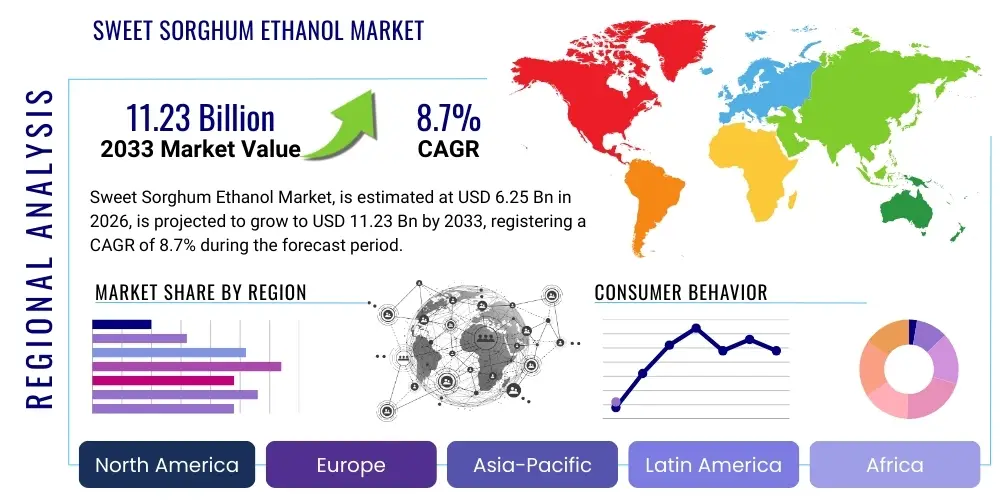

Sweet Sorghum Ethanol Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435185 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Sweet Sorghum Ethanol Market Size

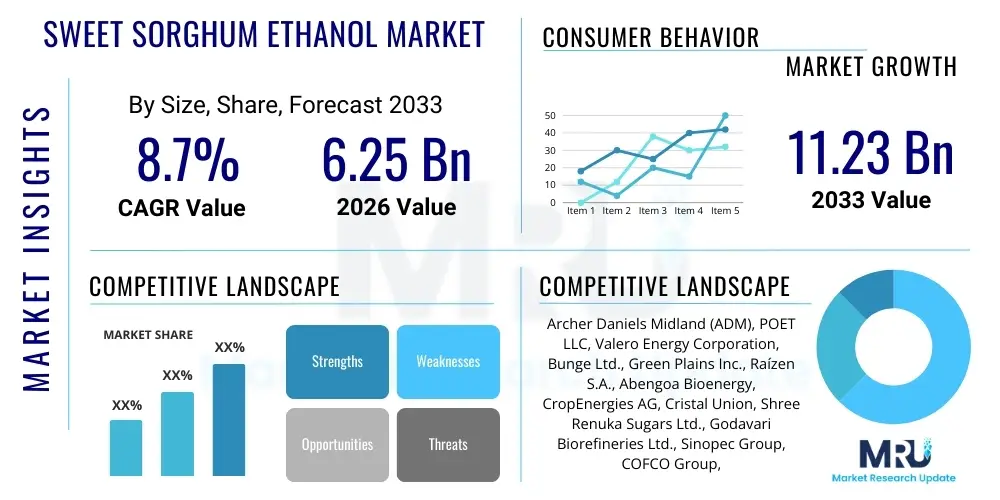

The Sweet Sorghum Ethanol Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.7% between 2026 and 2033. The market is estimated at USD 6.25 Billion in 2026 and is projected to reach USD 11.23 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating global demand for renewable energy sources and the increasing regulatory mandates promoting biofuel blending in transportation fuels across major economies. Sweet sorghum's inherent advantages, such as its high sugar yield, drought tolerance, and adaptability to marginal lands, position it as a critical, cost-effective, and sustainable feedstock alternative to traditional sources like corn and sugarcane, particularly in arid and semi-arid regions.

Sweet Sorghum Ethanol Market introduction

The Sweet Sorghum Ethanol Market encompasses the production and utilization of bioethanol derived from the fermentable sugars extracted from the sweet stalks of the sorghum plant (Sorghum bicolor L.). This bioethanol serves primarily as an oxygenate additive in gasoline, enhancing octane ratings and reducing harmful emissions, aligning with global efforts to mitigate climate change and enhance energy security. The product, often blended as E10 or E85, offers a sustainable substitute for fossil fuels, contributing significantly to the decarbonization of the transport sector. Sweet sorghum's rapid growth cycle and dual-purpose potential—providing both ethanol feedstock (stalk juice) and animal feed/biomass (bagasse)—optimize resource efficiency within the burgeoning bio-refinery complex.

Major applications for sweet sorghum ethanol span the transportation fuel sector, industrial solvent manufacturing, and the production of chemical intermediates. Its inherent characteristics, including lower water footprint and greater photosynthetic efficiency compared to corn, make it increasingly attractive for large-scale production, particularly in water-stressed areas like India, China, and parts of the United States. Key driving factors fueling this market include stringent government policies favoring renewable fuels, attractive subsidies and tax incentives for biofuel producers, and technological advancements that enhance extraction and fermentation efficiencies, thereby lowering the overall cost of production relative to fluctuating fossil fuel prices.

Furthermore, the economic benefits derived from sweet sorghum cultivation extend to rural employment generation and improved farm income diversification, reinforcing its appeal beyond environmental advantages. The shift towards non-food feedstocks for biofuel production—an area where sweet sorghum excels due to its primary use of stalks rather than grains—mitigates the "food vs. fuel" debate that often challenges the corn ethanol industry. This sustainable resource utilization pattern is critical for maintaining long-term market growth and securing investment in new cultivation and processing infrastructure globally.

Sweet Sorghum Ethanol Market Executive Summary

The Sweet Sorghum Ethanol Market is experiencing robust growth fueled by converging business trends, favorable regional policies, and significant segment expansion within the biofuel value chain. Business trends indicate a strong movement towards integrated bio-refinery models where sweet sorghum processing maximizes byproduct utilization (e.g., biogas from bagasse, feed from residues), significantly improving operational margins and environmental sustainability. Strategic partnerships between agricultural science institutions, processing technology providers, and major energy companies are driving innovation, particularly in developing high-yielding, stress-tolerant sweet sorghum varieties optimized for specific geographical climates. Investment in large-scale dedicated supply chains is a prevailing theme, focusing on minimizing transportation costs and ensuring consistent feedstock availability.

Regionally, Asia Pacific (APAC), particularly India and China, is emerging as the dominant growth engine due to favorable government mandates supporting ethanol blending targets (such as India's E20 target) and the widespread availability of suitable marginal land for cultivation. North America and Europe continue to support market expansion through R&D investment aimed at overcoming processing challenges related to juice preservation and sugar concentration, positioning sweet sorghum as a key non-food alternative feedstock. Latin America, led by Brazil, is leveraging its expertise in sugarcane processing to integrate sweet sorghum into existing bioethanol infrastructure during off-seasons, optimizing asset utilization throughout the year.

Segmentation analysis highlights the dominance of the Fuel Grade Ethanol segment, driven by regulatory blending requirements worldwide. However, the Industrial Grade Ethanol segment is forecast to exhibit rapid growth, supported by increasing demand for high-purity, bio-based solvents in pharmaceutical and cosmetic industries. Furthermore, the segmentation based on processing technology shows a strong shift toward continuous fermentation systems coupled with advanced separation techniques like molecular sieves, aiming to enhance product purity and energy efficiency across the entire production cycle, thereby streamlining market readiness and cost competitiveness.

AI Impact Analysis on Sweet Sorghum Ethanol Market

Common user questions regarding AI's impact on the Sweet Sorghum Ethanol Market frequently revolve around optimizing crop yield, predicting feedstock availability, and streamlining bio-refinery operations. Users are highly interested in how machine learning algorithms can manage complex agricultural parameters—such as water usage, nutrient application, and disease detection—to maximize sweet sorghum sugar content and biomass output. Concerns often center on the implementation cost of precision agriculture technologies and the integration of predictive analytics into existing, often traditional, farming and processing infrastructure. The general expectation is that AI will be a transformative force, enabling unprecedented levels of efficiency and sustainability, particularly in real-time juice quality assessment and predictive maintenance within high-volume fermentation plants, ensuring better consistency and lower operational expenditures.

- AI-Powered Precision Agriculture: Utilizing deep learning models for real-time monitoring of sweet sorghum health, predicting optimal harvest times based on sugar concentration, and minimizing water and fertilizer inputs, leading to maximized stalk juice yield per hectare.

- Supply Chain and Logistics Optimization: Deploying machine learning to forecast regional feedstock supply fluctuations, optimize transportation routes from farm to refinery, and minimize juice degradation during transit, thereby reducing logistical costs and improving overall supply chain reliability.

- Fermentation Process Control: Implementing AI-driven dynamic control systems within bio-refineries to adjust fermentation parameters (temperature, pH, yeast concentration) instantaneously, maximizing ethanol conversion efficiency and reducing batch cycle times.

- Predictive Maintenance: Using sensor data and AI algorithms to predict equipment failures in complex machinery like crushers, evaporators, and distillation columns, significantly reducing unplanned downtime and maintenance costs in ethanol plants.

- Quality Assurance and Grading: Automated systems utilizing computer vision and spectral analysis to rapidly grade sweet sorghum juice quality, ensuring consistent feedstock input and reducing variations in the final ethanol product purity.

- Climate Resilience Modeling: Developing AI models to simulate the impact of climate change scenarios on sweet sorghum cultivation in various geographies, assisting farmers and producers in selecting the most resilient and productive hybrid varieties.

DRO & Impact Forces Of Sweet Sorghum Ethanol Market

The dynamics of the Sweet Sorghum Ethanol Market are governed by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the key Impact Forces shaping its trajectory. The primary driver is the global mandate for achieving net-zero emissions, compelling governments and corporations to aggressively seek low-carbon fuel alternatives, where sweet sorghum ethanol offers a compelling pathway. However, this growth is significantly restrained by the perishability of sweet sorghum juice, which mandates rapid processing after harvest or substantial investment in preservation technologies, increasing initial capital expenditure and logistical complexities. Opportunities arise prominently from leveraging marginal land utilization, as sweet sorghum thrives where staple food crops struggle, mitigating resource competition. The net impact force is largely positive, pushing the market towards significant expansion, provided technological solutions effectively address the inherent processing challenges associated with feedstock instability and seasonal variations.

Key drivers include favorable governmental policies such as Renewable Fuel Standards (RFS) in the U.S. and aggressive national blending targets in emerging economies like India and China, which provide a guaranteed market mechanism for biofuel producers. The rising price volatility of crude oil also enhances the economic viability of bioethanol, making sweet sorghum an increasingly competitive feedstock. Furthermore, advancements in genetic engineering and conventional breeding have led to the development of high-biomass, disease-resistant sweet sorghum varieties, further boosting yield potential and production economics. These drivers collectively establish a fertile ground for sustainable capacity expansion and technological adoption across major producing regions.

Conversely, significant restraints hinder optimal market penetration. The seasonal nature of sweet sorghum harvesting limits year-round operation for dedicated refineries, necessitating strategies for storage or integration with other year-round feedstocks, which adds complexity. Furthermore, the lack of standardized global protocols for sweet sorghum cultivation and juice processing presents market entry barriers, particularly for smaller producers. Nonetheless, opportunities are abundant in developing value-added co-products from the bagasse and residual biomass, such as specialized bio-plastics, high-value chemicals, and sustainable aviation fuels (SAF) feedstock conversion, which dramatically improves the overall economic calculus of a sweet sorghum bio-refinery project, making the overall investment landscape increasingly attractive.

Segmentation Analysis

The Sweet Sorghum Ethanol Market is systematically segmented based on End-Product, Processing Technology, and Application, providing a detailed view of market dynamics and specialized revenue streams. This multi-dimensional segmentation is crucial for stakeholders to identify high-growth niches, especially as the industry shifts towards optimizing efficiency and product purity. The End-Product segmentation clearly delineates the primary market focus, separating high-volume fuel applications from smaller, high-margin industrial uses. Technology segmentation highlights the preferred methods for sugar extraction and conversion, reflecting the industry's continuous investment in optimizing yield and reducing energy consumption.

The largest segment by far remains Fuel Grade Ethanol, serving the mandates set by transportation policies globally. However, the fastest-growing segment is anticipated to be the Industrial Grade Ethanol, driven by the increasing consumer and corporate preference for bio-based solvents over petroleum-derived chemicals in paints, pharmaceuticals, and consumer goods. Technology-wise, advanced continuous fermentation techniques, coupled with efficient distillation and dehydration processes, are gaining traction over traditional batch methods, primarily due to their superior scalability and consistent output quality, critical for meeting stringent fuel standards.

- By End-Product:

- Fuel Grade Ethanol (Dominant segment due to blending mandates)

- Industrial Grade Ethanol (Growing segment for solvents and chemical precursors)

- Potable Alcohol (Niche application, highly regulated)

- By Processing Technology:

- Conventional Batch Fermentation

- Continuous Fermentation (High efficiency, preferred for scale)

- Enzymatic Hydrolysis (Focus on cellulosic components)

- Distillation and Dehydration Systems (Molecular sieves, advanced separation)

- By Application:

- Transportation Fuel Additive (Primary market driver)

- Chemical Feedstock (Production of ethylene, acetaldehyde)

- Solvents and Thickeners (Industrial cleaning, cosmetics)

- By Region:

- North America

- Europe

- Asia Pacific (APAC) (Highest growth potential)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Sweet Sorghum Ethanol Market

The value chain for Sweet Sorghum Ethanol is complex, commencing with specialized agricultural production and culminating in sophisticated distribution channels to meet energy sector demands. Upstream analysis focuses intensely on agricultural input providers, including seed developers (biotechnology firms specializing in high-sugar, drought-resistant varieties) and specialized equipment manufacturers for harvesting and initial crushing. The efficiency of the upstream segment is paramount, as feedstock cost represents the largest variable expense in ethanol production. Strategic collaborations ensuring timely harvesting and transport of the perishable juice are essential components of upstream optimization.

Midstream activities involve the core processing infrastructure, spanning initial juice extraction, clarification, fermentation, distillation, and dehydration. This stage is capital-intensive and relies heavily on advanced biotechnology and engineering solutions to maximize conversion rates and minimize energy consumption. Direct channels, often involving integrated energy companies that own both the refinery and the distribution network, ensure streamlined logistics. Indirect channels involve independent ethanol producers selling their finished product to large blending terminals or specialized chemical distributors who then route the product to end-users like gasoline stations or industrial manufacturers.

Downstream analysis centers on the logistics and end-user market penetration. Fuel grade ethanol moves through large petroleum distribution networks, subject to strict quality control and blending mandates enforced by national energy regulators. Industrial grade ethanol requires specialized distribution channels adhering to chemical safety standards. The increasing adoption of digital platforms for tracking supply chain provenance and ensuring sustainability credentials is a growing trend across both direct and indirect distribution methodologies, enhancing transparency and consumer confidence in the bio-based fuel segment.

Sweet Sorghum Ethanol Market Potential Customers

The primary customer base for the Sweet Sorghum Ethanol Market consists of large-scale integrated energy companies and national oil corporations mandated by government policy to meet biofuel blending targets in the transportation sector. These customers require high-volume, continuously supplied, and specification-compliant fuel-grade ethanol for blending with gasoline. Their purchasing decisions are critically influenced by feedstock sustainability credentials, price competitiveness against fossil fuels, and logistical reliability, favoring producers with well-established and diversified supply chains capable of navigating seasonal variability.

A rapidly expanding secondary customer segment includes chemical manufacturers and industrial solvent users seeking renewable alternatives to petrochemical derivatives. This group demands industrial-grade or even higher-purity ethanol for use in the production of bio-based plastics, cosmetics, pharmaceutical ingredients, and cleaning agents. For these buyers, consistency in purity, compliance with specific industrial certifications, and robust environmental, social, and governance (ESG) reporting are key purchasing criteria, often justifying a slight price premium over fuel-grade specifications due to the specialized nature of the application.

Government procurement bodies, particularly in developing nations focused on rural energy independence and agricultural support, also represent significant potential buyers. These entities may procure ethanol for specialized applications, such as running dedicated flex-fuel vehicle fleets or supporting decentralized power generation projects, driven not only by cost but also by broader socio-economic development goals related to agricultural stability and reduced import dependency. The diversity of these end-users underscores the broad market applicability of sweet sorghum ethanol beyond just the traditional transportation sector.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.25 Billion |

| Market Forecast in 2033 | USD 11.23 Billion |

| Growth Rate | CAGR 8.7% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Archer Daniels Midland (ADM), POET LLC, Valero Energy Corporation, Bunge Ltd., Green Plains Inc., Raízen S.A., Abengoa Bioenergy, CropEnergies AG, Cristal Union, Shree Renuka Sugars Ltd., Godavari Biorefineries Ltd., Sinopec Group, COFCO Group, The Andersons, Inc., Red River Commodities, Altiras Chemicals, Advanced Bioenergy LLC, Pure Energy Inc., Solvay S.A., Tereos Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sweet Sorghum Ethanol Market Key Technology Landscape

The technological landscape of the Sweet Sorghum Ethanol Market is focused heavily on improving feedstock handling efficiency, optimizing fermentation yields, and enhancing the energy neutrality of the bio-refinery process. A critical area of innovation is in field-to-refinery logistics, specifically the use of mobile crushing and pre-treatment units. These units allow for the immediate extraction and stabilization (e.g., pH adjustment or mild heating) of the sweet sorghum juice right at the farm gate, circumventing the primary challenge of juice rapid degradation, thereby allowing refineries to process stabilized concentrate rather than highly perishable whole stalks.

Within the refinery, the shift from traditional batch systems to advanced continuous fermentation technologies is driving market efficiency. Continuous systems offer higher throughput, reduced labor costs, and consistent product quality, essential for high-volume fuel production. Furthermore, research into robust, genetically engineered yeast strains (e.g., Saccharomyces cerevisiae variants) specifically tailored to tolerate high sugar concentrations and various inhibitors present in sweet sorghum juice is significantly boosting conversion rates and reducing overall processing time, directly impacting profitability.

Another pivotal technological development involves the efficient utilization of sweet sorghum bagasse, the fibrous residue left after juice extraction. Advanced gasification and pyrolysis technologies are being implemented to convert this lignocellulosic biomass into syngas, bio-oil, or directly into heat and power, which can make the ethanol plant largely energy self-sufficient, substantially lowering operational costs and improving the overall life cycle assessment (LCA) of the biofuel. Moreover, membrane separation techniques, such as reverse osmosis for juice concentration and molecular sieves for final ethanol dehydration, are replacing energy-intensive thermal methods, contributing to superior energy efficiency and cost competitiveness against fossil fuel production.

Regional Highlights

- Asia Pacific (APAC): Recognized as the epicenter of future market growth, driven primarily by India and China. India's aggressive Ethanol Blending Program (EBP) targeting 20% blending by 2025/2026 places immense pressure on domestic feedstock supply, making sweet sorghum an indispensable second-generation alternative due to its suitability for marginal and rain-fed land. China is heavily investing in large-scale bio-refineries and R&D for drought-resistant sorghum hybrids to enhance national energy security and reduce reliance on imported oil.

- North America: Remains a significant market focused on diversification away from corn ethanol. The U.S. Renewable Fuel Standard (RFS) provides a stable regulatory framework encouraging the use of advanced biofuels, including sweet sorghum ethanol. Research efforts here concentrate on optimizing storage and year-round processing solutions, integrating sweet sorghum into existing corn-based infrastructure during shoulder seasons to maximize asset utilization.

- Europe: Although facing limitations due to stringent sustainability criteria and feedstock sourcing rules, European countries are increasingly exploring sweet sorghum as a non-food, non-feed option compatible with the objectives of the Renewable Energy Directive (RED II). Investment focuses on pilot projects demonstrating the sustainability credentials and high sugar yield potential, particularly in Mediterranean climates where water scarcity is a growing concern.

- Latin America: Led by Brazil, this region strategically integrates sweet sorghum into the globally dominant sugarcane ethanol industry. Sweet sorghum serves as a complementary feedstock, providing raw materials during the sugarcane off-season, thus maintaining year-round employment and operational efficiency in established mills, capitalizing on existing infrastructure and expertise in fermentation science.

- Middle East & Africa (MEA): Emerging as a potential high-growth area, driven by governmental interest in sustainable agriculture and energy independence, particularly in nations facing extreme water stress. Sweet sorghum’s inherent drought resistance makes it uniquely suited for cultivation in arid and semi-arid zones, offering an avenue for renewable fuel production without compromising scarce water resources dedicated to food security.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sweet Sorghum Ethanol Market.- Archer Daniels Midland (ADM)

- POET LLC

- Valero Energy Corporation

- Bunge Ltd.

- Green Plains Inc.

- Raízen S.A.

- Abengoa Bioenergy

- CropEnergies AG

- Cristal Union

- Shree Renuka Sugars Ltd.

- Godavari Biorefineries Ltd.

- Sinopec Group

- COFCO Group

- The Andersons, Inc.

- Red River Commodities

- Altiras Chemicals

- Advanced Bioenergy LLC

- Pure Energy Inc.

- Solvay S.A.

- Tereos Group

Frequently Asked Questions

Analyze common user questions about the Sweet Sorghum Ethanol market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of sweet sorghum over corn for ethanol production?

Sweet sorghum is primarily advantageous due to its high water-use efficiency and drought tolerance, allowing it to grow on marginal or semi-arid land unsuitable for corn or sugarcane, thereby mitigating the 'food vs. fuel' conflict and providing greater feedstock security in water-stressed regions. Furthermore, the fermentable sugars are directly available in the stalk juice, simplifying the saccharification process required for starch-based feedstocks.

How is the seasonality of sweet sorghum harvesting managed in refineries?

Seasonality is managed through two primary strategies: first, by integrating mobile crushing units for immediate juice extraction and stabilization/concentration for later processing; and second, by co-locating or integrating sweet sorghum processing facilities with existing year-round bio-refineries (like sugarcane mills) to ensure continuous operation and optimal asset utilization throughout the year.

Which geographical region exhibits the highest growth potential for sweet sorghum ethanol?

Asia Pacific (APAC), specifically led by India and China, demonstrates the highest growth potential. This is driven by strong governmental blending mandates (e.g., India's E20 target), vast tracts of marginal land suitable for sweet sorghum cultivation, and the need to reduce substantial fossil fuel import dependencies.

What are the key technical constraints currently limiting widespread adoption of sweet sorghum ethanol?

The major constraints include the rapid perishability of the extracted sweet sorghum juice, which necessitates immediate processing or advanced preservation technologies, and the need for further standardization of high-efficiency harvesting and processing technologies to consistently meet low-cost operational targets at a commercial scale.

How does the use of AI influence sweet sorghum ethanol production costs?

AI significantly reduces production costs by optimizing upstream agricultural inputs (water, fertilizer) through precision agriculture, maximizing sugar yield per hectare, and streamlining midstream refinery operations by reducing energy consumption and minimizing unscheduled downtime through predictive maintenance of critical processing equipment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager