Substation Inspection Robots Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436092 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Substation Inspection Robots Market Size

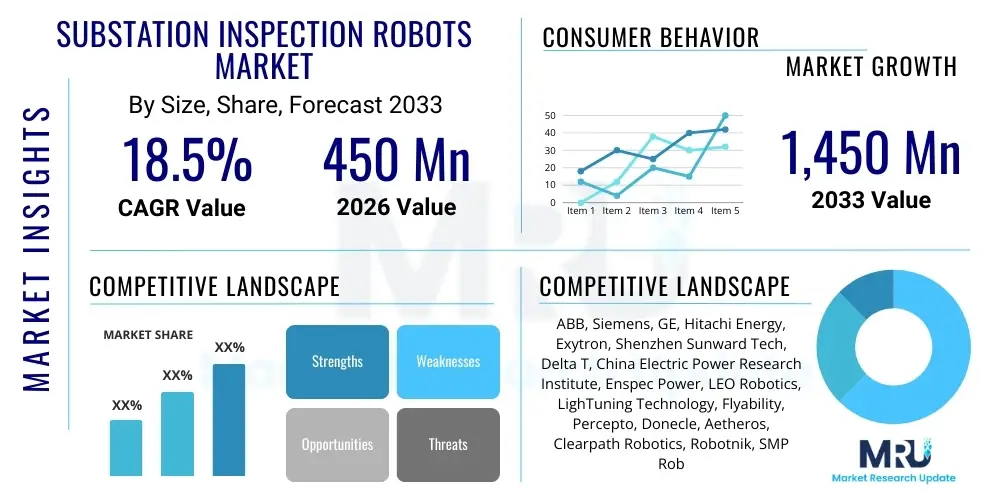

The Substation Inspection Robots Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at $450 Million in 2026 and is projected to reach $1,450 Million by the end of the forecast period in 2033.

Substation Inspection Robots Market introduction

The Substation Inspection Robots Market encompasses specialized automated systems designed for performing routine monitoring, data collection, and diagnostic checks within electrical substations. These sophisticated devices, ranging from ground-based autonomous vehicles (wheeled or tracked) to aerial drones, are crucial for enhancing operational safety, minimizing downtime, and ensuring the reliability of power transmission and distribution infrastructure. The primary product deployed includes high-definition cameras, thermal imaging sensors, acoustic sensors, and gas detection modules, enabling non-contact inspection of critical assets such as transformers, circuit breakers, insulators, and busbars. Major applications span high-voltage transmission substations and lower-voltage distribution substations across utilities worldwide, driven by the imperative to move away from hazardous manual inspection methods.

The core benefit derived from adopting these robotic systems is the significant improvement in safety, as they eliminate the need for human personnel to work in high-electromagnetic field environments or confined spaces, particularly during live operations. Furthermore, robots provide consistent, high-quality, and standardized inspection data, facilitating predictive maintenance strategies based on analyzed trends rather than reactive fixes. This technological shift is underpinned by robust driving factors, including stringent regulatory requirements for power grid reliability, the aging global substation infrastructure necessitating frequent monitoring, and the ongoing labor shortage of skilled substation technicians. The integration of advanced navigation, machine learning, and sensor fusion capabilities makes these robots indispensable tools for the modern utility sector aiming for operational excellence.

Substation Inspection Robots Market Executive Summary

The Substation Inspection Robots Market is experiencing robust acceleration, fueled primarily by the global transition towards smart grids and the increasing prioritization of worker safety across established utilities in North America and Europe. Business trends indicate a strong move toward Robotics-as-a-Service (RaaS) models, lowering the initial capital expenditure barrier for smaller utilities and accelerating market penetration. Technology advancements focus heavily on enhancing battery life, improving all-weather operational capabilities, and integrating AI for real-time anomaly detection, pushing market growth beyond initial projections. Strategic partnerships between established automation companies and specialized robotics firms are becoming common, consolidating expertise in both utility infrastructure and advanced robotics.

Regionally, Asia Pacific (APAC) is emerging as the fastest-growing market, led by massive infrastructure modernization projects in China and India, focusing on expanding electrification networks and improving existing grid stability. North America and Europe, while mature, remain dominant in terms of technology adoption and spending on fully autonomous solutions. Segment trends highlight the dominance of ground-based wheeled and tracked robots for detailed component inspection, although aerial (drone) solutions are gaining substantial traction, especially for high-rise infrastructure and rapid site assessments. The autonomous operation mode segment is projected to show superior growth, reflecting the industry's desire for automated, round-the-clock monitoring capabilities without constant human intervention.

AI Impact Analysis on Substation Inspection Robots Market

User queries frequently revolve around how Artificial Intelligence will move inspection robots beyond simple data collection towards autonomous decision-making and predictive analytics. Key concerns include the reliability of AI models in accurately identifying subtle equipment failures, the standardization of AI-driven reporting across different utility platforms, and the necessary infrastructure (5G, edge computing) required to support real-time data processing at the substation site. Users expect AI to handle the immense volume of data generated by thermal, visual, and acoustic sensors, automating anomaly classification and predicting failure timelines with high accuracy. The overarching theme is the transformation of the robot from a mobile sensor platform into an intelligent diagnostic agent, minimizing false positives and prioritizing critical maintenance tasks effectively, thereby maximizing utility asset utilization and reducing operational expenditure.

- Autonomous Anomaly Detection: AI algorithms analyze sensor inputs (thermal, visual, acoustic) instantly to identify signs of overheating, corrosion, or partial discharge, eliminating manual review.

- Predictive Maintenance Scheduling: Machine learning models utilize historical inspection data to forecast when specific components are likely to fail, optimizing maintenance cycles and reducing reactive repairs.

- Route Optimization and Self-Correction: AI enhances robot navigation by dynamically optimizing inspection routes based on real-time environmental changes and ensuring complete coverage without human programming.

- Data Fusion and Reporting: Advanced AI aggregates data from multiple sensor types and previous inspections, generating comprehensive, standardized diagnostic reports that inform complex asset management decisions.

- Edge Computing Integration: Deploying lightweight AI models directly on the robot (at the edge) ensures real-time analysis and rapid response to critical safety hazards without relying on constant cloud connectivity.

DRO & Impact Forces Of Substation Inspection Robots Market

The market dynamics are defined by a powerful convergence of technological drivers, structural restraints, and compelling opportunities, all contributing to significant market impact. Key drivers include the universal focus on enhancing worker safety by removing humans from hazardous high-voltage environments, coupled with the critical need to maintain aging electrical infrastructure efficiently. Opportunities are vast, particularly in integrating advanced technologies such as 5G connectivity for enhanced remote operation and leveraging sophisticated sensor technology (e.g., LiDAR, hyperspectral imaging) to capture richer diagnostic data. However, the market faces significant restraints, chiefly high initial deployment costs for fully autonomous systems and the need for seamless integration with highly customized legacy utility management systems (SCADA).

The principal impact forces shaping this market involve regulatory mandates for grid reliability and the competitive landscape pushing for reduced operational expenditures (OPEX). Regulatory bodies worldwide are tightening standards for downtime prevention, directly incentivizing utilities to adopt preventative monitoring technologies like inspection robots. Concurrently, the increasing maturity of robotic technology and associated software platforms is lowering the total cost of ownership over time, overcoming the initial capital hurdle. Geopolitical factors influencing supply chains for advanced components (sensors, processors) also represent a moderate impact force. Ultimately, the market is poised for transformative growth as utilities recognize the long-term ROI derived from improved grid uptime and decreased maintenance complexity achieved through robotic automation.

Segmentation Analysis

The Substation Inspection Robots Market is highly fragmented and segmented across multiple dimensions, including the mobility mechanism, the type of substation they operate within, and the level of autonomy they possess. This segmentation is crucial for understanding specific utility requirements and tailored product development. Mobility segmentation differentiates between ground-based and aerial solutions, addressing varying site topographies and inspection heights. Application segmentation focuses on whether the robot is deployed in critical, high-voltage transmission environments or localized distribution infrastructure. Finally, the operational segmentation distinguishes between systems requiring continuous human guidance (semi-autonomous) and those capable of executing entire missions independently (fully autonomous), reflecting the maturity and investment capacity of the end-user utility.

The technical specifications required for robots operating within transmission substations (EHV/HV) are significantly more stringent regarding electromagnetic interference shielding and sensor calibration compared to distribution substations. Similarly, the movement towards autonomous systems is heavily influencing the market, as utilities seek solutions that minimize human labor and maximize inspection frequency and consistency. The growth of RaaS models primarily targets the distribution substation segment and smaller utilities, offering a scalable entry point into robotic inspection without massive upfront investment. Analyzing these segments provides a clear roadmap for manufacturers focusing on specific technological challenges and market opportunities.

- By Type:

- Tracked Robots

- Wheeled Robots

- Aerial/Drone Robots (UAVs)

- By Application:

- Transmission Substation (EHV/HV)

- Distribution Substation (MV/LV)

- By Operation Mode:

- Autonomous

- Semi-Autonomous

- By Component:

- Hardware (Chassis, Sensors, Cameras, Navigation Systems)

- Software & Services (Data Analytics, Control Systems, Cloud Platforms)

Value Chain Analysis For Substation Inspection Robots Market

The value chain for the Substation Inspection Robots Market begins with upstream activities focused on the design and procurement of specialized components. This includes securing high-performance sensors (thermal, LiDAR, acoustic), robust communication modules (5G/LTE), and industrial-grade processing units capable of edge AI computations. Key upstream suppliers are often specialized technology firms providing military or aerospace-grade components adapted for harsh electrical environments. Manufacturing involves the assembly and rigorous testing of the robotic platform, requiring expertise in both robotics engineering and electromagnetic compatibility (EMC) shielding to ensure reliable operation in high-voltage fields. Integration of sophisticated proprietary software, which handles navigation, data logging, and preliminary AI analysis, represents a significant value-add component at this stage.

Downstream analysis focuses on the distribution channels and the final deployment to end-users. Distribution is multifaceted, involving both direct sales models, especially for large, bespoke projects with Tier 1 utility providers, and indirect channels leveraging system integrators and specialized technology vendors who can provide localized support and customized integration services. The distribution channel must also incorporate training and ongoing maintenance support, given the complexity of the technology. The final stage involves extensive post-deployment services, including data analysis subscription models (DaaS) and RaaS contracts, which ensure optimal robot performance and continuous software updates. The profitability often shifts downstream towards these recurring service revenues rather than solely relying on the initial hardware sale.

The complex interplay between component manufacturers, platform builders, software developers, and utility end-users dictates the overall market efficiency. Direct distribution allows manufacturers to maintain strict control over quality and integration, which is critical in safety-sensitive environments. Conversely, leveraging indirect distribution through experienced local integrators facilitates faster market entry into highly regulated or geographically dispersed regions. The trend toward cloud-based fleet management and data analytics strengthens the importance of the downstream service providers, who act as essential links between the data gathered by the robots and the utility's strategic asset management decisions.

Substation Inspection Robots Market Potential Customers

The primary end-users and buyers of substation inspection robots are large utility companies and electric power providers responsible for operating and maintaining extensive transmission and distribution networks globally. These organizations, which include Independent System Operators (ISOs) and Regional Transmission Organizations (RTOs), are driven by the necessity of minimizing transmission losses, preventing catastrophic failures, and complying with stringent grid reliability standards imposed by regulatory bodies. Their procurement decisions prioritize robots that demonstrate high reliability, proven accuracy in diagnosing faults (especially corona discharge and thermal anomalies), and seamless integration into existing operational technology (OT) infrastructure.

A secondary but rapidly growing customer segment includes industrial complexes, large campus facilities, and renewable energy farm operators (solar and wind) that maintain private substations. Although their inspection scale is smaller, their need for continuous uptime and reduced insurance liability makes robotic inspection a viable and cost-effective solution compared to traditional manual methods. Furthermore, specialized maintenance contractors and facilities management companies that offer outsourced utility maintenance services are increasingly investing in robotic fleets to enhance their service offerings, positioning them as essential intermediaries in the market. The adoption rate among municipal utilities, which often face tighter budget constraints, is typically slower, making the RaaS model particularly attractive for this cohort.

The typical buyer within a utility organization is usually situated within the Asset Management, Operations & Maintenance (O&M), or Health, Safety, and Environment (HSE) departments. These decision-makers require compelling evidence demonstrating the robot's ability to operate autonomously in complex, energized environments, provide actionable data that reduces unexpected outages, and, crucially, enhance employee safety metrics. The purchasing cycle is typically long, involving pilot programs and extensive regulatory approval processes, emphasizing the need for robust, reliable, and certified robotic platforms that offer comprehensive data security and localized support throughout their operational lifespan.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $450 Million |

| Market Forecast in 2033 | $1,450 Million |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB, Siemens, GE, Hitachi Energy, Exytron, Shenzhen Sunward Tech, Delta T, China Electric Power Research Institute, Enspec Power, LEO Robotics, LighTuning Technology, Flyability, Percepto, Donecle, Aetheros, Clearpath Robotics, Robotnik, SMP Robotics, ECA Group, Mitsubishi Electric |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Substation Inspection Robots Market Key Technology Landscape

The technological core of substation inspection robots revolves around robust sensor fusion, precision navigation systems, and electromagnetic shielding. Sensor fusion is critical, allowing robots to combine data from multiple modalities—such as visual spectrum cameras for structural integrity, infrared cameras for thermal hotspots, and acoustic sensors for detecting partial discharge (corona/arcing)—into a unified, actionable dataset. Advanced navigation technology, including Simultaneous Localization and Mapping (SLAM) and integration with high-precision GPS (RTK), enables the robots to operate autonomously within the complex, obstruction-heavy metallic environments of substations where standard navigation signals can be erratic. Furthermore, specialized electromagnetic shielding materials and design architectures are essential to prevent interference from high-voltage fields that could disrupt onboard electronics, ensuring continuous operation and data integrity.

A significant trend in the technological landscape is the rapid adoption of edge computing and specialized AI processors embedded within the robot platform. This allows for real-time processing of sensor data, enabling immediate anomaly detection and avoiding the latency associated with transmitting massive data streams back to a central server for analysis. The ability of the robot to analyze, classify, and even prioritize inspection points autonomously enhances operational efficiency exponentially. Coupled with this is the use of high-throughput communication technologies, particularly 5G networks where available, facilitating seamless remote monitoring, control, and instantaneous data transfer for critical alerts, thereby supporting fully remote operation centers.

The development of specialized robotic chassis is also paramount, tailored to withstand extreme weather conditions (rain, high temperatures) and navigate challenging terrain, including gravel, slopes, and tight clearances between equipment. Wheeled and tracked platforms offer stability and payload capacity, while aerial solutions leverage advanced stabilization algorithms for high-altitude inspection of bushings and overhead lines. Ongoing research is focused on developing modular payloads, allowing utilities to swap sensor configurations based on specific inspection needs (e.g., adding methane detectors or specialized gas analysis tools), making the platforms highly adaptable and future-proof against emerging regulatory or maintenance requirements.

Regional Highlights

The global Substation Inspection Robots Market exhibits varied growth patterns influenced by regulatory environments, infrastructure age, and technology adoption rates across key regions. Understanding regional nuances is vital for global expansion strategies.

- North America: Dominant in autonomous technology adoption, driven by high labor costs, strict safety regulations (OSHA), and the widespread implementation of smart grid initiatives. The focus here is on predictive maintenance strategies and integrating robotics with existing SCADA systems, with major utilities actively piloting and scaling autonomous fleets.

- Europe: Characterized by an aging energy grid and strong legislative mandates promoting renewable energy integration, requiring stable and constantly monitored infrastructure. European utilities prioritize highly reliable, certified robots (CE marking) and are strong adopters of RaaS models to manage capital expenditure, particularly in Germany, the UK, and the Nordics.

- Asia Pacific (APAC): The fastest-growing region, fueled by massive investment in grid expansion and modernization across economies like China, India, and Southeast Asian nations. While initial adoption may skew toward semi-autonomous or lower-cost solutions, the sheer volume of new substations being built provides an unprecedented market opportunity for ground-based and aerial inspection solutions.

- Latin America (LATAM): Growth is primarily concentrated in rapidly urbanizing countries like Brazil and Mexico. The market is moderately slow but shows high potential, driven by the need to combat system losses and improve reliability in geographically diverse and often challenging operational environments.

- Middle East and Africa (MEA): Emerging market characterized by large-scale, high-technology deployments, particularly in the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia). These regions focus on high-temperature endurance robots and specialized sensors due to the harsh desert climates, prioritizing reliability over cost in major infrastructure projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Substation Inspection Robots Market.- ABB

- Siemens

- GE

- Hitachi Energy

- Exytron

- Shenzhen Sunward Tech

- Delta T

- China Electric Power Research Institute

- Enspec Power

- LEO Robotics

- LighTuning Technology

- Flyability

- Percepto

- Donecle

- Aetheros

- Clearpath Robotics

- Robotnik

- SMP Robotics

- ECA Group

- Mitsubishi Electric

Frequently Asked Questions

Analyze common user questions about the Substation Inspection Robots market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for substation inspection robots?

The primary driver is the critical need to enhance worker safety by removing personnel from hazardous high-voltage environments, coupled with the necessity of improving grid reliability through consistent, data-driven predictive maintenance enabled by automated inspections.

How does electromagnetic interference (EMI) affect robot performance, and how is it mitigated?

EMI in substations can corrupt sensor readings and disrupt robot navigation and communication. Mitigation involves specialized electromagnetic shielding materials around sensitive electronic components and robust software filtering mechanisms to ensure data integrity and operational consistency in high-field environments.

Which type of robot (ground-based or aerial) is most effective for full substation coverage?

A hybrid approach is often most effective. Ground-based robots (wheeled/tracked) provide detailed, up-close thermal and acoustic inspection of ground-level components (transformers, circuit breakers), while aerial drones (UAVs) specialize in quick, high-altitude visual and thermal inspection of overhead lines and bushings that are otherwise inaccessible.

What role does AI play in reducing the total cost of ownership (TCO) for these robotic systems?

AI significantly reduces TCO by automating data analysis and fault identification, minimizing the need for specialized human analysts to sift through vast datasets. This shift from manual data interpretation to AI-driven predictive insights streamlines maintenance schedules and prevents costly unexpected outages, maximizing the robot's long-term ROI.

What are the key differences between inspecting transmission substations versus distribution substations?

Transmission substations (HV/EHV) require robots with superior EMI shielding and focus heavily on complex high-voltage equipment inspection (e.g., major transformers). Distribution substations (MV/LV) are generally smaller, often utilize lower-cost wheeled robots, and prioritize detecting minor defects or localized environmental damage within urban settings.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager