Suspension Ball Joint Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439103 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Suspension Ball Joint Market Size

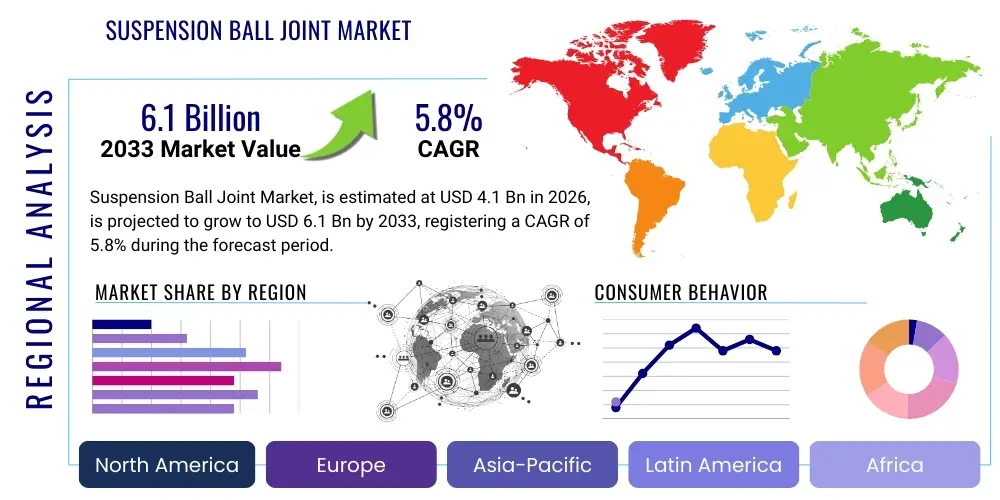

The Suspension Ball Joint Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.1 Billion in 2026 and is projected to reach USD 6.1 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily fueled by the accelerating global demand for passenger and commercial vehicles, coupled with stringent safety regulations mandating high-quality steering and suspension components. Furthermore, the increasing complexity of vehicle suspension systems, particularly in premium and electric vehicle (EV) segments, necessitates advanced ball joint designs capable of handling higher loads and dynamic stresses, thereby driving market value upward.

Suspension Ball Joint Market introduction

The Suspension Ball Joint Market encompasses the manufacturing, distribution, and sale of pivot components essential for the proper functioning of vehicle steering and suspension systems. A ball joint is a flexible, spherical bearing that connects the control arms to the steering knuckle, allowing for rotational movement and ensuring smooth articulation between the wheels and the chassis. This critical component facilitates directional changes and absorbs road vibrations, crucial for vehicle stability, driver comfort, and safety. Major applications span across passenger cars, light commercial vehicles (LCVs), heavy commercial vehicles (HCVs), and off-road equipment, with continuous innovation focused on enhancing durability, reducing friction, and improving corrosion resistance. The market's foundational benefits include improved vehicle handling, reduced tire wear, and enhanced occupant safety, while driving factors such as rapid urbanization, increasing average vehicle age requiring replacement parts, and the shift toward electric vehicle platforms utilizing specialized suspension geometries propel its expansion globally.

Suspension Ball Joint Market Executive Summary

The Suspension Ball Joint Market is characterized by robust resilience driven by the consistent growth in the global automotive fleet and a rising necessity for aftermarket maintenance and replacement components. Key business trends include the consolidation of Tier 1 suppliers striving for integrated chassis solutions and a heightened focus on lightweight materials, such as aluminum and high-strength polymers, to meet EV range targets and fuel efficiency standards in internal combustion engine (ICE) vehicles. Segment trends indicate a stronger demand for advanced ball joint types, including tension and compression ball joints, particularly within performance vehicles and complex multi-link suspension architectures. Geographically, the Asia Pacific region dominates the market, largely due to high production volumes in countries like China and India, alongside the burgeoning demand for new vehicles. Conversely, mature markets in North America and Europe emphasize the aftermarket segment, prioritizing extended service life and premium component quality, ensuring stable revenue generation across all major global regions.

AI Impact Analysis on Suspension Ball Joint Market

Common user questions regarding AI's impact on the Suspension Ball Joint Market typically revolve around predictive maintenance schedules, optimization of manufacturing processes, and the role of AI in designing lighter, more durable components for autonomous vehicles. Users are concerned about how AI-driven simulation tools can predict component failure under extreme operating conditions and how intelligent robotics might transform assembly line efficiency and quality control. The key themes summarized from user inquiries emphasize the transition from reactive component maintenance to proactive, AI-informed replacements, the integration of real-time monitoring sensors within ball joints (Smart Joints), and the use of machine learning algorithms to fine-tune material selection and reduce overall production waste, leading to higher component reliability and reduced warranty costs for manufacturers.

- AI-driven Predictive Maintenance: Enhancing the timing and accuracy of component replacement schedules by analyzing usage data and environmental factors, maximizing vehicle uptime.

- Generative Design for Components: Utilizing machine learning algorithms to optimize ball joint geometry, reducing mass while maintaining or improving strength and longevity.

- Automated Quality Control (QC): Implementing vision systems and deep learning models on assembly lines to detect microscopic flaws and inconsistencies that human inspectors might miss, drastically lowering defect rates.

- Supply Chain Optimization: Using AI to forecast raw material demand, manage inventory levels efficiently, and mitigate supply chain disruptions impacting production timelines.

- Simulation and Testing Acceleration: Employing AI/ML to reduce the physical testing duration needed for new designs by accurately modeling fatigue, wear, and stress distribution in virtual environments.

- Smart Manufacturing Integration: Connecting production machinery with AI platforms for real-time adjustments, improving yield rates and energy consumption in forging and machining processes.

- Autonomous Vehicle Requirement Alignment: Designing specialized, highly reliable ball joints that integrate sensors and meet the stringent durability demands of L4/L5 autonomous platforms.

- Customized Component Production: Facilitating small-batch production of specialized ball joints for niche or high-performance vehicles based on unique operational parameters derived from AI analysis.

- Material Science Exploration: Utilizing AI to rapidly screen and validate novel alloys or polymer composites that offer superior friction reduction and corrosion resistance for next-generation joints.

- Data Analytics for Warranty Reduction: Analyzing field performance data with machine learning to identify systemic design weaknesses or manufacturing variability contributing to premature failure, leading to rapid process iteration.

DRO & Impact Forces Of Suspension Ball Joint Market

The Suspension Ball Joint Market is fundamentally influenced by powerful drivers such as the sustained expansion of the global vehicle parc, particularly in developing economies, coupled with increasing regulatory focus on vehicle safety standards requiring high-performance, meticulously engineered suspension components. However, growth faces restraints, primarily stemming from fluctuating raw material costs, specifically steel and aluminum, which directly impact manufacturing profitability, alongside the proliferation of counterfeit or substandard parts in the aftermarket that erode consumer trust and legitimate manufacturer revenue. Significant opportunities emerge from the electrification of vehicles, necessitating specialized, robust, and often non-standard ball joints adapted for heavier battery packs and regenerative braking forces, and the growing integration of advanced driver assistance systems (ADAS) requiring precise steering feedback. These dynamics create a market impact characterized by high investment in R&D for lightweighting and material science, intense competitive pressure among global suppliers, and a persistent need for supply chain diversification to mitigate geopolitical risks and ensure stable production inputs.

Segmentation Analysis

The Suspension Ball Joint Market is comprehensively segmented based on several critical factors, including vehicle type, application (OEM vs. Aftermarket), component type, and material used. Understanding these segments is crucial for manufacturers to target specific market niches and allocate R&D resources effectively. The core distinction lies between the Original Equipment Manufacturer (OEM) segment, which demands high volume, stringent quality control, and long-term supply agreements, and the Aftermarket segment, characterized by high demand for quality replacements, price sensitivity, and a vast distribution network requirement. Furthermore, the functional classification into upper and lower ball joints dictates design specifications, load-bearing requirements, and typical failure modes, influencing replacement cycles and material choices across different vehicle architectures.

Technological differentiation is also a major segmentation factor, separating traditional lubricated ball joints requiring periodic servicing from sealed, maintenance-free ball joints which dominate modern vehicle production due to consumer preference for reliability and ease of ownership. The trend toward increased vehicle complexity, particularly in multi-link suspensions utilized by luxury and sport utility vehicles, further segments the market by demanding unique, custom-engineered ball joints that differ significantly from those used in simpler, MacPherson strut systems. This complexity drives up the average unit cost and shifts focus towards specialized manufacturing capabilities and advanced material formulations capable of withstanding extreme mechanical cycling and environmental exposure without premature failure.

- By Application:

- Original Equipment Manufacturer (OEM)

- Aftermarket

- By Vehicle Type:

- Passenger Cars (Sedans, Hatchbacks, SUVs)

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Off-Road Vehicles and Equipment

- By Component Type:

- Upper Ball Joints

- Lower Ball Joints

- Tension Ball Joints

- Compression Ball Joints

- By Material:

- Steel and Alloy Steel (Traditional and High-Strength)

- Aluminum and Lightweight Alloys

- Polymer-Hybrid Components

- By Sales Channel:

- Direct Sales (OEM)

- Independent Aftermarket (IAM)

- OES (Original Equipment Supplier) Aftermarket

- By Design Type:

- Greasable/Serviceable Ball Joints

- Sealed/Maintenance-Free Ball Joints

Value Chain Analysis For Suspension Ball Joint Market

The value chain for the Suspension Ball Joint Market begins with the upstream procurement of raw materials, primarily specialized high-grade steel alloys, aluminum, rubber, and various specialized plastic and polymer composites used for the bearing seats and dust boots. Efficient procurement management is critical, as raw material costs constitute a significant portion of the total manufacturing expense, making suppliers highly sensitive to global commodity market fluctuations and geopolitical trade policies. Key activities at this stage involve forging, machining, heat treatment, and precision grinding, demanding high capital investment in specialized machinery and rigorous quality control processes to ensure the metallurgical integrity and precise dimensional accuracy of the spherical components and housing units before final assembly and sealing.

Midstream activities involve the core manufacturing processes: assembly, sealing, lubrication, and rigorous testing for fatigue resistance, load bearing, and corrosion protection. Major suppliers, often Tier 1 automotive parts manufacturers, invest heavily in automated assembly lines and specialized testing rigs that simulate real-world road conditions over accelerated lifecycles to validate product reliability, securing their competitive edge through superior durability performance and meeting OEM longevity specifications. Distribution channels represent a complex downstream network; the OEM route involves direct supply to vehicle assembly plants under long-term contracts, while the aftermarket route relies on a diverse network comprising master distributors, regional wholesalers, retail auto parts stores, and independent repair shops. Effective inventory management and rapid logistics are paramount in the aftermarket to meet immediate repair needs globally.

Direct distribution, characterized by high volume and lower variability, offers greater control over quality and pricing for the OEM segment. Conversely, indirect distribution through the independent aftermarket is crucial for market penetration and accessibility, particularly in developing regions, but introduces challenges related to brand protection, managing counterfeit products, and ensuring consistent pricing across fragmented markets. Optimization of this value chain requires strategic collaboration between material providers and component manufacturers to develop innovative, lightweight materials, reducing overall system inertia and contributing to vehicle performance enhancements, especially within the context of rapidly evolving electric vehicle architectures and high-performance suspension design requirements.

Suspension Ball Joint Market Potential Customers

Potential customers for the Suspension Ball Joint Market are categorized primarily into two major groups: Original Equipment Manufacturers (OEMs) and the expansive Aftermarket segment, each presenting distinct purchasing requirements and volume demands. OEMs, including global automotive giants such as Volkswagen Group, General Motors, Toyota, and Tesla, represent the high-volume buyers requiring components that meet highly specific technical criteria, demanding zero defects per million (DPM) standards, and conforming to long-term supply agreements spanning the production lifecycle of multiple vehicle models. Their decision-making process is dominated by factors like design integration capabilities, compliance with global safety regulations, weight reduction goals, and the supplier's capacity for advanced technological collaboration during the vehicle development phase, making long-term partnership and quality consistency the paramount selection criteria.

The Aftermarket segment, encompassing independent workshops, authorized service centers, national parts distributors, and end-user DIY enthusiasts, constitutes the second massive customer base, focusing heavily on replacement parts for vehicles that are typically three years old or older and are outside of their primary warranty period. These customers prioritize availability, competitive pricing, and certified quality that meets or exceeds the OEM specification, often seeking maintenance-free or enhanced durability options to extend the operational life of their vehicles. Demand in this sector is highly sensitive to external economic factors, such as disposable income levels and the average age of vehicles in operation (VIO), driving sales during economic slowdowns as consumers opt for repair over new vehicle purchase.

A burgeoning potential customer base lies within the specialist vehicle sector, including high-performance racing teams, agricultural machinery manufacturers, and military vehicle producers. These customers require highly specialized, custom-engineered ball joints designed to withstand extreme environments, exceptional dynamic loads, and fatigue characteristics far exceeding standard passenger vehicle requirements. Suppliers targeting this niche must demonstrate expertise in high-stress metallurgy, advanced sealing technologies, and rapid prototyping capabilities. Furthermore, the rising proliferation of autonomous shuttle services and fleet operators represents a growing customer vertical demanding components with guaranteed ultra-long lifecycles and integration with onboard diagnostic systems for constant condition monitoring, setting new standards for durability and digital connectivity within mechanical components.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.1 Billion |

| Market Forecast in 2033 | USD 6.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ZF Friedrichshafen AG, Robert Bosch GmbH, Continental AG, Tenneco Inc., Delphi Technologies, BorgWarner Inc., GMB Corporation, Federal-Mogul Corporation, SKF Group, Knorr-Bremse AG, Mevotech LP, TRW Automotive, Schaeffler Group, Sogefi S.p.A., Mando Corporation, Hitachi Astemo, Sankei Industry Co., Ltd., Hyundai Mobis, JTEKT Corporation, Shandong Huagong Bearing Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Suspension Ball Joint Market Key Technology Landscape

The technological landscape of the Suspension Ball Joint Market is centered on advancements aimed at reducing friction, increasing fatigue life, decreasing component weight, and improving sealing effectiveness against environmental contaminants. A major focus area is the refinement of bearing materials, moving away from traditional metal-on-metal designs towards advanced polymer or PTFE-lined bearings that significantly reduce operational friction, which is vital for enhancing steering responsiveness and minimizing energy loss, a critical factor for extending the range of battery electric vehicles (BEVs). Furthermore, surface treatments, such as induction hardening and specialized anti-corrosion coatings like zinc-nickel plating, are routinely applied to the housing and stud components to enhance overall resistance to wear and rust, ensuring component integrity throughout the vehicle's extended lifecycle, particularly in regions exposed to harsh road salts and extreme weather conditions.

Another crucial technological development involves the continuous innovation in sealing mechanisms. The dust boot, responsible for retaining lubricant and excluding dirt, moisture, and road grit, now incorporates advanced elastomer materials that maintain flexibility and sealing capability across a broader range of temperatures and motion cycles, directly contributing to the prevalence of sealed, maintenance-free ball joints. This shift has redefined industry standards, making scheduled lubrication nearly obsolete in most modern passenger vehicle applications, thereby lowering the total cost of ownership for consumers. Furthermore, manufacturing techniques have evolved, embracing cold-forming and precision forging processes that create stronger, more durable components with less material waste and superior grain structure compared to older casting methods, thereby improving the inherent strength-to-weight ratio.

Looking ahead, the integration of 'smart' technologies is beginning to influence the market, although not yet mainstream. This involves embedding micro-sensors (like strain gauges or accelerometers) within the ball joint housing or stud to monitor component load, temperature, and vibration characteristics in real time. This capability, enabled by miniaturization and robust housing protection, allows for sophisticated on-board diagnostics and facilitates the transition towards condition-based maintenance schedules, perfectly aligning with the requirements of fleet operators and emerging autonomous vehicle platforms that necessitate continuous health monitoring of critical safety components. This technology requires robust data processing infrastructure and seamless integration with vehicle communication networks.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing regional market, driven by the massive automotive manufacturing base in China, India, and Japan, coupled with rapidly increasing vehicle ownership rates and infrastructural development. High production volumes of both ICE and EVs, along with robust replacement demand fueled by dense urban traffic and often challenging road conditions, make this region central to global market dynamics. Regulatory emphasis on safety and the massive internal consumption market solidify its leadership position.

- North America: This region is characterized by a mature OEM segment and a highly lucrative aftermarket segment, where consumers and repair shops prioritize premium, long-lasting replacement components due to higher labor costs and expectations for vehicle longevity. The demand is heavily influenced by the trend toward large SUVs and pickup trucks, which require heavy-duty ball joints capable of supporting increased vehicle weight and higher towing capacities, driving innovation in material strength and durability.

- Europe: The European market maintains a strong emphasis on precision engineering, sophisticated suspension design (due to high penetration of premium and performance vehicles), and strict environmental regulations. The rapid adoption of electric vehicles necessitates specialized ball joint designs for lower unsprung mass and handling the specific dynamics of battery-heavy platforms. The aftermarket segment here values certified quality and components manufactured to OE specifications to ensure adherence to stringent regulatory standards.

- Latin America (LATAM): Growth in LATAM is driven by recovering domestic automotive production in countries like Brazil and Mexico and a large, price-sensitive aftermarket that often utilizes older vehicle models. Market penetration requires manufacturers to balance cost-efficiency with acceptable durability, focusing on components suitable for poor road infrastructure common in many areas, leading to frequent replacement cycles and steady demand.

- Middle East and Africa (MEA): This region exhibits mixed demand, with developed Gulf Cooperation Council (GCC) countries focusing on luxury and high-performance vehicles requiring advanced components, while African markets are primarily driven by replacement demand for utility and commercial vehicles operating in extremely dusty and abrasive environments. Suppliers must offer products with exceptional sealing and heat resistance capabilities to succeed in the diverse operational climates found throughout the MEA region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Suspension Ball Joint Market.- ZF Friedrichshafen AG

- Robert Bosch GmbH

- Continental AG

- Tenneco Inc.

- Delphi Technologies

- BorgWarner Inc.

- GMB Corporation

- Federal-Mogul Corporation

- SKF Group

- Knorr-Bremse AG

- Mevotech LP

- TRW Automotive

- Schaeffler Group

- Sogefi S.p.A.

- Mando Corporation

- Hitachi Astemo

- Sankei Industry Co., Ltd.

- Hyundai Mobis

- JTEKT Corporation

- Shandong Huagong Bearing Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Suspension Ball Joint market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between upper and lower suspension ball joints in vehicle architecture?

The primary difference lies in their function and load bearing. The lower ball joint typically supports the entire weight of the vehicle and manages heavier compressive loads, particularly in MacPherson strut designs, making it larger and more robust. The upper ball joint, present in double wishbone or multi-link systems, primarily manages lateral and steering forces, often designed for precise articulation rather than maximum vertical load, influencing its material and sealing requirements significantly across different vehicle platforms.

How is the shift towards Electric Vehicles (EVs) affecting the demand and design requirements for ball joints?

The transition to EVs increases the demand for specialized, high-performance ball joints due to two main factors: increased vehicle mass from heavy battery packs and enhanced regenerative braking forces. Ball joints for EVs must offer superior durability, accommodate higher dynamic loads, and minimize rotational friction to optimize energy consumption and maximize driving range. This necessitates utilizing lighter materials (like aluminum alloys) and advanced low-friction polymer bearing inserts, driving up the complexity and cost of component engineering.

What major factors are restraining growth in the Suspension Ball Joint Aftermarket segment?

The aftermarket segment faces significant restraints primarily due to the high volatility of raw material costs, particularly steel and rubber, which limits profitability margins for suppliers. Additionally, the widespread presence of low-quality, non-certified counterfeit components poses a severe safety risk and erodes consumer confidence, challenging legitimate manufacturers who must constantly educate repair professionals and consumers on the superior quality and guaranteed safety of OE-equivalent replacement parts.

What role does predictive maintenance technology play in the future optimization of suspension component lifespan?

Predictive maintenance, often enabled by AI and embedded sensors (Smart Joints), will revolutionize component replacement by shifting from fixed mileage schedules to condition-based monitoring. By analyzing factors like load cycles, temperature, and vibration signatures, these technologies can accurately forecast the remaining useful life of a ball joint, enabling replacement precisely when needed, minimizing catastrophic failure risk, optimizing inventory for fleet operators, and significantly reducing overall vehicle maintenance costs and downtime.

Which geographical region exhibits the highest growth potential for high-end, technologically advanced ball joints, and why?

The Asia Pacific (APAC) region, specifically focusing on markets like China and South Korea, offers the highest growth potential for high-end ball joints. This is driven by massive domestic production capacity, the rapid adoption of sophisticated electric vehicle platforms requiring optimized suspension, and increasing consumer affluence demanding premium, safety-critical components in new vehicle purchases. Strong governmental support for automotive innovation further accelerates the adoption of advanced material science and manufacturing techniques in this region.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager