Sustainability Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433694 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Sustainability Software Market Size

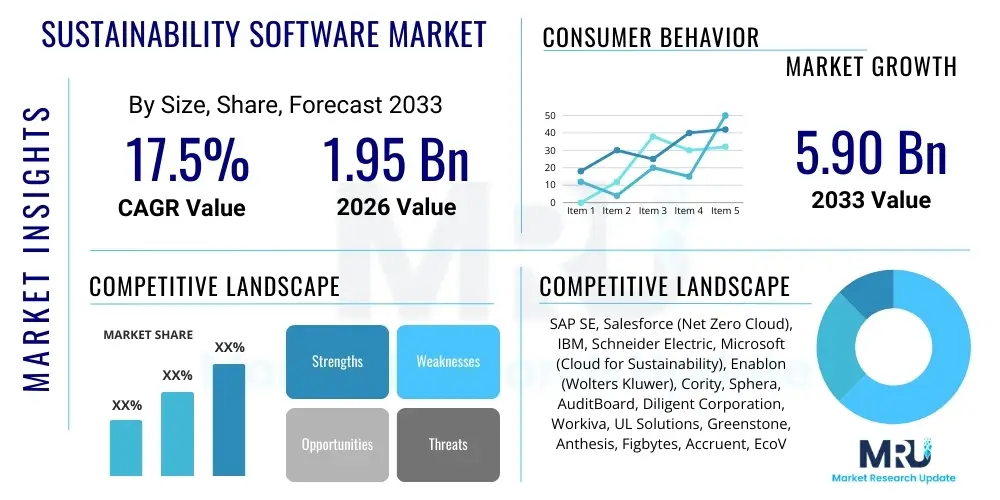

The Sustainability Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 17.5% between 2026 and 2033. The market is estimated at $1.95 Billion USD in 2026 and is projected to reach $5.90 Billion USD by the end of the forecast period in 2033. This robust expansion is primarily driven by escalating global regulatory mandates concerning Environmental, Social, and Governance (ESG) reporting, coupled with increasing corporate commitment towards achieving net-zero emissions targets. The adoption of cloud-based solutions and the integration of sophisticated data analytics capabilities are key technological accelerators sustaining this trajectory.

Sustainability Software Market introduction

Sustainability software encompasses a range of enterprise applications designed to help organizations measure, manage, and report their environmental performance, social impact, and corporate governance practices (ESG). These platforms facilitate critical functions such as carbon accounting, energy consumption management, waste tracking, supply chain transparency, and compliance with evolving global standards like the Task Force on Climate-related Financial Disclosures (TCFD) and the upcoming European Sustainability Reporting Standards (ESRS). The primary product categories include enterprise resource planning (ERP) extensions, dedicated ESG reporting tools, and environmental health and safety (EHS) systems integrated with sustainability modules.

Major applications of sustainability software span across numerous sectors, including manufacturing, energy and utilities, financial services, and retail, where managing scope 1, 2, and 3 emissions is paramount for operational continuity and investor relations. The key benefits derived from utilizing these solutions involve enhanced data accuracy, streamlined compliance processes, reduced operational risks related to climate change, and improved stakeholder trust through transparent reporting. Furthermore, these tools enable proactive decision-making, allowing companies to identify cost-saving opportunities through optimized resource utilization and energy efficiency projects.

The market is fundamentally driven by intensifying governmental pressure across major economies, particularly the EU’s Green Deal and stringent regulations implemented by the U.S. Securities and Exchange Commission (SEC) regarding climate disclosures. Additionally, the investment community, particularly large institutional investors and private equity firms, increasingly rely on robust, verifiable ESG data for capital allocation decisions, necessitating automated and auditable software solutions. Technological advancements, such as the deployment of advanced machine learning for predictive impact modeling and the shift towards Software-as-a-Service (SaaS) deployment models, further propel market growth by reducing implementation complexity and ensuring scalability for global enterprises.

Sustainability Software Market Executive Summary

The Sustainability Software Market is characterized by vigorous innovation and strategic consolidation, driven primarily by the global shift towards mandatory corporate sustainability reporting. Business trends indicate a strong preference for integrated, modular platforms capable of handling diverse ESG data streams, rather than relying on disparate point solutions. Large enterprise vendors are aggressively acquiring niche software providers to expand their service portfolios, focusing on areas like supply chain traceability and advanced carbon footprint analysis. Furthermore, the rising integration of AI and generative models is transforming data ingestion and reporting efficiency, making complex compliance requirements more manageable for multinational corporations and solidifying the shift from voluntary disclosures to regulated financial reporting standards.

Regionally, North America and Europe maintain dominance, fueled by robust regulatory frameworks (e.g., CSRD in Europe and state-level climate mandates in the US) and high corporate ESG maturity. The European market, in particular, is experiencing rapid growth due to immediate compliance needs associated with the Green Deal and associated directives, positioning it as a frontrunner in adopting integrated sustainability management platforms. Meanwhile, the Asia Pacific (APAC) region is emerging as the fastest-growing market, spurred by rapid industrialization, growing investor activism in economies like Japan and Australia, and governmental initiatives in China focusing on national carbon neutrality targets. This regional divergence reflects varying levels of regulatory stringency and corporate readiness across the globe.

Segment trends highlight the significant lead held by the Carbon Management and Energy Management applications, which are foundational requirements for nearly all industries pursuing decarbonization strategies. The SaaS deployment model continues to capture the largest market share owing to its flexibility, lower initial capital expenditure, and seamless update capabilities, crucial for coping with rapidly changing compliance protocols. Regarding organizational size, large enterprises currently represent the primary revenue source, possessing the complex operations and resources required to implement comprehensive software suites. However, the Small and Medium Enterprise (SME) segment is projected to exhibit the highest CAGR, driven by the increasing availability of affordable, simplified subscription-based ESG reporting tools tailored to smaller operational scales.

AI Impact Analysis on Sustainability Software Market

Common user questions regarding AI's impact on sustainability software revolve around its ability to automate data collection from disparate sources, improve the accuracy of complex environmental modeling (especially scope 3 emissions), and provide predictive analytics for resource optimization and climate risk mitigation. Users frequently question how AI can ensure data integrity and auditability necessary for regulatory reporting, and whether AI-driven systems can integrate seamlessly with existing ERP and operational technology (OT) systems. Key themes summarize to the expectation that AI must transition sustainability software from merely reporting historical data to offering prescriptive, real-time insights for operational change, thereby overcoming the critical challenges of data fragmentation and manual reporting overhead.

The integration of Artificial Intelligence (AI), specifically Machine Learning (ML) and Natural Language Processing (NLP), is revolutionizing the Sustainability Software market by enhancing the efficiency and depth of ESG data analysis. AI algorithms are crucial for processing massive, unstructured datasets—such as utility bills, supplier contracts, and satellite imagery—to automate the calculation of complex metrics like embedded carbon in supply chains. This automation drastically reduces the human error inherent in manual data input, ensuring the high integrity and granular detail required for rigorous regulatory filings and corporate due diligence. Predictive modeling using AI also allows companies to simulate the future impact of various operational changes, such as shifting energy sources or altering logistics routes, thereby providing actionable insights for strategic decarbonization efforts.

Furthermore, AI significantly enhances the risk management capabilities offered by sustainability software. ML models can identify potential environmental or social risks within the supply chain by analyzing news articles, regulatory filings, and third-party audit data at scale. This proactive identification capability allows corporations to mitigate risks related to reputation damage, operational disruptions due to climate events, or potential litigation arising from non-compliance. As sustainability metrics become increasingly linked to financial performance, AI-driven platforms provide the necessary speed and accuracy to correlate ESG performance with financial outcomes, supporting both internal management decisions and external investor communications based on verifiable, AI-validated data points.

- AI enhances data ingestion and normalization from diverse sources (IoT, ERP, supplier databases).

- Machine Learning optimizes Scope 3 emissions calculation complexity and accuracy.

- Predictive modeling offers scenario analysis for climate risk and energy efficiency planning.

- Natural Language Processing (NLP) streamlines compliance checks against evolving global regulations.

- AI enables automated anomaly detection in resource consumption and waste generation.

- Generative AI tools improve the customization and localization of sustainability reports.

DRO & Impact Forces Of Sustainability Software Market

The market is principally driven by stringent regulatory pressures and escalating demands from investors for transparent ESG disclosures. Key opportunities lie in integrating sustainability data directly into core financial and operational systems, leveraging advancements in predictive analytics, and expanding services to address the underserved Small and Medium Enterprise (SME) segment through affordable SaaS models. Conversely, the high initial implementation costs, complexity in integrating with legacy IT systems, and the persistent challenge of standardizing global ESG metrics act as significant restraints. These forces combine to create a dynamic market environment where compliance necessity meets technological innovation, significantly impacting vendor strategies and enterprise adoption rates.

Drivers: Regulatory enforcement, particularly in Europe (CSRD, SFDR) and North America (SEC climate disclosure rules), is the primary propellant, converting voluntary efforts into mandatory expenditures. The surging demand for actionable, auditable ESG data from institutional investors utilizing sustainable investment strategies further accelerates adoption, as companies seek to improve their ESG ratings and secure capital. Furthermore, the recognized financial benefits of sustainability, such as reduced energy costs, operational efficiency improvements, and enhanced brand value, reinforce the business case for software investment, moving it from a cost center to a strategic enabler of long-term value creation. Technological maturity in cloud computing and IoT also facilitates easier deployment and comprehensive data collection, lowering practical barriers to entry.

Restraints: Significant restraints include the highly fragmented nature of the global regulatory landscape, which necessitates constant, expensive customization of software solutions to comply with jurisdiction-specific rules, hindering standardization. The substantial initial investment required for sophisticated, integrated platforms, especially for large, decentralized corporations, presents a budgetary hurdle. Moreover, resistance to change within organizations, coupled with a persistent shortage of skilled professionals capable of effectively managing and interpreting the output of complex sustainability software, slows down successful deployment and utilization. Data quality and integrity issues, particularly concerning Scope 3 (value chain) emissions data which relies heavily on external partners, remain a core technological constraint.

Opportunities: Major market opportunities include the expansion of services into specialized areas such as biodiversity impact assessment, social sustainability metrics (S in ESG), and circular economy tracking, addressing emerging stakeholder concerns. The development of streamlined, modular, and affordable solutions targeting the massive, untapped SME market represents a high-growth avenue, often accessible via specialized industry partnerships. Finally, integrating sustainability software with cutting-edge technologies like blockchain for verifiable supply chain transparency and generative AI for enhanced reporting customization positions vendors to capture premium market share by offering next-generation compliance and strategic optimization tools.

Segmentation Analysis

The Sustainability Software Market is extensively segmented based on Component (Software and Services), Application (Carbon Management, Energy Management, EHS Management, etc.), Deployment Model (On-premise and Cloud/SaaS), and Enterprise Size (SMEs and Large Enterprises). This segmentation reflects the varied needs of global enterprises, ranging from large, complex organizations requiring full-scale, integrated suites delivered via the cloud to smaller entities needing specific, highly-focused modules, often favoring a services-led implementation approach. Understanding these granular segments is crucial for vendors to tailor their product offerings, pricing structures, and go-to-market strategies effectively across diverse industrial verticals and geographical regions where regulatory priorities differ substantially.

The Software segment dominates the market revenue, driven by continuous upgrades and the perpetual need for sophisticated reporting features to meet dynamic regulatory requirements. However, the Services segment, encompassing consulting, implementation, training, and managed services, is experiencing rapid growth as organizations seek external expertise to navigate complex global compliance frameworks and ensure seamless integration with legacy systems. Within applications, Carbon Management and ESG Reporting are pivotal segments, underpinned by the widespread corporate commitment to net-zero goals and mandatory TCFD/CSRD compliance, dictating the largest share of new software investments across all industries. This continuous investment ensures that segmentation analysis remains central to strategic market planning.

- By Component:

- Software (Platform and Modules)

- Services (Consulting, Implementation, Support & Maintenance)

- By Application:

- Carbon Management & Accounting

- Energy and Utility Management

- ESG Reporting & Compliance

- Environmental Health & Safety (EHS) Management

- Supply Chain Sustainability

- Waste Management & Resource Efficiency

- By Deployment Model:

- Cloud (Software as a Service - SaaS)

- On-premise

- By Enterprise Size:

- Large Enterprises

- Small and Medium Enterprises (SMEs)

- By Industry Vertical:

- IT & Telecom

- Manufacturing & Automotive

- Energy & Utilities

- Financial Services (Banking, Insurance)

- Retail & Consumer Goods

- Government & Public Sector

Value Chain Analysis For Sustainability Software Market

The Sustainability Software market value chain begins with upstream activities focused on technology development, encompassing core data science, AI/ML algorithm creation, and regulatory knowledge aggregation necessary for software design. Key participants at this stage include specialized software developers, data aggregators, and technology partners providing cloud infrastructure (e.g., AWS, Azure). The development phase is crucial for ensuring the platform’s scalability, data security, and capacity to handle diverse data formats essential for robust ESG reporting. Strategic partnerships with regulatory bodies and sustainability consultants often occur at this initial stage to embed compliance expertise directly into the software architecture, maximizing its utility.

Midstream activities involve core software development, integration, and customization. This stage is dominated by major software vendors who develop, maintain, and continually update the modular components, adapting swiftly to changing regulatory landscapes (e.g., updating compliance frameworks for new SEC or EU rules). Integration services, vital for connecting sustainability platforms with existing enterprise systems like ERP, human capital management (HCM), and supply chain management (SCM), form a significant value-add. Effective integration minimizes data silos and ensures real-time accuracy, which is non-negotiable for external assurance and auditing processes, making highly skilled implementation teams a critical bottleneck and value driver.

Downstream activities center on distribution, sales, and post-sales support. Distribution channels are typically a mix of direct sales forces handling large enterprise contracts and indirect channels, including value-added resellers (VARs), system integrators (SIs), and strategic alliances with consulting firms (e.g., Deloitte, PwC) who leverage the software in client engagements. Direct channels offer deep customization, while indirect channels facilitate broader market penetration, especially among SMEs. Post-sales support and ongoing maintenance services are critical for maintaining customer satisfaction, ensuring platform uptime, and providing necessary software updates to reflect the latest global sustainability benchmarks and reporting standards.

Sustainability Software Market Potential Customers

The primary end-users and buyers of sustainability software are large enterprises across highly regulated and resource-intensive sectors. These organizations require sophisticated tools to manage complex global operations, comply with multiple jurisdictional reporting mandates, and satisfy investor demands for verified ESG performance data. Financial institutions, including banks, asset managers, and insurance companies, are also significant buyers, utilizing the software for portfolio screening, climate-related financial risk assessment (e.g., assessing transition and physical risks), and complying with disclosure frameworks like SFDR and TCFD. For these large, established buyers, the software acts as a necessary infrastructural layer for risk mitigation and capital market access.

Beyond the heavily regulated sectors, potential customers include public sector entities, municipalities, and large academic institutions focused on smart city initiatives and mandated governmental decarbonization targets. Furthermore, the burgeoning segment of Small and Medium Enterprises (SMEs), particularly those embedded deeply within the supply chains of large corporations, represents a high-potential customer base. As large companies are now obligated to report Scope 3 emissions, they are driving their SME suppliers to adopt standardized, often lighter-weight, sustainability reporting solutions. This pressure transforms sustainability compliance from a large corporate challenge into a prerequisite for participation in global supply chains, exponentially expanding the market's reach into the SME sector.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.95 Billion USD |

| Market Forecast in 2033 | $5.90 Billion USD |

| Growth Rate | 17.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SAP SE, Salesforce (Net Zero Cloud), IBM, Schneider Electric, Microsoft (Cloud for Sustainability), Enablon (Wolters Kluwer), Cority, Sphera, AuditBoard, Diligent Corporation, Workiva, UL Solutions, Greenstone, Anthesis, Figbytes, Accruent, EcoVadis, OneTrust, Clarity AI, Persefoni |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sustainability Software Market Key Technology Landscape

The technological landscape of the Sustainability Software Market is characterized by the dominance of cloud-native architectures, primarily Software-as-a-Service (SaaS) models, which offer superior scalability, accessibility, and cost-effectiveness compared to traditional on-premise installations. This shift to cloud-based delivery is essential for handling the massive volumes of dispersed operational data required for comprehensive ESG analysis and facilitating continuous platform updates to meet rapidly evolving regulatory requirements. Key technological focuses include the development of open Application Programming Interfaces (APIs) to ensure seamless integration with existing enterprise systems (ERP, IoT sensors, supply chain platforms) and the adoption of high-performance data warehousing solutions designed specifically for ESG metrics, which often requires complex non-financial data modeling.

Advanced data processing technologies form the core intellectual property of leading vendors. Artificial Intelligence (AI) and Machine Learning (ML) are being deployed extensively for automating data capture, ensuring data quality checks, and generating highly accurate environmental models, particularly for Scope 3 emissions where estimation is often necessary. Furthermore, the utilization of advanced visualization tools and interactive dashboards is critical, translating complex sustainability performance data into accessible, actionable insights for both executive leadership and operational teams. Blockchain technology is also emerging as a pivotal component, especially in supply chain sustainability modules, offering immutable records of origin, carbon footprint verification, and ethical sourcing compliance, thereby boosting the credibility of reported data for external auditing purposes.

The industry is also witnessing significant investment in Geographic Information Systems (GIS) and remote sensing technology, primarily used for physical climate risk assessment, tracking land use impact, and managing biodiversity concerns, particularly relevant for sectors like agriculture, real estate, and energy. Data security protocols, including robust encryption and compliance with global data privacy regulations (e.g., GDPR), are paramount, given the sensitive nature of the operational and financial data integrated into these platforms. The future technological trajectory emphasizes hyper-personalization of reporting frameworks using generative AI and further standardization through industry-specific data connectors, making these complex software platforms more intuitive and user-friendly across varied industry verticals.

Regional Highlights

Regional dynamics play a crucial role in shaping the Sustainability Software Market, primarily driven by varying degrees of regulatory maturity, investor activism, and industrial structure. North America and Europe collectively command the largest market share, acting as the global benchmark for adoption and innovation due to stringent governmental mandates and a sophisticated corporate understanding of ESG integration. The Asia Pacific (APAC) region, while starting from a lower base, is registering the fastest growth rate, fueled by rapid urbanization, increasing domestic pressure for environmental accountability, and significant international investments requiring local compliance.

- North America: This region holds a substantial market share, driven primarily by strong investor influence and emerging state-level regulations (e.g., California’s climate disclosure laws) compensating for a less prescriptive federal approach compared to Europe. Adoption is particularly strong in the financial services, technology, and energy sectors, where TCFD and SASB standards are highly regarded. The market here favors comprehensive, integrated platforms often supplied by major tech firms, focusing heavily on climate risk modeling and Scope 3 supply chain management due to complex international operations. The competitive landscape is mature, emphasizing rapid innovation in AI-powered data validation and predictive analytics tools.

- Europe: Europe is characterized by the highest regulatory momentum globally, driven by pivotal legislation such as the Corporate Sustainability Reporting Directive (CSRD), the EU Taxonomy, and the Sustainable Finance Disclosure Regulation (SFDR). These mandates necessitate sophisticated, high-compliance sustainability software, resulting in higher average software expenditure per corporation. The market growth is mandatory and immediate, positioning Europe as the leading market for highly specialized ESG reporting and compliance modules, particularly those focused on double materiality and detailed impact assessment across diverse value chains.

- Asia Pacific (APAC): The APAC market is expanding rapidly, primarily led by economies like Japan, Australia, and South Korea, which have enacted strict climate pledges and reporting requirements. China's push for carbon neutrality by 2060 is creating massive demand for carbon accounting and energy efficiency software in the industrial and utility sectors. Growth is concentrated around foundational solutions such as resource optimization and EHS management. The region presents a significant opportunity for vendors offering scalable, localized SaaS solutions tailored to diverse regulatory environments and emerging market needs.

- Latin America (LATAM): Market adoption in LATAM is gradually increasing, propelled by cross-border trade agreements requiring compliance with international ESG standards and a growing focus on sustainable infrastructure development. Primary demand stems from large commodity producers, mining, and agricultural sectors needing transparency regarding land use, resource consumption, and social impact. The market often utilizes cloud-based solutions due to infrastructure cost constraints, with specific focus on regulatory frameworks related to biodiversity and community impact.

- Middle East and Africa (MEA): Growth in MEA is largely concentrated in the Gulf Cooperation Council (GCC) countries, driven by national diversification strategies (e.g., Saudi Vision 2030) that prioritize sustainability and energy transition projects. The oil & gas and utility sectors are major adopters, utilizing software for energy efficiency, carbon capture tracking, and environmental monitoring to meet international standards and attract global investment. Software adoption is often linked directly to major government-led infrastructure projects and public sector entities managing large resource bases.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sustainability Software Market.- SAP SE

- Salesforce (Net Zero Cloud)

- IBM

- Schneider Electric

- Microsoft (Cloud for Sustainability)

- Oracle Corporation

- Enablon (Wolters Kluwer)

- Cority

- Sphera

- AuditBoard

- Diligent Corporation

- Workiva

- UL Solutions

- Greenstone

- Anthesis

- Figbytes

- Accruent

- EcoVadis

- OneTrust

- Clarity AI

- Persefoni

- Emex

- ProcessMAP

- Gensuite

Frequently Asked Questions

Analyze common user questions about the Sustainability Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for the adoption of Sustainability Software in the current market?

The primary driver is the global escalation of mandatory Environmental, Social, and Governance (ESG) reporting regulations, particularly the EU’s CSRD and evolving SEC climate disclosure requirements, which necessitate automated, auditable data management systems for compliance and reduced legal risk.

How does AI contribute to enhancing sustainability software functionality?

AI significantly enhances functionality by automating the ingestion of complex, fragmented ESG data, improving the accuracy of Scope 3 emissions calculations through predictive modeling, and utilizing machine learning to offer proactive risk assessment and scenario planning for decarbonization strategies.

Which deployment model is dominating the Sustainability Software Market?

The Software-as-a-Service (SaaS) or Cloud deployment model dominates the market. It offers the flexibility, scalability, and continuous updating capabilities necessary to efficiently handle rapidly changing global regulatory frameworks and diverse operational data requirements with lower initial capital investment.

What are the key challenges facing companies implementing new sustainability platforms?

Key challenges include ensuring data quality and integrity across the extended value chain (Scope 3 data), integrating the new software seamlessly with fragmented legacy ERP and operational technology (OT) systems, and addressing the high initial implementation costs associated with comprehensive solutions.

Which segment of the market is expected to show the highest growth rate?

The Small and Medium Enterprises (SME) segment is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This growth is driven by the increasing availability of affordable, simplified cloud-based solutions and regulatory pressure exerted by large corporate partners requiring supplier-level ESG reporting compliance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager