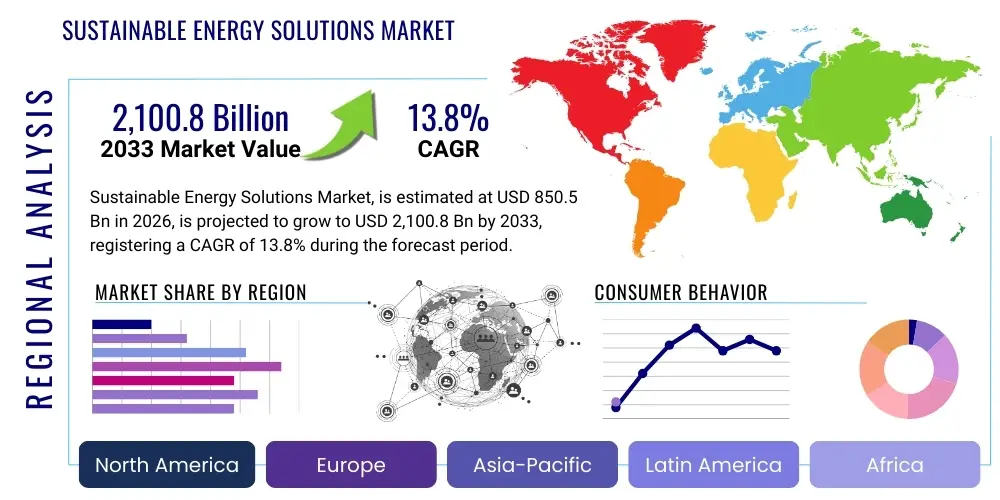

Sustainable Energy Solutions Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437446 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Sustainable Energy Solutions Market Size

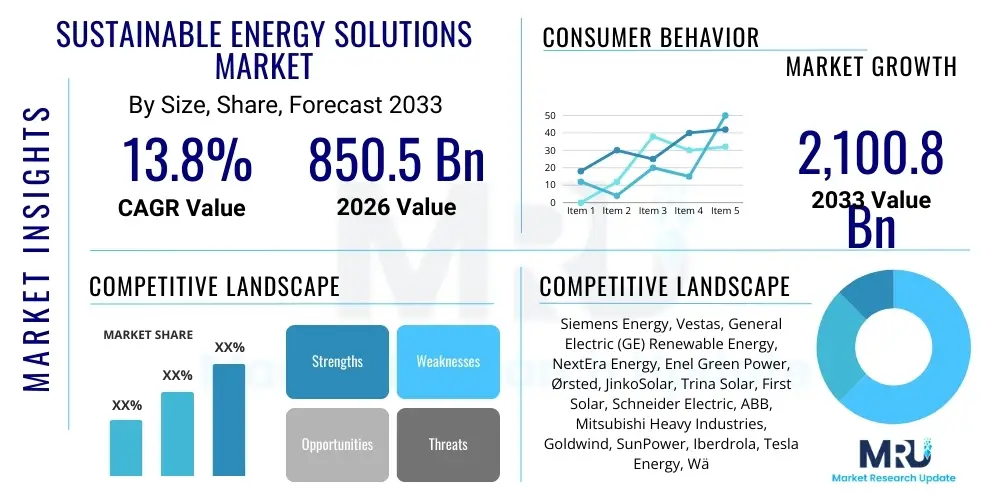

The Sustainable Energy Solutions Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 13.8% between 2026 and 2033. The market is estimated at 850.5 Billion USD in 2026 and is projected to reach 2,100.8 Billion USD by the end of the forecast period in 2033.

Sustainable Energy Solutions Market introduction

The Sustainable Energy Solutions Market encompasses a vast array of technologies, systems, and services dedicated to generating electricity and thermal energy using renewable resources while enhancing efficiency and minimizing environmental impact. Key components include hardware such as solar photovoltaic (PV) systems, wind turbines, hydropower facilities, geothermal plants, and advanced battery energy storage systems (BESS). The rapid technological advancements, coupled with urgent global commitments to climate mitigation, have propelled this market into a phase of unprecedented expansion. Furthermore, the convergence of renewable generation with digitalization, smart grid infrastructure, and sophisticated energy management software defines the modern landscape of sustainable energy adoption, moving beyond simple generation to holistic energy ecosystem optimization. This comprehensive approach addresses crucial challenges related to intermittency, grid stability, and efficient energy distribution, facilitating large-scale integration of renewables into national and regional power grids.

Product descriptions within this market span the entire value chain, from raw material procurement and component manufacturing (e.g., inverters, blades, panels) to large-scale utility installations and decentralized residential systems. Major applications are diverse, covering utility-scale power generation, commercial and industrial (C&I) self-consumption, residential distributed generation, and critical infrastructure power supply. The primary benefits derived from these solutions include significant reductions in carbon dioxide emissions, enhanced energy independence and security by diversifying away from volatile fossil fuels, and long-term economic advantages stemming from the continuously decreasing Levelized Cost of Electricity (LCOE) for solar and wind energy. The move towards decentralized energy systems (DERs) also empowers consumers, offering resilience against grid failures and enabling participation in demand response markets.

Driving factors for the market are multifaceted, anchored heavily by stringent government mandates and ambitious renewable portfolio standards (RPS) enacted across developed and developing nations alike, seeking to meet Net Zero targets. Financial incentives, such as production tax credits (PTCs) and investment tax credits (ITCs), further stimulate capital deployment in renewable projects. Additionally, soaring conventional fuel prices and growing consumer awareness regarding environmental stewardship contribute substantially to market momentum. The proliferation of digital technologies, particularly IoT and artificial intelligence (AI), is optimizing plant operations, minimizing downtime, and improving forecasting accuracy, thereby improving the economic viability and reliability of sustainable energy solutions.

Sustainable Energy Solutions Market Executive Summary

The Sustainable Energy Solutions Market is characterized by robust growth, primarily driven by converging global climate policies and substantial technological maturity across core renewable technologies. Business trends indicate a strong shift towards corporate Power Purchase Agreements (PPAs), where large multinational corporations are committing to 100% renewable energy sourcing, driving demand for utility-scale projects and innovative financing models. Furthermore, the rapid scaling of battery energy storage systems (BESS) is transforming market dynamics, mitigating the historical constraint of renewable intermittency and unlocking flexible capacity critical for grid balancing. This shift signifies a maturation where sustainable energy is increasingly viewed not just as an environmental imperative but as a cost-effective, reliable, and essential component of modern energy infrastructure, attracting massive institutional investment across the globe, particularly in green bond issuance and specialized infrastructure funds targeting decarbonization projects.

Regional trends reveal Asia Pacific (APAC) as the leading region in terms of capacity additions, propelled by massive investments in China and India focused on meeting rapidly escalating electricity demand and combating severe air pollution. Europe, supported by the ambitious European Green Deal and extensive grid modernization efforts, maintains its leadership in technology deployment, specifically in offshore wind and green hydrogen development, while North America’s growth is bolstered by substantial long-term federal legislation, such as the Inflation Reduction Act (IRA), which provides unprecedented stability and predictability for renewable energy project developers and domestic manufacturing expansion. Emerging markets in Latin America and Africa are capitalizing on abundant renewable resources, focusing on distributed generation and energy access initiatives, driven by foreign direct investment and multilateral development bank financing aimed at fostering sustainable economic development.

Segment trends highlight the dominance of Solar PV, particularly in the distributed generation segment, offering ease of deployment and scalability, followed closely by onshore and offshore wind power, benefiting from turbine size increases and efficiency gains. Crucially, the Energy Storage segment is witnessing the highest percentage growth, integrating seamlessly with both generation assets and transmission networks to provide essential ancillary services. The service sector, particularly advanced operations and maintenance (O&M) utilizing digital twin technology and predictive maintenance models, is becoming increasingly vital for maximizing asset lifecycles and ensuring optimal performance, shifting the competitive landscape from pure hardware costs to total system lifecycle value. Moreover, nascent technologies, such as advanced geothermal systems and sustainable biofuel production, are slowly gaining commercial traction, offering critical baseload capabilities and addressing hard-to-abate sectors like heavy transport and industrial heating.

AI Impact Analysis on Sustainable Energy Solutions Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Sustainable Energy Solutions Market center around three core themes: operational efficiency, grid reliability enhancement, and market penetration barriers. Users frequently ask how AI can effectively manage the inherent variability of solar and wind power, specifically querying its capacity for accurate, short-term forecasting and predictive maintenance for complex assets like wind farms and large solar installations. Concerns also revolve around data privacy, cybersecurity risks associated with digitized infrastructure, and the potential displacement of human labor in monitoring roles. The prevailing expectation is that AI systems will not only optimize current assets—extending their lifespan and boosting output—but also enable truly dynamic, self-healing smart grids capable of handling massive bidirectional energy flows, thereby accelerating the transition to 100% renewable energy grids by providing the necessary intelligence layer to manage complexity and maximize capital utilization across the entire energy supply chain.

- AI algorithms significantly improve renewable energy forecasting accuracy (solar irradiance, wind speed), reducing grid instability risks and minimizing reserve requirements.

- Predictive maintenance using machine learning models analyzes sensor data to anticipate equipment failures in turbines and inverters, cutting O&M costs by up to 30%.

- AI-powered smart grids enable dynamic load balancing, optimizing energy storage dispatch in real-time based on fluctuating demand and generation profiles.

- Advanced analytics supports automated energy trading and price arbitrage by optimizing BESS charge/discharge cycles in wholesale electricity markets.

- Digital Twin technology, supported by AI, simulates complex grid and asset performance under various scenarios, enhancing infrastructure planning and project development efficiency.

- AI optimizes site selection for new renewable projects by analyzing geospatial data, meteorological patterns, and regulatory constraints simultaneously.

- Machine vision and deep learning enhance quality control during the manufacturing process of solar panels and wind turbine components, improving product reliability.

- AI facilitates complex demand response programs by accurately predicting localized consumption patterns, enabling utilities to manage peak loads using distributed energy resources.

DRO & Impact Forces Of Sustainable Energy Solutions Market

The market dynamics of Sustainable Energy Solutions are shaped by compelling Drivers, structural Restraints, and transformative Opportunities, collectively defining the Impact Forces that govern competitive behavior and market direction. Key drivers include the overwhelming global imperative to combat climate change, translating into binding international agreements and domestic emissions reduction targets that necessitate rapid decarbonization of the power sector. Further impetus is provided by the dramatic decline in the Levelized Cost of Electricity (LCOE) for solar and wind, making them economically competitive, and often superior, to new fossil fuel generation assets, even without subsidies. Technological maturation in energy storage, alongside continuous improvements in material science and system efficiency, ensures that sustainable energy becomes an increasingly reliable and economically attractive investment, driving widespread commercial adoption across all sectors.

However, the sector faces considerable restraints, primarily centered around the intermittency and variability of solar and wind resources, necessitating expensive grid upgrades and robust energy storage solutions to maintain system reliability. Regulatory and policy uncertainty in certain jurisdictions, combined with complex and lengthy permitting processes for large infrastructure projects, can slow deployment rates. Furthermore, transmission bottlenecks and the significant capital investment required for modernizing aging grid infrastructure pose substantial hurdles, particularly in densely populated areas or remote regions where grid access is challenging. Supply chain vulnerabilities, particularly dependency on a few key regions for critical minerals and manufacturing components, also represent a systemic risk that needs diversification efforts.

Opportunities within this market are immense, focusing particularly on the integration of sustainable technologies with emerging digital platforms and infrastructure. The development of advanced Smart Grid technologies offers the potential to seamlessly manage millions of distributed energy resources, turning consumers into prosumers. Green hydrogen production, powered by excess renewable energy, presents a high-value opportunity to decarbonize heavy industry, long-haul transport, and seasonal energy storage. Moreover, niche applications like floating solar (floatovoltaics) and high-altitude wind are unlocking new geographical regions for deployment, while specialized services such as carbon capture utilization and storage (CCUS) linked to bioenergy (BECCS) offer pathways to achieve net-negative emissions, positioning sustainable energy solutions at the forefront of the global industrial transition.

Segmentation Analysis

The Sustainable Energy Solutions Market is highly diversified, segmented comprehensively across Technology, Application, and Service types, reflecting the wide scope of solutions offered to diverse end-users. Technology segmentation is critical, ranging from mature, large-scale utility solutions like conventional hydropower and established wind and solar technologies, to emerging high-growth areas such as advanced battery energy storage systems (BESS) and Power-to-X technologies, including green hydrogen. This technological breadth allows the market to cater to various geographical and environmental constraints, optimizing energy generation based on localized resource availability. Furthermore, the increasing efficiency and standardization of modular components, especially in solar PV and lithium-ion storage, have significantly reduced installation complexity and accelerated global market penetration across all segmented end-user groups, fostering robust competition and driving down the total cost of system ownership.

Application segmentation differentiates deployment based on end-user needs, separating centralized utility-scale projects—which focus on feeding bulk power into the transmission grid—from decentralized solutions designed for commercial, industrial (C&I), and residential premises. The C&I segment is particularly dynamic, driven by corporate sustainability targets and the economic benefit of reducing exposure to volatile retail electricity prices, often integrating rooftop solar with local storage. The Utilities segment remains the largest volume consumer, focusing on large-scale renewable parks and grid modernization projects. The market also segments by service offerings, crucial for the long-term viability of assets, encompassing specialized project development consulting, engineering procurement and construction (EPC), financing solutions, and sophisticated operations and maintenance (O&M) services, often incorporating advanced digital tools like remote monitoring and AI-driven diagnostics.

- Technology Type

- Solar Power (PV, CSP)

- Wind Power (Onshore, Offshore)

- Hydropower (Large Hydro, Small Hydro, Pumped Storage)

- Bioenergy and Biofuels

- Geothermal Energy

- Energy Storage Systems (Li-ion, Flow Batteries, Thermal Storage)

- Green Hydrogen (Electrolyzers, Fuel Cells)

- Application

- Utility Scale (Centralized Generation)

- Commercial & Industrial (C&I)

- Residential (Distributed Generation)

- Off-Grid/Microgrid Solutions

- Service Type

- Consulting and Feasibility Studies

- Engineering Procurement and Construction (EPC)

- Operations and Maintenance (O&M)

- Financing and Project Development

- Software and Energy Management Systems (EMS)

Value Chain Analysis For Sustainable Energy Solutions Market

The value chain for Sustainable Energy Solutions begins with the upstream segment, which involves the sourcing of critical raw materials, such as polysilicon for solar panels, rare earth metals for turbine magnets, lithium and cobalt for batteries, and steel/composites for structural components. Key upstream activities include the highly specialized manufacturing of components—such as solar cells, power electronics (inverters/converters), turbine blades, and battery cells—which often requires significant capital investment and highly technical production expertise. Supplier dominance and regional concentration in key manufacturing hubs, notably in Asia, define the competitive dynamics of this initial stage, often influencing global pricing and supply stability across the entire market, compelling developers to manage geopolitical risk associated with resource dependence.

The midstream phase focuses on project development, engineering, procurement, and construction (EPC). Project developers identify suitable sites, secure financing, obtain regulatory approvals, and manage the complexity of interconnecting generation assets to the transmission grid. EPC contractors are responsible for the detailed design, physical construction, and commissioning of the power plants. This phase is characterized by intense competition among EPC firms, where efficiency in project execution, adherence to safety standards, and speed of delivery are paramount. Financing institutions and specialized investment funds play a critical role here, providing the necessary capital through mechanisms like project finance and specialized green bonds to support the transition from design to operational asset.

The downstream segment encompasses the operational life of the assets, including operations and maintenance (O&M), power generation, and distribution channels. O&M services, increasingly predictive and remote, are essential for maximizing energy yield and extending asset longevity. Distribution channels are highly varied: utility-scale projects typically sell power directly to the grid operator or via long-term Power Purchase Agreements (PPAs) to corporate buyers. Distributed generation relies heavily on indirect channels, utilizing local installers, licensed dealers, and specialized integrators to reach residential and C&I customers. Direct sales channels are often employed by large manufacturers or vertically integrated utilities for specific large-scale projects, allowing greater control over the installation process and subsequent energy management services offered to the end-user.

Sustainable Energy Solutions Market Potential Customers

The primary consumers and beneficiaries of Sustainable Energy Solutions are categorized into distinct end-user segments, each driven by unique motivations and operational requirements. Utility companies represent the single largest customer group, purchasing large-scale renewable generation assets (solar farms, wind parks) to comply with regulatory mandates, replace aging fossil fuel plants, and modernize their transmission and distribution infrastructure with smart grid technologies and utility-scale energy storage. Their buying decisions are primarily influenced by regulatory stability, LCOE competitiveness, and the need for reliable, long-duration power supply options necessary for seamless integration into existing electricity networks.

The Commercial and Industrial (C&I) sector constitutes a rapidly expanding customer base, encompassing manufacturing facilities, data centers, retail chains, and universities. These entities are motivated by both financial savings—reducing operational expenditures through self-generated electricity—and ambitious corporate social responsibility (CSR) goals, particularly the commitment to net-zero emissions. C&I customers typically invest in distributed solar PV, small-scale storage, and energy management systems (EMS) to optimize consumption and hedge against escalating grid power costs, often seeking customized solutions that minimize downtime and maximize energy resilience for critical operations.

Finally, residential prosumers and government entities form essential customer segments. Residential customers adopt sustainable solutions, primarily rooftop solar and home battery storage, driven by a desire for energy independence, reduced monthly utility bills, and environmental consciousness. Governments and public sector organizations, including military bases, municipalities, and public transportation networks, act as major buyers, investing in renewable energy to power public infrastructure, demonstrate environmental leadership, and enhance the security and resilience of critical public services, often leveraging public-private partnerships (PPPs) to finance large-scale decarbonization initiatives across their respective jurisdictions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | 850.5 Billion USD |

| Market Forecast in 2033 | 2,100.8 Billion USD |

| Growth Rate | 13.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens Energy, Vestas, General Electric (GE) Renewable Energy, NextEra Energy, Enel Green Power, Ørsted, JinkoSolar, Trina Solar, First Solar, Schneider Electric, ABB, Mitsubishi Heavy Industries, Goldwind, SunPower, Iberdrola, Tesla Energy, Wärtsilä, Hanwha Q Cells, RWE, EDF Renewables. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sustainable Energy Solutions Market Key Technology Landscape

The technological landscape of the Sustainable Energy Solutions Market is rapidly evolving, driven by the dual goals of maximizing energy yield and enhancing system stability. The current focus is heavily concentrated on advanced energy storage technologies, primarily lithium-ion batteries, which are becoming ubiquitous in both utility-scale and distributed applications due to falling costs and improved energy density. However, continuous research is expanding into long-duration energy storage (LDES) solutions, including flow batteries (zinc-air, vanadium redox), compressed air energy storage (CAES), and green hydrogen derived from renewable electricity. These LDES solutions are critical for managing seasonal variability and ensuring reliable baseload power supply, addressing one of the most significant historical limitations of intermittent renewable generation sources and paving the way for grids operating at 80% or higher renewable penetration levels.

Beyond storage, sophisticated digitalization is a core technological pillar. This includes the widespread integration of Internet of Things (IoT) sensors into renewable assets for real-time performance monitoring and the deployment of advanced software platforms utilizing Artificial Intelligence (AI) and machine learning for predictive maintenance, yield optimization, and complex grid management. Smart Grid technologies, including Advanced Metering Infrastructure (AMI) and automated distribution management systems (ADMS), are transforming passive electricity networks into active, resilient systems capable of handling bidirectional power flows and managing millions of decentralized energy resources simultaneously. Furthermore, the development of specialized power electronics, such as high-efficiency inverters and flexible AC transmission systems (FACTS), is essential for ensuring power quality and grid synchronization during large-scale renewable integration events.

In terms of generation technology, incremental improvements continue to drive efficiency. Solar PV advancements include the commercialization of bifacial modules that capture sunlight from both sides, increasing overall yield, and the emerging potential of tandem cell structures, particularly perovskite-silicon combinations, promising significantly higher conversion efficiencies than standard silicon cells alone. In wind power, technology is focused on increasing turbine size—both rotor diameter and hub height—to capture stronger, more consistent wind resources, particularly in offshore environments, coupled with advanced aerodynamic designs and digital control systems that optimize performance under diverse wind conditions. Materials science also plays a vital role, with ongoing research into lightweight, durable composite materials for turbine blades and specialized alloys for high-temperature geothermal and concentrated solar power (CSP) systems, enhancing operational lifespan and reducing material usage.

Regional Highlights

Regional dynamics play a crucial role in shaping the global Sustainable Energy Solutions Market, reflecting variations in regulatory environments, resource availability, and economic maturity. Asia Pacific (APAC) stands as the undisputed leader in terms of installed capacity and manufacturing prowess, driven primarily by China’s massive domestic renewable energy targets and its position as the global hub for solar PV component manufacturing. India is also a significant contributor, focusing heavily on solar parks and domestic manufacturing incentives (PLI schemes) to meet rapidly accelerating energy demand, positioning APAC as the engine of global market growth through volume and scale. The region is characterized by aggressive competition and substantial government investment, often leading to lower hardware costs globally.

Europe represents a highly mature and innovation-focused market, characterized by stringent decarbonization targets set forth by the European Union (EU) and high consumer engagement. Northern European nations lead the world in offshore wind technology, benefiting from deep expertise and favorable geography, while Southern Europe is capitalizing on substantial solar resources. Key initiatives, such as the European Green Deal and significant investments in grid interconnectivity and green hydrogen infrastructure (e.g., the H2 pipeline network), ensure sustained long-term growth. The market here emphasizes technological integration, energy efficiency, and sophisticated market mechanisms like cross-border electricity trading and robust carbon pricing.

North America, led by the United States, is undergoing a profound transformation driven by highly supportive and long-duration federal policy, particularly the Inflation Reduction Act (IRA). The IRA provides powerful tax credits and incentives aimed at spurring domestic manufacturing across the entire sustainable energy supply chain, from polysilicon to battery cells, stabilizing investment decisions over the next decade. While utility-scale solar and wind remain dominant, the region is witnessing massive capital inflows into utility-scale storage, distributed generation, and the development of carbon capture and hydrogen technologies, particularly in states with strong renewable energy mandates and favorable utility commission structures.

- North America (US and Canada): Strong federal support (IRA/AEO), high investment in utility-scale battery storage, significant C&I adoption, and focus on energy independence and resilience.

- Europe (Germany, UK, Spain): Leading innovation in offshore wind and green hydrogen; highly integrated power markets; driven by strict EU decarbonization mandates and grid modernization efforts.

- Asia Pacific (China, India, Japan): Largest market by installed capacity; manufacturing hub for solar PV; driven by massive energy demand growth and addressing acute pollution concerns; rapid deployment of distributed generation.

- Latin America (Brazil, Chile): High potential due to excellent solar and wind resources; market growth fueled by attractive private investment and PPAs, focusing on utility-scale projects and electricity exports.

- Middle East and Africa (UAE, South Africa): Increasing focus on large-scale solar and specialized green hydrogen projects (especially in the Gulf region); driven by diversification away from fossil fuel dependency and improving energy access in African nations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sustainable Energy Solutions Market.- Siemens Energy

- Vestas Wind Systems A/S

- General Electric (GE) Renewable Energy

- NextEra Energy, Inc.

- Enel Green Power S.p.A.

- Ørsted A/S

- JinkoSolar Holding Co., Ltd.

- Trina Solar Co., Ltd.

- First Solar, Inc.

- Schneider Electric SE

- ABB Ltd.

- Mitsubishi Heavy Industries, Ltd. (MHI)

- Goldwind Science & Technology Co., Ltd.

- SunPower Corporation

- Iberdrola, S.A.

- Tesla Energy

- Wärtsilä Corporation

- Hanwha Q Cells Co., Ltd.

- RWE AG

- EDF Renewables

Frequently Asked Questions

Analyze common user questions about the Sustainable Energy Solutions market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the market growth for sustainable energy solutions?

The primary driver is the declining Levelized Cost of Electricity (LCOE) for both solar and wind power, making them the most economically attractive options for new generation capacity globally, supported significantly by stringent governmental climate policies and net-zero emissions mandates.

How does energy storage address the challenge of renewable energy intermittency?

Energy storage systems (ESS), particularly utility-scale batteries, store excess energy generated during peak production times (e.g., midday solar) and release it when generation drops (e.g., evening peak demand). This process stabilizes the grid, ensures reliable power delivery, and maximizes the economic value of renewable assets.

Which region currently dominates the global manufacturing of sustainable energy components?

Asia Pacific, specifically China, dominates the global manufacturing capacity for critical sustainable energy components, notably solar photovoltaic cells and modules, inverters, and key battery components, influencing global supply chains and pricing benchmarks.

What role does Artificial Intelligence play in the optimization of sustainable energy grids?

AI is essential for optimizing the integration of decentralized renewables by providing highly accurate energy forecasting, enabling predictive maintenance for assets, and managing real-time load balancing and dispatch optimization within sophisticated smart grid architectures.

What is the significance of Green Hydrogen in the long-term outlook for sustainable energy?

Green Hydrogen is crucial for decarbonizing hard-to-abate sectors like heavy industry, maritime transport, and long-duration seasonal energy storage. Produced via electrolysis powered by renewable electricity, it offers a high-density, versatile fuel source necessary for achieving complete energy transition goals.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager