Sweet Potato Starch Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432798 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Sweet Potato Starch Market Size

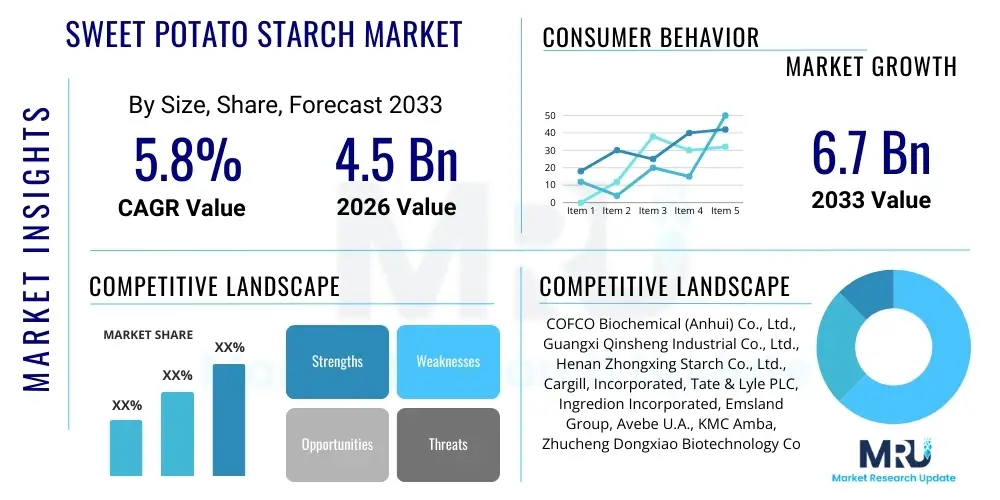

The Sweet Potato Starch Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. This robust growth trajectory is primarily fueled by the increasing application of sweet potato starch as a natural and gluten-free thickening agent across the food and beverage industry, coupled with its growing utilization in biodegradable packaging solutions. The superior functional properties, including high swelling power and excellent transparency, make it a preferred alternative over conventional starches in various industrial processes, particularly in the textile sizing and paper manufacturing sectors. Furthermore, the rising consumer demand for clean-label ingredients and the emphasis on sustainable agricultural practices contribute significantly to the market's expansion potential over the forecast period.

The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033. This valuation reflects the expanding capacity of major sweet potato-producing regions, particularly in Asia Pacific, to process raw sweet potatoes into high-quality starch products suitable for export and domestic consumption. Investment in advanced processing technologies, such as improved drying and separation techniques, is enhancing product purity and quality, thereby opening lucrative avenues in high-value applications like pharmaceuticals and specialized food additives. The shift toward specialized modification techniques, creating resistant starches and specialty texturizers, further justifies the anticipated growth in market valuation.

The growth rate is also underpinned by strategic collaborations between starch manufacturers and global food conglomerates seeking secure, sustainable supply chains for their ingredient needs. The escalating utilization of sweet potato starch in non-food applications, such as the production of bio-plastics and advanced materials, is expected to provide an additional layer of growth stability, mitigating potential volatility from agricultural yield variations. Regulatory environments favoring natural ingredients across North America and Europe also accelerate the adoption rate, positioning sweet potato starch as a key commodity in the global functional ingredients market.

Sweet Potato Starch Market introduction

The Sweet Potato Starch Market encompasses the production, processing, distribution, and utilization of starch derived from sweet potato tubers (Ipomoea batatas). This versatile carbohydrate polymer is extracted through wet milling processes, yielding a fine powder characterized by high purity, distinct functional attributes, and neutral flavor profiles. Primarily, the market is driven by the intrinsic properties of sweet potato starch, which include high viscosity, good stability during freezing and thawing, and the inherent characteristic of being gluten-free, making it highly attractive to health-conscious consumers and specialized food manufacturers.

The major applications of sweet potato starch span diverse industrial sectors. In the Food & Beverages industry, it functions critically as a thickener, binder, stabilizer, and texturizer in products such as noodles, baked goods, processed meats, soups, and sauces. Its ability to create unique textures, particularly in traditional Asian cuisine like glass noodles (vermicelli), sustains strong regional demand. Beyond food, it is extensively used in the textile industry for warp sizing to improve yarn strength and weaving efficiency, and in the paper and pulp industry as a binding agent and surface sizing material to enhance paper quality and strength. The pharmaceutical sector utilizes it as a binder and disintegrant in tablet formulations, capitalizing on its chemical inertness and high compressibility.

Key benefits driving market adoption include its classification as a natural, non-GMO, and often organic ingredient, aligning with global consumer trends toward clean labels. Furthermore, sweet potato cultivation is generally considered more resilient and sustainable than some other starch crops, offering a stable raw material supply base. The main driving factors include rapid urbanization in developing economies leading to increased consumption of processed foods, innovation in starch modification technologies that enhance functional characteristics for tailored industrial applications, and government initiatives promoting sweet potato farming due to its nutritional value and robust yield potential.

Sweet Potato Starch Market Executive Summary

The Sweet Potato Starch Market is experiencing significant momentum, propelled by robust business trends centered on technological advancements in extraction and modification processes. Manufacturers are increasingly focusing on developing pregelatinized and modified starches to cater to specific industrial needs, such as high-shear resistance or improved freeze-thaw stability required by the convenience food sector. Furthermore, sustainability is a core business trend, with leading producers integrating waste valorization techniques to utilize sweet potato residue, thereby reducing environmental impact and improving resource efficiency. Mergers and acquisitions targeting smaller, regional starch producers are common strategies employed by large market players to consolidate production capacity and optimize global supply chains, ensuring consistent product availability across key consuming regions like North America and Europe.

Regionally, Asia Pacific (APAC) dominates the market, primarily due to the large-scale cultivation of sweet potatoes in China, Vietnam, and Indonesia, coupled with the high per capita consumption of starch-based foods in these countries. However, North America and Europe are exhibiting the fastest growth rates, driven by the strong demand for gluten-free ingredients and the shift towards bio-based raw materials in industrial applications. Regulatory frameworks concerning food safety and ingredient transparency are more stringent in Western markets, prompting manufacturers to invest in high-purity, traceable starch products. Latin America and the Middle East & Africa are emerging markets, characterized by increasing industrialization in the food processing and textile sectors, slowly transitioning from imported starches to domestically sourced or regionally traded sweet potato starch derivatives.

Segmentation trends highlight the dominance of the Food & Beverages application segment, particularly in the production of baked goods, snacks, and specialized noodles, due to the starch’s excellent textural properties. Within the product type segment, the demand for modified sweet potato starch is escalating rapidly, outpacing native starch growth. This modification allows the starch to perform optimally in complex food matrices, resisting acidic conditions and high temperatures often encountered in industrial cooking processes. The industrial grade segment, encompassing textiles and paper applications, remains a stable consumer base, while the pharmaceutical and cosmetic grades represent niche, high-value segments demanding extremely high purity and consistent performance metrics, reflecting the industry's drive toward specialization and product differentiation.

AI Impact Analysis on Sweet Potato Starch Market

User inquiries concerning the impact of Artificial Intelligence (AI) on the Sweet Potato Starch Market frequently center on optimizing agricultural inputs, enhancing processing plant efficiency, and improving supply chain predictability. Users are keen to understand how AI-driven precision agriculture can boost sweet potato yields and quality, thereby stabilizing the raw material supply, which is often vulnerable to climate variability. Furthermore, there is significant interest in how machine learning algorithms can monitor and adjust parameters within the complex starch extraction and drying processes to maximize yield, reduce energy consumption, and ensure consistent batch-to-batch quality, particularly for specialized starch modifications. These concerns collectively reflect a desire for greater operational efficiency, risk mitigation in sourcing, and stringent quality control, driven by the need to meet global standards for food and industrial ingredients.

AI’s influence is profound, primarily manifesting through two critical areas: optimizing the upstream supply chain (agriculture) and streamlining the downstream manufacturing and logistics operations. In agriculture, AI-powered systems analyze soil data, weather patterns, and satellite imagery to provide farmers with optimized planting, irrigation, and fertilization schedules, directly translating to higher quality sweet potato tubers with optimal starch content. This predictive capacity minimizes resource wastage and enhances crop resilience, addressing the fundamental challenge of raw material consistency that affects starch production costs and quality. The integration of robotics and automated harvesting, guided by AI vision systems, further reduces labor costs and post-harvest losses, solidifying the economic viability of sweet potato cultivation for starch production.

In the processing stage, AI and machine learning are crucial for predictive maintenance of machinery, minimizing downtime in continuous processing environments. Furthermore, sophisticated spectral analysis combined with deep learning models allows for real-time quality assurance, ensuring that starch purity, particle size, and gelatinization properties meet precise client specifications before packaging. By forecasting market demand with high accuracy based on historical sales data, macroeconomic indicators, and even social media sentiment, AI systems enable producers to optimize inventory levels and transportation routes, reducing spoilage and logistics costs, thus improving the overall profitability and responsiveness of the sweet potato starch supply chain globally. This comprehensive integration of AI transforms the market from a traditional agricultural commodity trade into a highly optimized, technology-driven manufacturing sector.

- AI-driven Precision Agriculture: Optimizing sweet potato cultivation through predictive modeling of yield, soil health, and pest control, ensuring stable raw material supply.

- Automated Quality Control: Utilizing machine learning algorithms and computer vision for real-time monitoring of starch purity, moisture content, and particle size distribution during processing.

- Supply Chain Optimization: Implementing AI for demand forecasting, inventory management, and logistics route planning, reducing operational costs and improving market responsiveness.

- Predictive Maintenance: Deployment of sensors and AI analysis in processing plants to anticipate equipment failure, minimizing downtime and maximizing throughput efficiency.

- New Product Development Acceleration: Simulating the functional properties of modified starches under various conditions to rapidly develop and customize specialized starch derivatives for niche applications.

DRO & Impact Forces Of Sweet Potato Starch Market

The dynamics of the Sweet Potato Starch Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming the Impact Forces that dictate market direction and growth velocity. The primary drivers revolve around the global shift toward clean-label and gluten-free diets, significantly increasing the demand for naturally derived starches in the food industry. Concurrently, the versatility of the starch in non-food sectors, particularly in advanced biodegradable materials and pharmaceutical excipients, provides resilient demand streams. However, the market faces significant restraints, notably the volatility in raw material pricing due to dependence on agricultural yields susceptible to adverse weather conditions, and intense competition from larger, well-established starch sources like corn and tapioca, which benefit from economies of scale and extensive processing infrastructure. The critical opportunities lie in the commercialization of modified starches with enhanced functionalities and expanding penetration into emerging markets where processed food consumption is rapidly accelerating. These factors, alongside external regulatory and technological pressures, constitute the prevailing impact forces.

Key drivers include the technological advancements in starch modification techniques, enabling manufacturers to tailor the functional performance of sweet potato starch for specialized high-temperature or low-pH industrial applications. The burgeoning bio-plastics industry also serves as a strong driver, as sweet potato starch offers a sustainable, renewable resource for replacing petroleum-based polymers, aligning with global environmental protection mandates. Moreover, rising disposable incomes in APAC and Latin America are fueling the demand for premium food products and processed snacks that frequently utilize high-quality starches as essential components for texture and stability. Governmental support for sweet potato cultivation in developing nations, recognizing its role in food security and rural economic development, further stabilizes the supply side of the market equation, providing a reliable source of feedstock for starch extraction facilities.

The impact forces restraining growth include the substantial capital investment required for establishing efficient, modern wet-milling facilities that can produce high-purity starch required by the pharmaceutical and specialty food sectors. Furthermore, the lack of standardized global specifications for sweet potato starch purity and performance, especially compared to corn and wheat starches, sometimes acts as a barrier to large-scale international trade and adoption. Addressing these restraints requires significant investment in research and development and international harmonization of quality standards. However, the opportunities presented by exploiting the inherent natural properties of sweet potato starch—such as its high amylopectin content leading to excellent paste clarity and viscosity—position it uniquely for growth in premium and niche markets, offsetting some of the competitive pressures from bulk starches.

Segmentation Analysis

The Sweet Potato Starch Market is comprehensively segmented based on Type, Application, and Form, allowing for granular analysis of market dynamics and tailored strategy development. The Type segmentation distinguishes between Native Starch and Modified Starch, with the latter segment witnessing exponential growth due to the demand for customized functional properties such as cross-linking, etherification, and acetylation, which improve stability against heat, shear, and acidity. The application matrix is broad, covering sectors from high-volume food processing to specialized non-food industrial uses like textiles and pharmaceuticals, indicating the starch’s versatility. Understanding these segment dynamics is crucial for producers aiming to maximize returns by aligning production capabilities with high-growth, high-value end-user demands, especially those requiring specific textural or binding characteristics that native starch cannot provide efficiently.

The application segment, dominated by Food & Beverages, is further sub-segmented into categories such as noodles, bakery products, and dairy alternatives, each requiring distinct starch functionalities. For instance, the demand for sweet potato starch in high-quality, transparent glass noodles remains a major driver in Asia, while its use as a gluten-free flour alternative boosts demand in Western bakery markets. The non-food segments, especially Paper & Pulp and Textiles, depend on industrial-grade starches primarily for their strong binding and coating attributes. As sustainability concerns increase, the utilization of sweet potato starch in bio-degradable packaging films and compostable cutlery is gaining traction, signaling a future shift in the industrial segment towards eco-friendly applications and providing a long-term growth opportunity independent of food consumption trends.

The Form segmentation differentiates between Powder and Liquid formulations, although Powder form currently holds the majority share due to ease of transportation, storage, and application in dry mix products. Liquid starch formulations, often used as sizing agents or binders in textile and paper mills, require efficient logistics and specific preservation methods but offer advantages in continuous industrial processes where direct incorporation is preferred. Analyzing these segments helps stakeholders understand the specific value addition required at each stage—from basic milling to advanced chemical modification—and where targeted market penetration strategies, such as offering tailored technical support for specialized liquid formulations in textile mills, would yield the highest competitive advantage.

- By Type:

- Native Sweet Potato Starch

- Modified Sweet Potato Starch

- Pregelatinized Starch

- Cationic Starch

- Resistant Starch

- Acetylated Starch

- By Application:

- Food & Beverages

- Noodles & Pasta

- Bakery & Confectionery

- Soups, Sauces, & Dressings

- Processed Meat & Seafood

- Dairy & Frozen Desserts

- Industrial

- Textiles (Sizing & Finishing)

- Paper & Pulp (Surface Sizing & Coating)

- Adhesives & Binders

- Pharmaceuticals & Cosmetics

- Bio-plastics & Biomaterials

- By Form:

- Powder

- Liquid/Slurry

- By Grade:

- Food Grade

- Industrial Grade

- Pharmaceutical Grade

Value Chain Analysis For Sweet Potato Starch Market

The value chain of the Sweet Potato Starch Market begins with the upstream activities of raw material sourcing and cultivation, involving farmers and agricultural cooperatives specialized in high-starch-yielding sweet potato varieties. This stage is critical as the quality and starch content of the tuber directly impact the efficiency and cost structure of subsequent processing. Upstream analysis focuses heavily on crop science, including seed selection, precision farming techniques, and efficient harvesting to minimize post-harvest losses. Suppliers in this phase include fertilizer companies, agricultural machinery manufacturers, and biotechnology firms providing disease-resistant cultivars. The consolidation and reliability of raw material supply are the primary determinants of competitive advantage at the upstream end of the value chain, requiring strong contract farming and procurement agreements between processors and cultivators.

The midstream segment involves the core processing activities: wet milling, separation, purification, drying, and modification. This phase is capital-intensive and technology-driven, utilizing specialized machinery for raspers, centrifuges, hydrocyclones, and flash dryers. Companies invest heavily in patented modification technologies to produce specialized starches (e.g., resistant or pregelatinized) tailored for demanding industrial applications. Direct distribution often occurs for bulk industrial-grade starches directly from the manufacturing unit to large end-users like textile mills or paper factories. The complexity and cost structure of the midstream segment necessitate optimization through energy efficiency measures and utilization of co-products, such as sweet potato residue, for animal feed or fermentation substrates, which maximizes resource utilization and improves overall profitability.

Downstream analysis focuses on the distribution channels and end-user consumption. Products move through direct channels for large-volume industrial clients and indirect channels involving distributors, brokers, and food ingredient suppliers for smaller food manufacturers or retail packaging. Distributors play a vital role in market penetration by handling inventory, logistics, and technical support across diverse geographies. Direct sales channels are crucial for high-value pharmaceutical and specialty food grade starches where stringent quality control and direct technical consultation are required. The end-users, encompassing the food processing giants, textile manufacturers, and pharmaceutical companies, dictate the quality standards and functional requirements, thereby influencing investment decisions across the entire value chain. Efficiency in logistics and inventory management is paramount in the downstream segment to ensure timely delivery and product freshness.

Sweet Potato Starch Market Potential Customers

The potential customers for the Sweet Potato Starch Market are highly diverse, spanning both high-volume commodity buyers and niche specialized ingredient purchasers who prioritize natural, functional, and gluten-free attributes. The largest segment of buyers consists of multinational Food & Beverage corporations, particularly those involved in the production of convenience foods, snacks, and traditional Asian staple foods like noodles and dumplings. These manufacturers utilize sweet potato starch as a key functional ingredient for texture, viscosity, and binding in their product formulations, seeking stable pricing and consistent quality from suppliers. Specifically, companies focusing on clean-label or health-conscious product lines represent a rapidly growing customer base, viewing sweet potato starch as a premium, non-GMO alternative to conventional cereal starches.

Another major segment comprises large industrial consumers in the Paper & Pulp and Textile industries. Paper manufacturers utilize sweet potato starch as a sizing and coating agent to enhance surface strength, printability, and ink holdout. Textile companies rely on its strong adhesive properties for warp sizing to minimize thread breakage during weaving. These industrial buyers typically purchase large volumes of industrial-grade or modified cationic starch directly from manufacturers or major trading houses. Their purchase decisions are heavily influenced by performance metrics such as viscosity stability and biodegradability, often requiring long-term supply contracts to ensure uninterrupted manufacturing processes, making them high-volume, reliable customers for starch producers.

The third significant customer group includes pharmaceutical and nutraceutical companies, which represent a niche but high-value customer segment. These buyers require ultra-pure, consistently performing starches to be used as excipients, binders, or disintegrants in tablet and capsule formulations. The pharmaceutical grade demands rigorous quality assurance and regulatory compliance. Furthermore, emerging customers include firms specializing in bio-degradable materials and sustainable packaging. These innovators are keen on incorporating sweet potato starch into bio-plastics and compostable polymers, driven by increasing regulatory pressure against single-use plastics, positioning them as critical long-term growth partners for the sweet potato starch industry.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | COFCO Biochemical (Anhui) Co., Ltd., Guangxi Qinsheng Industrial Co., Ltd., Henan Zhongxing Starch Co., Ltd., Cargill, Incorporated, Tate & Lyle PLC, Ingredion Incorporated, Emsland Group, Avebe U.A., KMC Amba, Zhucheng Dongxiao Biotechnology Co., Ltd., China Starch Holdings Ltd., Sinsu Co., Ltd., Fujian Bestway Industry Co., Ltd., Jining Yongmei Starch Co., Ltd., Qinhuangdao Lihua Starch Co., Ltd., Agrana Beteiligungs-AG, Roquette Frères, Shijiazhuang Guangfa Starch Co., Ltd., Anhui Fengyuan Group Co., Ltd., Siyuan Starch Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sweet Potato Starch Market Key Technology Landscape

The technological landscape of the Sweet Potato Starch Market is continuously evolving, focused primarily on improving extraction efficiency, achieving higher purity levels, and customizing functional properties through modification. Advanced wet milling techniques, including multistage hydrocyclones and specialized disc centrifuges, are fundamental technologies employed to enhance the separation of starch granules from fibrous material and protein, minimizing water consumption and maximizing yield recovery. Key innovations also involve optimized drying technologies, such as flash drying and spray drying, which are critical for maintaining the native integrity of the starch granule while reducing moisture content efficiently and cost-effectively. Furthermore, energy recovery systems and closed-loop water circulation are becoming standard technological features in modern processing plants, aiming to minimize the environmental footprint and comply with stringent sustainability regulations globally.

Significant technological advancements are concentrated in the modification processes, which are essential for unlocking high-value applications. Chemical modification techniques, such as cross-linking and substitution (e.g., acetylation or etherification), are routinely used to produce starches resistant to high temperatures, acidic environments, and mechanical shear, making them suitable for canned foods, high-speed mixing, and specific textile applications. Enzymatic modification is gaining prominence as a green technology, allowing for the precise creation of resistant starches (dietary fibers) highly valued in the nutraceutical and functional food sectors, aligning with clean-label trends by avoiding synthetic chemical reagents. These enzymatic processes allow manufacturers to achieve specific degrees of polymerization and branching, resulting in tailored viscosity and textural profiles sought by specialized food developers.

Furthermore, the integration of process automation and analytical instrumentation defines the cutting edge of the technology landscape. Continuous monitoring systems utilizing Near-Infrared (NIR) spectroscopy and advanced rheometers enable real-time quality assurance of parameters such as viscosity, gelatinization temperature, and paste clarity. This level of control, often supervised by AI and IoT platforms, ensures batch consistency, reduces human error, and facilitates the efficient scale-up of customized starch formulations. The future technological trajectory is geared toward biorefinery concepts, wherein all components of the sweet potato tuber—not just the starch—are valorized into high-value co-products like protein, dietary fiber, and fermentation substrates, thereby achieving zero-waste manufacturing and maximizing economic output per ton of raw material processed.

Regional Highlights

The Sweet Potato Starch Market exhibits distinct regional consumption and production patterns, making regional analysis vital for global strategy. Asia Pacific (APAC) stands as the undeniable hub, dominating both production volume and consumption value. Countries like China, Vietnam, and Indonesia possess vast sweet potato cultivation capabilities, leveraging traditional methods and modern agricultural science to ensure consistent feedstock supply. The high regional consumption is intrinsically linked to traditional cuisine, where sweet potato starch is a fundamental ingredient in noodles, thickening agents, and desserts. Government initiatives promoting rural agriculture and infrastructure development for processing units further solidify APAC’s market leadership, making it the most competitive and mature market globally, characterized by high domestic consumption and significant export activity to North America and Europe.

North America and Europe represent the fastest-growing regions, driven not by raw material production but by high demand for imported functional ingredients, particularly the gluten-free, non-GMO variants. Consumer awareness regarding health and ingredient transparency is exceptionally high in these markets, fueling the adoption of sweet potato starch as a preferred substitute for wheat and corn starches in specialized bakery, processed food, and health food formulations. Strict regulatory standards in the European Union and the U.S. demand high-purity, traceable products, pushing manufacturers toward advanced processing and certification. Furthermore, the strong presence of major food processing companies and research institutions in these regions drives innovation in modified starch applications, focusing heavily on developing high-performance excipients for the pharmaceutical industry and stabilizers for the rapidly expanding dairy-free beverage sector.

Latin America and the Middle East & Africa (MEA) are characterized as emerging markets with immense untapped potential. In Latin America, countries such as Brazil and Argentina are increasing sweet potato production, and domestic food processing industries are beginning to scale up, reducing reliance on imported starches. The growth in MEA is more fragmented but is catalyzed by rapid urbanization, leading to higher consumption of convenience and packaged foods. Investment in localized processing infrastructure remains a challenge, yet increasing foreign direct investment in agriculture and food manufacturing is expected to accelerate the market's maturity in the latter half of the forecast period. The demand in these regions is initially focused on industrial applications, such as textile sizing and basic food thickening, but is steadily migrating toward specialized food grades as local economies develop and dietary patterns evolve.

- Asia Pacific (APAC): Dominates the market share due to extensive sweet potato cultivation (China, India, Vietnam), strong traditional usage in staple foods, and a robust processing industry. Key focus on high-volume production of native starch and basic modified starches for local and export markets.

- North America: Exhibits high growth driven by the strong demand for gluten-free products, clean-label ingredients, and advanced modified starches utilized in functional foods and nutraceuticals. Heavy reliance on imported raw materials or finished starch products.

- Europe: Characterized by stringent quality standards and a significant shift toward sustainable, bio-based industrial inputs (e.g., bio-plastics). High adoption of specialty and resistant starches in bakery, dairy alternatives, and pharmaceuticals.

- Latin America (LATAM): Emerging production base with growing domestic consumption in the food processing sector. Potential for increased utilization in animal feed and industrial binder applications due to expanding local economies.

- Middle East & Africa (MEA): Growth stimulated by increasing industrialization and rising packaged food consumption linked to urbanization. Focus remains on industrial grade applications, though high-purity food starch imports are rising to cater to urban consumer demands.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sweet Potato Starch Market. These companies are actively engaged in raw material procurement, advanced processing, distribution, and strategic R&D to maintain competitive superiority and expand their global market footprint through innovation and strategic alliances. Their operational strategies often involve optimizing production yield and developing novel modified starches tailored to specific end-user industry requirements, particularly in the gluten-free and sustainable materials sectors.- COFCO Biochemical (Anhui) Co., Ltd.

- Guangxi Qinsheng Industrial Co., Ltd.

- Henan Zhongxing Starch Co., Ltd.

- Cargill, Incorporated

- Tate & Lyle PLC

- Ingredion Incorporated

- Emsland Group

- Avebe U.A.

- KMC Amba

- Zhucheng Dongxiao Biotechnology Co., Ltd.

- China Starch Holdings Ltd.

- Sinsu Co., Ltd.

- Fujian Bestway Industry Co., Ltd.

- Jining Yongmei Starch Co., Ltd.

- Qinhuangdao Lihua Starch Co., Ltd.

- Agrana Beteiligungs-AG

- Roquette Frères

- Shijiazhuang Guangfa Starch Co., Ltd.

- Anhui Fengyuan Group Co., Ltd.

- Siyuan Starch Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Sweet Potato Starch market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between sweet potato starch and common starches like corn or tapioca?

Sweet potato starch generally exhibits higher viscosity and better paste clarity than corn starch, offering superior textural properties, especially in products requiring gelatinous textures, such as noodles and certain desserts. It is also naturally gluten-free and possesses unique swelling characteristics, often preferred in specific bakery and clean-label applications due to its neutral flavor profile.

Which applications drive the highest demand for modified sweet potato starch?

Modified sweet potato starch sees the highest demand in high-performance applications within the Food & Beverages industry (e.g., frozen meals, acidic sauces) requiring enhanced stability against high temperatures, freezing cycles, and high shear forces. Industrial applications like textile sizing and specialized paper coatings also heavily rely on chemically or enzymatically modified starches for superior binding and film-forming capabilities.

How do sustainability trends influence the sweet potato starch market?

Sustainability significantly boosts market appeal by positioning sweet potato starch as a renewable, non-GMO, and often locally sourced ingredient, aligning with clean-label mandates. Furthermore, its utilization in producing bio-plastics and biodegradable packaging substitutes directly supports environmental goals, driving substantial growth in the industrial segment as corporations seek eco-friendly raw materials.

What are the key challenges facing sweet potato starch producers regarding raw material supply?

The main challenge is the inherent agricultural volatility, where raw sweet potato yields and starch content are highly susceptible to weather conditions, pests, and regional diseases. This variability leads to price fluctuations and supply inconsistencies, which producers mitigate through contract farming, advanced forecasting (AI integration), and diversified sourcing strategies to stabilize input costs.

Which regions are expected to experience the fastest market growth, and why?

North America and Europe are projected to experience the fastest growth, primarily due to the accelerated consumer adoption of gluten-free, health-focused, and plant-based foods. While production remains concentrated in APAC, the high value, high-specification demand for specialty starches in Western markets, coupled with strong regulatory support for bio-based materials, fuels rapid market penetration and revenue expansion in these regions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager