Sweet and Salty Snacks Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433214 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Sweet and Salty Snacks Market Size

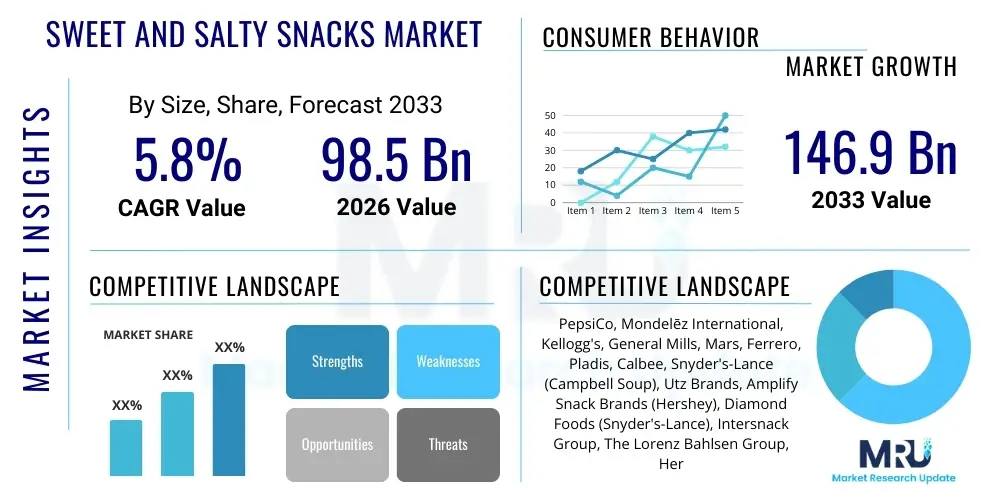

The Sweet and Salty Snacks Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 98.5 Billion in 2026 and is projected to reach USD 146.9 Billion by the end of the forecast period in 2033.

Sweet and Salty Snacks Market introduction

The Sweet and Salty Snacks Market encompasses a vast array of processed and packaged food items designed for immediate consumption between meals or as supplementary dietary components. These products are broadly categorized into savory items like potato chips, pretzels, nuts, and puffed snacks, and sweet items including cookies, biscuits, chocolate bars, and various confectionery types. The market’s dynamism is driven primarily by shifting consumer lifestyles, characterized by increased urbanization, time constraints, and a growing demand for on-the-go food solutions that offer immediate gratification and portability. Product innovation remains critical, with manufacturers constantly introducing new flavor profiles, healthier ingredient alternatives, and novel packaging formats to capture diverse consumer preferences across different demographics and regions. The convergence of sweet and salty flavors in hybrid products is a significant recent trend.

Major applications of sweet and salty snacks span diverse consumption scenarios, including quick energy boosts during work or exercise, casual consumption during entertainment, and as convenient components in packed lunches or travel provisions. The inherent benefits these products offer center around convenience, accessibility, and affordability, meeting the psychological need for comfort food while providing immediate caloric intake. Furthermore, the market benefits substantially from highly efficient global supply chains and sophisticated retail distribution networks, ensuring products are widely available across supermarkets, convenience stores, and rapidly expanding e-commerce channels. Manufacturers are leveraging advanced food science to enhance shelf life, improve sensory attributes, and comply with evolving nutritional labeling standards imposed by global regulatory bodies.

Driving factors for sustained market growth include rising disposable incomes in emerging economies, a pervasive culture of snacking replacing traditional mealtimes, and aggressive marketing strategies that link these products to lifestyle and emotional well-being. Additionally, product diversification into functional snacks, such as those fortified with protein, fiber, or vitamins, addresses the growing health consciousness among consumers without sacrificing the convenience factor. The market continues to evolve in response to sustainability concerns, with a noticeable shift toward eco-friendly packaging and ethically sourced ingredients, further broadening its appeal among environmentally conscious consumer groups globally.

Sweet and Salty Snacks Market Executive Summary

The Sweet and Salty Snacks Market is poised for robust expansion driven by converging business trends, prominent regional shifts, and continuous segment diversification. Key business trends indicate a strong focus on mergers and acquisitions (M&A) activities, allowing major industry players to consolidate market share, enter niche segments rapidly, and acquire innovative product lines, particularly those focused on clean labels or plant-based ingredients. Furthermore, digitalization and sophisticated data analytics are being employed extensively to optimize supply chain logistics, predict consumer demand accurately, and personalize marketing campaigns, moving away from traditional mass-market advertising toward highly targeted digital engagement. Sustainable sourcing and waste reduction initiatives are increasingly viewed not just as regulatory compliance measures but as competitive differentiators, influencing brand loyalty among younger generations.

Regionally, North America and Europe remain mature, high-value markets characterized by a strong emphasis on premiumization, functional snacking, and reduced sugar/sodium variants. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, fueled by substantial population expansion, rapid urbanization, and increasing Westernization of dietary habits, particularly in China, India, and Southeast Asia. Latin America is also emerging as a high-potential market, driven by expanding middle-class populations and improving retail infrastructure. Companies are strategically investing in localized production facilities and distribution networks within these emerging regions to mitigate logistical risks and tailor flavor profiles to regional palates, which often vary significantly from Western standards.

Segmentation trends highlight the accelerating dominance of the online retail segment, which offers unparalleled convenience and broader product availability, especially for specialty or imported snacks. Within product types, the demand for nuts and seeds, perceived as inherently healthier alternatives, is soaring. Concurrently, manufacturers are mitigating regulatory pressure on high-sugar items by intensely focusing on low-calorie, portion-controlled packaging, and utilizing natural sweeteners. Hybrid snacks, blending textural and flavor elements from both sweet and salty categories (e.g., chocolate-covered pretzels or salted caramel popcorn), are capturing significant market interest, bridging the gap between indulgence and sensory excitement, thereby driving volume sales across multiple categories simultaneously.

AI Impact Analysis on Sweet and Salty Snacks Market

Common user questions regarding AI's impact on the Sweet and Salty Snacks Market primarily revolve around how artificial intelligence enhances product innovation speed, improves predictive demand forecasting, and optimizes complex global supply chains. Consumers and industry stakeholders are highly interested in AI-driven personalization—specifically, whether AI can design snacks tailored to individual nutritional profiles or flavor preferences based on purchasing data and biometric feedback. There is also significant inquiry into the use of machine learning (ML) algorithms for quality control, flavor profile optimization, and ensuring regulatory compliance across various international markets. Key concerns often center on the initial investment costs associated with implementing AI infrastructure and the potential impact of automation on manufacturing employment, alongside ensuring data privacy in the collection and analysis of consumer consumption patterns. Users expect AI to reduce waste, increase efficiency, and fundamentally accelerate the transition towards healthier and more sustainable snack options.

- AI-powered Predictive Modeling: Enhancing demand forecasting accuracy by analyzing seasonal patterns, promotional efficacy, and external macroeconomic indicators, minimizing stockouts and excess inventory in perishable segments.

- Automated Quality Control: Implementing computer vision systems and ML algorithms on production lines to detect defects, inconsistencies in size or texture, and contamination far faster and more reliably than manual inspection.

- Optimized Flavor Formulation: Utilizing AI tools to analyze massive datasets of consumer sensory feedback and ingredient interactions, accelerating the development of novel, highly palatable, and stable flavor combinations.

- Hyper-Personalization in E-commerce: Generating tailored snack recommendations and subscription box offerings based on individual consumer purchase history, dietary restrictions, and demographic profiles.

- Supply Chain Efficiency: Applying algorithms to dynamically adjust raw material procurement, routing, and warehouse management, reducing logistical costs and improving overall traceability from farm to shelf.

- Robotics in Manufacturing: Integrating advanced robotics, guided by AI, for high-speed packaging, sorting, and palletizing, particularly in environments requiring strict hygiene standards.

- Sustainable Ingredient Sourcing: Leveraging AI to track the ethical and environmental impact of ingredient suppliers, optimizing sourcing strategies to meet corporate sustainability goals and consumer expectations.

DRO & Impact Forces Of Sweet and Salty Snacks Market

The dynamics of the Sweet and Salty Snacks Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the primary Impact Forces determining market trajectory. The core drivers include the undeniable convenience these products offer to time-constrained modern consumers, coupled with aggressive product innovation that addresses evolving dietary trends, such as gluten-free, vegan, and high-protein variants. Economic prosperity and the associated rise in disposable income globally further amplify consumer willingness to spend on premium and indulgence snacks. These factors create significant positive momentum, ensuring sustained volume growth even in mature markets. The impact force of convenience and lifestyle shifts is currently the most potent driver.

However, the market faces significant restraints, primarily stemming from heightened global health consciousness and increasing regulatory scrutiny. Government bodies worldwide are implementing taxes and marketing restrictions on products high in sugar, salt, and unhealthy fats, pressuring manufacturers to reformulate products, which often entails high research and development costs and potential alteration of familiar flavor profiles. Furthermore, escalating volatility in the pricing of key agricultural commodities, such as corn, sugar, and cocoa, alongside labor shortages and rising energy costs, squeeze profit margins, presenting an ongoing financial restraint to market expansion, particularly for smaller and mid-sized players.

Opportunities abound in leveraging digital transformation for direct-to-consumer (D2C) sales models, which allow companies to gather proprietary customer data and bypass traditional retail gatekeepers. Substantial potential also lies in the functional snack segment, catering specifically to sports nutrition and specific health needs (e.g., gut health, immunity). Moreover, the development and adoption of environmentally friendly and compostable packaging solutions represent a major opportunity for brands to differentiate themselves and meet stringent sustainability goals. The combined impact forces of changing regulations and technological advancements mandate continuous adaptation, making agility in innovation a critical success factor in this highly competitive industry.

Segmentation Analysis

The Sweet and Salty Snacks Market is segmented based on product type, distribution channel, packaging type, and flavor profile, reflecting the diverse consumption landscape and strategic marketing approaches utilized by industry stakeholders. Analyzing these segments provides critical insights into consumer behavior, market saturation levels, and high-growth niches. Product categorization is the most fundamental segmentation, distinguishing between traditional savory staples like chips and nuts and indulgent sweet treats, with the emerging segment of hybrid products increasingly blurring these lines. Geographic segmentation remains crucial for understanding regional dietary habits and tailoring market entry strategies effectively. The continuous evolution of distribution networks, especially the growth of online platforms, necessitates regular reassessment of channel performance metrics and investment priorities.

- By Product Type:

- Savory Snacks

- Potato Chips (Crisps)

- Extruded Snacks (Puffs, Rings)

- Nuts & Seeds (Almonds, Walnuts, Peanuts, Sunflower Seeds)

- Pretzels and Crackers

- Popcorn (Ready-to-Eat)

- Sweet Snacks

- Confectionery (Hard Candies, Gummy Candies)

- Cookies & Biscuits

- Chocolate and Chocolate Coated Snacks

- Snack Bars (Cereal Bars, Energy Bars)

- Hybrid/Combined Snacks (e.g., Sweet and Salty Mixes)

- By Distribution Channel:

- Supermarkets and Hypermarkets (Large Format Retail)

- Convenience Stores and Forecourts

- Online Retail (E-commerce Platforms and D2C)

- Specialty Stores (Health Food Stores, Bakeries)

- Vending Machines and Institutional Sales

- By Packaging Type:

- Bags and Pouches (Flexible Packaging)

- Boxes and Cartons

- Cans and Jars (For Nuts and Pretzels)

- Wrappers and Foils (Single-Serve)

- By Flavor Profile:

- Classic/Original

- Spicy/Hot

- Sour/Tangy

- Sweet (Pure Sugar/Confectionery)

- Savory (Cheese, Barbecue)

- Gourmet/Artisanal Flavors

Value Chain Analysis For Sweet and Salty Snacks Market

The value chain for the Sweet and Salty Snacks Market is long and complex, starting with the cultivation and sourcing of raw materials, moving through intensive processing and manufacturing, and concluding with extensive distribution to the final consumer. The upstream segment involves the procurement of essential agricultural commodities like potatoes, corn, wheat, cocoa, sugar, oilseeds, and nuts. Efficiency in upstream management is critical, as volatility in commodity prices directly impacts the cost of goods sold. Key activities at this stage include contract farming, quality assurance, and initial processing steps like drying and refining. Strategic partnerships with key suppliers who adhere to sustainable and ethical sourcing practices are increasingly important for mitigating risks and enhancing brand reputation.

The core manufacturing stage involves complex processes such as baking, frying, extruding, flavoring, and packaging. This stage is highly capital-intensive, relying on advanced automation and precision machinery to ensure product consistency, high-volume output, and stringent food safety compliance. Downstream analysis focuses primarily on the comprehensive distribution channel, which is highly diversified. This includes direct sales to large retailers (Supermarkets/Hypermarkets), utilization of wholesalers and distributors for smaller stores (Convenience Stores), and the rapidly growing role of third-party logistics (3PL) providers for e-commerce fulfillment. Effective shelf placement, promotional strategies, and optimizing cold chain logistics (especially for chocolate and other temperature-sensitive items) are crucial elements of downstream success.

Distribution channels are predominantly indirect, relying heavily on traditional retail networks. Direct distribution (D2C) is gaining traction, particularly for specialized or premium snack brands seeking greater control over customer experience and data. The overall structure emphasizes minimizing time-to-market and maximizing product freshness. Integrated supply chain management systems, often utilizing AI and IoT devices, are deployed across the entire chain to track inventory levels, monitor temperature fluctuations, and ensure operational efficiency from the raw ingredient stage to the consumer purchase point, driving continuous cost optimization and responsiveness to market shifts.

Sweet and Salty Snacks Market Potential Customers

The target audience for the Sweet and Salty Snacks Market is incredibly broad, essentially encompassing all demographics, but can be segmented into distinct psychographic and behavioral groups that drive specific consumption patterns. Primary consumers include urban professionals and millennials, who prioritize convenience and speed due to busy, on-the-go lifestyles, viewing snacks as necessary meal replacements or quick energy fixes. Another major segment comprises children and adolescents, driven by flavor and novelty, often influencing household purchasing decisions regarding mainstream confectionery and extruded snacks. Manufacturers target these groups with vibrant packaging and engaging marketing campaigns that emphasize immediate gratification and enjoyment.

A rapidly growing segment of potential customers includes health-conscious individuals, athletes, and those adhering to specific dietary regimens (e.g., keto, gluten-free, high-protein). These buyers seek 'better-for-you' alternatives, demanding transparency in ingredients, minimal processing, and functional benefits such as protein fortification or reduced sugar content. Brands targeting this segment focus heavily on premium ingredients, clean labels, and specialized distribution through health food stores and online platforms. This segment is willing to pay a premium price for products that align with their wellness goals, making them highly valuable customers.

Furthermore, occasional consumers, often driven by emotional factors, treat snacks as indulgent comfort food, particularly during entertainment events, social gatherings, or periods of stress. This segment is less price-sensitive and more responsive to limited-edition flavors or gourmet offerings. Institutional buyers, such as airlines, schools, offices, and large event venues, also represent significant bulk purchasing power. Understanding the specific needs of each customer segment—whether it’s high convenience for professionals, functional benefits for health enthusiasts, or novelty for adolescents—is paramount for tailoring product innovation, packaging sizes (single-serve vs. family packs), and targeted marketing campaigns effectively.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 98.5 Billion |

| Market Forecast in 2033 | USD 146.9 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | PepsiCo, Mondelēz International, Kellogg's, General Mills, Mars, Ferrero, Pladis, Calbee, Snyder's-Lance (Campbell Soup), Utz Brands, Amplify Snack Brands (Hershey), Diamond Foods (Snyder's-Lance), Intersnack Group, The Lorenz Bahlsen Group, Herr Foods |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sweet and Salty Snacks Market Key Technology Landscape

The technology landscape within the Sweet and Salty Snacks Market is rapidly evolving, moving far beyond traditional food processing techniques to incorporate advanced automation and digitalization across the value chain. Key technological advancements are focused on increasing manufacturing efficiency, improving food safety, and enabling rapid product innovation. In manufacturing, high-speed extrusion technology allows for the creation of novel snack shapes and textures with precise control over air inclusion and density, catering to specific mouthfeel demands. Furthermore, advanced frying technologies, such as vacuum frying and air frying, are being adopted to significantly reduce oil absorption, directly addressing consumer demand for lower-fat savory options, which helps in maintaining the flavor profile while improving the nutritional metrics of the final product.

Packaging technology represents another pivotal area of innovation. The move toward sustainable and biodegradable films and flexible packaging materials is paramount, driven by global pressure to reduce plastic waste. Smart packaging technologies, including QR codes for traceability and freshness indicators, are enhancing consumer engagement and ensuring product quality throughout the distribution cycle. On the research and development front, Artificial Intelligence (AI) and Machine Learning (ML) are being utilized for rapid prototyping and ingredient informatics, allowing food scientists to predict the stability, shelf life, and sensory attributes of new ingredient combinations before expensive physical trials are conducted, thereby significantly shortening the time-to-market for new snack launches.

Finally, the proliferation of Internet of Things (IoT) sensors and enterprise resource planning (ERP) systems ensures seamless integration and data flow across geographically dispersed manufacturing and storage facilities. These systems provide real-time monitoring of critical parameters like temperature, humidity, and machine performance, guaranteeing optimal operational uptime and immediate identification of potential food safety risks. The application of 3D printing technology is also being explored, primarily for creating highly customized or intricate confectionery items, offering unparalleled precision in design and ingredient layering for niche and luxury snack categories, further demonstrating the market's commitment to leveraging cutting-edge industrial technology.

Regional Highlights

Regional dynamics heavily influence the Sweet and Salty Snacks Market, with differences in cultural preferences, regulatory environments, and economic maturity dictating market size and growth trajectory. North America, encompassing the United States and Canada, represents a highly established and saturated market, yet remains dominant in terms of consumption value due to high disposable incomes and a pervasive culture of convenience snacking. Innovation here focuses intensely on premiumization, functional attributes (protein, fiber), and clean labels, with rapid adoption of plant-based and specialty diet snacks. The high competition mandates aggressive marketing and continuous portfolio refreshing by major players.

Europe mirrors North America in maturity but is characterized by stricter regulatory frameworks concerning sugar and fat content, particularly in Western European nations like the UK and Germany. This pressure drives significant investment in reformulation and smaller portion sizes. Eastern Europe, however, presents higher growth potential as incomes rise and modern retail channels proliferate. The cultural preference for traditional biscuits and confectionery remains strong, although the demand for savory, on-the-go options is steadily increasing, particularly among the younger, urban population segment.

Asia Pacific (APAC) is undoubtedly the growth engine of the global market. Countries like China, India, and Indonesia are experiencing unprecedented growth driven by large, youthful populations, rapid economic development, and increasing exposure to Western snacking culture. The market is highly fragmented, with strong regional players competing fiercely with multinational corporations. Localization of flavor (e.g., spicy, curry, seafood) and reliance on traditional snack ingredients (rice, lentils) are essential success factors. Investment in cold chain logistics and e-commerce infrastructure is paramount to serving this vast and geographically complex region effectively.

Latin America (LATAM), particularly Brazil and Mexico, showcases a promising expansion outlook. Economic stabilization and growing retail infrastructure support increased consumption. High preference for intense, bold flavors and savory products is notable. However, this region also faces rising public health concerns regarding obesity, leading to regulatory shifts such as front-of-pack warning labels, requiring companies to adapt quickly to evolving consumer sentiment and government mandates.

The Middle East and Africa (MEA) region is characterized by diverse market maturity levels. Gulf Cooperation Council (GCC) countries exhibit high purchasing power and demand for imported, premium, and luxury snacks. In contrast, Africa's potential is tied to improving economic conditions and the gradual formalization of the retail sector. The market is often sensitive to geopolitical instability and currency fluctuations, making robust risk management and localized manufacturing strategies crucial for sustainable growth.

- North America: Market leader in value; driven by premiumization, functional snacking, and intense focus on ‘better-for-you’ attributes. High consumption frequency.

- Europe: Mature market facing significant reformulation pressure due to high regulatory scrutiny on sugar and fat; growth accelerated by Eastern European expansion and demand for artisanal snacks.

- Asia Pacific (APAC): Fastest-growing region; powered by urbanization, rising disposable income, and localization of product offerings to cater to specific regional taste preferences (e.g., umami, intensely spicy).

- Latin America (LATAM): High potential market; strong growth in savory segment; regulatory challenges related to obesity and nutritional labeling are key constraints influencing product development.

- Middle East and Africa (MEA): Varied market structure; GCC nations favor premium imported goods; African growth linked to improved infrastructure and increasing access to modern retail chains.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sweet and Salty Snacks Market.- PepsiCo (Frito-Lay, Quaker)

- Mondelēz International (Oreo, Cadbury, Ritz)

- Kellogg's (Pringles, Cheez-It)

- General Mills (Nature Valley, Fiber One)

- Mars, Incorporated (M&M's, Snickers, Wrigley)

- Ferrero International S.A. (Nutella, Ferrero Rocher)

- Pladis Global (McVitie's, Godiva)

- The Hershey Company (Reese’s, Amplify Snack Brands)

- Calbee, Inc.

- Campbell Soup Company (Snyder's-Lance)

- Utz Brands, Inc.

- Nestlé S.A.

- The J.M. Smucker Co.

- Intersnack Group GmbH & Co. KG

- The Lorenz Bahlsen Group

- Herr Foods Inc.

- Conagra Brands, Inc.

- B&G Foods, Inc.

- Hostess Brands, Inc.

- Argo Foods, Inc.

Frequently Asked Questions

Analyze common user questions about the Sweet and Salty Snacks market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the demand for healthier sweet and salty snack options?

The primary driver is heightened consumer awareness regarding diet-related health issues such as obesity and diabetes, compounded by regulatory pressures on high-sugar and high-sodium products. Consumers seek transparency, clean labels, and functional benefits like high protein, low sugar, or non-GMO ingredients, pushing manufacturers towards intensive reformulation efforts.

How is e-commerce affecting the Sweet and Salty Snacks distribution channel?

E-commerce is revolutionizing distribution by providing expanded geographic reach, enabling direct-to-consumer (D2C) sales models, and facilitating targeted marketing. Online platforms allow smaller, innovative brands to compete effectively with established players and cater specifically to niche dietary requirements that might be underserved in traditional retail stores.

Which geographical region exhibits the highest growth potential in this market?

The Asia Pacific (APAC) region, led by rapidly expanding economies such as China and India, is projected to show the highest CAGR. This growth is attributable to massive populations, increasing urbanization, rising disposable incomes, and the modernization of retail and logistics infrastructure across key developing nations.

What are the main technological innovations impacting snack manufacturing?

Key technological innovations include the adoption of high-speed automation and robotics for packaging, the implementation of vacuum and air frying to reduce fat content, and the use of AI for quality control, predictive maintenance, and accelerating R&D processes related to flavor and texture formulation.

What role does sustainability play in the purchasing decisions of sweet and salty snack consumers?

Sustainability is becoming a crucial differentiating factor. Consumers, especially younger generations, increasingly prefer brands that demonstrate ethical sourcing of ingredients (e.g., certified cocoa) and utilize eco-friendly, biodegradable, or recyclable packaging materials, influencing brand loyalty and premium purchasing behavior.

How are macroeconomic factors, such as inflation, influencing the snack market?

Inflation significantly impacts the market through rising costs of raw materials (like sugar, grains, and oil) and energy, leading to price increases passed on to consumers. Manufacturers respond by optimizing portion sizes (shrinkflation) or focusing on value-tier offerings to maintain affordability and volume sales amidst economic pressures.

What are hybrid snacks, and why are they becoming popular?

Hybrid snacks merge attributes of both sweet and salty categories, such as salted caramel popcorn or chocolate-covered pretzels, offering a complex, balanced flavor profile. Their popularity stems from providing a dual sensory experience that satisfies both the craving for indulgence and the desire for contrasting textures and tastes, appealing to broad consumer preferences.

What is the current trend regarding packaging types in the sweet and salty snacks sector?

The dominant trend involves a shift away from large, multi-serve bags towards flexible, single-serve pouches and smaller, portion-controlled packaging. This aligns with convenience needs, helps consumers manage caloric intake, and facilitates on-the-go consumption, while simultaneously addressing sustainability goals through material reduction and the adoption of mono-material films for easier recycling.

How do global events, such as geopolitical conflicts, affect the market supply chain?

Geopolitical conflicts introduce significant volatility and disruption, particularly affecting the supply chain of staple ingredients like wheat, cooking oils, and cocoa from key producing regions. This results in unpredictable price spikes, increased logistics complexity, and necessitates that manufacturers diversify sourcing strategies and maintain larger buffer stocks to ensure production continuity.

Are private label brands gaining traction against established branded snacks?

Yes, private label snack brands are rapidly gaining market share, driven primarily by favorable pricing and often matching the quality and flavor profiles of national brands. Retailers are investing heavily in improving private label formulations, particularly in the healthier and organic snack categories, offering consumers attractive, cost-effective alternatives, particularly during periods of economic uncertainty.

What is the significance of the "clean label" movement in snack innovation?

The clean label movement signifies consumer demand for minimal ingredients, recognizable names on the ingredient list, and the absence of artificial colors, flavors, or preservatives. It compels manufacturers to reformulate products using natural alternatives, driving innovation in ingredient sourcing and processing techniques to maintain taste and shelf life without compromising transparency.

How does the market cater to specific dietary requirements like gluten-free or vegan diets?

The market caters through dedicated product lines utilizing alternative starches (rice, potato, tapioca) for gluten-free snacks and plant-based fats and proteins for vegan alternatives, ensuring texture and flavor mimic traditional options. This segmentation taps into niche markets with high purchasing intent and loyalty, often commanding a premium price point.

What is the impact of social media and influencer marketing on snack consumption trends?

Social media and influencer marketing significantly accelerate trend adoption by creating viral demand for new or exotic flavors and limited-edition releases. Short-form video content emphasizing taste tests and product challenges drives rapid trial and purchase, making digital engagement a critical component of launching new snack products successfully.

Which type of savory snack currently holds the largest market share globally?

Potato chips (or crisps) typically hold the largest share in the savory category globally, driven by widespread distribution, variety of flavor options, and strong brand recognition. However, the nuts and seeds segment is gaining ground due to its perceived superior nutritional profile and versatility.

What are the challenges associated with sourcing sustainable ingredients for snacks?

Challenges include fluctuating pricing for sustainably certified commodities (like cocoa and palm oil), ensuring verifiable traceability across the complex global supply chain, and meeting the required volume without compromising ethical standards. Manufacturers often face trade-offs between cost efficiency and commitment to rigorous environmental and labor practices.

How are food scientists using sensory analysis to optimize snack appeal?

Sensory analysis involves rigorous testing of texture, crunch, aroma, and flavor release profiles to achieve optimal hedonic appeal. Advanced techniques, including electrophysiological responses and consumer panels, help fine-tune ingredient ratios and processing methods to maximize the satisfying qualities of both sweet and salty snacks, ensuring repeatability across batches.

What role do vending machines play in the market’s distribution strategy?

Vending machines remain essential for instant, convenient access in high-traffic, non-traditional retail locations like offices, transport hubs, and universities. Modern smart vending machines, often equipped with digital payment options and real-time inventory tracking, provide a vital channel for single-serve product distribution and impulse purchases.

How does competitive intensity influence product pricing in the snack market?

The market exhibits intense competition, leading to frequent promotional activity, deep discounting, and aggressive price wars, especially in the mainstream categories like chips and biscuits. This intensity pressures manufacturers to achieve high production efficiencies and strict cost control to maintain profitability margins.

What is the typical shelf life of processed snacks, and how is it maximized?

The typical shelf life ranges from 6 to 12 months, maximized through sophisticated packaging technologies (e.g., barrier films, modified atmosphere packaging using nitrogen flushing), the inclusion of permitted natural antioxidants, and maintaining extremely low moisture content in the final product to inhibit microbial growth and prevent rancidity.

How are snack companies adapting to front-of-pack warning labels in Latin America?

Companies are adapting by aggressively reformulating products to reduce ‘critical nutrients’ (sodium, sugar, saturated fats) below the mandated thresholds to avoid the warning labels. They are also shifting marketing focus towards healthier, reformulated lines and investing in consumer education to maintain trust despite the visual warnings on non-compliant products.

What is the significance of co-branding and licensing in the snack industry?

Co-branding and licensing deals, often involving popular media franchises or established beverage/candy brands, create temporary novelty and excitement, driving impulse purchases and expanding market reach to specific demographic segments. This strategy capitalizes on the pre-existing emotional connection consumers have with the licensed property, generating high, short-term sales volume.

How is demographic aging in some Western nations affecting snack preferences?

Demographic aging is increasing demand for snacks focused on specific nutritional needs related to seniors, such as easier-to-chew textures, higher protein content for muscle health, and snacks formulated for lower glycemic indices. Marketing efforts are also shifting to emphasize health and digestion benefits rather than just indulgence.

What major regulatory changes are anticipated in the next five years regarding snack labeling?

Anticipated changes include stricter international alignment on sugar and sodium reduction targets, mandatory inclusion of sustainability metrics on packaging, and potentially expanded restrictions on the marketing of less healthy products directed at minors, requiring continuous compliance monitoring by global manufacturers.

How do flavor trends transition from local specialties to global bestsellers?

Flavor trends often originate in specific regions (e.g., spicy chili flavors from Asia, artisanal cheeses from Europe) and gain global traction through cross-cultural adoption, primarily facilitated by social media exposure, culinary tourism, and multinational companies actively testing and adapting localized flavors for wider international distribution.

What impact does the growth of home baking and cooking trends have on packaged snacks?

While home baking offers a momentary substitute for packaged snacks, its overall impact is minor. It primarily targets specific celebratory or seasonal occasions. However, it prompts packaged snack manufacturers to elevate the quality and perceived 'naturalness' of their ingredients to compete with the homemade perception of freshness and wholesomeness.

How are manufacturers managing volatile costs of ingredients like cocoa and sugar?

Manufacturers manage volatility through hedging strategies, diversifying sourcing geographically, entering into long-term supply contracts, and aggressively optimizing production processes to minimize waste. They also engage in strategic reformulation by substituting expensive ingredients or reducing overall content where feasible without compromising product acceptability.

What characterizes the premium segment of the sweet and salty snacks market?

The premium segment is defined by the use of high-quality, exotic, or organic ingredients, artisanal production methods, sophisticated and aesthetically pleasing packaging, and often a higher price point. Products focus on gourmet flavor combinations, transparency, and niche dietary claims, appealing to consumers seeking elevated consumption experiences.

How important is packaging design in driving consumer purchasing decisions for snacks?

Packaging design is extremely important as snacks are often impulse purchases. Key elements include eye-catching colors, clear visual appeal, accurate representation of the product, ease of opening/resealing, and prominent display of nutritional and certification labels. Effective design must communicate brand story and product value instantly at the point of sale.

What role does machine learning play in optimizing snack product shelf placement in retail?

Machine learning analyzes vast point-of-sale data, cross-referencing it with store layout, regional demographics, and promotional schedules to recommend optimal shelf placement, ensuring high-demand products are strategically positioned to maximize visibility and impulse purchasing, thereby improving retailer sales and reducing product waste.

Are snack bars categorized as sweet, salty, or functional, and how does this affect market analysis?

Snack bars are highly versatile and often straddle sweet and functional categories. They are analyzed distinctly due to their positioning as meal replacements or specialized nutrition (protein, fiber). Market analysis focuses on their functional claims and distribution channels (health food vs. mainstream retail) rather than purely on indulgent characteristics.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager