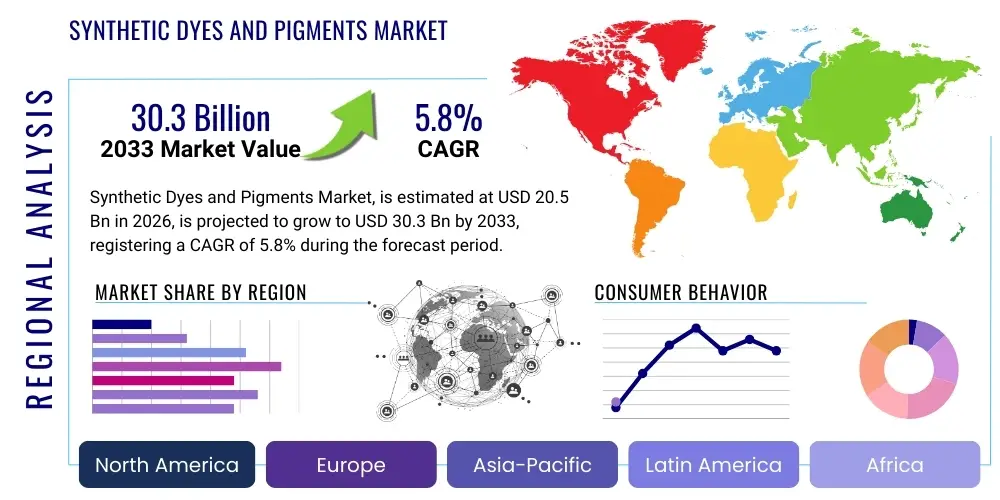

Synthetic Dyes and Pigments Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438996 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Synthetic Dyes and Pigments Market Size

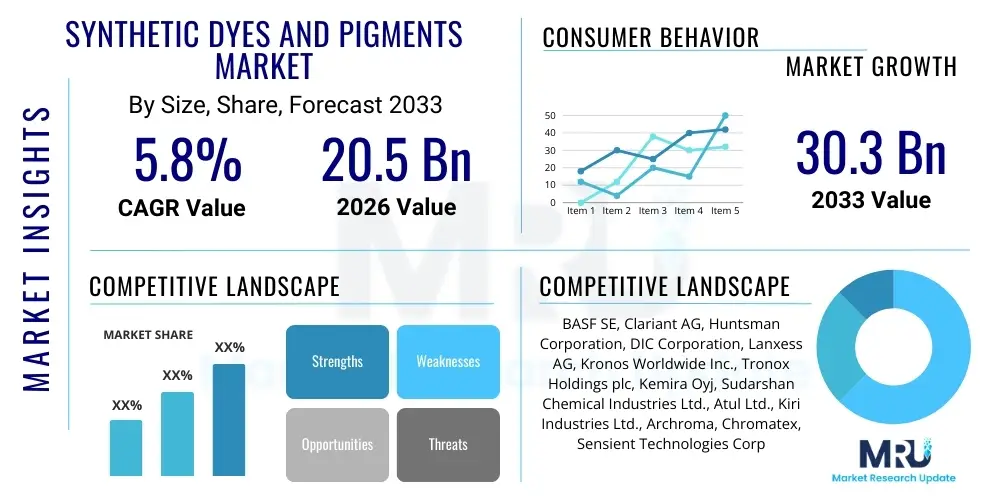

The Synthetic Dyes and Pigments Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $20.5 Billion in 2026 and is projected to reach $30.3 Billion by the end of the forecast period in 2033.

Synthetic Dyes and Pigments Market introduction

The Synthetic Dyes and Pigments Market encompasses a diverse range of chemical colorants utilized across various industrial sectors to impart color, opacity, and other functional properties to substrates. These compounds are synthesized through complex chemical processes, distinguishing them from naturally derived colorants. Synthetic dyes are soluble and bind chemically or physically to the material, predominantly used in textiles, leather, and paper. Synthetic pigments, conversely, are insoluble and provide color through dispersion, finding primary use in paints, coatings, plastics, and printing inks. The fundamental structure of these materials, often involving chromophores and auxochromes, determines their specific color characteristics and application suitability. Continuous innovation in synthesis processes is driven by the need for enhanced color fastness, thermal stability, and environmental compliance.

Major applications of these synthetic colorants span the textile industry, which remains a cornerstone consumer, demanding reactive and disperse dyes for synthetic and natural fibers. The paints and coatings sector utilizes high-performance pigments to ensure durability and aesthetic quality in automotive, architectural, and industrial coatings. Furthermore, the burgeoning plastics and packaging industries rely heavily on synthetic pigments for coloration and UV protection. The functional benefits offered by synthetic colorants, such as superior light fastness, thermal resistance, cost-effectiveness, and availability in a vast spectrum of shades, cement their irreplaceable role in modern manufacturing.

Driving factors propelling market expansion include rapid industrialization and urbanization in emerging economies, particularly in the Asia-Pacific region, leading to increased demand for processed goods, textiles, and construction materials. The automotive sector's increasing focus on high-gloss and durable exterior finishes necessitates advanced synthetic pigments. Moreover, consumer preference for vibrant and long-lasting colored products, coupled with technological advancements in digital printing and functional coatings, further stimulates market growth, compelling manufacturers to invest in environmentally sound and high-performance product lines.

Synthetic Dyes and Pigments Market Executive Summary

The Synthetic Dyes and Pigments Market is undergoing significant transformation, characterized by a dual focus on performance enhancement and sustainability compliance. Business trends indicate a strategic consolidation among major players seeking economies of scale and control over specialized product portfolios, particularly in high-performance organic pigments and reactive textile dyes. Innovation is concentrated on developing bio-based alternatives and processes that reduce water usage and effluent toxicity, driven by stringent global environmental regulations, particularly in Europe and North America. Supply chain resilience, following recent global disruptions, is a critical management focus, leading to diversification of raw material sourcing and increased localization of production facilities, especially for critical intermediates like phthalocyanines and azo compounds.

Regionally, Asia Pacific maintains its dominance in consumption and production capacity, spearheaded by robust manufacturing growth in China and India, fueled by massive textile and construction sectors. North America and Europe, while representing mature markets, are leading the shift towards premium, high-value, and eco-certified colorants, driving innovation in digital textile printing dyes and high-durability coatings pigments. Latin America and the Middle East & Africa (MEA) present promising growth avenues, linked to infrastructure development and rising domestic manufacturing capabilities, although market fragmentation and reliance on imports remain prevalent factors influencing competitive dynamics in these regions.

In terms of segmentation, the reactive dyes segment, primarily serving the cotton textile industry, is experiencing steady growth but faces competition from efficient dyeing technologies. The high-performance organic pigments (HPPs) segment shows accelerated growth, driven by their use in demanding applications like automotive coatings and specialized plastics, often replacing traditional inorganic pigments like cadmium and lead chromates due to toxicity concerns. The paints and coatings application sector continues to command the largest market share, though the printing inks segment is seeing renewed vitality through digital printing innovations requiring specialized solvent and disperse dyes.

AI Impact Analysis on Synthetic Dyes and Pigments Market

User queries regarding the impact of Artificial Intelligence (AI) on the Synthetic Dyes and Pigments Market primarily revolve around optimizing R&D cycles, improving manufacturing efficiency, and enhancing quality control. Users frequently inquire about how AI models can accelerate the discovery of new chromophores and tailor dye formulations for specific fiber types or environmental criteria, thereby reducing the time-to-market for novel, high-performing, and sustainable colorants. Furthermore, concerns are centered on leveraging machine learning for predictive maintenance in complex dye production reactors and optimizing inventory management to mitigate supply chain risks associated with volatile raw material inputs. The expectation is that AI will drastically reduce batch-to-batch variability and improve compliance monitoring related to hazardous substances during the synthesis process, ensuring safer and more efficient operations.

- AI-driven molecular modeling significantly accelerates the discovery and design of novel dyes and pigments with specific color properties and fastness characteristics, shortening R&D timelines.

- Predictive analytics optimize complex chemical reaction parameters in manufacturing, improving yield, reducing waste generation, and ensuring consistent batch quality.

- Machine Learning (ML) algorithms analyze large datasets related to raw material pricing and supply chain fluctuations, enabling proactive procurement strategies and inventory optimization.

- AI facilitates enhanced quality control through automated spectral analysis and defect detection in dyed textiles or pigmented coatings, minimizing human error.

- Process automation and robotics integrated with AI improve energy efficiency in high-temperature synthesis and drying stages, contributing to lower operational costs.

DRO & Impact Forces Of Synthetic Dyes and Pigments Market

The Synthetic Dyes and Pigments Market is principally influenced by the expansion of end-use industries, particularly textiles and construction, which drives volumetric demand (Driver). However, the market faces considerable headwinds due to increasingly stringent environmental regulations, especially concerning effluent discharge and the ban on certain heavy-metal-based pigments, which necessitate expensive reformulation and compliance costs (Restraint). Significant opportunities arise from the ongoing shift towards developing sustainable, high-performance pigments and bio-based dyes that address both performance demands and ecological concerns, particularly relevant in premium markets (Opportunity). These factors interact dynamically, where regulatory pressure acts as a powerful external Impact Force, compelling R&D investment and accelerating the transition away from traditional, less sustainable chemistries.

A key driver is the robust growth of the packaging and plastics industry globally, requiring colorants with excellent thermal stability and migration resistance. The proliferation of fast fashion and continuous innovation in technical textiles also sustains high demand for reactive and disperse dyes. Conversely, market growth is often restricted by the volatility and increasing cost of petrochemical raw materials, which form the basis for most synthetic colorants, squeezing profit margins for manufacturers and potentially leading to price sensitivity among consumers. The intellectual property landscape, characterized by complex patent portfolios surrounding new high-performance colorants, also creates high barriers to entry.

The primary Impact Forces shaping the market landscape are environmental legislation, technological disruption (e.g., digital printing requiring new ink formulations), and shifting consumer demand favoring eco-labeled and non-toxic products. These forces necessitate strategic flexibility, pushing companies toward vertical integration to control critical supply chains or forming strategic alliances to share the burden of expensive compliance and research initiatives. Success in this market is increasingly predicated not just on color quality but on demonstrated environmental stewardship and efficient compliance management across all operational territories.

Segmentation Analysis

The Synthetic Dyes and Pigments Market is comprehensively segmented based on product type, application, and end-use industry, providing granular insights into demand patterns and competitive dynamics. Segmentation by type differentiates between dyes (which dissolve and chemically bind to substrates) and pigments (which are insoluble and dispersed). Within dyes, classification depends on chemical structure and application method (e.g., reactive, acid, disperse). Pigments are segregated into organic (e.g., azo, phthalocyanine) and inorganic (e.g., titanium dioxide, carbon black). This analysis highlights the rapid substitution occurring within the colorant space, particularly the replacement of traditional inorganic pigments with higher-performing, non-toxic organic alternatives in sectors like automotive and premium plastics.

Application segmentation reveals the dominance of sectors such as paints and coatings, textiles, and printing inks, each requiring specific performance profiles from the colorants. The textiles segment, being highly volume-driven, commands substantial market share, focused on reactive and disperse dyes suitable for dyeing processes involving high water consumption. Conversely, the paints and coatings segment relies heavily on robust pigments offering superior weatherability, chemical resistance, and UV stability, essential for architectural and automotive applications. Understanding these unique requirements is paramount for strategic product development and market targeting.

The end-use segmentation provides context for macro-economic influences, linking colorant demand directly to the output of specific industries such as automotive manufacturing, residential and commercial construction, and consumer goods packaging. The construction boom in Asia Pacific significantly drives demand for architectural coatings pigments, while the global shift toward electric vehicles mandates specialized, heat-resistant pigments for interior and exterior components. Continuous analysis of these end-user segments allows stakeholders to anticipate demand fluctuations and allocate resources effectively for capacity expansion and technological readiness.

- Segmentation by Product Type:

- Synthetic Dyes (Acid Dyes, Basic Dyes, Reactive Dyes, Disperse Dyes, Vat Dyes, Solvent Dyes, Sulfur Dyes)

- Synthetic Pigments (Organic Pigments, Inorganic Pigments, High-Performance Pigments (HPPs))

- Segmentation by Application:

- Textiles

- Paints and Coatings (Architectural, Automotive, Industrial)

- Plastics and Polymers

- Printing Inks (Offset, Flexographic, Digital)

- Paper

- Leather

- Others (Cosmetics, Food & Beverages)

- Segmentation by End-Use Industry:

- Automotive

- Construction

- Packaging

- Apparel and Footwear

- Consumer Goods

- Segmentation by Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Synthetic Dyes and Pigments Market

The Synthetic Dyes and Pigments value chain is characterized by multiple intensive processing stages, starting with upstream petrochemical and chemical intermediate suppliers and culminating in the highly fragmented end-use markets. Upstream analysis focuses on the sourcing of critical raw materials, primarily derived from crude oil (e.g., benzene, naphthalene, phthalic anhydride) and inorganic minerals (e.g., titanium, iron ore). The high dependency on these volatile commodity markets exposes colorant manufacturers to significant price risk. Control over key intermediates, such as specialized amines and nitriles, is vital for maintaining cost competitiveness and proprietary product formulations. Key decisions in the upstream segment involve long-term procurement contracts and backward integration efforts by major players to secure critical feedstocks.

The core manufacturing stage involves complex chemical synthesis (diazotization, coupling, sulfonation, etc.), often requiring specialized high-pressure and high-temperature reactors. Efficiency and environmental compliance are paramount at this stage, as manufacturing processes are energy-intensive and generate significant wastewater. Following synthesis, the products undergo rigorous purification, standardization, and formulation (e.g., grinding, dispersion) to meet specific application requirements for particle size, solubility, and color strength. Manufacturing location decisions are heavily influenced by regulatory environments and proximity to major downstream consumption hubs, particularly in Asia where labor and operational costs were historically lower, though environmental scrutiny is intensifying.

The distribution channel is multifaceted, comprising direct sales channels for major industrial customers (e.g., large textile mills, global coatings manufacturers) and indirect channels utilizing a network of distributors and agents to reach smaller enterprises or diverse geographical markets. Direct distribution is preferred for specialized, high-volume products requiring technical support, allowing manufacturers tight control over product performance and customer relationship management. Indirect distribution allows broader market penetration and efficient inventory management across multiple smaller customers. Downstream analysis focuses on the final application industries (textiles, coatings, plastics) where the colorant is integrated into the final product. Success in the downstream sector relies on providing tailored color solutions, technical expertise in application processes, and rapid response to evolving end-user demands, especially concerning compliance and sustainable attributes.

Synthetic Dyes and Pigments Market Potential Customers

Potential customers for synthetic dyes and pigments represent a broad spectrum of industries where aesthetics, material identification, and functional coloration are essential components of the final product. The largest consumer base resides in the textile industry, comprising major apparel manufacturers, knitwear producers, and technical textile specialists (e.g., automotive fabrics, protective wear). These buyers frequently purchase large volumes of reactive, disperse, and acid dyes, prioritizing color consistency, wash fastness, and eco-certification (e.g., GOTS, OEKO-TEX compliance) over basic cost considerations. For these customers, the primary purchasing criteria include the total application cost and the environmental footprint of the dyeing process.

The second major cohort consists of manufacturers within the coatings sector, including architectural paint companies, automotive OEM coaters, and industrial maintenance providers. These buyers are typically interested in high-performance organic and inorganic pigments that offer superior durability, heat resistance, and opacity. Automotive customers specifically require pigments that meet rigorous specifications for weathering and chemical resistance. Purchasing decisions here are heavily influenced by regulatory adherence (e.g., restricting heavy metals), longevity claims, and the supplier's capacity for just-in-time delivery of complex color matching formulations.

Additionally, the plastics and packaging industries constitute a significant and growing customer segment, utilizing pigments and dyes for packaging materials, consumer durables, and masterbatches. These customers require colorants with excellent thermal stability during processing (extrusion, injection molding) and minimal migration risk, especially in food contact applications. The purchasing landscape is shifting towards suppliers who can provide highly concentrated, dust-free pigment preparations (masterbatches) that simplify the coloration process, thereby offering functional advantages beyond mere color provision.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $20.5 Billion |

| Market Forecast in 2033 | $30.3 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Clariant AG, Huntsman Corporation, DIC Corporation, Lanxess AG, Kronos Worldwide Inc., Tronox Holdings plc, Kemira Oyj, Sudarshan Chemical Industries Ltd., Atul Ltd., Kiri Industries Ltd., Archroma, Chromatex, Sensient Technologies Corporation, Rockwood Pigments, Ferro Corporation, Heubach GmbH, Shepherd Color Company, Sun Chemical (DIC), Cabot Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Synthetic Dyes and Pigments Market Key Technology Landscape

The technology landscape in the Synthetic Dyes and Pigments Market is primarily focused on achieving higher efficiency, superior functional performance, and radical environmental compliance. One critical area is microencapsulation technology, which is being increasingly utilized for pigments and certain specialized dyes. This process involves coating colorant particles with a polymer layer to improve dispersion stability, enhance thermal resistance, and control the release mechanism, which is particularly vital for inkjet printing inks and specialized coatings. Nanotechnology also plays a crucial role in pigment formulation, allowing manufacturers to control particle size in the nanometer range, resulting in higher color intensity, increased transparency, and improved UV blocking capabilities for high-end automotive and display applications.

Another dominant technological trend involves the shift towards environmentally benign synthesis pathways. This includes adopting continuous processing techniques over traditional batch methods to reduce energy consumption and streamline production, coupled with advanced wastewater treatment systems (e.g., membrane filtration, adsorption technologies) designed specifically to handle complex dye effluent, thereby minimizing environmental impact. Furthermore, digital dyeing and printing technologies are profoundly influencing the dye market. Digital textile printing utilizes specialized reactive, acid, or disperse inkjet inks, offering flexibility, rapid prototyping, and significantly reduced water and energy consumption compared to conventional dyeing processes, driving demand for high-purity, standardized ink formulations.

In the pigment sector, the emphasis is on developing High-Performance Pigments (HPPs) that can withstand extreme temperatures, chemicals, and prolonged exposure to weather, often required to substitute restricted inorganic pigments like cadmium and chrome-based alternatives. Advanced surface modification techniques, such as plasma treatment and chemical grafting, are employed to enhance the interfacial compatibility of pigment particles with various polymer matrices and coating binders. Finally, computational chemistry and AI-driven screening techniques are emerging as powerful tools, enabling rapid virtual screening of molecular structures to predict color performance, toxicity, and synthesis feasibility, thereby drastically reducing the time and cost associated with new product development.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market globally, driven by large-scale production capacities in China and India, particularly for textile dyes and architectural coating pigments. Rapid infrastructure development, expanding automotive manufacturing, and a massive consumer base propel the demand for both commodity and specialized colorants. The region is increasingly the focus of global investment despite rising environmental compliance scrutiny in key manufacturing hubs.

- Europe: Europe is characterized by stringent environmental regulations (e.g., REACH), making it a high-value, innovation-driven market focused on sustainable and high-performance colorants. Key growth is seen in specialized applications like automotive OEM coatings and high-end digital textile printing, favoring suppliers offering bio-based, low-VOC, and non-toxic formulations. Germany, Italy, and Switzerland are hubs for specialized pigment and dye manufacturers.

- North America: North America represents a mature market with high demand concentrated in architectural paints, high-performance automotive finishes, and specialized plastics. Growth is incremental and driven by technological adoption, particularly in solvent-free and waterborne coating formulations, requiring specialized, easily dispersible pigments. Regulatory compliance related to FDA standards for food contact materials significantly influences the regional pigment market.

- Latin America (LATAM): LATAM exhibits moderate growth potential, tied closely to economic stability and construction cycles, especially in Brazil and Mexico. The market is often price-sensitive, though there is a gradual shift towards higher-quality imported colorants, driven by multinational companies operating in the region's manufacturing sector. The textile and construction industries are the primary end-users.

- Middle East and Africa (MEA): The MEA market is expanding, fueled by significant investments in construction and infrastructure projects in the GCC nations. Demand is predominantly for architectural coating pigments (titanium dioxide, iron oxides) and, to a lesser extent, textile dyes. Market dynamics are heavily influenced by global trade flows and local manufacturing capacity investments, aiming to reduce reliance on imports.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Synthetic Dyes and Pigments Market.- BASF SE

- Clariant AG

- Huntsman Corporation

- DIC Corporation

- Lanxess AG

- Kronos Worldwide Inc.

- Tronox Holdings plc

- Kemira Oyj

- Sudarshan Chemical Industries Ltd.

- Atul Ltd.

- Kiri Industries Ltd.

- Archroma

- Chromatex

- Sensient Technologies Corporation

- Rockwood Pigments

- Ferro Corporation

- Heubach GmbH

- Shepherd Color Company

- Sun Chemical (DIC)

- Cabot Corporation

Frequently Asked Questions

Analyze common user questions about the Synthetic Dyes and Pigments market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift towards High-Performance Pigments (HPPs)?

The primary drivers are stringent environmental regulations restricting traditional heavy-metal-based pigments (like lead and cadmium), coupled with increasing technical demands from end-use sectors like automotive and aerospace for colorants exhibiting superior durability, heat fastness, and chemical resistance. HPPs offer advanced functional stability necessary for demanding applications.

How is the textile industry's sustainability focus affecting dye demand?

The textile industry’s sustainability initiatives are increasing the demand for low-impact dyes, such as reactive dyes with high fixation rates, solvent-free dyeing systems, and bio-based colorants. This shift accelerates the adoption of digital printing technologies that minimize water usage and effluent discharge, requiring specialized, high-purity inkjet dye formulations.

Which region dominates the Synthetic Dyes and Pigments Market, and why?

Asia Pacific (APAC) dominates the market due to its position as the global manufacturing hub for textiles, consumer goods, and construction materials. High domestic demand and substantial production capacities, particularly in China and India, drive both consumption and export volumes, despite rising operational costs related to environmental compliance.

What are the key technological advancements influencing pigment manufacturing?

Key advancements include nanotechnology for particle size control, enhancing color strength and transparency; advanced surface modification techniques to improve dispersion and compatibility with binders; and the integration of AI for optimizing complex synthesis reactions, leading to improved quality consistency and reduced production cycle times.

What are the major restraints facing market growth?

Major restraints include the increasing stringency of global chemical regulations (e.g., REACH, bans on certain azo dyes), which raise compliance costs and force expensive product reformulation. Additionally, the market is constrained by the volatility of raw material prices, as many synthetic colorants rely on petrochemical intermediates.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager