Sustainable Jewelry Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434212 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Sustainable Jewelry Market Size

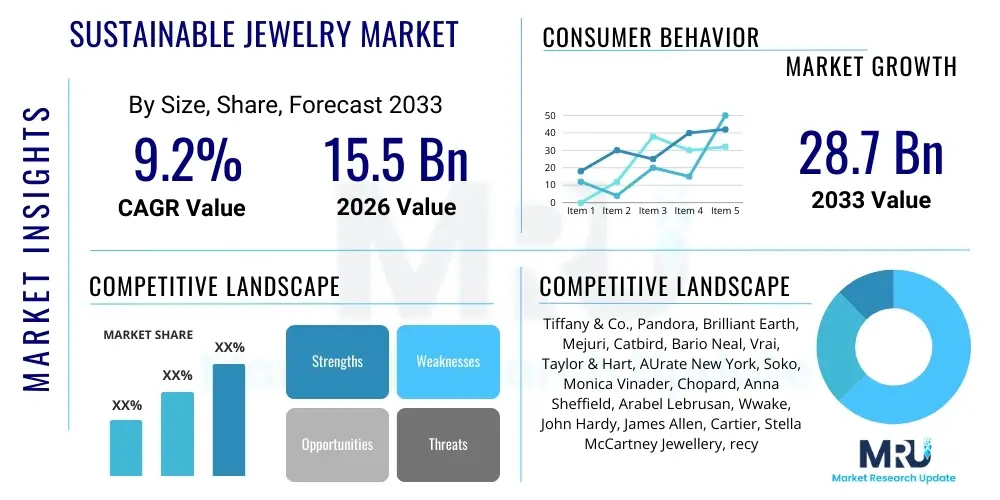

The Sustainable Jewelry Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.2% (Include CAGR Word with 9.2% Value) between 2026 and 2033. The market is estimated at $15.5 Billion USD in 2026 and is projected to reach $28.7 Billion USD by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by a global shift towards conscious consumerism, where purchasing decisions are increasingly influenced by ethical sourcing, environmental impact, and supply chain transparency. The market valuation reflects not only the increasing volume of sustainable products but also the premium price points often associated with certified ethical materials and advanced traceability mechanisms. The projected growth trajectory solidifies sustainable jewelry’s transition from a niche offering to a core segment within the global luxury and fashion accessories industry.

Market expansion is particularly evident in developed economies such as North America and Europe, which exhibit high consumer awareness and disposable income dedicated to ethical luxury goods. However, emerging economies, particularly in the Asia Pacific region, are rapidly adopting sustainable practices, fueled by evolving regulatory landscapes and increased visibility into manufacturing processes. Key growth catalysts include the widespread adoption of lab-grown diamonds, which offer a conflict-free and environmentally lighter alternative to mined stones, and the rising availability of certified recycled precious metals, reducing the reliance on new extraction activities. Furthermore, brand commitment to verifiable sustainability claims, often backed by blockchain technology, plays a crucial role in building consumer trust and driving market penetration across various demographics.

Sustainable Jewelry Market introduction

The Sustainable Jewelry Market encompasses the production, distribution, and sale of jewelry crafted using materials and processes that minimize environmental and social harm throughout the entire supply chain. This definition prioritizes ethical sourcing of gemstones, the utilization of recycled precious metals (such as gold, silver, and platinum), and manufacturing methods that reduce waste, water usage, and carbon emissions. Products range from high-end luxury items featuring large lab-grown diamonds or fair-trade colored stones to accessible fashion pieces made with recycled silver or bio-based materials. Major applications include personal adornment, gifting (especially milestone events like engagements and anniversaries), and corporate purchasing focused on aligning brand image with Environmental, Social, and Governance (ESG) criteria. The fundamental benefit of sustainable jewelry is providing consumers with verifiable assurance that their purchase supports ethical labor practices and ecological preservation, directly addressing the growing demand for responsible luxury.

The market is defined by several key innovations and operational shifts, including the robust integration of blockchain technology to ensure end-to-end traceability of materials, from mine (or lab) to retail shelf. Driving factors include the influential purchasing power of Millennials and Generation Z, who consistently prioritize corporate social responsibility, and increasingly stringent global regulations related to material sourcing and labor rights. The stigma previously associated with alternatives like lab-grown stones is rapidly diminishing, with many consumers perceiving them as superior due to their guaranteed origin and minimal environmental footprint. This shift is compelling traditional jewelers to integrate sustainable collections alongside conventional offerings, thereby broadening market accessibility and accelerating overall growth. The industry is also seeing collaboration between NGOs, regulatory bodies, and major market players to harmonize global certification standards, further legitimizing the sustainable segment.

The product description highlights jewelry items where material acquisition, manufacturing, and distribution align with ecological stewardship and fair labor standards. This includes the use of metals derived from certified recycled sources, gemstones that are conflict-free and traceable, or those grown in controlled laboratory environments using renewable energy. Key benefits extend beyond ethical sourcing to encompass design innovation, with many sustainable brands pioneering modular designs, minimal packaging solutions, and take-back programs that facilitate a circular economy model. The primary driving force remains the pervasive transparency imperative; modern consumers require irrefutable proof of ethical conduct, which market leaders are providing through digital provenance documentation and third-party certifications like Fairtrade Gold or Responsible Jewellery Council (RJC) standards.

Sustainable Jewelry Market Executive Summary

The Sustainable Jewelry Market is experiencing vigorous expansion, primarily fueled by shifting consumer values favoring ethical consumption and strict corporate ESG mandates. Business trends indicate a significant consolidation of sustainable practices within mainstream luxury brands, moving beyond specialized niche retailers. Key trends include the accelerated adoption rate of lab-grown diamonds, which are achieving price parity and quality metrics competitive with mined stones, and the proliferation of sophisticated recycling programs for precious metals, maximizing resource efficiency. Regional trends show North America and Europe leading in revenue generation due to mature consumer awareness and robust regulatory frameworks promoting transparency. However, Asia Pacific is projected to register the highest CAGR, driven by rising disposable incomes, rapid urbanization, and increased domestic manufacturing capacity focused on sustainable processes, particularly in countries like India and China that are major jewelry production hubs.

Segment trends reveal that the Material segment is dominated by Recycled Precious Metals and Lab-Grown Diamonds, both commanding premium market share due to their clear sustainability benefits. Within Product Type, Rings and Necklaces remain the most popular categories, often being the focus for significant ethical purchases like engagement rings. Distribution channel analysis highlights the increasing importance of E-commerce platforms, which offer enhanced transparency tools (digital certificates, blockchain tracking) and direct-to-consumer models, reducing supply chain complexity and cost. Price point segmentation shows strong growth in the affordable luxury segment, making sustainable jewelry accessible to a broader consumer base than ever before, while the high-end luxury market continues to demand bespoke, fully traceable heirloom pieces. These integrated trends underscore a fundamental industry transformation toward verifiable ethical supply chains and circular economy principles.

The overall market trajectory confirms that sustainability is no longer an optional add-on but a critical determinant of brand viability and consumer loyalty. Businesses that invest heavily in material certification, carbon-neutral manufacturing, and digital traceability tools are capturing market share rapidly. The executive outlook suggests continued strong investment in technology, specifically to enhance supply chain auditing and consumer education, reinforcing the market’s integrity. Furthermore, regulatory harmonization efforts across major trading blocs are expected to simplify international commerce for certified sustainable products, lowering barriers to entry for smaller ethical producers and accelerating global market adoption. The successful navigation of high initial sourcing costs and complex certification processes will be crucial for sustained competitive advantage in this rapidly evolving ethical luxury landscape.

AI Impact Analysis on Sustainable Jewelry Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Sustainable Jewelry Market frequently center on its ability to enhance supply chain transparency, verify ethical sourcing claims, and personalize sustainable consumption. Users are highly interested in how AI can detect fraudulent certifications or materials, thereby increasing the trustworthiness of sustainable products. A significant thematic concern revolves around the deployment of AI in predicting consumer preferences for materials (e.g., preference shifts between recycled gold and fair-mined gold) and optimizing inventory to minimize production waste. Expectations are high for AI-driven platforms that can provide real-time, comprehensive environmental impact reports for individual jewelry pieces, allowing consumers to make highly informed purchasing decisions based on verified metrics rather than generalized claims. AI integration is viewed as essential for scaling up ethical practices without compromising efficiency or increasing operational complexity.

AI’s role is increasingly pivotal in automating the complex auditing of supply chains, which traditionally required intensive manual labor and were susceptible to human error. Machine learning algorithms analyze vast datasets encompassing sourcing locations, transportation logistics, energy consumption metrics, and labor compliance records to flag anomalies or discrepancies that may indicate unethical practices or environmental risks. This capability significantly elevates the integrity of 'sustainable' claims, moving the industry beyond self-reporting. Furthermore, predictive AI models are instrumental in forecasting material demand, enabling jewelers to adopt just-in-time inventory systems for specialized materials like recycled platinum or specific cuts of lab-grown diamonds. This reduction in excess stock directly supports the sustainable objective of minimizing resource waste across the manufacturing lifecycle.

In the consumer-facing domain, AI is revolutionizing personalized marketing and product development. AI tools analyze individual purchasing histories, expressed sustainability values, and aesthetic preferences to recommend products that meet both ethical criteria and design taste. This personalization drives higher conversion rates for sustainable lines. Moreover, generative AI is being explored for designing jewelry with optimized material usage, minimizing scrap generation during the prototyping and production phases. The deployment of AI-powered customer service chatbots equipped with deep knowledge of material provenance (linked to blockchain data) further enhances transparency, providing instantaneous and verifiable answers to consumer inquiries about ethical standards and environmental footprint, solidifying trust in the sustainable brand identity.

- AI-driven supply chain auditing and risk assessment for ethical sourcing verification.

- Predictive modeling for consumer sustainable material preference and trend forecasting.

- Optimization of production schedules and inventory levels to reduce material waste.

- Enhanced counterfeit detection through image recognition and data anomaly analysis.

- Personalized sustainable product recommendations and customized shopping experiences.

- Automation of real-time environmental impact reporting (carbon and water footprint).

- Use of generative AI for material-efficient jewelry design and prototyping.

- Deployment of AI-powered chatbots for instantaneous verification of product provenance and certifications.

DRO & Impact Forces Of Sustainable Jewelry Market

The Sustainable Jewelry Market is robustly propelled by consumer-led demand for ethical products and rigorous regulatory pressures for supply chain transparency (Drivers). Key impediments include the higher initial cost associated with certified sustainable sourcing and the existing lack of universally standardized global certification schemes, which can lead to consumer confusion and potential greenwashing (Restraints). However, significant long-term growth opportunities arise from the rapid technological advancements in lab-grown diamond production, the increasing viability of circular economy models utilizing consumer recycling programs, and expansion into emerging markets where environmental awareness is rapidly increasing (Opportunities). These dynamics collectively exert a powerful force, mandating fundamental shifts in traditional mining and manufacturing practices across the entire jewelry sector, prioritizing verifiability and social accountability as core operational pillars (Impact Forces).

Drivers include the demographic shift where younger consumers (Millennials and Gen Z) actively seek products aligned with their socio-political values, viewing sustainability as a non-negotiable factor. The societal impact of high-profile documentaries and reports exposing environmental damage and human rights abuses in conventional mining areas further strengthens the demand for ethical alternatives. Regulatory pressure, especially in the EU and North America, requiring due diligence reporting on mineral sourcing and conflict materials, directly encourages market players to adopt traceable, sustainable supply chains. These drivers create a positive feedback loop where increased demand justifies the higher investment required for ethical sourcing and certified production processes.

Restraints primarily revolve around economics and infrastructure. Certified sustainable materials, such as Fairtrade Gold, often command a price premium over conventionally sourced alternatives, creating price sensitivity among segments of the consumer base. Moreover, the fragmented nature of global certification—with multiple standards (e.g., RJC, Fair Trade, SCS Global Services)—can complicate compliance for international brands and lead to complexity in consumer messaging. Another challenge is ensuring the traceability of small-scale artisanal mining operations, which often struggle to meet the strict documentation and auditing requirements necessary for formal certification, potentially excluding ethical small producers from the premium market. Overcoming these restraints requires industry-wide collaboration on technological solutions like shared blockchain ledgers and subsidized certification for small enterprises.

Opportunities center on technological disruption and market diversification. The continuous improvement in the quality and size capabilities of lab-grown diamonds, coupled with falling production costs, opens vast avenues for mass-market adoption. Furthermore, the development of sophisticated closed-loop recycling programs for precious metals positions established brands as leaders in the circular economy, appealing to environmentally conscious consumers. Geographically, emerging economies represent significant untapped potential as economic development coincides with increased environmental consciousness. The final major opportunity lies in developing comprehensive digital platforms that integrate traceability data and consumer education, turning the sustainability journey into a verifiable, engaging narrative for the end-user, transforming ethical sourcing from a cost burden into a substantial marketing asset.

Segmentation Analysis

The Sustainable Jewelry Market is segmented based on the type of material utilized, the product category, the distribution channel employed, and the pricing structure. This rigorous segmentation helps analyze specific growth pockets and consumer behavioral patterns within the ethical luxury space. Material segmentation is critical, distinguishing between metals (recycled versus fair-mined) and gemstones (lab-grown versus certified ethical mined). Product categories allow market players to focus their sustainable strategy on high-demand items like engagement rings or fashion accessories. Analyzing distribution channels highlights the increasing dominance of online platforms which are ideally suited for conveying the complex transparency information required by the sustainable consumer. Price segmentation reflects the dual nature of the market, which caters both to accessible fashion and high-end ethical luxury, necessitating distinct production and marketing strategies for each tier.

- By Material:

- Recycled Precious Metals (Gold, Silver, Platinum)

- Fair Trade/Fair Mined Precious Metals

- Lab-Grown Diamonds

- Certified Ethical Mined Gemstones (Conflict-Free)

- Alternative Materials (Recycled Glass, Sustainable Wood, Bio-Resins)

- By Product Type:

- Rings (Engagement, Wedding, Fashion)

- Necklaces and Pendants

- Earrings

- Bracelets and Bangles

- Custom Jewelry

- By Distribution Channel:

- Online Retail (E-commerce Websites, Dedicated Brand Stores)

- Offline Retail (Specialty Jewelry Stores, Luxury Boutiques, Department Stores)

- By Price Point:

- Affordable Luxury (Mass Market, Under $500)

- Mid-Range ($500 - $5,000)

- High-End Luxury (Above $5,000)

Value Chain Analysis For Sustainable Jewelry Market

The Value Chain for Sustainable Jewelry emphasizes transparency and certification at every stage, drastically diverging from conventional jewelry supply chains, which often lack visibility in upstream sourcing. Upstream analysis focuses on securing certified raw materials: either through controlled, closed-loop recycling of precious metals, or the procurement of Fairtrade certified mined materials and traceable lab-grown stones. Robust auditing and verification via technologies like blockchain are essential here. Midstream activities involve ethical manufacturing, including minimizing energy and water usage, eliminating harmful chemicals, and ensuring fair labor practices in cutting, polishing, and setting. Downstream operations, covering distribution and retail, leverage digital channels (Direct and Indirect) to communicate the product's sustainability narrative and provide digital provenance certificates to the consumer, solidifying trust and justifying the often higher price point associated with ethical sourcing.

Upstream complexity is defined by the choice between recycled and newly extracted materials. For recycled materials, the analysis focuses on the integrity of the recycling process and separation from non-certified scrap. For newly mined materials, stringent criteria must be met, including environmental remediation plans, community development investment, and verified conflict-free status, often requiring certification from bodies such as the Responsible Jewellery Council (RJC) or Fairtrade International. This early stage verification is the most resource-intensive step, but it forms the foundation of the product's sustainable claim. Manufacturers must also invest in green energy sources and waste reduction technologies to maintain ethical standards during refinement and alloy production.

Midstream processing involves specialized techniques like 3D printing for rapid prototyping and mass customization, which inherently reduce material waste. Quality control is linked not just to aesthetic finish but also to the ethical compliance of the entire workforce. Downstream channels are strategically crucial for communicating the sustainable value proposition. Direct distribution via dedicated brand e-commerce sites allows maximum control over messaging and provides the ideal platform for blockchain-enabled traceability tools, offering consumers interactive access to their product’s journey. Indirect channels, such as luxury department stores or certified multi-brand retailers, require strong partnership agreements that mandate adherence to transparent reporting standards, ensuring that the sustainable message is accurately and convincingly relayed to the end-buyer.

Sustainable Jewelry Market Potential Customers

The primary target demographic for the Sustainable Jewelry Market consists of socially conscious consumers, particularly Millennials (age 30–45) and Generation Z (age 18–29), who prioritize ethical consumption and verifiable transparency over traditional brand heritage alone. These individuals, often digitally native, actively seek out brands that align with their Environmental, Social, and Governance (ESG) values, and they are willing to pay a premium for certified ethical and traceable products. Key end-users also include high-net-worth individuals who demand bespoke, sustainable luxury items, viewing ethical sourcing as the new benchmark of exclusivity and responsible wealth. Additionally, the corporate sector represents a growing segment, utilizing sustainable jewelry for high-profile gifting and awards programs to demonstrate commitment to corporate responsibility and sustainable procurement policies.

Millennial and Gen Z consumers, driven by social media trends and peer influence, frequently use purchasing as a form of activism. They are highly educated about issues such as blood diamonds, environmental degradation from mining, and labor exploitation. Their purchasing behavior is therefore heavily influenced by third-party certification logos, digital traceability tools (like QR codes leading to blockchain records), and strong, authentic brand storytelling regarding material provenance. They are the primary buyers of lab-grown diamonds and recycled gold fashion pieces, demanding affordability without compromising their ethical stance. This segment is highly responsive to marketing campaigns that emphasize the jewelry's minimal carbon footprint or its direct contribution to miner welfare funds.

The secondary, yet highly lucrative, customer base includes older generations who are increasingly adopting ethical practices, particularly for significant, emotionally resonant purchases such as engagement rings. These buyers seek the reassurance that their investment is ethically sound and conflict-free, often favoring certified Fairtrade Gold or high-quality lab-grown alternatives. Furthermore, the rising demand for ESG compliance means corporate buyers across various industries are replacing traditional, non-certified gifts with sustainable alternatives, aligning their external communications with verifiable ethical sourcing. These corporate customers value clear, concise reporting on the sustainable credentials of the product and require bulk purchasing options that meet high standards of environmental stewardship and social equity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $15.5 Billion USD |

| Market Forecast in 2033 | $28.7 Billion USD |

| Growth Rate | 9.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tiffany & Co., Pandora, Brilliant Earth, Mejuri, Catbird, Bario Neal, Vrai, Taylor & Hart, AUrate New York, Soko, Monica Vinader, Chopard, Anna Sheffield, Arabel Lebrusan, Wwake, John Hardy, James Allen, Cartier, Stella McCartney Jewellery, recycled materials pioneers. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sustainable Jewelry Market Key Technology Landscape

The technology landscape for Sustainable Jewelry is characterized by innovations that enhance traceability, reduce manufacturing waste, and provide alternative material production methods. Blockchain technology is arguably the most critical development, providing an immutable ledger for tracking the provenance of every component—from the source of the metal or gemstone to the final retail transaction. This addresses the core consumer demand for transparency and mitigates the risk of counterfeit ethical claims. Concurrently, advanced manufacturing technologies, particularly 3D printing (Additive Manufacturing), enable brands to produce intricate designs with minimal material scrap, optimizing precious metal usage and reducing the overall environmental footprint of production. These technologies move the industry towards a digital, verifiable, and highly efficient manufacturing ecosystem.

Beyond traceability and manufacturing efficiency, significant technological advancements focus on material science. Chemical Vapor Deposition (CVD) and High-Pressure/High-Temperature (HPHT) methods for producing lab-grown diamonds have reached industrial scale, yielding high-quality, Type IIa stones that are chemically and physically identical to mined diamonds, but with a significantly lower and traceable carbon footprint. Furthermore, Artificial Intelligence (AI) and Machine Learning (ML) are being deployed for supply chain monitoring, analyzing satellite imagery and sensor data to detect illegal or environmentally harmful mining activities, thus strengthening the auditing process for certified ethical mined materials. This technological convergence ensures that sustainability claims are scientifically validated and transparently communicated to the market.

The integration of digital certification tools is also transforming retail processes. Instead of relying on physical paper certificates, sustainable jewelry brands increasingly offer digital certificates of authenticity and ethical sourcing, often embedded with non-fungible tokens (NFTs) or tied directly to blockchain records. This not only enhances security and prevents fraud but also allows consumers to easily verify the entire history of their purchase. Technologies supporting the circular economy, such as advanced spectroscopic analysis used for rapidly identifying and sorting different grades of recycled metals, are essential for maintaining the high quality and purity required for luxury jewelry production. This comprehensive technological toolkit supports the industry's shift towards verifiable, low-impact, and ethical business models, securing long-term market growth.

Regional Highlights

- North America (United States and Canada): This region dominates the Sustainable Jewelry Market in terms of early adoption and revenue contribution, driven by high consumer awareness, significant disposable income, and strong ethical purchasing power among Millennials and Gen Z. The US market is characterized by robust brand initiatives focusing on lab-grown diamonds and recycled gold. Regulatory bodies, coupled with influential NGOs, push for stringent supply chain transparency, particularly impacting high-value luxury purchases such as engagement rings. North America serves as a key innovator for e-commerce platforms and digital traceability solutions, setting benchmarks for consumer engagement in sustainable narratives.

- Europe (Germany, UK, France): Europe is defined by some of the world's most rigorous environmental and social regulations, heavily favoring certified materials like Fairtrade Gold. Consumer demand is deeply rooted in long-standing ethical and environmental movements, resulting in a preference for small, artisanal ethical brands alongside large luxury houses that meet high EU standards. Countries like the UK and Germany are leaders in developing circular economy models, encouraging jewelers to implement sophisticated metal recycling and take-back programs. The EU's mandatory due diligence legislation regarding conflict minerals significantly accelerates the shift toward fully traceable supply chains.

- Asia Pacific (APAC) (China, India, Japan): APAC represents the fastest-growing market region due to rapid economic development, a burgeoning middle class, and increasing urbanization leading to greater exposure to global sustainability trends. While historically a major manufacturing hub, the region is now quickly transitioning into a significant consumer market for sustainable products. Demand in markets like China and Japan is high for high-quality, certified lab-grown diamonds, valued for their purity and modern appeal. India, a traditional jewelry powerhouse, is increasingly integrating sustainable practices into its vast production sector to meet international export requirements and growing domestic ethical consumer interest.

- Latin America (LATAM): This region, rich in natural resources, faces unique challenges related to artisanal small-scale mining (ASM) and regulatory control. The sustainable market focuses heavily on ensuring fair compensation, safety, and environmental protection within ASM communities. Market growth is driven by international partnerships aimed at formalizing the mining sector and promoting Fair Mined certification standards. Consumer bases, particularly in urban centers like Brazil and Mexico, are slowly increasing their demand for ethically sourced local materials.

- Middle East and Africa (MEA): The MEA region is crucial due to its role as a key source of precious metals and stones. Market opportunities center on developing verifiable, ethical mining standards (especially in diamond-producing nations) to attract investment and comply with global transparency requirements. Consumer demand for sustainable jewelry is nascent but growing in high-income Gulf countries, reflecting a luxury segment that is slowly integrating ESG considerations into purchasing decisions, often favoring international brands with established sustainability credentials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sustainable Jewelry Market.- Brilliant Earth

- Pandora A/S (Focusing on recycled silver and lab-grown diamonds)

- Tiffany & Co. (Commitment to traceability and conflict-free sourcing)

- Chopard Group

- Mejuri

- Vrai

- Catbird

- Bario Neal

- Taylor & Hart

- AUrate New York

- Soko

- Monica Vinader

- Anna Sheffield

- Arabel Lebrusan

- Wwake

- John Hardy (Focus on artisanal craftsmanship and sustainability)

- James Allen (Prominent retailer of lab-grown diamonds)

- Cartier (Adopting sustainable materials and practices)

- Kinraden

- Pippa Small Jewellery (Focus on ethical production in developing nations)

Frequently Asked Questions

Analyze common user questions about the Sustainable Jewelry market and generate a concise list of summarized FAQs reflecting key topics and concerns.What defines Sustainable Jewelry beyond 'conflict-free' materials?

Sustainable jewelry encompasses a holistic approach to ethical production, focusing not only on conflict-free sourcing but also on minimal environmental impact, ethical labor practices, responsible use of water and energy, and traceability (often verified by blockchain). Key criteria include the use of recycled precious metals and lab-grown diamonds, and certification by third-party bodies like the Responsible Jewellery Council (RJC) or Fairtrade International.

Are lab-grown diamonds considered sustainable, and how do they compare to natural diamonds?

Yes, lab-grown diamonds are widely considered a sustainable alternative because their production eliminates the environmental and social consequences associated with mining, offering guaranteed conflict-free origins. They are chemically, physically, and aesthetically identical to natural diamonds. Sustainability comparison depends on the energy source used; stones grown using renewable energy have a significantly lower carbon footprint than most mined diamonds, providing a verifiable ethical advantage.

Why is supply chain transparency and traceability crucial in the Sustainable Jewelry Market?

Transparency is crucial because it provides verifiable proof of ethical claims, combatting greenwashing and building consumer trust. Traceability, often achieved through blockchain technology, allows consumers to track the journey of the materials (metal and stone) from their source to the final product. This level of verification ensures adherence to fair labor standards, environmental protection, and conflict-free sourcing requirements, fulfilling the core promise of sustainable luxury.

Is sustainable jewelry more expensive than traditional jewelry?

Sustainable jewelry can sometimes carry a small price premium due to the higher auditing costs, investment in certified materials (like Fairtrade Gold), and advanced, waste-reducing manufacturing technologies. However, the cost is increasingly competitive, especially with the mass-market adoption of lab-grown diamonds. Recycled metal jewelry often aligns closely with, or is comparable to, conventional pricing, balancing the ethical premium with efficient sourcing.

Which regions are leading the demand and production of sustainable jewelry?

North America and Europe currently lead the demand in terms of revenue and consumer awareness, driven by high ethical purchasing power and stringent regulatory frameworks. In terms of production, while manufacturing historically centered in Asia Pacific (APAC), this region is rapidly adopting sustainable processes and is projected to exhibit the highest CAGR as it transitions its production capabilities to meet global ethical standards and growing domestic demand for traceable, low-impact jewelry.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager