Sugarcane Bagasse Based Disposable Tableware Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438299 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Sugarcane Bagasse Based Disposable Tableware Market Size

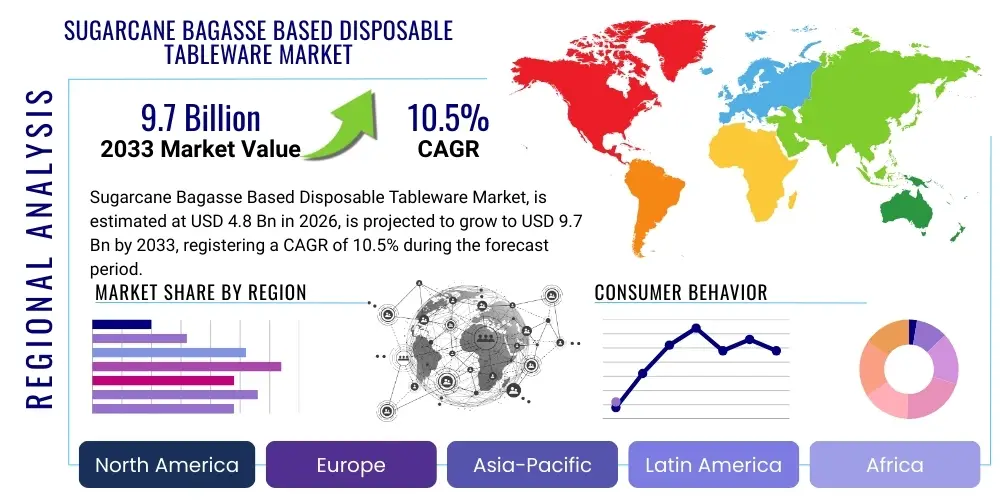

The Sugarcane Bagasse Based Disposable Tableware Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 9.7 Billion by the end of the forecast period in 2033.

Sugarcane Bagasse Based Disposable Tableware Market introduction

The Sugarcane Bagasse Based Disposable Tableware Market encompasses the production and distribution of disposable plates, bowls, cups, and cutlery manufactured using bagasse, a fibrous residue remaining after sugarcane stalks are crushed to extract juice. This market segment has emerged as a critical component of the global effort toward sustainability, offering a biodegradable and compostable alternative to conventional plastic and Styrofoam disposables. The core product, derived from an abundant agricultural waste product, effectively addresses environmental concerns related to landfill accumulation and plastic pollution, driving adoption across diverse end-use sectors including foodservice, institutional catering, and household consumption. The inherent strength, heat resistance, and grease resistance of bagasse products further enhance their commercial viability, positioning them as a premium sustainable option in fast-paced catering environments.

The major applications for bagasse-based tableware span quick-service restaurants (QSRs), full-service dining establishments focusing on takeout and delivery, corporate cafeterias, and large-scale public events where single-use items are necessitated by hygiene and convenience requirements. The rapid expansion of the food delivery ecosystem globally is a significant application driver, as consumers increasingly demand sustainable packaging solutions accompanying their delivered meals. Furthermore, governmental mandates, particularly in Europe, North America, and parts of Asia Pacific, banning or restricting single-use plastics accelerate the transition towards fiber-based alternatives like sugarcane bagasse. The versatility of bagasse allows for the manufacturing of a wide array of products, from deep bowls suitable for hot soups to compartmentalized trays for meal kits, ensuring broad market applicability and fueling consistent demand growth.

The primary benefits fueling the market’s growth include its superior environmental profile—being 100% compostable within 90 days in commercial composting facilities—and its derivation from a renewable, annually harvested resource that minimizes the use of virgin wood pulp or fossil fuels. Driving factors are multifaceted, centered around escalating consumer awareness regarding ecological footprints, proactive corporate sustainability initiatives (ESG goals), and favorable legislative frameworks that penalize plastic use while incentivizing bio-based solutions. The continuous technological advancements in molding and processing techniques are also contributing, leading to enhanced product durability and a reduction in manufacturing costs, making bagasse tableware increasingly competitive against traditional disposables in terms of pricing and performance.

Sugarcane Bagasse Based Disposable Tableware Market Executive Summary

The Sugarcane Bagasse Based Disposable Tableware Market is experiencing robust acceleration, characterized by decisive shifts toward sustainable business models and reinforced by stringent global regulatory landscapes targeting plastic waste. Business trends reveal a strong emphasis on capacity expansion and vertical integration among major manufacturers, particularly those seeking to secure stable access to bagasse pulp supply chains near sugar processing hubs in regions such as Southeast Asia and Latin America. The market is also seeing increased merger and acquisition activity as large packaging conglomerates seek to incorporate advanced bio-based material technologies into their portfolios, thereby scaling production capabilities and broadening product diversification. Innovation is concentrated on improving moisture barrier properties and product aesthetics, aiming to provide solutions that not only meet sustainability metrics but also offer a premium user experience comparable to high-quality conventional tableware, especially crucial for high-end catering applications and specialized food services.

Regional trends indicate that Europe and North America currently dominate in terms of value, driven by high consumer spending on sustainable products and the early implementation of sweeping plastic bans, such as the EU Single-Use Plastics Directive. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate (CAGR) due to rapid urbanization, burgeoning foodservice sectors, and the concurrent development of large-scale sugar processing industries, providing both demand and a localized raw material source. Countries like India and China, major sugar producers, are increasingly leveraging their abundant bagasse residue for domestic tableware manufacturing, creating a cost-effective localized supply chain that bypasses the logistical costs associated with international trade of bulky finished goods. Conversely, the market penetration in emerging economies remains contingent on establishing adequate composting infrastructure and overcoming initial cost parity challenges compared to inexpensive traditional plastics.

Segmentation trends highlight that the Commercial Application segment, specifically catering and QSRs, remains the largest revenue generator, driven by high volume usage and regulatory compliance mandates impacting businesses first. Within product type, plates and bowls collectively account for the majority share due to their necessity in almost all meal serving scenarios, while the cutlery segment is showing significant technological advancements in material strength to effectively replace plastic alternatives. The B2B distribution channel dominates the market landscape as manufacturers primarily supply directly to foodservice distributors, large restaurant chains, and institutional buyers. A crucial segment trend involves the increasing demand for customizable and branded bagasse tableware, allowing businesses to enhance their corporate social responsibility (CSR) image and differentiate themselves in highly competitive hospitality and retail environments.

AI Impact Analysis on Sugarcane Bagasse Based Disposable Tableware Market

User inquiries regarding AI's influence in the sugarcane bagasse tableware sector often revolve around optimizing the complex global supply chain, enhancing manufacturing efficiency, and predicting volatile raw material pricing. Key themes include the use of predictive analytics for securing bagasse feedstock—which is a seasonal agricultural byproduct—and minimizing waste in the thermoforming and molding processes. Users are concerned about how AI can handle quality control for natural fiber products, which exhibit variability, ensuring consistency in product strength and structure. Expectations focus on AI-driven market demand forecasting, especially in response to rapidly changing regulatory environments and consumer preferences for specific eco-friendly certifications. Furthermore, there is significant interest in how machine learning can accelerate material science innovation, potentially optimizing the formulations of bio-based coatings used to enhance water and grease resistance without compromising compostability standards.

The application of Artificial Intelligence is fundamentally transforming the operational efficiency and strategic planning within the bagasse tableware industry, moving beyond simple automation into complex resource management. AI algorithms are being deployed to analyze real-time data from sugar mills and pulp processing plants to optimize the logistics of bagasse transport, minimizing spoilage and maximizing yield, thereby stabilizing the highly variable cost of raw materials. In manufacturing, machine learning is employed for sophisticated process control, adjusting molding temperatures, pressure, and cure times instantaneously based on the fiber consistency batch characteristics, leading to a substantial reduction in defects and energy consumption per unit. This level of precision is crucial for achieving high-volume production while maintaining the demanding quality specifications required for commercial foodservice use.

Furthermore, AI-driven demand forecasting tools are essential for managing inventory and production schedules in a market sensitive to abrupt policy changes and seasonal demand spikes, such as major events or holiday periods. By analyzing historical sales data, social media sentiment related to environmental issues, and emerging legislative proposals, AI provides manufacturers with accurate projections, enabling just-in-time production planning and reducing inventory holding costs. In marketing and distribution, AI enhances segmentation by identifying businesses (e.g., specific QSR chains or large institutional buyers) most likely to adopt sustainable packaging based on their reported ESG performance, accelerating targeted B2B sales efforts and refining pricing strategies based on regional competitive intensity and environmental taxation models.

- AI optimizes bagasse pulp procurement logistics by predicting seasonal availability and supply bottlenecks.

- Machine learning algorithms enhance manufacturing quality control, detecting subtle structural defects during high-speed molding processes.

- Predictive maintenance schedules are generated by AI to minimize downtime for heavy-duty thermoforming machinery.

- AI-driven consumer insights forecast regional demand peaks influenced by governmental plastic bans and high-profile environmental campaigns.

- Advanced robotics guided by AI systems handle intricate post-molding trimming and packaging, improving operational safety and precision.

- Data analytics optimize energy consumption in drying and pressing stages, crucial for reducing the manufacturing carbon footprint.

DRO & Impact Forces Of Sugarcane Bagasse Based Disposable Tableware Market

The market for Sugarcane Bagasse Based Disposable Tableware is shaped by a confluence of powerful Drivers, Restraints, Opportunities, and external Impact Forces. The primary Driver is the overwhelming global momentum toward sustainability, specifically the legislative crackdown on conventional single-use plastics across major economies. This mandates that businesses, particularly in the foodservice sector, immediately transition to viable alternatives, positioning bagasse products as a preferred substitute due to their natural origins and certified compostability. Coupled with this is the escalating consumer pressure and corporate adoption of rigorous ESG (Environmental, Social, and Governance) commitments, which favor materials derived from agricultural waste, thereby turning a waste stream (bagasse) into a valuable resource.

However, significant Restraints persist, primarily the persistent price gap between bagasse tableware and cheaper, subsidized conventional plastic or even paper products in specific emerging markets. The cost structure of bagasse involves energy-intensive manufacturing processes and specialized logistics for securing the raw material from sugar mills, often resulting in higher unit costs. A further restraint is the lack of widespread and standardized composting infrastructure globally; if the products are incorrectly disposed of in landfills, their core environmental benefit is negated, leading to consumer confusion and skepticism regarding their true ecological advantage. Additionally, ensuring consistent product performance, especially barrier properties against liquids and grease, requires specialized, often proprietary, compostable coatings, adding complexity and cost.

The primary Opportunities lie in technological innovation, specifically the development of improved processing techniques that increase efficiency and reduce manufacturing costs, achieving better price parity with traditional materials. Expansion into untapped institutional sectors, such as defense, mass transit catering, and developing economies with high agricultural output (like Brazil and Thailand), presents vast growth avenues. Furthermore, the development of integrated supply chains where sugar mills co-locate processing facilities for bagasse pulp and finished tableware will drastically reduce logistical costs and enhance supply stability. Impact forces, such as fluctuating global sugar prices (which influence bagasse availability and cost) and evolving international trade regulations regarding bio-based materials, continually shape the market landscape, requiring manufacturers to maintain highly agile and responsive supply chain management strategies.

Segmentation Analysis

The Sugarcane Bagasse Based Disposable Tableware Market is comprehensively segmented across product type, application, and distribution channel, providing a granular view of demand patterns and competitive intensity within different market niches. The segmentation analysis is critical for manufacturers tailoring their production capacity and marketing efforts, allowing them to focus on high-growth areas, such as specialized catering applications requiring aesthetic and durable solutions, or volume-driven markets like institutional dining where cost efficiency is paramount. Understanding the interplay between these segments is vital, particularly in optimizing supply chain delivery mechanisms, differentiating between high-volume B2B institutional orders and lower-volume, higher-margin B2C retail sales.

The Product Type segmentation—including plates, bowls, cups, and cutlery—reflects varying technical challenges; for instance, manufacturing reliable, strong cutlery presents a far greater challenge than molding simple plates. The Application segmentation differentiates between the scale and requirements of usage; commercial applications demand resistance to hot oils and sauces suitable for QSR use, whereas institutional settings prioritize durability and bulk volume pricing. The Distribution Channel segmentation highlights the dominance of direct manufacturer-to-distributor relationships (B2B), a characteristic typical of markets driven by large commercial buyers who necessitate bulk purchasing and customized order fulfillment to meet their operational needs efficiently.

- By Product Type:

- Plates (Dinner Plates, Side Plates, Compartmentalized Plates)

- Bowls (Soup Bowls, Salad Bowls, Dessert Bowls)

- Cups and Lids (Hot Beverage Cups, Cold Cups)

- Trays and Containers (Clamshell Containers, Meal Trays, Food Boxes)

- Cutlery (Forks, Knives, Spoons)

- By Application:

- Commercial (Restaurants, Hotels, Quick Service Restaurants (QSRs), Catering Services)

- Institutional (Schools, Hospitals, Corporate Cafeterias, Government Facilities)

- Household and Events (Parties, Picnic Events, Personal Use)

- By Distribution Channel:

- Business to Business (B2B) (Direct Sales to Distributors, Foodservice Providers, Institutions)

- Business to Consumer (B2C) (Supermarkets/Hypermarkets, Online Retail, Specialty Stores)

Value Chain Analysis For Sugarcane Bagasse Based Disposable Tableware Market

The value chain for sugarcane bagasse based disposable tableware is unique, starting with the agricultural waste material and transitioning through specialized industrial processing before reaching the consumer. The upstream analysis begins with the sugarcane harvest and milling process. Bagasse is a byproduct generated in enormous volumes at sugar mills globally. Efficiency at this stage is crucial, focusing on immediate collection and proper storage of the bagasse residue to prevent microbial degradation and maintain fiber quality suitable for pulping. This raw bagasse is then transferred to specialized pulp mills where it undergoes chemical or mechanical pulping processes to create a fine, homogenized pulp fiber. Securing long-term, stable contracts with sugar mills is the foundation of supply chain resilience, mitigating seasonal risks and price volatility associated with this agricultural derivative.

The midstream component involves the manufacturing phase, where the bagasse pulp is mixed with water and binding agents (often natural starches) and then subject to high-pressure, high-temperature thermoforming or wet-press molding techniques. This phase requires significant capital investment in highly efficient machinery. A critical step is the application of specialized coatings—usually compostable PLA or proprietary bio-polymers—to impart necessary water and oil resistance, ensuring the tableware performs adequately for hot and greasy food applications. Quality control during manufacturing is paramount, ensuring structural integrity, particularly for complex shapes like cutlery and clamshell containers, which must withstand handling and transportation stresses.

The downstream analysis focuses on distribution channels, which are predominantly B2B. Direct distribution involves manufacturers supplying large foodservice management companies, national restaurant chains, or institutional bodies directly. Indirect distribution relies heavily on foodservice distributors and bulk packaging wholesalers who manage regional inventory and supply smaller, independent QSRs, hotels, and event organizers. The B2C channel, though smaller, uses supermarkets, hypermarkets, and increasingly, e-commerce platforms, requiring different packaging and logistics, typically focused on smaller consumer packs. Success in the downstream market is increasingly tied to effective branding, demonstrating third-party composting certifications (such as BPI or DIN Certco), and ensuring reliable, high-volume order fulfillment across geographically dispersed markets.

Sugarcane Bagasse Based Disposable Tableware Market Potential Customers

The potential customer base for Sugarcane Bagasse Based Disposable Tableware is broad and rapidly expanding, driven by regulatory compliance and corporate environmental mandates. The primary end-users are within the commercial foodservice sector, particularly quick-service restaurants (QSRs) and full-service restaurants transitioning to delivery and takeout models. These customers require high volumes of cost-effective, durable packaging that meets municipal compostability standards and aligns with their brand’s sustainability message. Major fast-food chains represent significant buying power, often necessitating customized product designs and dedicated supply agreements to ensure consistency across vast franchise networks and geographical regions where plastic bans are unevenly enforced.

Institutional buyers constitute another major segment. This includes hospitals, educational systems (universities and primary schools), and large corporate cafeterias that cater to thousands of meals daily. These customers prioritize hygiene, bulk pricing, and regulatory adherence, especially concerning safe food handling standards. For institutions, the decision to adopt bagasse is often budget-driven but also increasingly influenced by government procurement policies that favor sustainable and domestically sourced products. Their demand profile tends to be highly consistent, making them reliable long-term partners for manufacturers capable of fulfilling large, scheduled orders.

A rapidly growing customer segment comprises event organizers, music festivals, sports venues, and large-scale convention centers. These environments typically generate massive amounts of disposable waste over short periods, making certified compostable solutions essential for minimizing environmental impact and complying with venue-specific sustainability policies. Furthermore, the retail market—consumers purchasing for home use, picnics, and private parties—is expanding, especially in affluent regions where consumers willingly pay a premium for eco-friendly products. These buyers interact mostly through the B2C distribution channels, where product aesthetics and clear environmental labeling are critical purchase motivators.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 9.7 Billion |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Pactiv Evergreen, Huhtamaki, Dart Container, BioPak, Eco-Products (Novolex), World Centric, Reynolds Group Holdings, Vegware, Genpak, Good Start Packaging, Greenvale, Nature's Packaging, Guangzhou Greenhome, Chukwudum, Biodegradable Food Service, Biji-Pak, CKF Inc., PulpWorks, Eco-gecko Products, Harwal Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sugarcane Bagasse Based Disposable Tableware Market Key Technology Landscape

The technological landscape of the Sugarcane Bagasse Based Disposable Tableware Market is defined by continuous innovation focused on two primary areas: optimizing the conversion of raw bagasse fiber into high-quality pulp and improving the functional performance of the finished products, specifically concerning moisture and grease barriers. The standard production method relies heavily on wet-press molding and high-heat thermoforming techniques, adapted from the traditional molded fiber industry. Recent advancements involve sophisticated hydraulic presses and precision tooling that enable the creation of deeper, more intricate shapes with uniform wall thickness and density, crucial for products like complex clamshell containers that require robust hinge mechanisms and secure closing features. Automation using advanced sensor technology ensures that the precise amount of slurry is used, minimizing material waste and maximizing the dimensional stability of the final product, addressing a key challenge associated with using natural, variable fibers.

A major focus of technological research is the formulation and application of functional barrier coatings. Since bagasse pulp is naturally porous, an effective barrier is necessary for hot, liquid, and greasy foods. Traditional solutions often included fluorochemicals (PFAS), which are now subject to increasing regulatory scrutiny and phase-outs globally due to environmental and health concerns. The current technological breakthrough involves utilizing proprietary plant-based biopolymers, often starch-derived or PLA (Polylactic Acid) coatings, applied via advanced spraying or dipping methods that ensure thin, uniform coverage without hindering the underlying material's compostability. Companies are investing heavily in patented coating technologies that offer superior performance against 212°F boiling water and hot oil penetration, ensuring the structural integrity of the tableware for delivery and consumption.

Furthermore, the industry is exploring nanocellulose and microfibrillated cellulose (MFC) derived from bagasse itself. By incorporating these highly refined fibers into the pulp mixture, manufacturers aim to increase the natural strength and barrier properties of the molded product intrinsically, reducing the reliance on external coatings altogether. This approach improves the material's structural rigidity and wet strength, making it suitable for cutlery and heavy-duty trays. Digitization and the integration of the Industrial Internet of Things (IIoT) are also becoming critical, enabling real-time monitoring of energy consumption across the pulp drying and molding cycles, which are substantial energy users. This technological evolution not only improves product quality and performance but also significantly reduces the overall manufacturing carbon footprint, reinforcing the core sustainability proposition of bagasse tableware in the competitive bio-based materials market.

Regional Highlights

The global market for Sugarcane Bagasse Based Disposable Tableware exhibits highly differentiated growth patterns influenced by regional regulatory environments, local sugar industry maturity, and consumer purchasing power. North America, particularly the US and Canada, represents a high-value market segment. This dominance is attributed to early and widespread municipal bans on specific single-use plastic items, such as foam containers and plastic straws, especially in coastal states and major metropolitan areas. Consumer demand for certified compostable products is strong, supported by high disposable incomes and robust corporate sustainability commitments within the hospitality and quick-service restaurant sectors. The region often imports finished bagasse products from low-cost manufacturing hubs in Asia, though domestic production capacity is steadily growing.

Europe stands out due to the rigorous enforcement of the EU Single-Use Plastics Directive, which has dramatically accelerated the transition away from conventional plastics across all 27 member states. Countries like Germany, France, and the UK are primary adopters, benefiting from relatively well-established industrial composting infrastructures necessary to realize the compostability benefit of bagasse. The European market demands products that meet strict environmental certifications (like TÜV Austria's OK Compost standards) and tends to prioritize aesthetic quality and premium design features suitable for high-end catering and institutional food service. The high degree of regulatory certainty in Europe provides a stable investment environment for manufacturers focusing on sustainable material technology.

Asia Pacific (APAC) is positioned as the epicenter of future growth, primarily driven by the massive concentration of the global sugar industry and rapid urbanization fueling immense demand for disposable foodservice ware. Nations like China, India, and Thailand are both significant producers of sugarcane and increasingly large consumers of disposable products. The key differentiator in APAC is the localized supply chain; manufacturers can source bagasse pulp cheaply and locally, keeping production costs low. While regulatory adoption varies significantly—from comprehensive plastic bans in parts of India to more nascent policies in Southeast Asia—the sheer scale of population and the explosive growth in food delivery services ensure APAC will lead volume growth throughout the forecast period. Latin America, particularly Brazil, is also gaining momentum, leveraging its massive domestic sugarcane industry to establish regional manufacturing hubs for bagasse packaging.

- North America: High regulatory pressure (state/city plastic bans) and strong consumer willingness to pay for certified compostable alternatives drive market value. Focus on BPI certification and institutional adoption (universities, corporate campuses).

- Europe: Driven by the strict enforcement of the EU Single-Use Plastics Directive and stringent environmental certification requirements. Emphasis on premiumization and technological advancements in barrier coatings.

- Asia Pacific (APAC): Expected to show the highest volume growth due to localized raw material availability (sugar mills), rapid expansion of foodservice sectors, and emerging national-level plastic regulations (e.g., India's push against single-use plastics).

- Latin America (LATAM): Growth fueled by local sugar production giants, especially Brazil and Mexico, creating a robust domestic supply base and favorable export potential to North America.

- Middle East and Africa (MEA): Emerging market, constrained by initial infrastructure investment but showing strong potential in regions prioritizing tourism sustainability (e.g., UAE, Saudi Arabia) and leveraging agricultural waste resources.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sugarcane Bagasse Based Disposable Tableware Market.- Pactiv Evergreen Inc.

- Huhtamaki Oyj

- Dart Container Corporation

- BioPak (A member of Duni Group)

- Eco-Products (A Novolex Company)

- World Centric

- Reynolds Group Holdings Limited

- Vegware Ltd.

- Genpak LLC

- Good Start Packaging

- Greenvale (part of the Green Future Group)

- Nature's Packaging Inc.

- Guangzhou Greenhome Co., Ltd.

- Chukwudum International Co., Ltd.

- Biodegradable Food Service (BFS)

- Biji-Pak Manufacturing Sdn Bhd

- CKF Inc.

- PulpWorks Inc.

- Eco-gecko Products Inc.

- Harwal Group (Falcon Pack)

Frequently Asked Questions

Analyze common user questions about the Sugarcane Bagasse Based Disposable Tableware market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary performance advantages of bagasse tableware over standard paper or plastic?

Bagasse tableware offers superior heat resistance, making it ideal for hot foods and microwave use, a feature often lacking in standard paper products. Structurally, it is far more rigid and durable than foam or most plastic disposables, minimizing warping and leakage, and crucially, it is 100% compostable, providing a clear environmental benefit over petroleum-based plastics.

How is the cost of bagasse tableware compared to conventional disposable plastics, and why is there a price difference?

Bagasse tableware typically carries a higher unit cost (ranging from 15% to 40% more) than mass-produced conventional plastics due to the energy-intensive processing required for pulping and molding the natural fibers, the specialized nature of compostable barrier coatings, and the necessity for sourcing bagasse pulp rather than inexpensive fossil fuel derivatives. However, the price gap is narrowing as economies of scale improve.

Are sugarcane bagasse products truly biodegradable and compostable, and what certifications should I look for?

Yes, genuine sugarcane bagasse tableware is fully biodegradable and certified compostable. Key certifications to look for include the Biodegradable Products Institute (BPI) in North America, TÜV Austria’s OK Compost (Industrial or Home), and the European standard EN 13432. These certifications verify that the product breaks down into natural elements under specific composting conditions within a defined timeframe (usually 90-180 days).

What is the impact of global plastic bans, such as the EU SUP Directive, on the future growth of the bagasse market?

Global and regional plastic bans, especially the stringent EU Single-Use Plastics (SUP) Directive, serve as the single most powerful driver for the bagasse market. These regulations create a mandatory transition away from prohibited items (like foam containers), generating instant, immense demand for certified fiber-based alternatives, thereby ensuring sustained high growth and encouraging investment in manufacturing capacity.

Where does the raw material (bagasse) come from, and is its supply stable?

Bagasse is the fibrous residue left after sugarcane stalks are crushed for juice extraction. It is an abundant agricultural waste product, ensuring stable supply primarily linked to the global sugar production cycle. While availability is seasonal, large manufacturers mitigate instability through inventory management and sourcing strategically from major sugar-producing regions in Asia Pacific and Latin America, where the raw material is plentiful.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager