Sucralfate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434677 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Sucralfate Market Size

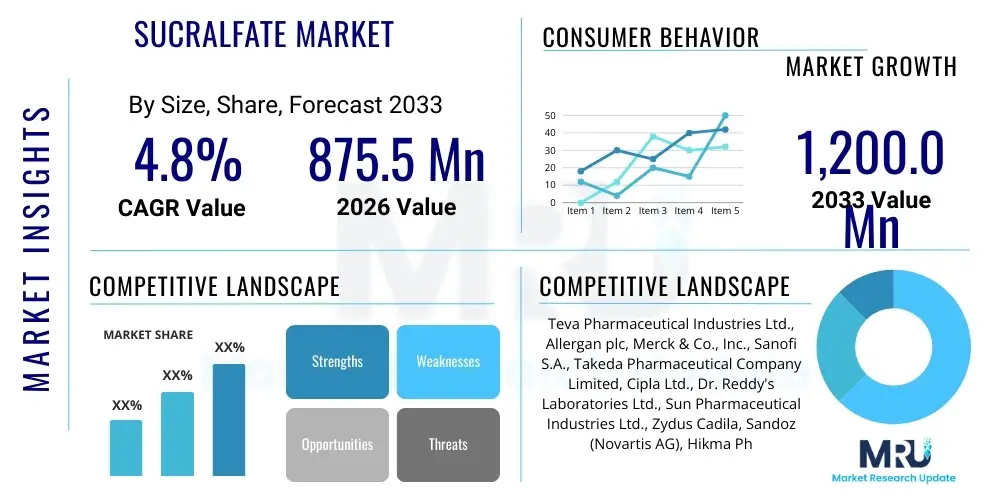

The Sucralfate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 875.5 Million in 2026 and is projected to reach USD 1,200.0 Million by the end of the forecast period in 2033.

Sucralfate Market introduction

The Sucralfate market encompasses the manufacturing, distribution, and sale of the aluminum salt of sulfated sucrose, a specialized pharmaceutical agent used primarily for the treatment of various gastrointestinal conditions. Sucralfate functions as a cytoprotective agent rather than an antacid, binding preferentially to damaged mucosal tissue—such as ulcers—to form a protective barrier against acid, pepsin, and bile salts. This mechanism promotes the healing process without significantly altering systemic pH levels, positioning it as a cornerstone therapy in managing complex upper GI tract disorders. The primary product forms include tablets, oral suspensions, and granules, catering to diverse patient needs, particularly those who struggle with swallowing traditional medication or require localized topical GI protection.

Major applications of Sucralfate are centered around treating and preventing recurrence of peptic ulcer disease (gastric and duodenal ulcers), managing stress ulcers in critically ill patients, and alleviating symptoms associated with gastroesophageal reflux disease (GERD) and gastritis. Its effectiveness stems from its ability to enhance local mucosal defense mechanisms, including prostaglandin synthesis and mucus production, offering comprehensive therapeutic benefits beyond simple acid neutralization. The growing incidence of lifestyle-related digestive disorders, coupled with increasing awareness regarding the long-term side effects of proton pump inhibitors (PPIs) in certain patient populations, is driving the continued demand for Sucralfate formulations globally.

The market is significantly propelled by several key driving factors. Firstly, the escalating prevalence of Helicobacter pylori infections and non-steroidal anti-inflammatory drug (NSAID)-induced gastropathy necessitates robust ulcer-healing agents. Secondly, the aging population, which is more susceptible to chronic GI inflammation and ulceration, contributes substantially to the consumer base. Furthermore, the expansion of healthcare infrastructure and improved accessibility to prescription drugs in emerging economies are crucial elements bolstering market expansion. Ongoing research into novel applications, such as using sucralfate for oral mucositis or radiation proctitis, further solidifies its position in the pharmaceutical landscape, ensuring sustained relevance throughout the forecast period.

Sucralfate Market Executive Summary

The global Sucralfate market exhibits robust growth characterized by strategic regional shifts and increasing clinical validation for specialized applications. Business trends indicate a focus on developing specialized dosage forms, particularly highly palatable suspensions and rapid-disintegrating tablets, to enhance patient compliance, especially in pediatric and geriatric demographics. Key pharmaceutical players are concentrating on consolidating their market share through robust supply chain management, ensuring the availability of cost-effective generic versions, which currently dominate the volume landscape. Furthermore, heightened regulatory scrutiny regarding quality and purity standards for active pharmaceutical ingredients (APIs) is prompting vertical integration among leading manufacturers to secure raw material stability and consistency, thereby mitigating potential supply disruptions.

Regionally, the Asia Pacific (APAC) area is emerging as the fastest-growing market due to rapidly improving healthcare spending, a massive population base suffering from GI disorders, and increased access to generic medication. North America and Europe, while mature markets, maintain significant revenue share, driven by complex treatment protocols for critical care patients (stress ulcer prophylaxis) and established prescription patterns. The emphasis in Western markets is shifting towards patented combination therapies where Sucralfate is used alongside other agents to offer synergistic therapeutic effects. Regulatory harmonization across countries and initiatives aimed at reducing out-of-pocket prescription costs are also shaping procurement and distribution strategies across continents.

Segmentation trends highlight the dominance of the Peptic Ulcer Disease (PUD) application segment, although Stress Ulcer management is registering the highest growth rate, primarily driven by expanding intensive care unit (ICU) capacities globally. In terms of dosage forms, the oral suspension segment is gaining traction over traditional tablets due to its ease of administration and superior mucosal coating capability, leading to enhanced therapeutic efficacy. The competitive landscape is characterized by a strong presence of generic manufacturers, pressuring pricing structures, and necessitating continuous process optimization and cost reduction strategies for profitability. The integration of advanced diagnostics for early detection of GI lesions also indirectly fuels the demand for subsequent Sucralfate treatment protocols.

AI Impact Analysis on Sucralfate Market

User inquiries regarding AI's influence on the Sucralfate market predominantly revolve around three critical themes: optimizing drug discovery and formulation, enhancing diagnostic accuracy for targeted patient selection, and improving supply chain efficiency. Users frequently ask how AI can help identify novel Sucralfate derivatives with improved adherence or reduced aluminum absorption. They also question the application of machine learning in parsing vast clinical data sets to pinpoint patient subpopulations that respond optimally to Sucralfate versus alternative cytoprotective or acid-suppressing agents, thereby customizing treatment pathways. Furthermore, there is significant interest in using predictive analytics to forecast demand fluctuations for both the API and finished products, particularly in hospital settings where stress ulcer prophylaxis inventories are crucial, leading to improved stock management and reduced waste.

The immediate impact of Artificial Intelligence is visible in the pharmaceutical research and development phase. AI algorithms are being employed to model the interaction of Sucralfate and its metabolites with biological targets, helping researchers understand its cytoprotective mechanisms at a molecular level with greater precision. This computational approach expedites the screening process for potential enhancements or modifications to the existing drug structure, potentially leading to faster development cycles for improved formulations with enhanced bioavailability or longer duration of action. For instance, AI can simulate how different excipients affect the coating property of the Sucralfate suspension in the gastric environment, optimizing formulation stability and efficacy.

In the clinical domain, AI's potential lies in transforming patient diagnostics and monitoring. Machine learning models, fed with endoscopic images, physiological data, and electronic health records (EHRs), can assist clinicians in the early and accurate identification of gastric and duodenal lesions, determining the severity of PUD or gastritis. This enhanced diagnostic capability ensures that Sucralfate treatment is initiated promptly and tailored precisely to the extent of mucosal damage. Moreover, AI-driven pharmacovigilance systems can rapidly analyze global adverse event reports related to Sucralfate use, identifying subtle drug interactions or risks in specific demographic groups, thereby improving overall patient safety profile management and regulatory compliance.

- AI-driven optimization of Sucralfate manufacturing processes to minimize impurity profiles and enhance API yield.

- Predictive modeling used to forecast regional demand, preventing critical stockouts in hospitals for stress ulcer prophylaxis.

- Machine learning algorithms assisting in personalized medicine by identifying optimal responders to Sucralfate therapy based on genetic markers or clinical comorbidities.

- Accelerated virtual screening for novel cytoprotective agents structurally related to Sucralfate with superior mucosal binding properties.

- Automation of clinical trial data analysis for Sucralfate, speeding up regulatory submissions and post-market surveillance.

DRO & Impact Forces Of Sucralfate Market

The Sucralfate market dynamics are shaped by a complex interplay of internal drivers that boost demand, external restraints that limit growth, and significant opportunities that promise future expansion, all culminating in measurable impact forces that influence strategic decisions. The market is primarily driven by the persistent and increasing global burden of gastrointestinal diseases, specifically peptic ulcer disease and GERD, coupled with the critical need for effective mucosal protection, especially in ICU settings where Sucralfate remains a standard protocol for stress ulcer prophylaxis. However, growth is restrained by the drug’s mature status, intense generic competition leading to price erosion, and concerns regarding aluminum absorption in patients with renal impairment, necessitating careful patient selection and monitoring.

Key market drivers include the rising consumption of non-steroidal anti-inflammatory drugs (NSAIDs) globally, which are notorious for causing gastric damage, thereby increasing the patient pool requiring cytoprotective agents. Furthermore, Sucralfate's relatively low cost compared to branded PPIs and its established safety profile for short-term use make it highly attractive for use in emerging markets with budget constraints. The demographic shift towards an older population segment, inherently more prone to chronic digestive conditions and requiring multi-drug regimens, also acts as a fundamental growth catalyst. The growing recognition of Sucralfate's utility in treating specialized conditions like radiation-induced proctitis or oral mucositis expands its therapeutic niche beyond traditional ulcer management, contributing positively to market momentum.

Restraints include the shift towards combination therapies that often favor newer, more convenient drug classes, potentially displacing Sucralfate from first-line treatment protocols in some regions. The major opportunity lies in developing novel, advanced drug delivery systems for Sucralfate, such as enteric-coated formulations or targeted release mechanisms that minimize systemic exposure to aluminum while maximizing local concentration at the ulcer site. Furthermore, expanding market access in underserved regions through collaborations with local distributors and investing in public awareness campaigns about GI health management present substantial avenues for revenue generation. The overall impact force is moderately high, leaning towards growth, contingent upon successful differentiation of Sucralfate formulations and strategic penetration into high-growth application segments like critical care medicine.

Segmentation Analysis

The Sucralfate market is meticulously segmented across application, dosage form, distribution channel, and end-user, enabling manufacturers and distributors to precisely target specific patient populations and healthcare settings. Understanding these segments is crucial for strategic pricing, inventory management, and marketing efforts, especially given the generic nature of the compound. The Application segment distinguishes between primary uses such as Peptic Ulcer Disease (PUD), Gastroesophageal Reflux Disease (GERD), and the highly critical segment of Stress Ulcer Prophylaxis, reflecting varying prescription volumes and profitability margins based on clinical guidelines and setting of care (inpatient vs. outpatient).

The segmentation by Dosage Form—encompassing tablets, oral suspensions, and granules/powders—is vital as it directly addresses patient compliance and drug efficacy. Suspensions, for instance, are often preferred for their superior coating capabilities, making them highly effective for severe esophageal or gastric damage, while tablets offer convenience for maintenance therapy. Distribution channel segmentation, covering hospital pharmacies, retail pharmacies, and online platforms, highlights the evolving landscape of drug dispensing, with online sales offering significant growth potential for maintenance therapies and chronic patient refills. End-users, including hospitals, specialized clinics, and ambulatory surgical centers, represent the diverse points of prescription and administration, each requiring unique supply chain logistics and bulk purchasing considerations.

- Dosage Form

- Tablet

- Oral Suspension

- Granules/Powder

- Application

- Peptic Ulcer Disease (PUD)

- Gastroesophageal Reflux Disease (GERD)

- Stress Ulcer Prophylaxis

- Gastritis

- Others (e.g., Radiation Proctitis, Oral Mucositis)

- Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- End-User

- Hospitals and Clinics

- Ambulatory Surgical Centers

- Retail Consumers

Value Chain Analysis For Sucralfate Market

The value chain for the Sucralfate market begins with the upstream segment, focusing intensely on the sourcing and synthesis of the active pharmaceutical ingredient (API) and key excipients. Sucralfate synthesis involves complex chemical processes starting from sucrose and aluminum compounds. Given that aluminum hydroxide is a key component, manufacturers must adhere to stringent quality control to minimize heavy metal impurities, which is a major regulatory concern, particularly concerning systemic aluminum exposure. Upstream suppliers are typically specialized chemical manufacturers, often based in Asia Pacific, who supply bulk API to formulation companies globally. Stability of raw material pricing, particularly for specialized sucrose derivatives, significantly impacts the final cost structure, necessitating long-term contracts and robust quality assurance partnerships to maintain competitive advantage.

The midstream phase involves the formulation, manufacturing, and packaging of the final dosage forms—tablets, suspensions, and granules. This stage demands precision engineering, particularly for oral suspensions, where stability, viscosity, and particle size distribution are critical for ensuring optimal mucosal coating and shelf life. Formulation manufacturers invest heavily in Good Manufacturing Practices (GMP) compliance to meet global standards. Distribution channels then link the finished product to the end-users. Direct channels involve large pharmaceutical companies selling directly to major hospital systems or government procurement agencies for bulk supply, especially for stress ulcer prophylaxis inventory. Indirect channels, which form the bulk of outpatient sales, utilize wholesalers, distributors, and third-party logistics (3PL) providers to reach retail and hospital pharmacies efficiently, managing cold chain logistics for certain suspension formulations.

The downstream analysis focuses on the final dispensing and consumption by the end-user. Hospital pharmacies act as critical points of distribution, especially for inpatient care and critical treatment protocols. Retail pharmacies cater to the vast outpatient segment requiring maintenance therapy for PUD or GERD. Price sensitivity is high in the downstream market due to the wide availability of generic Sucralfate versions, leading to intense competition among retail distributors and requiring strong marketing efforts targeting gastroenterologists and general practitioners to maintain prescription volume. Effective distribution management, minimizing stockouts in pharmacies, and optimizing inventory rotation are crucial components of success in the downstream sector, directly impacting patient access and treatment adherence.

Sucralfate Market Potential Customers

The primary potential customers and end-users of Sucralfate are healthcare institutions and patients requiring effective, localized cytoprotective therapy for mucosal damage in the gastrointestinal tract. Hospitals constitute a major segment, particularly high-acuity facilities and Intensive Care Units (ICUs), which rely heavily on Sucralfate for prophylactic treatment against stress-related mucosal bleeding, a significant complication in critically ill or traumatized patients. These institutions often purchase Sucralfate in large volumes, preferring oral suspension or powdered forms for easy administration via nasogastric tubes, making bulk pricing and reliable supply chain logistics paramount considerations for pharmaceutical vendors.

Gastroenterology clinics and specialized outpatient care centers form the second vital customer base. Physicians in these settings frequently prescribe Sucralfate for the curative management of diagnosed peptic ulcers (gastric and duodenal) and severe cases of reflux esophagitis that have proven refractory to acid suppression alone. Patients managing chronic conditions, such as those undergoing long-term NSAID therapy or suffering from Zollinger-Ellison syndrome, also represent a continuous stream of end-users. Furthermore, emerging applications targeting specific inflammatory conditions, such as radiation oncologists prescribing Sucralfate for radiation proctitis or dentists recommending it for oral mucositis associated with chemotherapy, expand the customer diversity beyond traditional GI practices.

Retail consumers constitute the final crucial customer segment, obtaining the medication through community pharmacies upon prescription. This segment is driven by patient awareness, prescription adherence rates, and the accessibility of generic alternatives. Due to the chronic nature of many GI disorders, repeat prescriptions are common, making retail volume highly stable. Pharmacy benefit managers (PBMs) and private insurance providers also act as influential indirect customers, as their formulary decisions heavily dictate which specific generic or branded Sucralfate products are reimbursed, thereby influencing physician prescribing behavior and patient out-of-pocket costs. Successfully serving these diverse customers requires tailored sales strategies addressing volume purchasing, clinical efficacy messaging, and cost-effectiveness analysis.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 875.5 Million |

| Market Forecast in 2033 | USD 1,200.0 Million |

| Growth Rate | CAGR 4.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Teva Pharmaceutical Industries Ltd., Allergan plc, Merck & Co., Inc., Sanofi S.A., Takeda Pharmaceutical Company Limited, Cipla Ltd., Dr. Reddy's Laboratories Ltd., Sun Pharmaceutical Industries Ltd., Zydus Cadila, Sandoz (Novartis AG), Hikma Pharmaceuticals PLC, Bausch Health Companies Inc., Mylan N.V. (now Viatris), Aurobindo Pharma, Wockhardt Ltd., Apotex Inc., Lupin Limited, Glenmark Pharmaceuticals Limited, Torrent Pharmaceuticals Ltd., Pfizer Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sucralfate Market Key Technology Landscape

The technology landscape in the Sucralfate market, while centered on a chemically mature molecule, is evolving through advancements focused on formulation science and drug delivery optimization rather than fundamental API discovery. A critical area of technological focus is the optimization of oral suspension formulations. Achieving optimal viscosity, stability, and sedimentation resistance in suspensions is crucial for ensuring that the Sucralfate remains uniformly dispersed and capable of forming an effective, durable protective layer over mucosal lesions upon ingestion. Manufacturers are utilizing advanced colloidal chemistry techniques and specialized excipient mixes (such as high-grade thickeners and stabilizers) to enhance the tactile feel and coating uniformity of the product, improving both efficacy and patient acceptance, particularly in pediatric and geriatric applications.

Another significant technological advancement involves particle engineering and micronization techniques. Sucralfate's therapeutic action is highly dependent on its ability to adhere locally. By employing specialized milling and micronization technologies, manufacturers can control the particle size distribution of the Sucralfate powder, maximizing the effective surface area for binding to proteins in ulcer exudates. Smaller, uniformly sized particles facilitate better suspension stability and enhanced interaction with damaged mucosal tissue, potentially leading to faster healing rates. Furthermore, packaging technologies, including single-dose oral suspension packets and blister-packed rapid-disintegrating tablets, are being introduced to improve convenience, compliance, and reduce the risk of dosing errors associated with bulk liquid medications.

Looking ahead, sustained-release and targeted delivery systems represent a high-potential technological frontier. Researchers are investigating complex polymeric matrices and hydrogel formulations that can ensure Sucralfate is released precisely at the site of inflammation, minimizing potential absorption elsewhere and extending the duration of the protective effect. For example, specific pH-sensitive polymers could be used to ensure the drug releases optimally in the slightly acidic environment created by the ulcer bed, rather than prematurely in the stomach or non-specifically throughout the GI tract. These technological integrations aim to address the limitations of the current formulations, such as frequent dosing requirements and concerns regarding minor systemic aluminum load, thereby rejuvenating the product’s appeal in advanced healthcare settings.

Regional Highlights

- North America (United States, Canada, Mexico): North America holds a substantial share of the Sucralfate market, primarily driven by high per capita healthcare spending, established clinical guidelines emphasizing stress ulcer prophylaxis in critical care settings, and a high prevalence of GERD and PUD linked to lifestyle factors. The market here is characterized by stringent regulatory environments and a strong preference for branded or high-quality generic formulations. The region is witnessing increased adoption of Sucralfate for specialized applications, such as managing symptoms of radiation proctitis, further solidifying its market position. The presence of major pharmaceutical innovators and a robust intellectual property framework influence the competitive dynamics.

- Europe (Germany, UK, France, Italy, Spain): The European market demonstrates steady growth, supported by universal healthcare systems that prioritize cost-effective generic medications like Sucralfate. Demand is robust across all major countries, with significant utilization in treating NSAID-induced gastropathy and conventional peptic ulcers. Regulatory bodies, such as the European Medicines Agency (EMA), maintain strict quality controls over API sourcing, which affects manufacturing investment decisions. Eastern European countries are showing higher growth rates compared to the mature Western markets, primarily due to expanding private healthcare insurance and increasing access to advanced GI diagnostics.

- Asia Pacific (China, India, Japan, South Korea): APAC is projected to be the fastest-growing region, fueled by an immense population base, increasing disposable incomes, and the rapid expansion of hospital infrastructure. Countries like China and India are major manufacturing hubs for Sucralfate API, providing a cost advantage to local players. The high incidence of H. pylori infection, a leading cause of PUD, drives significant demand for ulcer treatment. Furthermore, government initiatives aimed at improving healthcare accessibility and reducing drug costs favor the widespread use of affordable, efficacious agents, positioning APAC as the primary engine of future market expansion.

- Latin America (Brazil, Argentina, Rest of LATAM): The Latin American market for Sucralfate is growing steadily, propelled by increasing awareness of GI health, urbanization, and improvements in access to essential medicines. Market growth is often volatile due to economic instability and fluctuating currency values, which impact pharmaceutical import costs. However, the high prevalence of stress and lifestyle-related digestive disorders ensures consistent demand. Local manufacturing and regional trade agreements play a crucial role in stabilizing supply chains and ensuring affordable drug pricing within the region.

- Middle East and Africa (MEA): The MEA region presents a fragmented market. Gulf Cooperation Council (GCC) countries exhibit high per capita spending and sophisticated healthcare systems, leading to demand for premium Sucralfate formulations. Conversely, African nations face challenges related to low pharmaceutical penetration and infrastructure limitations. Growth is primarily concentrated in urban centers and driven by international aid and governmental programs aimed at enhancing critical care capacity, where Sucralfate is essential for stress ulcer prevention protocols. Investment in domestic pharmaceutical production in countries like South Africa and Egypt is beginning to reshape the market dynamics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sucralfate Market.- Teva Pharmaceutical Industries Ltd.

- Allergan plc (now part of AbbVie)

- Merck & Co., Inc.

- Sanofi S.A.

- Takeda Pharmaceutical Company Limited

- Cipla Ltd.

- Dr. Reddy's Laboratories Ltd.

- Sun Pharmaceutical Industries Ltd.

- Zydus Cadila

- Sandoz (Novartis AG)

- Hikma Pharmaceuticals PLC

- Bausch Health Companies Inc.

- Mylan N.V. (now Viatris)

- Aurobindo Pharma

- Wockhardt Ltd.

- Apotex Inc.

- Lupin Limited

- Glenmark Pharmaceuticals Limited

- Torrent Pharmaceuticals Ltd.

- Pfizer Inc.

Frequently Asked Questions

Analyze common user questions about the Sucralfate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of Sucralfate, and how does it differ from traditional antacids?

Sucralfate is a cytoprotective agent that locally forms a protective coating over ulcerated or damaged mucosal surfaces by binding to proteins found in ulcer exudates. Unlike antacids, which neutralize stomach acid, Sucralfate does not significantly alter gastric pH but instead shields the tissue from acid, pepsin, and bile, promoting intrinsic healing mechanisms such as prostaglandin synthesis and mucus production.

Which application segment drives the highest volume demand for Sucralfate globally?

While Sucralfate is heavily utilized in critical care for Stress Ulcer Prophylaxis, the largest volume demand driver remains the treatment and maintenance therapy of Peptic Ulcer Disease (PUD), encompassing both gastric and duodenal ulcers. The high global incidence of PUD, often linked to H. pylori infection and NSAID usage, necessitates continuous prescription volumes in outpatient settings.

What major restraints are impacting the growth and profitability of the Sucralfate market?

The primary restraints include intense generic competition, which significantly pressures pricing and profit margins, and the drug’s potential for systemic aluminum absorption, particularly raising safety concerns in patients with severe chronic kidney disease (renal impairment), necessitating cautious prescribing and patient monitoring, thus limiting its application in certain high-risk populations.

Why is the Asia Pacific region projected to be the fastest-growing market for Sucralfate?

The Asia Pacific region’s rapid growth is attributed to a confluence of factors including vast populations, rising prevalence of GI disorders, significant improvements in healthcare infrastructure and drug accessibility, and favorable cost structures due to the region's strong position as a major manufacturing hub for Sucralfate Active Pharmaceutical Ingredients (API) and generic formulations.

What future technological developments are expected to influence Sucralfate formulation?

Future technological developments focus on advanced drug delivery systems, specifically the creation of optimized oral suspension formulations utilizing advanced colloidal chemistry for better mucosal adhesion, and the development of sustained-release or targeted delivery systems using specialized polymers to minimize systemic aluminum load while maximizing local therapeutic concentration at the ulcer site.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager