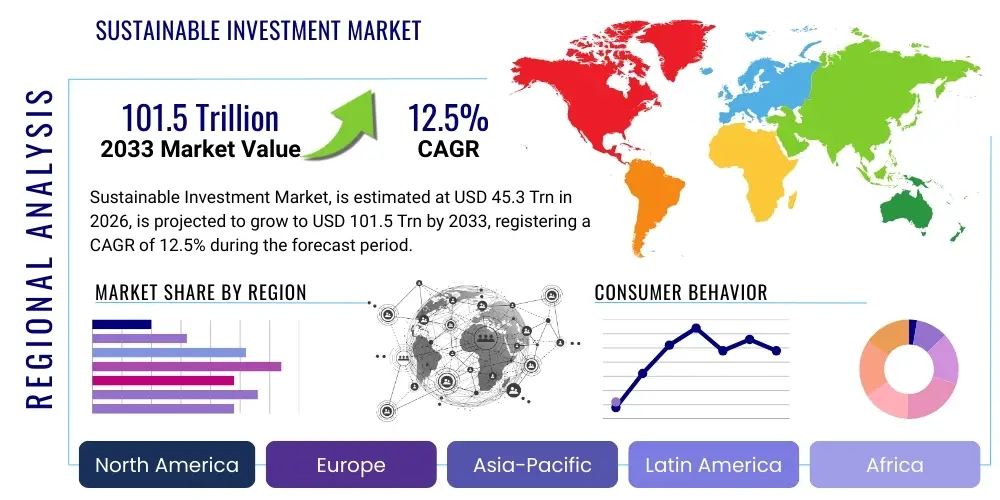

Sustainable Investment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437697 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Sustainable Investment Market Size

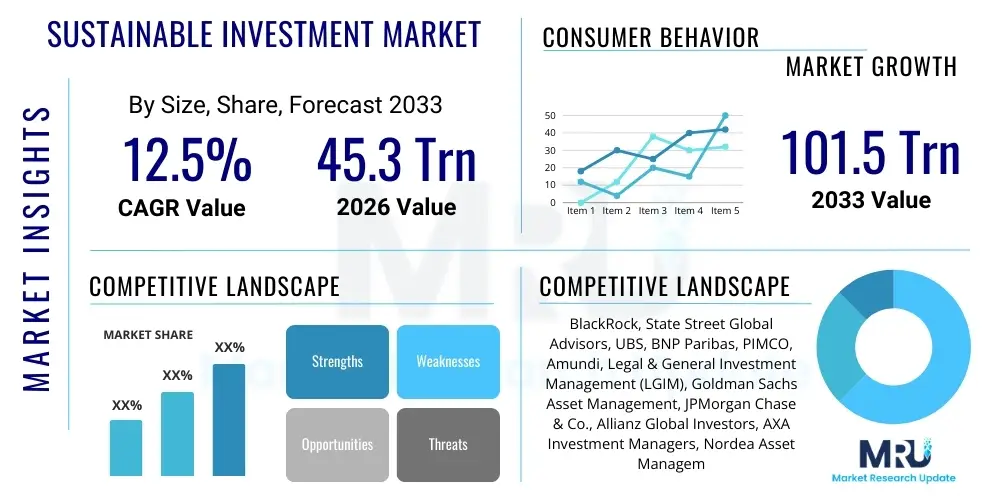

The Sustainable Investment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 45.3 Trillion in 2026 and is projected to reach USD 101.5 Trillion by the end of the forecast period in 2033.

Sustainable Investment Market introduction

The Sustainable Investment Market encompasses investment approaches that seek to incorporate Environmental, Social, and Governance (ESG) factors into investment decisions to generate both competitive financial returns and positive societal impact. This includes a broad spectrum of strategies, ranging from negative screening and ESG integration to impact investing, reflecting a fundamental shift in capital allocation towards long-term value creation. The market is characterized by increasing regulatory standardization, heightened investor demand for transparency, and the mainstreaming of climate risk assessment.

Major applications of sustainable investment span across public and private equity, fixed income, real estate, and infrastructure. Institutional investors, including pension funds and sovereign wealth funds, represent the largest segment, driven by fiduciary duty and risk management imperatives related to climate change and social inequality. Product innovation is accelerating, with tailored financial products such as green bonds, sustainability-linked loans, and thematic ETFs gaining prominence to meet specific investor mandates targeting areas like renewable energy, circular economy solutions, and social inclusion.

The primary benefits driving this market include enhanced portfolio resilience against systemic risks, improved corporate performance stemming from better governance and resource management, and the alignment of capital with global sustainability goals, such as the UN Sustainable Development Goals (SDGs). Key driving factors are the rapid accumulation of climate-related physical and transition risks, evolving consumer preferences, and substantial governmental incentives supporting green transitions globally. These elements collectively necessitate a profound re-evaluation of traditional investment models, positioning sustainable investment as a core component of modern financial strategy.

Sustainable Investment Market Executive Summary

The Sustainable Investment Market is experiencing unprecedented expansion, fundamentally shifting the global financial landscape due to powerful institutional adoption and burgeoning retail investor interest. Business trends indicate a strong move away from simple exclusionary screening towards sophisticated ESG integration and measurable impact investing, necessitating advanced data analytics and specialized thematic fund creation. Compliance costs are rising due to regulatory convergence across jurisdictions, demanding greater standardization in reporting and data quality, which simultaneously acts as a growth driver by boosting investor confidence.

Regionally, Europe continues to lead the market, largely driven by the ambitious European Green Deal and the Sustainable Finance Disclosure Regulation (SFDR), which have set global benchmarks for mandatory sustainability reporting. However, North America and Asia Pacific are demonstrating the fastest acceleration, fueled by significant corporate commitments to net-zero targets and increasing policy support for green infrastructure investment. The shift in APAC, particularly in countries like Japan and Australia, is notable, moving from voluntary guidelines to mandatory ESG disclosures.

Segment trends reveal that ESG integration remains the dominant strategy by Assets Under Management (AUM), though impact investing is growing at the highest pace, especially within private markets, as investors seek specific, demonstrable outcomes alongside financial returns. Fixed income, particularly green and social bonds, is emerging as a critical growth segment, providing a mechanism for large-scale capital deployment into verifiable sustainable projects. End-user demand is polarizing: large institutions seek customized mandates, while retail investors favor easily accessible, transparent Exchange-Traded Funds (ETFs) focused on high-impact themes.

AI Impact Analysis on Sustainable Investment Market

Common user questions regarding AI's impact on sustainable investment often revolve around its ability to address data quality, combat greenwashing, and enhance predictive modeling of climate risk. Users frequently ask how AI can standardize non-financial data, which is historically fragmented and qualitative, and whether machine learning algorithms can reliably assess the true environmental and social impact of complex supply chains. A significant concern is the ethical implementation of AI, ensuring that algorithmic biases do not lead to unintentional exclusion or misclassification of assets, while expectations center on AI's potential to accelerate the transition to sustainable finance by providing real-time risk intelligence and enabling personalized sustainable portfolios.

AI is transforming the sustainable investment workflow primarily through its capacity for massive data aggregation and processing, far exceeding human capability. It enables sophisticated analysis of unstructured data sources, such as regulatory filings, news sentiment, satellite imagery, and corporate sustainability reports, to generate dynamic, proprietary ESG scores. This technological intervention addresses the critical market need for reliable, timely, and comprehensive sustainability data, significantly improving the accuracy of risk assessments, particularly concerning transition risks and physical climate hazards, allowing portfolio managers to proactively adjust holdings.

Furthermore, AI algorithms are instrumental in identifying and mitigating the risk of greenwashing. By cross-referencing company claims with actual operational data, social media sentiment, and regulatory compliance records, AI can detect inconsistencies and potentially misleading statements that human analysts might miss. This enhanced scrutiny not only protects investors but also raises the bar for corporate sustainability performance, driving greater authenticity and transparency across the market, thereby improving overall confidence in sustainable investment products.

- AI enhances ESG data sourcing and standardization from unstructured text and alternative data.

- Machine learning models improve climate scenario analysis and predictive risk modeling for portfolios.

- Natural Language Processing (NLP) tools detect greenwashing by analyzing corporate communications against performance metrics.

- AI-driven algorithmic trading supports tactical allocation shifts based on real-time sustainability events.

- Robo-advisors utilize AI to create and manage personalized, goal-aligned sustainable investment portfolios for retail clients.

DRO & Impact Forces Of Sustainable Investment Market

The sustainable investment market is driven by robust legislative frameworks and rapidly shifting demographic preferences, primarily among Millennial and Gen Z investors who prioritize purpose alongside profit, creating sustained demand for ESG-integrated products. Regulatory intervention, such as mandatory climate-related financial disclosures and taxonomy development (e.g., the EU Taxonomy), is standardizing definitions and increasing transparency, which significantly de-risks sustainable finance and attracts larger institutional capital pools. This interplay of demand-side pressure and supply-side regulatory clarity forms a powerful positive feedback loop.

However, the market faces structural restraints primarily related to data fragmentation, lack of harmonization in reporting standards globally, and the complexity of measuring real-world impact. The absence of a universally accepted methodology for calculating and verifying impact, coupled with the heterogeneity of ESG metrics provided by different data vendors, creates friction and potential skepticism among investors. Furthermore, high initial costs associated with integrating complex ESG data systems and upskilling financial professionals act as barriers, especially for smaller asset managers.

Opportunities abound in thematic investing, focusing on critical global transitions like renewable energy infrastructure, water stewardship, and the just transition—ensuring that the shift to net-zero is equitable. Technological advancements, particularly in FinTech and blockchain, offer potential to create verifiable, immutable records of sustainable project funding and supply chain ESG performance, addressing transparency challenges. Impact forces, driven by catastrophic climate events and increasing societal pressure on corporate accountability, consistently push ESG considerations from niche add-ons into core financial risk management strategies, ensuring the long-term viability and growth trajectory of the market.

Segmentation Analysis

The Sustainable Investment Market is extensively segmented based on the specific investment strategy employed, the asset classes targeted, the type of capital owner (end-user), and geographic distribution. Understanding these segments is crucial as it reveals the depth and breadth of ESG integration across the financial sector. Strategies are evolving rapidly, moving beyond simple negative screening to active ownership and measurable impact, reflecting a sophisticated investor base demanding quantifiable environmental and social outcomes. The primary segments demonstrate market maturity and offer diverse risk-return profiles tailored to institutional mandates and individual ethical preferences.

- By Strategy:

- ESG Integration

- Exclusionary Screening (Negative Screening)

- Norms-Based Screening

- Impact Investing

- Sustainability Themed Investing

- Shareholder Engagement and Active Ownership

- By Asset Class:

- Equity (Public and Private)

- Fixed Income (Green Bonds, Social Bonds, Sustainability-Linked Bonds)

- Alternative Investments (Real Estate, Infrastructure, Hedge Funds)

- Money Market Instruments

- By End-User:

- Institutional Investors (Pension Funds, Insurance Companies, Sovereign Wealth Funds)

- Retail Investors

- High-Net-Worth Individuals (HNWIs)

- Foundations and Endowments

- By Region:

- North America (U.S., Canada)

- Europe (UK, Germany, France, Nordics)

- Asia Pacific (Japan, Australia, China, Singapore)

- Latin America (Brazil, Mexico)

- Middle East and Africa (MEA)

Value Chain Analysis For Sustainable Investment Market

The value chain of the Sustainable Investment Market begins with upstream activities focused on data generation, assessment, and validation. This stage involves specialized ESG data providers (e.g., MSCI, Sustainalytics, Bloomberg) and technology firms that collect, normalize, and score non-financial corporate data. The quality and robustness of this input data are paramount, as they determine the integrity of subsequent investment decisions. Upstream analysis also includes academic research and regulatory bodies that define taxonomies and disclosure mandates, setting the foundational standards for sustainability metrics and reporting.

The midstream component involves asset managers, investment banks, and financial advisors who integrate the ESG data into portfolio construction, risk management systems, and product development (e.g., thematic funds, customized mandates). Distribution channels play a vital role here, connecting sustainable investment products to end-users. Direct distribution includes proprietary platforms offered by large financial institutions, tailored to institutional investors or sophisticated HNWIs seeking highly customized solutions. Indirect distribution involves third-party intermediaries such as independent financial advisors (IFAs), brokerage firms, and robo-advisory platforms, which are crucial for reaching the mass retail segment.

Downstream analysis focuses on the end-users—the capital owners (institutional, retail, HNWI)—and the real-world impact resulting from the capital deployment. Post-investment activities involve active ownership, shareholder engagement, impact reporting, and ongoing monitoring to ensure alignment with sustainability goals. The effectiveness of the value chain is increasingly measured not just by financial return, but by verifiable environmental and social outcomes, closing the loop between investment decision and measurable positive change. The transparency facilitated by this chain is critical for maintaining investor trust and achieving AEO goals.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.3 Trillion |

| Market Forecast in 2033 | USD 101.5 Trillion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BlackRock, State Street Global Advisors, UBS, BNP Paribas, PIMCO, Amundi, Legal & General Investment Management (LGIM), Goldman Sachs Asset Management, JPMorgan Chase & Co., Allianz Global Investors, AXA Investment Managers, Nordea Asset Management, APG Asset Management, Schroders, Fidelity International, T. Rowe Price, Vanguard, Morgan Stanley, Robeco, Generali Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sustainable Investment Market Potential Customers

Potential customers in the Sustainable Investment Market primarily comprise institutional investors who manage vast pools of capital under long-term mandates, such as pension funds, insurance companies, and sovereign wealth funds. These entities are increasingly bound by fiduciary duty to consider systemic sustainability risks, including climate change and biodiversity loss, making ESG integration a necessity for portfolio stability and regulatory compliance. They seek sophisticated, large-scale sustainable mandates, tailored infrastructure investments, and private equity funds focused on deep impact.

Another significant customer base is High-Net-Worth Individuals (HNWIs) and family offices. This segment often views sustainable investing as a means of legacy planning and aligning personal values with wealth management. HNWIs typically demand bespoke solutions, including direct private investments in sustainable ventures and highly concentrated thematic portfolios (e.g., health technology, sustainable agriculture). Transparency and demonstrable impact reporting are key requirements for this cohort, driving demand for innovative structures like blended finance and impact funds.

Finally, the rapidly expanding retail investor segment, particularly younger generations (Millennials and Gen Z), represents a long-term growth driver. These investors utilize easily accessible digital platforms, such as robo-advisors and low-cost sustainable ETFs, often focusing on broad sustainability themes or socially responsible ethical funds. This segment is highly sensitive to fees and requires clear, simplified communication regarding the sustainable credentials and performance of their investments, making Answer Engine Optimization of product information crucial for asset gatherers targeting this demographic.

Sustainable Investment Market Key Technology Landscape

The technology landscape underpinning the Sustainable Investment Market is centered on enhancing data infrastructure, automating analysis, and ensuring transparency. Key technologies include advanced cloud computing platforms capable of ingesting and normalizing vast, disparate sets of ESG data from thousands of sources globally. Furthermore, proprietary ESG scoring models leveraging machine learning are becoming standard tools for asset managers, providing dynamic risk assessments and forecasting corporate sustainability performance under various climate scenarios. These technologies allow for rapid portfolio recalibration in response to evolving sustainability events or regulatory changes, improving investment decision-making speed and efficacy.

Blockchain technology is increasingly being piloted for its potential to introduce unprecedented traceability and security into sustainable finance, particularly in tracking the use of proceeds from green bonds or verifying the supply chain credentials of underlying assets. By providing an immutable ledger, blockchain can significantly reduce the risk of greenwashing and enhance investor confidence in impact verification. Concurrently, FinTech solutions, ranging from sophisticated data visualization tools to personalized robo-advisors dedicated entirely to ESG screening, are democratizing access to sustainable investing, making complex metrics understandable and actionable for the average retail investor and ensuring widespread market participation.

The integration of geospatial technology (satellite imagery and IoT sensors) provides crucial real-time environmental data, monitoring parameters such as deforestation, pollution levels, and carbon emissions from physical assets owned by portfolio companies. This non-traditional data source provides an independent layer of verification, crucial for assessing the real-world operational sustainability of investments, especially in areas like agriculture, real estate, and infrastructure. This technological ecosystem transforms subjective ESG opinions into quantifiable, auditable metrics, directly supporting the market's trajectory towards verifiable sustainability outcomes.

Regional Highlights

The regional analysis reveals significant divergence in regulatory frameworks and market maturity, heavily influencing sustainable investment capital flows and product development across the globe.

- Europe: Europe is the undisputed leader in sustainable investment, driven by comprehensive regulatory initiatives like the EU Sustainable Finance Disclosure Regulation (SFDR) and the EU Taxonomy, which mandate transparency and standardize definitions. The Nordic region and the UK remain pioneers in active ownership and climate-specific divestment strategies. European institutional investors have the highest allocation percentages to ESG strategies globally, focusing heavily on climate mitigation and corporate governance improvements.

- North America (U.S. and Canada): The U.S. market is experiencing rapid institutional growth, fueled by state-level policies and increasing corporate net-zero commitments, despite a historically fragmented federal regulatory approach. There is significant momentum in thematic investments focused on clean technology and social equity (S in ESG). Canada maintains a strong leadership position, particularly among pension funds, driven by robust fiduciary expectations regarding climate risk management.

- Asia Pacific (APAC): APAC is the fastest-growing region, transitioning rapidly from an emphasis on governance (G) to a broader focus on environmental (E) factors, particularly carbon transition and biodiversity protection, crucial for AEO targeting in this region. Countries like Japan, Australia, and Singapore are establishing robust green bond markets and mandatory climate reporting standards, driven by acute exposure to physical climate risks and governmental support for renewable energy deployment.

- Latin America: The market remains nascent but shows high potential, primarily focused on sustainable agriculture, forestry, and green infrastructure financing. Growth is spurred by multilateral development bank funding and regional initiatives focused on natural capital preservation and social inclusion, requiring significant foreign institutional capital to scale up.

- Middle East and Africa (MEA): Sustainable investing in MEA is primarily led by sovereign wealth funds (SWFs) investing in domestic energy transition projects and aligning capital with national diversification visions. Interest is high in renewable energy infrastructure, water security, and social impact funds, often leveraging local religious principles (Sharia-compliant ethical finance) to drive sustainable capital formation.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sustainable Investment Market.- BlackRock

- State Street Global Advisors

- UBS

- BNP Paribas

- PIMCO

- Amundi

- Legal & General Investment Management (LGIM)

- Goldman Sachs Asset Management

- JPMorgan Chase & Co.

- Allianz Global Investors

- AXA Investment Managers

- Nordea Asset Management

- APG Asset Management

- Schroders

- Fidelity International

- T. Rowe Price

- Vanguard

- Morgan Stanley

- Robeco

- Generali Group

Frequently Asked Questions

Analyze common user questions about the Sustainable Investment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between ESG Investing and Impact Investing?

ESG investing incorporates environmental, social, and governance factors into traditional financial analysis to manage risk and potentially enhance returns across a portfolio. Impact Investing, conversely, is a targeted strategy aiming to generate measurable, positive environmental or social impact alongside a financial return, typically focusing on specific themes or projects and requiring deep impact verification.

How does the EU Sustainable Finance Disclosure Regulation (SFDR) affect global sustainable funds?

The SFDR standardizes reporting requirements for financial market participants operating or selling products within the EU, classifying funds primarily as Article 8 (light green, promoting ESG characteristics) or Article 9 (dark green, having sustainability as their core objective). While regulatory, its influence extends globally as international asset managers must comply when targeting European clients, raising the baseline standard for transparency worldwide.

Can sustainable investments outperform traditional non-ESG investments?

Recent academic and market evidence suggests that sustainable investments often perform comparably to, and sometimes outperform, traditional benchmarks, especially over the long term and during periods of market volatility. Companies with robust ESG profiles generally exhibit better operational efficiency, lower regulatory risk, and stronger resilience, which translates into sustained financial outperformance.

What is the greatest barrier to scaling up the sustainable investment market?

The primary barrier remains the inconsistency and lack of standardization in ESG data quality and corporate disclosure across global markets. This fragmentation hinders direct comparability between assets and creates opacity, making it difficult for investors to accurately assess risk and verify claims, thereby contributing to the persistent challenge of greenwashing.

Which asset class is seeing the fastest growth in ESG integration?

Fixed income, specifically the market for Green Bonds, Social Bonds, and Sustainability-Linked Bonds (SLBs), is experiencing rapid growth. This segment provides governments and corporations with direct financing mechanisms for large-scale sustainable projects, offering investors verifiable deployment pathways for capital seeking specific environmental and social outcomes.

The comprehensive analysis provided herein establishes a robust foundation for strategic decision-making within the evolving landscape of sustainable finance. The market's shift toward standardized data, integration of advanced technologies like AI, and strong global regulatory convergence ensures its trajectory remains upward, driven equally by financial necessity and ethical imperative. Continued innovation in product development, particularly in thematic and impact-focused funds, will be crucial for capturing the projected USD 101.5 Trillion market potential by 2033. Investors and asset managers must prioritize the adoption of harmonized ESG metrics and robust impact verification protocols to maintain credibility and capitalize on sustained capital inflows, securing long-term value creation in the transition to a sustainable global economy. The dominance of institutional capital in driving standardized practices, coupled with the rapid growth of the retail segment seeking accessible ESG products, necessitates a dual strategy focused on highly customized mandates and scalable, transparent digital offerings. Navigating the regulatory divergence across Europe, North America, and Asia Pacific requires agile compliance strategies and localized product alignment to effectively penetrate key regional growth corridors and mitigate evolving transition risks related to climate policy.

Furthermore, technology adoption is non-negotiable for competitive advantage. Firms that successfully deploy AI for real-time risk modeling and greenwashing detection will set the benchmark for operational efficiency and investment integrity. The integration of environmental data from satellite and IoT sources provides an essential independent layer of accountability, pushing corporate disclosures beyond mere self-reporting. Addressing the inherent limitations in data quality through collaborative industry efforts and technological innovation is paramount to unlocking the full potential of sustainable investing. The market's future growth hinges on its ability to demonstrate verifiable, quantifiable impact, moving beyond reporting on processes to reporting on measurable results. This continuous demand for deeper transparency aligns perfectly with the principles of Answer Engine Optimization, requiring financial products to provide clear, immediate, and authoritative answers regarding their sustainability credentials and performance.

The competitive landscape highlights the strategic positioning of large, diversified financial institutions that can offer a full spectrum of sustainable products, from passive index funds to highly active impact private equity. Strategic acquisitions of specialist ESG data and technology firms are increasingly common, indicating that in-house technological capabilities are seen as crucial differentiators. Success in the next phase of market development will depend not only on the ability to integrate ESG factors seamlessly into investment processes but also on communicating those efforts effectively and authentically to a discerning global investor base. The market requires a strong commitment to shareholder engagement and active ownership practices to drive real-world corporate change, ensuring that sustainable investment fulfills its dual mandate of delivering financial returns and societal benefits.

The trajectory towards a market size exceeding USD 100 Trillion is cemented by macroeconomic tailwinds, including government green recovery packages post-pandemic and the societal cost of inaction on climate change, which translates directly into financial risk. This necessitates that all financial institutions, regardless of size, incorporate sustainable principles into their core business models, evolving from compliance-driven activities to core value drivers. The detailed segmentation analysis provided offers market participants a clear map for targeted product development, identifying high-growth areas such as thematic infrastructure and social bonds. Leveraging regional insights will allow firms to tailor compliance and product offerings to capitalize on localized regulatory incentives, maximizing geographical market penetration. This requires an in-depth understanding of regional nuances, particularly the strong push towards climate resilience in Asia and the prescriptive nature of the EU regulatory environment. The commitment to sustainability is no longer optional; it is the defining trend shaping global capital markets for the coming decades.

Investment in human capital is also a critical, often overlooked, component of the sustainable investment value chain. The complexity of ESG data analysis and the need for nuanced engagement require specialized expertise that combines financial acumen with sustainability science. Firms that invest heavily in training analysts and portfolio managers in advanced climate modeling and social impact assessment methodologies will secure a competitive edge. This specialized talent pool is essential for translating high-level ESG principles into actionable investment strategies, particularly in the rapidly growing fields of blended finance and transition finance, which aim to help carbon-intensive companies decarbonize responsibly. The market's structural evolution demands continuous education and collaboration across regulatory, academic, and financial sectors to standardize practices and facilitate cross-border capital flows into sustainable assets effectively. The focus remains on bridging the gap between intention and verifiable positive outcome, driven by technological enhancements and global standardization efforts.

The proliferation of new financial instruments designed specifically to address sustainability challenges, such as blue bonds for ocean health or resilience bonds for climate adaptation, underscores the dynamism of the market. These innovations attract specific pools of capital dedicated to solving particular environmental problems. The effectiveness of these instruments relies heavily on robust third-party verification and consistent, transparent reporting standards, ensuring investor confidence is maintained. As the market matures, the differentiation between truly sustainable products (Article 9 equivalent) and those simply incorporating basic ESG factors (Article 8 equivalent) will become increasingly sharp. Asset managers must clearly articulate their product’s sustainable objective and measurable indicators to satisfy both regulatory requirements and investor demands for credibility. This dedication to granular impact reporting is fundamental for long-term strategic positioning and market leadership.

The trajectory of sustainable investment is fundamentally intertwined with global policy shifts towards net-zero economies. Government mandates for phasing out fossil fuels, coupled with massive public investment in renewable energy and green infrastructure, create fertile ground for private sustainable capital. The transition risks associated with policy changes, such as carbon pricing and stranded assets, actively push mainstream investors towards sustainable alternatives. This systemic risk consideration means that even investors not explicitly seeking impact are integrating ESG to protect capital, making sustainable investment a core component of prudent risk management. The ongoing effort to standardize global carbon accounting and disclosure mechanisms, facilitated by bodies like the International Sustainability Standards Board (ISSB), promises to further solidify the data foundation necessary for sustained market growth and enhanced comparability across international borders.

The retail investor segment's growing clout also dictates that sustainable investing products must be made highly accessible and easy to understand. Digital platforms and robo-advisors are essential distribution channels for this demographic. Providing interactive tools that allow retail users to visualize the real-world impact of their investments, not just financial returns, is a key strategy for capturing this vast potential market. The clear communication of sustainability credentials, aligning with AEO best practices, ensures that retail investors can make informed choices, differentiating between various sustainable strategies like exclusion, integration, and high-impact thematic funds. The focus on transparency and education will be critical in converting interest into sustained investment commitments, driving the market toward its forecasted valuation.

Ultimately, the long-term success of the Sustainable Investment Market depends on its ability to move capital into areas that genuinely contribute to sustainable development without compromising financial integrity. This demands continuous improvement in measurement, reporting, and verification processes. Collaborative initiatives between financial institutions, regulators, and technology providers are necessary to resolve data scarcity and methodology inconsistencies. As the market expands, the integration of sustainability will become indistinguishable from core investment analysis, transforming sustainable finance from a specialty category into the standard operating procedure for global capital allocation, fulfilling the robust growth projections for the forecast period ending in 2033.

The convergence of fiduciary duty and sustainable objectives is driving a structural transformation in the asset management industry. Pension funds, managing assets for future generations, are leading this charge, recognizing that climate change and social inequality pose material, long-term risks to portfolio value. Their mandates often prioritize resilience and long-duration capital preservation, naturally aligning with sustainable strategies. This institutional imperative provides stability to the market and ensures continuous demand for high-quality ESG and impact products. The growing focus on measuring and managing biodiversity loss, beyond just carbon emissions, represents the next frontier of material risk assessment within the institutional segment.

The influence of technology extends to the creation of new financial ecosystems. Decentralized Finance (DeFi) platforms are exploring mechanisms to tokenize sustainable assets or link lending rates directly to verifiable ESG performance metrics using smart contracts. While still nascent, this convergence could revolutionize how sustainable projects are funded and monitored, offering highly efficient, immutable, and transparent capital deployment structures. The successful integration of these disruptive FinTech elements into traditional sustainable investment frameworks will be a key determinant of market efficiency and capital velocity over the next decade. These technological advancements are specifically designed to address historical shortcomings in transparency and verification, the core pain points identified in earlier market stages.

Furthermore, active ownership and shareholder engagement strategies are gaining prominence as vital tools for sustainable investors, particularly for large institutional players. By leveraging their voting power and engaging directly with corporate boards, investors can push for stronger climate governance, better labor practices, and improved supply chain oversight. This shifts the focus from simply excluding poorly performing companies to actively driving positive change within them. The increasing sophistication of collaborative investor initiatives on key issues like climate transition plans demonstrates the market's commitment to using influence strategically to generate measurable societal outcomes, underscoring the shift from passive screening to active sustainability management.

The regulatory environment, particularly in Europe, continues to refine its approach to prevent fragmentation and optimize capital flows toward green activities. The forthcoming updates to the SFDR and the expansion of the EU Taxonomy signal a sustained governmental commitment to defining "sustainable" investment rigorously. For investors globally, these frameworks act as critical reference points, even when not legally binding. Compliance with such stringent standards often becomes a competitive advantage, signaling credibility and attracting capital seeking genuinely sustainable assets. The global push for harmonized climate-related disclosures (e.g., via ISSB) aims to bridge the regulatory gap between major economies, further solidifying the data foundation for sustained global growth in ESG assets under management.

To conclude, the Sustainable Investment Market is not merely a niche trend but a profound, systemic shift in global capital allocation. Driven by regulatory pressure, evolving demographic values, and the tangible financial risks associated with climate change, the market is poised for exceptional growth. Success for market participants hinges on leveraging technology for data transparency, embracing rigorous impact verification, and continuously innovating product structures to meet the diverse needs of institutional, high-net-worth, and retail investors. The forecasted valuation of over USD 100 Trillion by 2033 reflects the irreversible integration of sustainability into core financial practice, defining the next era of investment management.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager