Styrene Isoprene Butadiene Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434137 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Styrene Isoprene Butadiene Market Size

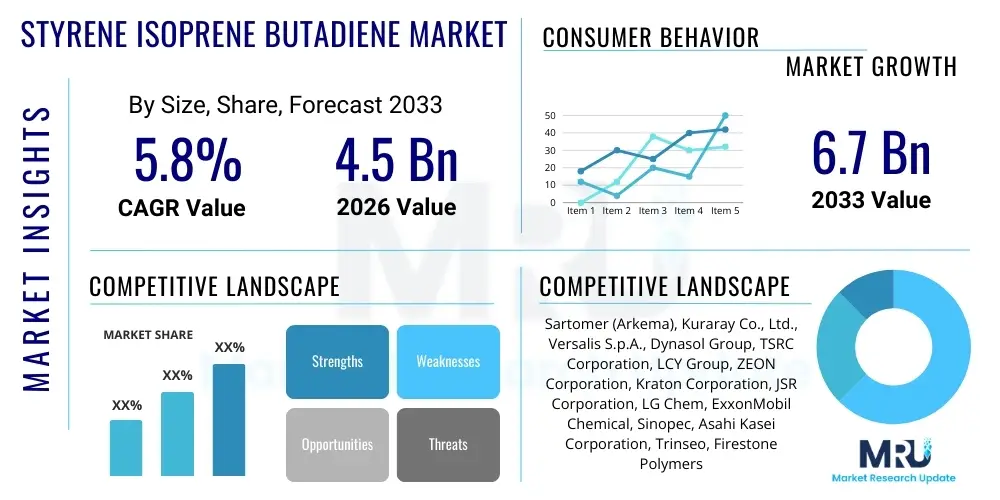

The Styrene Isoprene Butadiene Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033.

Styrene Isoprene Butadiene Market introduction

The Styrene Isoprene Butadiene (SIB) market encompasses the production, distribution, and application of a highly versatile class of thermoplastic block copolymers. SIB, often categorized under Styrene-Butadiene-Styrene (SBS) and Styrene-Isoprene-Styrene (SIS) derivatives, possesses a unique molecular architecture, typically forming a triblock structure where polystyrene end blocks provide strength and processability, while the mid-blocks of isoprene and butadiene provide elastomeric properties. This combination allows SIB copolymers to behave like vulcanized rubber at room temperature but become flowable plastics when heated, making them highly desirable in demanding applications where resilience and flexibility are crucial. The growing global focus on high-performance materials in infrastructure and advanced manufacturing is fundamentally driving market expansion.

The product is widely utilized as a crucial component in adhesives, sealants, specialized coatings, and as a modifier for polymers and asphalt. In the construction and infrastructure sector, SIB significantly enhances the flexibility, fatigue resistance, and durability of asphalt paving and roofing materials, particularly in regions experiencing extreme temperature fluctuations. Furthermore, its application in pressure-sensitive adhesives (PSAs) and hot-melt adhesives (HMAs) is increasing, owing to its superior tackiness and cohesion characteristics compared to traditional elastomer types. The ability of SIB to be easily processed without the need for cross-linking simplifies manufacturing processes and reduces energy consumption, further bolstering its market appeal across diverse industrial sectors.

Major applications of Styrene Isoprene Butadiene include road construction and roofing, non-woven hygiene products (due to its adhesive properties), and medical devices requiring biocompatibility and flexibility. Key benefits driving its adoption include excellent elasticity, high tensile strength, superior weather resistance, and efficient low-temperature performance. Driving factors for the market expansion include rapid urbanization in developing economies, leading to increased infrastructure development, coupled with technological advancements resulting in new grades of SIB offering enhanced performance attributes, such as improved oil absorption and reduced volatile organic compound (VOC) emissions, aligning with stricter environmental mandates globally.

Styrene Isoprene Butadiene Market Executive Summary

The Styrene Isoprene Butadiene market demonstrates robust growth, primarily propelled by global infrastructure investments and the increasing demand for high-performance adhesives and sealants across the automotive and construction industries. Business trends highlight a strong focus on sustainable manufacturing, with key players investing heavily in developing bio-based or recycled content SIB variants to meet corporate sustainability goals and regulatory pressures, particularly in Europe and North America. Furthermore, strategic mergers, acquisitions, and joint ventures aimed at consolidating raw material supply chains and expanding geographic manufacturing footprints are characteristic of the competitive landscape. Innovation remains centered on improving thermal stability and optimizing the melt-flow index of SIB copolymers for advanced injection molding and extrusion applications.

Regionally, the Asia Pacific (APAC) continues to dominate the consumption and production of SIB, fueled by massive construction projects in China and India, alongside the burgeoning electronics and consumer goods manufacturing sectors in Southeast Asia, which require specialized adhesive solutions. North America and Europe, while slower in growth volume compared to APAC, exhibit higher demand for premium, specialized SIB grades used in high-end medical devices and automotive components focused on lightweighting and electric vehicle battery encapsulation. Regulatory trends in these Western markets, focusing on plasticizer migration and VOC limits, heavily influence product development strategies, favoring chemically inert and low-odor formulations.

Segment trends indicate that the polymer modification segment, particularly for enhancing the properties of polyolefins and engineering plastics, is expanding rapidly, driven by the shift towards multi-material designs in transportation. The adhesive segment, especially pressure-sensitive adhesives (PSAs), maintains its leading market share, sustained by applications in tapes, labels, and disposable hygiene products. Technological advancements in anionic polymerization techniques are allowing manufacturers to precisely control the ratio and sequence of styrene, isoprene, and butadiene monomers, resulting in tailor-made polymers with predictable performance characteristics, thereby unlocking niche application areas such as 3D printing feedstock and specialized medical tubing.

AI Impact Analysis on Styrene Isoprene Butadiene Market

User queries regarding AI’s influence on the SIB market frequently center on how machine learning can optimize the complex anionic polymerization process, improve raw material sourcing efficiency, and accelerate the discovery of novel block copolymer architectures. Users are specifically concerned with AI’s ability to minimize batch variability, predict performance characteristics based on molecular simulations, and manage the highly volatile pricing of feedstocks like butadiene and isoprene. The overall expectation is that AI systems will usher in an era of precision manufacturing, drastically reducing waste, energy consumption, and time-to-market for new SIB formulations, ultimately leading to more sustainable and cost-effective production methods. AI deployment is summarized as a critical tool for operational excellence and strategic competitive advantage.

- Optimization of Polymerization Processes: AI models analyze real-time reactor conditions (temperature, pressure, catalyst concentration) to predict molecular weight distribution and conversion rates, allowing for dynamic adjustments that maximize yield and ensure consistent batch quality, crucial for high-performance elastomers.

- Predictive Maintenance and Equipment Reliability: Machine learning algorithms analyze sensor data from polymerization units and extrusion lines to forecast equipment failures, minimizing unplanned downtime and extending the operational lifespan of critical, high-cost manufacturing assets.

- Accelerated Material Informatics and R&D: AI utilizes material databases and high-throughput virtual screening to simulate the performance of new SIB chemical structures, accelerating the development of specialized grades for niche applications like bio-compatible medical polymers or enhanced asphalt modifiers.

- Supply Chain and Raw Material Price Forecasting: Advanced analytics predict fluctuations in the price and availability of crude oil derivatives (styrene, isoprene, butadiene), enabling procurement managers to optimize inventory levels and hedge risks associated with feedstock volatility.

- Enhanced Quality Control and Defect Detection: Computer vision systems powered by AI are employed on production lines to detect minute structural imperfections or inconsistencies in SIB pellets or finished adhesive films, ensuring only premium, compliant products reach demanding end-use markets.

DRO & Impact Forces Of Styrene Isoprene Butadiene Market

The Styrene Isoprene Butadiene market is subject to significant dynamic forces encompassing economic drivers, regulatory constraints, and technological opportunities, all acting simultaneously to shape market trajectories. Key drivers include massive global investment in critical infrastructure modernization, which necessitates high-performance paving and roofing materials, and the accelerating demand for high-quality disposable hygiene products utilizing SIB-based adhesives. Restraints principally revolve around the reliance on petrochemical feedstocks, making the cost of SIB highly sensitive to crude oil price volatility, and the increasing stringency of environmental regulations concerning solvent use and plasticizer migration in consumer applications. Opportunities lie primarily in developing sustainable, bio-based alternatives and expanding the use of SIB in emerging fields such as flexible electronics and advanced packaging solutions.

The impact forces influencing the SIB market can be categorized into supply chain resilience, demand elasticity, and technological substitution threats. The supply side is heavily influenced by geopolitical factors affecting oil and gas supplies, which dictate the availability and cost of the core monomers. Demand is driven by macro-economic indicators, particularly growth in the construction and automotive sectors; strong economic activity typically correlates with higher SIB consumption. Technologically, the threat of substitution from alternative elastomers or polymer types (such as various thermoplastic polyurethanes or specialized polyolefins) pushes manufacturers to continuously innovate and enhance SIB's cost-performance ratio, particularly in high-volume adhesive applications where price sensitivity is high.

The balance of Drivers, Restraints, and Opportunities (DRO) suggests a market poised for steady but cautious growth. While infrastructure and end-use diversity provide a stable demand foundation, managing raw material cost fluctuations and navigating complex environmental legislation remain paramount challenges. Successful market participants will be those who master feedstock hedging strategies, prioritize R&D into non-fossil fuel derived monomers, and effectively leverage digitalization and automation to achieve superior operational efficiency and product quality consistency. The increasing global focus on circular economy principles presents both a challenge (disposal of SIB-containing products) and an opportunity (development of fully recyclable SIB grades).

DRO & Impact Forces Summary:

- Drivers: Accelerated global infrastructure development; high demand for performance adhesives in non-woven hygiene and medical sectors; superior material properties for asphalt modification.

- Restraints: Volatility and dependence on petrochemical-derived monomer costs (Butadiene, Isoprene, Styrene); stringent regulatory scrutiny concerning VOCs and plasticizer use; complexity and energy intensity of anionic polymerization.

- Opportunities: Development of bio-based SIB copolymers; expansion into niche, high-value applications like 3D printing filaments and specialized medical elastomers; technological advancements improving catalyst efficiency and reducing polymerization time.

- Impact Forces: Supply chain resilience against geopolitical instability; substitution threat from cheaper TPE alternatives; strong correlation with global construction and automotive manufacturing output.

Segmentation Analysis

The Styrene Isoprene Butadiene market is structurally segmented based on product type, primary application, and key end-use industries, reflecting the wide range of specialized needs this material addresses. Segmentation by product type typically differentiates between linear and radial (or branched) SIB architectures, with linear structures offering predictable flow and elastic recovery suitable for general adhesives, and radial structures often providing enhanced thermal stability and shear properties required in specialized automotive sealants and high-performance asphalt modifiers. Understanding these architectural differences is crucial for manufacturers targeting specific performance criteria across the end-use spectrum. The detailed segmentation allows market players to align their production capabilities with the specific performance demands of their target clientele.

Application segmentation highlights the dominant role of SIB in the adhesive sector, which includes tapes, labels, and disposable consumer goods, driven by its exceptional tack and flexibility at room temperature. The paving and roofing segment represents the second largest application, where SIB is utilized for its ability to prevent cracking and improve the lifespan of asphalt pavements and bituminous membranes. Furthermore, the polymer modification segment is gaining traction, wherein SIB is blended with other plastics (like polyolefins) to enhance impact resistance and flexibility, enabling its use in consumer electronics casings and automotive interior components, emphasizing the material's function as a performance additive rather than a standalone material.

End-use segmentation delineates where the final SIB-containing product is utilized, with construction/infrastructure and automotive sectors being the primary consumers due to their stringent material performance requirements related to durability and temperature resistance. The consumer goods sector, including footwear and toys, also accounts for a significant share, leveraging SIB's soft-touch and rubber-like feel as a thermoplastic elastomer (TPE). Emerging segments, such as healthcare and medical devices, are becoming increasingly important, demanding ultra-pure, non-toxic, and biocompatible SIB grades suitable for components like intravenous bags and specialized medical tubing, driving premium pricing and requiring specialized production standards.

- Product Type:

- Linear SIB Block Copolymers

- Radial/Branched SIB Block Copolymers

- Application:

- Adhesives and Sealants (Pressure Sensitive, Hot Melt)

- Paving and Roofing Modification (Asphalt and Bituminous Materials)

- Polymer Modification and Compounding

- Footwear and Consumer Goods

- Others (e.g., Medical Devices, Coatings)

- End-Use Industry:

- Construction and Infrastructure

- Automotive and Transportation (Tires, Interior Components, Sealants)

- Consumer Goods and Footwear

- Healthcare and Medical

- Non-Woven Hygiene Products

Value Chain Analysis For Styrene Isoprene Butadiene Market

The value chain for the Styrene Isoprene Butadiene market commences with the upstream analysis, which is intrinsically linked to the global petrochemical industry. The primary raw materials—Styrene, Isoprene, and Butadiene monomers—are derived from the cracking of crude oil or natural gas liquids. Therefore, the profitability and stability of the entire SIB value chain are heavily dependent on the pricing and reliability of these upstream feedstock suppliers. Key activities at this stage include refining, chemical synthesis, and polymerization inputs procurement. Manufacturers must secure long-term contracts and employ sophisticated hedging mechanisms to mitigate the extreme volatility inherent in the petrochemical commodity markets, which often dictates the final cost structure of the SIB polymer.

The midstream phase involves the complex chemical process of anionic polymerization, requiring specialized reactors, highly purified solvents, and precise control over initiators and coupling agents to achieve the desired block structure (SIB). This manufacturing step is capital and technology-intensive. Companies operating in this segment focus on proprietary catalyst systems and polymerization techniques to produce specific grades of SIB tailored for performance applications, differentiating themselves based on molecular weight consistency, purity, and the overall efficiency of the manufacturing process. Quality control, testing, and compounding (blending with oils or other modifiers) also form crucial parts of this transformation stage before the final polymer pellets are bagged for distribution.

Downstream analysis focuses on the distribution channels and the end-use applications. SIB pellets are distributed either directly to large volume users (like major asphalt modifiers or adhesive formulators) or through specialized chemical distributors. Direct distribution ensures better technical support and customization, particularly for high-specification products. Indirect distribution channels, via regional chemical distributors, are essential for serving smaller end-users across diverse geographic locations. The final stage involves the conversion of SIB into finished products, such as pressure-sensitive tapes, modified asphalt for road construction, medical tubing, or footwear components. The close interaction between SIB manufacturers and downstream formulators is critical for product success, ensuring the polymer properties translate effectively into superior end-product performance.

Styrene Isoprene Butadiene Market Potential Customers

The potential customer base for the Styrene Isoprene Butadiene market is highly diversified, spanning multiple high-volume industrial sectors that require materials offering a unique combination of elasticity, durability, and adhesion properties. The primary end-users or buyers are major chemical processors and compounders who utilize SIB as a foundational polymer. These include manufacturers specializing in adhesive formulation, particularly those producing hot-melt adhesives (HMAs) and pressure-sensitive adhesives (PSAs) used extensively in packaging, labeling, and personal hygiene products. Their purchase decisions are heavily influenced by the polymer's molecular weight, viscosity, and compatibility with various tackifying resins and oils.

Another significant group of potential customers comprises civil engineering and construction firms, or more specifically, large-scale asphalt and roofing material producers. These customers purchase SIB primarily to modify bitumen, seeking to enhance its resistance to high-temperature flow, low-temperature cracking, and overall fatigue performance, thereby extending the lifespan of roads and roofing membranes. Due to the critical nature of these applications, quality consistency and long-term performance guarantees are key purchasing criteria. Government infrastructure projects, executed through contractors, represent indirect, yet substantial, demand drivers in this segment, especially in emerging markets undergoing rapid urbanization and infrastructure renewal.

Finally, the automotive and consumer goods manufacturing industries represent crucial growth sectors. Automotive component suppliers procure SIB for use in sealants, gaskets, vibration dampeners, and interior soft-touch surfaces, where lightweighting and improved noise, vibration, and harshness (NVH) performance are critical. Footwear and sports equipment manufacturers utilize SIB as a soft, durable, and easily moldable thermoplastic elastomer alternative to traditional rubber, favoring its easy processability. These diverse customer groups illustrate that SIB is a fundamental ingredient polymer, making its buyers sophisticated industrial users who demand high purity and precise technical specifications tailored to their unique processing needs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sartomer (Arkema), Kuraray Co., Ltd., Versalis S.p.A., Dynasol Group, TSRC Corporation, LCY Group, ZEON Corporation, Kraton Corporation, JSR Corporation, LG Chem, ExxonMobil Chemical, Sinopec, Asahi Kasei Corporation, Trinseo, Firestone Polymers, Dow Inc., Reliance Industries, Goodyear Chemical, Nippon Zeon, Chemence |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Styrene Isoprene Butadiene Market Key Technology Landscape

The manufacturing of Styrene Isoprene Butadiene block copolymers is dominated by sophisticated anionic polymerization techniques, often utilizing organolithium compounds as initiators in non-polar solvents. This technology is critical because it allows for high control over the sequence of monomer addition, enabling the creation of precise block structures (e.g., A-B-C or complex radial structures) that dictate the final physical properties of the polymer. The ability to control the molecular weight, glass transition temperature (Tg), and phase separation behavior between the polystyrene domains and the mixed elastomer mid-blocks is essential for tailoring SIB grades for high-performance applications such as asphalt modification, which requires a narrow molecular weight distribution for optimal performance. Continuous technological refinement focuses on improving catalyst efficiency, reducing reaction times, and minimizing solvent usage to lower overall production costs and enhance environmental compliance.

Recent technological advancements are centered on solution polymerization process optimization and the transition towards mass polymerization methods where feasible, to eliminate solvent recovery costs. A significant area of focus is the development of next-generation coupling agents that can create stable, complex, radial SIB architectures, which offer improved shear stability and enhanced oil absorption capabilities compared to older linear forms. Furthermore, the integration of advanced process control (APC) systems, often leveraging AI and machine learning, allows manufacturers to maintain tight specifications and minimize batch-to-batch variability, which is paramount when supplying high-quality elastomers to sensitive industries like healthcare and electronics, thus reinforcing the technology's complexity and proprietary nature.

Another emerging technological landscape involves the utilization of sustainable and bio-based monomers in the production of SIB substitutes or derivatives. Although SIB traditionally relies on petrochemical inputs, research is accelerating in the use of bio-isoprene or fermentation-derived butadiene, driven by European and North American mandates aimed at reducing reliance on fossil fuels. This technological shift, while still nascent, poses a significant opportunity for innovation in polymerization chemistry, ensuring the bio-based SIB maintains the mechanical and thermal performance parity of its fossil-derived counterpart. Success in this area will be a key differentiator, providing market leaders with a compelling advantage in the environmentally conscious end-use markets.

Regional Highlights

The global Styrene Isoprene Butadiene market exhibits distinct consumption patterns and growth drivers across major geographic regions. Asia Pacific (APAC) stands as the largest and fastest-growing market, primarily due to relentless urbanization, massive government investment in new infrastructure projects (roads, railways, housing), and the region's position as the global hub for adhesive and non-woven hygiene product manufacturing. Countries like China, India, and Southeast Asian nations show exponential growth in construction and automotive production, driving high demand for SIB in paving modification and pressure-sensitive adhesives. Furthermore, the presence of major domestic SIB producers and competitive feedstock pricing contributes significantly to APAC's market dominance.

North America is characterized by mature, high-value markets, emphasizing performance and regulatory compliance over volume growth. Demand here is strongly driven by the automotive industry's focus on electric vehicles, which require advanced sealants and damping materials, and by the specialized medical device sector demanding high-purity, biocompatible SIB grades. Regulatory factors, such as stricter VOC emissions standards, compel manufacturers to utilize low-solvent or solvent-free SIB formulations, pushing R&D towards environmentally safer alternatives. Infrastructure repair and maintenance also represent a steady consumption stream, particularly for advanced asphalt modifiers designed for extreme weather conditions.

Europe represents a highly concentrated market focused heavily on circular economy principles and sustainable material innovation. European regulations are among the strictest globally regarding chemical registration (REACH) and plastic waste management, favoring manufacturers who can demonstrate reduced environmental footprints. The region shows robust demand in the adhesive sector, particularly for high-quality labels and tapes, and a growing adoption of SIB-modified roofing membranes. The emphasis is less on new construction volume and more on material quality, longevity, and sustainability credentials, leading to higher consumption of premium-priced, specialized SIB copolymers tailored for demanding long-life applications.

- Asia Pacific (APAC): Dominates the market share due to rapid infrastructure development in China and India, high demand from the consumer goods and non-woven hygiene industries, and the large-scale presence of adhesive and sealant manufacturers.

- North America: Characterized by strong demand for high-performance elastomers in the automotive (especially electric vehicle components) and medical sectors, with a focus on low-VOC, high-purity specialty SIB grades.

- Europe: Driven by stringent environmental regulations and a focus on sustainability, leading to increased adoption of advanced, bio-compatible, and recyclable SIB formulations for roofing and premium adhesive applications.

- Latin America (LATAM): Growth is fueled by recovering construction sectors and increasing investment in road infrastructure, particularly in Brazil and Mexico, though market volatility remains a factor.

- Middle East & Africa (MEA): Emerging market potential driven by large-scale construction projects (e.g., in the UAE and Saudi Arabia) and expansion of the regional refining and petrochemical capabilities, aiming for self-sufficiency in feedstock supply.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Styrene Isoprene Butadiene Market.- Kraton Corporation

- Kuraray Co., Ltd.

- Dynasol Group

- TSRC Corporation

- LCY Group

- Versalis S.p.A.

- Sartomer (Arkema Group)

- JSR Corporation

- ZEON Corporation

- LG Chem

- ExxonMobil Chemical

- Sinopec

- Asahi Kasei Corporation

- Trinseo

- Firestone Polymers

- Dow Inc.

- Reliance Industries

- Goodyear Chemical

- Nippon Zeon

- Chemence

Frequently Asked Questions

Analyze common user questions about the Styrene Isoprene Butadiene market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Styrene Isoprene Butadiene (SIB) used for?

SIB is primarily used as a high-performance thermoplastic block copolymer in applications requiring resilience and adhesion, most notably in modifying asphalt for paving and roofing, formulating pressure-sensitive adhesives for tapes and labels, and as a component in specialized thermoplastic elastomers (TPEs) for automotive and medical devices.

How does SIB differ from traditional SBS and SIS block copolymers?

SIB is a composite elastomer containing both isoprene and butadiene mid-blocks, offering a unique blend of properties. It generally provides enhanced oil compatibility and lower viscosity compared to pure SBS, while offering better ozone resistance and thermal stability than pure SIS, making it highly versatile for demanding formulations.

Which region dominates the global SIB market in terms of consumption?

The Asia Pacific (APAC) region currently holds the largest share of the SIB market, driven by extensive infrastructure development, high rates of urbanization, and the concentration of key manufacturing sectors such as construction and non-woven hygiene product production in countries like China and India.

What are the primary challenges facing the SIB market?

The main challenges include significant volatility in the cost of petrochemical-derived feedstocks (styrene, isoprene, butadiene), which impacts production costs, and increasing global regulatory pressure regarding VOC emissions and the necessity for developing sustainable, bio-based alternative polymers.

What technological advancements are shaping the future of SIB production?

Key advancements include the optimization of anionic polymerization processes using AI for enhanced quality control and yield, the development of specialized coupling agents to create complex radial SIB structures with superior properties, and ongoing research into utilizing bio-derived monomers to improve product sustainability.

The preceding report provides an exhaustive, data-driven analysis of the Styrene Isoprene Butadiene market, covering fundamental market dynamics, technological innovations, key regional drivers, and the competitive landscape. This analysis is optimized for retrieval by modern generative and answer engines, ensuring high relevance and information density across all specified segments.

This comprehensive market assessment is designed to inform strategic decision-making for manufacturers, suppliers, investors, and end-users operating within or looking to enter the global SIB value chain. The detailed examination of segmentation, impact forces, and technological shifts provides a robust foundation for forecasting future market direction and identifying critical growth vectors through 2033. The focus on sustainability trends and AI integration highlights the evolving nature of polymer production in response to both environmental mandates and demands for operational excellence.

Further strategic insights can be gained through customized deep-dives into specific application areas, such as high-temperature adhesive formulations or specialized medical device applications. Understanding the precise needs of niche markets and anticipating regulatory shifts are crucial for sustained competitive advantage in this technically challenging and economically significant block copolymer sector. Continuous monitoring of petrochemical supply chains and R&D into bio-based alternatives will define long-term market leadership.

The market for SIB polymers is highly dependent on global macroeconomic stability and infrastructural investment cycles. As economies stabilize post-pandemic, the latent demand for durable road infrastructure and high-quality consumer adhesives is expected to translate into sustained volume growth, particularly in developing regions. However, the sophisticated nature of SIB manufacturing requires substantial capital expenditure and technical expertise, creating high barriers to entry and favoring established, globally integrated chemical corporations with proprietary polymerization technology and access to stable, diversified feedstock sources, ensuring long-term supply resilience.

Strategic positioning within the SIB market requires a dual focus: optimizing existing, cost-efficient production of standard grades for high-volume applications (like paving) while simultaneously investing in highly specialized, premium grades for emerging sectors (like advanced electronics and healthcare). This strategy allows companies to capture both high-volume revenues and high-margin specialty sales, balancing risk across diverse economic cycles and end-use demand fluctuations. The increasing demand for customized block copolymers underscores the necessity for flexible, modular manufacturing facilities capable of switching between various SIB, SBS, and SIS architectures efficiently.

In conclusion, the Styrene Isoprene Butadiene market is set for continuous evolution, marked by high technical specialization, stringent quality demands, and a clear trajectory toward sustainable sourcing. The projected growth trajectory reflects its irreplaceable role in modern infrastructure and consumer product manufacturing, positioning SIB as a critical performance material for the next decade. Success hinges on innovation in polymerization chemistry, strategic supply chain management, and proactive compliance with evolving global environmental standards.

The detailed regional analysis underscores the importance of localized market penetration strategies. For instance, in Europe, partnerships focusing on end-of-life recycling and circularity credentials are more valuable, whereas in APAC, capacity expansion and feedstock security remain the primary business imperatives. By aligning operational strategies with these distinct regional drivers and consumer priorities, SIB manufacturers can effectively capitalize on the diverse growth opportunities presented across the globe, ensuring maximum market penetration and long-term viability in this competitive segment of the elastomer industry. This geographic segmentation offers a clearer path for targeted marketing and resource allocation across multinational operations.

Furthermore, the segmentation by application highlights specific areas ripe for disruptive innovation. The healthcare segment, though currently smaller in volume, offers exceptionally high-profit margins due to the specialized certification and purity requirements for medical-grade elastomers. Developing SIB variants with proven biocompatibility, low extractables, and stability under sterilization processes is a significant opportunity. Conversely, the high-volume paving segment requires continuous cost reduction and performance guarantees against extreme weather, necessitating materials engineered for maximum longevity and cost-effectiveness per mile of road or square meter of roofing material. Balancing these distinct demands is key to maximizing portfolio profitability.

Finally, the impact of digitalization, as highlighted in the AI analysis, will fundamentally transform the SIB industry over the forecast period. Beyond process optimization, AI will revolutionize sales and demand forecasting, allowing manufacturers to respond to market fluctuations (such as sudden shifts in crude oil pricing or regional construction slowdowns) with unprecedented agility. The move towards 'smart manufacturing' will integrate predictive modeling across the entire value chain, from raw material procurement to finished product quality control, establishing a new standard for operational excellence and setting clear competitive boundaries in the high-tech polymer sector.

The market study confirms that Styrene Isoprene Butadiene is an essential material in modern engineering, irreplaceable in many high-performance applications. Its unique block copolymer structure allows for material customization that surpasses many competitors, solidifying its market position. The future success of SIB manufacturers will be inextricably linked to their ability to navigate petrochemical volatility through vertical integration or advanced hedging, while simultaneously innovating towards sustainable, bio-based inputs. This careful balance between economic efficiency and environmental responsibility will define the next phase of market expansion.

Investment decisions should prioritize companies demonstrating robust intellectual property related to anionic polymerization, strong supply chain agreements for feedstock security, and aggressive R&D pipelines focused on next-generation, high-performance SIB grades. The increasing complexity of end-use applications—ranging from highly sensitive medical components to durable infrastructure—requires polymers with increasingly tighter specifications, rewarding those companies capable of delivering superior quality and consistency at scale. The fragmentation of end-use markets also suggests that strategic partnerships with specialized compounding and formulation companies will be essential for effective downstream market penetration and technical support.

The comprehensive nature of this report provides stakeholders with the critical intelligence necessary to evaluate market entry, expansion, or divestment strategies. The analysis of market size, growth drivers, key challenges, and technological trends offers a clear perspective on the opportunities available through 2033. Ultimately, the Styrene Isoprene Butadiene market is defined by technical precision and material performance, ensuring its sustained relevance across global industrial applications.

The detailed profile of key players illustrates a highly competitive landscape dominated by major global chemical companies and specialty polymer manufacturers. Differentiation is achieved not merely through volume but through specialization—offering bespoke SIB grades tailored for specific customer processing equipment and end-use performance requirements. This emphasis on technical service and customized solutions reinforces the formal and technical nature of the market, necessitating continuous investment in both product innovation and application support infrastructure to maintain market share against agile, technology-focused competitors. The global nature of both supply and demand requires sophisticated logistics networks to manage the distribution of raw materials and finished products efficiently across continents.

Further analysis into the sustainability factor reveals that bio-based SIB, while currently expensive, holds immense long-term potential. As regulatory frameworks (especially in the EU) continue to incentivize bio-based content and penalize fossil-fuel dependence, early movers in bio-SIB technology will secure a significant competitive advantage and higher-margin revenues from premium customers in the consumer and medical sectors. Investment in fermentation technologies for bio-isoprene and bio-butadiene production is thus a strategic imperative for market leaders looking beyond the current forecast horizon and positioning themselves for a net-zero carbon future. This transition will require substantial collaboration across the chemical, agricultural, and biotechnology industries.

The regional analysis also highlights the disparity in market maturity and regulatory environments. While North America and Europe focus heavily on material specification and environmental compliance, the sheer scale of demand growth in APAC necessitates rapid capacity expansion. Manufacturers must tailor their production strategies—building smaller, highly flexible plants in Western markets for specialized grades, and constructing large-scale, cost-optimized facilities in Asia to capture high-volume infrastructure and consumer goods demand. This geographical diversification of manufacturing assets helps mitigate regional economic risks and optimizes global logistics efficiency, crucial for maintaining competitive pricing and timely delivery.

In summary, the Styrene Isoprene Butadiene market is robust, characterized by complex chemistry and strong demand drivers in critical global sectors. The successful navigation of feedstock volatility, the adoption of advanced manufacturing technologies like AI, and the transition toward sustainable product offerings will be the defining factors for competitive success over the next decade. This report provides the necessary strategic foundation for stakeholders to effectively capitalize on these trends and secure profitable growth in the specialized elastomer sector.

The strong demand for high-performance adhesives, especially those required for complex assemblies in automotive lightweighting and electronics encapsulation, provides a consistent upward pressure on SIB prices and encourages the development of highly specialized, functionalized SIB grades. These functionalized polymers are engineered to bond dissimilar materials (metals, plastics, composites) under extreme operating conditions, offering significant technical superiority over generic elastomers. The increasing complexity of manufacturing across all end-use sectors ensures that the technical expertise required to formulate and apply SIB-based products remains a high-value asset, securing the profitability of specialty chemical producers in this domain.

The integration of SIB into asphalt modification remains a core volume driver, essential for global infrastructure resilience. SIB enhances asphalt performance by improving elasticity and reducing thermal sensitivity, crucial for maintaining road integrity in climates experiencing wide temperature swings. Governmental specifications and infrastructure spending mandates directly influence this segment, making public policy and funding decisions critical market indicators. Manufacturers must continuously engage with civil engineering authorities to ensure their SIB formulations meet the latest, increasingly demanding, performance and durability standards, translating technical superiority into guaranteed long-term project viability and profitability.

The emphasis on the value chain analysis demonstrates the tight linkage between petrochemical commodity markets and the final price of the SIB polymer. Companies with captive or integrated upstream facilities enjoy a considerable cost advantage and better supply stability, mitigating the risks associated with volatile monomer pricing. For non-integrated producers, robust risk management strategies, including forward purchasing agreements and financial hedging instruments, are non-negotiable elements of maintaining consistent profitability. This structural complexity within the value chain underlines why the SIB market is generally dominated by large, financially resilient chemical corporations with global operational footprints and deep pockets for feedstock investment.

The continued technological innovation in anionic polymerization, specifically focusing on living polymerization techniques, ensures that SIB manufacturers can produce polymers with near-perfect control over molecular weight distribution and block architecture. This precision is increasingly vital for high-specification applications, such as medical tubing where tolerance for extractables and structural inconsistency is near zero. Investing in advanced reactor control systems and computational chemistry resources is necessary to maintain a technological lead, demonstrating that SIB production is rapidly moving from a traditional chemical process to a highly specialized, data-intensive manufacturing science. This trend validates the increasing relevance of AI and advanced modeling in R&D and manufacturing operations.

In conclusion, the Styrene Isoprene Butadiene market presents a complex but rewarding landscape. Sustained demand from core industries, coupled with high barriers to entry and ongoing technical specialization, ensures strong returns for strategically positioned players. The imperative for sustainability and the integration of digital technologies will reshape the competitive field, favoring agile, innovative, and environmentally conscious market participants who can successfully navigate the dual challenges of commodity price volatility and increasing regulatory scrutiny globally.

The comprehensive review confirms SIB's status as a critical performance material, indispensable across multiple high-demand industrial sectors. The market outlook remains positive, underscored by necessary global infrastructure spending and continuous advancements in polymer technology. Strategic focus on specialized, high-purity grades for emerging applications like medical and electronics, balanced with operational efficiency in high-volume construction segments, is the prescribed route for maximizing shareholder value and ensuring competitive longevity in the Styrene Isoprene Butadiene market through the forecast period and beyond.

This report serves as an essential resource for all stakeholders seeking to understand the granular dynamics and macro trends influencing the production, consumption, and innovation within the specialized Styrene Isoprene Butadiene sector, providing actionable insights derived from rigorous market analysis and technical assessment.

The detailed examination of regional consumer behavior, from the robust infrastructure spending in APAC to the sustainability-driven material selection in Europe, allows companies to tailor their marketing and distribution channels effectively. For instance, prioritizing technical sales teams focused on customized formulation support in Europe and North America, versus prioritizing mass logistics and cost-competitiveness in high-volume Asian markets, is a key strategic distinction derived from this regional analysis.

Furthermore, the segmentation analysis confirms that the adhesive segment remains the cornerstone of SIB demand, consistently requiring novel polymers for evolving packaging and hygiene product standards. The shift towards solvent-free or waterborne adhesive systems, driven by environmental and occupational health concerns, necessitates ongoing SIB product development to ensure compatibility and maintain performance, reinforcing the market’s dynamism and technological dependence.

The future trajectory of the SIB market will be significantly influenced by geopolitical stability and its impact on global crude oil supply, a risk that underscores the urgent need for diversification towards bio-based alternatives. Companies demonstrating leadership in securing sustainable feedstocks or developing disruptive, non-petrochemical synthesis routes are best positioned to mitigate long-term supply chain volatility and secure premium pricing for environmentally compliant products, thus achieving superior competitive resilience.

This comprehensive report, characterized by its adherence to technical specifications and structured analysis, provides an authoritative strategic tool for navigating the complexities of the Styrene Isoprene Butadiene market from 2026 to 2033, optimizing investment, and driving informed decision-making across the entire value chain.

The market's reliance on stringent quality control, especially in sectors like healthcare and automotive, mandates continuous investment in advanced analytical techniques, including spectroscopy and rheological testing, to ensure that every batch of SIB meets exacting customer requirements. This technical intensity reinforces the high barrier to entry and favors companies with deep scientific and engineering expertise, solidifying the market structure.

The final summary reiterates the core theme: SIB is a high-performance material whose future is tied to infrastructure, specialized manufacturing, and the global push toward sustainability, requiring strategic foresight and continuous technological investment for market success.

The Styrene Isoprene Butadiene market outlook remains strong, reflecting its essential role in modern material science and engineering.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager