Sustainability Reporting Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434301 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Sustainability Reporting Software Market Size

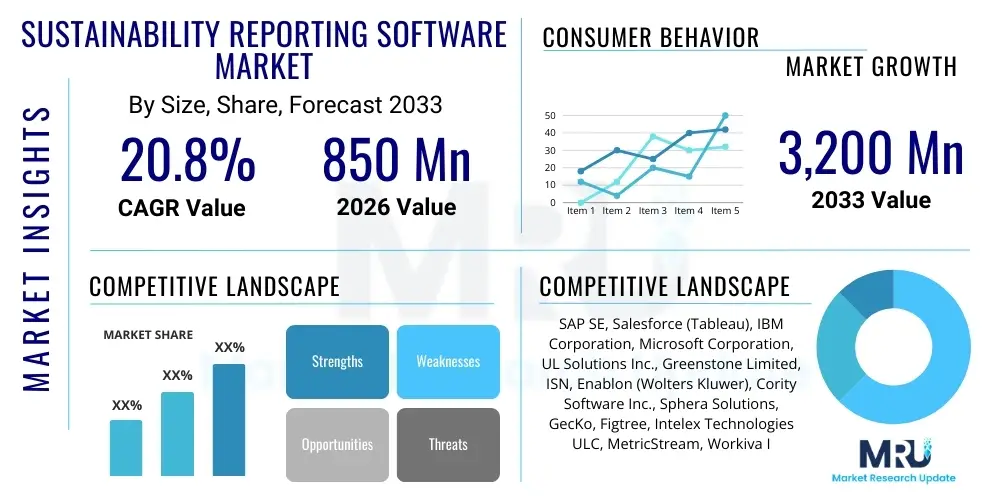

The Sustainability Reporting Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 20.8% between 2026 and 2033. The market is estimated at $850 Million USD in 2026 and is projected to reach $3,200 Million USD by the end of the forecast period in 2033.

Sustainability Reporting Software Market introduction

The Sustainability Reporting Software Market encompasses specialized technological solutions designed to assist corporations and organizations in collecting, analyzing, managing, and publicly disclosing their Environmental, Social, and Governance (ESG) performance data. These platforms streamline complex reporting processes mandated by various global regulatory bodies and frameworks, such as the Global Reporting Initiative (GRI), the Sustainability Accounting Standards Board (SASB), and the Task Force on Climate-related Financial Disclosures (TCFD). The core product description involves modular software suites offering functionalities like greenhouse gas (GHG) emissions tracking, resource consumption monitoring, waste management metrics, social impact assessments, and governance structure evaluation. These tools ensure data accuracy, traceability, and compliance, moving organizations away from manual, spreadsheet-based reporting toward automated, auditable systems.

Major applications of Sustainability Reporting Software span critical corporate functions, including risk management, investor relations, supply chain transparency, and operational efficiency improvements. By consolidating disparate sustainability data points into a single, cohesive platform, these tools enable proactive identification of material risks—ranging from climate vulnerability to supply chain labor issues. Furthermore, the software facilitates communication with stakeholders, particularly institutional investors who increasingly use ESG metrics as a fundamental criterion for capital allocation and long-term valuation. The benefits derived from adoption include enhanced corporate reputation, improved regulatory compliance readiness, reduced operational costs through optimized resource use, and access to sustainable finance opportunities.

Driving factors propelling market growth are fundamentally linked to the global acceleration of ESG mandates and heightened stakeholder activism. Governments and regulatory bodies across major economic blocs—notably the European Union (with directives like the CSRD) and the United States (with pending SEC climate disclosure rules)—are shifting from voluntary guidelines to mandatory disclosure requirements, creating immense demand for scalable reporting solutions. Additionally, the proliferation of sophisticated data acquisition methods (IoT, sensor technology) and the imperative for organizations to demonstrate verifiable progress toward net-zero commitments further solidify the necessity of these advanced software platforms. The competitive pressure among industry peers to achieve high ESG ratings also serves as a significant market stimulant.

Sustainability Reporting Software Market Executive Summary

The Sustainability Reporting Software Market is undergoing rapid expansion, driven primarily by evolving global mandatory ESG disclosure regulations and the surging demand from institutional investors for high-quality, auditable non-financial data. Key business trends indicate a strong move toward integrated Governance, Risk, and Compliance (GRC) platforms that incorporate ESG metrics seamlessly, transitioning sustainability reporting from a siloed compliance function into a core strategic business imperative. Furthermore, technology providers are focusing heavily on integrating advanced Artificial Intelligence (AI) and Machine Learning (ML) capabilities to automate data validation, identify non-reported material risks, and generate forward-looking climate scenario analyses. Mergers and acquisitions are frequent, as large enterprise resource planning (ERP) vendors acquire niche sustainability experts to broaden their environmental data management portfolios, ensuring competitive positioning in this high-growth sector.

Regionally, the market demonstrates significant segmentation in maturity and growth trajectory. Europe currently leads the market due to the robust and advanced regulatory framework, specifically the Non-Financial Reporting Directive (NFRD) and its successor, the Corporate Sustainability Reporting Directive (CSRD), which necessitate comprehensive digital reporting by thousands of companies. North America is poised for the highest growth rate during the forecast period, stimulated by the impending finalization of strict climate disclosure rules by the Securities and Exchange Commission (SEC) and increasing pressure from pension funds and activist shareholders. Asia Pacific (APAC) is emerging rapidly, particularly driven by large economies like Japan, Australia, and Singapore, which are implementing national ESG roadmaps and positioning themselves as hubs for green finance, thereby accelerating local enterprise software adoption.

Segment trends reveal that Cloud-based deployment models dominate the market due to their scalability, lower initial capital expenditure, and ease of integration with existing enterprise systems, offering flexibility essential for rapidly changing regulatory landscapes. In terms of application type, GHG Emission Management remains the largest segment, as carbon footprint accounting is the most established and frequently regulated area of environmental disclosure. However, the CSR & ESG Management segment, which incorporates broader social and governance metrics, is exhibiting the fastest growth, reflecting the holistic shift toward comprehensive stakeholder capitalism reporting. Adoption is accelerating fastest among the BFSI (Banking, Financial Services, and Insurance) and Manufacturing sectors, as these industries face dual pressure from both regulatory bodies concerning capital requirements (BFSI) and intense scrutiny regarding supply chain environmental impact (Manufacturing).

AI Impact Analysis on Sustainability Reporting Software Market

User queries regarding AI’s impact on sustainability reporting software frequently center on issues of data quality, automation potential, and the ethical use of predictive modeling. Users are keen to understand how AI can address the inherent challenges of collecting verifiable data from complex global supply chains, often asking: "Can AI truly validate the accuracy of Scope 3 emissions data?" and "How will generative AI streamline the actual narrative creation process of a report?" A significant theme revolves around risk prediction; organizations seek AI tools that can perform real-time scenario analysis, modeling the financial impact of climate change or regulatory non-compliance. Concerns generally focus on potential bias in AI-driven scoring models and the 'black box' nature of complex machine learning algorithms, which could undermine the auditability and transparency of the final sustainability reports.

The synthesis of these user inquiries indicates that the market expects AI to transition sustainability reporting from a retrospective compliance exercise into a proactive, strategic foresight capability. The key expectation is that AI will vastly reduce the manual burden associated with data aggregation and cleaning, which currently consumes a significant portion of reporting teams’ resources. By leveraging NLP (Natural Language Processing) and machine learning, software platforms are beginning to automatically extract relevant ESG data from unstructured documents, such as vendor contracts, public statements, and legal filings, thereby ensuring more comprehensive and faster data coverage. This automation is crucial for companies needing to comply with regulations like the EU's CSRD, which mandates disclosures across numerous non-financial topics.

Furthermore, AI is pivotal in enhancing the integrity and utility of sustainability reports. Machine learning algorithms can detect anomalies and inconsistencies in environmental data submissions, flagging potential greenwashing risks or operational inefficiencies that human analysts might overlook. Advanced statistical modeling powered by AI enables better scenario planning—for instance, simulating the cost of transitioning to renewable energy under various carbon tax regimes or evaluating the resilience of assets against different climate hazard projections. This shift toward predictive reporting capabilities transforms sustainability data from a mere disclosure requirement into a powerful tool for strategic decision-making and long-term value creation, thus fundamentally changing the competitive landscape of the software market.

- AI facilitates automated data extraction and validation from diverse sources, drastically reducing manual errors and preparation time.

- Machine learning improves Scope 3 emissions accounting by modeling and calculating data gaps in complex supply chains.

- Predictive analytics enables sophisticated climate scenario planning and financial risk assessment related to ESG factors.

- Natural Language Processing (NLP) assists in drafting and tailoring narrative sections of reports based on regulatory requirements and audience needs.

- AI algorithms enhance auditability by flagging data anomalies, ensuring higher data quality and reducing greenwashing risk.

DRO & Impact Forces Of Sustainability Reporting Software Market

The Sustainability Reporting Software Market growth is governed by a robust interplay of Drivers, Restraints, and Opportunities (DRO), collectively constituting the market's impact forces. The primary driver is the accelerating shift towards mandatory global ESG disclosure frameworks, forcing organizations to adopt structured software solutions for compliance. Coupled with this is the escalating pressure from institutional investors and financial regulators who mandate that investment decisions integrate material sustainability risks, directly correlating high-quality reporting with access to capital. Opportunities predominantly lie in the integration of specialized climate risk modeling tools and the expansion into emerging markets (e.g., Southeast Asia, Latin America) where foundational ESG infrastructure is currently being established, promising substantial future growth.

However, significant restraints temper the market’s expansion trajectory. The most pervasive restraint is the high initial cost of implementation and customization, particularly for large enterprises with complex, legacy IT infrastructures. Integrating new sustainability reporting systems requires substantial investment in both software licensing and the necessary training for personnel. Furthermore, the global landscape suffers from a lack of complete standardization; while major frameworks exist (GRI, SASB), discrepancies and evolving requirements across different jurisdictions (e.g., EU vs. US rules) create complexity and necessitate flexible, frequently updated software solutions, which can increase compliance fatigue among users and developers alike. The difficulty in accurately measuring and verifying Scope 3 (value chain) emissions also remains a persistent technical challenge for software providers.

The impact forces driving this market are predominantly external and regulatory. Regulatory push (e.g., CSRD, SEC rules) exerts a high-level, sustained force mandating technological adoption. Investor demand acts as a parallel, powerful financial force, linking market valuation and cost of capital directly to demonstrated sustainability performance, thus making software a business necessity rather than an optional expense. Conversely, the forces of data complexity (Scope 3 challenges) and integration difficulty act as resistive forces, requiring vendors to continuously innovate in areas like API integration and automated data capture to mitigate friction points. Over the forecast period, the strengthening regulatory forces are expected to significantly outweigh the resistive restraints, leading to accelerated enterprise adoption across all major regions.

Segmentation Analysis

The Sustainability Reporting Software Market is segmented based on critical technical and operational parameters, including deployment model, application type, and the end-use industry utilizing the product. This analysis provides a granular view of market dynamics, revealing where investment is flowing and which sectors are most rapidly adopting these technologies. The segmentation reflects the varied operational needs of organizations globally, ranging from small and medium-sized enterprises (SMEs) requiring quick, scalable cloud solutions to multinational corporations necessitating complex, customized on-premise systems capable of handling massive volumes of international data and proprietary internal security protocols. The segmentation also highlights the shift in focus from purely environmental compliance (GHG tracking) toward a holistic ESG approach that integrates social and governance metrics comprehensively.

- By Deployment Model: Cloud-based, On-premise

- By Application Type: GHG Emission Management, CSR & ESG Management, Waste & Water Management, Energy Management, Health & Safety Management, Others

- By End-Use Industry: Banking, Financial Services, and Insurance (BFSI), Government & Public Sector, Retail & Consumer Goods, Manufacturing, IT & Telecommunications, Energy & Utilities, Healthcare, Others

Value Chain Analysis For Sustainability Reporting Software Market

The value chain for Sustainability Reporting Software begins with upstream activities focused on foundational technological development, including R&D in data analytics, AI/ML algorithms tailored for ESG metrics, and specialized climate modeling capabilities. Key upstream participants include specialized data providers (e.g., satellite imagery companies for land use, utility data aggregators for energy consumption) and core software developers who build the foundational platform architecture. Innovation at this stage is crucial, focusing on enhancing the software's ability to ingest, standardize, and verify highly diverse, non-traditional data sets, transforming raw input into auditable ESG metrics.

The midstream segment involves the software design, platform integration, and customization required to make the generic solution operational within specific client environments. This stage is dominated by the core software vendors (like SAP, Workiva, Enablon) and specialized implementation partners. Distribution channels play a vital role here; while direct sales models are common for large enterprise contracts, indirect distribution through system integrators and consultancy firms (PwC, Deloitte, etc.) is highly critical. These consulting partners often embed the software within broader ESG strategy and compliance mandates, acting as trusted advisors who facilitate the adoption and initial setup, ensuring the software adheres to local regulatory requirements.

Downstream activities focus on deployment, user training, and ongoing support services. End-users interact directly with the software for data input and report generation. The primary goal downstream is maximizing the utility of the generated reports for both external compliance (investor disclosures) and internal strategic decision-making (operational efficiency). Post-sale services, including regulatory updates and continuous customization, are integral to maintaining customer satisfaction, given the highly dynamic nature of global ESG standards. The strong dependency on professional services (implementation and advisory) distinguishes this software value chain from many other enterprise software markets, emphasizing deep domain expertise alongside technological proficiency.

Sustainability Reporting Software Market Potential Customers

The primary end-users and buyers of Sustainability Reporting Software are large multinational corporations and publicly traded companies mandated to disclose ESG performance to regulatory bodies and financial markets. This includes organizations categorized under various reporting thresholds globally, particularly those operating in jurisdictions with stringent requirements like the European Economic Area or those listed on exchanges requiring TCFD-aligned disclosures. These customers are driven by compliance mandates, investor pressure (especially from ESG-focused funds), and the need to manage increasing climate-related financial risks, making the software a critical component of their financial and operational resilience strategy.

A secondary, rapidly expanding customer base includes financial institutions—specifically banks, asset managers, and insurance companies (BFSI). These entities require sustainability reporting software not only for their own corporate disclosures but crucially, to manage and report on the "financed emissions" or portfolio-level sustainability risks associated with their lending and investment activities. Regulations like Basel IV and various EU Taxonomy requirements compel financial services firms to quantify and disclose the climate alignment of their assets, driving demand for specialized software modules that can analyze external corporate ESG data and perform complex portfolio-level aggregation and scenario modeling.

Furthermore, SMEs (Small and Medium-sized Enterprises), particularly those embedded deep within the supply chains of large corporations, represent an emerging segment. While often not directly subject to the highest level of mandatory reporting, they are increasingly compelled by their major customers to provide validated ESG data (Scope 3 data provision). This supplier-driven demand necessitates simpler, more cost-effective cloud-based solutions tailored for basic data collection and sharing, broadening the overall customer ecosystem beyond the traditional large enterprise market and increasing the need for modular, scalable subscription offerings from vendors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $850 Million USD |

| Market Forecast in 2033 | $3,200 Million USD |

| Growth Rate | 20.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SAP SE, Salesforce (Tableau), IBM Corporation, Microsoft Corporation, UL Solutions Inc., Greenstone Limited, ISN, Enablon (Wolters Kluwer), Cority Software Inc., Sphera Solutions, GecKo, Figtree, Intelex Technologies ULC, MetricStream, Workiva Inc., Clarity AI, Diligent Corporation, ESG Enterprise, PricewaterhouseCoopers (PwC), Deloitte LLP. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sustainability Reporting Software Market Key Technology Landscape

The technological architecture of the Sustainability Reporting Software market is rapidly advancing, moving beyond simple data aggregation tools toward sophisticated, integrated platforms centered on Big Data analytics and Enterprise Resource Planning (ERP) integration. Core to this landscape is the adoption of highly flexible API-based structures that enable seamless connectivity with diverse operational data sources, including IoT devices (for real-time energy and water metering), industrial control systems (ICS), and third-party databases (e.g., carbon emission factor libraries). This integration capability is fundamental, allowing the software to draw verifiable data directly from source systems rather than relying on manual input, thereby dramatically improving data integrity and reducing audit risk. Cloud computing remains the dominant infrastructure choice, providing the necessary elasticity and processing power to handle the increasing volume and velocity of ESG data being collected globally.

The most transformative technologies driving innovation are Artificial Intelligence (AI) and Machine Learning (ML). AI is primarily deployed to address the complexity of Scope 3 emissions reporting, where ML models analyze expenditure data and supply chain logistics to estimate indirect emissions with greater precision than traditional methods. Furthermore, Natural Language Processing (NLP) is increasingly used to interpret and categorize unstructured textual data—such as mandatory disclosures, press releases, or legal documents—to identify material risks or extract compliance-relevant information. The rise of AI-driven scenario analysis tools, which model the financial impact of various climate transition pathways (e.g., 1.5°C vs. 2.0°C warming scenarios), is essential for compliance with TCFD and emerging global standards, positioning vendors who master these advanced analytics at the forefront of the competitive landscape.

Blockchain technology, while still nascent in widespread adoption within this sector, holds significant promise for enhancing supply chain transparency and data provenance. By creating immutable, verifiable records of environmental actions (e.g., certification of sustainable sourcing, tracking waste disposal), blockchain can radically reduce the potential for greenwashing and improve the trustworthiness of reported data for external auditors and regulators. Moreover, the emphasis on data visualization and dashboarding remains critical. Modern platforms incorporate advanced business intelligence (BI) tools to translate complex ESG performance metrics into accessible, customized reports suitable for diverse stakeholders, from the Chief Sustainability Officer to the investor relations team, ensuring data insights drive both strategic and operational decisions effectively.

Regional Highlights

- Europe: Europe represents the most mature and dominant market for Sustainability Reporting Software, largely due to its proactive and stringent regulatory environment. The implementation of the Corporate Sustainability Reporting Directive (CSRD) mandates extensive, digital, and assurance-ready sustainability reporting for nearly 50,000 companies, setting a global benchmark for comprehensive ESG disclosure. This regulatory necessity drives high adoption rates and favors integrated solutions that can handle both the specific EU Taxonomy requirements and international standards. The region’s focus is heavily weighted toward achieving verifiable net-zero targets and addressing material social factors. Key markets include Germany, France, and the Nordics, characterized by early adoption and high corporate governance standards.

- North America (NA): North America is poised to become the fastest-growing region, stimulated primarily by the anticipated climate disclosure rules from the U.S. Securities and Exchange Commission (SEC) and stringent state-level mandates (e.g., California’s climate disclosure laws). Although historically characterized by voluntary reporting frameworks, the shift toward mandatory, standardized disclosure is creating massive pent-up demand. The market is heavily driven by capital market pressure; investors demand TCFD and SASB alignment to manage portfolio risk. Canada is also a robust market, driven by its regulatory guidance for pension funds and high corporate reliance on energy and resource sectors, requiring detailed environmental tracking.

- Asia Pacific (APAC): APAC is an emerging powerhouse, exhibiting substantial growth potential. Growth is highly heterogeneous, led by countries like Japan, Australia, and Singapore, which have implemented clear green finance roadmaps and stock exchange listing requirements for sustainability data. Manufacturing dominance in China, India, and Southeast Asia drives demand for software solutions focused on operational efficiency, supply chain transparency, and waste management. While regulatory mandates are evolving, voluntary adoption is accelerating as local companies seek international capital and integration into global value chains that require adherence to Western ESG standards. The region offers significant opportunities for vendors providing scalable, multi-lingual, and regulatory-specific solutions.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions represent developing but crucial markets, where adoption is often focused on the primary resource extraction sectors (mining, oil & gas) and large financial institutions seeking foreign investment. In LATAM, Brazil and Mexico are leading the charge, driven by local stock exchange requirements and increasing awareness of climate vulnerability. In the MEA, adoption is concentrated in the Gulf Cooperation Council (GCC) states, propelled by national diversification strategies (e.g., Saudi Vision 2030, UAE Net Zero 2050), which emphasize sustainable infrastructure and green finance, requiring advanced reporting software to track national sustainability progress and corporate compliance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sustainability Reporting Software Market.- SAP SE

- Salesforce (Tableau)

- IBM Corporation

- Microsoft Corporation

- UL Solutions Inc.

- Greenstone Limited

- ISN

- Enablon (Wolters Kluwer)

- Cority Software Inc.

- Sphera Solutions

- GecKo

- Figtree

- Intelex Technologies ULC

- MetricStream

- Workiva Inc.

- Clarity AI

- Diligent Corporation

- ESG Enterprise

- PricewaterhouseCoopers (PwC)

- Deloitte LLP

Frequently Asked Questions

Analyze common user questions about the Sustainability Reporting Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Sustainability Reporting Software and why is it essential for corporate compliance?

Sustainability Reporting Software (SRS) is a digital platform designed to automate the collection, aggregation, analysis, and disclosure of an organization’s ESG (Environmental, Social, Governance) data. It is essential because mandatory global regulations (like the EU CSRD or proposed US SEC rules) require standardized, auditable, and transparent non-financial reporting, which manual processes cannot efficiently handle. SRS ensures data accuracy, compliance with multiple frameworks (GRI, TCFD, SASB), and reduces regulatory risk.

How does AI technology enhance the accuracy and utility of sustainability reports?

AI enhances reports by automating data validation and extraction from diverse sources, particularly improving the accuracy of complex Scope 3 (value chain) emissions calculations through machine learning models. Furthermore, AI enables predictive scenario analysis, allowing companies to model the financial impact of climate risks, moving reporting beyond mere compliance to strategic foresight and better risk management.

Which deployment model, Cloud-based or On-premise, is currently dominating the market?

The Cloud-based deployment model currently dominates the Sustainability Reporting Software market. Cloud solutions offer superior scalability, lower total cost of ownership (TCO), and faster implementation timelines, which are critical for companies needing to rapidly adapt to evolving global regulatory mandates without significant upfront IT infrastructure investments. This model facilitates easier integration and updates required by dynamic ESG frameworks.

Which industry vertical is showing the fastest growth rate in adopting Sustainability Reporting Software?

While the BFSI (Banking, Financial Services, and Insurance) sector is a massive adopter due to regulatory pressures concerning financed emissions, the Manufacturing and Retail & Consumer Goods sectors are exhibiting the fastest growth rates. This acceleration is driven by the urgent need to track and disclose complex supply chain ESG data (Scope 3) and meet consumer and regulatory demands for product sustainability and ethical sourcing, necessitating specialized tracking software.

What are the primary restraints hindering the widespread adoption of Sustainability Reporting Software?

The primary restraints include the high initial implementation costs and the substantial time required for integrating the software with existing legacy ERP and operational systems. Additionally, the lack of complete, consistent global standardization across all ESG metrics creates complexity for vendors, requiring frequent and costly software updates, which can deter adoption, particularly among smaller organizations or those operating across many disparate regulatory regimes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager