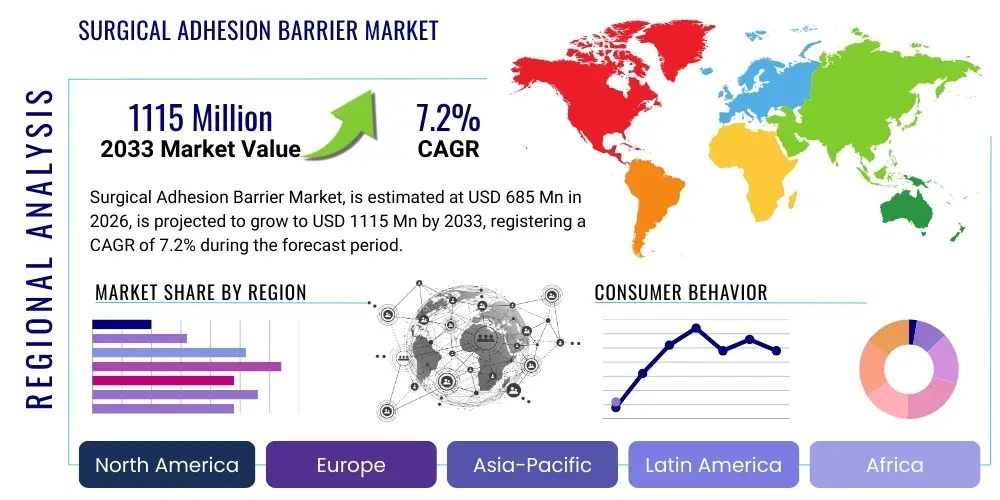

Surgical Adhesion Barrier Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437035 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Surgical Adhesion Barrier Market Size

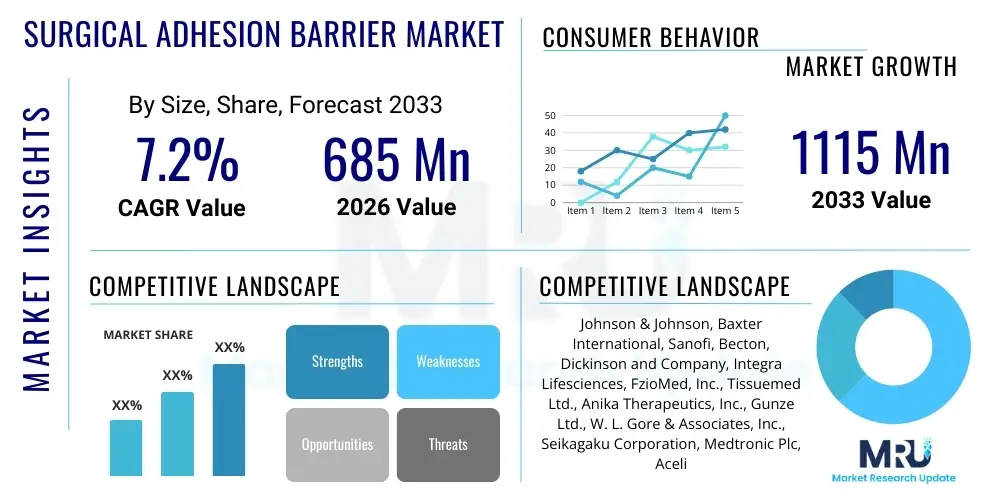

The Surgical Adhesion Barrier Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2026 and 2033. The market is estimated at USD 685 Million in 2026 and is projected to reach USD 1115 Million by the end of the forecast period in 2033.

Surgical Adhesion Barrier Market introduction

The Surgical Adhesion Barrier Market encompasses medical devices or biomaterials utilized during surgical procedures to minimize the formation of scar tissue, known as post-operative adhesions, between adjacent tissues or organs. These barriers are crucial in preventing severe complications such as chronic pain, small bowel obstruction, and secondary infertility, which frequently arise after invasive surgeries, particularly in abdominal and gynecological settings. The core product categories include synthetic materials (like hyaluronic acid and polyethylene glycol-based films) and natural materials (such as collagen and fibrin), offered in various formulations including films, gels, and sprays, designed for ease of application and effective temporary separation of tissue surfaces during the critical healing phase.

Major applications for surgical adhesion barriers span across critical surgical domains, including reconstructive surgery, cardiovascular interventions, general abdominal surgery (colectomy, appendectomy), and, most predominantly, gynecological procedures (myomectomy, hysterectomy). The primary benefit conferred by these products is the measurable reduction in adhesion incidence and severity, leading to improved patient outcomes, reduced need for adhesiolysis (adhesion removal surgery), and decreased healthcare costs associated with adhesion-related readmissions. Furthermore, the development of bioresorbable barriers, which degrade naturally over time after fulfilling their function, significantly mitigates the risk associated with leaving permanent foreign bodies inside the patient.

Driving factors for sustained market growth include the rising volume of surgical procedures globally, especially complex procedures related to obesity, cancer, and aging populations, which inherently carry a high risk of adhesion formation. Additionally, growing awareness among surgeons and patients regarding the long-term debilitating effects of adhesions, coupled with continuous advancements in material science leading to the development of more efficacious, easy-to-use, and biocompatible barriers (such as advanced oxidized regenerated cellulose and novel hydrogels), further propel market expansion. Regulatory approvals for next-generation products and supportive clinical data demonstrating long-term success are also foundational to the adoption of these essential surgical adjuncts.

Surgical Adhesion Barrier Market Executive Summary

The Surgical Adhesion Barrier Market demonstrates robust growth, primarily fueled by the increasing complexity and volume of laparoscopic and open surgeries across industrialized and emerging economies. Current business trends indicate a strong shift towards synthetic, film-based barriers due to their superior handling characteristics and proven clinical efficacy, alongside an escalating demand for liquid or gel formulations that can uniformly coat irregular tissue surfaces, making them highly suitable for minimally invasive procedures. Strategic initiatives by key market players focus heavily on R&D for bio-functional barriers that integrate anti-inflammatory or regenerative properties, aiming to move beyond mere physical separation towards active tissue modulation, thereby securing a competitive advantage in a consolidating market landscape characterized by stringent regulatory scrutiny and increasing pressure for cost-effectiveness in hospital settings.

Regionally, North America maintains market dominance, driven by established reimbursement structures, high surgical volumes, and rapid adoption of advanced medical technologies. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR), propelled by improving healthcare infrastructure, rising medical tourism, expanding access to advanced surgical care, and a growing incidence of lifestyle-related diseases necessitating surgical intervention. European markets show stable growth, guided by rigorous clinical guidelines and a preference for biodegradable, CE-marked products, while Latin America and the Middle East and Africa (MEA) offer emerging opportunities due to increasing government investment in surgical facilities and the adoption of standardized surgical protocols aimed at minimizing complications and improving overall surgical quality.

Segment trends highlight the Gynecological and Abdominal applications as the major revenue generators, owing to the particularly high incidence rates of adhesion formation post-procedure in these anatomical sites. Within product segmentation, the film segment, notably oxidized regenerated cellulose (ORC) barriers, maintains substantial market share due to its established clinical history and widespread acceptance. Simultaneously, the burgeoning growth of synthetic polymer-based gels and sprays signifies a growing preference for products that offer maximal coverage and ease of application, especially in complex or highly inflamed operative fields. The end-user segment is dominated by hospitals, yet Ambulatory Surgical Centers (ASCs) are emerging as critical adoption points due to their focus on high-efficiency, same-day surgeries and reduced patient recovery times, increasingly integrating these barriers into standardized procedure trays.

AI Impact Analysis on Surgical Adhesion Barrier Market

Common user questions regarding AI's influence center on how artificial intelligence can improve the efficacy and personalization of adhesion prevention strategies. Users frequently inquire about AI-driven predictive modeling to identify high-risk patients pre-operatively, optimizing barrier placement using robotic assistance, and utilizing machine learning for analyzing long-term patient registry data to correlate specific barrier types with surgical outcomes. Key concerns revolve around the ethical deployment of data, the integration challenges of AI software into existing robotic surgical platforms, and whether AI can help standardize the application technique of adhesion barriers, which is highly surgeon-dependent. The consensus expectation is that AI will move the field toward personalized adhesion management protocols, reducing unnecessary barrier use in low-risk cases while ensuring optimal coverage in complex, high-risk patients, thereby optimizing resource allocation and enhancing cost-effectiveness in adhesion prevention.

- AI integration into surgical planning software can analyze patient risk profiles (based on surgical history, inflammation markers, and genetic predisposition) to recommend the necessity and type of adhesion barrier.

- Machine learning algorithms can process intraoperative imaging data from robotic and laparoscopic systems to suggest optimal barrier placement and ensure complete tissue separation in difficult anatomical areas, enhancing application precision.

- AI-powered predictive analytics will be utilized post-market surveillance to correlate specific barrier material degradation profiles and patient inflammatory responses with long-term adhesion recurrence rates, driving evidence-based product improvement.

- Natural Language Processing (NLP) can rapidly analyze unstructured operative notes and Electronic Health Records (EHRs) across vast populations to identify patterns in adhesion formation etiology, informing clinical guideline updates and product usage recommendations.

- Adoption of augmented reality (AR) systems, powered by AI, could guide surgeons in applying liquid or spray barriers uniformly, particularly in challenging deep cavity surgeries, minimizing technique variability.

DRO & Impact Forces Of Surgical Adhesion Barrier Market

The dynamics of the Surgical Adhesion Barrier Market are shaped by powerful factors categorized into Drivers, Restraints, and Opportunities, which collectively determine the Intensity of Impact Forces. The primary drivers include the escalating global surgical burden resulting from chronic diseases, especially gynecological conditions and oncology treatments, where the risk of adhesion formation is substantial, directly stimulating demand. Furthermore, compelling clinical evidence supporting the cost-effectiveness of prophylactic barrier use—by significantly reducing subsequent hospital readmissions and the need for complex adhesiolysis procedures—provides a strong economic incentive for widespread adoption, particularly in health systems focused on quality metrics and value-based care models. These drivers exert a continuous, high-impact force on market expansion and penetration.

Conversely, significant restraints impede faster market growth. These include the high cost associated with premium, advanced bioresorbable barriers, which can create budgetary constraints in public healthcare systems and emerging markets, often leading to non-utilization or preference for cheaper, less effective alternatives. Additionally, the fragmented regulatory landscape across different countries, coupled with the need for extensive, long-term clinical trials to prove superior efficacy over existing methods, slows down the commercialization and uptake of novel technologies. A persistent challenge remains the lack of standardized surgical protocols in some facilities, where the use of adhesion barriers may be left to individual surgeon discretion rather than being mandatory for high-risk procedures, leading to inconsistent market demand.

Opportunities for profound growth lie in the development of multi-functional barriers that not only provide physical separation but also incorporate therapeutic agents, such as localized drug delivery systems for anti-inflammatory or anti-fibrotic medications, creating next-generation products with superior patient outcomes. Expansion into unexplored surgical applications, such as orthopedic and neurosurgical fields, where adhesion formation can significantly impair function, represents an untapped revenue stream. Furthermore, strategic market entry into high-growth, underserved regions like China and India, coupled with partnerships to enhance local manufacturing and distribution, promises long-term sustainable growth and competitive advantage. The interplay between strong clinical drivers and the continuous need to overcome cost and regulatory restraints defines the moderate to high impact force profile characterizing this specialized medical device sector.

Segmentation Analysis

The Surgical Adhesion Barrier Market is comprehensively segmented based on product type, formulation, application, and end-user, enabling focused strategic planning and targeted product development. Understanding these segments is crucial for identifying key growth vectors, recognizing varying user needs, and addressing specific clinical requirements across different surgical domains. The segmentation reflects both the material science advancements in barrier design—moving from basic physical films to sophisticated bio-integrated gels and sprays—and the critical clinical areas where the need for adhesion prevention is most urgent, particularly in the highly technical fields of minimally invasive surgery where precise and localized application is paramount.

- By Product Type:

- Synthetic Adhesion Barriers (e.g., Hyaluronic Acid, PEG, PTFE)

- Natural Adhesion Barriers (e.g., Collagen, Fibrin, Cellulose-based)

- By Formulation:

- Film/Membrane Barriers

- Gel Barriers

- Liquid/Spray Barriers

- By Application:

- General Surgery

- Gynecological Surgery

- Cardiovascular Surgery

- Neurological Surgery (Spinal and Cranial)

- Urological Surgery

- Orthopedic Surgery

- Reconstructive Surgery

- By End-User:

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

Value Chain Analysis For Surgical Adhesion Barrier Market

The value chain for the Surgical Adhesion Barrier Market is complex, beginning with the highly specialized procurement and manufacturing of advanced biomaterials. Upstream activities are dominated by pharmaceutical and chemical companies that supply high-grade raw materials such as oxidized regenerated cellulose, specialized polymers (like polyethylene glycol), and purified biological components (like fibrin or hyaluronic acid). This initial stage requires rigorous quality control and compliance with Good Manufacturing Practices (GMP) due to the implanted nature of the final product. Research and Development, encompassing material science innovation and clinical trials to establish efficacy and biocompatibility, constitutes a crucial, high-cost component of the upstream process, determining product differentiation and regulatory success in key markets like the US and EU.

Midstream activities involve the specialized manufacturing and assembly of the barriers, transforming raw materials into final formulations (films, gels, or sprays), requiring sterile processing environments and advanced packaging to maintain product integrity and shelf life. Distribution channels are highly controlled and segmented. Direct distribution involves manufacturers selling directly to major hospital systems and large Integrated Delivery Networks (IDNs) through specialized sales forces that often include clinical specialists providing application training and support. This direct model allows for better margin control and immediate feedback on product performance. Indirect distribution relies on global and regional medical device distributors, particularly crucial for penetrating smaller hospitals and Ambulatory Surgical Centers (ASCs) or accessing international markets where local regulatory knowledge and logistics expertise are essential for market access.

Downstream activities center on the end-users—hospitals and ASCs—where the product is utilized by specialized surgeons (general, gynecological, cardiovascular). Procurement decisions at this stage are heavily influenced by clinical efficacy data, total procedure cost, inclusion in hospital preferred product lists (PPLs), and positive surgeon preference driven by ease of use and perceived reduction in post-operative complications. The final stage involves post-market surveillance and reporting, which closes the feedback loop to R&D, ensuring continuous improvement and compliance, particularly in tracking long-term patient outcomes and adhesion recurrence rates, thereby substantiating the value proposition of the barrier to both the payer and the provider. This structured value flow ensures high product quality from raw material sourcing to surgical utilization.

Surgical Adhesion Barrier Market Potential Customers

The primary consumers and end-users of surgical adhesion barriers are institutions and medical professionals specializing in invasive surgical treatments where tissue trauma and subsequent inflammation carry a high risk of adhesion formation. Hospitals, particularly large tertiary and quaternary care centers with high-volume surgical departments—such as those focused on general surgery, oncology, trauma, and reproductive health—represent the largest segment of buyers. Within these settings, procurement decisions are often driven by centralized committees balancing clinical evidence from departments like Obstetrics and Gynecology, General Surgery, and Cardiac Surgery, against budgetary constraints and contract pricing established with major medical device manufacturers. The demand is specifically high in centers that perform complex, repeat surgeries, where previous operative sites are highly susceptible to dense adhesion formation, necessitating prophylactic barrier application to facilitate subsequent procedures.

Ambulatory Surgical Centers (ASCs) constitute a rapidly growing segment of potential customers, particularly in North America, focusing on less complex, high-turnover procedures like outpatient hernia repairs or diagnostic laparoscopic procedures. ASCs prioritize products that contribute to efficiency, minimal post-operative pain, and reduced patient recovery time, making high-quality, easily deployable adhesion barriers a necessary component of their surgical kits, aligning with their goal of maximizing patient throughput and outcome quality for same-day discharge. Furthermore, specialty clinics focused on fertility treatment represent highly motivated buyers, as post-surgical adhesions are a major cause of secondary infertility, driving the adoption of premium, clinically proven barriers in procedures like myomectomies or ovarian cystectomies, where preserving reproductive function is paramount.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 685 Million |

| Market Forecast in 2033 | USD 1115 Million |

| Growth Rate | 7.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Johnson & Johnson, Baxter International, Sanofi, Becton, Dickinson and Company, Integra Lifesciences, FzioMed, Inc., Tissuemed Ltd., Anika Therapeutics, Inc., Gunze Ltd., W. L. Gore & Associates, Inc., Seikagaku Corporation, Medtronic Plc, Acelity (3M), Hangzhou Singclean Medical Products Co., Ltd., Adhesions Prevention Ltd., Mast Biosurgery AG, C. R. Bard (BD), Chemclin Diagnostics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Surgical Adhesion Barrier Market Key Technology Landscape

The technological landscape of the Surgical Adhesion Barrier Market is rapidly evolving, driven by advances in biomaterial science focused on optimizing bioresorption rates, biocompatibility, and mechanical properties. Historically, the market was dominated by basic physical barriers, primarily composed of oxidized regenerated cellulose (ORC) or expanded polytetrafluoroethylene (ePTFE). While ORC (e.g., Johnson & Johnson’s Interceed) remains a clinical benchmark, modern innovation centers on creating fully synthetic, temporary physical separations that integrate seamlessly into the healing cascade without causing foreign body reactions. Key advancements involve hydrogel technology, utilizing materials such as polyethylene glycol (PEG) and highly pure hyaluronic acid derivatives, which transition from liquid/gel form to a viscous, non-adhering barrier upon contact with the tissue or upon temperature change, offering superior coverage over irregular surfaces and during minimally invasive procedures.

A major focus in technological advancement is the development of next-generation barriers that are not only physical separators but also therapeutically active or bio-functional. Researchers are exploring incorporating anti-inflammatory agents, such as specific corticosteroids or non-steroidal anti-inflammatory drugs (NSAIDs), directly into the barrier matrix, providing localized drug delivery to suppress the inflammatory response that initiates adhesion formation. This localized delivery minimizes systemic side effects while maximizing therapeutic concentration at the operative site. Furthermore, advancements in nano-fiber spinning techniques and 3D printing are enabling the creation of custom-fit, multi-layered films with engineered pore sizes and degradation profiles, allowing for precise control over the duration of tissue separation, matching the critical window required for specific types of surgical wound healing, such as nerve repairs or tendon surgery.

The trend towards minimally invasive surgery (MIS), including laparoscopic and robotic procedures, has necessitated the technological shift towards injectable, liquid, or sprayable barrier formulations. These delivery systems, often applied through specialized cannulas, must demonstrate excellent adherence to tissue surfaces in a wet environment, maintain visibility during application, and cure quickly in situ to form a robust, persistent gel layer. Technology providers are continuously refining the viscosity, elasticity, and flow characteristics of these gels to ensure they do not migrate away from the surgical site while maintaining sufficient mechanical strength to withstand peritoneal or cavity movements post-surgery. These technological adaptations are crucial for ensuring high clinical utility and surgeon preference, particularly as MIS becomes the standard of care for a growing range of surgical procedures globally.

Regional Highlights

- North America: This region holds the largest market share due to its sophisticated healthcare infrastructure, high prevalence of complex surgical procedures, and aggressive adoption of advanced bioresorbable barrier technologies. The presence of major market players and favorable reimbursement policies for specialized surgical adjuncts, particularly in the United States, drives high consumption. Furthermore, strong clinical guidelines advocating for adhesion prophylaxis in high-risk abdominal and gynecological surgeries contribute significantly to market maturity and sustained revenue growth in this region.

- Europe: Characterized by stringent regulatory approval processes (CE Mark) and a strong emphasis on clinical evidence, the European market exhibits steady growth. Western European countries, particularly Germany, France, and the UK, are key markets, driven by an aging population requiring complex cardiovascular and orthopedic interventions. The market shows a strong preference for highly documented, biodegradable, synthetic barriers, balancing efficacy with cost considerations within nationally managed healthcare systems.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing regional market, fueled by rapidly expanding healthcare expenditure, increasing surgical volumes driven by population growth, and improving access to modern surgical care in emerging economies like China, India, and South Korea. Increased awareness among surgeons regarding the benefits of adhesion barriers, coupled with the entry of local manufacturers offering cost-competitive products, is accelerating market penetration, though regulatory harmonization remains a challenge.

- Latin America (LATAM): The LATAM market is nascent but growing, primarily driven by investments in private healthcare facilities and medical tourism hubs in countries like Brazil and Mexico. Market growth is heavily influenced by the import of advanced devices from North America and Europe. Price sensitivity is a key factor, often leading to a preference for mid-range, proven film barriers, although increasing surgical complexity is gradually driving demand for higher-cost synthetic gels in major metropolitan medical centers.

- Middle East and Africa (MEA): Growth in the MEA region is localized, concentrated in technologically advanced healthcare centers in the Gulf Cooperation Council (GCC) countries, supported by high per capita healthcare spending and government initiatives to establish world-class specialty hospitals. Demand is high for advanced surgical products, largely imported. However, market penetration in broader African countries remains limited due to infrastructural challenges and low healthcare spending, necessitating targeted strategies focused on major urban surgical centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Surgical Adhesion Barrier Market.- Johnson & Johnson (Ethicon)

- Baxter International Inc.

- Sanofi

- Becton, Dickinson and Company (BD)

- Integra Lifesciences Corporation

- FzioMed, Inc.

- Tissuemed Ltd.

- Anika Therapeutics, Inc.

- Gunze Ltd.

- W. L. Gore & Associates, Inc.

- Seikagaku Corporation

- Medtronic Plc

- Acelity (3M Company)

- Hangzhou Singclean Medical Products Co., Ltd.

- Adhesions Prevention Ltd.

- Mast Biosurgery AG

- C. R. Bard (Becton, Dickinson and Company)

- Chemclin Diagnostics Co., Ltd.

- Ovesco Endoscopy AG

- Synergetics USA, Inc.

Frequently Asked Questions

Analyze common user questions about the Surgical Adhesion Barrier market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a surgical adhesion barrier and why are they necessary?

The primary function is to provide a temporary, physical separation between traumatized tissues or organs following surgery. They are necessary because post-operative adhesions, or scar tissue formation, are a major complication leading to chronic pain, infertility, and life-threatening bowel obstructions, necessitating costly and complex re-operations (adhesiolysis).

Which types of surgical adhesion barriers are considered the most effective in modern clinical practice?

Modern clinical practice favors bioresorbable barriers, particularly synthetic films (like oxidized regenerated cellulose or Hyaluronic Acid/CMC combinations) and polyethylene glycol-based gels or sprays. Gels and sprays are increasingly preferred in minimally invasive surgery due to their ability to provide conformal coverage over irregular anatomical surfaces.

Which surgical application segment drives the highest demand for adhesion barriers globally?

Gynecological and general abdominal surgeries are the largest application segments driving demand. Procedures such as myomectomy, hysterectomy, and colorectal surgeries carry inherently high risks of dense adhesion formation, making prophylactic barrier use a standard recommendation to preserve organ function and prevent future complications.

What are the main market restraints impacting the broader adoption of advanced surgical adhesion barriers?

The main restraints include the high acquisition cost of premium, advanced synthetic and bio-functional barriers, which often challenges hospital budgets. Additionally, inconsistent surgeon adoption across different facilities and the necessity for robust, long-term clinical evidence for new product efficacy pose significant barriers to rapid market penetration.

How is technological innovation affecting the future direction of adhesion prevention products?

Technological innovation is moving beyond passive separation to creating multi-functional barriers that integrate therapeutic agents, such as anti-inflammatory drugs, for localized delivery. Furthermore, advances in polymer chemistry are yielding custom-designed hydrogels that offer superior mechanical strength, specific degradation rates, and ease of application in complex robotic surgical environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager