Surgical Scalpel Blade Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435366 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Surgical Scalpel Blade Market Size

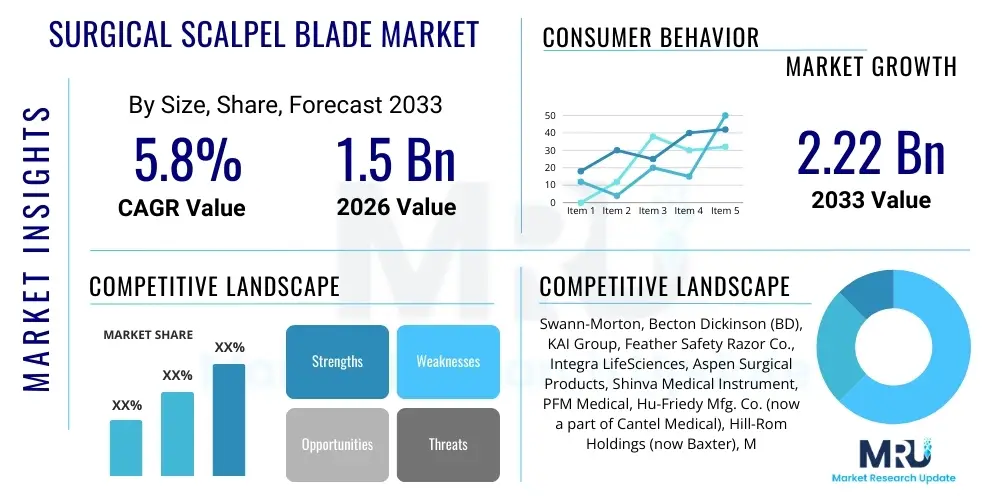

The Surgical Scalpel Blade Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.22 Billion by the end of the forecast period in 2033. This growth is intrinsically linked to the rising volume of surgical procedures performed globally, particularly in emerging economies experiencing improvements in healthcare infrastructure and increased access to medical services. Furthermore, technological advancements focused on optimizing blade sharpness, longevity, and safety mechanisms are consistently driving market valuation, ensuring the continued adoption of high-quality disposable blades across specialized surgical disciplines.

Surgical Scalpel Blade Market introduction

The Surgical Scalpel Blade Market encompasses the manufacturing, distribution, and consumption of precision cutting instruments used in various medical and surgical procedures. These blades, typically characterized by extreme sharpness and standardized fitting mechanisms (such as the standard number system 10 through 25, and specialized variants), are essential tools for making incisions through skin, muscle, and tissue with minimal trauma. The primary product offering consists of sterile, disposable blades made predominantly from carbon steel or stainless steel, mounted on specialized handles. The necessity of pristine cutting quality, strict sterilization protocols, and the trend toward single-use instruments to prevent cross-contamination are pivotal aspects defining this market landscape.

Major applications for surgical scalpel blades span a wide spectrum of medical disciplines, including general surgery, orthopedic procedures, cardiovascular operations, neurosurgery, and cosmetic surgery. The inherent benefit of these instruments lies in their precision, offering surgeons the ability to execute highly controlled movements critical for successful patient outcomes. Driving factors for market expansion include the global increase in the incidence of chronic diseases necessitating surgical intervention, a burgeoning elderly population requiring orthopedic and cardiovascular surgeries, and the expansion of ambulatory surgical centers (ASCs) which rely heavily on high-volume, standardized disposable medical supplies.

The operational environment for scalpel blades is continuously scrutinized through the lens of healthcare safety and efficiency. Product design innovations frequently focus on enhancing ergonomics for the surgeon, integrating protective shields or retraction mechanisms to minimize accidental sharps injuries (Needlestick/Sharps Injury Prevention), and optimizing material composition for specific surgical requirements, such as enhanced corrosion resistance or non-magnetic properties for use in advanced imaging environments. Regulatory adherence, particularly FDA and EU MDR standards regarding sterility and disposal, dictates the production methodologies and market entry strategies for manufacturers.

Surgical Scalpel Blade Market Executive Summary

The Surgical Scalpel Blade Market exhibits robust growth propelled by increasing surgical volumes globally and a strong preference for disposable, sterile instruments in modern clinical settings. Key business trends indicate a strategic focus on expanding manufacturing capacity in the Asia Pacific region to capitalize on lower operational costs and surging regional demand. Furthermore, mergers and acquisitions remain common, as large medical device conglomerates seek to integrate specialized blade manufacturers to consolidate supply chains and expand their sharps safety portfolio. Manufacturers are also heavily investing in automation and precision grinding technology to maintain quality consistency while scaling production volumes to meet global procurement demands from Group Purchasing Organizations (GPOs).

Regional trends reveal that North America and Europe currently represent the highest revenue-generating markets, characterized by established healthcare systems, rigorous safety protocols, and high per-capita spending on elective and essential surgeries. However, the Asia Pacific (APAC) region is forecasted to demonstrate the fastest growth rate, fueled by improving healthcare access, increasing medical tourism, and government initiatives aimed at modernizing hospital infrastructure, particularly in countries like China, India, and South Korea. This shift necessitates localized distribution strategies and compliance with varied regional regulatory requirements concerning medical device registration and approval processes.

Segment trends underscore the dominance of the disposable blade category due to strict infection control measures globally. In terms of material, while stainless steel remains prevalent for general use due to its durability and cost-effectiveness, carbon steel blades retain a strong market position, especially where superior edge retention and initial sharpness are paramount, such as in delicate procedures like ophthalmology. The primary end-use segment growth is accelerating within Ambulatory Surgical Centers (ASCs), driven by the move toward outpatient care models, which demand high turnover rates of standardized, sterile supplies, further solidifying the market position of bulk procurement contracts for disposable scalpel systems.

AI Impact Analysis on Surgical Scalpel Blade Market

User queries regarding AI's influence on the surgical scalpel blade market frequently center on how automation affects manufacturing precision, whether AI guides robotic surgery tool usage, and if predictive analytics can optimize inventory management in hospital supply chains. Key concerns often revolve around whether sophisticated AI-driven robotics might eventually replace traditional manual scalpel use, although the consensus suggests AI complements rather than replaces the fundamental mechanical cutting instrument. The primary theme emerging is that AI's impact is indirect but highly influential, improving the quality and accessibility of the blades rather than altering the core function of the product itself. AI is instrumental in enhancing quality control, optimizing production throughput, and providing critical data insights into sharps waste management and disposal protocols.

AI and machine learning algorithms are being integrated into the manufacturing process to refine precision grinding techniques. By analyzing microscopic variations in blade geometry and edge consistency across millions of units, AI systems can automatically adjust tooling parameters in real-time, ensuring superior sharpness and uniformity far exceeding the consistency achievable through manual oversight. This technological leap improves the reliability of the product, which is paramount in critical surgical procedures. Furthermore, AI-powered image recognition systems are utilized in automated quality inspection lines to detect microscopic defects or imperfections, guaranteeing that only flawless blades proceed to the sterilization and packaging stages.

In the supply chain and clinical environment, AI plays a crucial role in operational efficiency. Predictive inventory modeling helps hospitals and distributors forecast demand fluctuations based on surgical schedules, seasonal trends, and historical consumption data, minimizing stockouts and reducing unnecessary inventory holding costs associated with specialized scalpel types. Moreover, in robotic-assisted surgery, while the incision itself is mechanical, AI algorithms provide real-time guidance and feedback on tissue manipulation and instrument trajectory, enhancing the safety profile of procedures involving sharp tools, indirectly supporting the high-precision requirements of the scalpel blades used in conjunction with these robotic systems.

- AI optimizes blade manufacturing consistency through real-time precision grinding adjustments.

- Machine learning improves quality control by detecting microscopic surface defects during inspection.

- Predictive analytics enhance supply chain efficiency, reducing inventory waste and stockout risks in hospitals.

- AI-driven robotic surgical systems use advanced visualization, ensuring accurate scalpel placement and trajectory.

- Data analytics assist in regulatory compliance tracking and optimizing the disposal management of used sharps.

DRO & Impact Forces Of Surgical Scalpel Blade Market

The dynamics of the Surgical Scalpel Blade Market are governed by a complex interplay of Drivers (D), Restraints (R), and Opportunities (O), which collectively define the Impact Forces shaping industry development. Primary drivers include the global demographic shift toward an aging population, which requires a higher volume of surgical interventions, particularly orthopedic and cardiovascular procedures. Additionally, stringent regulatory mandates emphasizing infection control and sharps injury prevention globally mandate the continuous adoption of high-quality, single-use, safety-engineered scalpel systems, acting as a powerful market accelerator.

Restraints primarily revolve around the inherent risk of sharps injuries, despite advances in safety mechanisms, leading healthcare providers to seek alternative cutting technologies, such as harmonic scalpels or electrosurgical instruments, for specific applications. Furthermore, the increasing cost pressures faced by hospitals and healthcare systems, particularly in developed markets, can lead to procurement decisions favoring lower-cost generic alternatives over premium branded blades, marginally impacting revenue growth for specialized manufacturers. Supply chain vulnerabilities and fluctuations in raw material prices (steel and carbon) also pose consistent operational restraints.

Opportunities for growth are concentrated in the rapid expansion of healthcare infrastructure in emerging economies, opening untapped markets for high-quality disposable blades. Significant potential also exists in the development and integration of advanced material science, such as ceramic or coated blades, offering superior edge longevity and reduced friction for highly specialized surgeries. Manufacturers focusing on expanding their portfolio of safety scalpels, integrating automated retraction or sheath technology that adheres to stringent occupational safety guidelines (like OSHA standards), are well-positioned for future market penetration and differentiation. The overall impact force leans strongly toward growth, driven primarily by the non-negotiable requirement for sterility and the increasing global surgical burden.

Segmentation Analysis

Segmentation analysis provides a critical framework for understanding the diverse market dynamics within the Surgical Scalpel Blade industry, categorizing the market based on product type, material, application, and end-user. The segmentation reflects the varied technical requirements across different surgical specialties and the economic capabilities of various healthcare settings globally. The transition from traditional reusable scalpels to disposable blades represents the most impactful segment shift, driven by regulatory pressure and clinical consensus on reducing hospital-acquired infections (HAIs).

In terms of materials, the market is differentiated between carbon steel, known for its superior initial sharpness, and stainless steel, valued for its corrosion resistance and economic viability, particularly in general surgery environments. Emerging segments include specialized coated blades (e.g., polymer or ceramic coatings) designed to reduce friction during cutting, thereby minimizing tissue drag and improving incision quality in delicate operations like plastic surgery or microsurgery. Analyzing these materials allows manufacturers to target niche requirements where precision and specific mechanical properties outweigh standard cost considerations.

End-user segmentation highlights the critical roles of Hospitals and Ambulatory Surgical Centers (ASCs). While hospitals remain the largest volume consumer due to the complexity and diversity of procedures performed, ASCs are projected to be the fastest-growing end-user segment. This acceleration is due to the increasing shift of less complex procedures to outpatient settings, demanding high-volume, standardized, and readily available sterile surgical consumables. Understanding these varying procurement models—large volume GPO contracts in hospitals versus just-in-time smaller orders in ASCs—is crucial for effective market penetration strategies.

- By Product Type: Disposable Surgical Blades, Reusable Scalpel Handles and Blades, Safety Scalpels (Retractable, Protective Sheath).

- By Material: Carbon Steel, Stainless Steel, Ceramic, Specialty Coated Materials.

- By Application: General Surgery, Orthopedic Surgery, Cardiovascular Surgery, Neurosurgery, Cosmetic and Plastic Surgery, Other Specialized Procedures.

- By End User: Hospitals, Ambulatory Surgical Centers (ASCs), Specialty Clinics, Academic and Research Institutes.

Value Chain Analysis For Surgical Scalpel Blade Market

The value chain for the Surgical Scalpel Blade Market initiates with upstream activities involving the sourcing of specialized raw materials, primarily high-grade carbon and stainless steel alloys, which must meet stringent medical-grade specifications regarding purity and hardness. Key upstream activities also include precision manufacturing processes such as stamping, complex geometry grinding, and honing to achieve the necessary micro-level edge sharpness and consistent blade shape (ISO 7740 standards). The control over raw material quality and advanced manufacturing technology is a major determinant of product differentiation and cost structure in this market.

The midstream stage focuses on sterilization and packaging, which are non-negotiable regulatory requirements. Scalpel blades must be individually packaged in highly protective, tamper-evident sterile packaging (often foil or rigid plastic) to ensure sterility until the point of use. This is followed by distribution, involving sophisticated logistics to maintain sterile conditions during transit. The distribution channel is bifurcated into direct sales to large hospital networks and indirect channels utilizing third-party medical distributors, wholesalers, and Group Purchasing Organizations (GPOs). GPOs play a pivotal role in aggregating demand and negotiating standardized pricing for high-volume consumables, heavily influencing market access.

Downstream analysis involves the penetration into end-user segments like hospitals and ASCs, where procurement decisions are governed by clinical needs, budgetary constraints, and safety compliance. Direct sales are often preferred for highly specialized, premium product lines, allowing manufacturers to maintain closer relationships with surgeons and key opinion leaders. Conversely, indirect channels are critical for achieving broad market coverage and ensuring that standardized, general-purpose blades are available quickly and efficiently across diverse geographic regions. The final stage involves the post-use handling and safe disposal of sharps, which adds a significant regulatory and logistical cost component to the overall value chain.

Surgical Scalpel Blade Market Potential Customers

Potential customers for surgical scalpel blades primarily comprise institutional buyers within the healthcare sector who require high-volume, sterile surgical consumables. The largest cohort includes large Public and Private Hospitals, which act as primary healthcare centers, conducting the majority of complex surgical procedures, including long-duration and multi-specialty operations. These institutions typically operate under standardized procurement contracts managed by centralized purchasing departments or Group Purchasing Organizations (GPOs), making long-term supply agreements and competitive pricing critical for manufacturers aiming for high market share.

A rapidly expanding customer base consists of Ambulatory Surgical Centers (ASCs) and Outpatient Clinics. These facilities specialize in same-day, less invasive procedures and prioritize efficiency and quick turnover. ASCs demand consistent, reliable, high-quality disposable scalpel systems that streamline procedural setups and minimize infection risks. Manufacturers must tailor their product bundles and logistical support to meet the specific requirements of the ASC model, which often includes smaller, more frequent deliveries and strong emphasis on single-use safety products to comply with occupational health regulations.

Other significant end-users include specialized surgical centers (e.g., ophthalmology, dermatology, plastic surgery clinics), academic medical centers (for training and research), and government health facilities. Specialized clinics often seek premium, highly specialized blade types (e.g., micro blades, beaver blades) tailored for intricate work, emphasizing cutting quality over generalized cost efficiency. Furthermore, military and disaster relief organizations represent intermittent but critical bulk buyers, necessitating robust, standardized inventory accessible across emergency deployment scenarios, showcasing the diverse nature of institutional buyers in this essential medical consumables market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.22 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Swann-Morton, Becton Dickinson (BD), KAI Group, Feather Safety Razor Co., Integra LifeSciences, Aspen Surgical Products, Shinva Medical Instrument, PFM Medical, Hu-Friedy Mfg. Co. (now a part of Cantel Medical), Hill-Rom Holdings (now Baxter), Medline Industries, Surgical Specialties Corporation, JMI Laboratories, Bharat Surgeons, Angiotech Pharmaceuticals, Tiemann & Co., Mani, Inc., Johnson & Johnson (Ethicon), Codman & Shurtleff, Beaver-Visitec International (BVI) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Surgical Scalpel Blade Market Key Technology Landscape

The technology landscape for surgical scalpel blades is characterized by continuous advancements in precision engineering, material science, and safety design. At the core is advanced grinding technology, utilizing Computer Numerical Control (CNC) machinery and robotic polishing systems to achieve extremely fine and consistent cutting edges, often measured in nanometers. This precision is vital, as the sharpness and geometry of the blade edge directly correlate with reduced tissue trauma, faster healing, and overall surgical efficacy. Modern manufacturing techniques leverage laser verification systems to ensure that every blade meets rigorous quality benchmarks before packaging.

Material innovation is a significant technological focus, particularly the development of blades made from or coated with ceramic, diamond, or specialized polymers. Ceramic blades, for instance, offer superior edge retention and are non-magnetic, making them ideal for use in complex procedures that might involve advanced imaging. Furthermore, specialized hydrophobic or antimicrobial coatings are being developed to reduce friction during incision and potentially minimize the adherence of biological contaminants. These material science breakthroughs aim to differentiate premium scalpel offerings from traditional steel instruments, justifying a higher price point through demonstrable clinical benefits.

Safety technology represents another dominant segment of innovation, driven by regulatory demands to mitigate occupational hazards. Safety scalpels now incorporate sophisticated, automated retraction or protective sheath mechanisms that activate immediately upon use or disposal, preventing accidental contact with the used sharp edge. The engineering of these safety features demands precision interlocking mechanisms that are intuitive for the surgeon to use, reliable in deployment, and robust enough to prevent accidental exposure, ensuring strict compliance with global sharps safety standards and enhancing the overall clinical safety profile of the product category.

Regional Highlights

- North America: North America, led by the United States, commands the largest share of the global surgical scalpel blade market revenue. This dominance is attributed to a high volume of surgical procedures, sophisticated healthcare infrastructure, rapid adoption of advanced safety scalpels due to stringent occupational safety regulations (e.g., OSHA standards), and high healthcare expenditure. The presence of major global medical device manufacturers and highly standardized procurement through GPOs ensures consistent market growth and product innovation.

- Europe: Western European countries represent a mature and stable market, characterized by universal healthcare coverage and strict adherence to EU Medical Device Regulation (MDR) concerning sterility and quality. The region shows strong demand for high-quality disposable blades and advanced sharps protection systems, especially in Germany, France, and the UK. Market growth is moderate, driven by replacement cycles and the increasing focus on minimizing hospital-acquired infection rates.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region during the forecast period. This rapid expansion is fueled by increasing healthcare awareness, substantial government investment in modernizing hospital infrastructure, rising medical tourism, and a massive, underserved patient population in developing economies like India and China. While cost sensitivity remains a factor, the increasing number of surgical procedures and the shift from reusable to disposable instruments are powerful drivers.

- Latin America (LATAM): LATAM markets, including Brazil and Mexico, demonstrate steady growth, driven by improvements in economic stability and access to surgical care, particularly in private healthcare sectors. Challenges include variable regulatory environments and reliance on imports, but the increasing penetration of multinational manufacturers is stabilizing supply chains and driving the adoption of standardized sterile products.

- Middle East and Africa (MEA): The MEA region exhibits heterogeneous market characteristics. The Gulf Cooperation Council (GCC) countries show high demand for premium products due to high healthcare spending and advanced medical facilities. In contrast, the African subcontinent focuses predominantly on essential, cost-effective blades. Infrastructure development and international aid efforts focused on surgical care represent long-term growth opportunities in this region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Surgical Scalpel Blade Market.- Swann-Morton

- Becton Dickinson (BD)

- KAI Group

- Feather Safety Razor Co.

- Integra LifeSciences

- Aspen Surgical Products

- Shinva Medical Instrument

- PFM Medical

- Hu-Friedy Mfg. Co. (now a part of Cantel Medical)

- Hill-Rom Holdings (now Baxter)

- Medline Industries

- Surgical Specialties Corporation

- JMI Laboratories

- Bharat Surgeons

- Angiotech Pharmaceuticals

- Tiemann & Co.

- Mani, Inc.

- Johnson & Johnson (Ethicon)

- Codman & Shurtleff

- Beaver-Visitec International (BVI)

Frequently Asked Questions

Analyze common user questions about the Surgical Scalpel Blade market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for disposable surgical scalpel blades?

The primary factor is the global emphasis on stringent infection control protocols and patient safety. Disposable blades eliminate the risk of cross-contamination and hospital-acquired infections (HAIs) associated with reusable instruments, a requirement mandated by healthcare regulatory bodies worldwide.

Which material type offers superior edge retention for surgical scalpels?

Carbon steel blades typically offer superior initial sharpness and edge retention compared to standard stainless steel, making them preferred for intricate, delicate procedures requiring minimal tissue drag. However, specialty materials like ceramics are emerging with exceptional long-term sharpness.

What role do Ambulatory Surgical Centers (ASCs) play in market growth?

ASCs are a critical growth driver because the shift towards outpatient care increases the volume of procedures performed outside large hospitals. ASCs rely heavily on standardized, high-volume, disposable surgical supplies, fueling strong demand for safety scalpels and sterile kits.

How does safety technology impact the surgical scalpel blade market?

Safety technology, primarily automated retractable or shielded scalpels, is essential for compliance with occupational health mandates (like OSHA). These features prevent sharps injuries among healthcare staff, and their mandatory adoption drives the premium segment of the market.

Which region is expected to demonstrate the fastest growth rate for surgical scalpel blades?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth, primarily due to expanding healthcare access, increasing governmental investment in medical infrastructure, and a rising volume of surgical procedures being performed across major developing economies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager