Swiss Turn Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433154 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Swiss Turn Market Size

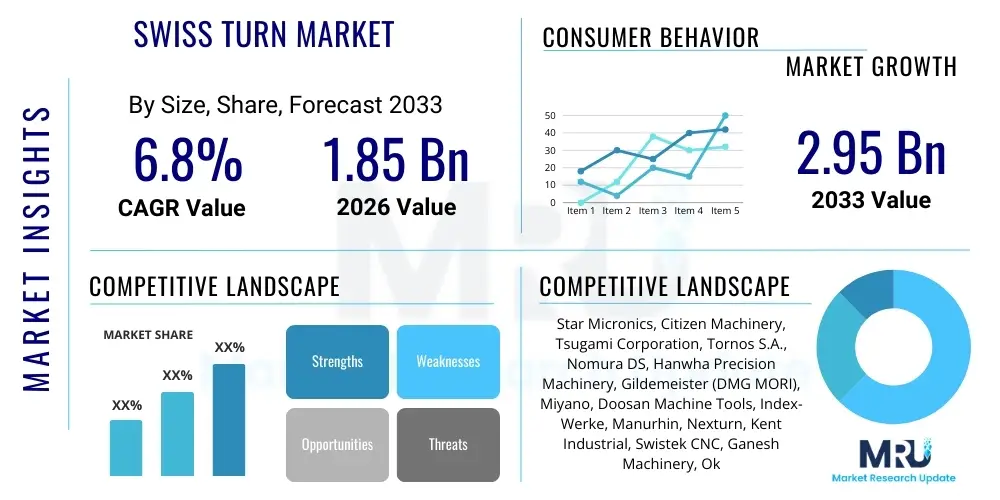

The Swiss Turn Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.95 Billion by the end of the forecast period in 2033.

Swiss Turn Market introduction

The Swiss Turn market, encompassing highly precise computer numerical control (CNC) lathes, specializes in the production of small, intricate, and high-tolerance components, fundamentally driving high-precision manufacturing across critical industrial sectors. Originally designed for watchmaking, these machines are characterized by a sliding headstock mechanism that feeds the material through a guide bushing, providing superior rigidity and minimizing material deflection. This design allows for the consistent creation of parts with high length-to-diameter ratios, maintaining exceptional accuracy, often down to micrometers. The primary benefits of utilizing Swiss Turn technology include unparalleled precision, reduced cycle times due to simultaneous machining operations (using multiple tools and spindles), and minimal secondary finishing requirements.

Major applications of Swiss Turn technology span high-growth sectors where component failure is critically costly. These include the manufacturing of complex surgical instruments, orthopedic implants, aviation fasteners, specialized fluid control valves, and minute electronic connectors. The inherent ability of these machines to handle diverse materials, from stainless steel and titanium to exotic alloys, positions them as indispensable assets in industries demanding strict quality control and regulatory compliance, such as medical devices and aerospace. The continuous innovation in machine architecture, incorporating features like B-axis capabilities and advanced tooling systems, further expands their utility into more complex geometries and tighter tolerances.

Driving factors propelling market expansion are fundamentally linked to global technological advancements and industrial modernization. The surging demand for miniature, high-precision electronic components, particularly in 5G infrastructure and consumer electronics, necessitates scalable high-accuracy production methods. Furthermore, the aging global population and corresponding increase in surgical procedures have catalyzed the demand for highly precise medical implants, which are predominantly manufactured using Swiss Turn technology. The imperative for manufacturing efficiency and waste reduction also favors these machines due to their high material yield and rapid setup capabilities, thereby reinforcing their market position.

Swiss Turn Market Executive Summary

The Swiss Turn Market is poised for robust expansion, primarily fueled by significant investments in medical device manufacturing and the accelerated pace of innovation within the aerospace and defense sectors globally. Business trends indicate a strong shift towards multi-axis machines, specifically those integrating five or more axes, along with sophisticated automation solutions such as robotic loaders and unmanned operation capabilities to enhance throughput and reduce labor costs. Key technological focus areas include improving thermal stability, integrating advanced vibration dampening systems, and developing proprietary software interfaces that simplify complex programming for operators. The market is increasingly competitive, with leading vendors focusing heavily on comprehensive service contracts and preventative maintenance offerings to ensure maximum machine uptime for end-users operating in zero-tolerance environments.

Regionally, Asia Pacific (APAC) stands as the dominant growth engine, driven by the massive expansion of electronics manufacturing in countries like China, South Korea, and Taiwan, coupled with increasing governmental emphasis on developing domestic high-tech manufacturing capabilities, particularly in India. North America and Europe maintain significant market shares, characterized by high adoption rates in the critical medical and aerospace sectors where stringent regulatory standards mandate the precision afforded by Swiss Turn technology. Regional trends also show a move towards localized supply chains, prompting manufacturers to invest in precision tooling centers closer to key assembly hubs, thereby shortening lead times and enhancing supply chain resilience.

Segmentation analysis highlights the dominance of the sliding headstock segment due to its intrinsic precision advantages for long, slender parts, though fixed headstock machines continue to hold relevance for shorter, higher-volume components. Application-wise, the Medical sector is projected to exhibit the highest CAGR, spurred by demand for miniature surgical components and personalized implants. Technology adoption is heavily weighted towards complex multi-axis configurations (7-axis and above) capable of complete part machining in a single setup. This trend toward complexity and consolidation is essential for meeting modern manufacturing demands that require unparalleled efficiency and accuracy simultaneously.

AI Impact Analysis on Swiss Turn Market

User queries regarding AI’s influence on the Swiss Turn market commonly revolve around predictive maintenance, optimization of machining parameters, and enhancing quality control. Users are concerned about how AI can mitigate tool wear, reduce scrap rates in high-value material operations, and enable true lights-out manufacturing. The consensus expectation is that AI integration will shift the role of the machine operator from manual adjustment and troubleshooting to supervisory management of autonomous systems. Key themes emerging include the need for seamless integration of AI algorithms with legacy CNC controls, defining data ownership and security in cloud-based monitoring systems, and the potential for AI-driven feedback loops to autonomously correct thermal drift or vibration issues in real-time, thereby pushing machine precision beyond current mechanical limitations.

- AI-Powered Predictive Maintenance: Utilizing sensor data (vibration, temperature, power consumption) to forecast tool failure and machine component degradation, significantly minimizing unplanned downtime.

- Real-time Process Optimization: Employing machine learning algorithms to dynamically adjust feed rates, spindle speeds, and coolant pressure based on material hardness and current cutting conditions, ensuring optimal chip control and surface finish.

- Automated Quality Control and Inspection: Integration of AI vision systems for instantaneous geometric inspection and anomaly detection, comparing finished parts against CAD models without manual intervention.

- Generative Design for Fixturing: Using AI to rapidly design optimized workholding and fixture solutions specific to complex Swiss Turn operations, maximizing stability and reducing setup time.

- Energy Consumption Management: Applying AI models to analyze production schedules and machine load to optimize energy usage, contributing to sustainable manufacturing goals.

- Enhanced Thermal Compensation: AI-driven modeling predicting and compensating for thermal expansion and contraction within the machine structure, crucial for maintaining micron-level tolerances over extended production runs.

DRO & Impact Forces Of Swiss Turn Market

The dynamics of the Swiss Turn market are governed by potent Drivers, Restraints, and Opportunities (DRO), which collectively form the impact forces shaping its trajectory. The primary driver is the pervasive trend of miniaturization across consumer electronics, medical devices, and automotive components, requiring complex, small parts that only Swiss Turn machines can reliably produce with necessary tolerances and efficiency. This demand is intrinsically linked to technological advancements, where every new generation of product—from smartwatches to electric vehicle sensors—requires increasingly sophisticated, tiny precision components. Coupled with this is the global focus on enhancing manufacturing efficiency and reducing operational costs, where the high throughput and single-setup capabilities of multi-axis Swiss Turn machines offer a compelling return on investment, particularly for high-volume, high-value manufacturing processes.

However, significant restraints temper this growth. The most prominent restraint is the exceptionally high initial capital expenditure associated with purchasing and implementing sophisticated multi-axis Swiss Turn machinery, alongside the necessary ancillary equipment, tooling, and specialized software. This cost barrier often limits adoption among smaller and mid-sized enterprises (SMEs) globally. Furthermore, the complexity of programming and operating these highly advanced machines necessitates a highly skilled and specialized workforce. The persistent global shortage of experienced CNC programmers and machine operators capable of maximizing the efficiency of Swiss Turn technology presents a critical bottleneck for potential market expansion, driving up labor costs and training requirements across the industry.

Opportunities in the market center on technological diversification and geographical expansion. The growing adoption of advanced materials like ceramics, specialty polymers, and exotic nickel alloys in aerospace and medical implants creates a niche for specialized Swiss Turn models designed for hard-to-machine materials. Furthermore, the integration of Industry 4.0 concepts, including comprehensive machine connectivity, real-time monitoring via the Industrial Internet of Things (IIoT), and machine automation, presents an opportunity for manufacturers to offer differentiated, high-value solutions that drastically improve factory floor efficiency and enable seamless integration into smart factory ecosystems. The rapid industrialization of emerging economies in Southeast Asia and Latin America also offers substantial untapped markets for market penetration over the forecast period.

Segmentation Analysis

The Swiss Turn market segmentation offers a granular view of demand based on machine architecture, component complexity, and primary end-use application. Understanding these segments is crucial for strategic market positioning and product development, as machine requirements vary drastically between, for instance, high-volume automotive fastener production and low-volume, high-mix surgical instrument manufacturing. The market is primarily broken down by machine type (Sliding Headstock vs. Fixed Headstock), the degree of operational complexity (Axis count), and the dominant industry applications driving procurement decisions globally.

Sliding headstock machines dominate the volume segment due to their intrinsic advantages in processing long, thin components with exceptional accuracy, making them the default choice for medical, defense, and electronics applications where high length-to-diameter ratios are common. Conversely, fixed headstock machines, while offering higher rigidity for shorter, thicker parts and often possessing larger maximum turning diameters, cater to specialized heavy-duty industrial or internal automotive component manufacturing. The continuous trend toward multi-tasking and single-setup machining strongly favors multi-axis segments, where integration of secondary machining capabilities significantly reduces handling time and cumulative error.

From an end-user perspective, the segmentation reveals highly inelastic demand from the Medical and Aerospace sectors, driven by non-negotiable precision standards and stringent certification requirements. These segments prioritize reliability, repeatability, and the ability to process difficult materials like medical-grade titanium and Inconel. In contrast, the Electronics and Automotive segments are characterized by higher volume production, focusing on speed, automated operation, and the ability to handle high-mix, low-volume scenarios rapidly as product cycles shorten. Future market growth will be significantly shaped by the rapid adoption of specialized Swiss Turn machines within the burgeoning electric vehicle (EV) component supply chain.

- By Type:

- Sliding Headstock Swiss Turns (Dominant for high precision, small diameter)

- Fixed Headstock Swiss Turns (Used for larger components and higher rigidity needs)

- By Axis Configuration:

- 3-Axis and 4-Axis Machines (Basic operations)

- 5-Axis Machines (Common standard, moderate complexity)

- 6-Axis and 7-Axis Machines (Advanced multi-tasking, high complexity)

- Multi-Axis Machines (8+ axes, integrating B-axis and sub-spindles)

- By Application:

- Aerospace & Defense (Fasteners, engine components, sensor housings)

- Medical & Healthcare (Implants, surgical tools, dental components)

- Electronics & Semiconductors (Connectors, pins, micro-components)

- Automotive (Fuel system parts, sensors, brake components)

- Industrial & Others (Fluidics, hydraulic components, watchmaking)

Value Chain Analysis For Swiss Turn Market

The value chain for the Swiss Turn Market begins upstream with raw material suppliers and component manufacturers, providing specialized materials such as high-grade steel, complex electrical components (servomotors, encoders), and specialized control systems (CNC units). Crucially, the quality and innovation provided by the component suppliers, particularly those offering high-performance spindles and advanced tooling systems, directly influence the final machine’s performance specifications regarding speed, accuracy, and reliability. Upstream analysis also includes specialized software developers providing integrated CAD/CAM solutions optimized for complex multi-axis Swiss Turn programming, a critical step that dictates machine usability and efficiency.

The midstream segment is dominated by the Original Equipment Manufacturers (OEMs), who undertake machine design, assembly, testing, and quality assurance. These manufacturers focus heavily on engineering excellence, thermal management, and integration of automated peripheral systems (bar feeders, parts catchers, robotics). The distribution channel forms a crucial link, relying heavily on specialized technical distributors and representatives who possess deep knowledge of precision machining applications. Direct sales models are often employed for large enterprise accounts, while distributors cater primarily to SMEs, providing localized sales support, financing options, and initial technical installation and training, ensuring proper machine deployment and maximum utilization.

Downstream analysis centers on the diverse end-user industries—Aerospace, Medical, and Electronics—who consume the precision components produced by Swiss Turn machines. The value chain extends into the maintenance, repair, and overhaul (MRO) services, where OEMs and third-party providers offer critical after-sales support, spare parts, and specialized preventative maintenance contracts. The long lifecycle and high investment cost of these machines necessitate robust after-sales support to minimize downtime. The efficiency and reliability delivered in the downstream segment directly translate into the competitive advantage of the component manufacturers, ultimately impacting global supply chains reliant on high-precision small parts.

Swiss Turn Market Potential Customers

Potential customers for Swiss Turn technology are primarily found in sectors where the tolerance requirements are extremely tight, and component miniaturization is a core design criterion. The most dominant end-users are specialized contract manufacturers and precision machine shops that serve high-mix, low-volume orders for industries such as orthopedic and dental implant production. These shops require machines capable of rapid setup changes and consistent output of parts fabricated from difficult-to-machine materials like titanium and cobalt-chrome alloys, making the stability and flexibility of Swiss Turns indispensable.

Secondly, large-scale, vertically integrated Original Equipment Manufacturers (OEMs) in the Electronics and Automotive sectors constitute significant buyers. Electronics OEMs require Swiss Turns for producing miniature connectors, sensor bodies, and specialized pins vital for devices ranging from smartphones to advanced military navigation systems. Automotive customers, particularly those transitioning to electric vehicle (EV) component manufacturing, utilize these machines for precision components in battery management systems, fluid control valves, and advanced fuel injection parts (for hybrid systems), demanding high throughput with sustained precision necessary for safety-critical components.

Finally, captive shops within the Aerospace and Defense industries are vital consumers. Companies manufacturing aircraft engine components, specialized hydraulic fittings, and mission-critical sensors rely on Swiss Turn technology for assured quality and traceability. These customers prioritize machine longevity, adherence to strict regulatory standards (such as AS9100), and the manufacturer's ability to provide comprehensive documentation and compliance support. The common thread among all potential customers is the overriding need for efficient, repeatable production of micro-components that cannot be reliably manufactured using standard CNC lathe technology.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.95 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Star Micronics, Citizen Machinery, Tsugami Corporation, Tornos S.A., Nomura DS, Hanwha Precision Machinery, Gildemeister (DMG MORI), Miyano, Doosan Machine Tools, Index-Werke, Manurhin, Nexturn, Kent Industrial, Swistek CNC, Ganesh Machinery, Okuma Corporation, Haas Automation, Hardinge Inc., Mazak Corporation, Goodway Machine. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Swiss Turn Market Key Technology Landscape

The core technological landscape of the Swiss Turn market is centered on achieving ultra-high precision and operational flexibility, moving beyond traditional mechanical limitations through the integration of digital and advanced physical components. A key focus is on B-axis technology and multi-spindle configurations, which allow for simultaneous front and back machining and angular cutting, drastically increasing part complexity capability and reducing total cycle time. Machine builders are consistently refining vibration dampening mechanisms and spindle design, often employing ceramic bearings and specialized hydrostatic guides, to achieve unprecedented thermal stability and rigidity critical for maintaining accuracy over long production runs involving high material removal rates.

The shift towards Industry 4.0 is profoundly impacting the technology landscape, with manufacturers prioritizing connectivity and data analytics. Modern Swiss Turn machines are equipped with extensive sensor packages monitoring parameters such as torque, temperature, acoustic emissions, and vibration, facilitating real-time condition monitoring and enabling sophisticated predictive maintenance. Communication protocols, primarily OPC UA, are standardizing machine-to-machine and machine-to-central monitoring system communication, allowing seamless integration into Manufacturing Execution Systems (MES) and enabling automated data capture for process optimization and quality verification. This connectivity is essential for supporting unmanned, lights-out operation models.

Furthermore, advancements in tooling and material handling technology are crucial differentiators. Modular tooling systems, such as quick-change gang tools and turret configurations, significantly reduce changeover times between different jobs, enhancing overall machine utilization. Automated bar feeders, often integrated with automatic stock detection and error recovery systems, ensure continuous material supply. Finally, the development of sophisticated CAD/CAM software tailored specifically for the complex kinematics of multi-axis Swiss Turn machines simplifies the programming of simultaneous cutting operations, making these high-end technologies more accessible to skilled programmers and reducing the potential for human error during code generation.

Regional Highlights

Regional dynamics within the Swiss Turn market demonstrate a correlation between advanced industrialization, specialized manufacturing demand, and technology adoption rates. Asia Pacific (APAC) currently dominates the market both in terms of production capacity and consumption volume. This leadership position is directly attributable to the expansive manufacturing base in China, which serves as the global hub for electronics and automotive component production, and the highly sophisticated medical device manufacturing ecosystems thriving in Japan and South Korea. Furthermore, government initiatives in countries like India promoting 'Make in India' and domestic aerospace/defense manufacturing are injecting significant capital expenditure into precision machining facilities, ensuring APAC’s continued dominance throughout the forecast period, specifically in high-volume, cost-competitive applications.

North America and Europe represent mature markets characterized by exceptionally high Average Selling Prices (ASP) for Swiss Turn machinery, driven by the uncompromising requirements of the Aerospace and Medical sectors. In North America, the focus is heavily skewed towards high-mix, low-volume production of mission-critical parts, prioritizing multi-axis and highly automated machines capable of processing high-performance alloys like titanium and stainless steel. European markets, particularly Germany, Switzerland, and Italy, are characterized by strong domestic machine builders and a robust user base in specialized industries such as fluidics, luxury goods (watchmaking), and specialized automotive systems. Regulatory compliance and the demand for absolute traceability often dictate purchasing decisions in these regions.

The Latin America (LATAM) and Middle East & Africa (MEA) regions, while smaller in market share, are emerging growth areas. LATAM's market expansion is primarily linked to the growth of its domestic automotive assembly operations and nascent medical manufacturing sectors, particularly in Brazil and Mexico. The MEA region is showing accelerated demand driven by diversification efforts away from oil dependency, leading to investments in defense equipment manufacturing and specialized infrastructure projects. However, growth in these regions is subject to greater economic volatility and reliance on imported machinery and specialized technical expertise, presenting both opportunities for new market entry and challenges related to service infrastructure.

- Asia Pacific (APAC): Highest growth driver, fueled by electronics, massive automotive production, and government support for high-tech domestic manufacturing in China, Japan, and South Korea. Focus on high volume and speed.

- North America: Dominant in high-value applications, particularly Aerospace, Defense, and Medical devices. Strong demand for 7-axis and B-axis machines, prioritizing precision and material compatibility (e.g., titanium, Inconel).

- Europe: Key market for machine innovation, driven by German and Swiss manufacturers. High adoption in watchmaking, specialized industrial components, and high-end automotive systems. Strong emphasis on automation and regulatory compliance.

- Latin America (LATAM): Emerging market driven by local automotive supply chain expansion (Mexico, Brazil). Focus on cost-efficient, reliable 5-axis machines.

- Middle East & Africa (MEA): Growth tied to industrial diversification projects, including defense and localized infrastructure development, although highly dependent on external technological import.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Swiss Turn Market.- Citizen Machinery Co., Ltd.

- Star Micronics Co., Ltd.

- Tsugami Corporation

- Tornos S.A.

- Nomura DS

- Hanwha Precision Machinery

- DMG MORI AG (through its Gildemeister technology)

- INDEX-Werke GmbH & Co. KG

- Doosan Machine Tools (Now DN Solutions)

- Miyano (part of Citizen Machinery)

- Nexturn Co., Ltd.

- Kent Industrial Co., Ltd.

- Swistek CNC

- Ganesh Machinery

- Okuma Corporation

- Mazak Corporation

- Hardinge Inc.

- Manurhin KMX

- TAJMAC-ZPS, a.s.

- Goodway Machine Corp.

Frequently Asked Questions

Analyze common user questions about the Swiss Turn market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of using Swiss Turn machines over conventional CNC lathes?

Swiss Turn machines utilize a guide bushing and sliding headstock mechanism, providing rigidity closer to the cutting point. This design is critical for machining long, thin components with high length-to-diameter ratios, ensuring superior precision (often sub-micron tolerances) and significantly reducing cycle times by allowing for simultaneous front and back machining.

Which industry applications drive the highest demand for Swiss Turn technology globally?

The Medical (implants, surgical tools) and Aerospace (fasteners, critical fittings) sectors are the core drivers due to their extremely high precision and zero-defect requirements. Additionally, the Electronics industry, demanding vast quantities of micro-connectors and sensor components, contributes significantly to high-volume market demand.

How is the integration of Industry 4.0 principles impacting the operational efficiency of Swiss Turn machines?

Industry 4.0 integration, through IIoT sensors and connectivity, enables predictive maintenance, real-time machine monitoring, and remote diagnostics. This maximizes machine uptime, optimizes tool life, and allows for data-driven process adjustments, facilitating true lights-out manufacturing and enhancing overall equipment effectiveness (OEE).

What are the main constraints limiting the adoption rate of Swiss Turn machinery in emerging markets?

The primary constraints are the substantial initial capital investment required for procurement and installation, coupled with the critical shortage of highly specialized CNC programmers and operators trained to effectively utilize complex multi-axis Swiss Turn kinematics. This skill gap increases operational costs and difficulty of implementation.

What role does multi-axis capability play in the future growth of the Swiss Turn market?

Multi-axis configurations (5-axis, 7-axis, and B-axis integration) are essential for market growth as they enable single-setup, complete machining of highly complex parts. This capability eliminates secondary operations, reduces cumulative errors associated with re-chucking, and is vital for meeting the demanding geometric specifications of next-generation components in aerospace and medical technology.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager