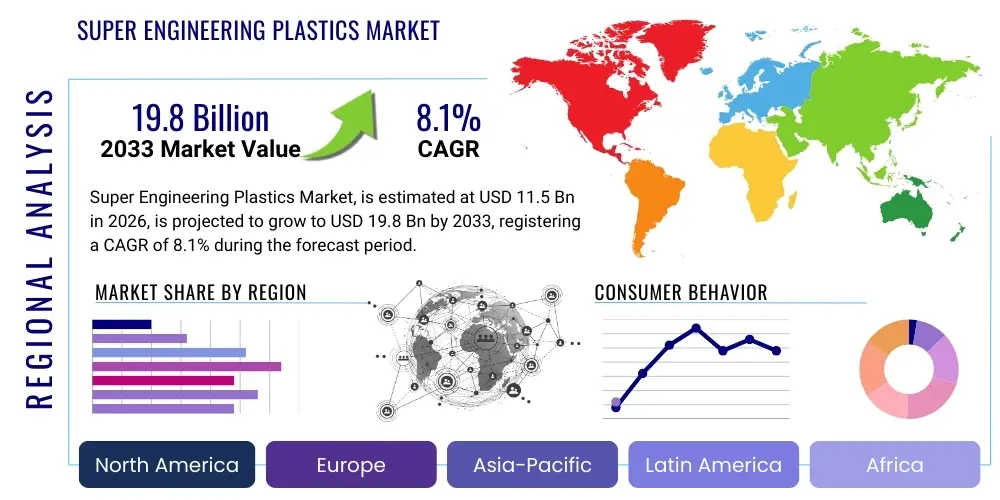

Super Engineering Plastics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437569 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Super Engineering Plastics Market Size

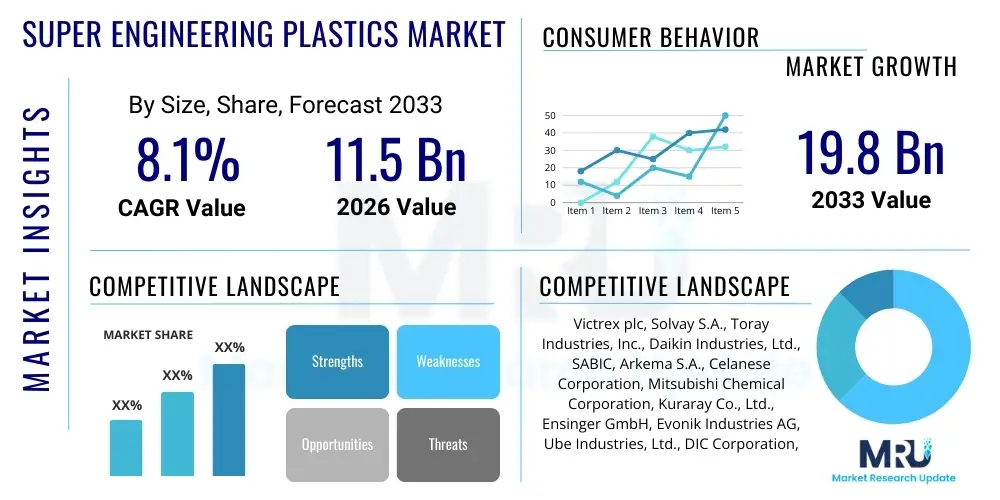

The Super Engineering Plastics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.1% between 2026 and 2033. The market is estimated at $11.5 Billion USD in 2026 and is projected to reach $19.8 Billion USD by the end of the forecast period in 2033.

Super Engineering Plastics Market introduction

Super Engineering Plastics (SEPs) represent a class of high-performance polymers characterized by superior mechanical properties, exceptional thermal stability, chemical resistance, and excellent performance under extreme conditions. Unlike standard engineering plastics, SEPs, such as Polyether Ether Ketone (PEEK), Polyimide (PI), Polysulfone (PSU), and Liquid Crystal Polymers (LCP), are designed to operate continuously at temperatures exceeding 150°C and often replace traditional materials like metals and ceramics in critical applications. The demanding requirements of modern industries, particularly aerospace, healthcare (medical devices), and high-voltage electronics, necessitate materials that offer reliability, reduced weight, and long-term durability, positioning SEPs as indispensable components in advanced manufacturing processes globally.

The primary applications driving the adoption of Super Engineering Plastics span across multiple sectors, including transportation (automotive and aerospace components subject to high stress and heat), electronics (connectors, insulators, and semiconductor fabrication equipment), and industrial machinery (compressor parts, bearings, and gears). A significant driver is the global shift toward electric vehicles (EVs) and advanced driver-assistance systems (ADAS), where SEPs provide lightweighting solutions alongside required electrical insulation and thermal management capabilities. Furthermore, the miniaturization trend in electronic devices and the increasing demand for biocompatible materials in medical implants heavily contribute to market expansion.

Key benefits associated with the use of these advanced polymers include significantly higher strength-to-weight ratios compared to metals, inherent resistance to hydrolysis and harsh chemical environments, superior dielectric properties, and reduced processing costs relative to machining metal parts. These benefits directly address critical industry challenges such as fuel efficiency in transportation, enhanced patient safety in medical technology, and improved operational lifespan in industrial settings. The continuous innovation in polymerization techniques and filler technology is further expanding the material portfolio, enabling custom formulations tailored for highly specific performance criteria, thereby solidifying the market’s robust growth trajectory over the forecast period.

Super Engineering Plastics Market Executive Summary

The Super Engineering Plastics market is experiencing robust growth driven primarily by escalating demand from the automotive sector, spurred by vehicle electrification and the relentless pursuit of lightweighting objectives, coupled with significant adoption in the medical sector for surgical instruments and long-term implants. Geographically, Asia Pacific remains the central hub of growth, fueled by massive industrial expansion, rapid infrastructure development, and substantial investments in the regional electronics and automotive manufacturing bases, particularly in China, Japan, and South Korea. Strategic imperatives for market players involve developing specialized, high-temperature grades of polymers and expanding compounding capabilities to meet customized application needs, ensuring compliance with stringent regulatory frameworks like REACH and RoHS, which govern materials used in sensitive industries.

Analyzing key business trends reveals a strong emphasis on backward integration among leading manufacturers, securing critical raw material supply chains, especially for high-purity monomers, and focusing intensely on sustainable manufacturing practices to minimize environmental impact and meet corporate social responsibility goals. Mergers, acquisitions, and strategic partnerships are prevalent, aimed at acquiring niche technological expertise, expanding geographical footprint into emerging markets, and enhancing material processing capabilities such as 3D printing compatibility for advanced SEPs. Pricing stability remains a competitive advantage, although fluctuations in petroleum-derived monomer costs occasionally exert pressure on profit margins, necessitating operational efficiency improvements and optimization of production scale.

Segment trends highlight the dominance of the Polyether Ether Ketone (PEEK) segment due to its unparalleled combination of high mechanical strength and thermal stability, making it the preferred material for orthopedic implants and critical aerospace components. Meanwhile, Polyimide (PI) is witnessing rapid uptake, especially in the electronics sector for flexible printed circuit boards (FPCBs) and thermal insulation films, catering to the burgeoning demand for thinner, lighter, and more flexible electronic devices. Furthermore, the rise of specialized applications in extreme environments, such as deep-sea oil and gas exploration and geothermal energy production, is bolstering the consumption of materials like Polyphenylsulfone (PPSU) and Polybenzimidazole (PBI), emphasizing the market's trajectory towards highly specialized, ultra-performance grades.

AI Impact Analysis on Super Engineering Plastics Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can revolutionize the costly and complex process of developing new super engineering plastic formulations, particularly focusing on optimizing material properties like fatigue resistance, thermal performance, and processability. Key user concerns revolve around the speed of material discovery, the prediction of long-term material degradation under specific operational stresses (e.g., creep in aerospace applications), and the optimization of intricate compounding and injection molding parameters to minimize waste and ensure high-precision component manufacturing. The consensus expectation is that AI will significantly accelerate R&D cycles, reduce the reliance on expensive and time-consuming physical testing, and enable the rapid prototyping of customized polymer structures, fundamentally changing how high-performance materials are brought to market.

AI's impact extends into advanced quality control and supply chain resilience. Users are keen to understand how ML algorithms can process vast amounts of sensor data collected during polymerization and extrusion processes to detect microscopic defects in real-time, thereby ensuring flawless production batches required for critical end-use applications like medical devices and engine parts. Furthermore, predictive maintenance models powered by AI are anticipated to become standard in the machines used to manufacture these plastics, reducing downtime and enhancing overall operational effectiveness. This technological integration is crucial for maintaining the high standards and zero-defect tolerances required in the super engineering plastics industry.

Ultimately, the core theme underlying user inquiries is efficiency and optimization. AI is viewed not merely as a tool for data analysis but as a strategic enabler for creating 'smart materials'—polymers whose performance characteristics can be accurately simulated and predicted before laboratory synthesis, leading to massive cost savings and superior end products. This convergence of material science and data science will unlock new application frontiers currently constrained by material limitations, particularly in extremely high-temperature or highly corrosive environments, accelerating material substitution efforts across aerospace and high-end automotive sectors.

- Accelerated discovery of novel polymer chemistries and optimized material formulations using generative AI models.

- Real-time quality control and defect prediction during high-precision injection molding and extrusion processes.

- Enhanced supply chain risk management and predictive logistics for high-value monomers and additives.

- Simulation of long-term mechanical and thermal performance (creep, fatigue) of finished SEP components, reducing physical prototyping cycles.

- Optimization of compounding process parameters (temperature, pressure, blending ratios) for maximized yield and reduced energy consumption.

- Development of standardized digital material databases accessible by AI systems for rapid design integration in end-user industries (e.g., aerospace CAD systems).

DRO & Impact Forces Of Super Engineering Plastics Market

The Super Engineering Plastics market is shaped by a confluence of powerful drivers related to technological shifts, stringent regulatory frameworks, and increasing consumer demands, balanced against significant material and processing restraints, while leveraging substantial opportunities emerging from high-growth industrial applications. A primary driver is the accelerating substitution of metals, ceramics, and lower-grade plastics across transportation and medical sectors due to SEPs’ superior performance attributes, driven by global mandates for lightweight, energy-efficient products. However, the market faces considerable restraint due to the high initial cost of monomers (like BPDA for PI or HQ for PEEK) and the complex, specialized processing equipment and expertise required for molding and handling these high-melt-temperature polymers, creating barriers to entry for smaller manufacturers.

The key opportunities lie in the booming fields of additive manufacturing (3D printing) of functional, end-use parts, where specialized PEEK and PEI filaments are gaining traction, and the rapidly growing semiconductor and microelectronics industry, which demands ultra-pure, high-temperature materials for fabrication tools and cleanroom environments. Furthermore, the energy sector, encompassing hydrogen fuel cells, concentrated solar power (CSP), and advanced battery systems, offers substantial avenues for utilizing SEPs' chemical resistance and dielectric strength. These opportunities require continuous investment in R&D to develop tailored grades that meet these highly specific environmental and functional requirements.

The impact forces currently governing the market dynamics are principally technological innovation, which dictates the pace of new material introduction and performance improvement, and environmental regulations, which increasingly favor sustainable, recyclable, and non-toxic polymer solutions, influencing material choice and product lifespan. The high capital intensity associated with establishing manufacturing facilities acts as a long-term barrier. Simultaneously, growing patent litigation and intellectual property protection surrounding proprietary polymer formulations maintain high entry barriers, ensuring that the market leadership remains concentrated among a few established global chemical companies with deep material science expertise and extensive patent portfolios.

Segmentation Analysis

The Super Engineering Plastics market is highly diverse, segmented based on material type, end-use industry, and geography, each exhibiting distinct growth dynamics and competitive landscapes. Segmentation by material type, which includes Polyether Ether Ketone (PEEK), Polyimide (PI), Polysulfone (PSU, PES, PPSU), Polyphenylenes Sulfide (PPS), and Liquid Crystal Polymers (LCP), reflects the varying thermal, mechanical, and chemical requirements of end-user applications. PEEK typically commands the highest value share due to its premium performance in critical applications, while PPS finds broader utility where high thermal resistance and chemical stability are required at a more moderate cost point. Strategic focus on LCPs is intensifying due to their excellent flow properties and ability to be molded into thin, complex geometries required by the miniaturization trend in electronics.

The end-use industry segmentation provides a clear picture of demand concentration, with Automotive and Transportation dominating in volume terms, driven by structural components, engine parts, and electrical insulation in EVs. Healthcare and Medical Devices represent the fastest-growing segment in terms of value, owing to the non-toxic, sterilizable, and biocompatible nature of materials like PEEK and PPSU used in surgical tools and implants. The Electric & Electronics sector remains a critical consumer, utilizing materials for high-frequency components, connectors, and thermal management films, benefiting from the superior dielectric strength and high-temperature performance capabilities of SEPs, particularly PI and LCPs.

Geographical analysis is crucial for understanding market maturity and growth potential. Asia Pacific leads the global market both in production capacity and consumption, fueled by its dominant position in global electronics and automotive manufacturing. North America and Europe, characterized by stringent performance standards and high-value applications (aerospace and advanced medical technology), remain crucial revenue generators, focusing on research and development of specialized, low-volume, high-margin products. Continuous monitoring of regional regulatory changes and technological adoption rates is essential for successful market navigation and strategic resource allocation across these diverse segments.

- By Material Type:

- Polyether Ether Ketone (PEEK)

- Polyimide (PI)

- Polysulfones (PSU, PES, PPSU)

- Polyphenylenes Sulfide (PPS)

- Liquid Crystal Polymers (LCP)

- Polybenzimidazole (PBI)

- Fluoropolymers (e.g., PTFE, FEP)

- By End-Use Industry:

- Automotive & Transportation

- Aerospace & Defense

- Medical & Healthcare

- Electric & Electronics

- Industrial & Manufacturing

- Oil & Gas

- Consumer Goods

- By Application:

- Structural Components

- Electrical Insulation

- Coatings & Films

- 3D Printing Filaments

- Bearings & Wear Pads

Value Chain Analysis For Super Engineering Plastics Market

The value chain for Super Engineering Plastics is characterized by complexity and high capital expenditure, starting with the upstream segment involving the synthesis and supply of specialized, high-purity chemical intermediates and monomers (e.g., bisphenol A, hydroquinone, various anhydrides, and sulfones). Only a limited number of specialized chemical companies possess the technological capability and scale to produce these monomers required for high-performance polymerization. The polymerization stage itself, often conducted under high pressure and temperature, demands stringent quality control, as any variation in raw material purity directly impacts the final polymer's properties, making the upstream segment highly influential and subject to proprietary intellectual property.

Moving downstream, the value chain encompasses compounding, processing, and distribution. Compounding involves blending the base polymer resin with various fillers (such as carbon fiber, glass fiber, or PTFE), additives, and pigments to tailor the final material characteristics—for example, enhancing mechanical strength, conductivity, or thermal stability—specifically for the end application. This processing stage adds substantial value and requires specialized equipment, like twin-screw extruders capable of handling high-viscosity, high-temperature melts. The material is then converted into various forms, including pellets, powders, sheets, rods, or filaments for additive manufacturing.

Distribution channels for SEPs are typically bifurcated into direct sales and indirect channels. Direct sales are predominant for high-volume, custom-engineered applications (e.g., major aerospace or automotive OEM contracts), requiring close technical collaboration between the polymer manufacturer and the end-user for material specification and process validation. Indirect channels involve specialized distributors and compounders who provide smaller batches, local inventory, technical support, and rapid delivery to small and medium-sized enterprises (SMEs). Given the highly technical nature of SEPs, the distribution network must include personnel with deep material science knowledge to advise customers on optimal material selection and processing parameters, reinforcing the importance of technical service as a key differentiator in the downstream market.

Super Engineering Plastics Market Potential Customers

Potential customers and end-users of Super Engineering Plastics are concentrated in industries that mandate performance under extreme conditions, where material failure carries significant safety or economic consequences. Key customers include global Original Equipment Manufacturers (OEMs) in the automotive sector, focusing on thermal management systems, high-voltage battery components, and interior/exterior structural parts demanding lightweighting and heat resistance, particularly for electric and hybrid vehicles. Additionally, tier-one and tier-two suppliers within the aerospace sector, specializing in interior components, engine parts, structural brackets, and electrical harnesses that require fire resistance, low smoke emission, and operation at high temperatures, are major consumers of materials like PEEK and PI.

The medical and healthcare industry constitutes a rapidly expanding customer base, encompassing manufacturers of reusable surgical instruments, minimally invasive devices, dental prosthetics, and long-term medical implants (e.g., spinal fusion cages, hip replacements). These customers prioritize biocompatibility, sterilizability (tolerance to repeated autoclave cycles), and mechanical strength. Furthermore, the electronics and semiconductor fabrication industries are vital customers, utilizing SEPs for wafer carriers, high-purity fluid handling components, and specialized connectors that must withstand corrosive chemicals and extreme heat associated with semiconductor processing environments, ensuring minimal contamination and high dielectric performance.

Beyond these core industries, customers are also emerging in the oil and gas sector (for seals, gaskets, and downhole tools capable of withstanding high pressures and corrosive media), the industrial machinery sector (for high-performance gears, bearings, and compressor parts that reduce noise and require little to no lubrication), and increasingly, specialized 3D printing service bureaus and manufacturers seeking high-performance filaments for functional prototyping and low-volume production of end-use parts. These diverse customer needs underscore the necessity for SEP manufacturers to maintain a broad portfolio of materials and offer sophisticated customization capabilities to meet highly granular application requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $11.5 Billion USD |

| Market Forecast in 2033 | $19.8 Billion USD |

| Growth Rate | 8.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Victrex plc, Solvay S.A., Toray Industries, Inc., Daikin Industries, Ltd., SABIC, Arkema S.A., Celanese Corporation, Mitsubishi Chemical Corporation, Kuraray Co., Ltd., Ensinger GmbH, Evonik Industries AG, Ube Industries, Ltd., DIC Corporation, PolyOne Corporation (Avient), Chevron Phillips Chemical Company, 3M Company, Saint-Gobain, Asahi Kasei Corporation, RTP Company, Kingfa Sci. & Tech. Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Super Engineering Plastics Market Key Technology Landscape

The technological landscape of the Super Engineering Plastics market is focused intensely on advanced polymerization techniques, innovative compounding methods, and the integration of these materials into novel manufacturing processes, particularly additive manufacturing. Key technological advancements center around synthesizing higher-purity monomers and controlling polymerization kinetics to yield polymers with extremely consistent molecular weight distribution, which is crucial for achieving predictable mechanical and thermal performance in demanding applications. Manufacturers are continuously investing in solid-state polymerization (SSP) and melt polymerization processes, seeking to improve efficiency and reduce the environmental footprint associated with solvent-based synthesis methods, while simultaneously enhancing the thermal stability and chemical inertness of the final resin.

A major technological trend is the evolution of compounding technology, moving towards high-shear, specialized extrusion processes that ensure homogenous dispersion of high-performance fillers, such as nanoscale carbon tubes, graphene, or chopped carbon fibers, into the polymer matrix. This precise compounding is vital for developing conductive, anti-static, or ultra-high-strength grades of SEPs required for grounding in electronic housings or structural integrity in aerospace components. Furthermore, surface modification technologies, including plasma treatment and specialized coating applications, are becoming essential for improving the adhesion properties of SEPs, particularly when bonding them to metals or other composite structures, which is common in multi-material assemblies in automotive body-in-white structures.

Additive manufacturing (AM), or 3D printing, represents a transformative technological frontier for SEPs. The development of high-temperature fused filament fabrication (HT-FFF) machines capable of processing high-melt-temperature polymers like PEEK and PEI, combined with the creation of AM-optimized powder and filament formulations, is opening avenues for complex geometry production that was previously impossible or prohibitively expensive using conventional injection molding. Furthermore, computational materials engineering, utilizing simulation tools like Finite Element Analysis (FEA) and Computational Fluid Dynamics (CFD), is standardizing the design and validation phases, allowing engineers to predict how SEP parts will perform under various operational loads and environments before manufacturing, drastically reducing design iterations and time-to-market for complex components.

Regional Highlights

Asia Pacific (APAC) stands as the dominant force in the Super Engineering Plastics market, representing the largest regional share both in terms of volume consumption and production capacity. This dominance is directly attributable to the region’s massive, rapidly expanding electronics manufacturing base, particularly in Taiwan, South Korea, and China, which heavily consume LCP and PI for high-frequency connectors and flexible circuits. Furthermore, the APAC region is the global epicenter for automotive manufacturing, especially in the production of Electric Vehicles (EVs), driving massive demand for high-performance plastics required for battery insulation, thermal runaway protection, and lightweight structural components. Favorable government policies promoting electric mobility and massive infrastructure projects requiring durable, high-performance materials continue to solidify APAC’s status as the principal growth engine for the foreseeable future, despite localized challenges such as fluctuating raw material costs and increasing labor expenses in established industrial hubs.

North America and Europe collectively constitute the second-largest market segment, characterized by high-value, low-volume applications driven by the highly regulated Aerospace & Defense and Medical industries. In North America, the emphasis is heavily placed on innovative materials for commercial aircraft (e.g., PEEK for fuselage brackets and interior components) and sophisticated medical devices (e.g., long-term implants using PEEK and specialized PPSU grades). European markets, driven by stringent environmental standards (e.g., EU Green Deal mandates), prioritize sustainable and easily recyclable SEP solutions, alongside robust demand from the advanced automotive sector for high-specification engine and transmission components. Both regions exhibit mature supply chains and high technological readiness, focusing on R&D, customization, and integrating SEPs into additive manufacturing processes to maintain technological leadership.

The Latin America, Middle East, and Africa (LAMEA) region, while currently holding a smaller market share, is demonstrating high growth potential, primarily fueled by investments in infrastructure, energy, and oil and gas exploration. Countries in the Middle East, such as Saudi Arabia and the UAE, are investing heavily in diversifying their economies away from traditional hydrocarbons, leading to increased adoption of SEPs in construction, industrial machinery, and water treatment facilities due to their superior resistance to harsh chemicals and extreme temperatures. Market penetration in these regions is currently hampered by reliance on imported materials and less developed specialized processing capabilities, but increasing foreign direct investment in manufacturing is expected to accelerate local consumption and processing over the forecast period, specifically targeting industrial maintenance and high-pressure fluid handling applications.

- Asia Pacific (APAC): Market leader driven by electronics, automotive electrification (EVs), and large-scale industrial manufacturing; high consumption of LCP, PI, and PPS.

- North America: High-value market focused on Aerospace & Defense, advanced medical devices, and high-performance PEEK applications; strong R&D investment in additive manufacturing.

- Europe: Mature market characterized by strict environmental regulations, premium automotive components, and industrial machinery; focus on sustainable and recyclable high-performance polymers.

- Middle East & Africa (MEA): Emerging market growth driven by oil & gas applications requiring high chemical and temperature resistance, and infrastructure development.

- Latin America: Gradual adoption across automotive replacement parts and industrial sectors; primarily reliant on imported SEPs but increasing local compounding capacity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Super Engineering Plastics Market.- Victrex plc

- Solvay S.A.

- Toray Industries, Inc.

- Daikin Industries, Ltd.

- SABIC

- Arkema S.A.

- Celanese Corporation

- Mitsubishi Chemical Corporation

- Kuraray Co., Ltd.

- Ensinger GmbH

- Evonik Industries AG

- Ube Industries, Ltd.

- DIC Corporation

- PolyOne Corporation (Avient)

- Chevron Phillips Chemical Company

- 3M Company

- Saint-Gobain

- Asahi Kasei Corporation

- RTP Company

- Kingfa Sci. & Tech. Co. Ltd.

Frequently Asked Questions

Analyze common user questions about the Super Engineering Plastics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between Super Engineering Plastics and standard Engineering Plastics?

Super Engineering Plastics (SEPs) are defined by their ability to maintain superior mechanical properties, dimensional stability, and chemical resistance at continuous operating temperatures exceeding 150°C, often reaching above 200°C. Standard engineering plastics typically cannot withstand such demanding thermal or chemical environments, limiting their use in high-stress or extreme temperature applications like aerospace components or medical sterilization equipment.

Which Super Engineering Plastic material holds the highest market value share?

Polyether Ether Ketone (PEEK) typically commands the highest market value share due to its unique combination of high strength, chemical inertness, excellent biocompatibility, and superior thermal performance, making it indispensable for high-stakes applications in aerospace, medical implants, and oil & gas environments.

How is the rise of electric vehicles (EVs) impacting the Super Engineering Plastics market?

EV adoption is a major growth driver. SEPs are crucial for EV battery components, offering necessary thermal management, electrical insulation, and flame retardancy to prevent thermal runaway. They also facilitate significant vehicle lightweighting, which is essential for extending battery range and improving overall energy efficiency, leading to increased demand for materials like PPS and specialty polyimides.

What role does 3D printing play in the future of Super Engineering Plastics?

Additive Manufacturing (AM) is transforming the SEP market by enabling the production of complex, functional end-use parts, especially for high-temperature applications. Specialized PEEK and PEI filaments and powders allow for customized, low-volume production in highly regulated sectors like aerospace and medical devices, driving technological innovation in material processing and machine design.

Which geographical region exhibits the fastest growth rate for SEPs?

Asia Pacific (APAC) is projected to exhibit the fastest growth rate, fueled by robust investment in the regional electronics industry, massive scale-up of automotive and EV manufacturing capacity, and increasing demand for advanced materials in infrastructure and industrial machinery across nations like China, India, and South Korea.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager