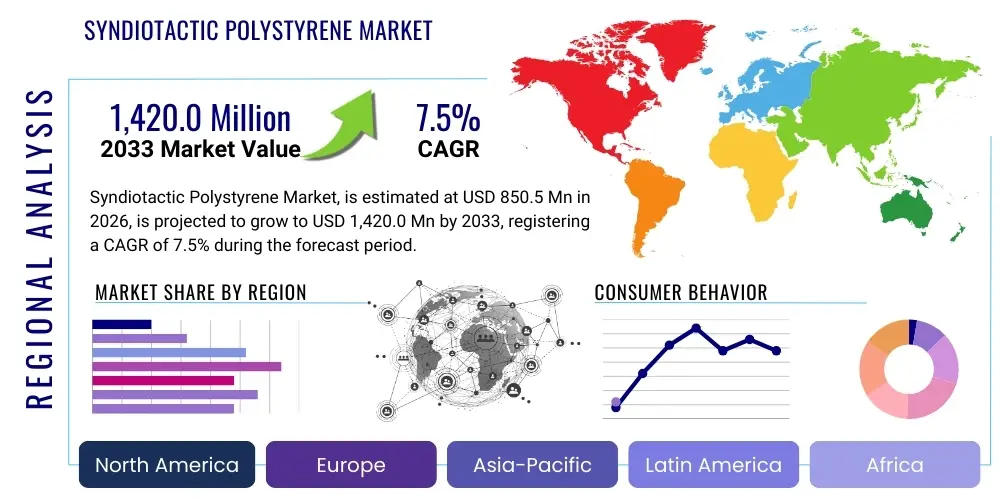

Syndiotactic Polystyrene Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438061 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Syndiotactic Polystyrene Market Size

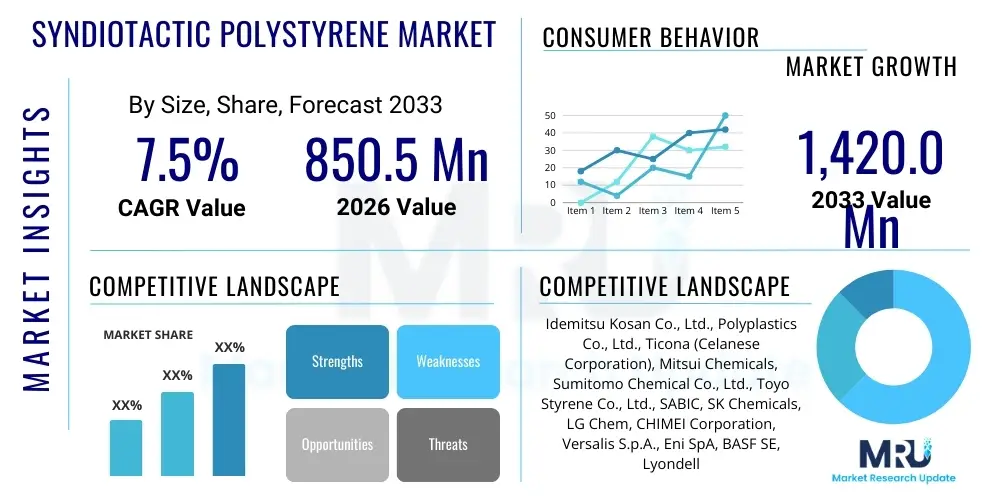

The Syndiotactic Polystyrene Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at $850.5 Million USD in 2026 and is projected to reach $1,420.0 Million USD by the end of the forecast period in 2033.

Syndiotactic Polystyrene Market introduction

Syndiotactic Polystyrene (SPS) is a high-performance, semicrystalline engineering thermoplastic characterized by a highly regular polymer chain structure that provides exceptional heat resistance, excellent electrical insulation properties, and superior chemical stability compared to conventional polystyrene. Its unique stereoregular configuration, achieved through advanced metallocene catalysis polymerization techniques, allows it to maintain structural integrity at high temperatures, making it indispensable in demanding industrial and electronic applications. The inherent low dielectric constant and low dissipation factor further establish SPS as a critical material for high-frequency electrical components and connectors where signal integrity is paramount.

The core applications of Syndiotactic Polystyrene span several high-growth industries. In the automotive sector, SPS is extensively utilized for components under the hood, such as ignition coil bobbins, sensors, and connectors, owing to its thermal stability and resistance to automotive fluids like oils and coolants. Within the burgeoning electrical and electronics market, SPS is a preferred material for surface-mount technology (SMT) components, capacitor casings, fiber optic connectors, and high-frequency communication equipment, including parts essential for 5G infrastructure deployment. Its dimensional stability and low moisture absorption ensure reliability in intricate electronic assemblies, minimizing the risk of failure under varying operational conditions.

Key market driving factors include the continuous global demand for miniaturization in electronic devices, which necessitates materials that can withstand rigorous processing temperatures and possess inherent flame retardancy. Furthermore, the automotive industry's pervasive shift toward electric vehicles (EVs) and advanced driver-assistance systems (ADAS) is fueling the need for high-performance, lightweight, and thermally resistant plastics like SPS. The material’s ability to replace more traditional, heavier materials (such as metals or thermosets) in certain high-heat applications provides significant weight reduction benefits, directly contributing to energy efficiency and performance improvements in modern transportation systems. The ongoing development of enhanced grades, particularly glass fiber reinforced variants, is expanding its penetration into structural components.

Syndiotactic Polystyrene Market Executive Summary

The Syndiotactic Polystyrene market is experiencing robust expansion driven primarily by accelerated investment in next-generation communication infrastructure, particularly 5G networks, and stringent lightweighting mandates within the global automotive industry. Technological advancements in polymerization processes have marginally improved the scalability and cost-efficiency of SPS production, though the material remains positioned as a premium engineering plastic. Key business trends indicate a strategic focus among leading manufacturers on developing specialized grades optimized for high-temperature and harsh-environment applications, alongside geographic diversification of manufacturing hubs, particularly towards emerging economies in the Asia Pacific region, to capitalize on localized demand from the mass electronics manufacturing base. Consolidation activities, primarily through strategic partnerships and focused R&D agreements between polymer producers and specialized catalyst developers, are shaping the competitive landscape.

Regionally, the Asia Pacific (APAC) stands as the dominant and fastest-growing market segment, attributable to the massive concentration of electronics manufacturing facilities, substantial growth in domestic automotive production, particularly in China and India, and significant government support for developing advanced communication technologies. North America and Europe, while representing mature markets, continue to provide consistent demand, particularly for high-specification SPS grades used in aerospace, defense, and premium automotive sectors where material performance often outweighs cost considerations. Regulatory pressures related to vehicle emissions and safety standards in these regions further propel the adoption of advanced materials like SPS that offer high mechanical strength and thermal performance necessary for complex electronic systems integrated into modern vehicles.

Segment trends reveal that the Electrical and Electronics application segment maintains the largest market share, directly correlated with the global surge in demand for sophisticated consumer electronics, industrial automation equipment, and data center infrastructure components. The High Flow Grade segment, prized for its excellent moldability and suitability for thin-wall components, is projected to register the highest growth rate as manufacturers seek increased production efficiency and design flexibility for miniaturized parts. Furthermore, the trend toward incorporating SPS into specialty compounded materials, often reinforced with glass fibers or mineral fillers, enhances its mechanical properties, expanding its utility beyond standard insulation uses into structural components requiring exceptional stiffness and heat deflection temperature (HDT).

AI Impact Analysis on Syndiotactic Polystyrene Market

User queries regarding the impact of Artificial Intelligence (AI) on the Syndiotactic Polystyrene market frequently center on how AI can optimize manufacturing efficiency, enhance material discovery, and predict future demand fluctuations in key end-use sectors like automotive and 5G communications. Users are keenly interested in the potential for AI-driven process control to minimize defects and increase yield in the complex metallocene catalysis used to synthesize SPS, thus addressing the material's traditional high-cost structure. Furthermore, common questions revolve around utilizing AI in materials informatics to simulate and predict the performance characteristics of new SPS composite formulations, accelerating the time-to-market for specialized grades required for emerging technologies such as advanced sensor systems and high-power density components, ensuring that R&D efforts are precisely aligned with future technological needs.

The direct influence of AI extends significantly into the supply chain management of Syndiotactic Polystyrene. Predictive analytics models, powered by machine learning, are increasingly deployed to forecast raw material costs (styrene monomer and specialized catalysts) and anticipate shifts in demand from major OEM customers, enabling producers to optimize inventory levels and scheduling. AI also plays a critical role in quality assurance; image processing and machine vision systems monitor the polymerization process in real-time, identifying subtle deviations in molecular weight distribution or crystallinity, which is crucial for maintaining the stringent specifications required for SPS used in sensitive electronic components. This enhanced oversight improves overall product consistency, reduces waste, and reinforces the material's viability in high-reliability applications.

- AI optimizes polymerization parameters to enhance reaction yield and purity of SPS.

- Predictive maintenance using AI minimizes downtime for expensive SPS manufacturing equipment.

- Machine learning algorithms accelerate the discovery and formulation of novel high-performance SPS composites.

- AI-driven supply chain forecasting improves inventory management for styrene monomer and specialty catalysts.

- Real-time quality control systems based on AI vision ensure stringent specifications for electronic applications are met.

DRO & Impact Forces Of Syndiotactic Polystyrene Market

The Syndiotactic Polystyrene market is primarily driven by the escalating demand for high-frequency electrical components essential for advanced networking and communication infrastructure, coupled with the relentless push for lighter and more fuel-efficient vehicles. However, the market faces significant restraints, chiefly the relatively high production cost associated with the complex stereospecific polymerization process and the dependence on specialized, high-cost metallocene catalysts, which limits its adoption compared to cheaper, high-volume commodity plastics. The primary opportunity lies in the rapid global adoption of 5G and 6G technologies, where SPS's superior dielectric properties are indispensable, and its expanding use in thermal management solutions for electric vehicle battery systems. These factors collectively create strong impact forces, pushing manufacturers towards strategic material development and process optimization to overcome cost hurdles and capitalize on performance-driven applications.

The major drivers underpinning market expansion are rooted in technological evolution across various sectors. The automotive industry’s transition towards electrification demands polymers that can withstand elevated operating temperatures generated by high-power electronics and provide lightweight solutions to maximize battery range, areas where SPS excels. Similarly, the explosive growth in data traffic necessitates constant upgrades to networking equipment, requiring materials with extremely low dielectric loss to maintain signal integrity at gigahertz frequencies. The superior thermal resistance (high melting point exceeding 270°C) allows SPS to survive the rigorous vapor phase soldering processes common in electronic assembly, distinguishing it from lower-grade thermoplastics. Furthermore, environmental regulations encouraging material efficiency inadvertently favor high-durability polymers like SPS, which offer longer service life and reduced replacement frequency.

Conversely, market growth is hampered by the relatively smaller production capacity compared to commodity polymers and the associated pricing premium, which restricts SPS usage mainly to performance-critical niches rather than bulk applications. Another restraint is the technical difficulty in processing and molding SPS, which requires precise temperature control and specialized equipment due to its high melting point and sensitivity to thermal degradation during processing. However, the opportunities presented by new technologies often outweigh these constraints for strategic investors. The application of SPS in micro-electromechanical systems (MEMS), high-temperature connectors for industrial ovens, and advanced composite structures designed for extreme environments represents untapped potential. The need for materials that maintain dimensional stability and electrical properties under severe thermal cycling positions SPS favorably for future innovation across numerous high-value chains.

Segmentation Analysis

The Syndiotactic Polystyrene market is segmented based on the specific grade of the polymer, defined by its formulation and intended mechanical properties, and its diverse range of end-use applications which dictates volume and performance requirements. Understanding these segmentations is critical for market participants, as it defines target manufacturing specifications and strategic pricing models. The Type segmentation primarily reflects modifications to the base SPS polymer, often involving reinforcing agents like glass fibers or flow modifiers to optimize processability for specific component geometries, leading to variants tailored for injection molding or extrusion. The Application segmentation highlights the material's penetration across major industrial verticals, with Electronics and Automotive consistently driving technological demands and volume uptake.

Specific market dynamics vary significantly across these segments. For instance, the demand within the Electrical and Electronics sector is heavily concentrated on grades exhibiting exceptional electrical insulation and dimensional stability, whereas the Automotive segment prioritizes reinforced grades that offer high mechanical strength, stiffness, and chemical resistance for powertrain and structural components. Geographical segmentation remains pivotal, with the Asia Pacific region dominating both production capacity and consumption due to the high volume manufacturing of automotive parts and electronics. The strategic allocation of resources into developing grades that comply with emerging global standards for flame retardancy and sustainable manufacturing practices is a current focus across all major segments, aimed at broadening the overall utility and compliance profile of SPS.

- Type

- General Grade Syndiotactic Polystyrene

- High Flow Grade Syndiotactic Polystyrene

- Glass Fiber Reinforced Grade Syndiotactic Polystyrene (GFR-SPS)

- Mineral Filled Grades

- Application

- Automotive Components (Under-the-hood parts, sensors, connectors)

- Electrical and Electronics (Connectors, SMT components, capacitor films, coaxial cables)

- Industrial Equipment (Pump impellers, seals, high-temperature housings)

- Consumer Goods and Appliances (Microwave oven parts, hair dryer components)

- Others (Aerospace, Medical Devices)

- Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Syndiotactic Polystyrene Market

The value chain for Syndiotactic Polystyrene is complex, commencing with the upstream production of raw materials, particularly styrene monomer and the highly specialized metallocene catalysts necessary for stereospecific polymerization. Styrene monomer is a widely available petrochemical product, but the catalysts—often proprietary and expensive—are critical differentiators impacting both cost and material quality. Upstream suppliers exert considerable influence on the market price of SPS, necessitating strong, long-term contractual relationships between polymer manufacturers and specialized chemical suppliers to ensure a consistent and cost-effective supply, thereby stabilizing manufacturing costs in a volatile chemical commodities environment. Polymer producers then utilize sophisticated manufacturing processes to synthesize the SPS resin, often focusing on patented processes to achieve the desired molecular structure and purity.

Midstream activities involve the compounding and conversion phase, where the base SPS resin is modified to create application-specific grades. This includes reinforcement with glass fibers, mineral fillers, or the addition of flame retardants and heat stabilizers, tailoring the material for specific end-use requirements such as high stiffness or enhanced electrical performance. This compounding phase adds substantial value, transforming the raw polymer into an engineering material ready for molding. Downstream distribution is managed through a mixed channel approach: large-volume clients, particularly major automotive tier-one suppliers and electronics OEMs, often receive direct sales and bulk shipments, ensuring technical support and tailored logistics. Smaller converters and regional fabricators are typically served through indirect distribution networks, utilizing authorized chemical distributors and specialty plastics resellers who manage localized inventory and provide technical consultation.

The efficiency of the distribution channel is paramount due to the specialized nature of SPS, which is often sourced for time-sensitive, high-reliability projects. Direct sales facilitate deep collaboration between the producer and the end-user, crucial for developing custom material specifications, especially in the high-stakes automotive and aerospace sectors. Conversely, the indirect channel, managed by specialized distributors, provides essential market reach into smaller fabrication shops and provides the necessary technical expertise to promote the proper handling and processing of the high-temperature polymer. This dual distribution strategy ensures both volume efficiency and market penetration, solidifying the material’s position across various industrial scales and geographical regions while mitigating the logistical challenges associated with handling specialized engineering plastics.

Syndiotactic Polystyrene Market Potential Customers

The primary consumers and end-users of Syndiotactic Polystyrene are large multinational corporations operating within high-reliability and high-temperature environments, specifically those engaged in the production of complex electrical systems, sophisticated automotive assemblies, and high-performance industrial machinery. These customers demand materials that offer consistent performance under extreme conditions, including high thermal load, chemical exposure, and electrical stress. Key buyers include Tier 1 automotive suppliers (e.g., Bosch, Continental), major electronics manufacturing services (EMS) providers (e.g., Foxconn, Flextronics), and specialized industrial equipment manufacturers who utilize SPS for pump housings, seals, and high-frequency connectors, where material failure could lead to significant operational disruption or safety hazards.

A rapidly growing customer base is emerging from sectors dedicated to next-generation technologies, particularly companies involved in 5G and future 6G communication infrastructure deployment. These customers, including telecommunications equipment manufacturers (e.g., Huawei, Ericsson) and specialized semiconductor packaging companies, require SPS for its outstanding low dielectric constant and low dissipation factor, which are essential for minimizing signal loss in high-speed, high-frequency antenna and base station components. These potential customers prioritize material consistency, long-term reliability, and compliance with stringent environmental and regulatory standards, making the technical specification and proven track record of the polymer supplier a critical factor in purchasing decisions. This focused customer base necessitates a highly consultative sales approach centered on technical superiority rather than simple price competition.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $850.5 Million USD |

| Market Forecast in 2033 | $1,420.0 Million USD |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Idemitsu Kosan Co., Ltd., Polyplastics Co., Ltd., Ticona (Celanese Corporation), Mitsui Chemicals, Sumitomo Chemical Co., Ltd., Toyo Styrene Co., Ltd., SABIC, SK Chemicals, LG Chem, CHIMEI Corporation, Versalis S.p.A., Eni SpA, BASF SE, LyondellBasell Industries N.V., Dow Inc., Asahi Kasei Corporation, Toray Industries, Inc., Kingfa Sci. & Tech. Co., Ltd., Shanghai Pret Composites Co., Ltd., Daicel Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Syndiotactic Polystyrene Market Key Technology Landscape

The technological core of the Syndiotactic Polystyrene market lies in the sophisticated metallocene catalysis polymerization process, which is essential for synthesizing the highly ordered, stereoregular polymer structure that defines SPS. Traditional radical polymerization of styrene yields atactic polystyrene, which lacks the high thermal stability required for engineering applications. Conversely, the use of proprietary metallocene catalysts, often based on titanocene or zirconocene complexes, precisely controls the insertion of styrene units, resulting in the syndiotactic configuration. Continuous innovation in catalyst design, focusing on improving activity, enhancing selectivity, and reducing catalyst residues, is the primary area of R&D investment, aimed at lowering production costs and improving the purity and consistency of the final resin, thereby expanding its viability for sensitive electronic applications.

Beyond polymerization chemistry, the key technology landscape includes advancements in compounding and processing technologies necessary for commercial application. Specialized twin-screw extrusion systems designed for high shear and high temperature are mandatory for incorporating reinforcing agents such as long glass fibers into the SPS matrix without inducing significant thermal degradation or fiber breakage. Furthermore, additive technologies, particularly the development of high-performance, non-halogenated flame retardant systems compatible with the high processing temperature of SPS, are crucial for meeting strict safety standards in electrical and automotive applications. Processing techniques like high-speed injection molding and extrusion are continually being refined to leverage the high flow characteristics of certain SPS grades, enabling the cost-effective manufacture of complex, thin-walled components required for modern miniaturization trends in the electronics sector.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the global SPS market in terms of both production capacity and consumption, fueled by the region's status as a global manufacturing hub for electronics, including consumer devices, semiconductor components, and 5G equipment. Countries like China, Japan, South Korea, and Taiwan house major SPS producers and high-volume end-users, especially in the automotive electrification sector. The rapid expansion of local data centers and network infrastructure mandates the extensive use of SPS in high-frequency connectors and insulating materials.

- North America: This region maintains robust demand for high-specification SPS, particularly within the aerospace, defense, and premium automotive segments. The stringent regulatory environment and the focus on integrating highly advanced electronic systems (e.g., ADAS sensors) in vehicles drive the adoption of top-tier, reinforced SPS grades. R&D activities here are often focused on specialized, low-volume, high-value applications requiring extreme temperature resistance and precise performance metrics.

- Europe: Europe represents a mature market characterized by strong automotive industry demand, driven by environmental mandates for lightweighting and the push towards electric mobility. German and French manufacturers are significant consumers of SPS for engine control units (ECUs), high-voltage connectors, and thermal management components. The region emphasizes sustainability, increasingly favoring suppliers capable of providing documentation regarding the material's lifecycle and recyclability.

- Latin America (LATAM) and Middle East & Africa (MEA): These emerging markets currently hold smaller shares but are projected for moderate growth, primarily driven by infrastructure development and increasing foreign investment in localized automotive assembly and basic electronics manufacturing. SPS adoption here is initially concentrated in industrial equipment maintenance and specific high-heat applications within the oil and gas sector (MEA).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Syndiotactic Polystyrene Market.- Idemitsu Kosan Co., Ltd.

- Polyplastics Co., Ltd.

- Ticona (Celanese Corporation)

- Mitsui Chemicals

- Sumitomo Chemical Co., Ltd.

- Toyo Styrene Co., Ltd.

- SABIC

- SK Chemicals

- LG Chem

- CHIMEI Corporation

- Versalis S.p.A.

- Eni SpA

- BASF SE

- LyondellBasell Industries N.V.

- Dow Inc.

- Asahi Kasei Corporation

- Toray Industries, Inc.

- Kingfa Sci. & Tech. Co., Ltd.

- Shanghai Pret Composites Co., Ltd.

- Daicel Corporation

Frequently Asked Questions

Analyze common user questions about the Syndiotactic Polystyrene market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Syndiotactic Polystyrene (SPS) and how does it differ from standard Polystyrene (PS)?

SPS is a high-performance engineering plastic characterized by a highly ordered, stereoregular structure achieved through metallocene catalysis, resulting in a crystalline polymer with a high melting point (over 270°C). Standard PS (atactic) is amorphous, has a lower heat deflection temperature, and is unsuitable for high-heat or electronic applications requiring stringent thermal stability.

Which application segment drives the highest demand for Syndiotactic Polystyrene?

The Electrical and Electronics segment currently drives the highest demand for SPS. This is due to the material's superior electrical properties—specifically low dielectric constant and low dissipation factor—making it essential for high-frequency connectors, SMT components, and critical infrastructure for 5G and future communication systems.

What are the primary factors restraining the growth of the SPS market?

The main restraints are the high cost of production, attributed to the need for specialized, proprietary metallocene catalysts and complex polymerization processes, and the resulting price premium which limits its adoption primarily to highly specialized, performance-critical niche applications.

How is the adoption of electric vehicles (EVs) impacting the demand for Syndiotactic Polystyrene?

The rapid adoption of EVs significantly boosts SPS demand. EVs require materials that can withstand high operating temperatures around battery and power electronics systems, necessitating SPS for high-voltage connectors, busbar supports, and sensor housings due to its thermal stability and dimensional reliability.

Which geographical region is projected to exhibit the fastest growth in the SPS market?

The Asia Pacific (APAC) region is projected to be the fastest-growing market due to massive investments in electronics manufacturing, expanding automotive production, and government-backed infrastructure projects, particularly in China and South Korea, driving both supply and consumption volumes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Syndiotactic Polystyrene Market Size Report By Type (LG Chem product, Idemitsu Kosan product), By Application (Automotive, Membrane, Food and Medical container, Electronic components), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Syndiotactic Polystyrene Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Atactic Polystyrene, Syndiotactic Polystyrene), By Application (Automotive, Membrane, Food and Medical Container, Electronic Components), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager