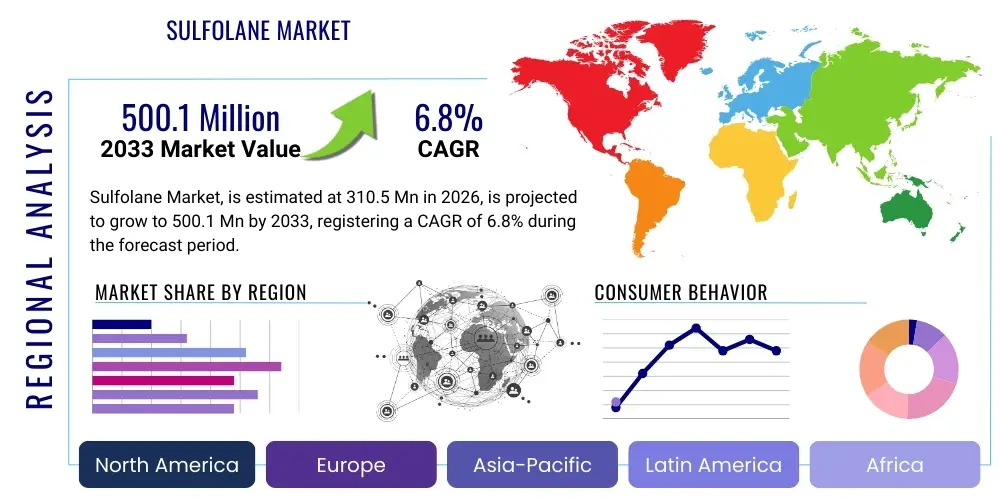

Sulfolane Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439743 | Date : Jan, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Sulfolane Market Size

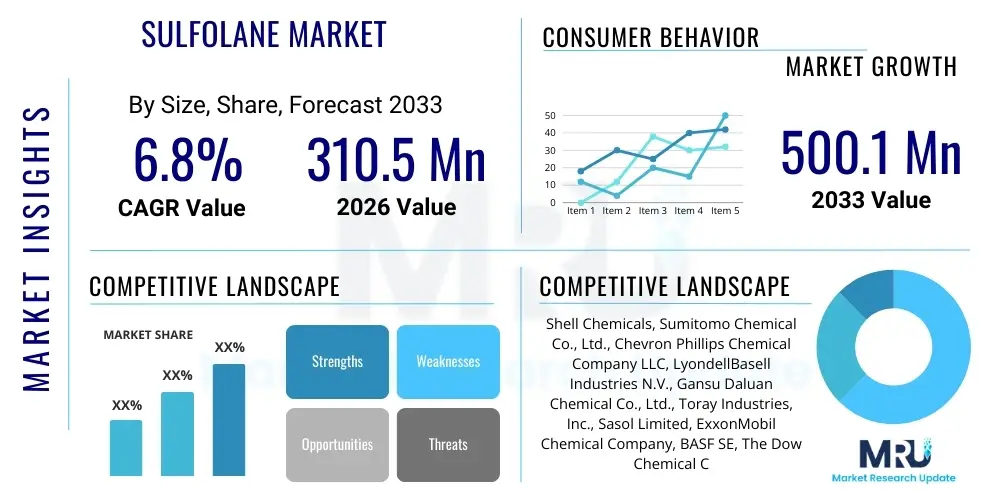

The Sulfolane Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 310.5 Million in 2026 and is projected to reach USD 500.1 Million by the end of the forecast period in 2033.

Sulfolane Market introduction

The Sulfolane Market is characterized by the widespread utility of sulfolane, a powerful polar aprotic solvent, primarily in industrial applications requiring high selectivity and thermal stability. Sulfolane, a cyclic sulfone, is renowned for its exceptional solvency, high boiling point, low toxicity, and thermal stability, making it an indispensable compound in various critical processes. Its primary synthesis pathways typically involve the reaction of butadiene with sulfur dioxide, followed by hydrogenation to achieve the desired saturated cyclic structure. The product description emphasizes its colorless, odorless, and highly stable nature, distinguishing it from many conventional solvents. Major applications are predominantly found in the oil and gas industry for gas sweetening, where it effectively removes hydrogen sulfide and carbon dioxide from natural gas streams, thereby preventing pipeline corrosion and enhancing fuel quality. Furthermore, it is extensively utilized in the petrochemical sector for the extractive distillation of aromatic compounds, such as benzene, toluene, and xylene (BTX), from reformer effluents, significantly improving product purity and process efficiency. Beyond these core applications, sulfolane also serves as a reaction solvent in the production of specialty chemicals, pharmaceuticals, and agricultural chemicals, where its unique properties facilitate challenging syntheses and purification steps. The benefits associated with sulfolane include its high efficiency in separating desired components, its recyclability which contributes to operational cost savings and environmental sustainability, and its overall reliability in demanding industrial environments. Driving factors for market expansion are multifaceted, stemming from increasing global demand for cleaner fuels and high-purity petrochemicals, stringent environmental regulations mandating reduced sulfur content in fuels, and the continuous expansion of natural gas infrastructure worldwide. The petrochemical industry's growth, particularly in Asia-Pacific, further amplifies the demand for sulfolane in BTX extraction processes, underscoring its pivotal role in modern industrial chemistry.

Sulfolane Market Executive Summary

The Sulfolane Market's executive summary reveals a dynamic landscape influenced by several overarching business trends, distinct regional developments, and nuanced segmental growth patterns. From a business trends perspective, the market is experiencing a significant push towards enhanced process efficiency and sustainability, driving innovations in sulfolane recovery and regeneration technologies, which not only reduce operational costs but also minimize environmental impact. There is a growing emphasis on optimizing solvent consumption and extending its lifecycle, leading to increased adoption of advanced filtration and purification systems within end-use industries. Consolidation among key players and strategic collaborations aimed at expanding production capacities or improving supply chain resilience are also notable trends. Furthermore, the market is witnessing a shift towards higher purity grades of sulfolane to meet the demanding specifications of specialized applications in pharmaceuticals and electronics, indicating a premiumization trend. Regional trends highlight Asia-Pacific as the unequivocal growth engine, primarily fueled by rapid industrialization, burgeoning petrochemical complexes, and escalating energy demands in countries like China, India, and Southeast Asian nations. North America continues to be a robust market, largely due to the sustained growth in shale gas production and associated gas sweetening requirements, alongside substantial investments in refining and petrochemical capacities. Europe, while a mature market, exhibits steady demand driven by strict environmental regulations and the need for high-quality fuels and chemical intermediates. Latin America, the Middle East, and Africa are emerging as significant growth pockets, propelled by new upstream oil and gas projects and expanding refining capabilities. Segment trends underscore the dominance of the gas sweetening application due to the continuous global demand for natural gas and the necessity for its purification. The BTX extraction segment also demonstrates strong growth, intrinsically linked to the expanding automotive and plastics industries. Technical grade sulfolane maintains its largest share, but high-purity grades are experiencing faster growth rates, reflecting the increasing sophistication of end-use applications. Overall, the market is poised for sustained growth, underpinned by fundamental industrial necessities and technological advancements.

AI Impact Analysis on Sulfolane Market

User questions regarding the impact of AI on the Sulfolane Market often revolve around how artificial intelligence can optimize production processes, improve supply chain efficiency, enhance product quality, and accelerate research and development of new solvent technologies. Common themes include the potential for AI-driven predictive maintenance to reduce downtime in sulfolane production plants, the application of machine learning algorithms for optimizing solvent regeneration and recovery, and the role of AI in analyzing complex chemical reactions to develop more efficient sulfolane derivatives or alternative solvents. Concerns frequently arise about the initial investment required for AI integration, the availability of skilled personnel, and data privacy issues associated with collecting and analyzing proprietary process data. Expectations are high for AI to bring about a new era of precision in chemical manufacturing, leading to significant cost reductions, improved safety, and faster innovation cycles within the sulfolane ecosystem. The integration of AI is expected to transform operations from raw material sourcing to end-use application, offering unprecedented levels of control and insight.

- AI-driven predictive maintenance for sulfolane production equipment, reducing unscheduled downtime and operational costs.

- Optimization of sulfolane regeneration and recovery processes through machine learning algorithms, enhancing solvent lifecycle and minimizing waste.

- Advanced process control systems leveraging AI to maintain optimal reaction conditions, improving yield and purity of sulfolane.

- Supply chain optimization using AI for demand forecasting, inventory management, and logistics, ensuring timely availability of raw materials and finished products.

- AI-assisted R&D for new sulfolane applications or novel solvent formulations by simulating molecular interactions and predicting performance characteristics.

- Enhanced quality control through AI-powered sensors and data analytics, detecting impurities or deviations in real-time during manufacturing.

- Automated monitoring and anomaly detection in industrial plants utilizing sulfolane, improving safety and operational stability.

- Energy consumption reduction in sulfolane-intensive processes via AI-driven energy management systems.

DRO & Impact Forces Of Sulfolane Market

The Sulfolane Market is profoundly shaped by a complex interplay of Drivers, Restraints, Opportunities, and broader Impact Forces that dictate its growth trajectory and competitive dynamics. Key drivers propelling market expansion include the surging global demand for natural gas, which necessitates extensive gas sweetening processes to remove corrosive impurities like H2S and CO2, positioning sulfolane as an indispensable solvent. Concurrently, the robust growth in the petrochemical industry, particularly the increasing requirement for high-purity aromatic compounds (BTX) for plastics, resins, and fibers, significantly boosts sulfolane consumption. Stringent environmental regulations aimed at reducing sulfur content in fuels globally further cement sulfolane's role in refining operations. The solvent's inherent benefits, such as high selectivity, thermal stability, and recyclability, also act as strong demand drivers, offering operational efficiencies and cost benefits to end-users. Conversely, the market faces several restraints, including the volatility of raw material prices, specifically butadiene and sulfur dioxide, which can directly impact production costs and profit margins. Intense competition from alternative solvent technologies, while not always as effective across all applications, presents a challenge, especially in cost-sensitive segments. Moreover, the high initial capital investment required for new sulfolane production facilities or for integrating advanced solvent extraction units can deter new entrants and limit expansion. Furthermore, the handling and transportation logistics of bulk chemicals add to operational complexities and costs. Despite these challenges, significant opportunities abound within the market. The burgeoning industrialization and economic growth in emerging economies, particularly in Asia-Pacific and Latin America, present vast untapped potential for sulfolane applications in new petrochemical and refining projects. The ongoing research and development into bio-based sulfolane or more environmentally benign synthesis routes offer avenues for sustainable growth and market differentiation. Additionally, the exploration of new niche applications in areas like advanced materials, specialty polymers, and electronics could unlock further market expansion. The impact forces influencing the market extend beyond immediate supply and demand dynamics, encompassing technological advancements in solvent recovery and purification, evolving geopolitical landscapes affecting energy policies and trade, and the ever-present pressure from environmental advocacy groups pushing for greener chemical processes. These forces collectively define the market's risk-reward profile and strategic direction for stakeholders.

Segmentation Analysis

The Sulfolane Market exhibits a multifaceted segmentation, allowing for a granular understanding of its diverse applications, grades, and end-use industries, which collectively define its overall structure and growth dynamics. This segmentation is crucial for stakeholders to identify specific market niches, tailor product offerings, and devise targeted strategies to capitalize on distinct demand patterns across various sectors and geographies. The market is primarily segmented by application, which delineates its major industrial uses, and by grade, which reflects the purity levels required for different processes. Further segmentation by end-use industry provides insights into the ultimate consumers of sulfolane, highlighting the sectors that drive its demand. Regional analysis then contextualizes these segments within a global economic framework, showcasing areas of high growth and established demand.

- By Application:

- Gas Sweetening: Dominant application in natural gas processing and refining for removal of acid gases (H2S, CO2).

- BTX Extraction: Critical for separating benzene, toluene, and xylene from reformate in petrochemical industry.

- Reaction Solvent: Used in various chemical syntheses, particularly in pharmaceutical and specialty chemical manufacturing.

- Chemical Intermediate: Employed in the production of other chemicals.

- Others: Includes applications in textiles, electronics, and agricultural chemicals.

- By Grade:

- Technical Grade: Standard purity for large-scale industrial applications like gas sweetening and BTX extraction.

- High Purity Grade: Refined for sensitive applications such as pharmaceuticals, electronics, and certain specialty chemicals requiring minimal impurities.

- By End-Use Industry:

- Oil & Gas: Major consumer for natural gas processing, refining, and sour gas treatment.

- Petrochemicals: Extensive use in aromatic extraction, particularly BTX production.

- Pharmaceuticals: Solvent in drug synthesis and purification processes.

- Agrochemicals: Utilized in the formulation and synthesis of pesticides and herbicides.

- Electronics: Employed in the manufacturing of electronic components and specialty materials.

- Others: Includes applications in textiles, adhesives, and coatings.

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Sulfolane Market

The value chain for the Sulfolane Market intricately links raw material suppliers to end-use industries, highlighting the various stages of production, processing, and distribution that add value to the final product. Upstream analysis focuses on the sourcing and supply of key raw materials essential for sulfolane synthesis, primarily butadiene and sulfur dioxide. Butadiene is typically derived from naphtha cracking or as a byproduct of ethylene production, while sulfur dioxide is often a byproduct of metal smelting or power generation, or produced directly from sulfur combustion. The stability and cost-effectiveness of these raw material supplies are critical, as price volatility can significantly impact production costs. Major chemical companies and petroleum refiners are typically the suppliers of these primary inputs, operating in a global market subject to commodity price fluctuations and supply chain disruptions. The next stage involves the manufacturing process of sulfolane itself, where specialized chemical producers, often integrated with petrochemical operations, convert these raw materials into sulfolane using proprietary technologies and catalytic processes. This manufacturing stage includes rigorous purification to achieve different grades, from technical to high-purity, depending on the intended application. Downstream analysis then examines the distribution and ultimate consumption of sulfolane. Once produced, sulfolane is distributed to a diverse array of end-user industries. This distribution can occur through various channels: direct sales from manufacturers to large-scale industrial consumers such as major oil and gas companies, petrochemical complexes, and pharmaceutical giants, who purchase in bulk for their continuous operations. Alternatively, indirect distribution channels involve chemical distributors and trading companies that specialize in providing smaller quantities to a wider range of clients, including specialty chemical manufacturers, research laboratories, and smaller industrial entities. These distributors often add value through inventory management, localized supply, technical support, and logistical expertise. The end-users then integrate sulfolane into their processes, whether for gas sweetening, BTX extraction, or as a reaction solvent in complex chemical syntheses. The efficiency of this value chain is paramount, as seamless coordination between raw material suppliers, manufacturers, and distributors ensures that the right grade of sulfolane reaches the right customer at the optimal time, thereby supporting the uninterrupted operation of critical industrial processes globally. Continuous optimization of this value chain, focusing on supply reliability, cost efficiency, and sustainable practices, is a key driver for market competitiveness and growth.

Sulfolane Market Potential Customers

The Sulfolane Market serves a diverse and expansive customer base, primarily comprising industries that rely on advanced solvent properties for critical separation and reaction processes. The end-users or buyers of sulfolane are predominantly large-scale industrial entities with a continuous demand for high-performance solvents. Within the oil and gas sector, national and international oil companies, independent refiners, and natural gas processing plants represent a major customer segment. These entities utilize sulfolane for efficient acid gas removal from natural gas, ensuring pipeline integrity and meeting stringent quality specifications for fuel. Furthermore, petroleum refineries extensively employ sulfolane for the extractive distillation of aromatic compounds from crude oil fractions, which is crucial for producing high-octane gasoline components and valuable petrochemical feedstocks. The petrochemical industry is another cornerstone of the customer base, encompassing major petrochemical producers responsible for manufacturing a vast array of chemicals. These companies are significant buyers of sulfolane for BTX (benzene, toluene, xylene) extraction, a fundamental process in the production of plastics, synthetic fibers, and various chemical intermediates that are vital for numerous downstream industries. Specialty chemical manufacturers also constitute a vital segment, leveraging sulfolane's unique characteristics as a reaction solvent in the synthesis of a wide range of complex organic compounds, including those used in polymers, resins, and fine chemicals where specific reaction conditions and high purity are paramount. The pharmaceutical industry is increasingly becoming a key customer for high-purity sulfolane, using it as a solvent in various drug synthesis and purification steps, where its aprotic nature and thermal stability are highly advantageous for achieving desired reaction outcomes and product quality. Moreover, companies in the agrochemical sector, involved in the development and production of herbicides, pesticides, and other crop protection agents, utilize sulfolane in their formulation processes. Emerging customer segments include manufacturers in the electronics industry, where sulfolane might find applications in specialized cleaning processes or component manufacturing, and research institutions conducting advanced chemical studies. The ongoing expansion of global industrial infrastructure, particularly in developing economies, continues to broaden the pool of potential customers, as new refineries, petrochemical complexes, and specialty chemical plants come online, each requiring reliable and efficient solvent solutions like sulfolane. Building strong relationships with these diverse end-users, understanding their specific technical requirements, and providing tailored solutions are critical for market players to sustain and expand their presence in the sulfolane market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 310.5 Million |

| Market Forecast in 2033 | USD 500.1 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Shell Chemicals, Sumitomo Chemical Co., Ltd., Chevron Phillips Chemical Company LLC, LyondellBasell Industries N.V., Gansu Daluan Chemical Co., Ltd., Toray Industries, Inc., Sasol Limited, ExxonMobil Chemical Company, BASF SE, The Dow Chemical Company, Honeywell UOP, Sinopec Corp., Reliance Industries Limited, SK Global Chemical Co., Ltd., Idemitsu Kosan Co., Ltd., Flint Hills Resources, Motiva Enterprises LLC, Eastman Chemical Company, K.S. CHEMICALS PVT. LTD., Mitsubishi Chemical Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sulfolane Market Key Technology Landscape

The Sulfolane Market's technological landscape is characterized by established production methods complemented by continuous advancements aimed at improving efficiency, purity, and sustainability. The primary technology for producing sulfolane involves a two-step process: the reaction of butadiene with sulfur dioxide to form 3-sulfolene, followed by the catalytic hydrogenation of 3-sulfolene to yield sulfolane. This process requires precise control over reaction parameters, including temperature, pressure, and catalyst selection, to optimize yield and minimize impurity formation. Manufacturers constantly refine these processes, exploring new catalytic systems that offer higher selectivity, longer catalyst life, and reduced energy consumption. Advancements in purification technologies are equally crucial, given the diverse purity requirements across different end-use industries. Techniques such as distillation, solvent extraction, and adsorption are employed, often in combination, to remove trace impurities and achieve the desired technical or high-purity grades of sulfolane. The development of more efficient and cost-effective purification methods directly impacts the market's ability to serve high-value applications like pharmaceuticals and electronics. Furthermore, solvent regeneration technologies are a significant area of focus within the sulfolane market. Given sulfolane's high cost and environmental considerations, its recyclability is a key advantage. Technologies for regenerating spent sulfolane, often involving distillation or specialized membrane separation processes, are continuously being improved to maximize recovery rates and reduce operational expenditure for end-users. Innovations in this area not only enhance economic viability but also contribute to the circular economy principles by minimizing waste. Emerging technological trends also include research into bio-based routes for sulfolane production, utilizing renewable feedstocks instead of petroleum-derived butadiene. While still in nascent stages, this area holds promise for future sustainability and reducing the market's reliance on fossil resources. Additionally, digital transformation, including the integration of advanced process control systems, real-time analytics, and AI/ML models, is enhancing operational efficiency, predictive maintenance, and overall plant safety in sulfolane manufacturing facilities. These technological advancements collectively contribute to making sulfolane production more cost-effective, environmentally friendly, and capable of meeting the evolving demands of a wide array of industrial applications.

Regional Highlights

- North America: A mature market driven by significant natural gas production, particularly from shale formations, which fuels demand for gas sweetening applications. The region also boasts a robust petrochemical industry with extensive refining capacities, ensuring sustained demand for BTX extraction. Stringent environmental regulations further compel the adoption of efficient sulfur removal processes, benefiting sulfolane consumption.

- Europe: Characterized by a stable demand primarily from its advanced petrochemical and refining sectors, coupled with strict environmental standards. Innovation in solvent regeneration and recycling technologies is a key focus here, promoting sustainable practices. The pharmaceutical and specialty chemical industries also contribute consistently to the market.

- Asia Pacific (APAC): The largest and fastest-growing market for sulfolane, propelled by rapid industrialization, massive investments in new petrochemical complexes, and burgeoning energy demand in economies like China, India, and Southeast Asia. The expansion of refining capacities and the escalating need for high-purity fuels and aromatics are significant drivers.

- Latin America: An emerging market with substantial growth potential, primarily driven by new upstream oil and gas projects and the expansion of existing refining and petrochemical facilities. Countries like Brazil and Mexico are key contributors to demand, particularly for gas sweetening and aromatic extraction processes.

- Middle East and Africa (MEA): Experiencing steady growth due to significant investments in oil and gas exploration, production, and downstream refining capacities. The region's abundant hydrocarbon resources and strategic location make it a crucial hub for petrochemical exports, fostering demand for sulfolane in extraction processes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sulfolane Market.- Shell Chemicals

- Sumitomo Chemical Co., Ltd.

- Chevron Phillips Chemical Company LLC

- LyondellBasell Industries N.V.

- Gansu Daluan Chemical Co., Ltd.

- Toray Industries, Inc.

- Sasol Limited

- ExxonMobil Chemical Company

- BASF SE

- The Dow Chemical Company

- Honeywell UOP

- Sinopec Corp.

- Reliance Industries Limited

- SK Global Chemical Co., Ltd.

- Idemitsu Kosan Co., Ltd.

- Flint Hills Resources

- Motiva Enterprises LLC

- Eastman Chemical Company

- K.S. CHEMICALS PVT. LTD.

- Mitsubishi Chemical Corporation

Frequently Asked Questions

What is sulfolane and what are its primary industrial uses?

Sulfolane is a highly polar, aprotic, cyclic sulfone solvent known for its excellent thermal stability, high solvency, and selectivity. Its primary industrial uses are in the oil and gas industry for gas sweetening (removing H2S and CO2 from natural gas) and in the petrochemical industry for the extractive distillation of aromatic compounds like benzene, toluene, and xylene (BTX) from reformate streams, enabling the production of high-purity chemicals.

Why is sulfolane preferred over other solvents in certain applications?

Sulfolane is often preferred due to its superior properties, including high selectivity for acid gases and aromatics, exceptional thermal and chemical stability, low toxicity, and high boiling point, which allows for efficient solvent recovery and reuse. Its non-corrosive nature and recyclability contribute to lower operational costs and improved process safety and environmental performance compared to many alternative solvents.

What are the key drivers for the growth of the Sulfolane Market?

The key drivers include increasing global demand for natural gas, necessitating efficient gas sweetening; the expansion of the petrochemical industry, particularly for BTX production; and stringent environmental regulations mandating lower sulfur content in fuels. Furthermore, sulfolane's recyclability and proven efficacy in critical industrial processes continuously bolster its market demand.

What challenges does the Sulfolane Market currently face?

The Sulfolane Market faces challenges such as the volatility of raw material prices (butadiene, sulfur dioxide), which can impact production costs and profit margins. Competition from alternative solvent technologies and the significant capital investment required for new production facilities or large-scale integration into industrial processes also pose notable restraints on market growth.

Which geographical region dominates the Sulfolane Market and why?

The Asia Pacific (APAC) region currently dominates the Sulfolane Market. This dominance is driven by rapid industrialization, massive investments in new petrochemical complexes, a burgeoning energy sector, and the expanding demand for high-purity fuels and aromatic chemicals in major economies like China and India, making it the primary hub for production and consumption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Sulfolane Market Size Report By Type (Anhydrous Type, Aqueous Type), By Application (Gas Production and Oil Refining, Purifying Gas Streams, Fine chemical Field, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Sulfolane Market Statistics 2025 Analysis By Application (Gas Production and Oil Refining, Purifying Gas Streams, Fine Chemical), By Type (Anhydrous, Aqueous), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager