SVoD Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432953 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

SVoD Market Size

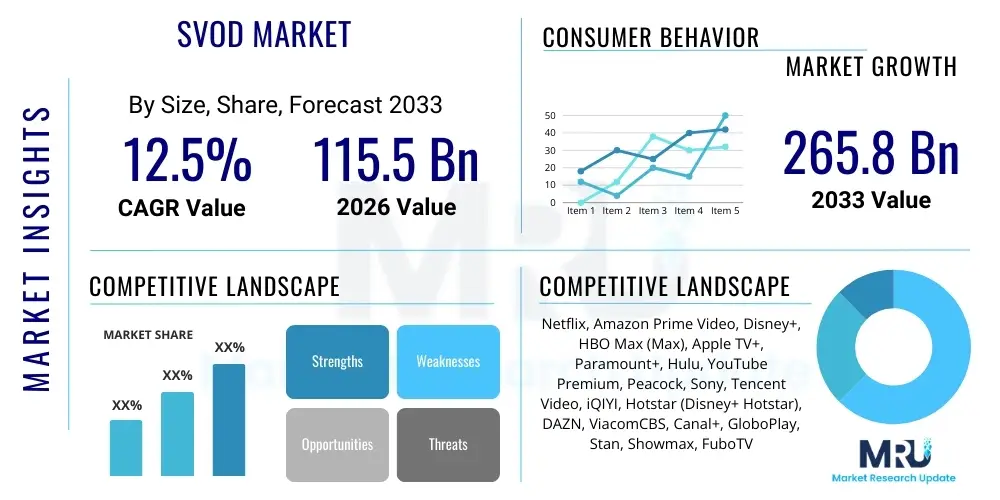

The SVoD Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 115.5 Billion in 2026 and is projected to reach USD 265.8 Billion by the end of the forecast period in 2033.

SVoD Market introduction

The Subscription Video on Demand (SVoD) market encompasses platforms that offer unlimited access to a library of video content for a recurring subscription fee. These services provide consumers with non-linear, ad-free or ad-light viewing experiences, fundamentally disrupting traditional broadcasting models. The core product involves high-quality streaming capabilities delivered across a wide range of internet-connected devices, featuring extensive libraries comprising licensed third-party content, original programming, and, increasingly, live events and news. Major applications of SVoD services are primarily centered around personal entertainment, providing flexibility and control over what, when, and where content is consumed.

Key benefits driving the rapid adoption of SVoD include unparalleled content selection diversity, the convenience of on-demand accessibility, and cost-effectiveness compared to large cable packages. Furthermore, SVoD platforms heavily invest in personalized recommendation systems and proprietary, high-budget original content, which serves as a powerful differentiator and customer retention tool. These services effectively cater to niche interests while also producing universally appealing blockbuster series and films, expanding their total addressable market globally.

The market is currently being driven by several macro-level factors, including the exponential increase in global broadband penetration and the proliferation of smart devices (Smart TVs, smartphones). Additionally, changing consumer habits, particularly among younger demographics who prioritize flexible viewing schedules, are accelerating the migration from linear television to streaming alternatives. The intense competition among major providers forces continuous innovation in user experience, content quality (4K, HDR), and localized content strategies, further stimulating overall market growth and consumer engagement. This dynamic environment ensures sustained investment in content creation and technological infrastructure.

SVoD Market Executive Summary

The SVoD market is characterized by robust growth, driven by an escalating global shift toward digital entertainment consumption and aggressive investment in content exclusivity. Current business trends indicate a critical movement away from pure subscription models towards hybrid pricing structures, incorporating Advertising-Video-on-Demand (AVoD) tiers to broaden market accessibility and combat subscription fatigue. Major market players are prioritizing global expansion, focusing specifically on scaling up localized content libraries and forming strategic regional partnerships to navigate complex regulatory environments and cultural preferences. The underlying economic dynamic is shifting toward prioritizing profitability and subscriber efficiency over sheer volume growth, necessitating rigorous churn reduction strategies and careful capital expenditure management, particularly concerning content production costs.

Regionally, North America remains the most mature and revenue-dominant market, yet the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, fueled by massive, untapped populations, improving digital infrastructure (5G deployment), and a strong appetite for mobile-first content delivery. European markets exhibit maturity but face high fragmentation due to language barriers and varied local content requirements, pushing global players to acquire or partner with established local streaming services. Emerging markets in Latin America (LATAM) and the Middle East and Africa (MEA) are critical future growth zones, heavily influenced by mobile penetration rates and affordable, scaled-down subscription plans tailored to localized economic conditions.

Segmentation analysis reveals that the Original Programming segment within content type drives significant long-term value, serving as the primary lever for subscriber acquisition and retention, thereby justifying massive content expenditure. The shift toward Ad-Supported (Hybrid) models is poised to be the fastest-growing segment in terms of revenue growth, providing diversified monetization streams and offsetting rising content licensing costs. Furthermore, the use of Smart TVs and smartphones remains the most critical access device category, emphasizing the need for cross-platform optimization and robust delivery infrastructure to ensure quality of service across diverse network conditions.

AI Impact Analysis on SVoD Market

Common user questions regarding AI's influence on the SVoD market center heavily on personalized content discovery, the ethics and effectiveness of algorithmic curation, and how AI can optimize content production costs and quality. Users are particularly keen to understand if AI will lead to "echo chambers" in recommendations or if it will genuinely improve the viewing experience by surfacing highly relevant, niche content. There are also frequent inquiries about AI's role in fraud detection, improving streaming quality (adaptive bitrate), and generating localized subtitles or dubbing rapidly. The consensus indicates high expectation for AI to fundamentally transform both the back-end operations (efficiency, infrastructure management) and the consumer-facing interface (recommendations, dynamic pricing), ultimately enhancing market profitability and user satisfaction through hyper-personalization and operational efficiencies.

The deployment of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is fundamentally reshaping the competitive landscape of the SVoD industry, moving beyond simple collaborative filtering to predictive analytics. AI is now crucial for optimizing the entire content lifecycle, from ideation and greenlighting new projects based on predicted audience success metrics to refining post-production processes like automated quality control and metadata tagging. This technological integration allows platforms to minimize risk associated with high-budget content creation by aligning production decisions with detailed behavioral and demographic data, ensuring higher return on investment (ROI) and strategic content portfolio development.

Furthermore, AI significantly enhances the end-user experience through highly sophisticated recommendation engines that learn individual viewing patterns, timing, genre preferences, and device usage context. Beyond recommendations, AI optimizes network infrastructure management by predicting peak demand times, dynamically allocating server resources, and ensuring seamless, high-definition streaming quality (QoS) even during periods of heavy load. The adoption of AI tools for generating dynamic, personalized promotional content and optimizing search functionality also plays a crucial role in reducing customer churn and improving overall platform navigability, thereby directly influencing key financial metrics like Lifetime Value (LTV) per subscriber.

- AI-driven Content Recommendation: Enhances personalization, increasing session time and reducing churn rates.

- Predictive Analytics for Content Greenlighting: Uses viewer data to forecast the success of potential new shows and films, optimizing content investment.

- Optimized Streaming Quality (QoS): Adaptive bitrate streaming managed by ML, ensuring high quality under variable network conditions.

- Dynamic Content Localization: AI accelerates automatic translation, dubbing, and subtitling, facilitating rapid global deployment.

- Churn Prediction and Prevention: ML models identify subscribers likely to cancel, allowing for targeted retention campaigns.

- Advanced Fraud and Piracy Detection: AI monitors network traffic and viewing patterns to detect and mitigate unauthorized content sharing.

- Automated Content Tagging and Metadata Generation: Improves search accuracy and content discoverability within large libraries.

DRO & Impact Forces Of SVoD Market

The SVoD market growth is powerfully driven by the accelerating global internet penetration, especially in developing economies, coupled with the increasing consumer demand for flexible, high-quality, and exclusive entertainment options, shifting preference away from traditional scheduled broadcasting. However, this expansion is substantially restrained by the intense market fragmentation, often referred to as "streaming fatigue," where consumers are overwhelmed by the number of competing services and hesitate to subscribe to multiple platforms simultaneously. This restraint leads to intense pricing pressure and content licensing wars, raising operational costs across the board. Opportunities abound in expanding into untapped geographical regions, particularly those with rapidly increasing mobile device adoption, and leveraging innovative hybrid (AVoD) business models that offer lower entry price points, addressing price sensitivity in emerging markets. The overall market trajectory is heavily impacted by technological advancements such as 5G deployment, which improves mobile streaming quality, and sustained content expenditure that defines competitive market positioning and subscriber loyalty.

The primary drivers fueling the SVoD market include substantial content investment, particularly in original intellectual property (IP), which serves as the fundamental differentiator in a saturated market. The technological evolution, specifically the rollout of 5G networks, is crucial, providing the necessary bandwidth to support widespread 4K/UHD streaming experiences on mobile devices, which is critical for markets like APAC. Furthermore, the global proliferation of smart home ecosystems, including connected Smart TVs and integrated voice assistants, simplifies access to streaming platforms, normalizing SVoD consumption as the default entertainment choice for households worldwide. These drivers collectively establish a robust foundation for market expansion, ensuring continued capital inflow for content and infrastructure development.

Conversely, the market faces significant structural restraints, most notably the high barriers to entry related to content creation costs; establishing a competitive SVoD library requires billions of dollars in annual expenditure, limiting sustainable competition to a few major players. Subscription fatigue, where consumers budget a limit for monthly streaming expenses, drives cyclical subscription behavior (churn) as users rotate between services based on newly released content. Regulatory hurdles, especially content censorship and local ownership requirements in high-growth regions like China and India, also pose substantial operational challenges. Lastly, digital piracy remains a constant threat, diverting potential revenue streams and necessitating continuous investment in robust digital rights management (DRM) technologies and legal enforcement.

Significant opportunities for future growth are identified in strategic diversification of revenue models, moving beyond the pure subscription model to incorporate transactional video on demand (TVoD) and AVoD tiers, capturing consumers across various price sensitivities. Geographic expansion into high-potential, underserved markets like Southeast Asia, Africa, and specific parts of LATAM represents critical greenfield growth, necessitating culturally relevant, highly localized content offerings. Technological integration, particularly the incorporation of interactive viewing experiences (gamification, choice-based narratives) and sophisticated AI tools for predictive audience targeting, offers competitive differentiation and improved user engagement metrics. Impact forces, driven predominantly by rapid technological shifts (5G, edge computing) and global economic stability (disposable income correlation), dictate the pace of infrastructure scaling and consumer willingness to pay for premium services. The competitive intensity, measured by content costs and promotional spend, is the most pervasive impact force, compelling continuous M&A activity and strategic collaboration within the industry.

Segmentation Analysis

The SVoD market segmentation provides a critical view of diverse revenue streams and consumption patterns, differentiating the landscape primarily by the subscription model, the nature of content offered, and the device used for access. Model-based segmentation highlights the fundamental shift towards hybrid offerings, catering to both price-insensitive (Ad-Free) and price-sensitive (Ad-Supported) consumers, maximizing total subscriber potential. Content segmentation confirms the strategic importance of Original Programming as a powerful proprietary asset that secures subscriber loyalty, distinguishing it from general licensed content. Device segmentation underscores the critical role of mobile devices in global growth, especially in emerging economies where smartphones often serve as the primary, if not sole, access point for streaming media.

Analyzing segmentation by Content Type is crucial for understanding investment strategy; while Movies and TV Shows provide bulk library value, the Original Programming segment is the key driver of new subscriber acquisition, allowing platforms to establish unique brand identities. This segmentation dictates marketing spend and content creation budgets, revealing a preference among major players to control their core IP pipeline. Furthermore, Live Sports, traditionally dominated by linear television, is rapidly emerging as a premium SVoD segment, offering unique opportunities for specialized platforms (like DAZN) or major integrated players (like Amazon Prime Video) to capture high-value subscribers willing to pay a premium for exclusive live content rights.

The segmentation by end-user, primarily residential, accounts for the vast majority of market revenue, focusing on household subscriptions. However, the commercial segment, including hospitality (hotels, airlines) and corporate waiting areas, represents an increasingly important, albeit smaller, B2B revenue stream, requiring specific licensing agreements for public viewing. This diverse segmentation ensures that SVoD providers can tailor their pricing, content acquisition, and technological delivery strategies to optimize penetration and monetization across distinct consumer behaviors and usage environments globally.

- By Type:

- Ad-Free SVoD

- Ad-Supported (Hybrid) SVoD

- By Content Type:

- Movies and Documentaries

- TV Shows and Series

- Original Programming

- Live Sports and Events

- Others (News, Educational)

- By Device Type:

- Smart TV

- Smartphone and Tablet

- Laptop and PC

- Gaming Consoles

- Streaming Media Players (Roku, Apple TV)

- By End User:

- Residential

- Commercial

Value Chain Analysis For SVoD Market

The SVoD value chain begins with Upstream content creation and acquisition, encompassing activities such as content ideation, script development, production, and securing licensing rights from third-party studios. This phase is capital-intensive and strategically crucial, as the uniqueness and breadth of the content library determine market competitiveness. Major SVoD players increasingly emphasize vertical integration, moving beyond licensing to control proprietary production studios, ensuring continuous flow of exclusive original content. Licensing agreements, however, remain a complex upstream activity, involving intricate negotiations over global rights and windowing strategies, significantly influencing cost structures.

The midstream phase involves technological infrastructure and distribution, requiring massive investment in Content Delivery Networks (CDNs), cloud storage solutions, and advanced streaming technology to ensure low latency and high-resolution delivery across diverse geographical locations. This phase also includes the development and maintenance of sophisticated platforms, user interfaces, personalization algorithms, and billing systems. Efficiency in the midstream is vital for maintaining Quality of Service (QoS) and optimizing operational expenses (OPEX), particularly related to bandwidth costs and data management.

Downstream activities focus on marketing, customer relationship management (CRM), and direct consumer interaction. Distribution channels are predominantly direct-to-consumer (D2C) via proprietary websites and mobile applications. However, indirect channels, such as partnerships with telecommunication companies (telcos), internet service providers (ISPs), and device manufacturers (Smart TV OEMs), play a crucial role in customer acquisition and bundling services. Effective downstream strategy relies heavily on data analytics to manage churn, optimize promotional campaigns, and tailor subscription tiers based on detailed consumer behavior, ensuring maximized subscriber Lifetime Value (LTV).

SVoD Market Potential Customers

Potential customers for the SVoD market are broadly segmented into households moving away from traditional cable and satellite television, often referred to as "cord-cutters," and digital-native demographics who have never subscribed to linear TV ("cord-nevers"). These primary residential end-users are characterized by their demand for flexibility, control over viewing schedules, and preference for highly personalized content experiences. Geographically, high-potential customer bases are concentrated in regions undergoing rapid urbanization and significant infrastructure development, particularly the young, middle-class populations in APAC and LATAM, who predominantly access content via mobile devices due to cost and convenience factors.

Secondary customer segments include niche audiences with specific content interests, such as anime enthusiasts, documentary aficionados, or specialized sports fans, who are often willing to subscribe to specific, targeted SVoD platforms (e.g., Crunchyroll, DAZN). Furthermore, the commercial sector, encompassing entities like hotels, healthcare facilities, and corporate offices, represents buyers seeking to enhance customer or client experience through entertainment. These commercial buyers require specific multi-user, institutional licensing models that differ significantly from standard residential terms, presenting distinct revenue opportunities for tailored enterprise solutions.

Ultimately, the most valuable prospective customers globally are those who prioritize quality, exclusivity, and convenience over cost, making them receptive to premium, ad-free tiers. However, the largest volume growth is expected from price-sensitive consumers in emerging markets, who are increasingly targeted through affordable, ad-supported tiers or subsidized bundles offered via mobile network operators. Effective identification of potential customers requires sophisticated psychographic segmentation alongside traditional demographic analysis, focusing on digital literacy, entertainment spending habits, and willingness to engage with localized content offerings.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 115.5 Billion |

| Market Forecast in 2033 | USD 265.8 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Netflix, Amazon Prime Video, Disney+, HBO Max (Max), Apple TV+, Paramount+, Hulu, YouTube Premium, Peacock, Sony, Tencent Video, iQIYI, Hotstar (Disney+ Hotstar), DAZN, ViacomCBS, Canal+, GloboPlay, Stan, Showmax, FuboTV |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

SVoD Market Key Technology Landscape

The SVoD market is fundamentally enabled by a sophisticated array of digital technologies focused on content delivery efficiency, personalization, and cross-platform compatibility. Core to the technical landscape is the utilization of advanced Content Delivery Networks (CDNs) and cloud-based architecture, essential for rapidly streaming vast amounts of data globally with minimal latency. Adaptive Bitrate Streaming (ABS) protocols, such as HLS (HTTP Live Streaming) and DASH (Dynamic Adaptive Streaming over HTTP), are standard technologies used to dynamically adjust video quality based on the user's current bandwidth, ensuring optimal viewing experience without buffering, a crucial component for retaining mobile subscribers in regions with varied network quality.

Furthermore, the shift toward higher-resolution formats (4K, 8K) and immersive audio standards (Dolby Atmos) necessitates continuous innovation in video compression technologies (e.g., HEVC, AV1) to manage bandwidth consumption effectively. Digital Rights Management (DRM) systems are non-negotiable back-end technologies, protecting high-value content from unauthorized copying and distribution across diverse devices. The integration of 5G infrastructure is rapidly becoming a key technology, significantly reducing mobile data latency and expanding the potential for high-quality, real-time interactive content, particularly live sports and interactive scripted narratives.

On the user interaction side, machine learning (ML) and artificial intelligence (AI) engines form the intelligence layer of the platform, powering not only recommendation systems but also critical operational tools like automated content tagging, quality control, and predictive infrastructure scaling. These AI algorithms analyze billions of data points daily—including pause/rewind behaviors, time of day, and completion rates—to refine content acquisition strategies and user interface design. Blockchain technology is also gaining traction, particularly for secure distribution ledgers and potentially revolutionizing how royalties and licensing payments are managed in the increasingly complex global content rights ecosystem, promising greater transparency and efficiency in the value chain.

Regional Highlights

- North America: This region holds the largest market share, characterized by high household penetration rates, high Average Revenue Per User (ARPU), and intense competition among established domestic players (Netflix, Disney+, HBO Max). The market focus is shifting towards consolidating services, offering hybrid AVoD tiers to maximize revenue, and investing heavily in premium original content to justify high subscription fees. Innovation in bundling and strategic partnerships with telcos are critical for maintaining growth momentum in a mature market.

- Europe: Europe is highly fragmented due to linguistic and cultural diversity, requiring strong localization strategies. Western Europe shows high SVoD penetration, mirroring North America's maturity. Eastern and Southern Europe represent significant growth opportunities, driven by rising disposable incomes and expanding high-speed internet access. Regulatory challenges, particularly surrounding European content quotas, mandate investments in local European productions, which is driving localized content strategies and M&A activities involving regional platforms.

- Asia Pacific (APAC): Expected to be the fastest-growing region, APAC is a vast, complex market defined by mobile-first consumption, high population density, and significant variance in economic maturity. Markets like India (Disney+ Hotstar) and Southeast Asia rely heavily on affordable, mobile-only plans and culturally relevant regional content. China, dominated by domestic giants (Tencent Video, iQIYI), operates under unique regulatory frameworks. The low ARPU is offset by massive subscriber volume potential and improving 5G infrastructure rollout.

- Latin America (LATAM): Growth is fueled by a young, digitally-savvy population and increasing household broadband penetration. Pricing sensitivity is high, making subsidized bundles and AVoD offerings particularly successful. Key growth dynamics involve battling piracy and tailoring payment methods to less traditional banking systems. Major players are focused on localized content production in Spanish and Portuguese to effectively penetrate key markets like Brazil and Mexico.

- Middle East and Africa (MEA): This region is emerging, driven by improving digital infrastructure, especially in the GCC countries and South Africa. Regulatory landscapes are diverse, with content censorship being a key factor. Growth strategies focus on mobile connectivity and leveraging partnerships with regional satellite operators and mobile service providers to offer bundled access. The demand for localized and religious-appropriate content is a unique characteristic driving content acquisition decisions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the SVoD Market.- Netflix Inc.

- Amazon Prime Video

- The Walt Disney Company (Disney+, Hulu, ESPN+)

- Warner Bros. Discovery (HBO Max / Max)

- Apple Inc. (Apple TV+)

- Paramount Global (Paramount+)

- Comcast Corporation (Peacock)

- Tencent Holdings Ltd. (Tencent Video)

- Baidu Inc. (iQIYI)

- Sony Group Corporation

- Globosat (GloboPlay)

- DAZN Group

- ViacomCBS

- FuboTV

- STAN Entertainment Pty Ltd

- Showmax (MultiChoice)

- MUBI

- Crunchyroll LLC

- BBC Studios (BritBox)

- Reliance Industries (JioCinema)

Frequently Asked Questions

Analyze common user questions about the SVoD market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the SVoD market?

The SVoD market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033, driven primarily by globalization of services and increasing digital content consumption.

How is "subscription fatigue" impacting SVoD market dynamics?

Subscription fatigue, resulting from excessive platform choice, is intensifying competition and driving providers to adopt hybrid monetization models (like Ad-Supported tiers) to offer lower price points and reduce customer churn caused by rotation between services.

Which region is expected to demonstrate the highest growth in the SVoD sector?

The Asia Pacific (APAC) region is forecasted to exhibit the highest growth rate, supported by massive populations, rapid mobile internet penetration (especially 5G), and strong demand for localized, mobile-first content solutions.

What is the primary driver for content investment in the SVoD market?

The primary driver for high content investment is the necessity to create exclusive Original Programming, which serves as the most effective tool for subscriber acquisition, platform differentiation, and long-term retention in a highly competitive landscape.

How does AI technology influence content recommendation systems?

AI significantly enhances content recommendation systems by leveraging machine learning to analyze complex behavioral data (viewing history, time of day, completion rates) to provide hyper-personalized suggestions, thereby improving user engagement and reducing the likelihood of subscription cancellation.

The market analysis confirms that strategic positioning in the SVoD sector requires a delicate balance between aggressive content investment and intelligent monetization diversification. Companies that successfully leverage technological advantages, particularly in AI-driven personalization and optimized content delivery infrastructure, are best positioned to navigate the intense competitive environment and capture sustained market share. The future trajectory is heavily reliant on successful integration of AVoD models and expansion into nascent, high-growth geographical regions like APAC and LATAM, while continuously managing the escalating costs associated with acquiring premium, exclusive content rights. Furthermore, regulatory compliance, particularly regarding data privacy and local content mandates, will increasingly define market entry strategies and operational viability across varied international territories. The sustained shift from linear to digital consumption is irreversible, cementing SVoD services as the dominant form of home entertainment globally, compelling traditional media companies to rapidly accelerate their digital transformation initiatives or risk becoming marginalized content suppliers to the dominant streaming platforms.

Technological advancement, especially in the realm of immersive experiences (VR/AR streaming) and interactive storytelling, promises to unlock new premium tier opportunities, distinguishing the offerings of leading market players. The standardization of delivery protocols and the widespread deployment of 5G will address lingering quality-of-service issues, which remain a significant barrier to entry in certain developing markets. Capital markets remain keen on the long-term prospects of the SVoD industry, but investor scrutiny has shifted from pure subscriber volume to profitability and free cash flow generation, suggesting a phase of rationalization and strategic consolidation is imminent. Effective management of churn through superior user experience and consistent delivery of high-value exclusive content will be paramount to demonstrating sustainable financial health and securing future funding for continuous growth initiatives. The competitive dynamics are forcing perpetual innovation in pricing strategies, service bundling, and marketing localization efforts, making the SVoD market one of the most dynamic segments within the global media and entertainment industry.

The sustained success of SVoD platforms hinges on the ability to master content licensing complexities while simultaneously building robust, globally scalable proprietary production capabilities. The trend towards 'windowing' content—strategically releasing titles across different platforms and timing them for maximum impact—has become a complex science managed by sophisticated data models. Moreover, the integration of gaming content and interactive elements into SVoD platforms represents a nascent yet powerful opportunity to increase user engagement metrics and time spent within the ecosystem, catering to younger, multi-platform consumers. Ultimately, the market leaders will be those who can effectively harmonize technological efficiency with compelling, culturally resonant content, adapting swiftly to varied consumer purchasing power and evolving regulatory landscapes across the globe, ensuring long-term profitability amidst ferocious competition and rising content expenditure burdens.

The proliferation of new devices and ecosystems, including smart home integration and enhanced automotive entertainment systems, is continually expanding the touchpoints for SVoD consumption, further embedding these services into daily life. This requires platform providers to maintain exceptional engineering flexibility to support seamless, authenticated access across all connected devices, often under partnership agreements with device manufacturers. Security, particularly against account sharing and professional piracy networks, remains a high-priority investment area, requiring the deployment of advanced cybersecurity measures and continuous refinement of DRM policies to protect intellectual property valued in the billions. The next wave of SVoD innovation will focus heavily on achieving true operational scalability and infrastructure resilience, especially as platforms increasingly handle live events and massive simultaneous viewer loads, pushing the limits of current Content Delivery Network (CDN) capacity and cloud computing resources. This infrastructure evolution is non-negotiable for players targeting high-definition, low-latency delivery across global markets, particularly where network conditions are volatile, making cloud optimization and edge computing pivotal technological battlegrounds.

Market sustainability is also increasingly linked to Environmental, Social, and Governance (ESG) considerations, as major media companies face pressure to address the energy consumption of data centers and streaming infrastructure. While not a direct consumer driver, corporate responsibility in this area impacts investor relations and public perception, adding a layer of strategic complexity to technology roadmap development. Furthermore, the employment market within the SVoD ecosystem—covering creative talent, data scientists, and specialized engineers—is experiencing intense demand, driving up labor costs and requiring innovative talent acquisition and retention strategies. The interplay between technological capability and creative output remains the defining characteristic of this industry; robust data analytics must inform, but not stifle, the creative processes that ultimately yield the exclusive, high-value content that attracts and retains subscribers, confirming content remains king, but technology is the throne. Successfully balancing these pressures—creative risks versus data-driven decision-making, cost optimization versus infrastructure investment, and global scale versus local relevance—will determine the eventual hierarchy of the global SVoD market by 2033.

The increasing adoption of virtual production techniques, leveraging technologies like LED walls and game engines (e.g., Unreal Engine), is another technological shift impacting the SVoD market, enabling content producers to significantly reduce location shooting costs and accelerate production timelines. This technological evolution democratizes high-quality visual effects and allows for greater creative control, especially crucial for platforms that rely heavily on continuous flow of original series. The financial efficiency gained through virtual production helps offset the rising costs of talent and post-production, directly influencing the profitability margins of large-scale SVoD operations. Moreover, the long-term strategic value of owned content libraries is beginning to be realized through intellectual property extensions, such as merchandise, theme park integrations, and spin-off shows, transforming SVoD platforms into integrated media ecosystems rather than simple distributors. This vertical integration strategy is a powerful competitive moat, securing long-term customer engagement beyond the monthly subscription fee, effectively maximizing the return on investment for the enormous content production budgets characteristic of market leaders.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager