

DRO & Impact Forces Of Stuffed & Plush Toys Market

The dynamics of the Stuffed & Plush Toys Market are governed by a complex set of drivers, restraints, and opportunities that collectively determine its trajectory. The primary driver is the pervasive influence of media licensing, where successful movie, TV, and video game releases instantly generate substantial demand for corresponding plush merchandise, creating rapid sales spikes. Restraints largely center around stringent safety regulations, particularly concerning material toxicity and flammability, which increase manufacturing complexity and cost. Opportunities are plentiful in emerging markets and through the development of eco-friendly, sustainable plush materials that appeal to modern consumer values. These forces, ranging from emotional attachment to regulatory hurdles, dictate the competitive landscape and investment decisions within the sector, requiring agile market responsiveness.

Drivers: Significant market momentum stems from cultural trends, including the rising consumer desire for nostalgic toys and the growing adult collector base that views plush items as decorative or investment pieces. Furthermore, the perceived safety and reliability of soft toys compared to electronic gadgets encourage consistent purchasing by parents and gift-givers. The expansion of e-commerce platforms has facilitated global reach for niche and independent plush creators, broadening consumer choice and boosting overall market visibility. Strategic cross-promotions between toy manufacturers and major retailers during peak seasons, such as Christmas and Easter, consistently solidify demand.

Restraints: The market faces considerable challenges, notably the fluctuating costs of raw materials, particularly synthetic fibers derived from petroleum, which directly impacts profitability. Counterfeit products and unauthorized licensing are pervasive issues, diluting brand value and eroding legitimate sales, especially in developing economies. Additionally, the increasing consumer preference for highly technological and digital toys poses a long-term threat to traditional, non-interactive plush segments. Economic downturns, which lead to decreased discretionary spending on non-essential items like toys, can also significantly dampen sales velocity across all regions.

Opportunities: Future growth is strongly linked to innovation in sustainability, including the utilization of recycled textiles and plant-based polymers for stuffing, which aligns with corporate social responsibility goals and consumer demand. The unexplored potential of therapeutic plush toys, used for anxiety management and special needs education, represents a specialized high-value niche. Geographically, penetration into untapped rural and semi-urban areas in APAC and Latin America, coupled with strategic partnerships with local distributors, offers avenues for sustained volume growth. Lastly, leveraging personalization technologies, such as customized embroidery or bespoke character creation, enhances customer engagement and premium pricing potential.

Segmentation Analysis

The Stuffed & Plush Toys Market is fundamentally segmented based on factors such as product type, material, end-user age group, and distribution channel, reflecting the diversity of consumer needs and purchasing behaviors. Product type segmentation, dividing the market primarily between Animal Figures, Licensed Characters, and Dolls/Other figures, helps manufacturers tailor their production based on current cultural trends and demographic appeal. Material composition is increasingly important, distinguishing between synthetic plush (polyester, acrylic) which dominates the mass market due to cost, and natural materials (cotton, wool) which capture the niche, premium, and sustainable segments. Understanding these segment dynamics is critical for targeted marketing and inventory planning.

Segmentation by end-user, categorized usually into Infants/Toddlers, Pre-school Children, School-aged Children, and Adults/Collectors, reveals significant differences in product specifications, size, and safety requirements. For instance, toys for infants must adhere to strict choking hazard standards, while adult collector items emphasize intricate detailing and high-quality materials, often commanding steep premium prices. Distribution channel analysis further clarifies the routes to market, showing a reliance on both traditional brick-and-mortar retail (mass merchandisers and specialized toy shops) for immediate purchases, and the exponential growth of e-commerce for convenience, specialized purchases, and direct-to-consumer (D2C) brand engagement. This multi-faceted segmentation guides strategic pricing and channel management decisions across the industry.

- By Product Type:

- Animal Figures (e.g., Teddy Bears, Wildlife, Domestic Pets)

- Licensed Characters (e.g., TV, Movie, Video Game characters)

- Dolls and Personalized Plush

- Seasonal and Occasional Plush

- By Material:

- Synthetic Plush (Polyester, Acrylic)

- Natural Plush (Cotton, Wool)

- Organic and Recycled Materials

- By End User:

- Infants (0-2 years)

- Pre-school Children (3-5 years)

- School-aged Children (6-12 years)

- Adults and Collectors (13+ years)

- By Distribution Channel:

- Online Channels (E-commerce, Company Websites)

- Offline Channels (Mass Merchandisers, Specialty Toy Stores, Department Stores)

Value Chain Analysis For Stuffed & Plush Toys Market

The value chain for the Stuffed & Plush Toys Market begins with upstream activities, focusing primarily on the sourcing and preparation of raw materials. This stage involves suppliers of textile materials (plush fabric, fleece, felt), filling materials (synthetic polyester fiberfill, cotton, recycled materials), and supplementary components like plastic eyes, noses, and sound chips. Optimization at this stage involves securing stable supply agreements and implementing robust quality control for material durability and safety standards, particularly ensuring compliance with global certifications like EN 71 (Europe) and ASTM F963 (US). Cost management at the upstream level is critical, as raw material costs represent a significant portion of the final product’s manufacturing expenditure.

Midstream activities encompass design, manufacturing, and assembly. Design involves character conceptualization, often heavily influenced by licensing agreements and market trend analysis. Manufacturing is typically labor-intensive, involving cutting, sewing, stuffing, and finishing. The global manufacturing hub remains concentrated in East Asia, particularly China and Vietnam, due to established infrastructure and lower operational costs, although regional manufacturing is emerging due to geopolitical considerations and supply chain diversification needs. Efficient production hinges on adopting semi-automated processes for high-volume standard items and maintaining skilled labor for intricate, detailed, or collectible plush figures.

Downstream analysis focuses on distribution and sales. The distribution channel is bifurcated into direct and indirect routes. Indirect channels, which include large mass market retailers (e.g., Walmart, Target) and specialty toy chains (e.g., Toys "R" Us equivalents), account for the majority of volume sales. Direct channels, primarily through e-commerce platforms and company-owned online stores, are vital for high-margin, exclusive, or personalized products, offering manufacturers better control over branding and pricing. Effective downstream logistics, especially during peak holiday periods, rely on sophisticated warehousing and expedited shipping capabilities to ensure timely stock replenishment and consumer satisfaction. Licensing holders are also key downstream players, dictating marketing themes and character availability.

Stuffed & Plush Toys Market Potential Customers

The primary end-users and buyers in the Stuffed & Plush Toys Market are highly diverse, spanning various age demographics and psychological needs. The largest and most consistent customer base consists of parents and relatives purchasing gifts for infants and children (ages 0-12). For infants and toddlers, the purchasing decision is driven heavily by safety certification, material softness, and developmental appropriateness, often favoring recognized, heritage brands. For older children, the appeal shifts dramatically toward licensed characters and trend-based items that align with peer influence and current media consumption, making this segment highly sensitive to marketing and intellectual property releases.

A rapidly expanding and high-value customer segment includes teenagers and adults, specifically collectors, nostalgia enthusiasts, and individuals seeking comfort items. Adult collectors are characterized by high purchasing power, interest in limited editions, designer collaborations, and high-fidelity representations of pop culture icons. These buyers are generally less price-sensitive than the mass market and drive the demand for premium, high-quality manufacturing and specialized distribution channels (conventions, dedicated online collector forums). The demand in this segment is less cyclical than children's toys and offers steady, year-round sales for specialized manufacturers.

Beyond personal use, institutional buyers constitute another crucial segment. This includes hospitals and therapeutic centers that utilize plush toys for emotional support, anxiety reduction, and pediatric care. Retail businesses, such as amusement parks, promotional companies, and media organizations, often purchase large quantities of custom-branded or licensed plush toys for merchandising, promotional giveaways, and retail sales within their venues. Understanding the procurement criteria of these institutional and commercial customers—focusing on bulk pricing, customization options, and ethical sourcing—is vital for manufacturers targeting volume sales outside of the traditional consumer market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 10.5 Billion |

| Market Forecast in 2033 | USD 16.3 Billion |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The LEGO Group, Hasbro Inc., Mattel Inc., Bandai Namco Holdings Inc., Build-A-Bear Workshop Inc., GUND (Enesco), Aurora World Inc., Ty Inc., Wild Republic, Sanrio Company Ltd., MGA Entertainment, Spin Master Corp., Playmates Toys, F.A.O. Schwarz, Steiff GmbH, Jellycat Ltd., Melissa & Doug, Funko Inc., Takara Tomy Co. Ltd., VTech Holdings Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Stuffed & Plush Toys Market Key Technology Landscape

The technology landscape in the Stuffed & Plush Toys Market is characterized by dual innovation paths: advancements in material science and the integration of smart electronics. In material technology, manufacturers are heavily invested in developing fire-retardant yet non-toxic synthetic fibers, recycled polyester (rPET) derived from plastic bottles, and organic dyes that ensure product safety and environmental compliance. Ultrasonic welding techniques are replacing traditional stitching in some assembly processes, offering greater durability and precision for mass-produced items. This technological evolution in materials not only addresses sustainability concerns but also enhances the tactile quality and longevity of the plush products, meeting higher consumer expectations.

The second, and perhaps more disruptive, technological trend is the proliferation of embedded electronics and connectivity, leading to the "Smart Plush" category. This involves integrating microprocessors, Bluetooth capabilities, speech recognition modules, and sensors directly into the toys. Technologies like Near Field Communication (NFC) are used to authenticate collectible items or unlock digital content linked to the physical plush toy. The core objective is to create interactive experiences that bridge the physical and digital worlds, often connecting the plush toy to proprietary mobile applications that track usage, offer games, or provide educational narratives, significantly extending the play value beyond traditional interaction.

Furthermore, technology is redefining design and manufacturing preparation. 3D modeling and scanning are routinely used to rapidly prototype new character designs, ensuring anatomical accuracy and efficient pattern cutting, which is crucial for quick turnarounds in licensed merchandise production. In the area of personalization, digital embroidery technology allows for highly detailed, customized embellishments (names, dates, special messages) directly onto the plush surface, driving the success of D2C models like Build-A-Bear Workshop. The continuous refinement of manufacturing automation, particularly robot-assisted stuffing and quality checks utilizing computer vision, ensures high consistency and output volume while mitigating risks associated with manual labor variability.

Regional Highlights

Regional dynamics are critical to understanding the global Stuffed & Plush Toys Market, as consumer preferences, regulatory environments, and purchasing power vary significantly. North America, encompassing the U.S. and Canada, represents a high-value, mature market characterized by extremely strong brand loyalty, high adoption rates of licensed characters, and robust consumer spending on premium and novelty items. The region benefits from established distribution networks and the consistent launch schedule of major Hollywood and gaming intellectual properties, which drive cyclical demand peaks. Sustainability and ethical sourcing are growing decision factors for parents in this region, compelling manufacturers to adhere to stringent transparency standards and utilize certified materials.

Asia Pacific (APAC) stands out as the primary engine of future growth, driven by sheer population size, rapidly increasing urbanization, and the corresponding rise in middle-class disposable income, particularly in emerging markets like China, India, and Southeast Asia. While APAC is the global manufacturing center, its consumption growth rate is accelerating due to cultural practices emphasizing gifting and the growing appeal of both Western and local licensed characters (e.g., from Japanese anime and local media). The challenge in APAC lies in navigating diverse regulatory standards and penetrating fragmented rural distribution landscapes, requiring region-specific marketing and tiered pricing strategies.

Europe represents a stable and highly regulated market, where demand is steady but growth is measured. Countries like Germany, France, and the UK prioritize quality, adherence to strict EU safety directives (e.g., CE marking), and increasingly, environmental certifications. The European consumer shows a strong preference for traditional, heritage brands (like Steiff) and sustainable, wooden/natural toy alternatives, positioning it as a market receptive to high-end, durable plush products. Latin America and MEA, while smaller, offer long-term potential, requiring investments in localized production or streamlined import logistics to overcome tariff barriers and distribution inefficiencies.

- North America: Mature market dominance, high consumer spending, driven by major licensing deals (Disney, Marvel, Nintendo). Focus on premium, interactive, and collectible items.

- Asia Pacific (APAC): Highest growth potential, fueled by demographics, rising disposable incomes, and the strong influence of local and global media franchises (especially anime/manga). Major manufacturing hub.

- Europe: Stable market with stringent safety regulations. Strong preference for sustainable materials, classic heritage brands, and high-quality construction.

- Latin America: Emerging market characterized by price sensitivity and a focus on essential, non-premium plush toys. Opportunities exist through expanded e-commerce reach.

- Middle East & Africa (MEA): Growth dependent on urbanization and luxury spending in the Gulf Cooperation Council (GCC) states. Demand for unique, culturally relevant, and highly exclusive international brands.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Stuffed & Plush Toys Market.- The LEGO Group

- Hasbro Inc.

- Mattel Inc.

- Bandai Namco Holdings Inc.

- Build-A-Bear Workshop Inc.

- GUND (Enesco)

- Aurora World Inc.

- Ty Inc.

- Wild Republic

- Sanrio Company Ltd.

- MGA Entertainment

- Spin Master Corp.

- Playmates Toys

- F.A.O. Schwarz

- Steiff GmbH

- Jellycat Ltd.

- Melissa & Doug

- Funko Inc.

- Takara Tomy Co. Ltd.

- VTech Holdings Ltd.

Frequently Asked Questions

Analyze common user questions about the Stuffed & Plush Toys market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the current growth driver for the Licensed Plush Toys segment?

The primary growth driver is the rapid and multi-platform distribution of intellectual property (IP) via streaming services, cinematic releases, and global video game phenomena. This creates immediate, high-volume demand for associated plush merchandise, amplified by sophisticated social media marketing campaigns and strategic partnerships between media studios and plush manufacturers.

How is sustainability impacting the selection of materials in the plush toys market?

Sustainability is a critical factor, driving a strong industry shift toward using recycled materials, particularly recycled polyester fiberfill (rPET), and certified organic cotton. Consumers, especially millennial parents, increasingly seek eco-friendly and ethically sourced products, leading manufacturers to invest heavily in supply chain transparency and non-toxic, bio-based materials to command premium pricing.

Which geographical region holds the highest growth potential for stuffed toys?

Asia Pacific (APAC), particularly the emerging economies of China and India, holds the highest growth potential. This growth is attributed to massive population bases, rapidly increasing middle-class disposable incomes, strong gifting traditions, and expanded access to international brands through improved distribution channels.

What are the main regulatory challenges faced by plush toy manufacturers?

The main regulatory challenges include adhering to complex, varying international safety standards, such as ASTM F963 (US) and EN 71 (EU), which govern material safety, flammability, small parts (choking hazards), and chemical composition. Compliance requires rigorous testing and documentation, adding significantly to manufacturing overheads and design constraints.

How are smart technologies being integrated into traditional plush toys?

Smart technologies are integrated via embedded microprocessors and sensors, enabling features like natural language processing (NLP) for interactive conversation, sound recording, Bluetooth connectivity, and app synchronization. These features transform traditional plush toys into interactive, educational companions that offer personalized experiences and data feedback, justifying a higher price point.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager