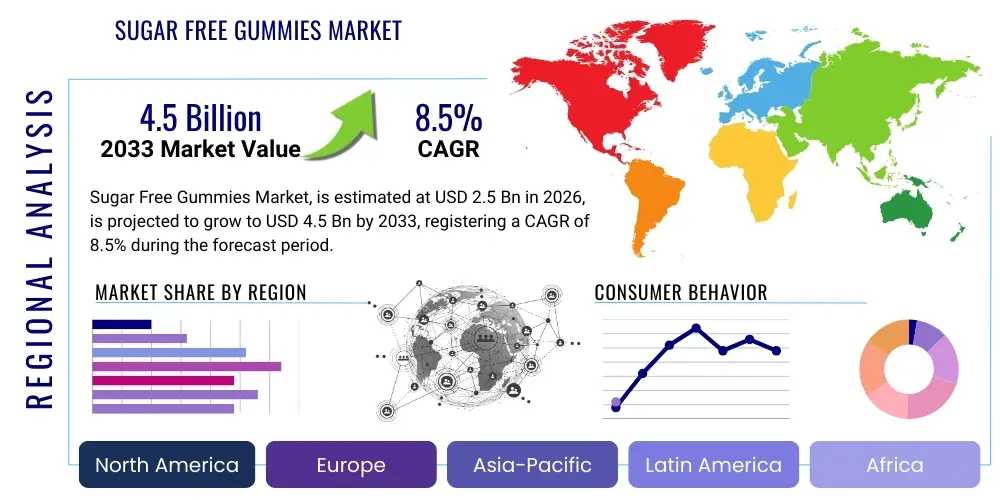

Sugar Free Gummies Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434707 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Sugar Free Gummies Market Size

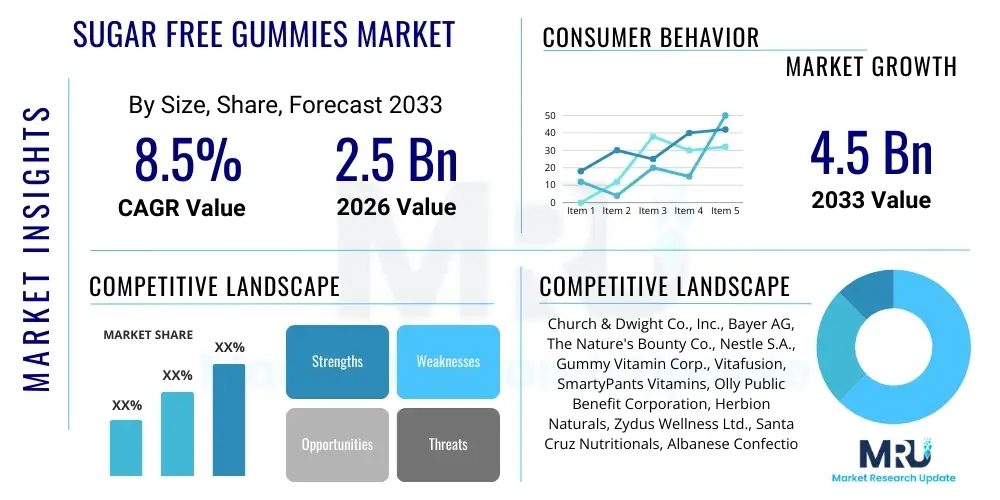

The Sugar Free Gummies Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $2.5 Billion in 2026 and is projected to reach $4.5 Billion by the end of the forecast period in 2033.

Sugar Free Gummies Market introduction

The Sugar Free Gummies Market encompasses dietary supplements and functional confectionery manufactured using non-nutritive sweeteners or sugar alcohols, designed to appeal to health-conscious consumers, diabetics, and those adhering to ketogenic or low-sugar diets. These products offer a palatable alternative to traditional pills and capsules, significantly enhancing user compliance, particularly among pediatric and elderly populations. The market growth is fundamentally driven by the escalating global incidence of lifestyle diseases such as obesity and diabetes, compelling consumers to seek alternatives that minimize sugar intake without compromising on taste or convenience. Furthermore, the expansion of functional ingredients, including vitamins, minerals, probiotics, and increasingly, cannabidiol (CBD), into the gummy format solidifies their position as a versatile and desirable health product.

The core product description revolves around the matrix formulation, primarily utilizing pectin, gelatin, or agar-agar as gelling agents, combined with approved sugar substitutes like Stevia, erythritol, xylitol, or monk fruit extract. Major applications span across daily nutritional supplementation (multivitamins, Vitamin D, Vitamin C), therapeutic uses (sleep aids like melatonin), gut health management (probiotics), and specialized dietary needs (keto supplements). The manufacturing process requires specialized equipment capable of precise dosing and temperature control to ensure stability of the active ingredients while maintaining the desired chewable texture. This technological complexity, especially concerning heat-sensitive ingredients, remains a critical differentiating factor among market players.

The primary benefits driving adoption include enhanced palatability, ease of consumption compared to large tablets, and the perception of a 'treat' that delivers nutritional value. Key driving factors include heightened consumer awareness regarding the negative health implications of excessive sugar consumption, robust marketing efforts positioning gummies as a convenient wellness solution, and continuous innovation in formulation science leading to cleaner label products. Furthermore, the regulatory environment in developed economies, while stringent concerning active ingredient claims, generally supports the use of approved low-calorie sweeteners, accelerating the launch of novel products tailored to specific health outcomes, thus sustaining market expansion.

Sugar Free Gummies Market Executive Summary

The global Sugar Free Gummies Market exhibits robust growth, characterized by significant business trends focused on ingredient purity and diversification across functional categories. A key trend involves the shift towards natural, plant-derived sweeteners such as Stevia and Monk Fruit, driven by consumer scrutiny of artificial ingredients and sugar alcohols. Manufacturers are heavily investing in research and development to stabilize delicate bioactive compounds, particularly probiotics and omega fatty acids, within the gummy matrix without relying on high sugar content. Strategic mergers, acquisitions, and partnerships aimed at securing specialized ingredient supply chains and expanding geographical footprint dominate the competitive landscape, reflecting a consolidation phase geared toward capturing niche health segments, such as personalized nutrition through tailored gummy formulations.

Regionally, North America maintains the leading market share due to high consumer spending on dietary supplements, a well-established regulatory framework, and aggressive marketing by prominent domestic players focusing on high-efficacy formulations, particularly in the CBD and adult vitamin segments. Europe follows, with growth underpinned by increasing consumer adoption of vegan and clean-label products, particularly in Western European countries like Germany and the UK. The Asia Pacific region, however, is projected to demonstrate the highest Compound Annual Growth Rate (CAGR), fueled by rising disposable incomes, rapid urbanization, and growing health awareness, especially in populous nations like China and India, where traditional preventative health measures are merging with modern, convenient supplementation formats.

Segment trends highlight the dominance of the Vitamin and Mineral gummies segment, though specialized segments like Probiotic and Herbal/Botanical gummies are experiencing accelerated growth rates. Within the sweetener segment, Erythritol and Xylitol remain staple choices for texture and bulk, but Stevia and Monk Fruit are gaining traction due to superior perception regarding natural origin and minimal caloric impact. Distribution channel analysis indicates that online retail platforms are rapidly increasing their market penetration, offering consumers wider selection, competitive pricing, and detailed product information, thereby challenging the traditional dominance of physical pharmacies and drug stores. The increasing prevalence of subscription models for recurring gummy purchases further underscores the importance of the e-commerce channel.

AI Impact Analysis on Sugar Free Gummies Market

Common user questions regarding AI's impact on the Sugar Free Gummies Market frequently center on themes of personalized nutrition formulation, efficiency in quality control, and optimized supply chain management. Users often inquire how AI algorithms can analyze individual health data, genetic predispositions, and dietary habits to recommend precise, tailored gummy compositions that maximize therapeutic efficacy while ensuring they remain sugar-free and palatable. Concerns often revolve around the security and privacy of the extensive health data required for such personalization. Furthermore, substantial interest exists in AI's role in predictive failure analysis in manufacturing, optimizing ingredient blending to prevent dosage variability, and using machine learning to forecast consumer demand based on real-time health trends and social media sentiment, thereby minimizing inventory waste and maximizing market responsiveness.

The application of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is poised to revolutionize the Sugar Free Gummies market, primarily by enhancing personalization capabilities and streamlining complex manufacturing processes. AI algorithms can ingest and process vast datasets related to ingredient interaction, stability under various processing conditions, and consumer preference mapping, allowing manufacturers to rapidly iterate on flavor profiles and texture optimization while strictly adhering to sugar-free criteria. This capability reduces the reliance on traditional, time-consuming trial-and-error methods in product development, leading to faster time-to-market for innovative, functional gummy products tailored for specific demographic or health groups, such as enhanced cognitive function or targeted muscle recovery.

Beyond product formulation, AI is transforming operational aspects, specifically in quality assurance and supply chain integrity. Computer vision systems powered by AI are being deployed on production lines to detect minute deviations in gummy shape, color, and size, ensuring uniform product quality far exceeding human inspection capacity. Predictive analytics utilizes historical data combined with external factors (like weather or geopolitical events) to forecast potential supply chain bottlenecks for specialized sugar-free ingredients, ensuring reliable sourcing and stable pricing. This proactive management capability significantly mitigates risks associated with volatile raw material markets and maintains the cost-effectiveness crucial for competitive market positioning in the functional confectionery space.

- AI-driven personalized nutrient recommendation systems based on genomic and metabolomic data.

- Optimization of non-sugar sweetener blending ratios for enhanced flavor masking and stability.

- Predictive maintenance schedules for high-throughput gummy depositing and curing equipment.

- Machine learning models for demand forecasting, optimizing inventory of specialized ingredients like Stevia extracts.

- Automated quality control using computer vision for shape, color, and contaminant detection during packaging.

- Real-time consumer sentiment analysis to identify emerging health trends and guide new product development focused on sugar alternatives.

DRO & Impact Forces Of Sugar Free Gummies Market

The Sugar Free Gummies market dynamics are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the impact forces dictating market trajectory. The primary Driver is the accelerating global shift toward preventative healthcare and the desperate need for sugar reduction, especially in combating the rising tide of type 2 diabetes and pediatric obesity. Opportunities arise from technological advancements in microencapsulation, which permits the inclusion of sensitive ingredients like certain vitamins and probiotics into the gummy format without degradation, broadening the product's functional scope. Conversely, Restraints include the high cost associated with sourcing quality, certified sugar-free natural sweeteners and the technical challenges in achieving mass-market scalability while maintaining stringent clean-label requirements, thereby necessitating premium pricing that limits affordability for lower-income demographics. These forces create a dynamic environment where innovation and regulatory compliance are paramount for sustained competitive advantage.

Specific drivers include regulatory approvals expanding the list of permissible novel sweeteners and functional ingredients, coupled with increasing consumer demand for convenient, enjoyable ways to consume daily supplements. The growing popularity of alternative diets, such as keto and paleo, which strictly limit carbohydrate and sugar intake, further fuels the market by providing a compliant indulgence. However, the market faces significant restraints related to the perception of efficacy; some consumers remain skeptical about the stability and bioavailability of nutrients delivered through gummy supplements compared to traditional pill formats. Furthermore, the risk of overconsumption, particularly by children attracted to the candy-like appearance and taste, poses a regulatory and ethical challenge that manufacturers must continuously address through responsible labeling and packaging design, often increasing regulatory compliance costs.

The convergence of these forces creates a high-impact environment. The opportunity to tap into the burgeoning sports nutrition and mood enhancement segments (e.g., L-theanine or adaptogens in sugar-free formats) provides significant avenues for product diversification and market penetration. The continuous push for "free-from" claims (gluten-free, non-GMO, allergen-free, sugar-free) acts as a powerful lever for premiumization. The most significant impact force remains the necessity for manufacturers to continually invest in research to overcome formulation hurdles, specifically stabilizing heat-sensitive compounds and maintaining the structural integrity of the gummy without relying on conventional sucrose, ensuring that the market trajectory remains upward, contingent upon successful technological adaptation and aggressive consumer education regarding the efficacy of sugar-free delivery systems.

Segmentation Analysis

The Sugar Free Gummies Market is intricately segmented based on Product Type, Sweetener Type, End-User, and Distribution Channel, allowing for granular analysis of consumer preferences and market penetration strategies. Product segmentation provides clarity on the dominant categories, with Vitamin and Mineral supplements currently holding the largest revenue share, reflecting their mass-market appeal for general wellness. However, specialized segments such as CBD, Probiotic, and Functional Botanical gummies are forecast to exhibit superior growth rates, driven by targeted health benefits and the willingness of consumers to invest in specialized dietary needs. Understanding these cross-segment dynamics is crucial for companies aiming to optimize product portfolio management and resource allocation.

Further analysis within the Sweetener Type segmentation reveals a crucial competitive battlefield. While sugar alcohols like Erythritol and Xylitol are cost-effective and provide excellent bulk and texture, the fastest growth is observed in the natural high-intensity sweetener category, dominated by Stevia and Monk Fruit. This trend aligns directly with the overall market shift towards clean-label, plant-derived ingredients perceived as healthier and less likely to cause digestive discomfort associated with excessive consumption of certain sugar alcohols. Manufacturers often employ blended sweetener solutions to achieve optimal taste and texture while mitigating the potential side effects associated with relying too heavily on one single sugar substitute.

The segmentation by End-User—Adults and Children—demonstrates distinct marketing requirements. The Adult segment accounts for the majority of the market value, driven by anti-aging, stress relief, and chronic disease management supplements. The Children's segment, while smaller, is characterized by high parental concern for sugar intake, making sugar-free variants highly desirable for daily vitamins and immune support. The Distribution Channel breakdown emphasizes the accelerating shift towards e-commerce, which offers unparalleled access to niche, specialized sugar-free brands often unavailable in traditional brick-and-mortar stores, optimizing inventory and directly facilitating brand-to-consumer relationships.

- By Product Type:

- Vitamin and Mineral Gummies (e.g., Multivitamins, Vitamin C, Vitamin D, B Complex)

- Probiotic Gummies

- CBD/Hemp Gummies

- Herbal/Botanical Gummies (e.g., Turmeric, Elderberry, Ashwagandha)

- Specialty Supplements (e.g., Melatonin, Collagen, Omega Fatty Acids)

- By Sweetener Type:

- Stevia

- Monk Fruit Extract

- Erythritol

- Xylitol

- Other Sugar Alcohols and Natural Sweeteners (e.g., Allulose, Sorbitol)

- By End-User:

- Adults

- Children

- By Distribution Channel:

- Online Retail (E-commerce, Company Websites)

- Pharmacies and Drug Stores

- Supermarkets and Hypermarkets

- Direct Sales/Other Channels

Value Chain Analysis For Sugar Free Gummies Market

The value chain for the Sugar Free Gummies Market begins with the upstream sourcing and processing of specialized raw materials, primarily focusing on high-quality gelling agents (pectin, gelatin), active pharmaceutical ingredients (APIs) or functional ingredients (vitamins, CBD), and crucially, approved sugar-free sweeteners. Upstream analysis highlights the critical importance of reliable suppliers capable of providing certified organic or naturally derived sweeteners like Stevia and Monk Fruit in stable, concentrated forms, as these ingredients heavily influence the final product's quality and clean-label status. High reliance on specialized extraction and purification technologies for both the functional ingredients and the sweeteners introduces complexity and dictates a significant portion of the production cost, making strategic long-term supplier contracts essential for mitigating price volatility and ensuring quality consistency.

The central phase involves formulation and manufacturing, where significant value addition occurs through specialized processing techniques. This includes precision blending of heat-sensitive active ingredients with the gummy matrix at specific temperatures to ensure bioavailability and potency stability over the product's shelf life. Quality control and regulatory compliance represent major investment areas in this phase, involving rigorous testing for accurate dosing, absence of contaminants, and adherence to sugar-free labeling claims. Midstream activities are characterized by high capital expenditure in sophisticated deposition equipment and climate-controlled curing rooms, demanding specialized technical expertise distinct from traditional confectionery manufacturing.

Downstream activities focus on packaging, marketing, and distribution. The distribution channel is bifurcated into direct sales (e-commerce) and indirect sales (retailers, pharmacies). Direct sales via online platforms offer superior margin control and data collection opportunities, allowing manufacturers to rapidly adjust marketing strategies based on consumer feedback. Indirect channels, while providing broader physical accessibility, require navigating complex retailer agreements and managing shelf-space competition. Efficient logistics, particularly for temperature-sensitive gummy products, are paramount to maintaining product integrity until it reaches the end-user, often utilizing specialized fulfillment centers capable of handling the high-volume, small-unit orders typical of the e-commerce supplement sector.

Sugar Free Gummies Market Potential Customers

The potential customer base for the Sugar Free Gummies Market is broad yet highly segmented, primarily encompassing individuals actively managing their sugar intake or seeking convenient alternatives to traditional supplement forms. The largest demographic comprises health-conscious adults aged 25-55 who are proactive about preventative wellness, seeking daily doses of vitamins, minerals, and specialized functional ingredients (like collagen or adaptogens). This segment is characterized by digital literacy, a willingness to pay a premium for clean-label, naturally sweetened products, and a strong preference for products that fit seamlessly into busy lifestyles, prioritizing ease of consumption and enjoyable sensory attributes over pill efficacy skepticism.

A second crucial segment includes consumers with specific medical conditions, notably individuals diagnosed with Type 1 or Type 2 Diabetes, as well as those with pre-diabetic conditions or severe obesity concerns. For these end-users, the "sugar-free" claim is a mandatory health requirement, and they actively seek supplements that offer functional benefits (e.g., B vitamins for neuropathy, Vitamin D deficiency correction) without spiking blood sugar levels. This segment relies heavily on medical professional recommendations and verified product certifications, making clinical data and low glycemic index certification essential marketing tools for conversion within this safety-conscious demographic.

Furthermore, the market targets parents of young children (pediatric consumers) who struggle with administering vitamins in traditional forms. Parents are primary buyers driven by the dual objective of ensuring nutritional adequacy while minimizing the child's exposure to excessive refined sugars commonly found in many children's supplements. Finally, fitness enthusiasts, athletes, and individuals following specific restrictive diets (Keto, Vegan) constitute a rapidly growing niche, utilizing sugar-free gummies for targeted nutrition like BCAAs, creatine, or specialized weight management formulations, demanding products that align strictly with their high-performance dietary compliance requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.5 Billion |

| Market Forecast in 2033 | $4.5 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Church & Dwight Co., Inc., Bayer AG, The Nature's Bounty Co., Nestle S.A., Gummy Vitamin Corp., Vitafusion, SmartyPants Vitamins, Olly Public Benefit Corporation, Herbion Naturals, Zydus Wellness Ltd., Santa Cruz Nutritionals, Albanese Confectionery Group, Ferrara Candy Company, Better Nutritionals, Procaps Group, Contract Nutra, Boscogen, Inc., Sirio Pharma Co., Ltd., Life Extension, Eurofins Scientific. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sugar Free Gummies Market Key Technology Landscape

The manufacturing of high-quality sugar-free gummies relies heavily on specialized technologies aimed at optimizing texture, taste, and the bio-availability of active ingredients while meticulously excluding traditional sugar. A fundamental technological advancement involves the precise formulation of hydrocolloid systems, primarily utilizing pectin and carrageenan rather than gelatin, especially for vegan formulations, to achieve the desired elasticity and chewiness without compromising heat stability during processing. Crucially, sophisticated vacuum cooking and depositors are employed to minimize moisture content and reduce cooking time, which is essential for protecting heat-sensitive vitamins (like Vitamin C and B-complexes) and ensuring stable encapsulation of functional compounds, thereby maintaining the supplement's declared potency throughout its shelf life, a common challenge in the sugar-free matrix.

Another significant technological focus lies in flavor masking and sweetener synergy. Natural sugar substitutes often present lingering aftertastes or texture differences compared to sucrose. Manufacturers utilize advanced sensory technology and specialized flavor encapsulation techniques to mask the off-notes associated with high-intensity sweeteners like Stevia or Monk Fruit. Furthermore, proprietary blending technologies are employed to combine various sugar alcohols (Erythritol, Xylitol) with high-intensity sweeteners to create synergistic sweetening profiles that closely mimic the mouthfeel and flavor release characteristics of sugar-laden gummies, enhancing consumer acceptance and minimizing the perceived compromise in taste required for sugar reduction.

The operational landscape is being revolutionized by automation and advanced analytical technologies. High-speed, continuous manufacturing lines equipped with robotic handling and precise ingredient injection systems ensure uniformity in dosing, which is paramount for supplement compliance. Quality assurance relies on High-Performance Liquid Chromatography (HPLC) and Mass Spectrometry (MS) to verify the precise concentration of active ingredients and confirm the total absence of residual sugar, fulfilling strict regulatory and labeling requirements. Emerging technologies also include 3D printing or additive manufacturing techniques, offering future possibilities for producing complex, multi-layered gummies with customized ingredient release profiles tailored for highly personalized nutritional interventions, although this remains primarily in the developmental phase for mass production.

Regional Highlights

The Sugar Free Gummies Market exhibits distinct regional consumption patterns and growth drivers, making regional analysis vital for targeted market entry strategies. North America, encompassing the United States and Canada, currently holds the largest market share. This dominance is attributed to a high consumer awareness of health and wellness, extensive consumption of dietary supplements, and an advanced regulatory infrastructure that supports the commercialization of novel sugar alternatives and functional ingredients, including the rapidly expanding market for hemp-derived CBD gummies. The region benefits from a high concentration of key market players who invest heavily in innovative formulations and aggressive digital marketing campaigns, solidifying its position as the primary trendsetter in product development and consumer uptake.

Europe represents the second-largest market, characterized by strong demand for natural, vegan, and clean-label products, particularly in Western Europe (Germany, UK, France). The European market is highly regulated by the European Food Safety Authority (EFSA), leading to a preference for well-established, scientifically backed ingredients and sugar substitutes. While growth is steady, it is moderated by stricter novel food regulations concerning certain ingredients, particularly specialized CBD derivatives, compared to the US. Nevertheless, the increasing consumer focus on immunity support and mental health supplements, delivered conveniently via sugar-free formats, ensures sustained, high-value growth throughout the forecast period, driven by consumer willingness to pay a premium for certified organic and allergen-free options.

Asia Pacific (APAC) is projected to be the fastest-growing region, driven by rapid economic development, rising disposable incomes, and the increasing westernization of diets leading to a surge in lifestyle diseases like diabetes and cardiovascular issues. Countries like China, India, and Japan are witnessing a transformation in consumer attitudes towards preventative healthcare. While the market base is currently smaller than in the West, localized manufacturing capabilities are rapidly improving, and international players are forming partnerships to navigate complex regional distribution channels and varied consumer tastes. The demand in APAC is particularly strong for beauty-from-within gummies (e.g., collagen, biotin) and traditional Chinese medicine (TCM) ingredients encapsulated in modern, sugar-free gummy forms, demonstrating high potential for future revenue generation.

- North America: Market leader, driven by high per capita supplement expenditure, advanced CBD market penetration, and strong e-commerce presence.

- Europe: Second largest market, characterized by strong demand for vegan and clean-label formulations and stringent regulatory oversight (EFSA).

- Asia Pacific (APAC): Highest projected growth rate, fueled by rising health awareness, increasing disposable income, and demand for functional beauty and wellness supplements in urban centers.

- Latin America (LATAM): Emerging market with increasing penetration, focused on basic vitamin supplementation; growth constrained by economic volatility and nascent regulatory frameworks.

- Middle East and Africa (MEA): Growth driven by expanding healthcare infrastructure and rising prevalence of diabetes, leading to high demand for medically essential sugar-free alternatives, concentrated in the Gulf Cooperation Council (GCC) countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sugar Free Gummies Market.- Church & Dwight Co., Inc.

- Bayer AG

- The Nature's Bounty Co.

- Nestle S.A.

- Gummy Vitamin Corp.

- Vitafusion

- SmartyPants Vitamins

- Olly Public Benefit Corporation

- Herbion Naturals

- Zydus Wellness Ltd.

- Santa Cruz Nutritionals

- Albanese Confectionery Group

- Ferrara Candy Company

- Better Nutritionals

- Procaps Group

- Contract Nutra

- Boscogen, Inc.

- Sirio Pharma Co., Ltd.

- Life Extension

- Eurofins Scientific

Frequently Asked Questions

Analyze common user questions about the Sugar Free Gummies market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between sugar-free gummies and regular gummies in terms of ingredients?

The primary difference lies in the sweetener used. Regular gummies rely on high levels of sucrose, corn syrup, or glucose, whereas sugar-free variants substitute these with non-nutritive sweeteners (NNS) like Stevia, Monk Fruit, or sugar alcohols such as Erythritol or Xylitol, significantly reducing calorie content and glycemic impact.

Are sugar-free gummies safe for individuals with diabetes, and how should they be consumed?

Sugar-free gummies are generally safe for diabetics as they typically have a low glycemic index, preventing sharp blood sugar spikes. However, they must be consumed in moderation, and individuals should check the label for total carbohydrate content (especially sugar alcohols) and consult a healthcare provider, as individual tolerance can vary.

What are the current key technological challenges in manufacturing sugar-free supplements?

Key challenges involve stabilizing heat-sensitive functional ingredients (like certain vitamins and probiotics) within the gummy matrix during processing, effectively masking the often-bitter aftertaste of natural high-intensity sweeteners, and ensuring consistent texture and potency stability without relying on traditional sugar as a structural component.

Which sugar-free sweetener type is gaining the most consumer popularity in this market?

Natural, plant-derived sweeteners, specifically Monk Fruit extract and Stevia, are rapidly gaining popularity due to their zero-calorie nature, high intensity, and favorable consumer perception compared to artificial sweeteners or synthetic sugar alcohols, aligning with the clean-label trend.

How is the growth of e-commerce impacting the distribution landscape for sugar-free gummies?

E-commerce is revolutionizing distribution by providing direct-to-consumer access, facilitating subscription models, enabling specialized niche brands (e.g., personalized nutrition) to bypass traditional retail barriers, and offering consumers detailed ingredient transparency and competitive pricing, significantly increasing market reach.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager