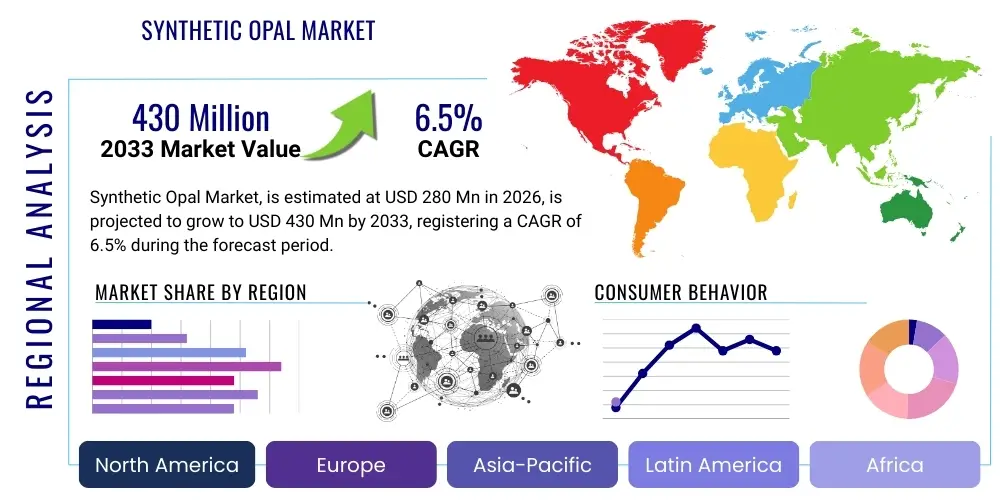

Synthetic Opal Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436615 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Synthetic Opal Market Size

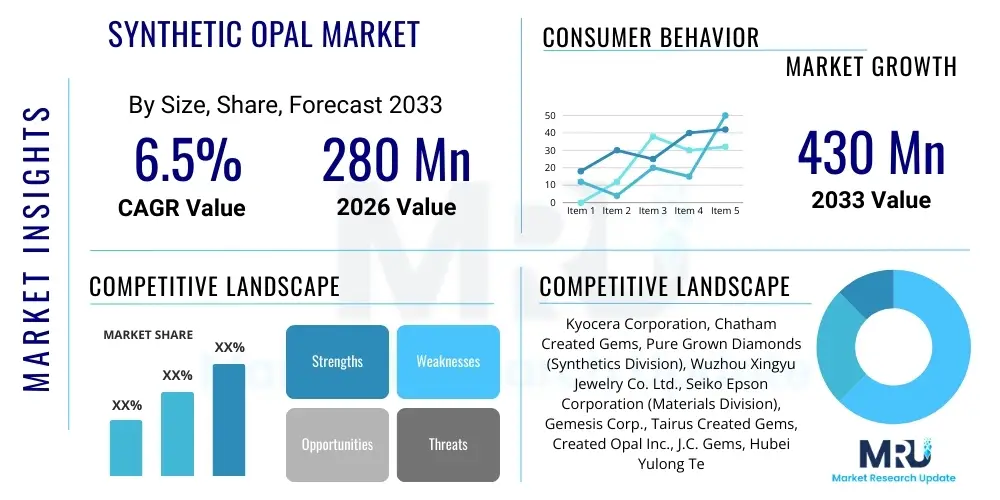

The Synthetic Opal Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 280 million in 2026 and is projected to reach USD 430 million by the end of the forecast period in 2033. This growth trajectory reflects increasing consumer acceptance of lab-created gemstones, driven primarily by their superior durability, consistent aesthetic quality, and ethical sourcing narrative compared to natural opals, which are often prone to crazing and supply volatility.

Synthetic Opal Market introduction

The Synthetic Opal Market encompasses materials that possess the structural characteristics and optical properties, specifically the unique play-of-color known as opalescence, of natural opals but are manufactured in a controlled laboratory environment. Unlike imitation opals, which lack the true crystalline silica structure, synthetic opals are composed of silica spheres arranged in a highly ordered, three-dimensional lattice—a microstructure that is essential for true diffraction of light. These products, often known by trade names such as Gilson opal, are chemically and structurally analogous to their natural counterparts, differing primarily in their formation speed and water content.

Key applications for synthetic opal extend far beyond traditional jewelry manufacturing. While high-end fashion jewelry and costume jewelry remain the largest consumers, the material's unique optical properties make it increasingly valuable in specialized industrial applications. These include the manufacture of photonic crystals, optical filters, specialized coatings, and components for scientific instrumentation where precise light manipulation is required. The ability to control parameters such as color, pattern, and density during synthesis provides manufacturers with an unprecedented level of customization, opening doors to advanced material science uses that natural opal cannot fulfill due to its inherent structural variability.

The primary driving factors sustaining market expansion include the significant cost advantage synthetic opals offer over natural opals, coupled with their enhanced physical stability. Natural opal often presents challenges regarding hardness and susceptibility to environmental changes (thermal shock or humidity fluctuations), leading to damage during setting or wear. Synthetic varieties, particularly those stabilized with polymers (polymer-impregnated opals), exhibit greater resistance to cracking and solvents. This robustness is highly appealing to mass-market jewelers and manufacturers requiring reliable, consistent material inputs, thereby ensuring steady demand across major geographic regions, particularly in Asia Pacific where volume manufacturing is prevalent.

Synthetic Opal Market Executive Summary

The Synthetic Opal Market is characterized by robust business trends centered on technological refinement in synthesis methods and a strong push toward consumer education regarding ethical sourcing and material quality. Manufacturers are increasingly adopting advanced sedimentation and hydrothermal techniques to produce opals with more distinct, vibrant color flashes and greater pattern complexity, minimizing the visual distinction between synthetic and high-grade natural stones. Furthermore, vertical integration across the supply chain, where synthetic material producers also offer cutting and setting services, is optimizing operational efficiencies and lowering final product costs. The consolidation of smaller players by larger chemical and advanced materials corporations signifies a maturing market focused on economies of scale and intellectual property protection related to specific color formulations.

Geographically, the Asia Pacific region, led by China and India, maintains dominance in both production capacity and consumption, fueled by a booming middle class and established jewelry manufacturing hubs. North America and Europe, however, represent critical markets for high-value applications, particularly in designer jewelry and optical components, where consumers prioritize certified laboratory origins and guaranteed physical specifications. Regional trends indicate a growing divergence: APAC focuses on cost-efficient, high-volume polymer-impregnated opals for mass-market jewelry, while Western markets drive demand for higher-cost, pure silica-based synthetics (Gilson type) valued for their closer resemblance to natural characteristics and stability in diverse climates. Regulatory clarity regarding labeling standards remains a key regional focus to maintain consumer trust.

Segment trends reveal that the Polymer-Impregnated Opal segment, due to its enhanced durability and lower production costs, holds the largest market share by volume. Nonetheless, the Monolithic Opal (pure silica) segment is projected to exhibit the highest Compound Annual Growth Rate (CAGR), driven by its utilization in advanced optics and luxury jewelry requiring minimal foreign material content. Application-wise, the Jewelry segment, covering rings, pendants, earrings, and beads, is the indisputable leader. However, the Decoration and Inlay segment, which includes watch faces, architectural detailing, and high-end accessories, is witnessing rapid expansion as designers leverage the material's versatility and vibrant color palette for unique aesthetic effects in consumer electronics and luxury goods manufacturing. Pricing pressure is higher in the mass-market segments, while highly customized colors and specific structural patterns command premium pricing across all geographies.

AI Impact Analysis on Synthetic Opal Market

Common user inquiries concerning the impact of Artificial Intelligence (AI) on the Synthetic Opal Market typically revolve around the automation of the synthesis process, the quality control of finished products, and the role of AI in material discovery. Users are keenly interested in whether AI-driven systems can optimize the complex sedimentation rates and temperature/pressure profiles required to grow high-quality silica spheres, thereby reducing batch failures and increasing yield. Another major theme is the use of machine vision and deep learning algorithms for automated grading and classification, particularly identifying minute defects, quantifying color saturation, and assessing the uniformity of the play-of-color—tasks traditionally reliant on highly skilled human gemologists. Concerns often center on the displacement of skilled labor and the potential homogenization of product aesthetics if AI dictates optimal color patterns, limiting unique artisanal variation.

AI is set to revolutionize several stages of synthetic opal manufacturing, offering unprecedented precision and efficiency. In the research and development phase, AI and machine learning algorithms can analyze vast datasets concerning crystal growth parameters, predicting the ideal chemical compositions and environmental conditions required to synthesize opals with specific desired characteristics, such as increased fire intensity or novel color combinations not yet achieved. This accelerates the time-to-market for new synthetic varieties, significantly cutting down experimental costs associated with trial-and-error manufacturing. Furthermore, AI-powered predictive maintenance in complex hydrothermal synthesis reactors ensures operational consistency, reducing downtime and optimizing energy consumption, which is a major factor in the overall cost structure of advanced material production.

The most immediate and critical application of AI lies in enhancing quality control and market responsiveness. By deploying advanced imaging sensors and neural networks, manufacturers can scan every batch of synthetic opal, ensuring that only materials meeting stringent color depth, uniformity, and defect standards proceed to cutting and polishing. This capability minimizes waste and guarantees the consistency demanded by major jewelry brands. On the market side, AI analyzes consumer trends, social media sentiment, and sales data across different regions, providing manufacturers with real-time insights into color preferences and pattern demands, allowing for dynamic adjustment of production schedules and inventory levels to maximize profitability and capture fleeting fashion trends efficiently. This transition transforms synthetic opal production from a rigid chemical process into an agile, data-driven manufacturing operation.

- AI optimizes silica sphere sedimentation and growth conditions, improving batch consistency and yield rates.

- Machine vision and deep learning automate quality control, detecting microscopic flaws and grading play-of-color intensity with superior accuracy.

- Predictive modeling accelerates material R&D, enabling the rapid development of novel color formulations and unique structural patterns.

- AI systems manage process control in synthesis reactors, minimizing energy consumption and ensuring stable production environments.

- Data analytics provides real-time market insights, allowing manufacturers to tailor production based on consumer color and style demand (AEO/GEO optimization).

DRO & Impact Forces Of Synthetic Opal Market

The dynamics of the Synthetic Opal Market are powerfully shaped by a complex interplay of Drivers, Restraints, and Opportunities, which collectively constitute the Impact Forces influencing strategic decision-making and market trajectory. Primary drivers include the growing preference for sustainable and ethically sourced materials, particularly among younger generations of consumers, who view lab-created gemstones as a responsible alternative to materials involving potential ecological or social concerns associated with mining. This ethical appeal is strongly reinforced by the superior material stability and standardized quality control inherent in laboratory production, which mitigates risks for jewelers during the setting and retail phase. Furthermore, the ability to produce highly consistent, vibrant colors that are often rare or nonexistent in natural forms drives demand in decorative and high-fashion applications seeking unique aesthetic profiles, creating a stable, long-term driver for market expansion.

However, the market faces significant restraints, primarily centered on consumer perception and regulatory hurdles. Despite advancements, a segment of the luxury consumer base still associates "synthetic" or "lab-grown" with lower value or imitation, creating a marketing challenge that necessitates intensive consumer education campaigns. Furthermore, strict regulatory requirements and varying international standards regarding proper disclosure and labeling of synthetic materials can complicate global distribution and consumer trust, leading to potential trade disputes or consumer backlash if transparency is compromised. Another critical restraint is the volatility in the prices of key raw materials, particularly high-purity silica precursors and specialized polymers, which can impact manufacturing costs and compress profit margins, especially for volume producers competing in cost-sensitive segments.

Opportunities for exponential growth lie mainly in technological breakthroughs that reduce production cycle times and enhance the material's structural integrity, allowing for broader application in high-stress environments. Specifically, the expansion into non-traditional markets, such as advanced material composites, medical devices, and high-performance automotive interiors, presents substantial potential outside the saturated jewelry sector. The ability to precisely tune the optical properties of synthetic opal to create highly efficient photonic crystals opens lucrative avenues in telecommunications and sensing technology. The consolidated impact of these forces suggests a clear trajectory towards material diversification and application expansion, where the ethical sourcing driver overcomes perception restraints, pushing the market toward stable, value-added growth, particularly through strategic investment in automated production and targeted application development in niche industrial sectors.

Segmentation Analysis

The Synthetic Opal Market is primarily segmented based on the composition and manufacturing technique (Product Type) and the final destination of the material (Application). This segmentation structure provides critical insights into manufacturing capabilities, price points, and end-user demand patterns. The Product Type segmentation distinguishes between high-purity silica synthetics (Monolithic/Gilson type) and those impregnated or stabilized with polymers. This distinction is crucial because it defines the material's properties—polymer-impregnated opals are generally tougher and cheaper but may contain a high percentage of polymer (up to 20%), while monolithic opals are chemically closer to natural stones, demanding higher prices due to complex synthesis processes. Analyzing these segments helps stakeholders understand the trade-offs between cost, durability, and chemical authenticity across the product spectrum.

The Application segmentation highlights the material's commercial importance across diverse industries. While the Jewelry sector (encompassing custom, designer, and mass-market pieces) remains the dominant revenue generator, segmentation across Decoration, Watch Components, and Optical Components reveals emerging, high-growth industrial niches. The Decoration segment, for instance, includes inlay work for musical instruments, luxury accessories, and architectural features, leveraging the opal's vibrant aesthetic for interior design. The Optical Components segment, though smaller in volume, commands high value per unit due to the necessity for ultra-high purity and precisely controlled photonic bandgap structures, catering to specialized scientific and technological demands that prioritize functional performance over aesthetic considerations.

Geographic segmentation is equally vital, dividing the market into major regions—North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Asia Pacific dominates due to concentrated production facilities and massive regional consumption in jewelry, while North America and Europe lead in the adoption of higher-grade, often pure silica synthetic opals for niche luxury and advanced optical applications. Understanding these regional consumption patterns allows manufacturers to tailor their product mix and marketing strategies, ensuring compliance with regional import standards and catering specifically to local consumer preferences regarding color, size, and material composition. This detailed segmentation is foundational for accurate market forecasting and competitive analysis.

- By Product Type:

- Gilson Opal (Impregnated Silica Opal)

- Monolithic Opal (Pure Lab-Grown Silica Opal)

- Polymer-Impregnated Opal (Enhanced Durability Opal)

- By Application:

- Jewelry (Rings, Pendants, Earrings, Bracelets)

- Decoration and Inlay (Architectural Elements, Luxury Accessories, Electronics Casings)

- Watch Components (Watch Dials, Bezel Inlays)

- Optical and Scientific Components (Photonic Crystals, Filters)

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy)

- Asia Pacific (China, India, Japan, South Korea)

- Latin America (Brazil, Argentina)

- Middle East and Africa (UAE, Saudi Arabia, South Africa)

Value Chain Analysis For Synthetic Opal Market

The value chain for the Synthetic Opal Market begins with the upstream procurement of highly specialized raw materials. The synthesis process demands ultra-high purity silica precursors, often silicon alkoxides or colloidal silica suspensions, which must be meticulously sourced to ensure the structural integrity and optical clarity of the final product. For polymer-impregnated varieties, specific cross-linking acrylics or epoxy resins are procured. Upstream analysis reveals that the cost and quality of these chemical inputs are major determinants of the final product price and performance. Key strategic focus at this stage is securing long-term supply contracts with specialized chemical producers to mitigate price fluctuations and guarantee material consistency, thereby stabilizing the manufacturing cost base.

The core manufacturing process constitutes the middle segment of the value chain, involving sophisticated laboratory operations such as controlled sedimentation, hydrothermal growth, and subsequent stabilization (polymer infiltration). This stage requires significant capital investment in highly specialized equipment, including high-pressure reactors and precision temperature control systems. Manufacturers focus on maximizing yield through proprietary synthesis protocols and minimizing the lengthy growth cycles, which can span several months. Following synthesis, the material undergoes expert cutting, shaping, and polishing. Direct sales channels, often through in-house sales teams, handle major B2B transactions with large jewelry manufacturers and industrial component procurers. This direct approach offers greater control over pricing and specifications.

Downstream analysis focuses on distribution channels and the ultimate end-users. Indirect channels involve partnerships with wholesale gemstone distributors, jewelry findings suppliers, and regional trade show networks that facilitate market penetration, especially into smaller, independent jewelers. For industrial applications (optical and scientific), specialized technical distributors or direct sales teams handle engagement with research institutions and material engineering firms. The final consumer stage is crucial; synthetic opal materials often reach consumers through fine jewelry retailers, mass-market jewelry chains, or specialized luxury brands. The efficacy of marketing efforts, emphasizing the material's benefits—consistency, ethics, and durability—directly influences consumer pull and overall downstream profitability, underscoring the critical need for transparent labeling and strong brand narrative development.

Synthetic Opal Market Potential Customers

The potential customer base for the Synthetic Opal Market is diverse, spanning luxury goods manufacturing, mass-market retail, and advanced scientific sectors. The largest segment of end-users consists of jewelry manufacturers, ranging from large, multinational corporations that require high volumes of consistent, calibrated stones for their global collections to bespoke, independent designers seeking unique, high-quality, and ethically sourced accent stones. These buyers prioritize aesthetic uniformity, material stability during setting, and reliable supply chains. Their purchasing decisions are heavily influenced by the material's certified origin and its ability to withstand standard cleaning and wear processes, making durability a key purchasing criterion over pure novelty.

A rapidly expanding segment of potential customers includes specialized manufacturers in the luxury and high-end consumer electronics space. This encompasses companies producing luxury watches, high-end accessories (pens, purses), and customized consumer electronics casings. These buyers leverage synthetic opal for its dramatic visual appeal and ease of integration into complex designs requiring precise machining, such as watch dials or decorative inlays. For these end-users, consistency in color-matching across large batches and the ability to source opals in non-standard shapes and sizes are paramount, driving demand for advanced cutting and customization services offered by synthetic opal producers.

The third major category comprises industrial and scientific procurement specialists. These customers are typically involved in optical engineering, photonics, and specialized research and development (R&D) fields. They are not concerned with aesthetic appeal but require opals with precise and tunable physical properties, particularly specific photonic bandgap characteristics for creating optical filters, laser components, or chemical sensors. These buyers represent a high-value, low-volume segment where procurement is driven strictly by technical specifications, demanding material certification, and proof of performance under extreme environmental conditions, necessitating direct engagement with the R&D arms of synthetic material suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 280 Million |

| Market Forecast in 2033 | USD 430 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kyocera Corporation, Chatham Created Gems, Pure Grown Diamonds (Synthetics Division), Wuzhou Xingyu Jewelry Co. Ltd., Seiko Epson Corporation (Materials Division), Gemesis Corp., Tairus Created Gems, Created Opal Inc., J.C. Gems, Hubei Yulong Technology, Opalite Labs, Created Gemstones Inc., Advanced Materials Synthesis, Gemological Institute of Research, Synthetic Gemstone Manufacturers Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Synthetic Opal Market Key Technology Landscape

The manufacturing of synthetic opal relies heavily on advanced material science techniques, primarily focusing on controlled chemical synthesis to mimic the geological formation process. The most widely recognized technique is the Gilson method, which involves the controlled sedimentation of monodisperse silica spheres (typically 150 to 300 nanometers in diameter) in an aqueous or alcoholic medium. This sedimentation process is crucial, as it dictates the precise stacking of the spheres into a ordered cubic or hexagonal close-packed structure, which is the mechanism responsible for the diffraction and resultant play-of-color. The challenge in this technology lies in maintaining perfect uniformity and preventing structural defects across large volumes, demanding highly refined temperature and pH control throughout the prolonged growth phase, which often spans 12 to 18 months.

A major evolution in the technology landscape is the widespread adoption of polymer stabilization, particularly in commercial-grade materials. In this process, the pores remaining after the initial silica sphere sedimentation are infiltrated with a hard polymer, such as polymethyl methacrylate (PMMA) or epoxy resin. This infiltration significantly enhances the opal’s mechanical strength, making it easier to cut, polish, and set without the risk of crazing (micro-fracturing) associated with pure silica opals. While these polymer-impregnated opals are technically composites, they dominate the mass-market jewelry segment due to their durability and lower production costs. Ongoing R&D is focused on finding new polymers that improve refractive index matching, enhancing the vibrancy of the color play while maintaining structural resilience.

Furthermore, research into hydrothermal synthesis methods represents the frontier of technological development, aiming to produce true monolithic (pure) synthetic opals that are chemically and structurally identical to natural opals, potentially bypassing the need for polymer stabilization entirely. While more complex and energy-intensive, successful hydrothermal growth techniques promise faster production cycles and yield materials acceptable for stringent optical and scientific applications where polymer content is unacceptable. Parallel technological advancements involve the use of nanotechnology to precisely control the size and arrangement of the silica spheres, allowing for the creation of new materials with custom-engineered photonic bandgaps, tailoring the material not just for jewelry aesthetics but for specialized light management functions in telecommunications and sensor technology.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest market both in terms of production volume and consumption, driven by China's extensive manufacturing infrastructure and India's massive jewelry market. China acts as a global hub for cost-effective polymer-impregnated opal production, supplying materials globally, particularly for costume jewelry and mass-market consumer accessories. The demand is heavily influenced by regional aesthetic preferences for vibrant colors and intricate inlay work. Furthermore, rising disposable incomes in economies like Vietnam and Indonesia are rapidly expanding the regional consumer base for both synthetic and natural gemstones. This region's dominance is underpinned by supply chain integration, rapid prototyping capabilities, and large, skilled labor forces capable of high-volume cutting and polishing operations.

- North America: North America represents a mature, high-value market characterized by a strong consumer preference for ethical sourcing and transparency. Consumers are increasingly willing to pay a premium for certified lab-grown materials, including synthetic opal, provided the ethical narrative is strong. The market is primarily driven by high-end designer jewelry and increasing adoption in specialized industrial niches, such as aerospace and advanced material R&D, requiring high-specification, monolithic synthetic opals. Stringent labeling laws and high regulatory scrutiny ensure material quality and disclosure, fostering high consumer trust in certified synthetic products.

- Europe: The European market is characterized by a mix of traditional luxury jewelry consumption and significant advanced materials research. Western European countries like Germany and France are key consumers of high-quality synthetic opal in fashion and accessories. There is a notable trend towards integrating synthetic opal into architectural and decorative materials, leveraging the material’s unique appearance for high-end interior design and custom fixture creation. Regulatory environment focuses heavily on sustainability and traceability, influencing manufacturers to adopt greener synthesis processes and robust ethical supply chain practices, driving innovation toward environmentally conscious production methods.

- Latin America and Middle East & Africa (LAMEA): LAMEA represents an emerging market with significant growth potential, although current consumption volumes are comparatively low. The Middle East, particularly the UAE and Saudi Arabia, exhibits high demand for luxury goods, which includes high-end jewelry incorporating synthetic accent stones. Latin America shows nascent growth, driven by regional manufacturing expansion and consumer demand for affordable, durable alternatives to natural gemstones. Market expansion in these regions is contingent upon improved distribution logistics, greater consumer awareness, and adaptation of product offerings to meet local cultural and aesthetic specifications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Synthetic Opal Market.- Kyocera Corporation

- Chatham Created Gems

- Pure Grown Diamonds (Synthetics Division)

- Wuzhou Xingyu Jewelry Co. Ltd.

- Seiko Epson Corporation (Materials Division)

- Gemesis Corp.

- Tairus Created Gems

- Created Opal Inc.

- J.C. Gems

- Hubei Yulong Technology

- Opalite Labs

- Created Gemstones Inc.

- Advanced Materials Synthesis

- Gemological Institute of Research

- Synthetic Gemstone Manufacturers Group

- Swarovski Group (Materials Science)

- Applied Optoelectronics Inc.

- Shenzhen Fuyuan Crystal Co. Ltd.

- Guangzhou Aokace Gem Co. Ltd.

- Thermo Fisher Scientific (Advanced Materials)

Frequently Asked Questions

Analyze common user questions about the Synthetic Opal market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between synthetic opal and natural opal?

Synthetic opal possesses the same chemical composition (hydrated silica spheres) and structural organization (diffraction lattice) as natural opal, resulting in identical optical properties. The primary difference is the formation environment: synthetic opals are grown in controlled laboratories, yielding faster production, greater uniformity, and enhanced structural stability compared to the slower, geologically variable formation of natural stones.

Are synthetic opals considered genuine gemstones, and are they ethical?

Synthetic opals are considered genuine in structure but lab-created in origin; they must be clearly labeled as synthetic. They are highly ethical as their production avoids the environmental disturbance and labor concerns associated with large-scale mining operations, appealing strongly to consumers prioritizing sustainable and transparent sourcing.

What are the main advantages of Polymer-Impregnated Opal over Monolithic Opal?

Polymer-impregnated opal offers superior durability, resistance to crazing (cracking), and lower cost, making it ideal for high-volume jewelry manufacturing. Monolithic (pure) opal is chemically closer to natural opal, commands higher prices, and is preferred for specialized optical applications where the presence of polymers is unacceptable.

Which application segment drives the highest growth rate in the Synthetic Opal Market?

While the Jewelry segment accounts for the largest revenue share, the Optical and Scientific Components segment is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This acceleration is driven by increasing demand for engineered photonic crystals and specialized optical filters utilizing the precise light manipulation capabilities of high-purity synthetic opal.

How does technological advancement influence the price of synthetic opal?

Technological advancements, particularly the optimization of automated sedimentation and hydrothermal synthesis, reduce the required production cycle time and minimize batch defects. This efficiency ultimately lowers the manufacturing cost per carat, making high-quality synthetic opal more accessible and stabilizing prices in the highly competitive mass-market segments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager