Surveyor Tapes Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432507 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Surveyor Tapes Market Size

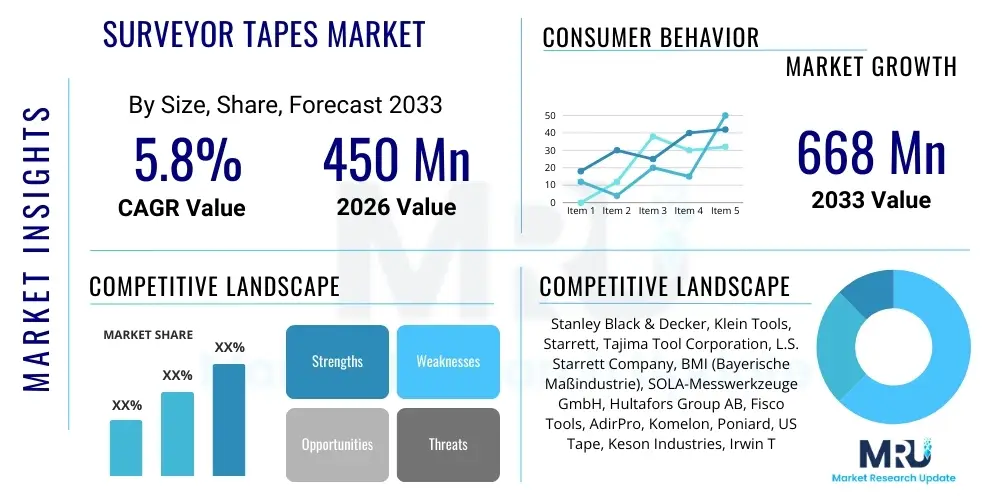

The Surveyor Tapes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 668 Million by the end of the forecast period in 2033.

Surveyor Tapes Market introduction

The Surveyor Tapes Market encompasses the production, distribution, and utilization of precision linear measurement tools essential for civil engineering, construction, cartography, and land surveying applications. These tools, traditionally consisting of flexible metal, fiberglass, or synthetic materials marked with graduated measurements, provide foundational accuracy for establishing boundary lines, calculating distances, and verifying structural dimensions. The market dynamism is intrinsically linked to global infrastructure spending, urbanization trends, and stringent regulatory requirements concerning land ownership and development project execution. As foundational instruments, surveyor tapes maintain relevance even alongside advanced digital surveying technologies, often serving as crucial backup or verification tools, particularly in complex or remote field environments where reliability and simplicity are paramount.

Surveyor tapes are critical components in a wide range of professional tasks, including large-scale construction site layout, topographical mapping, quantity surveying, and agricultural land measurement. The key product types generally segment based on material composition—steel tapes offering high durability and precision for critical applications, and fiberglass tapes providing non-conductive properties and resistance to rust, making them ideal for utility and wet environments. Major applications involve determining horizontal and vertical measurements with high fidelity, ensuring project compliance with design specifications. The enduring demand for these instruments is bolstered by their relatively low cost, ease of use, and robustness under demanding field conditions, contrasting favorably with the maintenance requirements of more sophisticated electronic distance measurement (EDM) equipment.

Driving factors for sustained market growth include the burgeoning global population leading to increased residential and commercial construction activities, alongside governmental investments in modernizing aging infrastructure such as roads, bridges, and utility networks. The accuracy achieved by high-quality surveyor tapes remains indispensable for maintaining quality control and mitigating measurement errors that could lead to significant financial liabilities in large projects. Furthermore, emerging economies in Asia Pacific and Latin America, undergoing rapid industrialization and urban expansion, represent substantial untapped demand for both conventional and technologically enhanced surveying tools, underpinning the positive market outlook throughout the forecast period. The industry continues to innovate, focusing on enhanced material stability, improved ergonomic design, and integration features suitable for modern fieldwork.

Surveyor Tapes Market Executive Summary

The Surveyor Tapes Market executive summary highlights a stable, albeit mature, market experiencing moderate growth driven primarily by developing infrastructure in emerging markets and stringent regulatory demands for construction precision globally. Key business trends indicate a strategic shift towards hybrid solutions, where traditional physical tapes are often integrated with digital readout systems or specialized coatings to improve longevity and readability under varied environmental conditions. Manufacturers are focusing on differentiating their products through superior materials (e.g., specialized stainless steels or advanced polymer coatings) that offer enhanced resistance to wear, temperature fluctuations, and chemical exposure, catering to niche applications like hazardous waste site measurement or extreme climate construction projects. Consolidation among smaller regional players by large international measuring instrument manufacturers is also a noticeable trend aimed at expanding global distribution networks and achieving economies of scale in raw material procurement.

Regionally, the Asia Pacific (APAC) stands out as the primary engine of market expansion, attributable to massive governmental and private sector investment in mega-infrastructure projects, particularly in China, India, and Southeast Asian nations. North America and Europe, representing mature markets, exhibit stable demand driven mostly by replacement cycles, sophisticated commercial construction, and specialized high-precision surveying requirements. These developed regions are often the first adopters of premium, technologically augmented tapes and accessories designed for superior ergonomic performance and data reliability. The Middle East and Africa (MEA) are also showing promising growth, largely dependent on energy sector development and ongoing urbanization initiatives in GCC countries and strategic African economies, where reliable basic measurement tools are essential for ground-level operations.

Segment trends reveal that the Material Type segmentation favors steel tapes for high-accuracy civil engineering tasks, while fiberglass tapes maintain dominance in general construction and utility work due to their safety profile and flexibility. In terms of End-User Application, the Construction segment consistently accounts for the largest market share, though the importance of specialized segments like Mining and Forestry is growing, necessitating tapes engineered for extreme durability and visibility. Furthermore, the Measurement Standard segment sees metric standards dominating globally, but imperial standards remain strong in specific markets like the United States. Innovation in tape housing design, particularly shock-absorbent and sealed casings (closed case tapes), is driving growth in the premium product category, reflecting user demand for tools that withstand rigorous job site conditions over extended periods.

AI Impact Analysis on Surveyor Tapes Market

User queries regarding AI’s influence on the Surveyor Tapes Market typically revolve around whether automated surveying technologies, such as drone photogrammetry and LiDAR systems integrated with AI-driven processing, will render manual measurement tools obsolete. Common concerns address the diminishing role of traditional manual surveying in complex projects and the potential for AI algorithms to detect and correct human measurement error more effectively than traditional QA/QC methods. Users also seek information on how AI might assist in optimizing the use of physical tapes—perhaps through predictive maintenance of the tape material itself or by analyzing environmental data to determine the most accurate time and method for manual measurement, thereby maximizing precision despite the inherent limitations of physical tools. The overriding expectation is that AI will transform the *analysis* and *verification* of data collected using tapes, rather than entirely replacing the physical tapes themselves.

While AI technologies are unlikely to directly replace the physical requirement of a surveyor tape for direct linear measurement on the ground, they significantly impact the downstream workflow and the validation process. AI-powered software integrates data captured by various field instruments, including data input from manual tape measurements, comparing them instantly against 3D models and design blueprints. This capability enhances quality assurance, rapidly flagging discrepancies between the physical site measurement and the digital design, thereby reducing rework costs and improving project timelines. This integration mandates that even simple tools like tapes must be utilized in conjunction with structured data collection protocols to be compatible with advanced AI analysis frameworks.

The main impact of AI is therefore seen in its complementary role, elevating the utility of manual tools through smarter data interpretation. For instance, AI algorithms can process visual data captured via smartphones or dedicated handheld devices alongside the tape, automatically calculating complex offsets, adjusting for temperature variations affecting tape length, or suggesting optimal placement points for measurements based on previously scanned terrain data. This sophistication extends the practical lifespan and relevance of high-precision tapes, shifting their role from primary data collection to localized, highly accurate verification points within a larger, automated geospatial data ecosystem. This ensures that surveyor tapes remain relevant as reliable, verifiable ground truth markers for AI-driven large-scale site mapping.

- AI integrates tape measurements into 3D modeling and automated site verification processes.

- Predictive analytics use tape data to enhance accuracy by factoring in environmental variables like temperature and tension.

- Automated quality control (QA/QC) algorithms instantly cross-reference manual tape measurements against CAD designs, minimizing human error.

- AI assists in optimizing measurement routines and calculating complex geometric layouts derived from basic linear inputs.

- Enhanced data logging systems utilize AI to structure and geo-reference tape-derived data for seamless integration with advanced Geographic Information Systems (GIS).

DRO & Impact Forces Of Surveyor Tapes Market

The Surveyor Tapes Market is primarily driven by global infrastructure development and the consistent regulatory need for dimensional accuracy in construction and civil works, yet it faces restraints from the increasing adoption of highly automated surveying technologies. Opportunities exist in developing specialized materials and integrating digital features, mitigating the impact of external forces. The key drivers include robust growth in residential and commercial real estate across emerging nations, mandatory requirements for precise land demarcation for legal and ownership purposes, and the inherent reliability and affordability of tapes compared to high-capital electronic equipment, particularly for smaller contractors or preliminary site work. These drivers ensure a baseline demand that is resistant to complete technological disruption, establishing tapes as indispensable tools for localized, granular measurement tasks.

Conversely, the market growth is constrained by the widespread proliferation of Electronic Distance Measurement (EDM) tools, Total Stations, and GPS/GNSS technologies, which offer superior speed and accuracy over longer distances, reducing reliance on manual chaining and taping methods for large projects. Furthermore, the market faces the challenge of standardization across diverse international requirements, and the susceptibility of tapes to measurement errors caused by sag, tension, and temperature variations—factors largely eliminated by electronic methods. Restraints are particularly pronounced in highly developed markets where project budgets often accommodate the premium cost of advanced automated equipment, reserving tapes primarily for short-distance checks or inaccessible areas.

Opportunities for market expansion are centered on innovation in material science, focusing on producing tapes with lower thermal expansion coefficients and improved wear resistance, extending product lifespan and measurement reliability. Digital integration, such as smart tapes featuring quick-read digital displays or Bluetooth connectivity to input data directly into field software, represents a significant avenue for value addition, bridging the gap between traditional manual tools and modern data collection workflows. The industry's impact forces are high, primarily stemming from substitution threats posed by superior electronic technology, balanced by the low switching cost and high reliability of tapes in challenging environments. The bargaining power of buyers is moderate to high, as the product is standardized, but differentiation in quality and material offers some pricing leverage for premium brands.

Segmentation Analysis

The Surveyor Tapes Market is comprehensively segmented based on material, measurement standard, product type, and application, allowing for targeted product development and market penetration strategies. Segmentation by material—steel, fiberglass, and synthetic/plastic tapes—reflects the core attributes required by different end-users, where steel offers maximum precision and durability for professional surveying, and fiberglass provides safety and non-conductivity for electrical utility applications. Product type segmentation further refines this by classifying tapes into open reel and closed reel designs, impacting portability, protection from contaminants, and ease of cleaning, directly addressing the varying demands of construction and engineering environments. This structured segmentation is vital for manufacturers to tailor their production lines and marketing efforts to specific professional requirements globally.

The segmentation based on application is arguably the most dynamic, encompassing civil engineering, residential and commercial construction, utility installation (power, water, telecom), mining, and forestry. The construction sector remains the largest consumer, driving volume demand, while niche sectors like mining or specialized industrial applications drive demand for highly durable, specialized materials or unique measurement markings. Analyzing these segments provides crucial insight into regional demand patterns, as infrastructural focus shifts between regions—for instance, heavy emphasis on forestry tapes in resource-rich regions of Canada and Russia, versus intense demand for construction-grade steel tapes in rapidly urbanizing areas of Asia.

Furthermore, segmentation by measurement standard (Metric vs. Imperial) dictates product viability across different geopolitical regions, influencing inventory management and distribution logistics for international companies. The market increasingly requires dual-standard or easily switchable measurement formats to serve global contractors operating across various regulatory jurisdictions. Understanding these segments allows stakeholders to forecast demand for specific product variations, anticipate shifts in procurement preferences (e.g., favoring anti-corrosive coatings or high-visibility markings), and strategically position their offerings against competitors focusing solely on standardized, low-cost options. This multi-dimensional segmentation ensures thorough market coverage and informs product innovation cycles.

- By Material Type:

- Steel Tapes (High Precision, Durable)

- Fiberglass Tapes (Non-Conductive, Water Resistant)

- Synthetic/Plastic Tapes (Lightweight, Economical)

- By Measurement Standard:

- Metric System

- Imperial System

- By Product Type:

- Open Reel Tapes

- Closed Reel Tapes

- Pocket Tapes (Shorter Lengths)

- By Application/End-User:

- Construction and Infrastructure

- Land Surveying and Mapping (Geomatics)

- Utility and Telecommunications

- Mining and Quarrying

- Forestry and Agriculture

- Architectural and Interior Design

Value Chain Analysis For Surveyor Tapes Market

The value chain for the Surveyor Tapes Market begins with upstream activities focused on the procurement and processing of key raw materials, primarily high-grade stainless steel or carbon steel for metallic tapes, and specialized fiberglass threads combined with PVC or polymer coatings for non-metallic tapes. Raw material quality is paramount, as it dictates the tape's durability, flexibility, and, most crucially, its thermal stability and accuracy. Manufacturers engage in complex metal treatment processes, including etching, printing, and coating application, to ensure the graduations are permanent and resistant to abrasion and corrosion. Efficiency in this upstream segment relies heavily on maintaining strategic supplier relationships to manage volatile commodity prices, particularly for steel and specific polymer resins necessary for high-performance casings.

Midstream activities involve the core manufacturing processes: slitting and cutting the raw material strips, highly precise calibration and marking (graduation), assembly of the tape measure mechanism (including spring mechanisms for retractable models), and final fitting into the reel casing and accessories (hooks, handles). Quality control at this stage is intensive, focusing on ensuring absolute linear accuracy according to international standards (e.g., NIST, CE). Distribution forms the crucial downstream segment, utilizing a mix of direct and indirect channels. Direct sales are often reserved for large governmental tenders or substantial bulk orders from major construction conglomerates, allowing manufacturers to maintain higher margins and direct customer feedback loops. This approach is highly effective for premium, specialized products requiring technical support.

Indirect distribution relies heavily on specialized industrial supply distributors, hardware retailers, construction supply stores, and increasingly, specialized e-commerce platforms catering to professionals. These indirect channels provide wide geographical reach and local inventory management, catering efficiently to smaller contractors and individual surveyors. The final step involves the end-user application across various sectors. The effectiveness of the overall value chain is maximized when robust material science in the upstream segment meets efficient, widespread distribution in the downstream, ensuring that high-precision tools are available where and when construction and surveying activity peaks. Optimization of this chain seeks to minimize lead times and logistical costs associated with transporting bulky, heavy steel products globally.

Surveyor Tapes Market Potential Customers

The primary consumers, or potential customers, in the Surveyor Tapes Market are professional entities and skilled tradespeople who require high-accuracy linear measurement for technical compliance and project execution. This vast customer base spans across governmental bodies, private construction firms, independent land surveyors, and utility companies. Government agencies, including public works departments and transportation authorities, represent significant buyers, often procuring high volumes of standardized, durable steel tapes for major infrastructure projects like highway construction, dam building, and municipal utility upgrades, prioritizing longevity and adherence to strict regulatory specifications over initial cost. These customers often utilize formal tender processes, making them crucial targets for large-scale contracts.

The largest volume of demand originates from the private sector construction industry, encompassing general contractors, civil engineers, architectural firms, and specialized subcontractors (e.g., foundation specialists, plumbers, electricians). While general construction often utilizes standard fiberglass tapes due to their affordability and non-conductive properties, high-rise and large commercial projects necessitate premium steel tapes with superior accuracy and resilience for precise structural layout. These users prioritize ease of use, durability under adverse conditions (mud, moisture, concrete exposure), and the ergonomics of the reel casing for day-long usage. The purchasing decision for this segment is often influenced by brand reputation, professional recommendations, and availability through local distribution channels.

Beyond construction, specialized end-users include professionals in the environmental, mining, and forestry sectors. Environmental engineers use tapes for mapping contamination boundaries or monitoring groundwater levels in wells, often requiring specialized, non-corrosive materials. Mining operations demand exceptionally robust, highly visible tapes designed to withstand abrasive materials and harsh subterranean conditions. Furthermore, educational institutions and vocational training centers represent a consistent, if smaller, customer segment, purchasing tapes for instructional purposes. Targeting these distinct customer profiles requires a segmented product portfolio, offering entry-level, general-purpose tapes alongside highly specialized, high-tolerance tools designed for niche industrial applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 668 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Stanley Black & Decker, Klein Tools, Starrett, Tajima Tool Corporation, L.S. Starrett Company, BMI (Bayerische Maßindustrie), SOLA-Messwerkzeuge GmbH, Hultafors Group AB, Fisco Tools, AdirPro, Komelon, Poniard, US Tape, Keson Industries, Irwin Tools, Apex Tool Group, Milwaukee Tool, Wera Tools, Richter, and CST/berger (A Bosch Company). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Surveyor Tapes Market Key Technology Landscape

The technology landscape for the Surveyor Tapes Market is characterized by incremental improvements focused on material science, enhanced calibration precision, and passive digital integration, rather than revolutionary breakthroughs. Material technology centers on developing proprietary coatings for steel tapes to maximize corrosion resistance and minimize glare, enhancing longevity and readability in harsh outdoor conditions. Furthermore, advanced manufacturing techniques are employed to ensure the lowest possible coefficient of thermal expansion (CTE) in high-precision tapes, addressing one of the primary historical sources of measurement error. The use of specialized synthetic materials in fiberglass tapes, incorporating high-strength polymer strands, is designed to reduce stretch and increase tensile strength, thereby closing the accuracy gap with traditional steel tapes while retaining non-conductive safety features. These material innovations are crucial for maintaining the market relevance of physical tapes in modern, demanding environments.

In terms of digital integration, the technological emphasis is on improving data capture and minimizing manual data entry errors. This includes the development of 'smart' tape measures that, while physically using traditional materials, incorporate small digital interfaces or measurement wheels (rotary encoders) within the reel mechanism. These components allow the user to read the exact measurement digitally and, in some high-end models, instantly transmit that data via Bluetooth or NFC to a dedicated field application running on a smartphone or tablet. This technology bridges the gap between purely mechanical tools and modern digital workflows, enabling surveyors to geo-tag measurements accurately and incorporate them into complex BIM (Building Information Modeling) or GIS projects without transcription errors. The reliability of these integrated systems is improving rapidly, increasing their adoption among tech-savvy professional users.

The manufacturing process itself incorporates sophisticated laser etching and photolithography techniques to ensure that the graduations on the tape (the millimeter or inch markings) are highly accurate, permanent, and consistent along the entire length. Calibration technologies, including controlled environment testing utilizing high-precision laser trackers, ensure that every manufactured tape meets or exceeds international standards for accuracy (Class I or Class II). Technology also extends to ergonomic design, focusing on shock-absorbent reel casings, high-leverage folding cranks, and specialized end-hooks (e.g., self-adjusting or zero-point hooks) that maximize user efficiency and minimize the potential for physical fatigue or measurement setup errors. The combined effect of these technologies is a more durable, reliable, and workflow-compatible surveyor tape, positioning it as a robust auxiliary tool to electronic surveying systems.

Regional Highlights

The global Surveyor Tapes Market exhibits distinct regional dynamics driven by varying levels of infrastructural maturity, regulatory environments, and expenditure patterns. Asia Pacific (APAC) is the dominant and fastest-growing region, fueled by unprecedented rates of urbanization and industrialization across countries like China, India, and Indonesia. Massive government investments in transportation networks (high-speed rail, ports) and extensive residential construction projects drive exceptionally high volume demand for all types of surveying tools, including both basic and premium tapes. The market here is highly competitive, characterized by the presence of large local manufacturers competing with established international brands, often focusing on cost-effectiveness and volume supply, especially within the construction segment.

North America (primarily the US and Canada) represents a mature, high-value market where demand is stable and driven by sophisticated commercial construction, high-precision engineering projects, and necessary infrastructure maintenance. North American users prioritize durability, ergonomic design, and technologically augmented tapes (such as those with digital readouts). Regulatory compliance, especially concerning job site safety and material standards, is stringent, favoring established brands known for reliability. The replacement cycle for professional-grade tools is a significant determinant of sales volume, alongside demand generated by specialized applications in oil and gas and large-scale architectural projects requiring verifiable linear measurements.

Europe is another mature market demonstrating steady demand, characterized by strong quality preferences and adherence to strict EU measuring instrument directives. Countries like Germany, France, and the UK have historically robust manufacturing bases for precision measuring instruments, maintaining a high standard for tape accuracy (often demanding Class I certification). The emphasis in Europe is shifting towards sustainable manufacturing practices and specialized professional tools, particularly for restoration, precision mechanical engineering, and advanced civil works. Meanwhile, Latin America and the Middle East & Africa (MEA) show increasing market potential. Growth in MEA is highly concentrated around mega-projects in the GCC states (Saudi Arabia, UAE), while Latin America's market expansion is tied to economic stabilization and subsequent investment in mining, utilities, and public housing infrastructure, creating emerging demand centers for affordable, reliable surveying equipment.

- Asia Pacific (APAC): Highest growth trajectory driven by urbanization, infrastructure mega-projects (rail, housing), and high-volume construction activity, leading to strong demand for all tape types.

- North America: Stable, high-value market focused on replacement demand, premium digital-ready tapes, and specialized applications in commercial and energy sectors, emphasizing durability and accuracy.

- Europe: Mature market characterized by stringent quality standards, Class I accuracy requirements, and steady demand from professional engineering and construction firms, focusing on specialized and sustainable products.

- Latin America (LATAM): Emerging market growth supported by resource extraction (mining) and utility expansion, creating demand for robust, general-purpose measuring instruments.

- Middle East & Africa (MEA): Growth tied to concentrated development projects in Gulf Cooperation Council (GCC) countries and urbanization efforts, requiring reliable basic surveying equipment for rapid development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Surveyor Tapes Market.- Stanley Black & Decker (including Stanley Tools)

- The L.S. Starrett Company

- Tajima Tool Corporation

- BMI (Bayerische Maßindustrie)

- SOLA-Messwerkzeuge GmbH

- Hultafors Group AB

- Fisco Tools

- AdirPro

- Komelon

- Keson Industries

- US Tape

- Apex Tool Group (including Crescent Lufkin)

- Irwin Tools

- Milwaukee Tool (Techtronic Industries Co. Ltd.)

- Wera Tools

- Klein Tools

- Richter

- CST/berger (A Robert Bosch Tool Corporation Brand)

- General Tools & Instruments

- Kielder Industrial Ltd.

Frequently Asked Questions

Analyze common user questions about the Surveyor Tapes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Surveyor Tapes Market between 2026 and 2033?

The Surveyor Tapes Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 5.8% during the forecast period from 2026 to 2033, driven largely by global infrastructure development.

Which material type of surveyor tape is generally preferred for non-conductive and wet environments?

Fiberglass tapes are highly preferred for environments requiring non-conductivity, such as near electrical utilities, and are also resistant to moisture and rust, making them ideal for damp or wet field conditions where steel tapes could corrode.

How do advanced electronic surveying technologies like LiDAR and Total Stations affect the Surveyor Tapes Market?

While advanced electronic tools handle long-distance and complex surveys more efficiently, surveyor tapes remain essential for localized, high-precision verification, short-distance checks, and as a reliable, low-cost backup tool, thus sustaining a consistent market demand.

Which geographical region is expected to dominate market growth in the near future?

The Asia Pacific (APAC) region is expected to lead market growth, primarily due to unprecedented investment in large-scale infrastructure projects, rapid urbanization, and a high volume of residential and commercial construction activity across major economies like China and India.

What technological innovations are being implemented in modern surveyor tapes to improve accuracy?

Innovations include advanced material coatings to reduce thermal expansion coefficients, precision laser etching for permanent and accurate graduations, and the integration of smart features like digital readouts and Bluetooth connectivity for error-free data logging.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager