Sulfur Tetrafluoride Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433732 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Sulfur Tetrafluoride Market Size

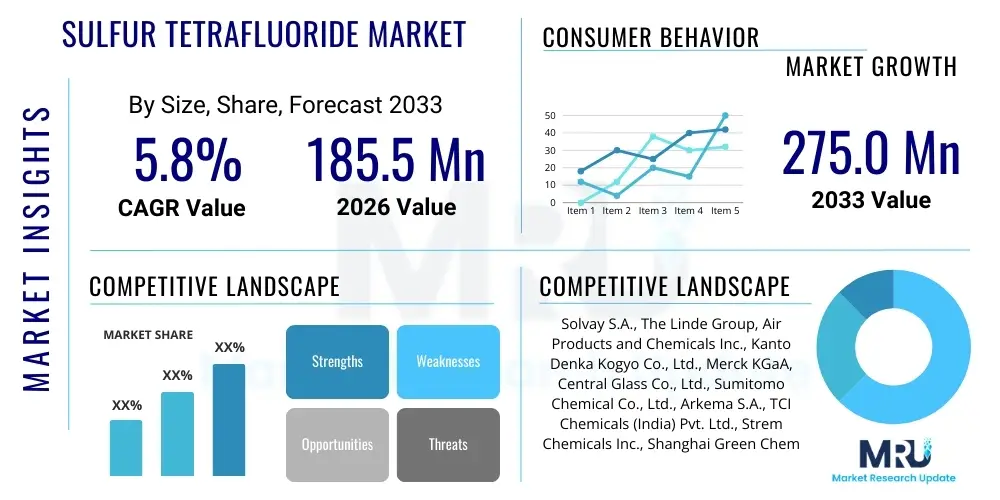

The Sulfur Tetrafluoride Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at 185.5 Million USD in 2026 and is projected to reach 275.0 Million USD by the end of the forecast period in 2033. This consistent growth trajectory is primarily underpinned by the increasing demand for high-purity fluorinating agents in specialized chemical synthesis, particularly within the advanced electronics and pharmaceutical sectors. The unique chemical properties of sulfur tetrafluoride (SF4), enabling highly selective fluorination reactions, position it as an indispensable reagent in the production of complex molecules.

Market expansion is also supported by continuous advancements in manufacturing processes, focusing on enhancing the safety and purity profile of SF4 production. Regulatory environments, particularly those related to pharmaceutical intermediates and agrochemicals, necessitate stringent quality control, driving the adoption of high-grade Sulfur Tetrafluoride. Furthermore, emerging applications in material science, such as the modification of polymer surfaces and the creation of novel fluorinated compounds, contribute significantly to the overall market valuation throughout the forecast period.

Sulfur Tetrafluoride Market introduction

Sulfur Tetrafluoride (SF4) is a highly potent and selective fluorinating agent used predominantly in organic synthesis. It is recognized for its ability to convert carbonyl groups (C=O) into difluoromethyl groups (CF2) and hydroxyl groups (OH) into fluorides (F), reactions critical for creating novel pharmaceutical drugs and advanced agrochemicals. The product is a colorless, highly reactive gas, requiring specialized handling and storage, which contributes to its premium pricing and controlled distribution landscape. Its application scope extends beyond traditional chemical synthesis into specialized areas like material science and semiconductor manufacturing, where ultra-high purity SF4 is required for etching processes.

The core application driving the Sulfur Tetrafluoride market growth lies in the synthesis of fluorinated compounds, which often exhibit enhanced stability, lipophilicity, and bioavailability, making them superior candidates for drug development. As research and development activities in oncology, neurology, and infectious diseases escalate globally, the demand for sophisticated fluorination tools, such as SF4, increases proportionally. Key benefits of using SF4 include its high reactivity, selectivity in fluorination reactions, and efficiency in producing complex fluorinated intermediates that are difficult to synthesize through alternative methods.

Major driving factors include the burgeoning global pharmaceutical industry, particularly the robust pipeline of fluorinated drugs, and the rapid expansion of the semiconductor sector requiring high-purity SF4 for plasma etching processes. However, challenges related to its toxicity, handling complexities, and the search for safer, more user-friendly fluorinating alternatives (like DAST derivatives) temper market acceleration, ensuring that market growth remains steady but highly specialized.

Sulfur Tetrafluoride Market Executive Summary

The Sulfur Tetrafluoride market is characterized by intense specialization, high entry barriers due to complex handling requirements, and reliance on innovation in end-user industries like pharmaceuticals and electronics. Business trends indicate a strong focus on supply chain security and the development of regional manufacturing capabilities, particularly in the Asia Pacific (APAC) region, driven by the massive concentration of electronics fabrication and generic drug manufacturing facilities. Manufacturers are prioritizing R&D investments to improve product purity (electronic grade SF4) and develop less hazardous SF4 complexes or in-situ generation methods to broaden user accessibility.

Regional trends highlight APAC as the dominant and fastest-growing market segment, primarily due to supportive government policies promoting semiconductor production in countries like China, South Korea, and Taiwan. North America and Europe maintain significant market shares, driven by established pharmaceutical and specialty chemical industries, focusing on high-value, patent-protected drugs. Segment trends indicate the electronic grade SF4 segment (purity 99.9% and above) commanding a premium price and experiencing accelerated growth compared to standard chemical grade SF4, owing to stringent quality requirements in microelectronics.

The market structure remains oligopolistic, dominated by a few global chemical and specialty gas producers capable of managing the inherent risks associated with SF4 production and transport. Strategic collaborations between SF4 suppliers and large contract research organizations (CROs) or pharmaceutical companies are emerging as key strategies to stabilize demand and integrate the supply chain. Overall, the market outlook is positive, contingent upon sustained investment in fluorinated drug discovery and the continued global expansion of advanced semiconductor manufacturing capabilities.

AI Impact Analysis on Sulfur Tetrafluoride Market

Common user questions regarding AI's impact on the Sulfur Tetrafluoride market often revolve around optimizing synthesis processes, predicting supply chain disruptions, and accelerating drug discovery where SF4 is a key reagent. Users are keen to understand if AI-driven molecular modeling can replace or reduce the need for specific, complex fluorinating agents, or conversely, if AI can accelerate the identification of novel drug candidates requiring SF4, thereby increasing demand. Key concerns focus on how AI tools can manage the extreme safety hazards associated with SF4 handling, utilizing predictive maintenance for high-pressure systems and optimizing real-time safety protocols in manufacturing plants. The consensus expectation is that AI will enhance operational efficiency and safety rather than directly impacting SF4's chemical necessity.

AI's primary influence will be felt in process optimization and safety management within SF4 production facilities. Machine learning algorithms can analyze complex reaction parameters, temperature, pressure, and gas flow rates to minimize byproducts, optimize yield, and reduce energy consumption during SF4 synthesis. Furthermore, AI-powered predictive analytics are instrumental in forecasting demand from pharmaceutical pipelines and semiconductor fabrication schedules, allowing manufacturers to manage their specialized inventory and production capacity more effectively. This enhancement in supply chain resilience is crucial for a product with limited producers and complex logistics.

In the end-user industries, AI accelerates the design of novel fluorinated compounds, leading to an increased, targeted demand for SF4. Computational chemistry and retrosynthesis tools powered by AI can efficiently screen millions of potential drug molecules and identify those that require specific SF4-mediated fluorination steps. This precision in R&D shortens the drug development lifecycle, potentially boosting the consumption of high-purity SF4, making AI an indirect, but powerful, demand generator for this specialized chemical.

- AI optimizes complex SF4 synthesis parameters, enhancing yield and purity.

- Predictive maintenance driven by AI improves safety and reduces downtime in SF4 production plants.

- Machine learning accelerates the identification of novel fluorinated drug candidates, increasing SF4 consumption.

- AI-powered supply chain analytics improve inventory management and logistical planning for this hazardous substance.

- Computational chemistry tools validate SF4 reaction pathways, leading to more efficient process scale-up in pharma.

DRO & Impact Forces Of Sulfur Tetrafluoride Market

The Sulfur Tetrafluoride market is powerfully shaped by the accelerating demand from the pharmaceutical industry for highly specific fluorination reagents, countered by significant environmental and safety restrictions. The primary driver is the necessity of fluorine atoms in modern drug design, enhancing metabolic stability and membrane permeability, directly fueling the usage of high-efficiency fluorinating agents like SF4. However, the extreme toxicity, corrosive nature, and handling difficulty of SF4 act as major restraints, compelling end-users to seek alternative reagents (like Deoxofluor or DAST derivatives), thereby limiting the market’s expansion potential primarily to specialized applications where SF4 is irreplaceable.

Opportunities for market growth stem from the expansion of the electronics sector, particularly the surge in advanced semiconductor manufacturing (e.g., 5G and AI chips), which mandates ultra-high-purity SF4 for precision etching and cleaning processes. Furthermore, technological improvements in packaging, transportation, and safe handling equipment, coupled with the development of "easier-to-handle" SF4 precursor systems that generate the gas in situ, present significant avenues for market penetration into smaller research labs and less specialized manufacturing settings. The competitive landscape focuses intensely on purity levels, making technological innovation in purification a critical impact force.

Impact forces are multifaceted, encompassing regulatory pressures (especially concerning environmental releases and occupational safety), technological shifts (development of greener, safer fluorination methods), and economic factors (the high cost of SF4 due to complex manufacturing). The need for specialized infrastructure and highly trained personnel to manage SF4 operations creates substantial entry barriers, consolidating market power among established producers. These forces collectively dictate the market’s slow, deliberate expansion rate, ensuring that demand growth is inextricably linked to high-value, regulated industries.

Segmentation Analysis

The Sulfur Tetrafluoride market is strategically segmented primarily based on its purity level, which directly corresponds to its end-use application, and by the application type itself. Purity segmentation is crucial, distinguishing between standard chemical grades used in agrochemicals and specialty chemicals, and the ultra-high purity Electronic Grade (99.9% and above) required for etching sensitive semiconductor components. This differentiation in purity dictates pricing, manufacturing complexity, and distribution channels. The application segmentation demonstrates the dependency of SF4 on specific, high-growth industries, namely pharmaceuticals and advanced electronics, which collectively account for the largest share of market revenue and future growth prospects.

The electronic grade segment is expected to exhibit the highest CAGR during the forecast period due to the global shortage and subsequent massive investment in semiconductor fabrication facilities (fabs), particularly in APAC. These fabs require extremely low levels of impurities to prevent defects in advanced chip manufacturing, sustaining the premium pricing structure for this segment. Conversely, while the pharmaceutical synthesis application holds the largest revenue share currently, its growth rate is steady, tied directly to the success rate of clinical trials for fluorinated drugs. Geographic segmentation further reveals market concentration, with manufacturing capabilities often clustered near major end-user hubs to mitigate the risks and costs associated with transporting this hazardous material.

- By Purity:

- Chemical Grade (99.0% - 99.5%)

- Research Grade (99.5% - 99.9%)

- Electronic Grade (99.9% and above)

- By Application:

- Pharmaceutical Synthesis (Drug Intermediates, Active Pharmaceutical Ingredients - APIs)

- Agrochemicals Production (Pesticides, Herbicides)

- Electronic Etching and Cleaning (Semiconductor Manufacturing)

- Specialty Chemicals and Polymer Synthesis

- By End-Use Industry:

- Pharma & Biotech

- Semiconductor & Electronics

- Agriculture

- Advanced Material Science

Value Chain Analysis For Sulfur Tetrafluoride Market

The value chain for the Sulfur Tetrafluoride market begins with the upstream procurement of raw materials, primarily elemental sulfur and fluorine sources (like hydrogen fluoride), which requires sophisticated chemical handling due to the highly corrosive nature of the precursors. The synthesis process itself is complex, typically involving high-pressure and high-temperature reactions under strictly controlled conditions, often utilizing specialized reactors and purification techniques to achieve the required purity, especially for electronic grade applications. This highly technical upstream phase, dominated by a few global specialty chemical and gas companies, constitutes the primary value addition point due to high capital investment and technical expertise requirements.

The midstream phase involves specialized packaging, storage, and distribution. Given SF4’s gaseous state and high toxicity, its transportation relies exclusively on specialized high-pressure cylinders and containers designed to meet stringent international hazardous material transport regulations. Distribution channels are predominantly direct, linking the manufacturer or primary distributor directly to the large-scale end-users (major semiconductor fabs, large pharmaceutical API manufacturers) to minimize handling risks and ensure product integrity. Indirect channels, involving smaller specialized chemical distributors, typically cater only to research institutions or small-batch specialty chemical producers, often for lower-purity grades.

The downstream sector is characterized by the application in high-value synthesis processes. Pharmaceutical companies use SF4 as a critical intermediate for complex drug molecules, while semiconductor manufacturers utilize it in precision plasma etching. The value derived at this stage is massive, as SF4 enables the creation of proprietary, high-margin products. The efficiency and reliability of the upstream synthesis and specialized distribution directly impact the successful integration of SF4 into these critical downstream manufacturing processes, emphasizing the necessity of a highly controlled and secure supply chain throughout the entire value chain.

Sulfur Tetrafluoride Market Potential Customers

Potential customers for Sulfur Tetrafluoride are highly concentrated within industries that require precise, highly selective fluorination chemistry or advanced material modification. The largest volume buyers are global pharmaceutical companies and Contract Manufacturing Organizations (CMOs) specializing in the synthesis of Active Pharmaceutical Ingredients (APIs). These entities rely on SF4 for late-stage fluorination reactions that are essential for developing next-generation drugs, particularly those treating chronic diseases like cancer and autoimmune disorders, where the enhanced properties conferred by fluorine atoms are indispensable for efficacy and oral bioavailability.

The second major customer segment comprises the world’s leading semiconductor and microelectronics fabrication plants (fabs). These facilities purchase electronic grade SF4 for highly specific dry etching processes critical for manufacturing advanced integrated circuits (ICs), including memory chips, processors, and specialized sensors. As chip geometries shrink and complexity increases, the demand for ultra-high purity, defect-free etching gases like SF4 intensifies, positioning these technology giants as premium customers in the market. Their demand is inelastic regarding price but extremely sensitive to purity and consistent supply reliability.

Additional customer groups include major agrochemical manufacturers utilizing SF4 to produce fluorinated pesticides and herbicides known for their enhanced stability and effectiveness. Furthermore, academic and industrial research laboratories focused on material science, polymer chemistry, and novel battery electrolytes also represent a steady, though lower-volume, customer base for research and chemical grade SF4, seeking to develop advanced fluorinated materials for various high-tech applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | 185.5 Million USD |

| Market Forecast in 2033 | 275.0 Million USD |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Solvay S.A., The Linde Group, Air Products and Chemicals Inc., Kanto Denka Kogyo Co., Ltd., Merck KGaA, Central Glass Co., Ltd., Sumitomo Chemical Co., Ltd., Arkema S.A., TCI Chemicals (India) Pvt. Ltd., Strem Chemicals Inc., Shanghai Green Chemical Co., Ltd., Shandong Weijie Chemical Co., Ltd., Wuxi Yueda Gas Co., Ltd., Zhejiang Juhua Co., Ltd., Praxair Technology Inc. (now part of Linde) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sulfur Tetrafluoride Market Key Technology Landscape

The core technology in the Sulfur Tetrafluoride market revolves around the highly efficient and safe synthesis of SF4 and subsequent purification to meet stringent application-specific demands. Historically, SF4 is synthesized through the reaction of elemental sulfur or sulfur halides with sodium fluoride or chlorine trifluoride. The modern technological landscape is focused heavily on optimizing these reaction conditions (temperature, pressure, and catalyst selection) to maximize yield while simultaneously minimizing hazardous byproducts. A key technological trend is the development of continuous flow processing systems, which enhance safety and scalability compared to traditional batch processes, crucial for maintaining consistent supply to major industrial customers.

A second major technological area involves the advanced purification and analytical monitoring, particularly for electronic grade SF4. Semiconductor manufacturers require SF4 with parts per billion (ppb) levels of impurity control, necessitating advanced cryogenic distillation and membrane separation technologies. Suppliers are investing heavily in highly sophisticated inline analytical techniques, such as mass spectrometry and gas chromatography, to ensure real-time purity certification and maintain quality control throughout the production and packaging lifecycle. This technological expertise in purification serves as a major competitive differentiator.

Furthermore, technology related to safe handling and delivery systems is crucial. Innovations include the development of highly specialized container materials resistant to the corrosive nature of SF4, and the adoption of proprietary gas management systems that allow for precise dosing and minimized residual gas volume upon depletion. The emerging technology of "in-situ" SF4 generation—where stable, solid precursors are used to generate small, measured quantities of SF4 directly at the point of use—is gaining traction, aiming to circumvent the logistical and safety nightmares associated with transporting and storing large cylinders of the pressurized gas, offering a significant technological shift for research and small-scale applications.

Regional Highlights

The global Sulfur Tetrafluoride market exhibits distinct regional dynamics driven by localized industrial demands and regulatory environments.

- Asia Pacific (APAC): Dominates the market and is projected to demonstrate the highest growth rate. This is primarily attributed to the region’s massive concentration of semiconductor manufacturing hubs (Taiwan, South Korea, China) and the rapidly expanding pharmaceutical and generic API manufacturing bases, particularly in India and China. Government incentives favoring high-tech manufacturing further accelerate the demand for electronic grade SF4.

- North America: Represents a mature market driven by the presence of major global pharmaceutical companies and significant R&D spending in advanced chemistry and biotech. Demand is focused on high-value, research-grade SF4 for innovative drug discovery and specialized aerospace material development. Strict environmental regulations necessitate the adoption of sophisticated gas abatement technologies.

- Europe: Characterized by a strong specialty chemical and agrochemical industry, particularly in Germany, Switzerland, and the UK. European demand is consistent, driven by established pipelines of fluorinated crop protection chemicals and niche pharmaceutical development. The region emphasizes safety standards (REACH regulations), influencing manufacturers to prioritize safer delivery methods.

- Latin America (LATAM): A smaller, emerging market primarily driven by agricultural chemical production in countries like Brazil and Argentina. Demand is typically for chemical grade SF4, and market penetration relies heavily on imports from major Asian and North American producers.

- Middle East & Africa (MEA): Currently holds the smallest share, with limited high-tech manufacturing capabilities. Demand is sporadic, mainly focused on regional specialty chemical production or specific infrastructure projects, relying entirely on imported SF4 supplies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sulfur Tetrafluoride Market.- Solvay S.A.

- The Linde Group (including Praxair Technologies Inc.)

- Air Products and Chemicals Inc.

- Kanto Denka Kogyo Co., Ltd.

- Merck KGaA

- Central Glass Co., Ltd.

- Sumitomo Chemical Co., Ltd.

- Arkema S.A.

- TCI Chemicals (India) Pvt. Ltd.

- Strem Chemicals Inc.

- Shanghai Green Chemical Co., Ltd.

- Shandong Weijie Chemical Co., Ltd.

- Wuxi Yueda Gas Co., Ltd.

- Zhejiang Juhua Co., Ltd.

- Taiyo Nippon Sanso Corporation

- Messer Group GmbH

- Deepwater Chemical Co., Ltd.

- Haohua Chemical Science and Technology Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Sulfur Tetrafluoride market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for the growth of the Sulfur Tetrafluoride Market?

The primary driver is the accelerating requirement for selective fluorinating agents in the production of advanced fluorinated pharmaceuticals and agrochemicals. The ability of SF4 to precisely convert specific functional groups is critical for enhancing the efficacy and stability of modern drug molecules, directly correlating demand with R&D intensity in the life sciences sector.

How does the Electronic Grade segment differ from the Chemical Grade SF4 market?

Electronic Grade SF4 demands ultra-high purity, typically 99.9% or higher, with impurities measured in parts per billion (ppb). This grade is essential for sensitive semiconductor etching processes. Chemical Grade SF4, used in pharmaceuticals and agrochemicals, has slightly lower purity requirements but significantly higher volume demand, differentiating the segments in terms of price, manufacturing complexity, and end-user strictness.

What major restraints hinder the broader adoption of Sulfur Tetrafluoride?

The principal restraints are the extreme toxicity, corrosiveness, and complicated handling and storage requirements of SF4. These factors necessitate substantial investment in specialized infrastructure, safety protocols, and highly trained personnel, often pushing smaller enterprises to seek alternative, less hazardous fluorinating reagents.

Which region currently leads the global Sulfur Tetrafluoride market in terms of consumption?

The Asia Pacific (APAC) region currently leads the market in consumption. This dominance is fueled by robust growth in semiconductor fabrication capacity (especially in Northeast Asia) and the region’s expansive generic and specialty API manufacturing sectors, driving high demand for both electronic and pharmaceutical grades of SF4.

Are there safer alternatives emerging that could potentially replace Sulfur Tetrafluoride?

Yes, safer alternatives, particularly DAST (Diethylaminosulfur trifluoride) derivatives and novel solid-state reagents (such as Deoxofluor), are emerging. These reagents offer comparable fluorination selectivity with significantly reduced handling hazards. However, SF4 remains superior and often irreplaceable in large-scale industrial processes requiring maximum efficiency and cost-effectiveness for specific fluorination transformations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager