Surgery Robotic Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431699 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Surgery Robotic Market Size

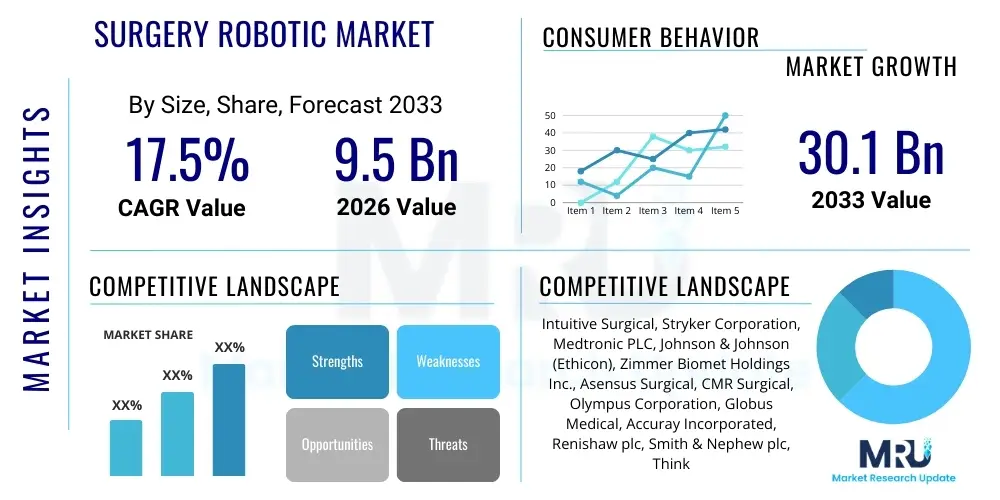

The Surgery Robotic Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 17.5% between 2026 and 2033. The market is estimated at USD 9.5 Billion in 2026 and is projected to reach USD 30.1 Billion by the end of the forecast period in 2033.

Surgery Robotic Market introduction

The Surgery Robotic Market encompasses systems designed to assist surgeons in performing complex procedures with enhanced precision, flexibility, and control compared to conventional techniques. These sophisticated systems integrate advanced hardware, software, imaging capabilities, and telemanipulation technologies, fundamentally shifting surgical paradigms toward minimally invasive approaches. Key components include surgeon consoles, patient-side carts, and high-definition vision systems. The primary product segments include robotic systems, instruments & accessories, and services, catering primarily to applications in general surgery, gynecology, urology, orthopedics, and neurosurgery. The descriptive definition of a surgical robotic system centers on its ability to filter natural hand tremors and scale the surgeon's movements, translating them into precise instrument actions inside the patient's body.

Major applications driving market expansion are urological procedures, particularly prostatectomy, and gynecological procedures, such as hysterectomy, where the benefits of robotic precision significantly reduce patient recovery time and hospital stays. Furthermore, general surgery applications, including colorectal and bariatric procedures, are rapidly adopting robotic platforms due to evidence demonstrating improved clinical outcomes and reduced complication rates. The ongoing technological evolution is moving toward smaller, more specialized, and modular robotic systems that can be integrated into various operating room (OR) environments, increasing accessibility beyond large teaching hospitals.

The primary benefits fueling adoption include reduced invasiveness, minimized blood loss, decreased post-operative pain, and faster patient recovery. These clinical advantages are strongly correlated with improved economic outcomes for healthcare providers, as efficiency in the OR increases and length of stay decreases. Driving factors for market growth include the global aging population, which necessitates more complex surgical interventions; increasing prevalence of chronic diseases requiring surgical treatment; and significant investments in healthcare infrastructure development, particularly in emerging economies where governments are prioritizing advanced medical technologies. The regulatory landscape, while stringent, is also adapting to facilitate the introduction of next-generation robotic platforms, accelerating market maturity.

Surgery Robotic Market Executive Summary

The Surgery Robotic Market is characterized by robust business trends centered on technological diversification, strategic acquisitions, and increasing democratization of surgical robotics. Key market players, previously dominated by proprietary systems, are now facing heightened competition from new entrants offering specialized, lower-cost, or collaborative robotic platforms. The dominant business trend involves shifting revenue models from capital equipment sales to recurring revenue streams derived from proprietary instruments, accessories, and maintenance contracts, ensuring long-term financial stability for system manufacturers. Furthermore, significant investment in artificial intelligence (AI) and machine learning (ML) integration is becoming standard, aiming to enhance surgical planning, real-time guidance, and workflow optimization, thereby cementing the transition from purely teleoperated systems to intelligent, assisted platforms.

Regionally, North America maintains the largest market share, driven by high purchasing power, favorable reimbursement policies, and early, widespread adoption of advanced medical technologies in centers of excellence. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR), fueled by expanding healthcare infrastructure, rising medical tourism, increasing government initiatives to modernize surgical care, and a substantial unmet clinical need stemming from large patient populations. Europe demonstrates steady growth, concentrating on the integration of robotic systems into public health services (NHS, etc.) and focusing on cost-effectiveness and outcome standardization through centralized procurement processes. Latin America and the Middle East & Africa (MEA) are emerging as high-potential markets, though penetration rates remain lower, constrained primarily by capital investment limitations and the necessity for specialized surgeon training programs.

Segment trends reveal that instruments and accessories consistently account for the largest revenue share, reflecting the high volume and disposable nature required for each procedure. Among applications, General Surgery is rapidly accelerating its adoption rate, threatening to overtake established segments like Urology and Gynecology due to the broad applicability of robotic platforms in complex abdominal procedures. In terms of product segmentation, hybrid and modular robotic systems are gaining traction, offering greater flexibility compared to large, monolithic platforms. End-user trends show that hospitals, particularly large integrated delivery networks (IDNs) and ambulatory surgical centers (ASCs), are the predominant buyers, with ASCs showing increasing interest due to their focus on cost-efficient, high-volume elective procedures, especially in orthopedics and ophthalmology, prompting the development of smaller, purpose-built robotic units.

AI Impact Analysis on Surgery Robotic Market

Users frequently inquire about how AI enhances surgical precision, if AI will replace human surgeons, and the role of machine learning in training and simulation. These common questions highlight a key theme: users are seeking clarity on AI's ability to transition robotic systems from mere tools into cognitive assistants capable of decision support and autonomous execution of micro-tasks. The consensus expectation revolves around AI augmenting the surgeon's capabilities through real-time data analysis, predictive modeling of potential complications, and optimizing surgical workflows. Concerns often focus on data privacy, the validation of algorithmic decision-making, and the ethical implications of increasing automation, while simultaneously recognizing the potential for AI to dramatically improve patient outcomes and standardize surgical quality across different institutions.

AI's influence is profound, transforming robotic platforms by incorporating deep learning algorithms for image recognition and surgical scene segmentation. This allows systems to differentiate tissue types, identify critical structures like nerves and vessels, and provide augmented reality overlays that guide the surgeon during critical dissection phases. Furthermore, AI is central to improving robotic kinematics and control by predicting optimal force feedback and compensating for minute instrument drift, thereby enhancing dexterity. Predictive analytics, trained on vast datasets of previous surgical videos, are now being deployed to estimate operative time, material usage, and potential intra-operative challenges, enabling better resource allocation and scheduling efficiency in the operating room.

The future expectation is that AI will be integrated into every stage of the surgical journey, from pre-operative planning—using patient-specific anatomical models derived from scans—to post-operative care monitoring. AI-driven simulation platforms are also revolutionizing surgeon training by providing highly realistic, personalized training modules that dynamically adapt difficulty based on trainee performance. This leads to faster skill acquisition and better proficiency assessment. Overall, the market views AI not as a replacement for the surgeon, but as the essential layer of intelligence that maximizes the utility, safety, and performance of robotic hardware, leading to a new era of cognitive surgery where data-driven insights are integrated seamlessly into real-time operational execution.

- Real-Time Surgical Guidance: AI algorithms enable automatic identification of critical anatomical structures and provide real-time augmented reality overlays.

- Automated Task Execution: ML allows for the semi-autonomous execution of repetitive, high-precision micro-tasks, reducing surgeon fatigue.

- Predictive Analytics: AI analyzes surgical video data to predict potential complications, bleeding risk, and optimize workflow timing.

- Enhanced Robotics Control: Machine learning optimizes instrument force feedback and movement trajectories, improving system dexterity and safety.

- Advanced Training & Simulation: AI-driven simulators offer personalized, data-validated training paths for robotic surgeons, accelerating proficiency.

- Image Segmentation: Deep learning facilitates faster and more accurate processing of intraoperative imaging (e.g., fluoroscopy, ultrasound).

DRO & Impact Forces Of Surgery Robotic Market

The Surgery Robotic Market is driven significantly by technological advancements and the escalating demand for minimally invasive procedures globally. The primary driver is the demonstrable clinical superiority of robotic surgery in complex procedures, leading to superior patient outcomes, shorter hospital stays, and quicker return to normal activities. Restraints, however, revolve primarily around the substantial initial capital investment required for robotic systems, which can exceed several million dollars, and the high operational costs associated with disposable instruments and specialized maintenance. Opportunities lie in expanding the application base to emerging fields like spine and interventional radiology, developing affordable modular systems for global scalability, and leveraging AI to reduce procedure variability. The impact forces are characterized by strong regulatory scrutiny balanced against high unmet clinical needs, creating a pressurized environment where innovation must prioritize safety, efficacy, and economic viability.

A key internal impact force is the intellectual property landscape, which has traditionally been highly concentrated, acting as a soft restraint. However, the expiration of several core patents is now accelerating innovation by encouraging new entrants and fostering competition, thus reducing overall system costs over the long term and expanding market accessibility. Externally, the increasing focus on value-based healthcare models serves as a potent driver, as robotic surgery systems, despite their high upfront cost, demonstrate a positive return on investment (ROI) by reducing readmission rates and complication management expenses, aligning well with payment structures that reward quality outcomes rather than volume. This economic justification is crucial for adoption in competitive healthcare markets like the US and Western Europe.

Furthermore, the persistent challenge of training qualified personnel represents a significant restraint. Proper utilization of robotic systems requires extensive, specialized training for surgeons, nurses, and technicians, which demands considerable time and resources. Addressing this training bottleneck, often through simulator technology and standardized certification programs, is a major focus for market participants. The opportunity to introduce robotic platforms into underserved regions and outpatient settings remains vast, provided manufacturers can address the cost barrier effectively. The synergistic impact of AI and 5G connectivity is also acting as a powerful disruptive force, paving the way for tele-surgery capabilities, which will expand access to specialized robotic procedures in remote or rural locations, redefining the geography of surgical care.

Segmentation Analysis

The Surgery Robotic Market segmentation provides a granular view of revenue distribution across distinct product categories, clinical applications, and end-user types, reflecting diverse adoption patterns and investment priorities across the global healthcare ecosystem. The market is primarily segmented by Product (Robotic Systems, Instruments & Accessories, Services), Application (General Surgery, Urology, Gynecology, Orthopedics, Neurology, Others), and End User (Hospitals, Ambulatory Surgical Centers, Research & Academic Institutes). Analysis reveals that the recurring revenue generated by instruments and accessories forms the bedrock of market financial health, while the application segment highlights shifting clinical focus, particularly the rapid growth of non-traditional robotic applications like spine and bariatric surgery. End-user segmentation emphasizes the importance of hospitals as central purchasing hubs, simultaneously noting the increasing economic influence of outpatient facilities.

- By Product:

- Robotic Systems (Systems are further segmented into Da Vinci Systems, Non-Da Vinci Systems, and emerging modular platforms)

- Instruments & Accessories (Disposable instruments, Endoscopes, Cautery tools, Staplers, Energy devices)

- Services (Maintenance contracts, Software upgrades, Training services)

- By Application:

- General Surgery (Colorectal, Bariatric, Hernia repair)

- Urology (Prostatectomy, Nephrectomy)

- Gynecology (Hysterectomy, Myomectomy)

- Orthopedics (Joint Replacement, Spine Surgery)

- Neurology

- Others (Cardiothoracic, ENT)

- By End User:

- Hospitals (Large-scale public and private institutions)

- Ambulatory Surgical Centers (ASCs)

- Research & Academic Institutes

Value Chain Analysis For Surgery Robotic Market

The value chain for the Surgery Robotic Market is complex and capital-intensive, starting with sophisticated upstream activities involving R&D, component manufacturing, and software development. Upstream analysis focuses heavily on precision engineering, advanced material science (for lightweight and biocompatible instruments), and highly specialized sensor technology. Key upstream suppliers include manufacturers of high-performance robotics components, advanced imaging sensors (4K/8K cameras), and complex control software systems. The high barrier to entry in this segment is driven by the need for regulatory compliance (FDA/CE Mark) and extensive intellectual property protection, favoring established technology integrators and specialized component providers that can meet stringent medical device quality standards.

The core midstream activity involves the final system assembly, calibration, and meticulous quality control, culminating in manufacturing the integrated robotic platforms. Following manufacturing, the distribution channel is critical. Direct distribution, where system manufacturers sell and service their products directly to hospitals, is the predominant model, particularly for high-value capital equipment like the main robotic system. This direct model ensures control over installation, specialized training, and ongoing proprietary maintenance services, maximizing customer relationship management. However, for instruments and accessories, a blend of indirect distribution through authorized dealers and third-party logistics partners is often utilized to ensure efficient, timely delivery of disposable items to various geographic locations.

Downstream analysis centers on the deployment, utilization, and maintenance of the robotic systems within end-user settings, primarily hospitals and ASCs. Success downstream is highly dependent on post-sales support, robust service contracts, and continuous software updates. The shift towards recurring revenue is heavily influenced by the consumption of disposable instruments (indirect revenue stream) and essential service contracts (direct revenue stream). Potential customers require not just the hardware but a complete ecosystem, including accredited training programs, dedicated clinical support staff, and integration with existing hospital IT systems (EHR/PACS). The efficiency and profitability realized by the end-user through patient throughput and reduced complication rates ultimately validates the entire value chain, driving future purchasing decisions and market adoption rates globally.

Surgery Robotic Market Potential Customers

The primary potential customers and end-users of surgical robotic systems are institutions heavily focused on complex, high-volume surgical procedures and committed to adopting minimally invasive technologies to improve patient outcomes. Large, tertiary care hospitals and Integrated Delivery Networks (IDNs) represent the most significant segment due to their substantial capital budgets, high procedure volumes across multiple specialties (Urology, GYN, General Surgery), and strong focus on achieving status as centers of excellence, which is often tied to technology adoption. These institutions utilize robotic systems for their most demanding cases, valuing the system’s precision, ergonomic benefits for surgeons, and marketing advantage in attracting patients.

Ambulatory Surgical Centers (ASCs) are rapidly emerging as a critical customer segment, particularly for orthopedic and certain general surgery applications. While traditionally constrained by the high cost of older monolithic systems, the development of smaller, purpose-built, and potentially portable robotic units is making these advanced tools accessible to the ASC environment. ASCs prioritize efficiency and rapid patient turnover, and robotics that facilitate faster recovery times and standardized procedures are highly attractive. The financial model in ASCs necessitates careful ROI calculation, making lower total cost of ownership (TCO) models, often favored by newer competitors, particularly appealing.

A third, specialized customer segment includes academic medical centers and specialized research institutions. These entities purchase robotic systems not only for clinical use but also for advanced surgeon training, biomedical research, and the development/testing of novel surgical techniques and devices. Their demand is often for cutting-edge platforms, including those integrated with advanced imaging, experimental force feedback, or telerobotic capabilities, driving the foundational R&D that eventually trickles down to general clinical practice. These institutions act as key opinion leaders (KOLs), influencing purchasing decisions across the broader market. The purchasing cycle for all potential customers is lengthy, involving technology assessment committees, financial viability reviews, and clinical champion buy-in.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 9.5 Billion |

| Market Forecast in 2033 | USD 30.1 Billion |

| Growth Rate | 17.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Intuitive Surgical, Stryker Corporation, Medtronic PLC, Johnson & Johnson (Ethicon), Zimmer Biomet Holdings Inc., Asensus Surgical, CMR Surgical, Olympus Corporation, Globus Medical, Accuray Incorporated, Renishaw plc, Smith & Nephew plc, Think Surgical, Siemens Healthineers, B. Braun Melsungen AG, Corindus Vascular Robotics (Siemens Healthineers), Titan Medical Inc., Microsure, Stereotaxis, Tianjin Microport Orthopedics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Surgery Robotic Market Key Technology Landscape

The technological landscape of the Surgery Robotic Market is characterized by rapid convergence of sophisticated mechanical engineering, advanced computer vision, and machine learning. The core technology centers around master-slave manipulators (teleoperation), where the surgeon controls the instruments remotely via a console, translating large hand movements into precise, micro-scale actions at the surgical site. A critical technological component is the integration of high-definition 3D visualization systems, often utilizing 4K or even 8K resolution cameras, which provide the surgeon with immersive depth perception and highly detailed visual feedback essential for complex procedures. Force feedback (haptic) technology, though still evolving, is becoming increasingly important, aiming to restore the tactile sensation lost in traditional teleoperated systems, enhancing the surgeon's ability to gauge tissue tension and prevent inadvertent damage.

Beyond the core robotic arm mechanics, the proliferation of specialized instrument technology is a key differentiator. This includes highly articulated, wrist-like instruments (endowrist technology) that mimic the full range of human hand movement but with enhanced articulation unavailable to the human wrist inside the body. Furthermore, energy devices, staplers, and specialized suction tools designed specifically to interface seamlessly with robotic platforms are continuously refined to improve surgical efficiency and reduce operative time. The shift toward single-port access systems, which minimize incision size and complexity, requires highly advanced instrument design capable of multi-functional performance through a very small, confined entry point.

The emerging technological frontier is the rise of next-generation robotic platforms focusing on modularity, mobility, and artificial intelligence integration. Modular systems, unlike the fixed, large platforms of the past, allow hospitals to customize the system configuration based on specific procedural needs and space constraints, increasing utilization rates. Furthermore, advanced AI capabilities are being built into the operating system for autonomous tracking, motion planning, and data logging. Navigation technologies, particularly crucial in orthopedics and neurosurgery, are incorporating robotics with pre-operative imaging (CT/MRI) and real-time intra-operative imaging (fluorscopy) to guide precise bone cutting or implant placement. The implementation of 5G networks is also a technological disruptor, providing the necessary low latency and high reliability required to make telerobotic surgery viable over long distances.

Regional Highlights

- North America (NA): North America dominates the global market, primarily driven by the United States, which accounts for the highest installed base of robotic systems worldwide. This leadership position is underpinned by high healthcare expenditure, established reimbursement frameworks for robotic procedures (especially in urology and gynecology), and the presence of major robotic market pioneers. The region exhibits high acceptance among both surgeons and patients, propelled by continuous investment in R&D and rapid adoption of cutting-edge technologies like AI-enhanced guidance systems. The competitive landscape is intense, focusing on expanding robotic applications into spine, lung, and specialized cardiovascular interventions.

- Europe: The European market demonstrates steady, mature growth, albeit often constrained by centralized budgeting processes in national healthcare systems (e.g., NHS in the UK, centralized procurement in Scandinavia). Adoption is high in Western European countries like Germany, France, and Italy, where economic stability allows for substantial capital investments in surgical robotics. The focus here is increasingly on demonstrating cost-effectiveness and long-term clinical superiority to justify expensive technology purchases. Regulatory standards (MDD/MDR transition) are driving a push toward robust data collection and standardization of training protocols.

- Asia Pacific (APAC): APAC is the fastest-growing region, fueled by rapidly expanding economies, significant government investments in healthcare infrastructure (particularly in China, India, and South Korea), and a growing middle class demanding high-quality care. While adoption started slower due to high cost barriers, new regional manufacturers and the introduction of more affordable, local robotic solutions are accelerating penetration. Medical tourism is a significant driver, particularly in countries like Singapore and Thailand, where hospitals actively adopt advanced technology to attract international patients. Training and localized language support for complex systems remain key challenges.

- Latin America (LATAM): Market penetration in LATAM remains nascent compared to North America and Europe, largely concentrated in major urban centers of Brazil, Mexico, and Argentina. Growth is gradual, limited by volatile economic conditions, currency fluctuations affecting imported capital equipment costs, and inconsistent reimbursement policies. The primary opportunity lies in high-volume private hospitals seeking differentiation through advanced technology adoption.

- Middle East and Africa (MEA): The MEA market is largely dependent on oil-rich nations in the GCC (Saudi Arabia, UAE) where substantial healthcare infrastructure development projects fund the adoption of advanced robotics. These regions often import the latest generation systems to establish world-class medical facilities. Africa's market remains largely untapped, constrained by funding issues and infrastructure limitations, though isolated high-end facilities in South Africa and Egypt are adopting introductory systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Surgery Robotic Market.- Intuitive Surgical

- Stryker Corporation

- Medtronic PLC

- Johnson & Johnson (Ethicon)

- Zimmer Biomet Holdings Inc.

- Asensus Surgical

- CMR Surgical

- Olympus Corporation

- Globus Medical

- Accuray Incorporated

- Renishaw plc

- Smith & Nephew plc

- Think Surgical

- Siemens Healthineers

- B. Braun Melsungen AG

- Corindus Vascular Robotics (Siemens Healthineers)

- Titan Medical Inc.

- Microsure

- Stereotaxis

- Tianjin Microport Orthopedics

Frequently Asked Questions

Analyze common user questions about the Surgery Robotic market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving force behind the adoption of surgical robotics?

The primary driving force is the clear clinical benefit of minimally invasive robotic surgery, which translates into reduced patient trauma, decreased blood loss, lower infection rates, and significantly faster recovery times compared to traditional open surgery, enhancing overall patient outcomes.

How does the high cost of robotic systems affect market growth in developing regions?

The substantial initial capital expenditure and associated consumable costs act as a significant restraint, limiting widespread adoption in developing regions. Market growth relies heavily on manufacturers introducing more affordable, modular, and specialized systems that offer a favorable total cost of ownership (TCO) and higher ROI for cost-sensitive healthcare providers.

In which surgical application is robotic technology most established?

Robotic technology is most established and utilized in urological procedures, particularly radical prostatectomy, where the precision and enhanced visualization offered by the systems are crucial for nerve sparing and optimal functional outcomes. Gynecology also represents a highly mature application segment.

What role does Artificial Intelligence (AI) play in the evolution of surgical robotics?

AI is transforming surgical robotics by providing cognitive assistance, enabling real-time intra-operative guidance, enhancing image recognition for anatomical segmentation, optimizing surgical workflow, and powering advanced simulators for standardized surgeon training, ultimately moving toward augmented surgical execution.

Is the market dominated by a single company, and is competition increasing?

Historically, the market has been dominated by Intuitive Surgical, but competition is rapidly increasing due to patent expirations and aggressive R&D from global players like Medtronic, Johnson & Johnson, and Stryker. This heightened competitive environment is fostering innovation and driving down overall system costs across various application segments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager