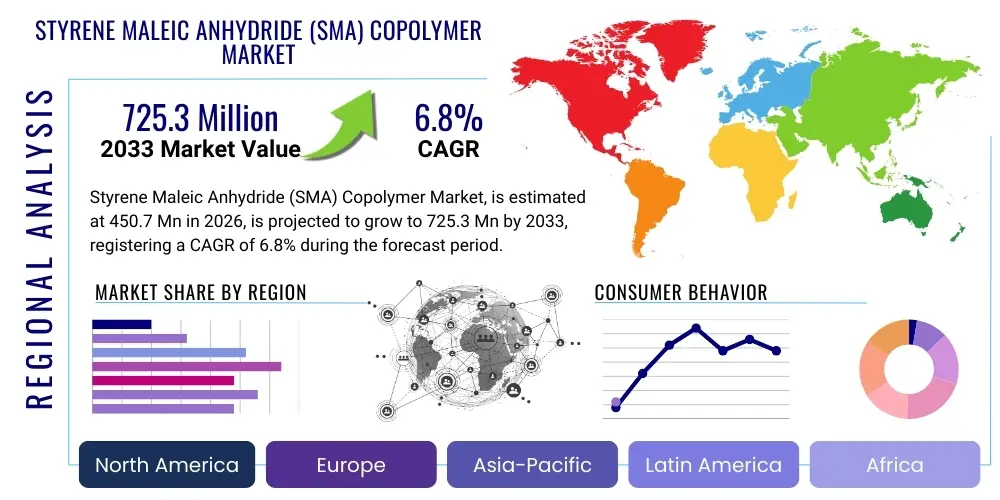

Styrene Maleic Anhydride (SMA) Copolymer Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440129 | Date : Jan, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Styrene Maleic Anhydride (SMA) Copolymer Market Size

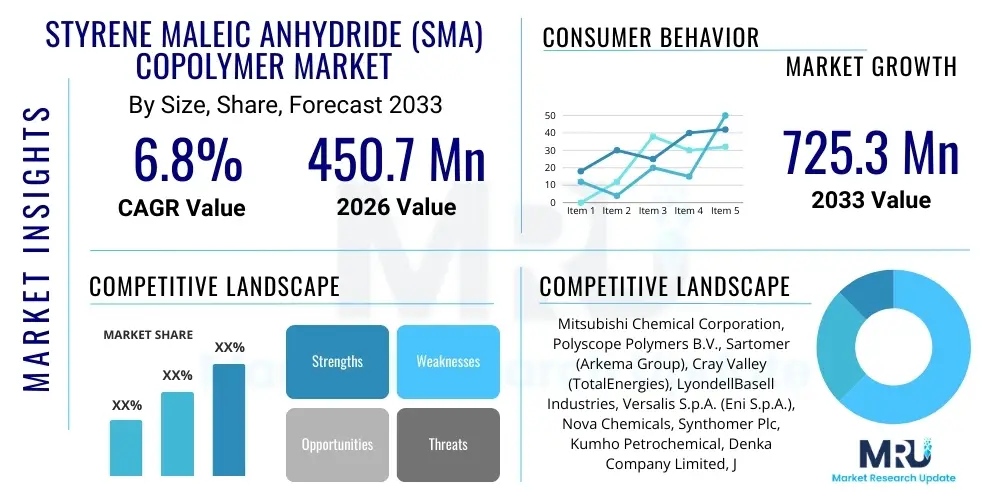

The Styrene Maleic Anhydride (SMA) Copolymer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450.7 Million in 2026 and is projected to reach USD 725.3 Million by the end of the forecast period in 2033.

Styrene Maleic Anhydride (SMA) Copolymer Market introduction

Styrene Maleic Anhydride (SMA) copolymer is a versatile thermoplastic polymer characterized by its unique combination of properties, including high heat resistance, excellent dimensional stability, and strong adhesion. This alternating copolymer of styrene and maleic anhydride typically comes in various grades, offering a broad spectrum of performance characteristics that can be tailored for specific applications. Its inherent polarity, attributed to the maleic anhydride units, enables good compatibility with a range of other polymers and materials, making it a valuable additive in complex formulations. The ability to modify SMA further through reactions with amines or alcohols expands its utility, enhancing its functionality as a compatibilizer, dispersant, or coupling agent in diverse industrial settings.

The product finds extensive utility across numerous major applications due to its superior performance attributes. In the automotive industry, SMA copolymers are crucial for enhancing the heat resistance and impact strength of engineering plastics, contributing to lightweight vehicle components and improved fuel efficiency. Electronics manufacturers leverage SMA for its excellent dielectric properties and thermal stability in circuit boards and encapsulants, ensuring device reliability and longevity. Beyond these, SMA plays a vital role in specialized packaging, construction materials, and a wide array of specialty chemicals where enhanced adhesion, thermal performance, and processability are paramount. Its versatility makes it indispensable for applications requiring high-performance polymers.

Key benefits driving the adoption of SMA copolymers include their ability to improve the mechanical properties and thermal stability of blends, act as effective compatibilizers for immiscible polymer systems, and function as excellent dispersants for pigments and fillers. These characteristics contribute to enhanced product performance, extended material lifespan, and improved manufacturing processes. The market for SMA copolymers is primarily driven by the escalating demand for high-performance engineering plastics, particularly from the rapidly expanding automotive and electronics sectors. Continuous innovation in material science, coupled with the rising need for lightweight and durable materials across various industries, further propels the growth of the SMA copolymer market. The increasing focus on sustainable solutions and the development of bio-based SMA variants also present significant growth opportunities.

Styrene Maleic Anhydride (SMA) Copolymer Market Executive Summary

The Styrene Maleic Anhydride (SMA) Copolymer Market is experiencing dynamic shifts, influenced by several prominent business trends. A notable trend involves the consolidation of market players through mergers and acquisitions, aimed at expanding product portfolios, enhancing technological capabilities, and achieving greater economies of scale. Furthermore, there is a growing emphasis on research and development activities focused on developing sustainable and bio-based SMA variants, responding to increasing environmental regulations and consumer demand for eco-friendly materials. Manufacturers are also investing in advanced polymerization techniques to produce SMA copolymers with tailored properties, allowing for customization to meet specific application requirements across diverse industries. This strategic focus on innovation and sustainability is reshaping competitive landscapes and opening new avenues for market expansion.

Regional trends indicate a robust and accelerated growth trajectory in the Asia Pacific (APAC) region, primarily fueled by rapid industrialization, burgeoning manufacturing sectors, and increasing investments in automotive and electronics industries, particularly in countries like China, India, and South Korea. Conversely, North America and Europe represent mature markets, characterized by a focus on high-performance and specialty SMA applications, alongside stringent regulatory frameworks promoting the adoption of advanced and environmentally compliant materials. These regions are also witnessing a strong push towards circular economy principles, driving demand for recycled content and bio-based polymers, which is influencing production strategies and product offerings. The Middle East and Africa, along with Latin America, are emerging as promising markets, driven by infrastructure development and diversified industrial growth.

In terms of segment trends, the automotive industry continues to be a dominant end-use sector for SMA copolymers, particularly with the increasing production of electric vehicles and the persistent drive for vehicle lightweighting to improve fuel efficiency and performance. The electronics sector is another significant segment, with SMA contributing to the development of advanced circuit boards, semiconductors, and protective coatings, responding to the ongoing miniaturization and performance enhancement of electronic devices. Emerging applications in 3D printing and additive manufacturing are also gaining traction, where SMA's thermal stability and mechanical strength are leveraged for high-performance prototypes and functional parts. The packaging and construction sectors also demonstrate steady demand, albeit with a focus on specific grades designed for enhanced barrier properties and durability, indicating a diversified growth across the application spectrum.

AI Impact Analysis on Styrene Maleic Anhydride (SMA) Copolymer Market

The integration of Artificial Intelligence (AI) and machine learning technologies is poised to significantly transform various facets of the Styrene Maleic Anhydride (SMA) Copolymer market, addressing common user questions related to efficiency, innovation, and market responsiveness. Users frequently inquire about how AI can optimize the complex polymerization processes involved in SMA production, reduce waste, and improve product consistency. There's also considerable interest in AI's role in accelerating the discovery and development of novel SMA formulations, particularly those with enhanced properties or improved sustainability profiles. Furthermore, stakeholders often seek to understand how AI can better predict market demand fluctuations, manage supply chain complexities, and enable more precise customer targeting, thereby reducing operational costs and enhancing competitive advantages in a rapidly evolving global market.

The impact of AI extends across the entire value chain of the SMA copolymer industry, from raw material procurement to end-use applications. Predictive analytics, powered by AI, can offer unparalleled insights into raw material price volatility and supply chain disruptions, allowing manufacturers to make more informed purchasing decisions and mitigate risks. In research and development, AI algorithms can sift through vast datasets of chemical compounds and experimental results to identify promising new SMA derivatives or blend formulations, significantly shortening the innovation cycle. Moreover, quality control processes can be revolutionized by AI-driven visual inspection systems and sensor data analysis, ensuring higher product quality and reducing the incidence of defects, which is crucial for high-performance applications in automotive and electronics industries.

- AI-driven process optimization enhances manufacturing efficiency, reducing energy consumption and waste in SMA production facilities.

- Predictive maintenance using AI minimizes downtime of critical equipment, ensuring continuous and reliable copolymer manufacturing.

- AI accelerates material discovery and design, facilitating the development of novel SMA formulations with customized properties for specific applications.

- Advanced analytics for supply chain management improves logistics, inventory control, and raw material sourcing, mitigating market volatility.

- AI-powered market forecasting provides deeper insights into demand trends, enabling more strategic production planning and resource allocation.

- Automated quality control systems using machine vision and data analysis ensure consistent product quality and adherence to specifications.

- Personalized product development through AI helps tailor SMA solutions to unique customer requirements, enhancing market responsiveness.

- Real-time performance monitoring of SMA in end-use applications allows for continuous product improvement and innovation cycles.

- AI assists in identifying sustainable raw material sources and optimizing recycling processes for SMA-containing materials, promoting circularity.

- Enhanced competitive intelligence through AI-driven analysis of market dynamics, competitor strategies, and emerging technological trends.

DRO & Impact Forces Of Styrene Maleic Anhydride (SMA) Copolymer Market

The Styrene Maleic Anhydride (SMA) Copolymer market is significantly influenced by a complex interplay of drivers, restraints, opportunities, and broader impact forces. Key drivers propelling market growth include the escalating demand for lightweight materials in the automotive industry, where SMA contributes to fuel efficiency and reduced emissions through its application in high-performance composites and interior components. Additionally, the continuous growth and innovation within the electronics sector, particularly in miniaturization and the development of advanced circuits, necessitate SMA's unique thermal and electrical properties. The increasing adoption of SMA as a compatibilizer and impact modifier in various polymer blends to enhance performance and processability across diverse industries also serves as a crucial growth driver, expanding its application footprint in demanding environments. This robust demand from core manufacturing sectors underpins the market's positive trajectory.

Despite the strong growth drivers, the SMA copolymer market faces several notable restraints. The volatility of raw material prices, particularly for styrene monomer and maleic anhydride, presents a significant challenge, directly impacting production costs and profit margins for manufacturers. Geopolitical tensions and disruptions in global supply chains further exacerbate this issue, leading to unpredictable pricing and availability. Environmental concerns regarding plastic waste and the carbon footprint associated with petrochemical-derived polymers also pose a restraint, pushing industries towards more sustainable alternatives and increasing regulatory scrutiny. Furthermore, the availability of substitute materials, such as other impact modifiers or compatibilizers, introduces competitive pressures, potentially limiting SMA's market penetration in certain applications where cost-effectiveness or specific performance traits are prioritized.

Opportunities within the SMA market are abundant, particularly in the realm of sustainable innovation and new application development. The increasing focus on bio-based and biodegradable polymers presents a significant opportunity for the development of green SMA variants, aligning with global sustainability goals and expanding market appeal. Exploration into novel applications in emerging sectors such as additive manufacturing (3D printing), renewable energy systems (e.g., wind turbine blades), and medical devices could unlock substantial new revenue streams. Moreover, advancements in functionalization techniques and polymer blending technologies allow for the creation of highly customized SMA solutions, catering to niche market demands for enhanced performance characteristics. Strategic collaborations and partnerships aimed at joint research and development initiatives are also seen as vital avenues for accelerating innovation and market expansion, fostering a more resilient and forward-looking industry landscape.

Segmentation Analysis

The Styrene Maleic Anhydride (SMA) Copolymer market is comprehensively segmented to provide granular insights into its diverse applications, product types, and end-use industries. This detailed segmentation allows for a precise understanding of market dynamics, identifying key growth areas and competitive landscapes across various categories. The market is primarily categorized based on the physical form of the copolymer, its functional application within polymer systems, and the specific industries that utilize SMA in their products. Each segment exhibits unique growth patterns influenced by technological advancements, regulatory environments, and evolving consumer preferences, contributing to the overall market complexity and strategic planning for stakeholders.

Understanding these segmentations is critical for market participants to tailor their product offerings, marketing strategies, and R&D investments effectively. For instance, the demand for SMA in granule form might be driven by large-scale compounding operations, while powdered SMA could be favored in specialty coating or adhesive formulations requiring finer dispersion. Similarly, the growth of SMA as an impact modifier is intrinsically linked to the performance requirements of engineering plastics, whereas its use as a dispersant aligns with advancements in pigment and filler technology. Furthermore, the varying growth rates and adoption patterns across distinct end-use industries, such as automotive versus packaging, necessitate differentiated approaches, highlighting the strategic importance of this detailed market breakdown for accurate forecasting and competitive positioning.

- By Type

- Granules: Preferred for large-scale compounding, offering ease of handling and processing in extrusion and injection molding applications.

- Powder: Utilized in specialty applications like coatings, adhesives, and textile finishes where fine dispersion and specific surface area are critical.

- Solution: Employed in specific coating formulations and as an intermediate in chemical synthesis, allowing for easier integration and processing.

- By Application

- Compatibilizers: Used to improve the compatibility and adhesion between immiscible polymers in blends, enhancing mechanical properties and reducing phase separation.

- Impact Modifiers: Incorporated into brittle polymers (e.g., PVC, ABS) to increase their resistance to impact and enhance overall toughness and durability.

- Dispersants: Facilitate the uniform distribution of pigments, fillers, and other additives in polymer matrices, improving color consistency and material performance.

- Processing Aids: Improve the flow and processability of polymers during manufacturing, reducing energy consumption and enhancing production efficiency.

- Cross-linking Agents: Enable the formation of cross-linked structures, enhancing thermal stability, chemical resistance, and mechanical strength.

- Adhesion Promoters: Enhance the bonding strength between different materials, crucial in multi-layer structures and composite applications.

- By End-Use Industry

- Automotive: Employed in lightweight components, interior trims, under-the-hood applications, and advanced composites for improved performance and fuel efficiency.

- Electronics: Used in circuit boards, encapsulants, connectors, and casings for enhanced thermal stability, dielectric properties, and dimensional accuracy.

- Packaging: Applied in multi-layer films, food packaging, and industrial containers for improved barrier properties, adhesion, and printability.

- Construction: Integrated into building materials, coatings, and adhesives for enhanced durability, weather resistance, and bonding strength.

- Specialty Coatings & Adhesives: Utilized in high-performance coatings, pressure-sensitive adhesives, and sealants requiring superior adhesion and thermal resistance.

- Marine: Used in boat hulls, decks, and structural components for improved strength, stiffness, and resistance to harsh environmental conditions.

- Textiles: Applied in fabric coatings and binders for enhanced performance characteristics like water resistance, durability, and texture.

- Others (e.g., Medical Devices, Consumer Goods): Niche applications requiring specific material properties such as biocompatibility, chemical resistance, or aesthetic appeal.

Value Chain Analysis For Styrene Maleic Anhydride (SMA) Copolymer Market

The value chain for the Styrene Maleic Anhydride (SMA) Copolymer market is a multi-tiered structure, commencing with upstream raw material suppliers and extending through production, compounding, distribution, and ultimately to end-use industries. The upstream segment is dominated by petrochemical companies that supply critical precursors, primarily styrene monomer and maleic anhydride, derived from crude oil. The stability of these supply chains, as well as the volatility of their pricing, significantly impacts the cost structure and profitability of SMA manufacturers. Robust relationships with reliable raw material suppliers are therefore paramount for ensuring consistent production and maintaining competitive pricing in the downstream market. Innovations in feedstock sourcing, including bio-based alternatives, are emerging as strategic considerations in this initial phase of the value chain.

Moving downstream, the core of the value chain involves the polymerization process where styrene and maleic anhydride are reacted to form SMA copolymer. This stage requires specialized chemical expertise and capital-intensive manufacturing facilities. Following polymerization, the crude SMA may undergo further processing, such as grinding into powder or pelletizing into granules, depending on the intended application. This is often followed by compounding activities, where SMA is blended with other polymers, fillers, or additives to create customized compounds that meet specific performance requirements for various end-use applications. These compounders play a critical role in bridging the gap between basic polymer production and specialized industry demands, adding significant value through formulation and customization.

The distribution channel for SMA copolymers is a critical link connecting manufacturers and end-users, encompassing both direct sales and indirect channels through distributors and agents. Direct sales are often favored for large-volume customers and strategic partnerships, allowing for closer collaboration, technical support, and customized solutions. Indirect channels, involving a network of distributors, are crucial for reaching a broader customer base, particularly small and medium-sized enterprises (SMEs), and for serving diverse geographical markets more efficiently. These distributors typically offer local warehousing, technical expertise, and logistical support, making SMA products readily accessible to a wide array of end-users. The choice of distribution strategy depends on market reach, customer segment, and the level of technical support required, optimizing market penetration and customer service.

Styrene Maleic Anhydride (SMA) Copolymer Market Potential Customers

The potential customers for Styrene Maleic Anhydride (SMA) copolymer span a wide array of industrial sectors, each leveraging SMA's unique properties to enhance their product performance and manufacturing processes. At the forefront are original equipment manufacturers (OEMs) and component suppliers within the automotive industry, particularly those involved in producing lightweight vehicle parts, interior trims, and under-the-hood components where high heat resistance, dimensional stability, and impact strength are critical. As the automotive sector increasingly shifts towards electric vehicles and stringent emission standards, the demand for advanced materials like SMA that contribute to weight reduction and enhanced durability continues to grow, making these entities prime customers for SMA suppliers.

Another significant customer segment includes electronics manufacturers, ranging from producers of circuit boards, semiconductors, and electronic housings to companies developing advanced display technologies. These buyers are primarily interested in SMA's excellent dielectric properties, thermal stability, and ability to act as an effective encapsulant or binder, crucial for ensuring the reliability and longevity of sensitive electronic components. The ongoing trend of miniaturization and increasing performance requirements in consumer electronics, telecommunications equipment, and industrial electronics continually drives the need for high-performance polymers like SMA, positioning these manufacturers as key strategic customers for the market.

Beyond automotive and electronics, the customer base extends to packaging companies seeking to enhance barrier properties and adhesion in multi-layer films, food containers, and industrial packaging. Construction material producers also represent a significant segment, utilizing SMA in high-performance coatings, adhesives, and specialty building materials for improved durability and weather resistance. Furthermore, compounders and formulators who blend SMA with other polymers to create customized plastic compounds for various industries, and specialty chemical manufacturers developing advanced resins, dispersants, or adhesion promoters, also constitute vital indirect customers. The diversity of these end-user segments underscores the broad applicability and value proposition of SMA copolymers across modern industrial landscapes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.7 Million |

| Market Forecast in 2033 | USD 725.3 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mitsubishi Chemical Corporation, Polyscope Polymers B.V., Sartomer (Arkema Group), Cray Valley (TotalEnergies), LyondellBasell Industries, Versalis S.p.A. (Eni S.p.A.), Nova Chemicals, Synthomer Plc, Kumho Petrochemical, Denka Company Limited, Jiangsu Sanmu Group, Sumitomo Chemical Co., Ltd., BASF SE, Dow Inc., Eastman Chemical Company, INEOS Styrolution, Zhejiang Polystar Chemical Co., Ltd., China Petroleum & Chemical Corporation (Sinopec), Mitsui Chemicals, Inc., DIC Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Styrene Maleic Anhydride (SMA) Copolymer Market Key Technology Landscape

The Styrene Maleic Anhydride (SMA) Copolymer market is driven by an evolving technology landscape focused on enhancing product performance, improving manufacturing efficiency, and addressing sustainability concerns. Key technological advancements include sophisticated polymerization techniques, such as continuous mass polymerization and solution polymerization, which allow for greater control over molecular weight distribution, maleic anhydride content, and polymer architecture. These advancements enable manufacturers to produce a wider range of SMA grades with tailored properties, optimizing them for specific applications like high-temperature resistance in automotive components or enhanced adhesion in specialized coatings. The focus is on achieving higher reaction efficiencies and reducing byproduct formation, leading to more cost-effective and environmentally friendly production processes.

Furthermore, significant technological progress is observed in compounding and functionalization methods. Advanced compounding technologies, including twin-screw extrusion, are crucial for effectively blending SMA with other polymers, fillers, and additives to create high-performance polymer alloys and compounds. These processes ensure uniform dispersion and optimal interaction between components, thereby maximizing the impact modification or compatibilization effects of SMA. Functionalization technologies, such as grafting reactions and reactive extrusion, are also key, allowing for the introduction of various functional groups onto the SMA backbone. This functionalization capability expands SMA's utility as an adhesion promoter, cross-linking agent, or reactive compatibilizer, opening doors to novel applications in composites, adhesives, and advanced materials science.

The increasing emphasis on sustainability is also shaping the technology landscape, with growing investments in technologies for developing bio-based SMA and improving recycling processes. Researchers are exploring methods to synthesize SMA using renewable feedstocks, such as bio-styrene or bio-maleic anhydride, which could significantly reduce the carbon footprint of SMA production. Simultaneously, technologies for the chemical and mechanical recycling of SMA-containing plastics are gaining traction, aiming to establish circular economy models within the industry. Innovations in catalyst systems, process intensification, and digital manufacturing (e.g., AI-driven process control) are further contributing to the efficiency, quality, and environmental profile of SMA copolymer production, positioning the market for sustained growth and innovation.

Regional Highlights

- North America: A mature market characterized by high demand for specialty and high-performance SMA copolymers in automotive and aerospace applications, driven by stringent quality standards and a strong focus on advanced material innovation.

- Europe: Exhibits steady growth, with a strong emphasis on sustainability, bio-based solutions, and circular economy principles, influencing SMA development for eco-friendly packaging and construction materials.

- Asia Pacific (APAC): The largest and fastest-growing market, propelled by rapid industrialization, burgeoning automotive and electronics manufacturing in China, India, and ASEAN countries, leading to significant consumption of SMA in various industrial applications.

- Latin America: An emerging market with increasing industrial investments, particularly in automotive and construction sectors, driving a gradual increase in SMA copolymer demand as regional economies expand and modernize.

- Middle East & Africa (MEA): A developing market with growing potential, influenced by infrastructure development projects and diversification of industrial bases, leading to increased adoption of SMA in construction and specialized coatings.

- China: Dominant in APAC, fueled by its vast manufacturing base and continuous expansion in electronics, automotive (especially EVs), and construction sectors, making it a primary consumer and producer of SMA.

- India: Experiencing robust growth in manufacturing and automotive industries, contributing to a rising demand for SMA, particularly for lightweight and high-performance applications.

- Germany: A key European market, renowned for its strong automotive sector and advanced engineering, driving demand for high-quality SMA in premium and specialized vehicle components.

- Japan: A technologically advanced market with a focus on innovation in electronics and precision engineering, leading to sustained demand for high-performance SMA copolymers.

- United States: A major North American consumer, driven by its large automotive industry, robust electronics sector, and significant research and development in advanced materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Styrene Maleic Anhydride (SMA) Copolymer Market.- Mitsubishi Chemical Corporation: A global leader offering a wide range of chemical products, including various grades of SMA for diverse applications.

- Polyscope Polymers B.V.: Specialized in high-performance SMA copolymers, known for innovative solutions in automotive and specialty plastics.

- Sartomer (Arkema Group): Provides SMA-based solutions, focusing on reactive systems and coatings applications with a strong R&D pipeline.

- Cray Valley (TotalEnergies): A key player in specialty chemicals, offering SMA copolymers that cater to various industrial demands.

- LyondellBasell Industries: A major global chemical company with a broad portfolio, including styrene-based polymers and related derivatives.

- Versalis S.p.A. (Eni S.p.A.): Engaged in the production of elastomers and plastics, with a focus on sustainable solutions and advanced polymers.

- Nova Chemicals: A leading producer of plastics and chemicals, providing styrene-based products essential for SMA production.

- Synthomer Plc: Specializes in various polymer types, offering SMA-derived products for coatings, adhesives, and construction.

- Kumho Petrochemical: A significant Asian producer of synthetic rubber and resins, including components relevant to SMA manufacturing.

- Denka Company Limited: A Japanese chemical company with a diverse product portfolio, including high-performance resins.

- Jiangsu Sanmu Group: A prominent Chinese chemical company involved in the production of resins and related chemical products.

- Sumitomo Chemical Co., Ltd.: A major diversified chemical company with a global presence, offering advanced materials.

- BASF SE: One of the world's largest chemical producers, involved in a wide array of plastics and performance chemicals.

- Dow Inc.: A leading materials science company, producing a wide range of polymers and chemical intermediates.

- Eastman Chemical Company: A global specialty materials company offering a broad portfolio of advanced plastics and fibers.

- INEOS Styrolution: A global leader in styrenics, providing critical raw materials for SMA production and specialized styrenic polymers.

- Zhejiang Polystar Chemical Co., Ltd.: A Chinese manufacturer focusing on specialty polymers and chemical intermediates.

- China Petroleum & Chemical Corporation (Sinopec): A major state-owned enterprise in China, active in petrochemicals and related products.

- Mitsui Chemicals, Inc.: A Japanese chemical company with a strong focus on mobility, health, and food solutions, including advanced polymers.

- DIC Corporation: A global leader in printing inks, organic pigments, and synthetic resins, including specialized polymer solutions.

Frequently Asked Questions

What is Styrene Maleic Anhydride (SMA) Copolymer and its primary uses?

SMA copolymer is a versatile thermoplastic polymer formed from styrene and maleic anhydride, known for its high heat resistance, dimensional stability, and excellent adhesion. Its primary uses span across automotive, electronics, packaging, and construction industries, where it serves as a compatibilizer, impact modifier, dispersant, and processing aid for various polymer blends and applications requiring enhanced performance.

Which factors are driving the growth of the SMA Copolymer market?

The market's growth is predominantly driven by the increasing demand for lightweight and high-performance materials in the automotive industry, particularly with the rise of electric vehicles. Additionally, the continuous expansion and technological advancements in the electronics sector, along with the growing need for effective polymer compatibilizers and impact modifiers across diverse industrial applications, are significant driving factors.

What are the key challenges faced by SMA Copolymer manufacturers?

Key challenges include the volatility of raw material prices for styrene and maleic anhydride, which directly impacts production costs and profitability. Environmental concerns regarding plastic waste and the push for sustainable alternatives also pose restraints, along with competition from substitute materials that offer similar functionalities or cost advantages in specific applications.

How is the Asia Pacific region contributing to the SMA Copolymer market?

The Asia Pacific (APAC) region is the largest and fastest-growing market for SMA copolymers, primarily driven by rapid industrialization, robust growth in the manufacturing sectors (especially automotive and electronics) in countries like China and India, and increasing foreign investments. The region's expanding industrial base and rising demand for advanced materials significantly contribute to global SMA consumption.

What are the emerging opportunities in the Styrene Maleic Anhydride Copolymer market?

Emerging opportunities include the development and commercialization of bio-based and sustainable SMA variants, aligning with global environmental objectives. Expansion into new application areas such as additive manufacturing (3D printing), renewable energy systems, and advanced medical devices also presents significant growth avenues. Furthermore, innovations in functionalization and polymer blending technologies offer potential for highly customized SMA solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager