Sustainable Supply Chain Finance Assessment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434153 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Sustainable Supply Chain Finance Assessment Market Size

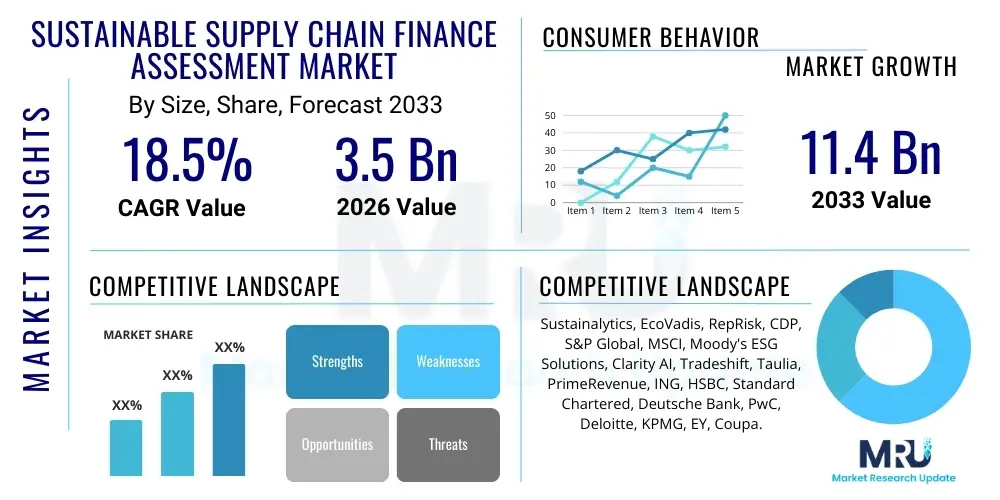

The Sustainable Supply Chain Finance Assessment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 11.4 Billion by the end of the forecast period in 2033.

Sustainable Supply Chain Finance Assessment Market introduction

The Sustainable Supply Chain Finance Assessment Market encompasses technology and service solutions designed to evaluate, monitor, and finance the environmental, social, and governance (ESG) performance of suppliers within a corporate value chain. This market is fundamentally driven by the rising imperative for corporations to demonstrate accountability beyond tier-one suppliers, integrating sustainability metrics directly into financing mechanisms such as reverse factoring, dynamic discounting, and supply chain loans. The core product offering includes advanced software platforms that automate data collection, verification, risk scoring, and reporting on key sustainability indicators, enabling financial institutions and buying organizations to link favorable financing terms to verifiable improvements in supplier ESG performance, thereby creating a financial incentive for sustainable practices.

Major applications of these assessment tools include regulatory compliance tracking, mitigating supply chain disruption risks associated with climate change or labor practices, and enhancing brand reputation through transparent reporting. These platforms utilize complex algorithms and data analytics to standardize non-financial data, often leveraging big data sets, satellite imagery, and localized environmental impact reports to provide a holistic view of supplier sustainability. The primary benefit derived is the creation of resilient, ethical, and resource-efficient supply chains, ensuring long-term operational stability and adherence to increasingly stringent global ESG mandates, such as the EU’s Corporate Sustainability Due Diligence Directive (CSDDD).

The market is experiencing exponential growth, primarily driven by mandatory sustainability reporting requirements globally and the shift in investor preference towards ESG-aligned assets. Furthermore, the high cost of capital for small and medium-sized enterprises (SMEs) can be significantly lowered through sustainable supply chain finance (SSCF) programs, providing a tangible financial incentive that acts as a major market accelerator. The integration of advanced analytics, artificial intelligence (AI), and blockchain technology is continually refining the accuracy and integrity of these assessments, solidifying their role as indispensable tools for modern corporate finance and procurement departments seeking to institutionalize sustainability.

Sustainable Supply Chain Finance Assessment Market Executive Summary

The Sustainable Supply Chain Finance Assessment Market is characterized by robust growth, fueled by convergent trends across business operations, regulatory landscapes, and investor expectations. Business trends show a strong shift from purely transactional supply chain finance models to relationship-based, sustainable models, where access to capital is conditional on demonstrable ESG improvements. This shift is generating high demand for integrated software platforms that combine financial data, risk analytics, and ESG performance scoring into a single decision-making framework. The proliferation of voluntary and mandatory disclosures, such as those governed by the Task Force on Climate-related Financial Disclosures (TCFD) and impending Sectoral Reporting Standards, compels large enterprises to deploy comprehensive assessment solutions across their entire vendor ecosystem, driving significant expenditure in the Services segment, particularly consulting and implementation support.

Regionally, Europe maintains its leadership position, driven by pioneering regulatory frameworks like the CSDDD and the Sustainable Finance Disclosure Regulation (SFDR), which impose stringent due diligence requirements on companies operating within the EU. North America is rapidly catching up, pushed by strong institutional investor activism and stakeholder pressure, especially concerning climate change and social equity metrics. Asia Pacific (APAC) represents the fastest-growing market, propelled by rapid industrialization, increasing awareness of environmental degradation, and the necessity for global exporters in countries like China and India to comply with the sustainability standards set by their Western buyers. Investment in localized data collection and assessment tools specifically tailored for complex, multi-tiered supply chains is a key regional trend.

Segment trends indicate that the Services component (including consulting, implementation, and managed services) currently holds the dominant market share, reflecting the complexity of integrating ESG data sources and harmonizing standards across diverse supply chain participants. However, the Software segment, particularly cloud-based SaaS solutions, is projected to exhibit the highest CAGR, driven by the need for scalability, real-time data monitoring, and interoperability with existing enterprise resource planning (ERP) and procurement systems. Large Enterprises remain the primary clientele, given their extensive supply chain networks and high regulatory visibility, but the increasing availability of modular, affordable cloud solutions is opening significant opportunities within the Small and Medium-sized Enterprises (SMEs) segment, particularly those embedded in large sustainable supply chains.

AI Impact Analysis on Sustainable Supply Chain Finance Assessment Market

User questions frequently revolve around how Artificial Intelligence (AI) can move sustainable supply chain assessment beyond simple compliance checks into predictive risk modeling and automated validation. Key themes focus on AI's ability to handle the sheer volume and unstructured nature of ESG data, ensuring its integrity, and detecting potential instances of greenwashing or misreporting faster than traditional methods. Users are highly interested in AI-driven tools that can assess complex, multi-tier supply chains where visibility is traditionally low, querying whether AI can leverage alternative data sources (e.g., satellite imagery, social media chatter, news reports) to provide near real-time sustainability scoring. The overriding expectation is that AI will democratize sophisticated ESG assessment, making it accessible and cost-effective for smaller financial institutions and procurement departments, ultimately standardizing verifiable sustainability performance across global trade flows.

AI significantly enhances the efficiency and accuracy of sustainable supply chain assessments by automating the collection, processing, and normalization of diverse, unstructured data points spanning environmental performance, labor practices, and corporate governance. Machine Learning (ML) algorithms are crucial for identifying patterns indicative of high sustainability risk, such as sudden shifts in water usage or documented labor violations, enabling preemptive intervention and precise risk prioritization for both financiers and buyers. Furthermore, AI-powered natural language processing (NLP) is increasingly used to analyze vast quantities of qualitative data, including supplier codes of conduct, policy documents, and regulatory filings, automatically extracting relevant ESG commitments and validating these against reported metrics, substantially reducing the manual effort required in due diligence processes.

The application of predictive analytics, a core capability of advanced AI models, allows market participants to forecast future sustainability performance based on current trends and external environmental factors, moving the assessment process from reactive reporting to proactive risk management. For instance, AI models can predict which suppliers are most likely to violate carbon emission targets or face material shortages due to climate transition risks, allowing financial terms to be adjusted accordingly. This integration not only improves the robustness of the assessment but also creates dynamic pricing mechanisms within supply chain finance, where interest rates or discounts are automatically linked to real-time, verified sustainability scores, fully embedding the 'sustainable' element into the financing structure.

- AI facilitates automated data ingestion and standardization from disparate global sources.

- Machine Learning models enable predictive risk forecasting for environmental and social compliance failures.

- Natural Language Processing (NLP) speeds up the analysis of unstructured legal and policy documents for due diligence.

- Computer Vision analyzes satellite imagery and geospatial data to verify physical environmental compliance (e.g., deforestation, pollution monitoring).

- AI enhances anti-greenwashing measures by cross-referencing public statements with verifiable performance data.

- Algorithmic scoring models enable dynamic pricing mechanisms in SCF based on real-time ESG metrics.

DRO & Impact Forces Of Sustainable Supply Chain Finance Assessment Market

The Sustainable Supply Chain Finance Assessment Market is profoundly influenced by a complex interplay of Drivers (D), Restraints (R), and Opportunities (O), creating significant Impact Forces. Key drivers include accelerating mandatory ESG regulations globally and pervasive investor pressure demanding verifiable non-financial performance data. Conversely, the market faces strong restraints primarily related to the complexity of data standardization across highly diverse and often opaque global supply chains, coupled with the high initial implementation costs for integrated software solutions. However, emerging opportunities, particularly the technological advancement in AI and blockchain for enhanced data verification, combined with substantial unmet demand in developing economies, are expected to mitigate these restraints and sustain rapid market expansion.

The impact forces driving growth are primarily regulatory compliance and risk mitigation. Regulatory drivers, such as the EU’s emphasis on corporate responsibility across the value chain, fundamentally transform the assessment process from optional best practice to mandatory legal requirement, compelling companies to invest heavily in robust assessment mechanisms. Simultaneously, the financial risk associated with environmental liabilities, reputational damage from labor abuses, and operational disruptions due to climate instability have galvanized corporate treasuries and procurement teams to adopt SSCF assessment tools as essential risk management instruments. This dual pressure—legal requirement and financial necessity—ensures sustained demand regardless of immediate economic fluctuations.

Restraining factors center on technical and organizational hurdles. Many smaller suppliers lack the resources or expertise to accurately measure and report their ESG data, leading to significant data gaps and quality issues that challenge the efficacy of any assessment framework. Furthermore, integrating new assessment platforms with legacy Enterprise Resource Planning (ERP) and existing treasury management systems can be costly and time-consuming, creating barriers to rapid adoption, particularly for companies operating on thin margins. The market must continuously address the need for user-friendly, interoperable solutions and standardized data taxonomies to overcome these technical restraints and ensure equitable participation across the supply chain tiers.

Segmentation Analysis

The Sustainable Supply Chain Finance Assessment Market is segmented based on the type of offering, deployment model, organizational scale, and core application, reflecting the diverse needs of both the financing and procurement ecosystems. The primary segmentation distinguishes between Software platforms, which provide the automated infrastructure for assessment and scoring, and Services, which encompass the crucial consulting, integration, and managed support required for effective implementation and continuous verification. Market performance is highly dependent on the synergy between these components, with sophisticated software demanding expert services for successful deployment in complex multinational environments, thereby ensuring comprehensive coverage across varied regulatory and logistical requirements inherent in global supply chains.

Further granularity is achieved through deployment and enterprise size segmentation. The Cloud segment dominates deployment due to its scalability, lower operational expenditure, and real-time accessibility, which are critical for monitoring dynamic supply chain data globally. Large Enterprises constitute the largest revenue source, driven by their extensive supplier base and heightened public and regulatory scrutiny, making them the first adopters of comprehensive, integrated solutions. However, the fastest growth is anticipated in specialized applications like ESG Scoring and Compliance Management, as these directly address the most pressing current market needs for verifiable data to meet internal reporting standards and external regulatory mandates.

- By Component

- Software (Platform solutions, API integration, Analytics tools)

- Services (Consulting, Implementation, Managed Services, Data Verification)

- By Deployment Model

- Cloud-based (SaaS)

- On-premise

- By Enterprise Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

- By Application

- ESG Scoring and Benchmarking

- Risk Assessment and Mitigation

- Compliance Management and Auditing

- Supplier Onboarding and Monitoring

Value Chain Analysis For Sustainable Supply Chain Finance Assessment Market

The value chain for Sustainable Supply Chain Finance Assessment begins with upstream data providers and technology developers, followed by assessment solution providers, and culminates in downstream users—the financial institutions and large buying organizations—that deploy the solution to their suppliers. Upstream analysis focuses on the input sources: raw ESG data originating from suppliers, complemented by technical data from third-party environmental monitoring agencies, satellite imagery firms, and regulatory databases. Key players in this initial stage are data aggregators and specialized ESG rating agencies, which validate and structure the disparate information, feeding it into the core assessment platforms.

The core value creation stage involves the assessment solution providers (the market players). They convert validated data into actionable insights, providing proprietary risk models, scoring algorithms, and user-friendly dashboards. This stage includes heavy investment in software development, particularly integrating AI and robust data security protocols (crucial for handling sensitive financial and performance data). Distribution channels are predominantly indirect, relying heavily on partnerships. Solutions are often channeled through global financial institutions (GFIs) like major commercial banks, which embed the assessment criteria into their financing products, or through large consulting firms that implement the software as part of broader digital transformation and sustainability compliance projects for major corporate clients.

Downstream analysis centers on the application and adoption by end-users. Large corporations utilize these platforms to monitor compliance, determine payment terms, and manage risk across their procurement spend. Financial institutions use the resulting scores to differentiate lending rates, manage portfolio risk, and comply with sustainable finance disclosure requirements. The effectiveness of the solution relies heavily on the 'stickiness' achieved downstream—the adoption rate by suppliers, often incentivized by the promise of cheaper capital (sustainable financing). The continuous feedback loop, where supplier performance updates feed back into the assessment algorithm, ensures the ongoing relevance and accuracy of the system, driving recurring service revenue.

Sustainable Supply Chain Finance Assessment Market Potential Customers

The primary customers for Sustainable Supply Chain Finance Assessment solutions are multinational corporations (MNCs) that have complex, global supply chains, and the financial institutions that service them. MNCs act as the buying organizations, compelled by regulation, shareholder activism, and consumer pressure to ensure their entire value chain meets stringent sustainability standards. These companies are the direct purchasers of assessment platforms and consulting services, using them to evaluate thousands of suppliers, particularly those in high-risk sectors such as textiles, electronics, automotive, and fast-moving consumer goods (FMCG), where environmental and social impacts are highly scrutinized.

Financial institutions, including commercial banks, investment banks, and development banks, constitute the second major customer group. They integrate assessment criteria directly into their sustainable supply chain finance offerings, using the resultant scores to price credit risk and allocate capital preferentially towards high-performing sustainable suppliers. For banks, these solutions are essential for managing transition risk in their loan portfolios and for meeting their own mandatory reporting requirements related to financed emissions (Scope 3 reporting). They leverage these platforms to automate due diligence and scale their green financing initiatives across their corporate client base.

Furthermore, specialized non-banking financial companies (NBFCs) and institutional investors increasingly rely on the data generated by these assessment tools. Institutional investors utilize the verified supplier performance data to assess the operational and reputational risk exposure of the companies they invest in, driving demand for data aggregators that leverage these core assessment outputs. Ultimately, any organization participating in a sustainable lending ecosystem—from the initial buyer to the end supplier seeking preferential terms—is a potential stakeholder benefiting from the transparency and standardization offered by these market solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 11.4 Billion |

| Growth Rate | CAGR 18.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sustainalytics, EcoVadis, RepRisk, CDP, S&P Global, MSCI, Moody's ESG Solutions, Clarity AI, Tradeshift, Taulia, PrimeRevenue, ING, HSBC, Standard Chartered, Deutsche Bank, PwC, Deloitte, KPMG, EY, Coupa. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sustainable Supply Chain Finance Assessment Market Key Technology Landscape

The technology landscape for Sustainable Supply Chain Finance Assessment is defined by the necessity for robust data handling, complex scoring, and secure transaction verification. The foundational technology involves cloud-based Software as a Service (SaaS) platforms, which offer the necessary scalability to manage thousands of supplier profiles and real-time monitoring capabilities across global supply chains. These platforms leverage APIs (Application Programming Interfaces) extensively to integrate seamlessly with existing financial systems (e.g., enterprise resource planning and accounts payable software) and third-party data providers, ensuring continuous data flow and reducing implementation friction for buyers and financiers.

Central to advanced assessment is the utilization of Artificial Intelligence (AI) and Machine Learning (ML). AI algorithms are deployed for sophisticated data validation, outlier detection (identifying anomalous ESG reporting), and automating the translation of unstructured compliance documentation into quantifiable metrics. Furthermore, ML models are crucial for developing proprietary predictive risk scores, allowing institutions to forecast potential social or environmental incidents based on historical performance and external indicators, thereby enhancing the preventive capabilities of the assessment mechanism and providing a competitive advantage in risk pricing.

Blockchain technology is emerging as a critical component, primarily addressing the market's need for immutable data records and enhanced supply chain traceability. By securely logging verified ESG milestones and associated financial transactions on a distributed ledger, blockchain guarantees the integrity of the reported data, effectively combating greenwashing and establishing verifiable provenance for sustainable products. This integration allows for 'smart contracts' within the finance component, where pre-agreed financial incentives are automatically triggered upon the successful, verifiable achievement of sustainability targets, linking finance and performance inextricably.

Regional Highlights

- Europe: Europe is the dominant market leader, largely due to its proactive and comprehensive regulatory environment. Regulations such as the Corporate Sustainability Reporting Directive (CSRD) and the Corporate Sustainability Due Diligence Directive (CSDDD) mandate detailed reporting and accountability across the entire value chain, forcing large European corporations to invest heavily in advanced assessment platforms. The region benefits from highly sophisticated financial institutions that are rapidly embedding ESG criteria into their core lending and supply chain finance products, establishing the continent as the benchmark for sustainable finance practices. The strong focus on decarbonization and social compliance ensures continued market buoyancy.

- North America: The North American market is characterized by robust growth, primarily driven by institutional investor mandates and corporate voluntary commitments rather than broad federal regulation. Powerful shareholder groups and asset managers demand transparent, verifiable ESG data to inform capital allocation, making assessment tools essential for US and Canadian listed companies. While regulatory frameworks are fragmented, state-level initiatives and SEC proposals are pushing greater standardization, leading to rapid adoption of software solutions, particularly in technology, finance, and industrial sectors. The market sees significant demand for AI-driven risk models tailored to specific regional climate change vulnerabilities.

- Asia Pacific (APAC): APAC is the fastest-growing region, representing a massive opportunity due to its status as the world’s manufacturing hub and the increasing awareness of climate risk exposure (e.g., severe weather impacting operations). Growth is propelled by the need for local suppliers to comply with the sustainability requirements of their major buyers in Europe and North America. Governments in countries like Singapore, Japan, and Australia are actively promoting sustainable finance initiatives. The challenge in APAC lies in the vast fragmentation and complexity of supply chains, necessitating tailored, localized data collection and assessment services, thereby driving high demand for consulting and managed services components.

- Latin America (LATAM): The LATAM market is emerging, driven by high environmental biodiversity risk and increasing global scrutiny of resource extraction and agricultural practices. Assessment adoption is concentrated in sectors like mining, agriculture, and renewable energy. The focus is often on social governance, anti-corruption, and environmental impact mitigation. Market growth is supported by development banks and regional financial institutions that leverage assessment tools to de-risk investments in infrastructure and critical resource sectors.

- Middle East and Africa (MEA): The MEA market shows selective growth, often linked to major national sustainability visions (e.g., Saudi Vision 2030) and large infrastructure projects. In the Middle East, investment is focused on diversifying economies and meeting global clean energy standards, driving demand for assessment tools in finance and construction. In Africa, the focus is critical in managing risks related to conflict minerals, labor standards, and ensuring compliance for commodity exports, often utilizing international assessment frameworks dictated by European buyers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sustainable Supply Chain Finance Assessment Market.- Sustainalytics (Morningstar)

- EcoVadis

- RepRisk

- CDP (Carbon Disclosure Project)

- S&P Global (Trucost)

- MSCI ESG Research

- Moody's ESG Solutions

- Clarity AI

- Tradeshift

- Taulia

- PrimeRevenue

- ING Groep N.V.

- HSBC Holdings plc

- Standard Chartered PLC

- Deutsche Bank AG

- PwC (PricewaterhouseCoopers)

- Deloitte Touche Tohmatsu Limited

- KPMG International Limited

- Ernst & Young Global Limited (EY)

- Coupa Software (Supply Chain Finance solutions)

Frequently Asked Questions

Analyze common user questions about the Sustainable Supply Chain Finance Assessment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Sustainable Supply Chain Finance Assessment (SSCF Assessment)?

SSCF Assessment is the process of evaluating the environmental, social, and governance (ESG) performance of suppliers and linking the resulting scores to the terms of supply chain finance (SCF) instruments, such as offering better payment terms or lower financing costs to high-performing sustainable suppliers.

How does AI improve the accuracy of ESG data assessment?

AI utilizes Machine Learning and Natural Language Processing (NLP) to automate the collection and verification of massive, unstructured data sets, identify reporting anomalies, and cross-reference supplier claims against external data sources (like satellite imagery or news), substantially increasing data integrity and reducing manual effort.

Which regulatory frameworks are primarily driving market growth?

Key drivers include the European Union’s Corporate Sustainability Due Diligence Directive (CSDDD), the Corporate Sustainability Reporting Directive (CSRD), and global frameworks like the Task Force on Climate-related Financial Disclosures (TCFD), which mandate accountability and transparency across the value chain.

What role does blockchain play in SSCF assessment solutions?

Blockchain provides an immutable, transparent ledger for tracking verified sustainability milestones and associated financial transactions, ensuring data integrity, combating greenwashing, and enabling automated triggering of financial incentives via smart contracts when sustainability targets are met.

Are these assessment tools affordable for Small and Medium-sized Enterprises (SMEs)?

Yes, the shift towards cloud-based (SaaS) and modular assessment solutions is making these tools increasingly accessible and cost-effective for SMEs, particularly when their participation is incentivized by large buying organizations offering preferential financing rates based on compliance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager