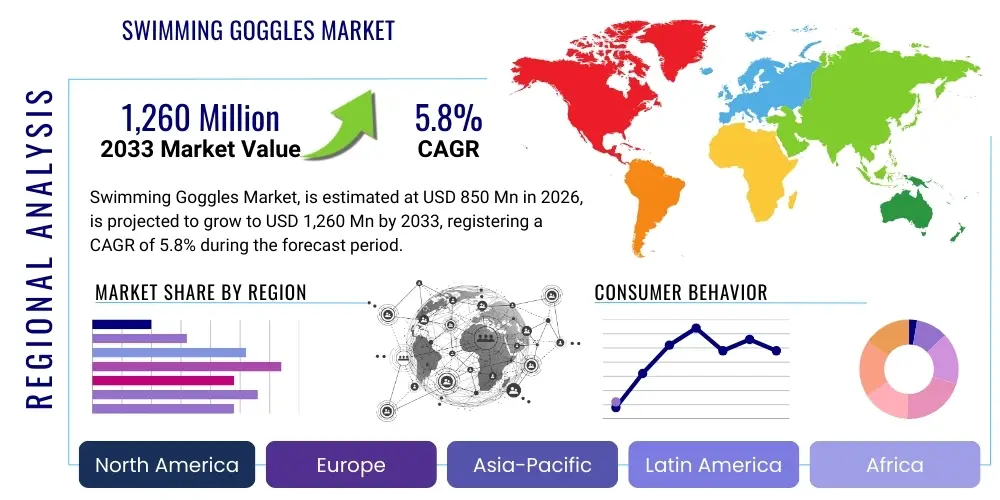

Swimming Goggles Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435451 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Swimming Goggles Market Size

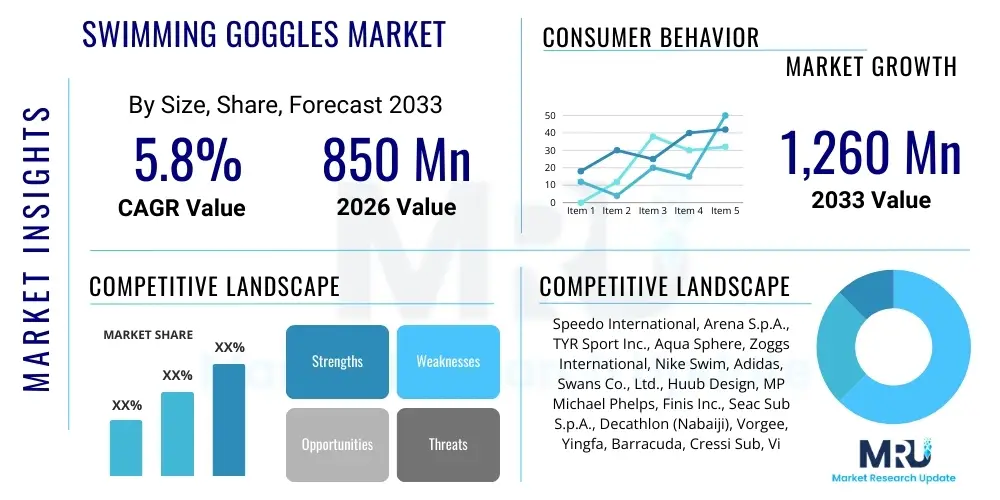

The Swimming Goggles Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $850 Million USD in 2026 and is projected to reach $1,260 Million USD by the end of the forecast period in 2033.

Swimming Goggles Market introduction

The Swimming Goggles Market encompasses the global trade of protective eyewear designed for use in aquatic environments, primarily to shield the eyes from chlorinated water, saltwater, and debris, while simultaneously offering enhanced underwater visibility. These products range from basic recreational models to high-performance competitive gear featuring advanced materials and ergonomic designs. The market is characterized by innovations in lens technology, anti-fog coatings, UV protection, and customizable fittings, addressing the diverse needs of casual swimmers, fitness enthusiasts, and professional athletes globally. Adoption is driven by increasing participation in water sports, mandatory use in competitive events, and a growing health and fitness consciousness among consumers worldwide.

Swimming goggles serve several critical functions, including optical clarity, leak prevention, and impact resistance. Major applications span recreational swimming (pools, beaches), competitive training and racing, open-water swimming (triathlons), and specialized uses such as therapeutic aquatic exercises. Key benefits include preventing eye irritation and conjunctivitis caused by pool chemicals, providing essential UV protection for outdoor swimming, and significantly improving visual acuity underwater, thereby contributing to safety and performance. The product evolution often focuses on improving comfort through silicone gaskets and adjustable straps, alongside enhancing durability and style to appeal to modern consumer preferences.

Driving factors for sustained market growth include favorable demographic trends, such as the rising number of middle-aged and elderly individuals engaging in low-impact aquatic fitness, and robust investments in public and private swimming infrastructure across emerging economies. Furthermore, the commercial success of major international swimming competitions continuously elevates the profile of water sports, stimulating demand for advanced and branded equipment. Strategic marketing efforts by major manufacturers, often involving sponsorships of elite athletes, also play a crucial role in shaping consumer choice and reinforcing the perception of goggles as essential performance equipment.

Swimming Goggles Market Executive Summary

The global Swimming Goggles Market exhibits stable growth, propelled by the convergence of expanding global swimming participation and continuous product innovation focused on comfort and performance. Business trends indicate a strong move toward customization, with prescription goggles and modular designs gaining traction. Manufacturers are strategically investing in sustainable materials and smart technologies, such as integrated heads-up displays (HUDs), to differentiate their offerings and capture premium market segments. The competitive landscape remains moderately consolidated, dominated by established sports brands leveraging extensive distribution networks and strong brand loyalty, while smaller, specialized firms drive innovation in niche areas like extreme open-water or triathlon-specific eyewear.

Regionally, Asia Pacific (APAC) is emerging as the fastest-growing market, largely due to rapid urbanization, increasing disposable incomes, and widespread government initiatives promoting swimming and aquatic safety. North America and Europe, while mature, maintain dominance in terms of market value, driven by high consumer awareness, robust competitive swimming infrastructure, and a strong culture of recreational water activities. The Middle East and Africa (MEA) are also showing promising growth, supported by tourism-related water activities and the development of world-class sporting facilities, although distribution challenges in some sub-regions remain a constraint.

Segment trends reveal that the competitive segment, though smaller in volume, holds a higher average selling price (ASP) and drives technological advancement, particularly in hydrodynamic designs and superior anti-fog solutions. Meanwhile, the recreational segment remains the largest volume contributor, driven by affordability and broad availability through mass-market channels. The distribution paradigm is shifting, with e-commerce platforms experiencing accelerated growth, offering consumers a wider selection and the convenience of direct-to-consumer models, which necessitates key players to optimize their omnichannel strategies to maintain market share and visibility.

AI Impact Analysis on Swimming Goggles Market

Common user questions regarding AI's impact on the Swimming Goggles Market often center on how technology can solve persistent problems like customized fit, lens fogging, and real-time performance tracking. Users inquire about AI-driven manufacturing processes for creating perfect seals based on facial biometrics and the potential for AI algorithms to personalize training by integrating real-time data collected via smart goggles. Key themes revolve around enhanced user experience, predictive maintenance (e.g., forecasting anti-fog coating degradation), and optimization of supply chain logistics. Consumers expect AI to transition goggles from simple protective gear to sophisticated, data-generating fitness tools, significantly improving both safety and athletic output.

The integration of Artificial Intelligence primarily revolutionizes the product design and personalization phases. AI-powered scanning technology allows manufacturers to analyze complex facial geometries accurately, leading to the production of custom-molded gaskets and nose bridges that achieve superior comfort and leak prevention—a significant value-add for professional and high-end consumers. Furthermore, AI contributes substantially to optimizing manufacturing processes by enabling predictive quality control, reducing material waste, and streamlining complex assembly lines, ultimately decreasing production costs and accelerating time-to-market for novel designs.

In the realm of smart goggles, AI acts as the processing engine for performance data. Embedded sensors collect metrics such as lap times, stroke efficiency, distance, and heart rate. AI algorithms then process this raw data to provide swimmers with immediate, actionable feedback via heads-up displays, or post-session analysis through connected apps. This capability transforms the training experience, offering personalized coaching insights without the need for external monitoring devices. Future developments are anticipated to include AI systems that can detect and correct improper swimming form in real-time, thereby maximizing efficiency and minimizing injury risks.

- AI-Driven Custom Fitting: Utilization of machine learning for personalized goggle frame and seal design based on 3D facial scans, ensuring optimal fit and zero leakage.

- Manufacturing Optimization: Predictive analytics and robotics integration in production lines, reducing defects and optimizing material usage, particularly for complex coatings.

- Real-Time Performance Analytics: AI processing of sensor data in smart goggles to provide immediate feedback on stroke rate, pace, and energy expenditure via integrated displays.

- Inventory and Demand Forecasting: Use of AI tools to predict regional demand shifts and optimize inventory levels for various product segments (e.g., recreational vs. competitive).

- Virtual Try-On Experiences: Implementation of augmented reality and AI to allow consumers to virtually try on different goggle styles and assess fit effectiveness before purchase.

- Personalized Training Recommendations: Algorithms analyze swimming metrics over time to suggest customized training drills and recovery protocols.

DRO & Impact Forces Of Swimming Goggles Market

The Swimming Goggles Market is significantly shaped by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO). Major drivers include the global expansion of recreational and competitive swimming, rising consumer awareness regarding eye protection against chlorine and UV radiation, and continuous technological advancements in anti-fog and UV filtering lens technologies. These drivers create a consistently favorable environment for market expansion, particularly in regions investing heavily in sports infrastructure. Conversely, key restraints such as the persistent challenge of fogging and leakage, high price points for specialized performance goggles, and consumer sensitivity to short product lifecycles due to wear and tear, temper the market's maximum growth potential. The ongoing need for perfect sealing and long-lasting anti-fog properties represents a technical hurdle that manufacturers must continuously address to enhance user satisfaction.

Opportunities within the market are predominantly concentrated in the smart eyewear segment, which integrates technology for fitness tracking and real-time performance monitoring, appealing to serious athletes and tech-savvy consumers. The growing market for prescription swimming goggles represents a substantial untapped segment, driven by the increasing global prevalence of vision correction needs. Furthermore, strong opportunities lie in sustainable manufacturing, where brands incorporating recycled or bio-based materials can attract environmentally conscious consumers, thereby building brand equity and establishing a competitive advantage in mature markets. Diversification into open-water and triathlon-specific goggles, which require enhanced peripheral vision and durability against harsh environments, also presents profitable avenues for growth.

Impact forces influencing market behavior are categorized into Porter's Five Forces, highlighting competitive rivalry, which is intense due to numerous established and emerging players. The threat of new entrants is moderate, cushioned by high initial investment in R&D for advanced coatings and established distribution channels, but vulnerable to disruptive innovation. The bargaining power of buyers is significant, particularly in the recreational segment, due to product similarity and wide availability, driving price competition. The threat of substitutes is low, as no true substitute offers the comprehensive protection and visual clarity of dedicated swimming goggles. Lastly, the bargaining power of suppliers remains moderate, influenced by the specialized nature of materials like high-grade silicone and proprietary lens coatings, creating a complex supply chain dynamic that manufacturers must carefully manage.

Segmentation Analysis

The Swimming Goggles Market is intricately segmented based on product type, application, lens type, and distribution channel, reflecting the diverse consumer needs across recreational, fitness, and professional sporting demographics. Analyzing these segments provides critical insights into purchasing patterns and technological preferences. The recreational segment consistently holds the largest market share by volume due to high participation rates, prioritizing comfort and affordability, while the competitive segment generates higher revenue through premium pricing driven by specialized hydrodynamic features and advanced materials. Understanding the interplay between these segments allows manufacturers to tailor R&D and marketing strategies effectively, ensuring optimal resource allocation across product lines.

- By Type:

- Prescription Goggles

- Non-Prescription Goggles

- By Application:

- Competitive Swimming

- Recreational Swimming

- Training/Fitness Swimming

- By Lens Type:

- Clear Lenses

- Mirrored Lenses

- Tinted/Smoked Lenses

- Photochromic Lenses

- By Distribution Channel:

- Online Retail (E-commerce, Brand Websites)

- Offline Retail (Sporting Goods Stores, Specialty Retailers, Hypermarkets)

Value Chain Analysis For Swimming Goggles Market

The value chain for the Swimming Goggles Market begins with upstream activities involving the procurement of specialized raw materials. Key inputs include high-grade polycarbonate or cellulose propionate for lenses, medical-grade silicone or thermoplastic elastomers (TPE) for gaskets and straps, and proprietary chemical compounds for anti-fog and UV protection coatings. Suppliers of these specialized materials, particularly those providing patented lens technologies, hold moderate bargaining power. Manufacturing involves complex processes such as injection molding, precision coating application, and assembly. Manufacturers that invest heavily in automated production and advanced quality control systems gain cost efficiencies and maintain a strong competitive edge over smaller players.

Downstream activities focus on marketing, sales, and distribution. The distribution channel is crucial, balancing the penetration of mass-market retail (hypermarkets and sporting goods chains) with the rapid growth of specialized online platforms. Direct distribution through brand websites is increasing, allowing manufacturers to control branding, pricing, and consumer engagement directly. For the high-end competitive segment, specialized sports retailers and direct supply contracts with swimming clubs or national federations remain important, ensuring product visibility among key influencers and professional users. Effective logistics management is essential to handle seasonal demand peaks, particularly during summer months and major competition cycles.

Direct channels (e.g., brand e-commerce sites) offer higher margins and better data collection capabilities, enabling personalized marketing and faster product iteration based on consumer feedback. Indirect channels, such as large international retailers (e.g., Decathlon, Dick's Sporting Goods), provide extensive market reach but involve lower margins and dependency on retailer promotions. The increasing globalization of manufacturing often necessitates complex cross-border logistics, making efficient supply chain management and inventory optimization critical for overall profitability and responsiveness to global consumer demand shifts. Successful companies prioritize optimizing the final mile distribution and strengthening retail partnerships across both online and offline platforms.

Swimming Goggles Market Potential Customers

The customer base for the Swimming Goggles Market is highly diversified, encompassing professional athletes, recreational swimmers, competitive clubs, and military/rescue personnel. End-users fall primarily into two major categories: performance-oriented consumers and comfort-oriented consumers. Performance consumers, including triathletes and competitive swimmers, seek features such as superior hydrodynamics, precision fit, wide peripheral vision, and minimal drag. This group is less price-sensitive and regularly updates equipment based on seasonal performance improvements and technological releases from key brands. They are typically reached through specialized sports outlets, training camps, and online forums dedicated to water sports.

The majority of the market volume is driven by recreational and fitness swimmers, encompassing families, fitness club members, and individuals participating in water aerobics or rehabilitation therapies. These buyers prioritize durability, ease of use, affordability, and basic anti-fog properties. For this segment, the buying decision is often influenced by brand recognition, comfortable sealing (e.g., soft silicone), and immediate availability in mass-market retail locations. The growth in aquatic fitness among the aging population also creates a specific niche requiring goggles with enhanced durability and ease of adjustment.

A rapidly expanding customer segment includes individuals requiring vision correction. The demand for prescription swimming goggles is high, as standard goggles do not accommodate corrective lenses, forcing many to choose between clear vision and eye protection. This segment demands customizable lens powers, durable optical quality, and accessible purchasing options, often leading them toward specialized online prescription services or optometrist-linked retailers. Furthermore, institutional buyers, such as swimming schools, public pools, and military/maritime organizations, represent a large volume segment focusing on bulk purchasing of durable, standardized, and cost-effective training models.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $850 Million USD |

| Market Forecast in 2033 | $1,260 Million USD |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Speedo International, Arena S.p.A., TYR Sport Inc., Aqua Sphere, Zoggs International, Nike Swim, Adidas, Swans Co., Ltd., Huub Design, MP Michael Phelps, Finis Inc., Seac Sub S.p.A., Decathlon (Nabaiji), Vorgee, Yingfa, Barracuda, Cressi Sub, View, Engine Swim, Kiefer Aquatics |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Swimming Goggles Market Key Technology Landscape

The technological landscape of the Swimming Goggles Market is primarily driven by innovations aimed at enhancing vision clarity, comfort, and durability. The most crucial advancements involve proprietary anti-fog treatments and advanced UV protection. Traditional anti-fog solutions often degrade quickly; therefore, modern research focuses on permanent, hydrophobic, and hydrophilic coatings integrated into the lens material itself, offering activated fog resistance that lasts the product's lifespan. Further developments include curved lens technology to provide superior 180-degree peripheral vision without significant distortion, crucial for competitive swimmers and open-water athletes who require maximum situational awareness.

Material science also plays a significant role, particularly in frame and gasket design. Key players utilize liquid silicone rubber (LSR) injection molding to create anatomically optimized gaskets that adapt to various facial structures, ensuring a pressure-free, secure seal. Furthermore, the introduction of interchangeable nose pieces and strap mechanisms allows for highly customized adjustments, addressing the primary consumer complaint of poor fit. Lens materials are continuously being refined, with high-impact polycarbonate offering excellent clarity and shatter resistance, essential for safety standards across all market segments. The growing trend toward photochromic lenses, which automatically adjust tint based on ambient light levels, provides versatile utility for swimmers transitioning between indoor pools and bright outdoor environments.

The future technology frontier is firmly centered on smart integration. Smart swimming goggles embed micro-electronics, including accelerometers, gyroscopes, and proximity sensors, often paired with sophisticated heads-up displays (HUDs) powered by miniaturized projection systems. These devices allow swimmers to view real-time data—such as elapsed time, stroke count, caloric expenditure, and even navigation cues for open water—directly within their field of vision. This technology transforms the product into a crucial piece of wearable tech, driving higher ASPs and attracting a new demographic interested in detailed biometric and performance analysis, thus solidifying the goggles' position within the broader sports technology ecosystem.

Regional Highlights

- North America: This region maintains a high market value, driven by significant consumer spending on sports and fitness equipment, extensive participation in competitive swimming, and strong early adoption of smart wearable technology. The presence of major global manufacturers and a mature retail infrastructure facilitates high product availability and rapid adoption of premium, performance-focused goggles. The U.S. remains the core contributor, characterized by large annual athletic events and a strong cultural emphasis on personal fitness.

- Europe: Europe is a highly competitive market, distinguished by robust swimming cultures, especially in countries like the UK, Germany, and Italy. Demand is consistently high across both recreational and competitive segments. The region exhibits a strong preference for high-quality, European-branded products, often emphasizing design, sustainability features, and long-term durability. Regulatory adherence to strict health and safety standards also influences product development, particularly concerning anti-allergy materials and non-toxic coatings.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region during the forecast period. Growth is fueled by increasing disposable incomes, rapid expansion of public and private swimming facilities, and government initiatives promoting sports and healthy lifestyles, particularly in China and India. The demand here is diverse, ranging from affordable mass-market options for beginners to high-performance competitive models driven by strong Olympic performance aspirations across several nations. Local manufacturing and rising e-commerce penetration are key market accelerators.

- Latin America (LATAM): Growth in LATAM is steady, driven by coastal tourism and increasing participation in water sports like surfing and snorkeling, which often necessitate quality eye protection. Brazil and Mexico are leading contributors. Market development faces challenges related to economic volatility and reliance on imported premium brands, though local assembly and distribution partnerships are helping stabilize pricing and availability.

- Middle East and Africa (MEA): This region offers potential driven by affluent consumer bases in the GCC countries, heavy investment in luxury sporting facilities, and year-round utilization of pools due to climate. Demand for performance and mirrored lenses (due to intense sunlight) is particularly strong. However, market size in many sub-regions is constrained by limited access to standardized distribution channels and lower swimming participation rates outside of organized institutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Swimming Goggles Market.- Speedo International

- Arena S.p.A.

- TYR Sport Inc.

- Aqua Sphere

- Zoggs International

- Nike Swim

- Adidas

- Swans Co., Ltd.

- Huub Design

- MP Michael Phelps

- Finis Inc.

- Seac Sub S.p.A.

- Decathlon (Nabaiji)

- Vorgee

- Yingfa

- Barracuda

- Cressi Sub

- View

- Engine Swim

- Kiefer Aquatics

Frequently Asked Questions

Analyze common user questions about the Swimming Goggles market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Swimming Goggles Market?

The global Swimming Goggles Market is projected to grow at a CAGR of 5.8% between 2026 and 2033, driven primarily by increasing worldwide participation in recreational and competitive aquatic activities and continuous innovation in product design.

Which technology is currently driving innovation in swimming goggles?

Key technological innovations center on integrated smart features, such as heads-up displays (HUDs) for real-time performance metrics, along with proprietary, long-lasting anti-fog and photochromic (light-adjusting) lens coatings to enhance visual clarity and user experience.

How does the segmentation by application influence pricing strategies?

The competitive swimming application segment commands premium pricing due to the demand for superior hydrodynamics, specialized materials, and advanced fitting features, contrasting with the recreational segment which is highly price-sensitive and volume-driven.

What role does AI play in the manufacturing of swimming goggles?

AI is increasingly utilized in manufacturing to facilitate hyper-personalized fitting through 3D facial scanning and custom-molded gaskets, ensuring optimal seal and comfort, while also optimizing production lines for quality control and material efficiency.

Which regional market is expected to exhibit the fastest growth?

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market segment, primarily due to expanding consumer fitness awareness, rising disposable incomes, and significant public and private investment in modern aquatic infrastructure, especially in emerging economies like China and India.

What are the primary restraints affecting market growth?

The market faces restraints related to persistent technical challenges, notably the difficulty in providing permanent, reliable anti-fog solutions and leak-proof seals across diverse facial profiles, alongside the high manufacturing cost of specialized high-performance models.

What are prescription swimming goggles and why are they a key opportunity?

Prescription goggles feature corrective lenses to accommodate vision impairment, eliminating the need for contact lenses while swimming. This segment presents a significant growth opportunity due to the large, underserved population requiring vision correction and seeking safe, high-clarity aquatic eyewear.

How significant is the shift towards online retail in this market?

Online retail (e-commerce) is rapidly gaining dominance as it offers wider product selection, detailed reviews, and the convenience of direct-to-consumer models. This shift forces established brands to invest heavily in omnichannel strategies and digital marketing to maintain market share.

What types of lens coatings are most popular in the market?

The most popular lens types include clear lenses (for indoor swimming), mirrored lenses (for intense sun glare reduction, common in outdoor racing), and tinted lenses (for general outdoor use). There is rising demand for photochromic lenses for versatile light adaptation.

What distinguishes a competitive goggle from a recreational goggle?

Competitive goggles prioritize hydrodynamics (low drag profile), secure, low-profile seals, and enhanced peripheral vision for racing, often featuring rigid frames and advanced coatings. Recreational goggles focus primarily on maximum comfort, soft silicone seals, and ease of adjustment.

How do manufacturers address sustainability concerns in the market?

Manufacturers are addressing sustainability by exploring and adopting recycled plastics for frames and straps, using bio-based or non-toxic materials, and minimizing packaging waste, particularly in response to strong consumer demand for eco-friendly products in mature markets.

What is the primary function of a high-grade silicone gasket?

A high-grade silicone gasket is critical for achieving a comfortable, leak-proof seal that minimizes pressure around the eyes. Silicone is preferred for its hypoallergenic properties, flexibility, and resistance to degradation from chlorine and saltwater exposure.

What is upstream analysis within the goggles value chain?

Upstream analysis focuses on the initial stages of the value chain, specifically the procurement and quality control of specialized raw materials, including polycarbonate, high-quality silicone, and proprietary anti-fog chemicals, which are foundational to product performance.

Who are the major end-users in the institutional buyer segment?

Institutional buyers typically include large swimming schools, aquatic fitness centers, government-operated public pools, and specialized organizations such as military or coast guard training facilities, purchasing durable, standardized models in bulk.

Why is UV protection important even for indoor swimming goggles?

While less critical than outdoors, UV protection is still beneficial indoors as some UV rays can penetrate windows or reflective surfaces. More importantly, nearly all high-quality lenses now integrate UV blocking as a safety standard, regardless of intended use environment.

How does the threat of substitutes rank in the Swimming Goggles Market?

The threat of substitutes is generally low because no other product type offers the essential combination of clear underwater vision, protection from chemicals, and a secure fit required for prolonged swimming activities. Specialized masks exist but target snorkeling, not performance swimming.

What characterizes the competition among key players?

Competition is intense, driven by continuous innovation in coatings and fit systems, extensive athlete sponsorship to build brand visibility, aggressive pricing in the recreational segment, and strategic expansion into high-growth APAC markets.

What is the potential impact of modular goggle designs?

Modular designs, allowing users to swap lenses, nose bridges, and straps, enhance customization, extend product life, and reduce waste. This flexibility appeals to performance users seeking different lens options for varied conditions and environments.

What are the key components of the downstream analysis?

Downstream analysis involves distribution (online and offline channels), marketing, sales, and post-sales service. Optimization of omnichannel logistics and direct consumer engagement through digital platforms are crucial downstream activities.

How is the seasonality of demand managed in the market?

Demand peaks are seasonal, usually in the summer months and preceding major competitive seasons. Manufacturers mitigate this by managing inventory efficiently, leveraging global supply chains, and promoting year-round products like fitness and indoor training goggles during off-peak seasons.

What is the typical product lifecycle for swimming goggles?

The product lifecycle varies; recreational goggles have shorter lifecycles due to general wear and tear and lower investment, while high-performance models have a moderate lifecycle, often replaced seasonally to maintain optimal seal integrity and coating performance.

Why is the quality of the anti-fog coating a major focus area for R&D?

Fogging is the most common customer complaint and significantly diminishes the swimming experience and safety. R&D focuses on durable, internal, proprietary coatings that reactivate upon rinsing, aiming to provide permanent clarity without toxic chemical release.

How does the market cater to open-water swimmers?

Open-water swimmers require specific features like polarized or mirrored lenses for intense glare reduction, larger frames for wider peripheral visibility (crucial for sighting/navigation), and extremely secure seals to handle unpredictable conditions and currents.

What is the significance of the base year 2025 in the forecast period?

The base year 2025 provides a stabilized benchmark for market valuation, incorporating the latest economic shifts and consumer behavioral changes observed after the historical period (2019-2024), against which future growth projections are calculated.

How does the presence of professional athletes impact market trends?

Sponsorship and endorsement by professional swimmers significantly influence consumer purchasing behavior, particularly in the competitive segment, validating product performance and driving demand for the specific models used by elite athletes, setting design trends.

What are the advantages of polycarbonate lenses over other materials?

Polycarbonate lenses offer superior impact resistance and are virtually shatterproof, making them highly safe. They are also lightweight, offer good optical clarity, and are easily moldable, which makes them the standard material for most high-quality swimming goggles globally.

How do regulatory standards influence the market?

Regulations, particularly concerning eye protection (like European CE standards) and the use of non-toxic, hypoallergenic materials (especially silicone and plasticizers), mandate strict quality control and testing, influencing material sourcing and manufacturing practices across all regions.

What is the main driver of growth in the Latin American market?

Growth in Latin America is primarily driven by expanding tourism sectors focused on aquatic activities, increasing public investment in sporting infrastructure, and a growing middle class capable of purchasing recreational sports equipment.

What demographic trends favor the market's expansion?

Favorable demographic trends include the increasing global awareness of health and wellness, leading more adults, especially the aging population, to engage in low-impact aquatic exercises, thereby sustaining demand for comfortable, reliable fitness goggles.

How does distribution channel affect brand visibility?

Offline specialty retailers offer direct consumer engagement and product testing, vital for high-end brands. Conversely, large online platforms provide massive reach and visibility to the mass-market consumer, necessitating balanced omnichannel management for maximum impact.

What is the expected market size by the end of the forecast period in 2033?

The global Swimming Goggles Market is projected to reach an estimated value of $1,260 Million USD by the end of the forecast period in 2033, reflecting consistent demand and premiumization through technological integration.

How do manufacturers ensure a perfect seal for different users?

Manufacturers employ multiple strategies, including interchangeable nose pieces of varying sizes, highly flexible and adaptive silicone gaskets (3D shaping), and, increasingly, AI-driven custom molding technologies based on facial contour analysis to ensure a personalized, leak-free fit.

What is the function of a 'Heads-Up Display' (HUD) in smart goggles?

A Heads-Up Display (HUD) projects real-time swimming data, such as lap count, split times, and heart rate, directly onto the goggle lens within the swimmer's field of view, minimizing interruption and maximizing data utility during training sessions.

Why are mirrored lenses highly sought after in open water environments?

Mirrored lenses feature a reflective coating that drastically reduces glare from intense sunlight and water surfaces, offering superior visual comfort and protection, which is essential for endurance and open-water events like triathlons.

What is the impact of supply chain resilience on market stability?

Supply chain resilience is vital for market stability, ensuring timely delivery of specialized materials and finished goods. Disruptions (e.g., geopolitical events, shipping constraints) can impact production schedules and lead to price volatility, especially for components like proprietary anti-fog coatings.

How do specialized triathlon goggles differ from standard competitive models?

Triathlon goggles are often slightly larger, offering a wider field of view for sighting during open-water swims, prioritizing comfortable extended wear, and featuring durable, protective anti-scratch coatings designed to withstand harsh natural elements and accidental contact.

What distinguishes prescription goggles from optical inserts?

Prescription goggles feature lenses that are custom-manufactured with the required corrective power, offering permanent vision correction. Optical inserts are prefabricated corrective lenses that can be fitted into standard goggle frames, offering a more modular, albeit less integrated, solution.

What technological advancements are crucial for the training/fitness segment?

For the training segment, advancements focusing on comfort, ease of adjustment, durability for frequent use, and basic integration with fitness tracking apps (via smart features) are paramount, prioritizing reliable performance over maximum hydrodynamic efficiency.

How important is brand loyalty in the competitive swimming segment?

Brand loyalty is extremely important in the competitive segment, often established through early usage and endorsement. Swimmers rely on brands known for consistent fit, reliable seals, and optimal performance profiles necessary for high-stakes competition.

What is the forecast for the use of materials like TPE in gaskets?

While high-grade silicone remains dominant, Thermoplastic Elastomers (TPE) are gaining traction in the mid-range and recreational segments due to their lower cost, recyclability, and ability to be injection molded rapidly, balancing comfort with cost efficiency.

What are the main drivers of consumer choice in the recreational market?

In the recreational market, consumer choices are overwhelmingly driven by affordability, comfortable eye seals, attractive design/color options, and immediate availability at easily accessible retail locations such as hypermarkets and general sports stores.

Why is the Middle East and Africa (MEA) segment showing potential growth?

The MEA segment shows potential due to significant governmental investment in high-quality sports and tourism infrastructure, coupled with high demand for swimming due to warm climates and a wealthy consumer base in the GCC nations.

How do global events, such as the Olympic Games, influence market demand?

Major global events dramatically boost market demand by increasing media coverage and public interest in swimming, leading to higher participation rates and spiking sales of competitive and brand-endorsed gear globally.

What are the challenges associated with photochromic lens technology?

Challenges associated with photochromic lenses include their relatively slower reaction time compared to manual lens changes and the higher production cost, which limits their adoption primarily to the premium price segment of the market.

How does the bargaining power of buyers affect manufacturers?

The high bargaining power of buyers, especially large retail chains, forces manufacturers to maintain competitive pricing, invest in continuous product improvements, and offer strong promotional support to secure premium shelf space and achieve high sales volumes.

What is the role of specialized sporting goods stores in the distribution channel?

Specialty sporting goods stores are crucial for providing expert advice, allowing customers to try and test premium models, and stocking niche or high-performance products that may not be available in mass-market retail outlets, servicing the dedicated athlete.

What defines the market landscape of the APAC region?

The APAC market is defined by its vast population base, rapidly industrializing economies, significant urbanization leading to better access to facilities, and strong governmental backing for sports promotion, resulting in high volume growth and segmentation complexity.

What is the significance of the interchangeable nose piece feature?

The interchangeable nose piece is highly significant as it allows swimmers to customize the distance between the lenses, which is vital for achieving a stable, non-leaking fit, especially important for competitive models requiring a secure, low-profile placement.

How are companies using digital engagement to strengthen their market position?

Companies utilize digital engagement through social media campaigns, sponsored athlete content, virtual try-on tools, and integrated coaching apps linked to smart goggles, fostering brand community and driving direct-to-consumer sales and loyalty.

What are the projected growth implications of the Prescription Goggles segment?

The Prescription Goggles segment is expected to experience above-average growth as vision correction needs are globally rising, and manufacturers are improving accessibility and customization options, opening up a specialized, high-margin market for eye protection.

How does the material used for lenses affect their performance?

Lens material dictates optical clarity, resistance to impact, and ability to accept advanced coatings. Polycarbonate offers impact resistance and good clarity, whereas some higher-end materials like cellulose propionate offer superior optical quality with a focus on distortion minimization.

What key challenge do new entrants face in the swimming goggles market?

New entrants face challenges related to overcoming high barriers to entry, primarily concerning the necessity of proprietary R&D for effective, long-lasting anti-fog technology, establishing reliable global distribution channels, and competing with established brand loyalty.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager