Super Tough Nylon Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433598 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Super Tough Nylon Market Size

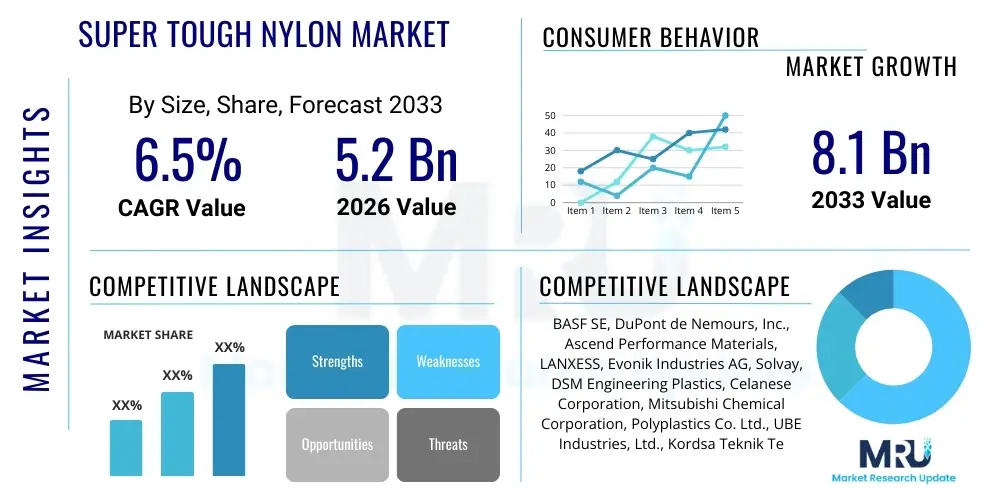

The Super Tough Nylon Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 5.2 Billion in 2026 and is projected to reach USD 8.1 Billion by the end of the forecast period in 2033.

Super Tough Nylon Market introduction

The Super Tough Nylon (STN) market encompasses high-performance polyamide materials specifically engineered to exhibit superior mechanical strength, exceptional impact resistance, and enhanced durability compared to standard nylon grades. These specialized polymers are created through advanced compounding techniques, often involving impact modifiers, elastomers, and sophisticated reinforcement agents, resulting in materials capable of withstanding extreme mechanical stress, harsh environments, and low-temperature conditions without fracturing. The primary product description centers on polyamides, such as Nylon 6 and Nylon 6,6, that have been chemically or physically modified to achieve dramatically increased toughness, elongation at break, and notched Izod impact strength, making them ideal replacements for metals and other conventional engineering plastics in demanding applications.

Major applications of Super Tough Nylon span critical sectors, predominantly the automotive industry, where STN is utilized in under-the-hood components, exterior body panels, and safety parts requiring robust energy absorption capabilities. Other significant application areas include electrical and electronics (E&E) for durable connectors and housings, industrial machinery for gears, bearings, and structural components, and high-quality consumer goods, such as power tool casings and sporting equipment. The key benefits of adopting STN include significant weight reduction compared to metal parts, excellent chemical resistance, superior processing characteristics, and the capability to integrate multiple functions into a single molded component, streamlining manufacturing processes and reducing assembly costs.

The market growth is primarily driven by the global trend toward vehicle lightweighting mandated by stringent emission regulations and the increasing demand for high-performance, durable plastics in the rapidly expanding electric vehicle (EV) sector. Furthermore, the persistent push for miniaturization and enhanced reliability in the electrical and electronics sector fuels the adoption of STN for thin-walled, yet incredibly strong, components. Investment in research and development, particularly focusing on bio-based and sustainable super tough nylon variants, represents a crucial secondary driving factor influencing market dynamics and opening new avenues for application expansion in specialized packaging and infrastructure projects.

Super Tough Nylon Market Executive Summary

The Super Tough Nylon (STN) market is characterized by robust growth, driven primarily by the automotive sector's rigorous requirements for lightweight, high-impact materials essential for enhancing fuel efficiency and structural safety, particularly within the expanding electric vehicle (EV) infrastructure. Business trends indicate a strong focus among leading manufacturers on backward integration to secure critical raw material supply (caprolactam and adipic acid) and aggressive investment in co-polymers and specialized blending technologies to tailor materials for specific end-user demands, such as flame retardancy and hydrolysis resistance. Furthermore, sustainability is emerging as a critical competitive differentiator, pushing companies toward developing bio-based STN grades and advanced recycling programs for existing polyamide waste streams, thereby addressing increasing regulatory pressures and consumer preferences for eco-friendly materials.

Regionally, the Asia Pacific (APAC) market, spearheaded by China and India, maintains dominance in both consumption and production capacity, benefiting from massive domestic automotive and electronics manufacturing bases and rapid industrialization. North America and Europe, while representing mature markets, exhibit high growth potential driven by the rapid adoption of advanced engineering plastics in aerospace and specialized industrial applications, alongside strict regulatory mandates promoting vehicle efficiency. Regional trends also show a diversification of manufacturing away from traditional automotive hubs towards emerging economies in Southeast Asia and Mexico, influencing global supply chain adjustments and the localized establishment of STN compounding facilities.

Segmentation trends highlight the Nylon 6,6 segment, modified for super toughness, as highly lucrative due to its superior thermal and mechanical performance, making it preferred for high-heat automotive applications. However, the Nylon 6 segment is experiencing strong growth due to its lower cost base and improved compounding technologies that allow it to meet challenging performance requirements, especially in consumer goods and certain industrial applications. In terms of application, the Electric and Electronics segment is witnessing the highest proportionate growth rate, driven by the escalating demand for highly durable, thin-walled enclosures and intricate connector systems necessitated by 5G technology and smart device proliferation, demanding materials that offer superior mechanical resilience without compromising on size or weight.

AI Impact Analysis on Super Tough Nylon Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can optimize the material science and manufacturing processes related to Super Tough Nylon (STN), focusing on enhancing material predictability, reducing R&D cycles, and optimizing production efficiency. Key themes include the use of AI for computational material design—predicting the performance characteristics of new polymer blends and impact modifier combinations before physical synthesis—thereby accelerating the creation of next-generation super tough polymers customized for extreme environments. Concerns often revolve around the upfront investment required for integrating AI into legacy compounding operations and the need for specialized data infrastructure to handle complex rheological and mechanical property datasets generated during testing. Expectations are high regarding AI's ability to drive down manufacturing defects, predict equipment failure in extrusion lines, and significantly improve quality control by analyzing spectroscopic and sensor data in real-time, moving STN manufacturing towards a truly smart, predictive environment.

The integration of AI also addresses the challenge of achieving consistent batch-to-batch quality in complex polymer compounding, which is crucial for high-reliability applications like automotive safety parts. AI algorithms can continuously monitor variables such as temperature, pressure, flow rate, and additive dispersion within the extruder, making instantaneous micro-adjustments that human operators cannot perceive, thus maximizing the material's super toughness characteristics. This predictive quality management not only reduces scrap rates but ensures the STN products meet the rigorous, non-negotiable specifications demanded by Tier 1 automotive suppliers and electronics manufacturers, fundamentally enhancing market confidence in the consistency and reliability of specialized polyamide products.

Furthermore, AI is pivotal in optimizing supply chain logistics for STN, especially considering the volatility in raw material costs (caprolactam and adipic acid). Predictive analytics allow manufacturers to forecast demand accurately, optimize inventory levels of specialty additives, and strategically source raw materials based on projected price fluctuations and regional availability, leading to reduced operational costs and increased responsiveness to market shifts. The adoption of AI-powered digital twins for STN manufacturing facilities is also gaining traction, enabling complex scenario planning for capacity expansion and optimizing energy consumption, contributing directly to the market's sustainability goals.

- AI-driven computational material science accelerates the development of novel high-impact nylon formulations.

- Machine Learning models optimize extrusion and compounding parameters, ensuring superior batch-to-batch consistency and toughness.

- Predictive maintenance uses sensor data to minimize downtime in high-cost STN production lines.

- AI enhances quality control by analyzing real-time spectroscopic data for immediate defect detection.

- Advanced analytics are used for raw material price forecasting and optimizing complex global supply chains for monomers and additives.

DRO & Impact Forces Of Super Tough Nylon Market

The Super Tough Nylon (STN) market dynamics are shaped by a balanced interplay of strong drivers, significant restraints, and emerging opportunities, all contributing to the overarching impact forces governing market expansion and competitive intensity. The primary driver is the pervasive demand for material substitution across end-use industries, particularly in automotive and aerospace, where STN provides an essential combination of low weight and high mechanical performance, directly impacting fuel economy and safety standards. This is complemented by the sustained growth of the consumer electronics sector, which requires materials that offer superior drop protection and durability for portable devices, pushing manufacturers to continuously upgrade material specifications. However, the market faces significant restraints, chiefly stemming from the high cost associated with specialty impact modifiers and complex compounding processes required to achieve the 'super tough' designation, often making STN considerably more expensive than standard engineering plastics, thereby limiting adoption in cost-sensitive applications.

A crucial opportunity lies in the rapid technological shifts within the energy and infrastructure sectors, specifically the construction of wind turbine components, demanding highly resilient polymers capable of withstanding extreme environmental loads and temperature variances. Furthermore, the development of sustainable Super Tough Nylon derived from bio-based sources or chemical recycling presents a long-term growth opportunity, allowing manufacturers to cater to environmentally conscious markets and comply with increasingly stringent European regulations on plastics usage. The impact forces acting on the market are high, characterized by moderate to high barriers to entry due to the specialized technology and IP required for effective compounding, resulting in intense competition among established players who continuously invest in proprietary stabilization and modification packages.

The market also contends with the threat of substitute materials, primarily advanced polycarbonates, high-performance polypropylenes, and specialized blends, which sometimes offer competitive mechanical properties at a lower cost base or with inherent advantages like transparency or lower density. The overall impact force is positive, however, because Super Tough Nylon offers a unique balance of thermal, chemical, and mechanical properties (specifically high notched impact resistance) that are difficult to replicate cost-effectively with most substitutes, especially in high-stress applications. Regulatory changes concerning plastic waste and sustainability in key regions like the EU act as both a driver (for bio-based STN) and a restraint (due to compliance costs), further intensifying the need for innovation and strategic differentiation among market participants.

Segmentation Analysis

The Super Tough Nylon market is comprehensively segmented based on product type, application, and geography, allowing for a nuanced understanding of regional consumption patterns and technological preferences. The core of product segmentation revolves around the base polymer used—Nylon 6 (PA6) and Nylon 6,6 (PA66)—each offering distinct thermal and chemical advantages, which are then enhanced through the incorporation of various impact modifiers, such as polyethylene elastomers or specialized grafted polymers, to achieve the desired high-toughness profile. Application analysis confirms that the market's trajectory is intrinsically linked to heavy industries, where material failure carries significant safety and economic implications, hence justifying the premium price point of STN materials for enhanced reliability.

Segmentation by product type also includes specialty polyamides (e.g., PA11, PA12, and polyphthalamide (PPA) modified for toughness), which cater to niche, high-end applications demanding superior chemical resistance or ultra-low moisture absorption, essential in aerospace and oil and gas sectors. The granular segmentation by application reveals shifting demand priorities; while automotive remains the largest volume consumer, driven by engine covers, intake manifolds, and structural brackets, the electrical and electronics sector is leading in terms of incremental growth, demanding STN for sophisticated, high-density connection systems and durable device casings.

Geographically, the market analysis provides crucial insights into manufacturing hubs and consumption centers. Asia Pacific (APAC) dominates due to its status as the world’s manufacturing powerhouse for vehicles and electronics, whereas North America and Europe are pivotal markets driven by stringent safety standards and the early adoption of advanced engineering thermoplastics in specialized fields. Understanding these segments is vital for manufacturers to tailor their portfolio (e.g., focusing on higher heat-resistant PA66 in Europe for traditional automotive, or focusing on cost-effective, high-impact PA6 in APAC for consumer goods) and optimize global distribution strategies.

- By Product Type:

- Super Tough Nylon 6 (PA6)

- Super Tough Nylon 6,6 (PA66)

- Specialty Polyamides (PA11, PA12, PPA Modified)

- Bio-based Super Tough Nylon

- By Application:

- Automotive (Structural components, Under-the-hood parts, Interior components)

- Electrical & Electronics (Connectors, Housings, Circuit Breaker Parts)

- Industrial Goods (Gears, Bearings, Pump Components, Casings)

- Consumer Goods (Power tool casings, Sporting equipment, Appliances)

- Packaging (Film and Barrier Applications)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Super Tough Nylon Market

The value chain for the Super Tough Nylon (STN) market is inherently complex, starting with the petrochemical industry (upstream) and culminating in highly specialized end-use manufacturing (downstream). Upstream analysis focuses on the supply of key monomers: caprolactam (for Nylon 6) and adipic acid, hexamethylene diamine (for Nylon 6,6). The price and stability of these petrochemical feedstocks critically influence the cost structure of STN, making backward integration a strategic imperative for large polymer producers. Key players in this phase include petrochemical giants who supply the base materials, which are then polymerized into standard nylon resin. This phase is capital-intensive and subject to global oil and gas price volatility, necessitating robust risk management strategies for polymer manufacturers to maintain competitive pricing for the final super tough compounds.

The central phase of the value chain involves polymerization, compounding, and modification—where standard nylon resins are transformed into Super Tough Nylon. This is achieved by incorporating highly specialized impact modifiers (e.g., functionalized polyolefins or specialty elastomers), stabilizers, and sometimes reinforcements like glass fibers, using twin-screw extrusion technology. The intellectual property and technological expertise embedded in the compounding formulation are the primary value-add components in this segment. Distribution channels are varied, involving both direct sales to large, Tier 1 automotive and electronics manufacturers (downstream) and indirect sales through specialized distributors who cater to smaller industrial users and custom compounders, providing local technical support and smaller batch sizes. Direct distribution ensures tight control over product specifications and allows for co-development of custom materials, highly valued in high-reliability applications.

Downstream analysis centers on the converting industry (injection molders, extruders) and the final end-user markets. Injection molding is the predominant processing method for STN parts, demanding specialized machinery and tooling due to the material's viscosity and thermal properties. Potential customers are heavily concentrated in the automotive sector (OEMs and Tier 1 suppliers), followed by high-specification electronics manufacturers. Successful market penetration relies on providing extensive technical service, material traceability, and certification (e.g., ISO/TS 16949 for automotive), validating the material's fitness for critical application performance, such as crash safety or long-term component durability under load. The effectiveness of the indirect channel is crucial for reaching fragmented markets such as smaller industrial machinery manufacturers and niche consumer goods producers.

Super Tough Nylon Market Potential Customers

The primary consumers and potential buyers of Super Tough Nylon are concentrated in industries that mandate the use of engineering plastics offering an exceptional combination of high impact resistance, reduced weight, and long-term durability, often replacing metal alloys or less resilient polymers. The largest cluster of potential customers resides within the automotive manufacturing ecosystem, encompassing Original Equipment Manufacturers (OEMs) and their Tier 1 suppliers. These entities utilize STN extensively for safety-critical components (e.g., pedestrian protection systems, crash energy absorbers), functional parts (e.g., engine covers, air intake manifolds, fluid reservoirs), and structural elements that require superior performance upon impact, driven by vehicle lightweighting targets and stringent crash test standards.

Another significant cohort of potential customers is found within the electrical and electronics (E&E) sector, specifically manufacturers of industrial control systems, circuit protection devices, and high-end consumer electronics. These customers require STN for applications where components must withstand repeated mechanical stress, impact from drops, and often maintain dimensional stability in environments with fluctuating temperatures, making it ideal for robust connectors, complex electrical housings, and casings for high-power handheld devices like power tools and medical instruments.

Furthermore, industrial machinery manufacturers represent a key segment, utilizing STN for demanding applications such as high-load bearings, gear systems, conveyor components, and pump casings where the material's abrasion resistance and noise damping properties, coupled with extreme toughness, provide a competitive advantage over traditional materials. The ability of STN to resist fracture under dynamic loading conditions ensures longer operational lifespan and reduces maintenance frequency, providing a compelling total cost of ownership proposition for industrial buyers seeking high-reliability components.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.2 Billion |

| Market Forecast in 2033 | USD 8.1 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, DuPont de Nemours, Inc., Ascend Performance Materials, LANXESS, Evonik Industries AG, Solvay, DSM Engineering Plastics, Celanese Corporation, Mitsubishi Chemical Corporation, Polyplastics Co. Ltd., UBE Industries, Ltd., Kordsa Teknik Tekstil A.Ş., EMS-CHEMIE HOLDING AG, Trelleborg AB, Ensinger GmbH, Saudi Basic Industries Corporation (SABIC), RTP Company, Techno Polymer Co. Ltd., RadiciGroup, Toray Industries, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Super Tough Nylon Market Key Technology Landscape

The technological landscape of the Super Tough Nylon (STN) market is primarily defined by advanced polymer compounding techniques aimed at achieving superior impact modification without compromising the inherent strength and thermal stability of polyamides. The core technology involves reactive extrusion and proprietary grafting methods, where impact modifiers—often specialized elastomers such as ethylene-propylene-diene monomer (EPDM) or functionalized polyolefins (like maleic anhydride grafted polyolefins)—are chemically bonded or finely dispersed within the nylon matrix. This fine dispersion, facilitated by high-performance twin-screw extruders operating under tightly controlled shear and temperature profiles, creates a microstructure that effectively absorbs impact energy by generating micro-crazes, thus preventing catastrophic brittle failure, especially at low temperatures. Continuous refinement of modifier selection and processing parameters remains the paramount technological focus for manufacturers seeking a competitive edge.

Beyond basic modification, the integration of nanofillers and specialized reinforcement agents represents a forward-looking technological trend. While glass fibers are common for stiffness, the incorporation of materials like carbon nanotubes or nano-clays, often surface-treated, is being explored to simultaneously enhance toughness, strength, and barrier properties, addressing demanding applications in aerospace and high-performance packaging. Furthermore, critical technological advancements are centered around improving the resistance of STN to harsh operating environments. This includes proprietary formulations to enhance hydrolysis resistance (especially critical in automotive cooling systems and electronic immersion applications) and the development of non-halogenated flame-retardant (FR) packages that maintain the material's super toughness, meeting stringent safety standards without sacrificing mechanical performance.

A key focus area involves processing technology optimization, particularly for manufacturing thin-walled components utilized in electrical connectors and small device casings. This requires materials with optimized melt flow characteristics that fill intricate mold geometries while retaining the requisite molecular structure for super toughness. Digitalization, specifically the use of advanced simulation tools (FEA and molecular modeling), plays an increasingly critical role in predicting the final part performance based on processing conditions and material formulation, drastically reducing the physical prototyping cycles and accelerating the time-to-market for novel STN products tailored for specific customer specifications.

Regional Highlights

Regional dynamics play a crucial role in shaping the Super Tough Nylon (STN) market, driven by varying industrial outputs, regulatory environments, and technological adoption rates across different geographies.

- Asia Pacific (APAC): APAC is the dominant market globally, characterized by expansive manufacturing capabilities in both automotive and consumer electronics, particularly in China, Japan, and South Korea. This region benefits from lower operating costs and government initiatives supporting the growth of domestic production, leading to high consumption volumes of STN for mass-market applications and significant local investment in compounding capacity expansion.

- North America: North America represents a mature, high-value market focused on highly specialized and certified STN applications. Growth is propelled by stringent safety regulations driving the adoption of high-performance plastics in the automotive sector, especially in EV battery components and structural elements. The region is also a key innovation hub for aerospace and specialized industrial machinery, demanding premium, high-specification STN grades.

- Europe: Europe is characterized by a strong emphasis on sustainability and circular economy principles. While automotive consumption remains high (driven by German and French manufacturers), the market is seeing rapid growth in bio-based and recycled STN variants, influenced by EU directives regarding plastic use and vehicle end-of-life treatment. Demand is concentrated in highly engineered, heat-resistant STN (often PA66-based) for demanding under-the-hood applications and industrial safety equipment.

- Latin America (LATAM): LATAM, primarily Brazil and Mexico, serves as a major manufacturing base, particularly for the automotive sector targeting both domestic and export markets. The market here is cost-sensitive but demonstrates steady growth as multinational corporations expand their manufacturing footprints, increasing the regional demand for standard and intermediate grades of Super Tough Nylon.

- Middle East & Africa (MEA): This region is an emerging market with specialized demand, largely driven by infrastructure projects, oil and gas piping, and local automotive assembly. Growth rates are moderate but are expected to accelerate with increasing urbanization and diversification efforts away from traditional energy sectors, generating demand for STN in construction and specialized industrial applications requiring high durability in harsh climatic conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Super Tough Nylon Market.- BASF SE

- DuPont de Nemours, Inc.

- Ascend Performance Materials

- LANXESS

- Evonik Industries AG

- Solvay

- DSM Engineering Plastics

- Celanese Corporation

- Mitsubishi Chemical Corporation

- Polyplastics Co. Ltd.

- UBE Industries, Ltd.

- Kordsa Teknik Tekstil A.Ş.

- EMS-CHEMIE HOLDING AG

- Trelleborg AB

- Ensinger GmbH

- Saudi Basic Industries Corporation (SABIC)

- RTP Company

- Techno Polymer Co. Ltd.

- RadiciGroup

- Toray Industries, Inc.

- Sumitomo Chemical Co., Ltd.

- Nylon Corporation of America (NYCOA)

Frequently Asked Questions

Analyze common user questions about the Super Tough Nylon market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Super Tough Nylon and how does it differ from standard polyamides?

Super Tough Nylon (STN) is a specialized engineering plastic, typically based on PA6 or PA66, chemically modified using impact modifiers and elastomers via advanced compounding (extrusion) to achieve significantly higher impact resistance, especially at low temperatures, compared to standard nylon grades. This modification results in superior fracture resistance and elongation at break, making it suitable for high-stress, safety-critical applications.

Which industry drives the highest demand for Super Tough Nylon?

The automotive industry is the largest end-user segment for Super Tough Nylon. It utilizes STN extensively for components requiring exceptional durability, energy absorption, and lightweight characteristics, such as under-the-hood parts, engine covers, and structural components critical for vehicle safety and fuel efficiency targets.

What are the primary restraints affecting the growth of the STN market?

The main restraints include the high production cost associated with the specialized impact modifiers and complex compounding processes required to achieve the 'super tough' characteristics. Furthermore, market growth is sometimes challenged by competition from alternative, often cheaper, high-performance substitutes like reinforced polycarbonates and specialized PBT blends.

How is sustainability impacting the development of Super Tough Nylon products?

Sustainability is a major trend, driving manufacturers to invest heavily in developing bio-based STN (derived from castor oil or other renewable resources) and formulations utilizing recycled content. These developments address increasing regulatory pressure, particularly in Europe, and cater to customer demand for more environmentally friendly high-performance polymer solutions.

What role does technology play in customizing Super Tough Nylon for niche applications?

Advanced technology, particularly reactive extrusion, additive chemistry, and computational material science (AI/ML), is crucial. These technologies allow manufacturers to precisely control the dispersion of impact modifiers and nanofillers, tailoring STN's properties (such as hydrolysis resistance, flow characteristics, and low-temperature performance) for highly demanding, niche applications in the aerospace, medical device, and specialized electronics sectors.

Is Super Tough Nylon used in electric vehicle battery systems?

Yes, STN is increasingly used in electric vehicle (EV) battery systems, primarily for battery module housings, cell separators, and structural components. Its lightweight nature, combined with high impact absorption capacity, provides critical protection against mechanical intrusion and structural integrity maintenance under stress, essential for EV safety protocols.

What is the key difference in application between Super Tough Nylon 6 and Nylon 6,6?

Super Tough Nylon 6 (PA6) is often preferred for applications requiring a balance of cost-effectiveness and high impact strength, common in consumer goods and non-high-heat automotive components. Super Tough Nylon 6,6 (PA66) is typically reserved for applications demanding superior thermal stability, higher melting points, and enhanced chemical resistance, making it ideal for engine components and systems operating at elevated temperatures.

What are common material specifications used to define 'Super Tough' in nylon?

'Super Tough' is commonly defined by significantly high Notched Izod Impact Strength values (often exceeding 800 J/m, compared to 50-100 J/m for standard nylon) and high elongation at break (often over 50-100%). These specifications ensure the material can absorb substantial energy without brittle fracture under sudden loading conditions.

How do manufacturers ensure batch consistency for Super Tough Nylon?

Manufacturers ensure batch consistency through rigorous quality control protocols, leveraging high-precision twin-screw extrusion equipment, continuous inline monitoring of compounding parameters (using sensors and spectroscopic techniques), and strict control over the ratio and quality of specialized impact modifiers, often supported by AI-driven process optimization.

Which region shows the highest projected growth rate for STN consumption?

The Asia Pacific (APAC) region is projected to exhibit the highest growth rate due to its burgeoning electric vehicle manufacturing sector, rapid industrialization, and sustained expansion of the electronics and consumer goods production bases across countries like China, India, and Southeast Asia.

What are the main distribution channels used in the STN market?

The STN market utilizes both direct and indirect distribution channels. Large volumes are sold directly to major Tier 1 automotive suppliers and OEMs. Indirect channels involve specialized plastic distributors and compounders who provide smaller batch sizes, technical support, and logistical services to small and medium-sized enterprises (SMEs) in various industrial sectors.

How does the implementation of 5G technology affect STN demand?

5G technology increases demand for STN in the Electrical & Electronics segment. It requires smaller, lighter, yet extremely durable and heat-resistant components for base stations, high-density connectors, and advanced device housings, where STN's high toughness and processing characteristics are highly valued.

Is Super Tough Nylon resistant to common chemicals?

Super Tough Nylon generally offers good resistance to common automotive fluids, oils, and solvents. However, its chemical resistance profiles vary depending on the base polymer (PA6 vs. PA66) and the specific impact modifiers used, necessitating careful selection for applications exposed to strong acids, bases, or high concentrations of zinc chloride solutions.

What role does recycling play in the future of the Super Tough Nylon supply chain?

Recycling is crucial for future supply chain resilience. Manufacturers are investing in chemical recycling technologies to depolymerize STN back into usable monomers (caprolactam, etc.) or developing high-quality mechanical recycling processes to reuse post-industrial or post-consumer STN waste, addressing resource scarcity and sustainability mandates.

Are there different grades of Super Tough Nylon for temperature extremes?

Yes. Manufacturers offer various grades tailored for temperature performance. While all STN shows excellent low-temperature toughness (a key differentiator), specialized PA66 or PPA-modified STN grades offer superior high-temperature resistance and long-term thermal aging stability, essential for demanding under-the-hood applications where continuous operating temperatures can exceed 150°C.

How does Super Tough Nylon compare to Polycarbonate (PC) in terms of performance?

While Polycarbonate offers inherent transparency and good impact strength, Super Tough Nylon provides superior chemical resistance, better abrasion resistance, higher melting temperatures, and often superior fatigue resistance, making STN preferred for structural and functional parts subjected to harsh chemical or thermal environments where PC might fail.

What is the significance of hydrolysis resistance in the STN market?

Hydrolysis resistance is highly significant, particularly in automotive (cooling lines) and industrial fluid handling systems where the material is exposed to hot water or steam. Standard nylon can degrade rapidly under these conditions; thus, high-performance STN grades are formulated with specialized additives to significantly mitigate hydrolysis, extending component lifespan.

How is the industrial goods segment utilizing Super Tough Nylon?

The industrial segment utilizes STN for robust components like safety helmets, machine covers, heavy-duty gear trains, and pneumatic tools. The material’s ability to withstand repeated physical abuse, minimize noise generation, and resist oil and grease makes it an indispensable choice for extending the service life of high-wear industrial parts.

Which technological innovation is currently most impactful for STN development?

The most impactful current innovation is the refinement of reactive extrusion and compounding techniques that allow for the precise and uniform dispersion of highly functionalized elastomeric impact modifiers. This technological mastery enables the production of ultra-high impact grades with minimal compromise on stiffness and superior consistency across batches.

Are small and medium enterprises (SMEs) major buyers of STN?

SMEs are significant potential customers, especially in localized industrial machinery and consumer appliance manufacturing. They typically procure STN through indirect distribution channels (authorized compounders and distributors) rather than direct OEM supply, requiring smaller volumes but demanding comprehensive technical support and tailored material advice.

What role does the aerospace industry play in STN consumption?

The aerospace industry is a small but critical consumer, primarily demanding specialized, high-cost, high-performance STN grades (often PA11 or PA12 based for superior chemical and moisture resistance) for interior components, brackets, and fluid conveyance systems where lightweighting and adherence to strict flame and smoke safety standards are paramount.

How does the price volatility of raw materials affect the profitability of STN manufacturers?

Price volatility of monomers like caprolactam and adipic acid significantly impacts STN manufacturers' margins. Companies mitigate this through long-term supply contracts, strategic inventory management, and backward integration into monomer production to stabilize costs and maintain competitive pricing in the specialized finished polymer market.

What is the competitive landscape like in the Super Tough Nylon market?

The competitive landscape is highly concentrated, featuring major global chemical and materials companies that possess the necessary R&D capabilities and proprietary compounding technologies. Competition centers on material performance specialization (e.g., enhanced thermal resistance or hydrolysis protection) and the ability to offer globally consistent supply and technical service.

What characteristics make STN suitable for power tool housings?

For power tool housings, STN offers excellent toughness to withstand repeated drops and impacts, resistance to chemicals (oils and greases), and good dielectric properties. Furthermore, its ability to be molded into complex geometries and its inherent vibration damping characteristics enhance both product performance and user comfort.

Are there flame retardant (FR) grades of Super Tough Nylon available?

Yes, non-halogenated flame retardant (FR) grades of Super Tough Nylon are available. These grades are essential for electrical and electronic applications, maintaining the high impact strength of STN while complying with critical flammability standards like UL 94 V-0, crucial for safety certifications.

How are simulation tools used in the STN product development cycle?

Simulation tools, including Finite Element Analysis (FEA) and computational fluid dynamics (CFD), are utilized to predict the material behavior under various stress conditions and to optimize mold design. This digital approach ensures that the final molded STN component retains its intended mechanical properties and minimizes potential failure points before physical tooling begins.

What distinguishes high-end specialty polyamides (like PA12) when modified for toughness?

Toughness-modified specialty polyamides like PA12 offer enhanced chemical resistance and significantly lower moisture absorption compared to PA6/PA66. This makes them crucial for specific high-performance applications like automotive fuel lines, pneumatic tubing, and demanding outdoor or medical environments where dimensional stability in wet conditions is non-negotiable.

How does the Super Tough Nylon market benefit from the trend toward miniaturization in electronics?

Miniaturization demands materials that can be molded into extremely thin walls while retaining high structural integrity and drop protection. STN meets this requirement by offering superior mechanical properties in thin-walled designs, essential for the high-density and compact construction of modern consumer electronic devices and connectors.

What is the current state of bio-based Super Tough Nylon adoption?

Bio-based STN (often derived from PA10 or PA11 precursors) is currently a niche but rapidly growing segment. While generally higher in cost, its adoption is increasing in premium consumer goods and specific European industrial applications where brand sustainability mandates and regulatory pressures favor non-fossil-derived polymers.

Why is impact modification crucial for nylon below the glass transition temperature?

Nylon becomes naturally brittle below its glass transition temperature (Tg). Impact modification is crucial because it introduces elastomeric phases that act as stress absorbers, maintaining the material’s ductility and preventing brittle fracture when exposed to low temperatures, such as those encountered in cold-weather automotive or industrial use.

Which countries in APAC are leading STN consumption growth?

China is the primary growth driver due to its massive domestic manufacturing base. However, countries like India, Vietnam, and Thailand are demonstrating strong incremental growth as global manufacturing supply chains diversify, leading to increased localized demand for high-performance polymers like STN in their respective automotive and electronics sectors.

How is the industrial printing (3D printing) market influencing STN demand?

While traditional STN is optimized for injection molding, the demand for high-performance polymer powders and filaments for industrial additive manufacturing (3D printing) is growing. This segment requires STN materials that offer inherent toughness and excellent layer adhesion, expanding STN use into rapid prototyping and customized tooling applications.

What are the typical lifespan expectations for STN components in demanding applications?

In demanding applications such as automotive timing components or industrial gears, STN components are expected to maintain functional integrity throughout the intended operational life of the equipment, often exceeding 10 to 15 years, due to their superior creep resistance, fatigue performance, and environmental stability compared to general-purpose plastics.

How do global trade tariffs or geopolitical tensions affect the STN supply chain?

Global trade tariffs, particularly those affecting petrochemical feedstocks or finished polymer compounds, introduce cost instability and necessitate complex sourcing strategies. Geopolitical tensions can disrupt critical supply routes for specialized additives and monomers, forcing manufacturers to regionalize production and seek secure, local material inputs, potentially impacting global pricing.

What distinguishes the packaging application segment for Super Tough Nylon?

In packaging, STN is used for specialized barrier films and high-strength flexible packaging where superior puncture resistance and barrier properties are required. This toughness is essential for packaging sharp or heavy items, reducing product damage and enhancing shelf life, differentiating it from commodity plastic films.

What are the limitations of standard melt-processing techniques for STN?

Standard melt-processing (like basic injection molding) requires careful temperature control, as excessive shear or prolonged residence time can degrade the specialized impact modifiers, reducing the material's intended 'super toughness'. Hence, specialized low-shear screws and optimized molding cycles are essential to preserve performance integrity.

What is the primary factor driving R&D investment in the STN market?

The primary factor driving R&D is the constant need to meet higher performance thresholds in the automotive and EV sectors—specifically, enhancing thermal stability (higher continuous use temperature) while simultaneously increasing impact absorption capability and ensuring resistance to new chemical agents (like aggressive battery coolants).

How does weight reduction compare between STN and aluminum alloys?

Replacing aluminum alloys with Super Tough Nylon can achieve weight reductions often exceeding 50%. While aluminum offers higher stiffness, STN provides a superior strength-to-weight ratio and better damping properties, making it preferred for semi-structural components where static loads are manageable but impact resistance is critical.

What market segment is currently most challenging for STN penetration?

The most challenging segment is typically high-volume, cost-sensitive consumer goods where the performance requirements are met by much cheaper materials like high-impact polypropylene (HIPP) or standard ABS. STN's premium pricing often limits its adoption to high-end, durable consumer products.

How important are certifications and standards (e.g., ISO, UL) for STN manufacturers?

Certifications (such as ISO 9001, IATF 16949 for automotive, and UL listings for flame retardancy) are mandatory for STN manufacturers. These standards validate the material's quality, consistency, and fitness for use in safety-critical applications, acting as non-negotiable entry requirements for major global buyers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager