Supply Chain Strategy and Operations Consulting Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435598 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Supply Chain Strategy and Operations Consulting Market Size

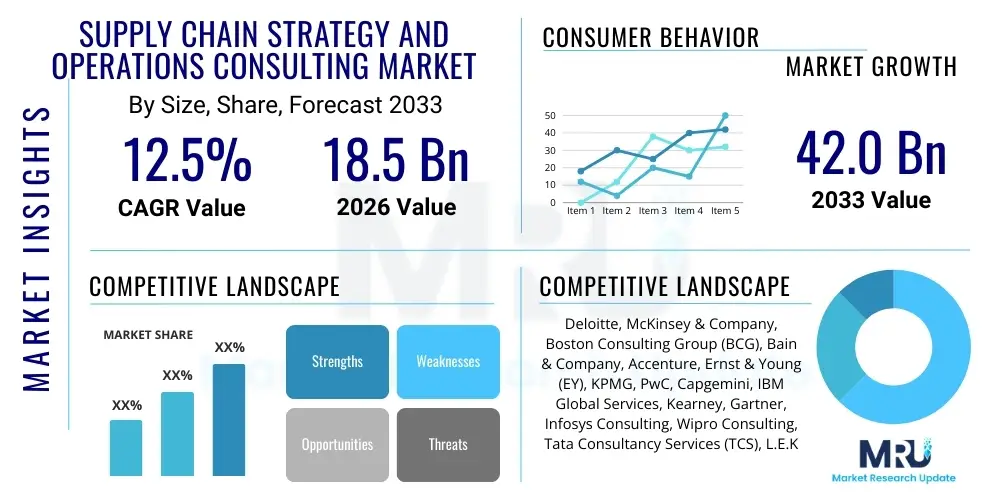

The Supply Chain Strategy and Operations Consulting Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at $18.5 Billion in 2026 and is projected to reach $42.0 Billion by the end of the forecast period in 2033.

Supply Chain Strategy and Operations Consulting Market introduction

The Supply Chain Strategy and Operations Consulting Market encompasses advisory services aimed at optimizing the design, planning, execution, control, and monitoring of supply chain activities with the objective of creating net value, building a competitive infrastructure, leveraging worldwide logistics, synchronizing supply with demand, and measuring performance globally. These services are crucial for enterprises navigating increasing complexities driven by globalization, geopolitical risks, sustainability mandates, and rapid technological adoption. The core offering includes strategic guidance on network design, inventory management optimization, procurement efficiency, and implementing digital transformation initiatives across the value chain to enhance resilience and responsiveness, thereby directly contributing to improved operational efficiency and reduced cost structures for client organizations.

The demand for these consulting services is intrinsically linked to the macroeconomic environment and the pace of technological disruption, particularly the integration of advanced analytics, Artificial Intelligence (AI), and Internet of Things (IoT) into logistics and manufacturing processes. Consultants assist clients in migrating from traditional, siloed supply chain models to integrated, end-to-end digital supply networks (DSNs). This transition involves evaluating existing systems, recommending best-fit technologies, and managing the change process to achieve agile and demand-driven operations. Furthermore, the increasing consumer expectation for faster delivery and personalized experiences necessitates sophisticated strategies that consulting firms are uniquely positioned to provide, driving continuous engagement in sectors such as retail, manufacturing, and healthcare where inventory and logistics are mission-critical components.

Major applications span diverse industries including automotive, fast-moving consumer goods (FMCG), healthcare, and aerospace, each requiring specialized expertise tailored to regulatory environments and product complexity. The primary benefit derived from engaging consulting services is tangible financial improvement, manifesting as reduced working capital, optimized transportation costs, enhanced forecasting accuracy, and minimization of stock-outs or excess inventory. Key driving factors include the mandatory need for supply chain risk mitigation following global disruptions, the pressure to comply with environmental, social, and governance (ESG) criteria, and the competitive necessity of achieving supply chain transparency and traceability from source to consumption, cementing the necessity of expert strategic oversight in complex operational environments.

Supply Chain Strategy and Operations Consulting Market Executive Summary

The Supply Chain Strategy and Operations Consulting Market is characterized by robust growth, propelled by the urgent corporate need for operational resilience and digital maturity in the wake of unprecedented global supply chain turbulence. Business trends indicate a pivot from efficiency-focused strategies toward balanced strategies emphasizing agility, redundancy, and sustainable practices. Large enterprises, particularly in the manufacturing and retail sectors, are the primary adopters, utilizing consulting expertise to deploy sophisticated tools such as digital twins and predictive analytics for real-time visibility and proactive decision-making. Mergers and acquisitions among consulting firms and specialized technology providers are increasing, aiming to create integrated service offerings that couple strategic advice with implementation support for complex SCM software solutions.

Segment trends highlight a significant acceleration in demand for Technology Consulting services within the supply chain domain, notably surrounding cloud-based SCM platform migration and the integration of AI-driven forecasting and automation solutions. While traditional Operations Consulting remains foundational, the growth trajectory is heavily skewed toward services addressing digital transformation (DX) and risk management frameworks. Furthermore, there is a clear segmentation trend emerging based on industry specialization; consulting services dedicated to life sciences and pharmaceuticals, dealing with cold chain logistics and regulatory compliance, are experiencing above-average growth compared to more mature segments like general manufacturing, reflecting the complexity and high-stakes nature of modern specialized logistics requirements.

Regionally, North America and Europe currently dominate the market due to the presence of global headquarters, high digital infrastructure maturity, and extensive outsourcing culture among large corporations seeking external strategic guidance. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR), driven by rapid industrialization, massive infrastructure development in emerging economies like India and Southeast Asia, and the increasing sophistication of local manufacturing hubs. These APAC regions are not only becoming major consumption centers but also critical nodes in global production networks, necessitating substantial investment in localized supply chain strategy development and optimization projects to manage complexity and improve intra-regional trade flows effectively.

AI Impact Analysis on Supply Chain Strategy and Operations Consulting Market

Common user questions regarding AI’s impact on Supply Chain Strategy and Operations Consulting frequently revolve around the potential for job displacement within the consulting sector, the measurable Return on Investment (ROI) of implementing AI-driven SCM solutions, and how consultants are adapting their methodologies to leverage predictive and prescriptive analytics offered by AI technologies. Users are keen to understand if AI tools will replace human strategic judgment or merely augment it, particularly concerning complex tasks like geopolitical risk modeling, demand forecasting under highly volatile conditions, and optimizing multimodal transportation networks. The consensus expectation is that AI will fundamentally shift the consulting value proposition from data gathering and basic analysis toward high-level strategic interpretation and the orchestration of complex, interconnected digital supply networks, necessitating new skill sets focused on data science and machine learning application in logistics.

- AI significantly enhances predictive maintenance and reduces unplanned operational downtime in manufacturing logistics.

- Implementation of AI-driven demand forecasting models minimizes inventory buffers and reduces working capital requirements.

- Consultants utilize machine learning algorithms for advanced risk scenario planning and geopolitical volatility assessment.

- AI-powered automation optimizes warehouse management systems (WMS) and autonomous material handling processes, reducing labor costs.

- Generative AI tools accelerate market research and benchmarking phases of consulting projects, increasing speed and accuracy.

- The rise of prescriptive analytics enables consultants to provide definitive, data-backed recommendations rather than relying solely on experience-based strategic hypotheses.

- AI adoption drives demand for specialized consulting services focused on data governance and ensuring ethical AI deployment in sensitive supply chain operations.

DRO & Impact Forces Of Supply Chain Strategy and Operations Consulting Market

The market dynamics are governed by a complex interplay of Drivers (D), Restraints (R), and Opportunities (O), which collectively constitute the Impact Forces shaping the consulting landscape. A major driver is the accelerating pace of global digital transformation (DX), pushing companies to modernize legacy supply chain systems, alongside the imperative for supply chain resilience demonstrated by recent global crises. These drivers necessitate external expertise to manage complexity, implement advanced analytics, and integrate disparate systems effectively, ensuring business continuity. Conversely, the high cost associated with premium consulting engagements, especially for Small and Medium Enterprises (SMEs), and the internal resistance to organizational change act as significant restraints, limiting the pace of full-scale digital adoption across all market segments.

Opportunities are abundant, particularly centered around sustainability and Environmental, Social, and Governance (ESG) mandates. Companies increasingly require consulting assistance to design circular supply chains, calculate scope 3 emissions, and implement transparent traceability solutions, creating a new, high-value niche within the market. Furthermore, the rise of specialized micro-consulting focused on niche technologies like blockchain for secure provenance tracking or quantum computing applications for highly complex route optimization presents avenues for diversification and specialized service development. Successful navigation of these forces requires consulting firms to continuously update their knowledge base, integrate technological expertise directly into their strategic teams, and develop tiered pricing models to cater to a broader client base.

The primary impact force remains the volatility of the global economic and geopolitical environment. Supply chain disruptions, whether from trade wars, pandemics, or natural disasters, instantly convert potential strategic risks into urgent operational priorities, mandating immediate consulting intervention. This creates a cyclical, reactive demand surge. On the proactive side, the continuous innovation cycle in SCM technology—where new tools like IoT sensors, 5G connectivity, and sophisticated ERP systems are constantly emerging—ensures sustained demand for strategic guidance on technology selection, integration, and maximum utilization, solidifying the continuous relevance of external advisory services in maintaining competitive parity or superiority.

Segmentation Analysis

The Supply Chain Strategy and Operations Consulting Market is segmented based on the type of service offered, the enterprise size engaging the services, and the specific end-use industry being served, reflecting the diversity of client needs and operational complexities across sectors. The segmentation allows consulting firms to develop targeted expertise and customized methodologies. Key segments include the broad categories of Strategy Consulting (focused on long-term goals and network design), Operations Consulting (focused on process improvement and tactical optimization), and Technology Consulting (focused on system implementation and digital enablement). The end-use industry segmentation, such as Automotive or Retail, is particularly critical as regulatory frameworks and operational challenges are highly unique to each sector, requiring deep industry knowledge from advisory professionals.

- By Service Type:

- Strategy Consulting (Network Design, Risk Management, Sourcing Strategy)

- Operations Consulting (Process Improvement, Lean Management, Inventory Optimization)

- Technology Consulting (System Implementation, Digital Transformation, Data Analytics Integration)

- By End-Use Industry:

- Manufacturing (Discrete and Process)

- Retail and Consumer Packaged Goods (CPG)

- Healthcare and Pharmaceuticals

- Automotive

- Aerospace and Defense

- Oil and Gas

- Technology and Telecommunications

- By Enterprise Size:

- Large Enterprises

- Small and Medium Enterprises (SMEs)

Value Chain Analysis For Supply Chain Strategy and Operations Consulting Market

The value chain for Supply Chain Strategy and Operations Consulting begins with the upstream component, which primarily involves the recruitment, development, and retention of highly specialized human capital. The quality of the consultant pool, encompassing expertise in advanced analytics, specific industry domain knowledge (e.g., cold chain logistics, automotive JIT), and change management skills, determines the premium pricing and efficacy of the services offered. Key upstream activities also include intellectual property development, such as proprietary methodologies, benchmarking databases, and patented diagnostic tools, which differentiate top-tier firms. Strategic partnerships with academic institutions for talent pipeline development and technology providers (e.g., SAP, Oracle, specialized AI vendors) for co-development of solutions are crucial upstream functions supporting service delivery.

The core midstream activity involves the actual delivery of consulting projects, segmented into phases like diagnosis, solution design, pilot implementation, and scale-up. This phase relies heavily on efficient project management, data security protocols, and robust quality assurance mechanisms to ensure that strategic recommendations translate into measurable operational improvements. Distribution channels for these services are predominantly direct, characterized by high-touch engagement where partners and senior managers maintain direct relationships with C-level executives of client organizations. However, indirect channels are growing, driven by technology alliances where SCM software vendors embed or recommend consulting partners during large-scale ERP or warehouse management system deployments, forming a symbiotic relationship.

Downstream activities focus on post-implementation support, continuous monitoring, and relationship management. This involves tracking Key Performance Indicators (KPIs) recommended in the strategy, offering periodic operational audits, and identifying subsequent phases for optimization (e.g., transitioning from a simple efficiency project to a full-scale digital twin deployment). Potential customers, or end-users, span the entire spectrum of global commerce, from multinational conglomerates to niche market players. The value chain is constantly being disrupted by digital platforms offering fractional consulting services or specialized SCM analytics tools, forcing traditional consulting firms to integrate these digital offerings into their service models to maintain relevance and competitive advantage against specialized technology-enabled competitors.

Supply Chain Strategy and Operations Consulting Market Potential Customers

Potential customers for Supply Chain Strategy and Operations Consulting services are broadly defined as any organization whose operational success is fundamentally dependent on the efficient and resilient movement, storage, and transformation of goods and information. The primary buyers are large multinational corporations (MNCs) that possess complex, globally distributed supply chains requiring sophisticated risk management frameworks and continuous technological upgrades. Within these organizations, the key decision-makers usually reside in the C-suite—specifically the Chief Operating Officer (COO), Chief Supply Chain Officer (CSCO), and increasingly the Chief Information Officer (CIO), as digital transformation projects become central to supply chain strategy. These large enterprises typically engage consulting firms for high-stakes, long-duration projects such as end-to-end network redesign or major system implementations.

Another significant customer segment comprises rapidly growing mid-market companies (SMEs) experiencing scaling challenges. These companies often lack the internal expertise or resources to formalize strategic supply chain functions as they transition from regional to national or international operations. For SMEs, consulting services are often utilized to establish foundational processes, implement scalable technologies (such as cloud-based SCM suites), and develop robust standard operating procedures (SOPs). The engagement model for this segment is typically focused on shorter, project-based interventions with clear, quantifiable outcomes, primarily aimed at unlocking immediate efficiencies and ensuring readiness for future growth demands and increased production volumes.

Furthermore, entities in highly regulated and specialized sectors, such as defense, public sector logistics, and pharmaceutical manufacturing, represent crucial niche buyers. These customers require specialized consulting expertise not only in operations optimization but also in adherence to stringent regulatory compliance standards (e.g., FDA requirements, ITAR regulations). For these clients, the value proposition extends beyond cost savings to include regulatory assurance and quality control. Ultimately, any organization facing strategic inflection points—such such as market entry into a new geography, post-merger integration, or a major sustainability pledge—becomes a high-potential customer seeking external guidance to navigate complex transitional periods effectively.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $18.5 Billion |

| Market Forecast in 2033 | $42.0 Billion |

| Growth Rate | CAGR 12.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Deloitte, McKinsey & Company, Boston Consulting Group (BCG), Bain & Company, Accenture, Ernst & Young (EY), KPMG, PwC, Capgemini, IBM Global Services, Kearney, Gartner, Infosys Consulting, Wipro Consulting, Tata Consultancy Services (TCS), L.E.K. Consulting, AlixPartners, Grant Thornton, GEP, Oliver Wyman. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Supply Chain Strategy and Operations Consulting Market Key Technology Landscape

The consulting market is intricately linked to the rapid evolution of technology, necessitating that consulting firms maintain deep expertise in implementing and integrating complex digital tools. Key technologies forming the foundation of modern supply chain optimization include advanced Enterprise Resource Planning (ERP) systems and specialized Supply Chain Management (SCM) software suites (e.g., SAP SCM, Oracle SCM Cloud) which provide the infrastructural backbone for integrated operations. However, the differentiation now lies in leveraging overlaying technologies such as predictive and prescriptive analytics platforms powered by Artificial Intelligence (AI) and Machine Learning (ML). These tools enable consultants to move beyond descriptive analysis to offer forward-looking, definitive strategic recommendations regarding inventory placement, routing optimization, and proactive risk detection, fundamentally changing the traditional operational consulting paradigm.

The increasing focus on end-to-end visibility and traceability has elevated the importance of technologies like Blockchain and Internet of Things (IoT). IoT sensors are critical for real-time monitoring of asset location, condition (temperature, humidity), and performance, particularly vital in high-value or temperature-sensitive logistics such as the cold chain. Consulting services are required to design the technical architecture for collecting and synthesizing this massive influx of sensor data into actionable insights for the client’s decision-makers. Similarly, consultants are guiding clients on how to utilize blockchain for creating immutable, transparent records of product provenance, ownership transfer, and regulatory compliance documentation, thereby building trust and reducing fraud within complex, multi-party supply networks.

Furthermore, advanced simulation tools and Digital Twins are becoming indispensable components of high-level strategy consulting. A digital twin is a virtual representation of the entire physical supply chain network, allowing strategists to run millions of ‘what-if’ scenarios—testing the resilience to geopolitical shocks, changes in tariffs, or surges in demand—without impacting actual operations. Consulting engagements often center on building, validating, and training client teams to use these sophisticated simulation environments. The integration of 5G connectivity is also a crucial factor, enabling the low-latency, high-volume data transfer required for real-time robotic process automation (RPA) in warehouses and manufacturing facilities, demanding consulting input to ensure seamless integration across the operational technology (OT) and information technology (IT) divide within the client organization.

Regional Highlights

North America remains the dominant revenue contributor to the Supply Chain Strategy and Operations Consulting Market, primarily driven by the high concentration of Fortune 500 companies, a mature outsourcing culture, and aggressive adoption of digital technologies, particularly in e-commerce and advanced manufacturing sectors. U.S. corporations, facing intense pressure to mitigate risks associated with reliance on overseas manufacturing (nearshoring/reshoring initiatives), are heavily investing in consulting services to redesign their North American logistics networks, focusing on automation, resilience, and sustainability compliance. The availability of high-level talent and significant expenditure on SCM software integration projects ensures that demand for strategic advisory services remains robust, often focusing on advanced AI implementation and sophisticated risk mapping strategies to ensure regulatory adherence and operational superiority.

Europe represents the second-largest market, characterized by stringent regulatory environments, especially concerning environmental sustainability (ESG) and cross-border trade complexities within the EU common market and post-Brexit trade arrangements. European companies are leading the charge in circular economy consulting, seeking expert advice on waste reduction, reverse logistics optimization, and achieving carbon neutrality goals within their supply chains. The demand is particularly strong in Germany (automotive and industrial machinery) and the UK (retail and financial services). Consulting firms in Europe are emphasizing specialized offerings around GDPR-compliant data sharing in supply chain ecosystems and strategies for achieving full traceability to meet increasingly demanding consumer and governmental scrutiny.

The Asia Pacific (APAC) region is projected to exhibit the fastest growth over the forecast period, fueled by rapid economic expansion, massive infrastructural investments (e.g., China's Belt and Road Initiative, India's manufacturing drive), and the accelerating digital transformation across industries like electronics, textiles, and CPG. While digital maturity varies greatly within APAC, countries like Japan, South Korea, and Australia lead in adopting advanced SCM technologies, driving demand for high-end strategy consultation. Emerging markets such as India, Vietnam, and Indonesia require consulting expertise to establish foundational logistics infrastructure, optimize distribution networks in challenging environments, and implement scalable cloud-based SCM solutions to manage unprecedented volume growth and escalating cross-border supply chain complexities across diverse regulatory and geographical landscapes.

- North America: Dominant market share; driven by high digital maturity, nearshoring trends, and large-scale AI integration projects in retail and manufacturing.

- Europe: Strong focus on ESG consulting, circular supply chains, and complex intra-European customs and trade compliance optimization services.

- Asia Pacific (APAC): Highest CAGR; growth driven by infrastructural development, massive e-commerce penetration, and increasing sophistication of local manufacturing hubs in countries like China and India.

- Latin America (LATAM): Growing demand for visibility and resilience solutions, addressing regional infrastructure deficits and macroeconomic volatility concerns.

- Middle East and Africa (MEA): Investments in mega-projects and diversification efforts in logistics, particularly in the UAE and Saudi Arabia, are driving bespoke consulting requirements focused on establishing modern logistics corridors and high-tech ports.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Supply Chain Strategy and Operations Consulting Market.- Deloitte

- McKinsey & Company

- Boston Consulting Group (BCG)

- Bain & Company

- Accenture

- Ernst & Young (EY)

- KPMG

- PwC

- Capgemini

- IBM Global Services

- Kearney

- Gartner

- Infosys Consulting

- Wipro Consulting

- Tata Consultancy Services (TCS)

- L.E.K. Consulting

- AlixPartners

- Grant Thornton

- GEP

- Oliver Wyman

Frequently Asked Questions

Analyze common user questions about the Supply Chain Strategy and Operations Consulting market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Supply Chain Strategy and Operations Consulting Market?

The Supply Chain Strategy and Operations Consulting Market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 12.5% during the forecast period from 2026 to 2033, driven by continuous digital transformation initiatives and the urgent need for global supply chain resilience strategies.

Which industry segment is driving the highest demand for specialized supply chain consulting services?

The Manufacturing sector, including both discrete and process manufacturing, remains a core driver due to its need for complex network optimization, advanced inventory control, and integrating IoT and AI technologies into production logistics to mitigate risks and enhance operational throughput.

How does the emergence of Artificial Intelligence (AI) affect the value proposition of supply chain consultants?

AI shifts the consultant's role from basic data analysis to strategic orchestration. Consultants now leverage AI for predictive modeling and scenario planning, enhancing the accuracy of recommendations related to demand forecasting and risk mitigation, thereby elevating their strategic advisory role.

What are the primary restraints impacting the growth of the Supply Chain Strategy Consulting Market?

The primary restraints include the high financial cost of comprehensive consulting engagements, which limits SME adoption, coupled with significant internal organizational resistance to implementing the systemic operational and cultural changes recommended by external advisors.

Which geographical region is expected to demonstrate the fastest growth in supply chain consulting?

The Asia Pacific (APAC) region is forecasted to achieve the highest growth rate, fueled by accelerated industrialization, widespread adoption of e-commerce logistics complexity, and substantial government and private investment in establishing modern, resilient supply chain infrastructure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager