Sushi Restaurants Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433511 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Sushi Restaurants Market Size

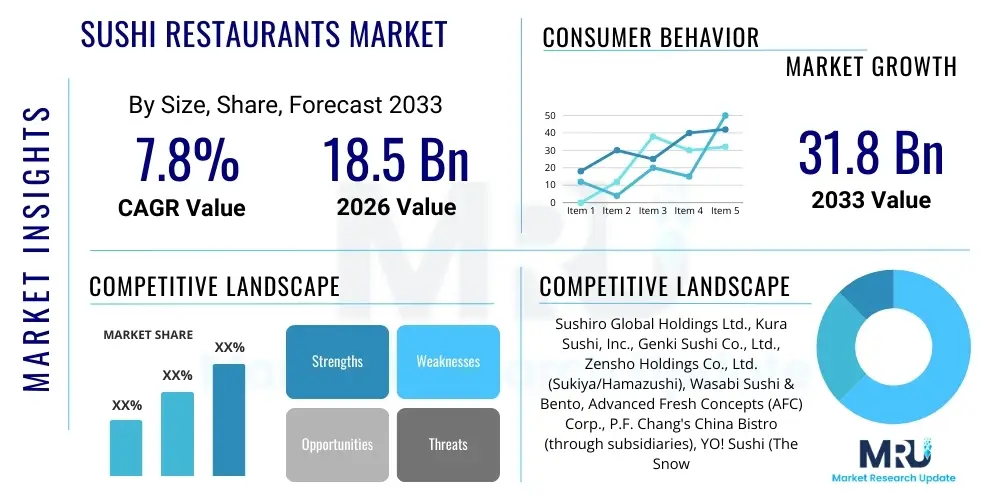

The Sushi Restaurants Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 31.8 Billion by the end of the forecast period in 2033.

Sushi Restaurants Market introduction

The global Sushi Restaurants Market encompasses establishments primarily engaged in preparing and serving Japanese cuisine, with a central focus on sushi, sashimi, and related culinary offerings. This market is driven by increasing globalization, rising consumer preference for ethnic and healthy food options, and growing disposable incomes across emerging economies. Sushi, recognized globally for its nutritional value, presentation, and cultural significance, has transitioned from a niche ethnic food to a mainstream dining category, stimulating significant investment in both fine dining and fast-casual segments. The product description spans traditional Edomae sushi, fusion rolls, vegan sushi, and delivery-optimized formats, catering to diverse palate preferences and dietary restrictions globally. The market environment is highly competitive, necessitating constant innovation in menu design, ingredient sourcing, and customer experience management.

Major applications of the Sushi Restaurants Market extend beyond dine-in experiences to include robust catering services, corporate events, and highly efficient third-party delivery services, which have significantly broadened the market reach, especially in urban centers. The primary benefits driving consumer adoption include the perception of sushi as a fresh, low-calorie, and high-protein meal choice, aligning perfectly with contemporary health and wellness trends. Furthermore, the experiential aspect of sushi preparation, often involving open kitchen concepts or specialized service techniques (like conveyor belt sushi), adds intrinsic value that attracts repeat customers. The continuous evolution of supply chain logistics, ensuring the availability of high-quality, fresh seafood worldwide, is foundational to sustaining market growth and maintaining product integrity.

Key driving factors propelling the Sushi Restaurants Market include demographic shifts, such as the increasing population of millennials and Gen Z consumers who prioritize culinary exploration and authenticity. The substantial growth in tourism and international travel also exposes new consumer segments to sushi, subsequently generating long-term demand in diverse geographical locations. Moreover, the increasing standardization of food safety protocols and traceability of seafood ingredients have bolstered consumer confidence, mitigating previous concerns related to raw fish consumption. Technological integration, particularly in reservation systems, inventory management, and digital ordering platforms, is enhancing operational efficiency and customer satisfaction, further solidifying the market's trajectory toward substantial expansion.

Sushi Restaurants Market Executive Summary

The Sushi Restaurants Market is experiencing robust expansion characterized by strong business trends centered on digitalization and experiential dining, coupled with significant regional diversification favoring Asia Pacific and North America. Business trends underscore a pivot towards sustainable sourcing practices, addressing mounting environmental concerns regarding overfishing and ethical labor, which is becoming a crucial differentiator for premium brands. Furthermore, the proliferation of specialized QSR (Quick Service Restaurant) sushi concepts, emphasizing grab-and-go options and automated vending machines in high-traffic areas, reflects a strategic shift toward convenience and speed, capturing the busy urban demographic. Successful market players are leveraging advanced data analytics to tailor marketing campaigns and optimize menu pricing, leading to enhanced profitability and operational scale, while simultaneously managing the volatile costs associated with high-grade seafood procurement.

Regionally, the market dynamics show Asia Pacific maintaining its dominance, fueled by the deep cultural integration of sushi consumption in countries like Japan, South Korea, and increasingly, China and Southeast Asian nations where middle-class affluence is surging. North America, particularly the United States, represents the fastest-growing market due to high consumer willingness to pay for premium dining experiences and the vast acceptance of fusion sushi concepts, adapting traditional Japanese forms to local tastes. European markets, while mature, are characterized by slow but steady growth, focusing heavily on imported Japanese quality standards and high-end restaurant concepts. Geopolitical stability and local economic strength directly correlate with consumer spending on discretionary dining experiences, making macroeconomic indicators vital for predicting regional performance and investment opportunities across all major territories.

Segmentation trends highlight the rapid expansion of the Fast Casual and Delivery segments over traditional Full-Service establishments, driven primarily by cost-effectiveness and accessibility. The Ingredient Type segment is witnessing heightened interest in sustainable and plant-based alternatives, such as "in-vitro" seafood and meticulously crafted vegetable sushi, broadening the consumer base beyond traditional fish-eaters. Moreover, the segmentation based on Price Range shows polarized growth, with significant activity both in the ultra-premium, Omakase-style dining sector, catering to high-net-worth individuals seeking authenticity, and the value-driven, all-you-can-eat buffet style, targeting budget-conscious diners. This segmented growth requires operators to adopt highly specific operational models and supply chain strategies tailored to their intended market positioning and target demographic.

AI Impact Analysis on Sushi Restaurants Market

User queries regarding AI in the Sushi Restaurants Market predominantly focus on automation potential, supply chain optimization, and personalized customer experiences. Key concerns revolve around whether AI could replace skilled sushi chefs (itamae) and the maintenance of traditional culinary artistry versus efficiency gains. Users expect AI to revolutionize back-of-house operations, specifically predicting inventory needs, minimizing food waste, and ensuring optimal freshness through sophisticated cold chain monitoring. Additionally, there is significant interest in AI-driven personalization, where systems analyze past orders, dietary preferences, and demographic data to recommend bespoke menu items or optimize service flow, enhancing overall dining satisfaction and efficiency. The consensus suggests AI will act as an augmentative tool, increasing profitability and hygiene standards rather than fundamentally altering the core culinary process.

- AI-Powered Demand Forecasting: Utilizing machine learning algorithms to predict daily, weekly, and seasonal ingredient needs, significantly reducing spoilage, particularly for highly perishable raw fish.

- Robotics and Automation: Implementation of specialized robotic arms for repetitive tasks like rice preparation (shari) and standard roll cutting, improving consistency and speed in high-volume settings.

- Personalized Menu Recommendations: AI systems analyzing customer data to offer tailored sushi selections and beverage pairings, boosting average check size and customer loyalty.

- Quality Control and Safety Monitoring: Computer vision and sensors deployed to monitor seafood freshness, temperature consistency during preparation, and adherence to rigorous hygiene standards.

- Optimized Labor Scheduling: AI analyzing peak hours and workflow patterns to dynamically schedule staff, ensuring optimal service levels while controlling labor costs.

- Automated Customer Service: Deploying chatbots and voice assistants for reservation management, detailed menu inquiries, and immediate feedback collection, streamlining front-of-house operations.

DRO & Impact Forces Of Sushi Restaurants Market

The market trajectory is primarily driven by global health consciousness and the culinary appeal of Japanese culture, counterbalanced by supply chain volatility and the high capital investment required for quality control. Drivers include the increasing adoption of healthy eating habits globally, recognizing sushi as a nutritious, protein-rich meal. Restraints involve the inherent risks associated with raw fish consumption, requiring stringent, often costly, regulatory compliance and traceability measures. Opportunities lie in expanding into untapped geographical regions, particularly those with rising middle-class disposable incomes, and pioneering sustainable/plant-based sushi alternatives. The impact forces show strong leverage from consumer trends, where authenticity and sustainability are non-negotiable, putting pressure on ingredient sourcing, while competitive intensity necessitates continuous operational efficiency improvements to maintain margins.

Drivers are intrinsically linked to macroeconomic factors, such as sustained urbanization and the associated convenience culture, making delivery services and quick-service sushi segments highly attractive. Furthermore, cultural globalization, amplified by media and social platforms, consistently introduces and normalizes Japanese dining habits in Western and emerging cultures, creating a consistent pipeline of new consumers. The proliferation of specialized diets (Keto, Paleo, low-carb) often finds sushi accommodating, provided rice is limited or substituted, thereby expanding the potential addressable market. This persistent growth in consumer awareness and preference for high-quality, non-processed foods acts as a powerful, reinforcing mechanism for market expansion, dictating menu innovation and service standardization worldwide.

Restraints are deeply rooted in operational complexities, most critically the price volatility and ethical concerns surrounding key ingredients like tuna and salmon. Overfishing and climate change threaten wild stock populations, pushing up input costs and forcing businesses to invest in sustainable aquaculture, which itself carries initial high costs. Labor shortages, particularly for highly trained sushi chefs (itamae), pose a significant constraint on scaling premium operations and maintaining consistent quality across multiple outlets. Moreover, the stringent food safety regulations pertaining to raw fish handling vary significantly by country, introducing complex compliance burdens for international chains attempting standardized global expansion. These challenges necessitate sophisticated risk mitigation strategies focusing on diversified sourcing and talent development pipelines.

Opportunities are vast, centering around technological disruption and market penetration strategies. The integration of technology, from automated sushi preparation systems to advanced reservation and personalized marketing tools, offers significant avenues for competitive advantage and margin improvement. Geographically, markets in Southeast Asia (e.g., Vietnam, Thailand) and Latin America are poised for explosive growth as local consumers embrace international cuisine and dining out becomes a more frequent activity. Additionally, the increasing consumer focus on environmental, social, and governance (ESG) factors presents an opportunity for brands specializing in certified sustainable, traceable, or lab-grown seafood, allowing them to capture premium pricing and secure brand loyalty among environmentally conscious clientele, thereby unlocking substantial long-term growth potential.

Segmentation Analysis

The Sushi Restaurants Market segmentation provides a granular view of market dynamics, categorized primarily by Service Type (Full Service, Fast Casual, QSR/Takeaway), Ingredient Type (Traditional Seafood, Plant-Based/Vegan, Fusion/Non-Traditional), and Price Range (Economy, Mid-Range, Premium/Luxury). Analyzing these segments reveals shifting consumer behavior, highlighting a strong trend towards convenience-driven dining (Fast Casual and Takeaway) spurred by post-pandemic preferences and rapid urbanization. The Ingredient Type segmentation reflects innovation aimed at inclusivity, with plant-based options emerging as a critical growth engine catering to health-conscious and ethical consumers, while traditional seafood remains the backbone of the market, driven by authenticity demands in high-end venues. Understanding these segment behaviors is crucial for operators designing effective market entry and expansion strategies, especially when tailoring supply chains and marketing efforts.

- Service Type:

- Full-Service Restaurants: High-end dining, Omakase experiences, traditional service models focusing on ambiance and artistry.

- Fast Casual Restaurants: Hybrid model offering higher quality than QSR but faster service; often conveyor belt (Kaiten) sushi.

- Quick Service Restaurants (QSR) / Takeaway: Focus on affordability, speed, and convenient grab-and-go options, heavily reliant on digital ordering platforms.

- Ingredient Type:

- Traditional Seafood: Predominantly tuna, salmon, yellowtail, and shellfish; driven by quality and sourcing transparency.

- Plant-Based/Vegan Sushi: Utilizing vegetables, mushrooms, innovative rice substitutes, and engineered plant-based fish alternatives; targeting dietary restrictions and sustainability advocates.

- Fusion/Non-Traditional: Incorporating non-Japanese ingredients (e.g., specific fruits, creamy sauces, fried components) to appeal to localized tastes.

- Price Range:

- Economy: High-volume, standardized offerings, often buffet or all-you-can-eat formats.

- Mid-Range: Balanced quality and price, catering to routine dining and casual occasions.

- Premium/Luxury: Focus on rare or exotic seafood, highly personalized service, and elite culinary craftsmanship (Itamae-led experiences).

- Distribution Channel:

- Dine-in

- Online Delivery (Third-party aggregators and proprietary apps)

- Catering and Events

Value Chain Analysis For Sushi Restaurants Market

The Sushi Restaurants Market value chain begins with highly specialized upstream activities, primarily involving global fishing and aquaculture industries, where raw material quality and ethical sourcing are paramount differentiators. Upstream analysis focuses on securing traceable, high-quality seafood (often premium grade, flash-frozen, or fresh wild catch) and specialized Japanese ingredients such as Nori, specific rice variants, and specialized seasonings (soy sauce, wasabi). The inherent perishability of these ingredients dictates the necessity for exceptionally robust and efficient cold chain logistics, which constitutes a major cost center and competitive hurdle. Successful players establish direct relationships with certified suppliers or vertically integrate parts of the supply chain to ensure consistent quality and mitigate price volatility driven by global commodity markets.

The core midstream activity involves preparation and processing within the restaurant environment, demanding highly skilled labor (sushi chefs) and specialized equipment for temperature and hygiene control. This stage adds significant value through culinary artistry, presentation, and service quality, defining the customer experience. Downstream activities focus on reaching the end consumer through diverse distribution channels. These include direct service through traditional dine-in establishments, which prioritize ambiance and service quality, and increasingly, indirect channels such as proprietary mobile apps, third-party food aggregators (like Uber Eats and DoorDash), and specialized retail partnerships (e.g., supermarket sushi counters). The shift towards digital ordering platforms has fundamentally altered the downstream landscape, emphasizing speed, packaging quality, and efficient last-mile delivery management.

The direct channel, represented by the physical restaurant premises, allows for direct control over brand experience, quality presentation, and direct feedback collection, fostering strong customer relationships crucial for high-end segments. The indirect channel, dominated by digital delivery platforms, offers massive market reach and convenience but introduces complexity regarding commission structures, quality maintenance during transit, and reliance on external delivery infrastructure. Optimizing this distribution channel mix is critical for maximizing profit margins while catering to the modern consumer's demand for convenience. Effective management of the entire value chain—from transparent sourcing to seamless last-mile delivery—is essential for sustained growth and brand integrity in this highly competitive, quality-sensitive market segment.

Sushi Restaurants Market Potential Customers

The primary consumers (End-Users/Buyers) of the Sushi Restaurants Market are highly diversified, ranging from affluent epicureans seeking authentic Japanese dining experiences to health-conscious professionals demanding quick, nutritious lunches, and younger demographics experimenting with new food trends. Affluent customers often seek premium, Omakase-style dining where the quality of the fish, rarity of ingredients, and the chef’s personalized service justify high prices. These consumers prioritize authenticity, freshness transparency, and sophisticated beverage pairings. Conversely, the millennial and Gen Z segments, particularly in urban areas, are driven by convenience, variety, and competitive pricing, making fast-casual and delivery models highly attractive. This demographic also shows a higher propensity towards trying fusion concepts and plant-based sushi options, reflecting evolving dietary and ethical concerns.

Business professionals and corporate clients constitute another critical segment, utilizing sushi restaurants for networking, high-level business lunches, and frequent corporate catering needs due to the cuisine’s perceived premium quality and ease of sharing. These buyers emphasize reliability, timely service, and discretion. Furthermore, a growing segment consists of health and wellness advocates who select sushi as a low-carb, high-protein alternative to traditional fast food. This group often targets restaurants that explicitly highlight ingredient sourcing, nutritional information, and options that cater to specific dietary needs, such as gluten-free or low-sodium preparations. Understanding the motivations (health, status, convenience) of each customer cohort allows market players to tailor their operational setup, menu architecture, and marketing messaging effectively across different restaurant formats.

Tourists and international travelers represent a fluctuating but significant customer base, especially in major cosmopolitan and cultural centers, seeking both authentic local Japanese experiences and familiar comfort food abroad. The geographic location of the restaurant often determines the profile of this consumer group. Finally, the growing population of families, particularly in suburban areas, increasingly views sushi as a suitable, slightly upscale option for casual family dining, driving demand for affordable, accessible formats with broad menu appeal. Targeting these potential customers requires restaurants to segment their offerings carefully—premium brands must maintain impeccable sourcing and ambiance, while casual operators must focus on streamlined processes, competitive pricing, and efficient, high-quality delivery mechanisms to maximize market share.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 31.8 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sushiro Global Holdings Ltd., Kura Sushi, Inc., Genki Sushi Co., Ltd., Zensho Holdings Co., Ltd. (Sukiya/Hamazushi), Wasabi Sushi & Bento, Advanced Fresh Concepts (AFC) Corp., P.F. Chang's China Bistro (through subsidiaries), YO! Sushi (The Snowfox Group), The Cheesecake Factory Incorporated (through subsidiaries), Benihana National Corporation, Blue Ribbon Sushi, Nobu Restaurants, Zuma Restaurants, Feng Sushi, Sushi Samba, Haru Sushi, Roka Akor, Sticks'n'Sushi, Sushi of Gari, and Din Tai Fung (indirect competitor in Asian dining). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sushi Restaurants Market Key Technology Landscape

The technology landscape in the Sushi Restaurants Market is rapidly evolving, driven by the need for enhanced efficiency, precision, hygiene, and optimized customer interaction. Core technological adoptions include advanced kitchen automation and robotics, specifically designed for repetitive, high-volume preparation tasks such as forming uniform rice portions (shari), slicing consistent vegetable strips, and assembling standard rolls. These robotics systems ensure unparalleled consistency and speed, mitigating labor dependency for basic tasks and freeing up skilled chefs to focus on specialized cutting and premium preparations. Furthermore, sophisticated thermal monitoring and cold chain management technologies, often involving IoT sensors and cloud-based logging, are essential for maintaining the integrity and safety of highly perishable raw ingredients from supplier receipt through to final plate presentation, satisfying stringent global health standards.

On the customer-facing side, the implementation of seamless digital ecosystems is critical for modern operations. This includes sophisticated Point-of-Sale (POS) systems integrated with inventory management software, reducing waste by accurately correlating sales data with ingredient usage rates. Advanced reservation platforms, often coupled with AI-driven waitlist management, optimize seating capacity and reduce customer frustration. Moreover, many high-volume establishments, particularly in Asia, utilize digital ordering via tablets at the table or self-service kiosks, which reduces human error and accelerates the ordering process, significantly improving table turnover rates. The convergence of these front-of-house and back-of-house systems is creating an operational synergy that is defining competitive advantage in the QSR and fast-casual sushi sectors globally.

Another crucial area is the utilization of data analytics and generative AI tools for personalized customer engagement and strategic decision-making. AI algorithms analyze historical purchasing patterns, demographic data, and peak demand cycles to predict ingredient requirements and forecast staffing needs, minimizing labor and food waste expenses. Furthermore, augmented reality (AR) applications are being explored to enhance the dining experience, providing interactive menu descriptions or visual guides to ingredient origins, particularly valuable for high-end dining. The deployment of specialized packaging technologies also falls under this landscape, ensuring that sushi ordered via delivery maintains optimal temperature, structural integrity, and presentation quality during transit, addressing a historical pain point in the market and supporting the robust expansion of off-premise sales channels.

Regional Highlights

- Asia Pacific (APAC): The dominant region, characterized by deep cultural affinity and high consumer frequency. Japan remains the innovation hub for traditional and automated sushi technology. China and South Korea are experiencing massive growth driven by domestic demand and international chain expansion. APAC focuses heavily on authentic sourcing and highly automated conveyor belt models (Kaiten sushi) to achieve scale and affordability while maintaining quality perception. The rapidly growing middle class in Southeast Asia (e.g., Singapore, Thailand, Indonesia) is driving demand for both premium and fast-casual concepts.

- North America (NA): Represents the fastest-growing market by value, primarily fueled by the strong acceptance of fusion sushi and high disposable incomes in metropolitan areas, particularly the US and Canada. NA consumers prioritize convenience (delivery), large portion sizes, and creative menu adaptations (e.g., California rolls, specialized sauces). Food safety and ethical sourcing certifications are crucial marketing tools in this region, defining premium brand positioning and consumer trust.

- Europe: A mature market focusing heavily on high-quality, authentic Japanese imports and high-end dining experiences, especially in Western European hubs like the UK, France, and Germany. Growth is steady but constrained by higher regulatory hurdles for imported raw fish and generally conservative consumer adoption compared to NA. Scandinavian countries show emerging growth, often prioritizing sustainability and clean labeling of ingredients.

- Latin America (LATAM): An emerging growth region, with Brazil and Mexico showing the most dynamic expansion, driven by cultural integration (e.g., Japanese-Brazilian fusion in São Paulo) and increasing urbanization. The market is highly price-sensitive, leading to strong performance in economy and mid-range segments. Challenges include cold chain logistics reliability and access to high-quality imports, requiring localized supply chain solutions.

- Middle East and Africa (MEA): Growth is concentrated in affluent urban centers (Dubai, Riyadh, Johannesburg), catering to expatriate and high-net-worth local populations. MEA markets demand luxury dining experiences and rely heavily on specialized, high-cost imported ingredients. The adoption rate is slower in broader African markets due to economic constraints, focusing mainly on premium dining niches.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sushi Restaurants Market.- Sushiro Global Holdings Ltd.

- Kura Sushi, Inc.

- Genki Sushi Co., Ltd.

- Zensho Holdings Co., Ltd. (Hamazushi, Sukiya)

- Wasabi Sushi & Bento

- Advanced Fresh Concepts (AFC) Corp.

- P.F. Chang's China Bistro (through subsidiaries and strategic partnerships in Asian cuisine)

- YO! Sushi (The Snowfox Group)

- The Cheesecake Factory Incorporated (operating diverse concepts including Asian fusion)

- Benihana National Corporation

- Blue Ribbon Sushi

- Nobu Restaurants

- Zuma Restaurants

- Feng Sushi

- Sushi Samba

- Haru Sushi

- Roka Akor

- Sticks'n'Sushi

- Sushi of Gari

- Din Tai Fung (indirect competitor and operator of high-volume Asian chains)

- Sushi King (Japan)

- Maki-San (Singapore)

- Akira Back Group

- Tao Group Hospitality (managing various Japanese concepts)

- Marugame Seimen (Focus on udon, but expanding adjacent Japanese food court concepts)

- ITSU (UK based fast casual)

Frequently Asked Questions

Analyze common user questions about the Sushi Restaurants market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the Sushi Restaurants Market globally?

Market growth is primarily driven by rising consumer health awareness, classifying sushi as a nutritious, high-protein meal, coupled with the increasing digitalization of food service (delivery platforms) and the persistent globalization of Japanese culinary culture, particularly among younger, urban demographics seeking authentic and experiential dining options.

How significant is sustainability in the procurement of seafood for sushi restaurants?

Sustainability is a critical factor, especially for premium and international chains. Consumers increasingly demand transparent sourcing, ethical fishing practices, and certified ingredients (e.g., MSC certification). Failure to adhere to sustainable practices poses significant reputational and supply chain risks, compelling operators to invest in traceable and often aquaculture-sourced alternatives.

What role does technology play in the operational efficiency of fast-casual sushi establishments?

Technology, including AI-driven demand forecasting, robotics for rice preparation, integrated POS systems, and automated ordering (e.g., conveyor belt systems with digital ordering), is crucial for maximizing throughput, maintaining consistency, reducing labor costs, and significantly minimizing food waste inherent in dealing with perishable raw materials in the fast-casual segment.

Which geographical region holds the largest market share for sushi restaurants, and why?

The Asia Pacific region, led by Japan, maintains the largest market share due to the deep cultural heritage, established high-frequency consumption patterns, and the continuous innovation in service models (such as advanced Kaiten sushi). However, North America is exhibiting the highest CAGR, signaling rapid consumer acceptance and market expansion.

What are the primary challenges facing premium, full-service sushi restaurants?

The main challenges involve the high cost and volatility of acquiring ultra-premium, certified fresh seafood globally, the acute shortage of highly skilled, veteran sushi chefs (itamae), and the necessity of maintaining impeccable, labor-intensive food safety and hygiene standards to justify premium pricing and brand trust.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager