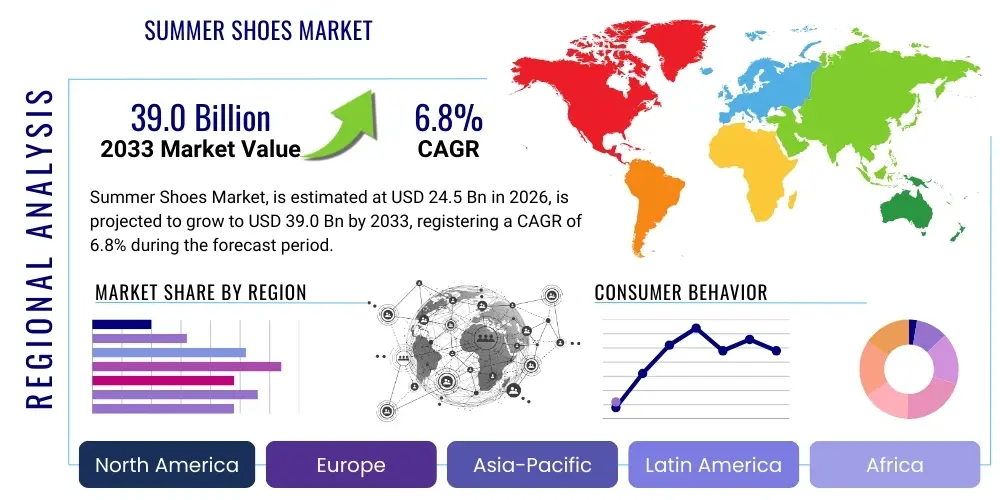

Summer Shoes Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437797 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Summer Shoes Market Size

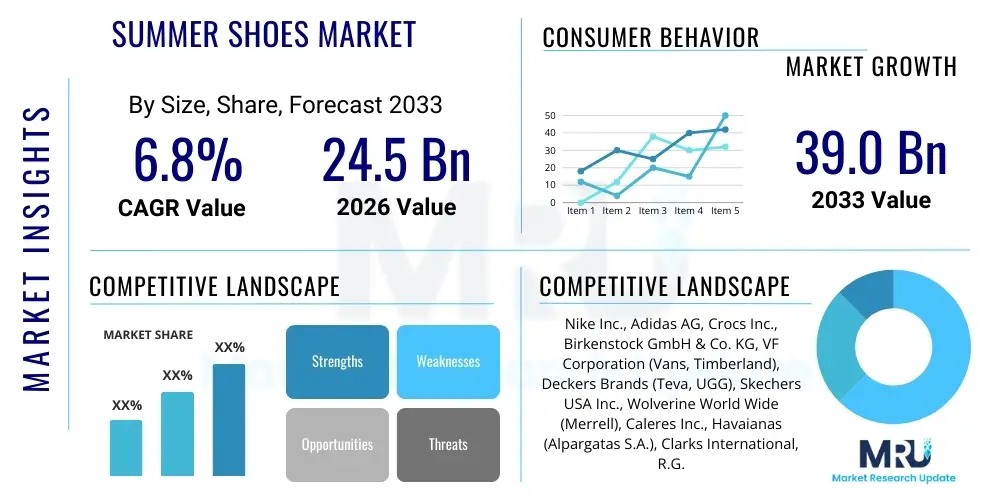

The Summer Shoes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 24.5 Billion in 2026 and is projected to reach USD 39.0 Billion by the end of the forecast period in 2033.

Summer Shoes Market introduction

The Summer Shoes Market encompasses a diverse range of footwear designed specifically for warm weather conditions, emphasizing comfort, breathability, and seasonal aesthetics. Products include sandals, flip-flops, espadrilles, lightweight sneakers, boat shoes, and water shoes, catering to various activities such as beach outings, casual urban wear, watersports, and light recreational activities. The market's robust expansion is primarily driven by increasing global temperatures, rising consumer disposable incomes in emerging economies, and the growing influence of fashion and lifestyle trends promoting specialized seasonal wardrobes. Manufacturers are consistently innovating in terms of materials, prioritizing sustainable sourcing like recycled plastics, organic cotton, and biodegradable components, aligning with heightened consumer environmental awareness. Major applications span casual daily wear, vacation and travel use, and specific niche markets such as high-performance outdoor summer activities and luxury resort wear. The inherent benefits of summer footwear, such as ventilation, lightweight construction, and ease of wear, position them as essential items during the forecast period.

Summer Shoes Market Executive Summary

The Summer Shoes Market exhibits dynamic growth propelled by key business trends, notably the significant integration of digitalization into retail strategies and a pronounced shift toward Direct-to-Consumer (D2C) models, allowing brands greater control over pricing and customer experience. Regionally, Asia Pacific is anticipated to demonstrate the fastest CAGR, driven by rapid urbanization, substantial middle-class expansion in countries like India and China, and increasing adoption of Western casual wear trends. North America and Europe maintain dominance in terms of market value, fueled by established brand loyalty, high consumer spending on specialized athletic and outdoor summer footwear, and robust e-commerce penetration. Segment trends underscore a shift towards the Athleisure category, where functional and comfortable footwear suitable for light activity is preferred, blurring the lines between sportswear and casual shoes. Furthermore, the segmentation by end-user shows strong growth in the women's category due to greater variety in seasonal styles and higher frequency of purchase, while sustainability-focused product lines are becoming central to brand differentiation across all segments, influencing purchasing decisions significantly.

AI Impact Analysis on Summer Shoes Market

Common user inquiries concerning the impact of Artificial Intelligence (AI) on the Summer Shoes Market frequently revolve around personalization, supply chain efficiency, and sustainable production planning. Users are keen to understand how AI-driven recommendation engines can enhance the online shopping experience by suggesting seasonally relevant styles based on local climate data and individual fashion preferences. Additionally, there is significant interest in how AI optimization tools are revolutionizing inventory management—predicting peak seasonal demand for specific styles (e.g., highly sought-after sandals or water shoes) and reducing overstocking, which is a major concern given the short lifecycle of seasonal products. Furthermore, consumers and industry professionals are exploring AI's role in ethical sourcing and material tracking, seeking transparency regarding the environmental footprint of their summer footwear choices.

AI is fundamentally reshaping the design and manufacturing lifecycle within the summer footwear industry, moving beyond simple automation to deep generative design. Algorithms can now analyze vast amounts of data—including weather patterns, social media trends, sales figures, and material stress tolerance—to generate novel summer shoe designs that are optimally suited for comfort and performance. This capability significantly shortens the time-to-market for new seasonal collections, allowing companies to react almost instantaneously to micro-trends observed during the summer months. Moreover, predictive maintenance utilizing AI in manufacturing facilities minimizes downtime during critical peak production seasons, ensuring that high-demand items like flip-flops and lightweight canvas shoes are produced efficiently and reliably.

The retail interface is also undergoing profound changes due to AI integration, specifically through enhanced customer journey mapping and predictive analytics regarding returns. Virtual try-on technology, powered by computer vision and AI, allows customers to visualize how different summer shoe styles look and fit without physically being present, drastically reducing the high rate of returns associated with online footwear purchases. For brands, AI-driven dynamic pricing models allow for real-time adjustments based on competitor activity, current inventory levels, and location-specific seasonal demand surges (e.g., boosting prices for beach sandals in coastal areas just before a holiday weekend), maximizing revenue during the short, high-volume summer selling window while improving overall profitability.

- AI-driven trend forecasting for seasonal color palettes and style adaptations.

- Optimized inventory management and logistics planning to reduce seasonal overstock and waste.

- Personalized product recommendations based on wearer activity, location, and climate data.

- Generative design for creating lightweight, durable, and ergonomically superior summer footwear.

- Enhanced virtual try-on experiences and accurate size prediction to lower e-commerce return rates.

- AI monitoring of supply chain ethical compliance and sustainable material traceability.

DRO & Impact Forces Of Summer Shoes Market

The Summer Shoes Market is characterized by a complex interplay of forces that collectively influence its trajectory, encompassing powerful drivers, inherent restraints, promising opportunities, and critical impact forces. The primary drivers revolve around global demographic shifts, specifically the expansion of the millennial and Gen Z consumer base, who prioritize aesthetic appeal combined with functional comfort, leading to high demand for hybrid footwear such as lightweight sneakers suitable for casual summer activities. Furthermore, the pervasive trend of 'athleisure' has normalized the wearing of comfortable, sport-inspired footwear in non-athletic settings, significantly boosting demand for premium summer sneakers and performance sandals. Counterbalancing this growth are key restraints, notably the highly seasonal nature of the product, leading to volatile sales cycles and high risks associated with inventory management, as styles quickly become obsolete once the season concludes. Additionally, the market faces significant pressure from low-cost counterfeit products and intense competition from fast-fashion retailers who quickly replicate popular designs, challenging established brands' pricing strategies and brand value perception.

Opportunities within the summer footwear sector are heavily concentrated in sustainable innovation and technological integration. The rising consumer demand for eco-friendly products creates substantial opportunities for brands investing in bio-based materials, recycled rubber, and closed-loop manufacturing processes, potentially commanding premium pricing for ethical products. Geographically, untapped potential exists in secondary and tertiary cities across rapidly developing markets in Southeast Asia and Africa, where rising economic prosperity translates directly into increased purchasing power for branded seasonal apparel. The expansion of niche markets, such as specialized water-resistant hiking sandals and high-end luxury resort wear designed for sustainable travel, also presents lucrative avenues for market penetration, requiring targeted marketing and unique product development to address these specialized consumer needs effectively.

The overall impact forces are dominated by regulatory shifts concerning material safety and global trade dynamics, particularly tariffs impacting manufacturing hubs located in Asia. Furthermore, rapid technological advancement in 3D printing and customized manufacturing represents a transformative impact force, allowing smaller brands to enter the market with highly personalized and localized seasonal offerings, potentially fragmenting market share away from traditional mass-market manufacturers. Ultimately, consumer lifestyle evolution, particularly the increased focus on outdoor recreation and wellness following global events, ensures sustained, high demand for performance-oriented and durable summer footwear. Successfully navigating these forces requires agile supply chains, continuous material science investment, and highly effective digital engagement strategies focused on seasonal relevancy and rapid consumer feedback loops.

Segmentation Analysis

The Summer Shoes Market segmentation provides a granular view of consumer preferences, product dynamics, and strategic market positioning, crucial for tailored marketing and product development efforts. Key segmentation criteria include product type (Sandals, Flip-Flops, Sneakers, Espadrilles, etc.), end-user (Men, Women, Kids), distribution channel (Online, Offline), and material type (Leather, Synthetic, Rubber, Sustainable Materials). The product type segmentation reveals that sandals and flip-flops consistently account for the largest volume sales due to their universal appeal and functional necessity in warm climates, while lightweight sneakers (casual and athletic) command the highest value share, driven by their versatility and premium pricing points associated with advanced technology and branding.

The analysis by end-user demonstrates that the women's footwear segment holds the largest market share, characterized by high style turnover and greater variety in design, leading to more frequent purchasing cycles throughout the summer season. However, the men's segment is rapidly expanding, particularly in high-performance outdoor and specialized water footwear categories, driven by increased participation in summer adventure sports and a growing acceptance of high-fashion men's sandals. In terms of distribution, while physical stores (Offline) remain crucial for immediate try-on and impulse purchases, the Online distribution channel is experiencing explosive growth, propelled by strong mobile commerce adoption, vast inventory options, and the ability of digital platforms to use visual merchandising effectively for seasonal products.

A burgeoning area of segmentation lies in material type, where the shift towards sustainable materials is no longer a niche but a mainstream competitive factor. Products utilizing recycled ocean plastics, innovative vegan leather alternatives, and ethically sourced natural fibers are commanding a growing premium. Brands strategically segment their offerings by price point and material, ensuring they cater to both the budget-conscious consumer seeking basic functionality (often synthetic or rubber) and the environmentally conscious, affluent buyer willing to invest in ethically produced, durable summer footwear. Understanding these overlaps allows market players to optimize their product portfolios for maximum seasonal impact and long-term brand equity.

- By Product Type:

- Sandals (Flat, Heeled, Performance)

- Flip-Flops and Slippers

- Lightweight Sneakers and Casual Shoes (Canvas, Mesh)

- Espadrilles and Wedges

- Boat Shoes and Loafers

- Water and Aqua Shoes

- By End-User:

- Men

- Women

- Kids

- By Distribution Channel:

- Offline Retail (Department Stores, Specialty Footwear Stores, Hypermarkets)

- Online Retail (E-commerce Platforms, Brand Websites, Third-party Marketplaces)

- By Material Type:

- Leather and Suede

- Synthetic and Rubber

- Textile and Canvas

- Sustainable and Bio-based Materials

Value Chain Analysis For Summer Shoes Market

The value chain for the Summer Shoes Market begins with upstream activities heavily focused on sourcing raw materials, where the industry increasingly prioritizes lightweight, breathable, and water-resistant inputs. Upstream analysis involves the procurement of specialized synthetic meshes, advanced thermoplastic elastomers (TPE) for soles, innovative cushioning foams, and sustainable materials such as recycled cotton or organic jute. Key suppliers in this phase must demonstrate capabilities in rapid prototyping and high compliance with international chemical restrictions, as summer footwear often involves direct skin contact. Efficiency in this segment dictates the final product's cost and sustainability profile, pushing manufacturers towards vertically integrated material suppliers or long-term partnerships guaranteeing ethical sourcing and consistent quality for high-volume seasonal production.

Midstream activities encompass design, manufacturing, and assembly, which are intensely seasonal and geographically concentrated, primarily in Asia (Vietnam, China, Indonesia) for mass production. The manufacturing process for summer shoes, particularly for highly functional products like performance sandals or complex espadrilles, requires highly automated yet flexible production lines capable of switching styles and material inputs quickly. Advanced CAD/CAM systems are utilized extensively during the design phase to minimize material waste and optimize the ergonomic profile for comfortable summer wear. Successful midstream players leverage lean manufacturing principles to handle the rapid demand spikes typical of the summer season, utilizing modular component production to scale production capacity quickly and efficiently respond to urgent seasonal restock requests from retailers.

Downstream analysis focuses on distribution and sales, covering both direct and indirect channels. The distribution channel is bifurcated: Indirect distribution relies on global freight logistics for wholesale shipping to large department stores, specialized sports retailers, and mass merchants, where inventory turnover is quick but profit margins are shared. Direct distribution, via branded physical stores and dedicated e-commerce sites, offers higher margins and invaluable customer data regarding seasonal preferences, fit, and style trends. Direct channels are becoming paramount for building brand loyalty and managing the end-of-season clearance effectively. Effective digital marketing, focused on lifestyle branding and seasonal utility (e.g., vacation wear, beach preparedness), is critical for maximizing sales velocity during the short summer window.

Summer Shoes Market Potential Customers

The potential customers for the Summer Shoes Market are broad, segmented primarily by lifestyle, geographic location, and income level, but generally defined as individuals across all age demographics living in or traveling to regions experiencing warm weather, typically between May and September in the Northern Hemisphere. The primary end-users or buyers include individuals seeking comfort, functionality, and style during high-temperature months. High-value customers include active millennials and Gen Z consumers who prioritize lightweight, technologically advanced athletic sandals and sneakers that align with the athleisure trend, purchasing these items often for both fashion and functional use in urban and outdoor environments. This demographic is highly responsive to digital marketing, influencer campaigns, and sustainable product narratives, driving significant investment in high-margin specialized seasonal footwear.

Another significant segment comprises families and general consumers seeking practical, durable, and affordable seasonal wear. This segment is characterized by high volume purchases, particularly for children’s summer footwear (due to rapid growth rates) and basic adult essentials like flip-flops and casual slide sandals purchased via hypermarkets or large online marketplaces. Purchasing decisions in this segment are often driven by value, perceived durability for heavy use (e.g., poolside or backyard activities), and accessible retail points. Brands catering to this market focus on robust material construction, simple logistics, and competitive price positioning, often relying on high-volume production to maintain profitability.

A third, high-growth potential customer group is the eco-conscious traveler and the luxury resort consumer. These buyers seek premium, fashionable, and specialized summer footwear, such as designer espadrilles or ethically sourced artisan sandals. Their purchasing criteria extend beyond mere functionality to include origin story, material transparency (e.g., organic fibers, traceable leather), and alignment with luxury travel aesthetics. These customers are less price-sensitive and represent a critical target for high-end fashion houses and niche sustainable brands, driving innovation in material luxury and ethical manufacturing practices within the summer shoes ecosystem.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 24.5 Billion |

| Market Forecast in 2033 | USD 39.0 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nike Inc., Adidas AG, Crocs Inc., Birkenstock GmbH & Co. KG, VF Corporation (Vans, Timberland), Deckers Brands (Teva, UGG), Skechers USA Inc., Wolverine World Wide (Merrell), Caleres Inc., Havaianas (Alpargatas S.A.), Clarks International, R.G. Barry Corporation (Dearfoams), Ecco Sko A/S, PUMA SE, New Balance Athletics Inc., Reef, Aetrex Worldwide, Camper, Columbia Sportswear Company, and FitFlop. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Summer Shoes Market Key Technology Landscape

The technology landscape in the Summer Shoes Market is rapidly evolving, driven primarily by the need for enhanced comfort, lightweight construction, and sustainable production methods. Material science innovations are central, with advancements in lightweight, durable polymers and foams, such as specialized EVA (Ethylene-Vinyl Acetate) formulations and proprietary cushioning systems, crucial for performance sandals and high-end flip-flops. Furthermore, the integration of quick-drying, antibacterial textiles and mesh fabrics is standard for water shoes and performance sneakers, addressing consumer needs for hygiene and functionality in hot, moist environments. Digital manufacturing technologies, including 3D printing and advanced computer-aided design, are increasingly used for rapid prototyping and creating geometrically complex sole structures that optimize airflow and reduce overall weight, enabling faster and more responsive seasonal collection launches.

Manufacturing process technology is focusing heavily on sustainability and waste reduction. Automation, including robotic assembly and precision cutting, minimizes material waste, a critical factor given the volume of materials processed for mass-market summer footwear. Laser cutting and stitching technologies ensure perfect alignment and consistency across large production runs of canvas shoes and espadrilles. Crucially, the implementation of circular economy principles is being supported by technology that facilitates the use of recycled content, such as machines capable of processing and spinning yarns from recycled plastic bottles (rPET) for textile uppers, or reusing rubber scraps for outsole construction, moving the industry towards greener manufacturing footprints.

On the consumer-facing side, e-commerce technologies are paramount for driving seasonal sales. The adoption of Augmented Reality (AR) and Virtual Reality (VR) tools allows shoppers to visualize summer shoes in real-world settings or virtually try them on, mitigating the hesitation associated with online footwear purchases. Furthermore, data analytics and machine learning technologies are optimizing customer engagement by analyzing purchasing patterns, local climate data, and social media trends to predict seasonal demand for specific colors and styles with unprecedented accuracy. This technological reliance on consumer data ensures that the right seasonal product is available at the right time and location, maximizing profit during the market’s peak sales windows.

Regional Highlights

The regional analysis reveals distinct market maturity and growth dynamics across different geographical areas, heavily influenced by climate variability, consumer culture, and economic development levels. North America (NA) represents a substantial portion of the market value, characterized by high consumer spending on specialized athletic and outdoor summer footwear, especially high-tech performance sandals and branded lightweight sneakers. The U.S. market drives innovation, with strong demand for sustainable brands and digitally integrated retail experiences. The European market, particularly Southern Europe, shows a strong preference for traditional seasonal footwear like espadrilles, leather sandals, and fashion-forward resort wear, with high penetration of both luxury and fast-fashion seasonal brands. Germany and the UK lead in the consumption of specialized hiking and outdoor summer footwear, driven by strong outdoor recreation cultures.

Asia Pacific (APAC) is projected to be the fastest-growing region during the forecast period. This explosive growth is attributed to rising disposable incomes, rapid urbanization, and a massive, youthful consumer base adopting Western casual wear trends. Countries like China and India present huge volume opportunities for mass-market flip-flops, slide sandals, and basic canvas shoes due to their large populations and extended warm weather periods. Furthermore, high population density and advanced mobile penetration in East Asia support robust e-commerce growth, allowing international brands to rapidly deploy seasonal collections and promotional campaigns directly to consumers, bypassing traditional retail intermediaries and accelerating market penetration.

Latin America (LATAM) and the Middle East and Africa (MEA) offer unique market dynamics. LATAM, particularly Brazil, is a major consumption and production hub, dominating the global market for basic footwear like flip-flops (e.g., Havaianas). The high year-round temperatures across much of the region ensure stable demand for lightweight, open footwear, making seasonality less acute than in temperate zones. The MEA region is characterized by fragmented demand, with affluent Gulf Cooperation Council (GCC) countries showing strong demand for luxury branded sandals and resort wear, while African nations offer long-term potential for basic, durable, and affordable summer shoes as economic development continues. Strategic focus in MEA should target distribution scalability and product durability tailored to diverse local climates and consumer purchasing power.

- North America: Market maturity, driven by performance footwear and significant e-commerce uptake; high adoption of sustainable products.

- Europe: Strong bifurcation between fashion-focused Southern European markets (espadrilles, leather sandals) and performance/outdoor markets in Northern Europe.

- Asia Pacific (APAC): Highest growth rate fueled by large population bases, rising incomes in emerging economies, and strong adoption of digital retail for seasonal purchases.

- Latin America (LATAM): Stable, year-round demand for basic and colorful open footwear; Brazil is a key manufacturing and consumption hub.

- Middle East and Africa (MEA): Growing luxury segment in GCC and increasing demand for value-based, durable footwear across wider African markets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Summer Shoes Market.- Nike Inc.

- Adidas AG

- Crocs Inc.

- Birkenstock GmbH & Co. KG

- VF Corporation (Vans, Timberland)

- Deckers Brands (Teva, UGG)

- Skechers USA Inc.

- Wolverine World Wide (Merrell)

- Caleres Inc.

- Havaianas (Alpargatas S.A.)

- Clarks International

- R.G. Barry Corporation (Dearfoams)

- Ecco Sko A/S

- PUMA SE

- New Balance Athletics Inc.

- Reef

- Aetrex Worldwide

- Camper

- Columbia Sportswear Company

- FitFlop

Frequently Asked Questions

Analyze common user questions about the Summer Shoes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Summer Shoes Market?

The Summer Shoes Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 6.8% during the forecast period from 2026 to 2033, driven by increasing consumer preference for lightweight, comfortable, and seasonally appropriate footwear, coupled with expanding e-commerce accessibility.

Which product segment dominates the Summer Shoes Market in terms of volume sales?

The Sandals and Flip-Flops product type segment consistently dominates the market in terms of volume sales due to their widespread acceptance, affordability, and essential functional necessity for casual use in warm and coastal climates globally.

How is sustainability influencing purchasing decisions in the Summer Shoes sector?

Sustainability is a major purchasing driver, particularly among younger consumers. Demand is increasing significantly for summer shoes made from recycled materials, bio-based polymers, and ethically sourced natural fibers, leading brands to invest heavily in material transparency and eco-friendly manufacturing processes to secure market share.

Which geographical region is expected to experience the fastest market growth?

Asia Pacific (APAC) is projected to be the fastest-growing regional market, fueled by substantial increases in disposable income, rapid urbanization, and the large, youthful population's increasing adoption of branded and casual seasonal footwear trends through robust online channels.

What key role does AI play in optimizing the Summer Shoes supply chain?

AI is crucial for optimizing the highly seasonal supply chain by providing highly accurate demand forecasting based on localized climate data and trends. This enables predictive inventory management, reducing the risks of overstocking or stockouts of specific styles, and improving overall seasonal profitability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager