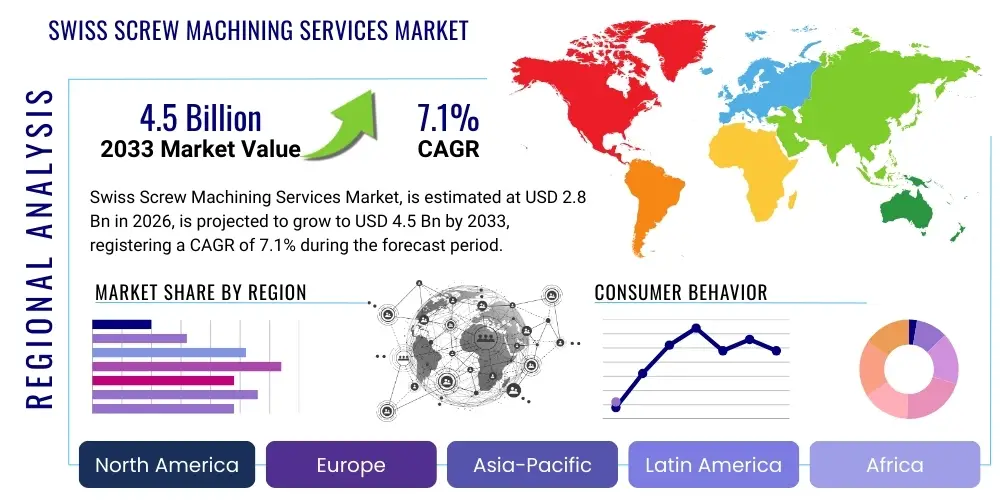

Swiss Screw Machining Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438377 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Swiss Screw Machining Services Market Size

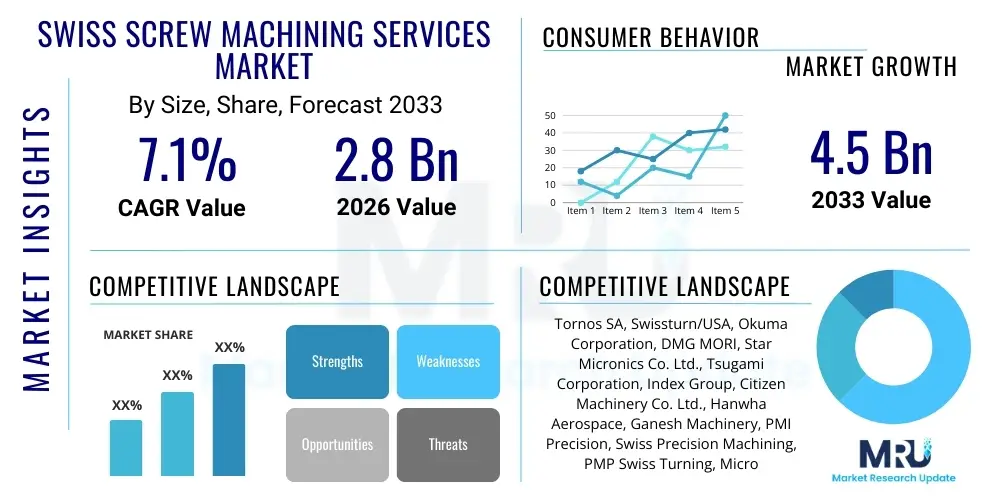

The Swiss Screw Machining Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.1% between 2026 and 2033. The market is estimated at USD 2.8 Billion in 2026 and is projected to reach USD 4.5 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the escalating demand for highly precise, small, and complex components across critical industries such as medical devices, aerospace, and advanced electronics. Swiss machining, known for its ability to produce intricate parts with tight tolerances and exceptional repeatability, is becoming indispensable in sectors where component failure is unacceptable.

The market expansion is further supported by the increasing adoption of multi-axis CNC Swiss machines, which offer higher throughput and reduced lead times compared to conventional machining methods. While geographical concentration of expertise remains a factor, the globalization of supply chains and the need for precision manufacturing outsourcing are opening new avenues for specialized service providers globally. The capital intensity of acquiring and maintaining high-end Swiss machines necessitates reliance on specialized service providers, bolstering the outsourced services market segment significantly.

Swiss Screw Machining Services Market introduction

The Swiss Screw Machining Services Market encompasses the provision of precision manufacturing services utilizing specialized Swiss-style lathes, characterized by their sliding headstock design. This unique mechanism enables the machining of long, thin components with extreme accuracy and minimal deflection, making it the preferred method for producing miniature parts requiring complex geometries and stringent tolerance levels. These services are crucial for sectors demanding high-volume production of small components, including shafts, connectors, medical implants, and micro-electromechanical systems (MEMS). The primary product offering is the production of customized precision metal or plastic parts, often ranging in diameter from sub-millimeter up to 32mm, with exceptional surface finish quality.

Major applications of Swiss screw machining services span across numerous high-tech verticals. In the medical field, they are indispensable for creating delicate components for surgical tools, dental devices, and internal implants (like pacemakers and orthopedic screws). The automotive industry utilizes these services for complex fuel injection components and sensor housings, while aerospace relies on them for critical fastenings, hydraulic system valves, and guidance system parts where reliability is paramount. The fundamental benefits driving the market include superior dimensional accuracy, the capacity for complex machining operations in a single setup (reducing handling and errors), high repeatability crucial for mass production, and minimized material waste due to efficient chip removal systems inherent in the design.

Driving factors for this market include the global trend toward device miniaturization, particularly in consumer electronics and medical technology, necessitating smaller, more precise components. Furthermore, the increasing complexity of regulatory requirements in sectors like healthcare and defense drives demand for validated and highly reliable manufacturing processes, favoring Swiss machining. Economic drivers include the efficiency gains offered by modern CNC Swiss machines, allowing service providers to maintain competitive pricing while delivering premium quality parts. Technological advancements, such as enhanced tooling materials and integrated automation, are continually expanding the scope and speed of these services, ensuring sustained market growth.

Swiss Screw Machining Services Market Executive Summary

The Swiss Screw Machining Services Market is characterized by robust growth, primarily fueled by sustained demand from the medical and aerospace sectors requiring ultra-high precision components. Key business trends include the consolidation of mid-sized service providers seeking economies of scale and technological integration, along with a pronounced shift towards specialized material processing, particularly titanium and high-grade stainless steel, necessitated by advanced industrial applications. Service customization and rapid prototyping capabilities are becoming standard competitive differentiators, as clients prioritize supply chain agility. Furthermore, there is an observable trend among leading service providers to invest heavily in advanced five- and seven-axis CNC Swiss machines to handle increasingly complex component designs and leverage lights-out manufacturing capabilities to optimize operational costs.

Regionally, North America and Europe currently dominate the market, largely due to established infrastructure in aerospace and medical technology industries, coupled with high regulatory compliance standards demanding superior machining quality. However, the Asia Pacific region, led by China and India, is emerging as the fastest-growing market, driven by rapid industrialization, expansion of domestic automotive and electronics manufacturing bases, and the establishment of sophisticated contract manufacturing hubs serving global original equipment manufacturers (OEMs). Within the segments, the Medical Application segment maintains the largest market share owing to the continuous innovation in implantable devices and surgical instrumentation, while the segment focused on components smaller than 10mm diameter exhibits the highest CAGR, reflecting the persistent trend toward miniaturization across technology sectors.

Segment trends underscore the increasing importance of exotic materials. While traditional materials like brass and standard steel remain relevant for general engineering, the demand for machining difficult-to-cut materials, such as specific cobalt-chrome alloys for implants and specialized nickel alloys for jet engine components, is elevating the required expertise and driving up service costs. The market is also seeing specialization based on production volume, with some providers focusing exclusively on high-mix, low-volume rapid prototyping, and others centering on high-volume production runs using highly automated facilities. This specialized approach allows service providers to cater effectively to diverse customer needs while optimizing their specific machine tool investments and labor skill sets.

AI Impact Analysis on Swiss Screw Machining Services Market

Users frequently inquire about how Artificial Intelligence will fundamentally alter the operational dynamics, quality control standards, and labor requirements within the highly specialized Swiss Screw Machining sector. The primary themes circulating include concerns regarding the integration cost versus return on investment, the practical application of machine learning for predictive maintenance, and the role of AI-driven vision systems in achieving zero-defect production. Users express high expectations that AI could mitigate the persistent skilled labor shortage by automating complex decision-making processes, particularly related to tooling compensation, thermal drift correction, and optimal cutting parameter selection. Conversely, there is apprehension about the necessary investment in data infrastructure and the potential displacement of highly experienced, but traditionally trained, machine operators.

- AI-Enhanced Predictive Maintenance: Utilizing machine learning algorithms to analyze sensor data from CNC machines, predicting component failure (spindle, tooling, motors) and scheduling maintenance proactively, minimizing expensive unplanned downtime.

- Optimized Tool Path Generation: AI algorithms generate and refine complex tool paths in real-time, improving material removal rates, reducing cycle times, and optimizing chip evacuation for increased efficiency.

- Automated Quality Control (QC): Implementation of AI-powered vision systems and in-process metrology that instantly compare manufactured parts against CAD models, flagging dimensional deviations faster and more accurately than human inspection.

- Adaptive Process Control: AI systems dynamically adjust cutting feeds, speeds, and coolant flow based on real-time feedback from the machining process (e.g., vibration or temperature), ensuring consistent tolerance maintenance regardless of environmental or material variations.

- Demand Forecasting and Scheduling: AI tools improve job scheduling and resource allocation by analyzing historical demand and machine capabilities, optimizing utilization rates and reducing bottlenecks in high-volume production facilities.

- Mitigation of Skilled Labor Gap: AI interfaces simplify the operational complexity of advanced CNC machines, allowing less experienced technicians to manage sophisticated production lines under the guidance of intelligent diagnostics and operational suggestions.

DRO & Impact Forces Of Swiss Screw Machining Services Market

The Swiss Screw Machining Services Market is significantly shaped by compelling demand drivers, primarily the mandated trend of miniaturization across consumer electronics and specialized medical implants, necessitating micron-level precision that standard CNC techniques often cannot achieve efficiently. Restraints largely center on the prohibitively high initial capital investment required for modern, multi-axis Swiss machines, coupled with the critical and worsening global shortage of highly skilled machinists capable of programming and maintaining these complex systems. Opportunities abound in emerging sectors such as electric vehicle (EV) component manufacturing, particularly for high-precision sensor parts and battery connection elements, and in the burgeoning field of customizable dental and orthopedic devices. These forces collectively exert high impact, pushing the market towards greater automation and specialization, prioritizing quality and speed in outsourced manufacturing.

- Drivers: Growing demand for complex, small-diameter parts in regulated industries (medical, aerospace); technological advancements in multi-axis CNC Swiss machines increasing throughput; outsourcing trend by OEMs to reduce internal capital expenditure and leverage specialized expertise.

- Restraints: High initial investment cost of precision Swiss-type lathes; shortage of specialized and experienced CNC programmers and operators; vulnerability to fluctuations in raw material prices (e.g., titanium, specialty steel alloys).

- Opportunities: Expansion into electric vehicle (EV) battery and powertrain components; growth in custom-made orthopedic and dental implants; potential integration of additive manufacturing (hybrid solutions) for specialized tooling and fixtures; servicing growing demand in emerging APAC markets.

- Impact Forces: The critical reliance of key industries (medical, defense) on zero-defect components ensures price sensitivity is often secondary to quality and compliance, sustaining demand for premium services. The global supply chain shifts incentivize regionalization and the establishment of resilient, local precision manufacturing hubs, impacting competitive strategy and distribution networks.

Segmentation Analysis

The Swiss Screw Machining Services Market is comprehensively segmented based on material type, application, and component diameter size, allowing service providers to specialize and target specific high-value customer needs. Segmentation by material is vital as the tooling, speeds, and costs vary dramatically between machining soft metals like brass and difficult-to-machine superalloys like Inconel or specific grades of titanium. Application segmentation, particularly separating the highly regulated Medical and Aerospace sectors from general industrial uses, dictates the necessary quality certifications (e.g., ISO 13485, AS9100) and regulatory compliance burden carried by the service provider. Diameter size segmentation reflects the inherent machine capabilities, as smaller diameters demand true sliding headstock capabilities, while larger components might be handled by hybrid machines. This structured market segmentation aids strategic business planning and identifies key growth areas based on end-user technology adoption rates.

- By Material Type:

- Stainless Steel (300 series, 400 series)

- Titanium and Titanium Alloys (Grade 2, Grade 5)

- Brass and Copper Alloys

- Plastics (PEEK, PTFE, Delrin)

- Aluminum

- Exotic Alloys (Inconel, Hastelloy, Cobalt-Chrome)

- By Application:

- Medical Devices and Implants (Orthopedics, Dental, Surgical Instruments)

- Aerospace and Defense (Fasteners, Hydraulic Components, Sensors)

- Automotive (Fuel System Components, Sensors, Electronic Connectors)

- Electronics and Telecommunications (Connectors, Fiber Optic Parts)

- Industrial and General Engineering

- By Component Diameter Size:

- Sub-10 mm Diameter

- 10 mm to 20 mm Diameter

- Above 20 mm Diameter

Value Chain Analysis For Swiss Screw Machining Services Market

The value chain for Swiss Screw Machining Services begins with upstream material procurement, dominated by specialized suppliers providing certified raw stock (rods or bars) in precision grades demanded by end-users like the medical sector. The core of the value chain involves the service providers themselves—the machining companies—who invest heavily in specialized CNC equipment, precision tooling, and skilled labor. This phase includes programming, setup, machining, and rigorous in-process quality control. The midstream involves complementary services such as secondary operations (e.g., heat treating, plating, deburring) and advanced metrology services, often performed by third-party specialists due to the cost of specialized equipment. Efficiency and cost optimization at this stage are paramount, requiring advanced logistics and inventory management.

Downstream analysis focuses on the direct and indirect distribution channels used to reach the end-user. Direct distribution involves the service provider delivering finished, often kitted, components directly to the OEM or Tier 1 supplier (common in medical and aerospace). This channel demands high levels of transparency, traceability, and documentation compliance. Indirect distribution often involves contract manufacturers or distributors who manage complex supply chains, bundling Swiss-machined parts with other components before delivering the final assembly to the end-user. The increasing globalization of manufacturing necessitates service providers to have robust international shipping and regulatory knowledge, particularly concerning export controls and tariffs. The integrity of the distribution channel is critical, especially for sensitive components, ensuring proper handling and delivery conditions.

The relationship between upstream material certification and downstream application compliance drives significant value. For instance, in medical device manufacturing, material traceability from the mill to the finished component is non-negotiable, adding complexity and cost throughout the chain. Service providers must manage supplier risk diligently. Furthermore, the reliance on high-tech machine tool manufacturers (e.g., Tornos, Citizen) for capital equipment and technical support forms a crucial external linkage, where innovation in machine speed and accuracy immediately translates into competitive advantage for the machining service provider. Ultimately, value capture is highly concentrated in the machining phase, where precision, quality certifications, and intellectual property protection differentiate the top-tier service providers from general machining shops.

Swiss Screw Machining Services Market Potential Customers

Potential customers for Swiss Screw Machining Services are predominantly Original Equipment Manufacturers (OEMs) and Tier 1 suppliers operating in high-precision, regulated industries where component quality and long-term reliability are crucial. The primary end-users are concentrated in the medical sector, including manufacturers of cardiovascular devices, orthopedic implants, and sophisticated diagnostic equipment, who require components made from certified biocompatible materials with micro-tolerances. Another key customer segment is the aerospace and defense industry, purchasing mission-critical components such as fuel nozzles, sensor housings, and specialty fasteners that must withstand extreme operational conditions and adhere to strict traceability standards. These customers typically prioritize established service providers with demonstrable expertise, robust quality management systems (like AS9100), and capacity for high-volume, repeatable production runs.

Beyond these highly regulated sectors, the electronics industry, particularly those manufacturing sophisticated connectors, optical components, and micro-actuators for 5G infrastructure and data centers, represents a rapidly growing customer base. Automotive OEMs, especially those focused on complex advanced driver-assistance systems (ADAS) and electric powertrain components, also increasingly rely on these services for high-precision sensor and linkage parts. The defining characteristic of potential customers is their requirement for small, complex parts that cannot be economically or accurately produced using conventional machining processes. Furthermore, smaller, high-mix product development firms often rely on Swiss machining service providers for rapid prototyping and initial low-volume production before scaling up, highlighting the versatility of the customer base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.8 Billion |

| Market Forecast in 2033 | USD 4.5 Billion |

| Growth Rate | 7.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tornos SA, Swissturn/USA, Okuma Corporation, DMG MORI, Star Micronics Co. Ltd., Tsugami Corporation, Index Group, Citizen Machinery Co. Ltd., Hanwha Aerospace, Ganesh Machinery, PMI Precision, Swiss Precision Machining, PMP Swiss Turning, Micro Machine Company, Cox Manufacturing, Accu-Swiss, Tecomet Inc., LVD Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Swiss Screw Machining Services Market Key Technology Landscape

The technological landscape of the Swiss Screw Machining Services market is defined by continuous innovation aimed at enhancing speed, precision, and operational autonomy. Central to this landscape are the multi-axis CNC Swiss-type lathes, which have evolved significantly from basic single-spindle machines to highly sophisticated, seven-to-nine axis machines featuring secondary opposing spindles and live tooling capabilities. These technological advancements permit complex components to be fully finished in a single handling, drastically reducing setup time and eliminating stacking errors. Key differentiators include machines equipped with B-axis functionality, which allows for intricate angular machining, essential for advanced surgical tools and aerospace components. The integration of high-pressure coolant systems and thermal stabilization features is also critical for maintaining tight tolerances during prolonged, high-speed operations on difficult materials like titanium.

Furthermore, the market relies heavily on advanced peripheral technologies, including automated bar feeders and parts catchers, which enable 'lights-out' manufacturing—unattended operation for extended periods, significantly lowering labor costs and increasing machine utilization. The software ecosystem is equally crucial; modern Computer-Aided Manufacturing (CAM) software specifically optimized for Swiss machine kinematics allows programmers to simulate and verify complex tool paths, minimizing costly errors during physical machining. The use of sophisticated sensors for in-process metrology and vibration monitoring is increasing, providing real-time data feedback essential for the nascent integration of AI and machine learning for adaptive control and predictive maintenance within the service sector.

The materials science aspect also defines the technological landscape, focusing on specialized tooling. Service providers are increasingly utilizing advanced cutting tool materials, such as specific ceramic inserts and diamond-like carbon (DLC) coatings, which are essential for achieving desired surface finishes and extending tool life when working with abrasive or heat-resistant alloys. The implementation of specialized deburring and surface finishing technologies, including electropolishing or micro-blasting, post-machining, forms an integral part of the comprehensive service offering. These integrated technologies collectively push the boundaries of achievable precision and component complexity, sustaining the competitive edge of specialized Swiss machining service providers over general machine shops.

Regional Highlights

Regional dynamics play a significant role in the Swiss Screw Machining Services Market, reflecting global distribution of high-tech manufacturing expertise and regulatory environments. North America, particularly the United States, remains a dominant force, characterized by high demand from the large, established medical device and aerospace clusters. This region benefits from stringent quality standards (FDA, FAA), which necessitate premium, highly reliable machining services. The emphasis here is on complex geometries, exotic materials, and adherence to tight intellectual property safeguards, supporting higher average selling prices for services.

Europe, driven by Germany, Switzerland, and France, is another critical market hub, historically known for its strong presence in precision engineering, luxury goods, and automotive technology. Swiss manufacturing expertise itself forms a global benchmark for quality. Regulatory frameworks like the EU's Medical Device Regulation (MDR) further amplify demand for certified, high-quality services. Investment in advanced automation and skilled labor training programs is prominent across Western Europe, maintaining its competitive stance in high-mix, low-volume specialist production.

Asia Pacific (APAC) is projected to exhibit the fastest growth over the forecast period. This rapid expansion is fueled by massive foreign direct investment in manufacturing capabilities in China, India, and Southeast Asia, catering to escalating domestic demand for consumer electronics, automotive components, and localized medical device production. While cost competitiveness is a primary driver in APAC, the increasing requirement for high-end precision, especially in the growing aerospace maintenance, repair, and overhaul (MRO) sectors and advanced electronics, is simultaneously elevating the quality standards of local service providers, challenging the historical dominance of Western players in high-end segments.

- North America (USA, Canada): Dominant market driven by large Medical Device and Aerospace sectors; focus on high-reliability components and stringent regulatory compliance (FDA/AS9100).

- Europe (Germany, Switzerland, France): Strong historical presence in precision engineering; focus on luxury goods components, high-end automotive, and adherence to MDR standards.

- Asia Pacific (China, India, Japan, South Korea): Fastest-growing region due to mass manufacturing and electronics demand; increasing investment in high-precision capacity to meet global export standards.

- Latin America (Brazil, Mexico): Emerging manufacturing hubs, benefiting from nearshoring trends, particularly serving the US automotive and consumer electronics supply chains with cost-effective solutions.

- Middle East and Africa (MEA): Limited but growing presence, driven primarily by investments in domestic defense and oil and gas sector maintenance, requiring specialized, rugged components.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Swiss Screw Machining Services Market.- Tornos SA

- Swissturn/USA

- Okuma Corporation

- DMG MORI

- Star Micronics Co. Ltd.

- Tsugami Corporation

- Index Group

- Citizen Machinery Co. Ltd.

- Hanwha Aerospace (Machinery Division)

- Ganesh Machinery

- PMI Precision

- Swiss Precision Machining

- PMP Swiss Turning

- Micro Machine Company

- Cox Manufacturing

- Accu-Swiss

- Tecomet Inc.

- LVD Company

- Wickman Group

- Hardinge Inc.

Frequently Asked Questions

Analyze common user questions about the Swiss Screw Machining Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between Swiss machining and traditional CNC turning?

Swiss machining utilizes a sliding headstock design that feeds the bar stock through a guide bushing, providing superior support directly at the cutting point. This eliminates material deflection, allowing for the manufacture of long, slender parts with extremely tight tolerances and exceptional surface finishes, which is highly challenging for traditional fixed-headstock CNC lathes.

Which industries rely most heavily on outsourced Swiss Screw Machining services?

The Medical Device industry is the largest consumer, requiring components like orthopedic screws and catheter parts. Aerospace, Defense, and advanced Electronics sectors also rely heavily on these services for mission-critical, high-precision fasteners, connectors, and hydraulic components due to the strict quality and reliability mandates.

What is the typical cost structure of Swiss machining services?

Costs are primarily determined by material type (exotic alloys cost more to machine), complexity of the component (setup and programming time), required tolerance levels, and production volume. High-volume, high-tolerance parts manufactured on automated machines generally achieve a better unit cost compared to low-volume, highly complex custom jobs.

How is the shortage of skilled labor impacting the market?

The shortage of experienced CNC programmers and operators represents a significant restraint, leading to increased operational costs and reliance on advanced automation. Service providers are mitigating this by investing in sophisticated, user-friendly control software and prioritizing AI-driven adaptive manufacturing systems to maintain productivity and quality output.

Which regional market is exhibiting the fastest growth in Swiss machining capacity?

The Asia Pacific (APAC) region, driven by countries like China and India, shows the fastest CAGR. This growth is linked to rapid industrial expansion, increased domestic demand for complex electronics, and global supply chain diversification which is spurring local investment in high-precision manufacturing capabilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager