Synthetic Graphite Materials Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433927 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Synthetic Graphite Materials Market Size

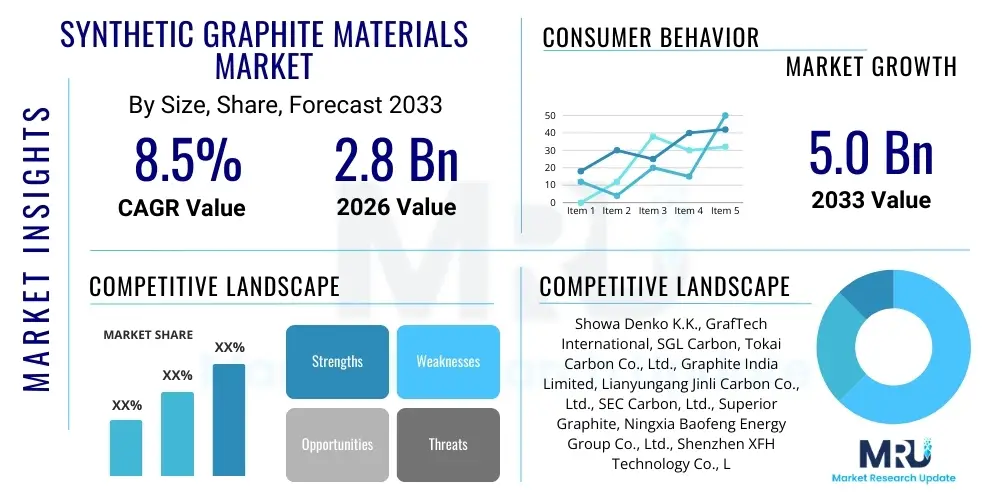

The Synthetic Graphite Materials Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $2.8 Billion in 2026 and is projected to reach $5.0 Billion by the end of the forecast period in 2033.

Synthetic Graphite Materials Market introduction

Synthetic graphite materials are engineered carbon products characterized by their high purity, exceptional thermal and electrical conductivity, superior strength, and chemical inertness. Unlike natural graphite, synthetic graphite is manufactured through the high-temperature graphitization of carbonaceous precursors, typically petroleum coke or coal tar pitch, using energy-intensive processes such as the Acheson method. This rigorous manufacturing process allows for precise control over the crystalline structure, making it indispensable for high-performance applications where consistency and purity are paramount. The resulting material exhibits a near-perfect graphitic structure, driving its adoption across critical industrial sectors globally.

The primary application driving the contemporary market expansion is its utilization as anode material in lithium-ion batteries (LiBs), which are foundational components for the booming Electric Vehicle (EV) and energy storage systems (ESS) industries. Synthetic graphite offers longer cycle life and higher safety features compared to its natural counterpart in many battery chemistries, cementing its status as the material of choice for high-density power requirements. Beyond energy storage, synthetic graphite products manifest as high-purity electrodes vital for electric arc furnaces (EAFs) in the steel and aluminum industries, critical thermal management solutions in electronics, and specialized components in nuclear reactors and aerospace engineering.

The core benefits of synthetic graphite include its customizable morphological characteristics, high bulk density, and exceptional performance under extreme thermal loads. Market growth is fundamentally propelled by global governmental mandates promoting electrification, massive investments in renewable energy infrastructure requiring grid-scale storage, and the pervasive expansion of 5G infrastructure and data centers demanding advanced thermal dissipation materials. Technological advancements focused on optimizing graphitization efficiency and developing spherical synthetic graphite (SSG) tailored for superior battery performance continue to reinforce the market’s robust trajectory, mitigating supply risks associated with sourcing and refining natural minerals.

Synthetic Graphite Materials Market Executive Summary

The Synthetic Graphite Materials Market is experiencing a paradigm shift driven primarily by the escalating demand from the battery manufacturing sector, repositioning it from a predominantly metallurgical material to a critical component in the energy transition. Current business trends indicate significant capital expenditure in Asia Pacific, particularly China, which dominates both production capacity and subsequent consumption due to its stronghold in the global electric vehicle and battery supply chain. Companies are intensely focused on securing raw material supply chains, moving towards vertical integration, and investing in energy-efficient graphitization technologies to manage volatile energy prices, which represent a major operating cost element in synthetic graphite production.

Regionally, Asia Pacific maintains the highest growth momentum, fueled by supportive government policies and the concentration of gigafactories. North America and Europe, while representing smaller production volumes currently, are rapidly expanding their domestic synthetic graphite production capabilities to enhance supply chain resilience and reduce dependency on foreign imports, largely catalyzed by geopolitical trade dynamics and domestic content requirements for EV subsidies. This localized manufacturing push is fostering innovation in non-petroleum-based precursors and high-efficiency furnace designs, diversifying the global production footprint over the forecast period and creating premium market opportunities in advanced industrial economies.

Segmentation trends highlight the overwhelming dominance of the Li-ion battery application segment, specifically the demand for specialized spherical synthetic graphite (SSG) used in anodes, which consistently registers the highest CAGR. Concurrently, the demand for ultra-high power (UHP) graphite electrodes remains robust, correlating directly with global steel production volumes via the cleaner Electric Arc Furnace route, providing a stable, high-value segment. The market is also seeing increasing penetration of synthetic graphite powders and fibers into advanced composite materials, heat exchangers, and friction components, underscoring the material’s versatility and role in engineering high-performance industrial solutions across diverse end-use sectors.

AI Impact Analysis on Synthetic Graphite Materials Market

Common user questions regarding AI’s influence on the synthetic graphite market frequently center on its ability to mitigate manufacturing costs, enhance product consistency, and accelerate material discovery for next-generation batteries. Users are primarily concerned with whether AI can optimize the extremely energy-intensive graphitization process to reduce carbon footprint and operational expenditure, and how sophisticated machine learning algorithms might improve quality control checks for high-purity materials required in anode manufacturing. The consensus expectations involve AI transitioning synthetic graphite production from a semi-batch process to a highly controlled, continuous manufacturing environment, primarily by optimizing furnace temperature profiles, predicting equipment failures, and modeling precursor conversion kinetics to minimize waste and ensure strict adherence to high specifications demanded by sectors like aerospace and electric mobility.

- AI-Driven Process Optimization: Utilizing machine learning to optimize furnace temperature curves and heating rates during the Acheson process, drastically reducing energy consumption and cycle time while maximizing throughput consistency.

- Predictive Maintenance: Deployment of AI algorithms to analyze sensor data from graphitization furnaces and milling equipment, forecasting potential breakdowns and scheduling proactive maintenance, minimizing costly downtime and improving capital asset utilization.

- Enhanced Quality Control (QC): Implementing computer vision and AI analytics for real-time monitoring of particle size distribution, morphology (especially for spherical graphite), and purity levels, ensuring the synthesized material meets stringent battery-grade specifications automatically.

- Supply Chain Optimization: AI models deployed for predictive sourcing of carbonaceous precursors (petroleum coke, pitch), managing price volatility, and optimizing inventory levels across complex global production and consumption networks.

- Accelerated Material Discovery: Using generative AI to model and predict the performance characteristics of novel synthetic graphite structures or composites blended with silicon, accelerating R&D cycles for higher energy density anode materials.

DRO & Impact Forces Of Synthetic Graphite Materials Market

The market dynamics for synthetic graphite are powerfully shaped by an interplay between unprecedented demand driven by electrification and significant operational challenges related to energy intensity and precursor availability. The primary driver remains the monumental proliferation of Electric Vehicles and supporting grid infrastructure, demanding enormous volumes of high-performance anode material. However, the market faces structural restraints including the inherently high capital expenditure required for establishing large-scale graphitization facilities and the extraordinary consumption of electricity, which ties production costs directly to volatile energy commodity markets. Opportunities arise from technological diversification, such as using synthetic graphite in nuclear applications or leveraging its properties in advanced lightweight composites, alongside the development of sustainable, bio-based carbon precursors to reduce reliance on petrochemical derivatives.

The impact forces influencing the market trajectory are multi-faceted, encompassing technological advancements in material synthesis, global regulatory pressure favoring sustainable production, and fundamental economic factors governing raw material costs. Specifically, the regulatory environment is introducing mandates for local content procurement and cleaner manufacturing processes, forcing producers to innovate in energy conservation. Furthermore, the competitive landscape is defined by the strategic maneuvering of key players in APAC securing long-term contracts with battery manufacturers. These forces collectively underscore a market characterized by high barriers to entry, continuous innovation necessity, and intense sensitivity to macroeconomic shifts in the automotive and energy sectors.

Segmentation Analysis

The Synthetic Graphite Materials Market is comprehensively segmented based on its structural form, which dictates suitability for end-user applications, and the major industry vertical utilizing the product. The key differentiation lies in the physical format—whether the material is processed into large, dense electrodes for high-temperature metallurgy, milled into fine, highly pure powder for battery anodes and lubricants, or structured into fibers and sheets for thermal management solutions. Analyzing these segments provides crucial insight into the distinct growth engines, pricing strategies, and regional supply-demand imbalances affecting the market landscape, showing a clear shift in investment focus from traditional industrial segments towards energy transition applications.

- By Product Type:

- Graphite Electrodes (Ultra-High Power, High Power, Regular Power)

- Graphite Blocks and Rods (Isostatic, Extruded)

- Graphite Powder (Battery Grade, Lubricant Grade, Conductive Grade)

- Graphite Fibers and Sheets

- By Application:

- Lithium-ion Batteries (Anodes)

- Metallurgy (Steel, Aluminum Production)

- Electronic and Thermal Management

- Aerospace and Defense

- Nuclear Power Generation

- Automotive (Non-Battery Components)

- Other Industrial Applications (Lubricants, Refractories)

- By Purity Grade:

- High Purity Grade (99.9%+)

- Commercial Grade

Value Chain Analysis For Synthetic Graphite Materials Market

The value chain for synthetic graphite materials is characterized by high complexity, significant capital investment in the manufacturing stage, and close interdependence between upstream raw material suppliers and downstream specialized end-users. The upstream analysis begins with the sourcing of primary carbonaceous precursors, predominantly needle coke derived from petroleum refining and coal tar pitch from coking operations. These inputs must adhere to strict quality parameters, as precursor quality directly determines the structural integrity and performance attributes of the final synthetic graphite product. Supplier concentration and volatility in the oil and coal markets thus exert considerable influence over the initial cost structure of synthetic graphite manufacturers, creating inherent vulnerabilities in the early stages of the value chain.

The core manufacturing process involves calcination, mixing, molding, baking, and the highly energy-intensive graphitization step, where the structured carbon material is converted into crystalline graphite at temperatures often exceeding 2,500°C. This central stage adds the most substantial value and involves proprietary technology and deep material science expertise. The distribution channel structure varies significantly by end-use application. Direct sales channels are prevalent for large volume consumers, such as major steel producers purchasing graphite electrodes, or Tier 1 battery manufacturers securing long-term contracts for anode materials, facilitating tailored product specifications and technical support. Specialized distributors and agents manage indirect sales for lower volume, high-mix products like graphite powders and fibers used across diverse industrial sectors.

Downstream analysis focuses on specialized processing steps required to transform bulk synthetic graphite into application-ready formats. For the battery industry, this involves complex milling and spheroidization processes to produce spherical synthetic graphite (SSG), followed by surface coating and quality assurance checks, significantly enhancing the purity and performance characteristics for LiB anodes. The strong downstream requirement for customization compels synthetic graphite producers to invest heavily in advanced finishing and quality assurance technologies, thereby increasing the value proposition. This end-use specialization minimizes generalized commodity trading and fosters strong, highly technical relationships between producers and their strategic buyers across the electric mobility, metallurgy, and advanced electronics supply chains.

Synthetic Graphite Materials Market Potential Customers

The potential customer base for synthetic graphite materials is extremely broad yet concentrated in sectors demanding high performance, thermal stability, and electrical conductivity, with the Electric Vehicle (EV) and energy storage sectors now representing the fastest-growing buyer demographic. Manufacturers of lithium-ion batteries stand as the primary potential customers, requiring high volumes of spherical synthetic graphite (SSG) to serve as the anode material. These battery producers, including major companies like CATL, LG Energy Solution, and Panasonic, necessitate strict specifications regarding particle size, purity, and tap density to maximize energy density and cycle life, making them crucial strategic partners for synthetic graphite suppliers globally.

The traditional metallurgical industry, encompassing large-scale steel and aluminum producers utilizing Electric Arc Furnaces (EAFs), remains a bedrock customer base. These entities require ultra-high power (UHP) graphite electrodes for efficient smelting, a demand linked closely to infrastructure development and global industrial output. Furthermore, the specialized electronics and thermal management sectors, serving high-end computing, data centers, and 5G equipment manufacturers, are increasingly relying on synthetic graphite sheets and powders for superior thermal dissipation and lightweighting solutions, seeking materials that perform reliably under continuous high-heat loads where conventional materials fail.

Additionally, the automotive industry (beyond batteries) procures synthetic graphite for specialized brake linings, clutch facings, and various friction and lubrication components due to its self-lubricating properties and heat resistance. The aerospace, defense, and nuclear industries also represent high-value, albeit lower volume, end-users, where synthetic graphite is used in specialized composite structures, reactor moderator blocks, and sealing rings that require extreme resistance to radiation and thermal shock. These diverse applications necessitate highly specific product grades, positioning synthetic graphite suppliers who offer customized purification and shaping capabilities favorably within the highly technical customer environment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.8 Billion |

| Market Forecast in 2033 | $5.0 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Showa Denko K.K., GrafTech International, SGL Carbon, Tokai Carbon Co., Ltd., Graphite India Limited, Lianyungang Jinli Carbon Co., Ltd., SEC Carbon, Ltd., Superior Graphite, Ningxia Baofeng Energy Group Co., Ltd., Shenzhen XFH Technology Co., Ltd., AEM Components (Suzhou) Co., Ltd., HEG Limited, Inner Mongolia Xinghe Graphite Products Co., Ltd., Nippon Carbon Co., Ltd., Fujian Xinjinwei Carbon Co., Ltd., Qingdao Kaiyuan Graphite Co., Ltd., Qingdao Haida Graphite Co., Ltd., Jiangxi Xinte Graphite Co., Ltd., Hunan Shinyu New Materials Co., Ltd., Tianshan Kexin New Material Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Synthetic Graphite Materials Market Key Technology Landscape

The technology landscape governing the synthetic graphite market is predominantly defined by continuous refinement of the foundational Acheson process and intense innovation focused on optimizing anode material production for lithium-ion batteries. While the Acheson graphitization furnace remains standard for high-volume production, technological advances are concentrated on improving energy efficiency through advanced insulation, recuperation systems, and transitioning to continuous or semi-continuous production flow rather than traditional batch processing. Furthermore, pulse-current graphitization methods are being explored to potentially reduce cycle times and achieve higher uniformity in structural characteristics, which is crucial for electrodes used in demanding applications like EDM and aerospace components where structural defects are unacceptable.

A significant area of technological focus is the specialized processing required for spherical synthetic graphite (SSG). This involves advanced milling, purification, and spheroidization techniques—such as jet milling and chemical vapor deposition (CVD) surface coating—to ensure the particles meet the precise morphological and purity requirements for LiB anodes. Manufacturers are leveraging nanotechnology to apply protective coatings, often carbonaceous layers derived from pitch or asphalt, to enhance the long-term cycling performance and safety characteristics of the anode material, thereby differentiating their product offerings in the hyper-competitive battery supply chain.

Emerging technologies also involve utilizing alternative, non-petrochemical precursors, driven by environmental concerns and the search for stable, sustainable supply sources. Research and development efforts are directed towards converting biomass-derived carbons and waste tires into graphitizable carbon precursors, potentially circumventing the cost and geopolitical volatility associated with traditional petroleum coke and coal tar pitch. If scaled successfully, these innovations could fundamentally alter the cost structure and environmental profile of synthetic graphite production, providing a critical technological advantage to manufacturers prioritizing sustainable material sourcing and reduced carbon intensity in their manufacturing operations.

Regional Highlights

The global synthetic graphite market exhibits significant regional disparities, largely dictated by industrial capacity, energy costs, and the geographical concentration of key downstream sectors, specifically battery manufacturing. Asia Pacific (APAC), led overwhelmingly by China, serves as the global epicenter for synthetic graphite production and consumption. China's dominance is attributed to massive domestic EV production, heavily subsidized infrastructure, and low-cost access to necessary carbon precursors. The region not only houses the largest graphitization furnace capacity but also controls the vast majority of the global spherical synthetic graphite processing capability, making it the central pillar of the market's supply dynamics and trajectory.

North America and Europe are characterized by robust, albeit smaller, markets focused on high-purity, premium applications such as aerospace, nuclear energy, and high-performance electronics, as well as the emerging demand from domestic gigafactories. Regulatory initiatives, such as the US Inflation Reduction Act (IRA) and European Green Deal policies, are actively encouraging reshoring and localization of the entire EV supply chain, driving substantial investment into new regional synthetic graphite facilities. These regions are prioritizing highly controlled, environmentally compliant production methods and seeking to secure stable, non-Chinese sourced materials for strategic national security and industrial autonomy purposes.

- Asia Pacific (APAC): Dominates production and consumption, driven by China's comprehensive EV ecosystem and massive steel production. It is the primary global source of spherical synthetic graphite (SSG) for battery anodes. Key growth markets include South Korea (battery hub) and India (emerging EV market).

- North America: Focuses on establishing domestic supply chain security, high-end electrode manufacturing (UHP for EAFs), and supplying specialized aerospace and nuclear grades. Growth is catalyzed by federal incentives for battery localization.

- Europe: Driven by strict environmental standards and the rapid deployment of battery gigafactories (Germany, Hungary, Poland). Emphasis on sustainable sourcing and technological innovation in energy-efficient production processes.

- Latin America & MEA: Smaller market shares, primarily serving regional metallurgical industries and specialized local manufacturing needs. Potential growth linked to regional electrification projects and future mining development activities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Synthetic Graphite Materials Market.- Showa Denko K.K.

- GrafTech International

- SGL Carbon

- Tokai Carbon Co., Ltd.

- Graphite India Limited

- Lianyungang Jinli Carbon Co., Ltd.

- SEC Carbon, Ltd.

- Superior Graphite

- Ningxia Baofeng Energy Group Co., Ltd.

- Shenzhen XFH Technology Co., Ltd.

- AEM Components (Suzhou) Co., Ltd.

- HEG Limited

- Inner Mongolia Xinghe Graphite Products Co., Ltd.

- Nippon Carbon Co., Ltd.

- Fujian Xinjinwei Carbon Co., Ltd.

- Qingdao Kaiyuan Graphite Co., Ltd.

- Qingdao Haida Graphite Co., Ltd.

- Jiangxi Xinte Graphite Co., Ltd.

- Hunan Shinyu New Materials Co., Ltd.

- Tianshan Kexin New Material Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Synthetic Graphite Materials market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for high-purity synthetic graphite?

The dominant driver is the unprecedented growth in the Lithium-ion battery sector, particularly the production of anodes for Electric Vehicles (EVs) and grid-scale Energy Storage Systems (ESS), which rely on high-purity spherical synthetic graphite (SSG) for optimal performance and safety.

How does synthetic graphite differ from natural graphite in market applications?

Synthetic graphite offers higher purity, greater crystalline uniformity, and customizable structural characteristics, achieved through energy-intensive manufacturing. This makes it preferred for high-specification applications like EV anodes and Ultra-High Power (UHP) electrodes where consistency and thermal performance are critical, differentiating it from mined natural graphite.

What are the major challenges impacting the profitability of synthetic graphite production?

The main challenge is the extreme energy intensity of the graphitization process, which ties operational costs directly to volatile electricity prices. Furthermore, securing stable, high-quality carbonaceous precursors (petroleum coke/pitch) and managing associated environmental compliance costs pose ongoing profitability constraints.

Which region currently dominates the global supply chain for synthetic graphite materials?

Asia Pacific, specifically China, maintains overwhelming dominance in both the manufacturing capacity of synthetic graphite materials and the specialized downstream processing required for spherical battery-grade graphite. This dominance is integral to the global EV battery supply chain.

Will silicon-anode technology entirely replace synthetic graphite in future batteries?

No, synthetic graphite is unlikely to be entirely replaced in the near term. Silicon is typically blended with graphite to create composite anodes (Si-Gr) to achieve higher energy density. Graphite remains essential to provide structural stability, high conductivity, and buffer the volume expansion challenges inherent in pure silicon anodes, ensuring continued significant demand for high-performance synthetic grades.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager