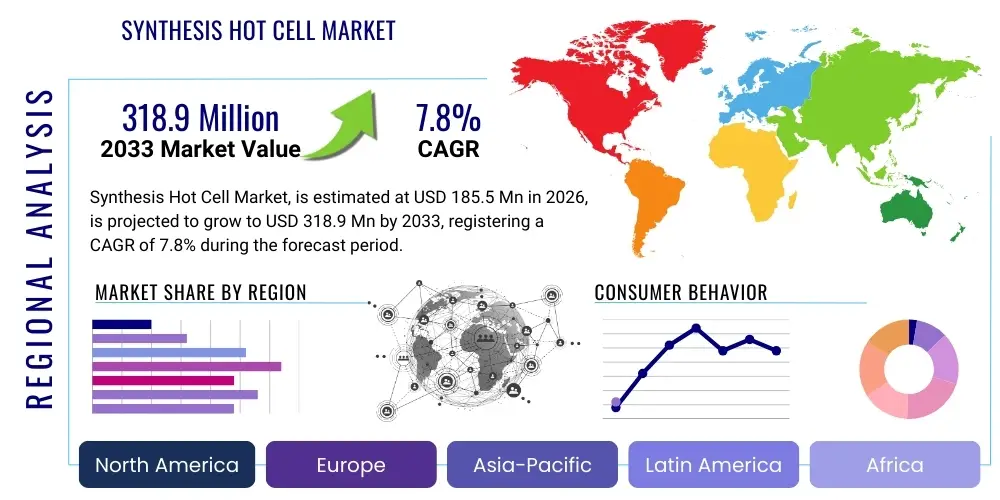

Synthesis Hot Cell Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438235 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Synthesis Hot Cell Market Size

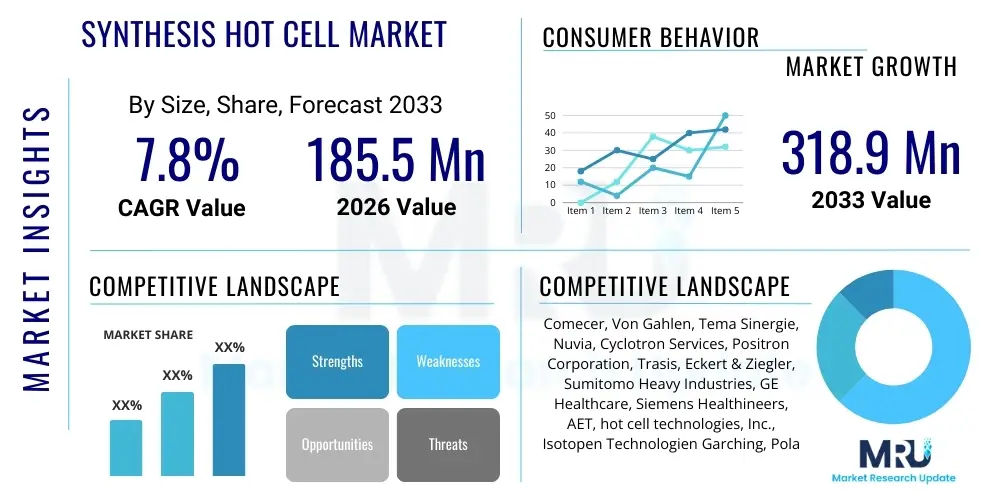

The Synthesis Hot Cell Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. This robust expansion is primarily driven by the escalating demand for Positron Emission Tomography (PET) diagnostics and the subsequent necessity for safe, automated handling of short-lived radioisotopes used in drug synthesis. These specialized containment systems ensure regulatory compliance and operator safety, making them indispensable infrastructure in modern nuclear medicine facilities and cyclotrons.

The market is estimated at USD 185.5 million in 2026. This valuation reflects the current investment in new cyclotron facilities, upgrades to existing nuclear pharmacies, and the increasing adoption of personalized medicine which relies heavily on high-purity radiotracers. The synthesis hot cell segment is witnessing technological advancements, particularly in integrated automation and miniaturization, which lowers operational complexity and improves yield efficiencies, thereby justifying high initial capital expenditure for end-users across established and emerging healthcare economies.

The market is projected to reach USD 318.9 million by the end of the forecast period in 2033. This growth trajectory is underpinned by favorable reimbursement policies for nuclear medicine procedures, the expansion of clinical trials leveraging novel radiopharmaceuticals for oncology, neurology, and cardiology, and the geographic proliferation of radiopharmacies into developing regions. Furthermore, the stringent global regulatory environment concerning radiation safety mandates the consistent deployment of state-of-the-art synthesis hot cell technologies, solidifying long-term market expansion.

Synthesis Hot Cell Market introduction

The Synthesis Hot Cell Market encompasses highly specialized, shielded containment units designed for the safe and sterile synthesis of radiopharmaceuticals, particularly those utilizing short-lived radionuclides produced by cyclotrons, such as Fluorine-18 (18F) for Fluorodeoxyglucose (FDG) and other PET tracers. These cells provide critical shielding against gamma and beta radiation while maintaining an ultra-clean, often Grade A/B compliant, environment necessary for pharmaceutical production, preventing cross-contamination and ensuring product sterility. The core product offering includes automated synthesis modules integrated within shielded enclosures, along with sophisticated remote handling tools, ventilation systems, and specialized waste disposal mechanisms. These systems are foundational infrastructure for radiopharmaceutical production facilities, academic research centers, and large hospital systems equipped with nuclear medicine departments.

Major applications of synthesis hot cells span clinical diagnostics, therapeutic radiopharmaceuticals (theranostics), and fundamental research. In the clinical realm, their primary use is facilitating the high-volume, automated production of diagnostic tracers that are essential for early disease detection, cancer staging, and monitoring treatment response. The benefits derived from deploying these technologies are substantial, including enhanced operator safety through minimized radiation exposure, improved process reproducibility due to automation, and guaranteed compliance with Good Manufacturing Practice (GMP) standards. This stringent control over the synthesis process directly contributes to the quality and efficacy of injectable radiopharmaceuticals, which is paramount for patient safety and clinical outcomes.

Key driving factors fueling the expansion of this market include the global aging population, which necessitates greater use of advanced diagnostic imaging techniques like PET/CT, and the rapid expansion of the radiotheranostics pipeline, where radionuclides are used both for imaging and targeted therapy. Moreover, increasing investments in cyclotron infrastructure globally, particularly in Asia Pacific and Latin America, coupled with rising awareness and adoption of molecular imaging techniques, are accelerating demand for integrated synthesis hot cell solutions. The continuous innovation in automation and shielding materials, aimed at maximizing throughput and minimizing footprint, further enhances the market appeal and technological maturity of these essential devices.

Synthesis Hot Cell Market Executive Summary

The Synthesis Hot Cell Market is currently characterized by significant growth driven by heightened demand in nuclear medicine and oncology, reflecting substantial business trends focused on automation and facility consolidation. Strategic investments are concentrated on developing modular and customizable hot cells that can seamlessly integrate disparate synthesis units, supporting the rapid diversification of radiotracer production beyond standard FDG. Market leaders are emphasizing turnkey solutions, encompassing full commissioning, validation, and maintenance services, allowing end-users to achieve faster regulatory clearance and operational readiness. This shift towards comprehensive solution provision is a critical business trend aimed at capturing market share in the competitive, capital-intensive healthcare infrastructure sector.

Regional trends indicate North America and Europe retaining dominant positions due to established nuclear medicine infrastructure, robust funding for R&D in molecular imaging, and stringent regulatory environments that necessitate high-specification equipment. However, the Asia Pacific region is demonstrating the highest growth velocity, propelled by massive government investment in healthcare modernization, the installation of new cyclotron centers in countries like China and India, and the rising prevalence of chronic diseases requiring advanced diagnostics. Emerging economies are prioritizing cost-effective yet compliant solutions, driving regional specialization in modular and semi-automated synthesis cells suitable for smaller institutional setups. This geographical expansion is crucial for overall market maturation.

Segmentation trends highlight the dominance of the Single-cell type due to its cost-effectiveness and suitability for dedicated synthesis applications, though the Multi-cell type is gaining traction in centralized radiopharmacies requiring flexible production capacity for various tracers. By application, Hospitals and Clinics represent the largest segment, driven by the immediate clinical need for diagnostic tracers, while Research Institutes are anticipated to exhibit the fastest growth, fueled by the accelerating pace of novel radiopharmaceutical discovery, particularly in targeted alpha therapy. Furthermore, the shielding material segment shows a noticeable pivot toward tungsten alloys, valued for their superior density, shielding efficiency, and capability to reduce overall equipment footprint compared to traditional lead shielding, aligning with modern spatial efficiency requirements in laboratory design.

AI Impact Analysis on Synthesis Hot Cell Market

Common user inquiries regarding AI's influence on the Synthesis Hot Cell Market revolve primarily around improving automation efficiency, predictive maintenance, and data integrity in radiopharmaceutical production. Users frequently ask how AI can optimize synthesis yield, minimize human intervention within the hot cell environment, and predict equipment failure to prevent costly downtime. There is significant interest in utilizing machine learning algorithms to analyze complex reaction parameters and optimize the synthesis protocol for novel tracers, reducing manual trial-and-error processes. Additionally, concerns are raised about the validation and regulatory approval pathways for AI-driven synthesis processes, emphasizing the need for robust explainable AI (XAI) to maintain GMP compliance and ensuring the secure integration of sophisticated software without compromising radiation safety protocols or cybersecurity.

- AI algorithms optimize radiopharmaceutical synthesis parameters, enhancing yield and purity consistency.

- Machine learning facilitates predictive maintenance of hot cell components (e.g., manipulators, ventilation systems), drastically reducing unexpected downtime.

- Integration of Computer Vision with robotic arms allows for highly precise, automated remote handling and quality control checks within the shielded environment.

- AI-driven data analytics streamlines documentation and validation processes, ensuring faster compliance with strict GMP regulations.

- Intelligent monitoring systems provide real-time radiation exposure optimization, further safeguarding operators and enhancing operational efficiency.

- Natural Language Processing (NLP) aids in analyzing large volumes of synthesis log data, identifying subtle trends and operational bottlenecks for continuous process improvement.

DRO & Impact Forces Of Synthesis Hot Cell Market

The Synthesis Hot Cell Market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities, which collectively constitute the Impact Forces shaping its trajectory. The primary driver is the exponentially growing field of nuclear medicine, specifically the increased adoption of PET imaging and the emergence of theranostics, which demand specialized infrastructure for tracer production. Restraints largely center on the prohibitively high initial capital investment required for establishing cyclotron and radiopharmacy facilities, coupled with the stringent, complex regulatory hurdles associated with handling radioactive materials and validating GMP compliance. Opportunities arise from technological advancements, such as the miniaturization of synthesis modules and the integration of advanced robotics, which promises greater accessibility and efficiency in synthesis operations. These factors create an environment where sustained infrastructural investment is mandatory, but operational excellence and compliance require continuous technological upgrading.

Key drivers include the global increase in cancer prevalence, necessitating sophisticated diagnostic tools, and the subsequent expansion of commercial radiopharmacy networks that require standardized, high-throughput hot cells. The mandate for superior operator safety, driven by international bodies like the IAEA and local regulatory agencies, compels facilities to invest in advanced shielded environments, replacing older, less automated systems. Furthermore, the diversification of the radiopharmaceutical portfolio, moving beyond 18F-FDG to include Gallium-68 and Copper-64 tracers, mandates flexible synthesis platforms that only high-specification modern hot cells can provide, thereby securing long-term demand across clinical and research settings. These systemic requirements ensure that investment in hot cell infrastructure remains a non-negotiable component of nuclear medicine expansion globally.

Conversely, significant restraints hinder market potential, chiefly the scarcity of highly trained personnel proficient in operating and maintaining complex synthesis hot cells and associated chemistry modules. This skills gap impacts operational efficiency and increases dependency on manufacturer support services. Moreover, the cyclical nature of public and private funding for large-scale healthcare infrastructure projects introduces uncertainty in major capital expenditure planning. The opportunities, however, are substantial, notably in developing modular and fully automated solutions that reduce footprint and complexity, making high-quality tracer production viable for smaller hospitals or remote locations. Additionally, the development of sophisticated remote monitoring and diagnostic capabilities, potentially leveraging 5G connectivity, offers pathways for global technical support, mitigating the local expertise shortage and accelerating market penetration in emerging economies.

Segmentation Analysis

The Synthesis Hot Cell Market is comprehensively segmented based on Type, Application, and Shielding Material, reflecting the diverse operational requirements and technological specifications utilized by end-users across the nuclear medicine value chain. Segmentation by Type distinguishes between single-cell and multi-cell configurations, fundamentally determining the throughput capacity and flexibility of the production unit. Application segmentation identifies the primary usage environments—clinical versus research—which dictates the regulatory standards and complexity required. The segmentation analysis is essential for understanding purchasing decisions, as institutional buyers often prioritize features such as shielding efficacy and internal automation levels based on their specific radionuclide portfolio and mandated regulatory compliance.

The segmentation by Shielding Material, which includes lead, tungsten, and steel, represents a critical differentiation point, affecting both the physical footprint and the cost efficiency of the hot cell. Lead remains a standard choice due to its proven efficacy and cost profile, but tungsten is increasingly preferred for high-energy applications or where minimizing footprint is paramount, despite its higher procurement cost. This detailed structural breakdown allows market participants, including manufacturers and suppliers, to tailor their product offerings to specific geographical demands and regulatory adherence requirements, optimizing production and distribution strategies to maximize market penetration across distinct user profiles.

- By Type:

- Single-Cell Synthesis Hot Cells

- Multi-Cell Synthesis Hot Cells (e.g., dual-cell, tandem)

- By Application:

- Hospitals and Clinics (Primary use: Diagnostic tracer production like 18F-FDG)

- Research Institutes and Universities (Primary use: Novel tracer development and clinical trials)

- Pharmaceutical and Biotechnology Companies (Primary use: Commercial scale production and drug development)

- By Shielding Material:

- Lead Shielding

- Tungsten Shielding

- Steel and Concrete Shielding (for specialized applications)

Value Chain Analysis For Synthesis Hot Cell Market

The Value Chain for the Synthesis Hot Cell Market begins with upstream analysis, focusing on the procurement of critical raw materials, predominantly high-density shielding materials such as lead, tungsten, and specialized stainless steel, along with sophisticated electronic and mechanical components for automation (robotics, sensors, micro-controllers). Key upstream challenges involve maintaining a stable supply chain for high-purity shielding metals and ensuring the integration of highly reliable synthesis chemistry modules sourced from specialized providers. Component suppliers must meet strict quality assurance standards (e.g., ISO certifications) as any failure in a single component can compromise the integrity and regulatory compliance of the final hot cell unit.

The manufacturing stage involves the complex assembly, integration, and verification of the shielding structure, the interior cleanroom components (including pressure differentials and HEPA filtration), and the remote handling technology (manipulators, transfer systems). This stage is capital-intensive and requires specialized expertise in radiation engineering and cleanroom validation. Distribution channels are typically direct, necessitated by the highly technical nature of the product, requiring manufacturers to engage directly with end-users for custom design, installation, site preparation, and extensive regulatory qualification (IQ/OQ/PQ). Indirect channels are less common but may involve specialized distributors or system integrators managing regional sales or integration into large-scale cyclotron facility projects.

Downstream analysis centers on the end-user deployment—primarily radiopharmacies, hospitals, and research facilities—where the hot cells are utilized for the GMP-compliant production of radiopharmaceuticals. This stage includes ongoing critical maintenance, calibration, and provision of consumable items (e.g., sterile vials, tubing sets). The ultimate value is derived when the hot cell reliably and safely produces high-quality radiotracers for patient diagnostics and therapy. This reliance on post-sales service, technical support, and regulatory compliance expertise makes the downstream service component a significant revenue stream and competitive differentiator for major hot cell vendors.

Synthesis Hot Cell Market Potential Customers

Potential customers, or the end-users/buyers of synthesis hot cells, are entities heavily involved in the production, research, or clinical application of radiopharmaceuticals. The primary customer base comprises large hospital networks and specialized nuclear medicine clinics that operate their own in-house radiopharmacies, often located adjacent to or integrated with PET/CT imaging centers. These institutions require hot cells for the routine, high-volume preparation of diagnostic tracers like 18F-FDG, where operational efficiency and patient scheduling capacity are paramount. Their purchasing decisions are highly influenced by system throughput, reliability, and the ease of regulatory validation for clinical use.

A second major customer segment includes dedicated commercial radiopharmacies and cyclotron centers. These facilities operate on a centralized model, producing and distributing radiopharmaceuticals to multiple hospitals across a regional radius. Their demand is characterized by the need for high-capacity, multi-cell setups that can synthesize a diverse portfolio of tracers, including novel research agents, requiring superior automation and quality control systems to handle batch variability and strict logistical timelines. For these commercial entities, total cost of ownership (TCO) and long-term service contracts are critical components of the procurement process.

The third significant segment encompasses academic research institutions and pharmaceutical/biotechnology companies. Research institutes utilize synthesis hot cells for preclinical development, toxicology studies, and early-stage clinical trials involving novel radiolabeled compounds. Their requirements emphasize flexibility, ability to handle unique chemistries, and integration with advanced analytical equipment. Pharmaceutical companies, particularly those developing theranostic pairs, require highly specialized, GMP-grade hot cells for large-scale, consistent production and regulatory filing of their investigational products, viewing the hot cell as an integral part of their drug manufacturing infrastructure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 185.5 Million |

| Market Forecast in 2033 | USD 318.9 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Comecer, Von Gahlen, Tema Sinergie, Nuvia, Cyclotron Services, Positron Corporation, Trasis, Eckert & Ziegler, Sumitomo Heavy Industries, GE Healthcare, Siemens Healthineers, AET, hot cell technologies, Inc., Isotopen Technologien Garching, Polat & Güneş, ShieldWerx, JME, Alpi, Lemer Pax, MarShield |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Synthesis Hot Cell Market Key Technology Landscape

The technology landscape of the Synthesis Hot Cell Market is defined by the integration of advanced shielding design, ultra-clean environment control, and sophisticated remote handling automation. Modern hot cells utilize high-density materials like proprietary tungsten alloys and specialized lead formulations to maximize radiation attenuation while minimizing the physical footprint, which is crucial for maximizing laboratory space utilization. Furthermore, the internal environment control leverages Grade A/B compliant laminar flow systems, maintaining positive pressure differentials and ensuring strict aseptic conditions necessary for GMP production. HEPA filtration units are integral, designed to safely contain and filter radioactive gases or particulate matter, upholding both product sterility and environmental safety standards, reflecting a continuous drive towards enhanced containment solutions.

A major technological advancement lies in the automation and robotics utilized within the shielded chamber. Automated synthesis modules (e.g., cassette-based systems) are increasingly common, offering reproducible and high-yield synthesis with minimal operator intervention. These modules are often coupled with advanced master-slave manipulators or specialized robotic arms equipped with force feedback and vision systems, allowing for precise remote manipulation of components, liquid transfers, and quality control sampling. The move towards fully integrated, software-controlled systems facilitates batch record generation and traceability, crucial for adhering to rigorous regulatory standards set by bodies such as the FDA and EMA.

The newest generation of hot cells incorporates smart technology and connectivity features. Remote diagnostics capabilities allow manufacturers to monitor system performance and troubleshoot issues without physical access to the facility, improving uptime and service response. Integration with institutional IT infrastructure, including Laboratory Information Management Systems (LIMS), is becoming standard, streamlining data management and quality assurance documentation. Furthermore, there is growing exploration of novel shielding composites, including specialized concrete and boronated materials, particularly for containing neutron radiation generated in certain cyclotron targetry systems, pushing the boundaries of material science in radiation protection applications.

Regional Highlights

North America, led by the United States and Canada, currently holds the largest market share in the Synthesis Hot Cell Market. This dominance is attributed to high expenditure on healthcare infrastructure, a robust installed base of cyclotrons, and widespread adoption of molecular imaging in oncology and neurology. Strict regulatory requirements enforced by the FDA necessitate continuous modernization and investment in compliant, high-specification hot cell technology, driving demand for premium, highly automated systems. The concentration of leading radiopharmaceutical developers and major research universities further solidifies North America's position as a mature, high-value market.

Europe represents the second-largest market, characterized by strong governmental support for nuclear medicine research, especially in countries such as Germany, France, and the UK. The European market focuses heavily on adopting complex multi-cell systems to support the diverse portfolio of tracers required by centralized production facilities serving multiple hospital sites. Regulatory harmonization efforts across the EU drive consistent demand for validated, high-quality synthesis solutions, though market growth can sometimes be constrained by complex national reimbursement policies and infrastructure funding variability across member states.

The Asia Pacific (APAC) region is projected to experience the fastest growth during the forecast period. This accelerated expansion is fueled by rapidly developing healthcare infrastructure, increasing awareness of nuclear medicine diagnostics, and significant governmental investment in establishing new cyclotron centers, particularly in China, Japan, and India. While initially focused on cost-effective solutions, the market is rapidly maturing, shifting towards high-throughput automated hot cells to meet the burgeoning clinical demand from large, densely populated urban centers. Latin America and the Middle East & Africa (MEA) are emerging markets, where growth is currently concentrated in major metropolitan areas, driven by the establishment of first-time nuclear medicine facilities and increasing international collaboration in health infrastructure development.

- North America (U.S., Canada): Market leader due to advanced infrastructure, high adoption rates of PET/CT, stringent FDA regulations, and large R&D investments in new tracers.

- Europe (Germany, France, UK): Strong demand driven by established nuclear medicine frameworks and emphasis on centralized radiopharmacy production utilizing flexible multi-cell setups.

- Asia Pacific (China, India, Japan): Highest growth potential fueled by large-scale public investment in healthcare expansion, construction of new cyclotron facilities, and rising patient populations requiring advanced diagnostics.

- Latin America (Brazil, Mexico): Emerging demand concentrated in urban clinical centers, focusing on acquiring reliable, validated systems for basic tracer production.

- Middle East and Africa (KSA, UAE, South Africa): Growth stimulated by strategic government healthcare initiatives and partnerships aimed at developing regional centers of excellence in nuclear medicine.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Synthesis Hot Cell Market.- Comecer

- Von Gahlen

- Tema Sinergie

- Nuvia

- Cyclotron Services

- Positron Corporation

- Trasis

- Eckert & Ziegler

- Sumitomo Heavy Industries

- GE Healthcare

- Siemens Healthineers

- AET

- hot cell technologies, Inc.

- Isotopen Technologien Garching

- Polat & Güneş

- ShieldWerx

- JME

- Alpi

- Lemer Pax

- MarShield

Frequently Asked Questions

Analyze common user questions about the Synthesis Hot Cell market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a Synthesis Hot Cell in nuclear medicine?

The primary function of a Synthesis Hot Cell is to provide a sterile, shielded environment for the automated synthesis of radiopharmaceuticals, such as PET tracers (e.g., 18F-FDG). It protects operators from radiation exposure while maintaining the strict aseptic conditions required for Good Manufacturing Practice (GMP) compliance necessary for injectable drug production.

How does the choice of shielding material impact hot cell performance and cost?

The choice of shielding material (typically lead, tungsten, or steel) significantly affects the hot cell’s footprint, weight, and cost. Lead is cost-effective for standard applications, while tungsten offers superior density and shielding capacity, enabling a smaller footprint, often preferred for high-energy isotopes or space-constrained facilities, though at a higher initial capital expenditure.

What key factors are driving the high growth rate in the Asia Pacific Synthesis Hot Cell Market?

The high growth rate in APAC is driven by substantial government investment in modernizing healthcare infrastructure, the rapid expansion of installed cyclotron capacity, increasing prevalence of chronic diseases (especially cancer), and the subsequent need for advanced diagnostic capabilities requiring local radiotracer production capabilities.

What are the main regulatory requirements for operating a Synthesis Hot Cell facility?

The main regulatory requirements center on strict adherence to current Good Manufacturing Practice (cGMP), documented validation processes (IQ/OQ/PQ), maintaining ultra-clean (aseptic) conditions, and compliance with national and international radiation protection standards to minimize occupational exposure and ensure product quality and sterility.

How is automation technology changing the operational efficiency of hot cells?

Automation technology, including advanced robotics and integrated cassette systems, is improving operational efficiency by reducing human error, maximizing synthesis yield consistency, shortening production cycle times, and significantly minimizing operator radiation exposure, which allows for increased throughput in high-volume production facilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager