Synthetic Paraffin Wax Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434628 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Synthetic Paraffin Wax Market Size

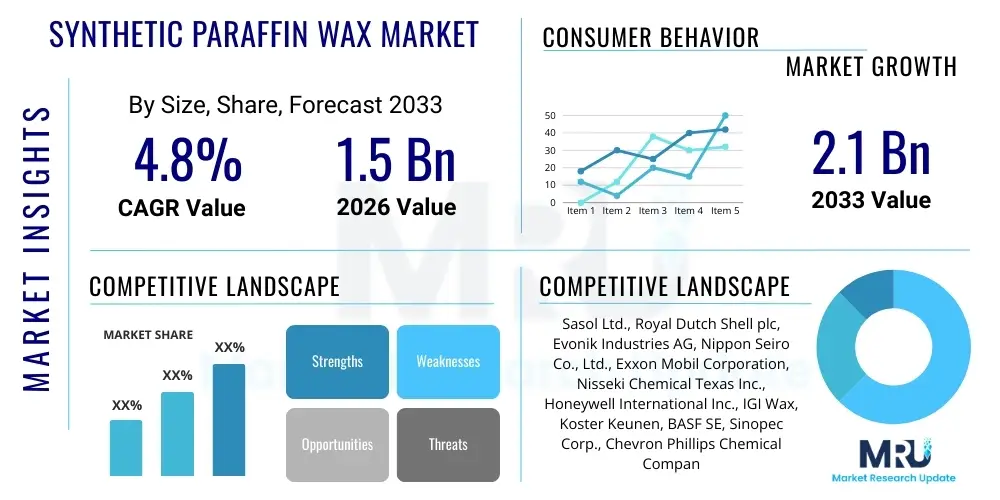

The Synthetic Paraffin Wax Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.1 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating demand from crucial end-use sectors, particularly packaging, adhesives, and industrial coatings, which increasingly favor synthetic waxes over traditional petroleum-derived alternatives due to superior purity, consistency, and controlled molecular weight distribution.

Synthetic Paraffin Wax Market introduction

Synthetic paraffin waxes, predominantly manufactured through the Fischer-Tropsch (FT) process or via polymerization routes like polyethylene (PE) and polypropylene (PP) wax synthesis, are high-purity, long-chain hydrocarbons characterized by a high degree of linearity and precise melting points. These waxes are distinct from their mineral wax counterparts (petroleum waxes) due to their controlled synthesis, offering consistent physical properties such as hardness, viscosity, and thermal stability. This consistency makes them indispensable components in high-performance industrial applications where variability cannot be tolerated, ensuring optimal performance in complex formulations, especially in sectors like hot-melt adhesives and specialty coatings. The growing regulatory pressures concerning the use of aromatic hydrocarbons and impurities found in traditional waxes further accelerate the shift towards high-purity synthetic options.

Major applications of synthetic paraffin wax include serving as a rheology modifier, slip agent, mold release agent, processing aid, and a critical component in formulating waterproof barriers. In the adhesives industry, they contribute to faster setting times and improved bond strength. Within the plastics and rubber sector, these waxes act as external lubricants, enhancing the flow and processability of polymers and preventing adhesion to metal surfaces during extrusion and molding. Furthermore, the cosmetics industry utilizes their exceptional purity and emollient properties, particularly in high-end creams and protective formulations where contaminant-free ingredients are paramount for consumer safety and product efficacy. The versatility and tailored specifications achievable through synthetic production routes allow manufacturers to meet stringent performance demands across a spectrum of industrial and consumer product formulations.

The primary benefits driving market adoption stem from their narrow molecular weight distribution, excellent thermal stability, and low oil content, which translate into superior end-product quality and reduced processing variability for end-users. Key driving factors include the rapid industrialization in the Asia Pacific region, leading to booming construction and automotive sectors, both heavy consumers of specialty coatings and adhesives. Moreover, advancements in Fischer-Tropsch technology are improving production efficiency and cost-competitiveness, positioning synthetic waxes as the preferred material for high-volume, high-specification applications globally. This sustained demand profile, supported by technological evolution in synthesis methods, firmly underpins the market's positive trajectory.

Synthetic Paraffin Wax Market Executive Summary

The Synthetic Paraffin Wax Market is characterized by robust growth, primarily fueled by shifting industrial preferences towards high-performance, consistent wax additives, moving away from conventional mineral waxes. Business trends indicate a strong focus on strategic mergers and acquisitions among major producers aimed at consolidating market share and achieving economies of scale in feedstock procurement and FT catalyst development. Furthermore, significant investment is being directed toward expanding capacity in key manufacturing hubs, particularly those near affordable natural gas sources, which are the primary feedstocks for FT synthesis. Sustainability initiatives are also emerging as a critical trend, with producers exploring bio-based synthetic wax alternatives to align with global environmental mandates, though conventional production still dominates the volume.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, driven by massive infrastructure projects, burgeoning manufacturing capabilities in China and India, and rising consumer spending leading to increased demand for packaged goods and personal care products. North America and Europe, while mature markets, emphasize specialization and high-value applications, focusing on highly technical segments such as advanced automotive coatings and high-specification printing inks, often driven by strict regulatory requirements regarding migration and purity. The Middle East and Africa (MEA) are emerging due to substantial investments in petrochemical refining and local production capabilities, aiming to capitalize on regional feedstock availability and reduce reliance on imports for industrial chemicals.

Segment trends reveal that the Fischer-Tropsch (FT) Wax segment maintains the largest market share due to its superior hard wax properties, high melting point, and applicability across adhesives and coatings. However, Polyethylene (PE) Wax is exhibiting the fastest growth, particularly in plastics processing and color concentrates, owing to its cost-effectiveness and excellent lubricating properties. Application analysis highlights that the Adhesives segment, especially hot-melt adhesives (HMAs) used in packaging and non-woven fabrics, is the dominant application sector. The underlying market structure suggests increasing vertical integration by key players to secure raw material supply (natural gas or naphtha) and enhance control over the purification and specialization stages, ensuring product quality meets stringent customer specifications globally.

AI Impact Analysis on Synthetic Paraffin Wax Market

User inquiries regarding the influence of Artificial Intelligence (AI) in the Synthetic Paraffin Wax market typically center around optimizing complex chemical processes, enhancing supply chain predictability, and developing novel formulations. Key user concerns revolve around whether AI can significantly reduce the high energy consumption associated with the Fischer-Tropsch process, improve catalyst longevity, and accurately predict product performance under diverse application conditions (e.g., rheology under shear stress). Users also express interest in AI's role in quality control, specifically using machine learning models to analyze spectral data (like FTIR or GC-MS) to ensure ultra-high purity required for food contact materials and medical applications. The collective expectation is that AI integration will primarily drive operational efficiencies, leading to cost reduction and accelerating the development of customized wax grades tailored to niche industrial demands, thereby reinforcing the market's shift toward high-specification products.

- AI-driven optimization of Fischer-Tropsch reactor parameters, leading to improved yield and reduced energy intensity.

- Predictive maintenance schedules for synthetic wax production facilities, minimizing downtime and increasing operational efficiency.

- Machine learning models for feedstock quality analysis, ensuring consistency of natural gas or synthesis gas inputs.

- Development of virtual prototyping tools, utilizing AI to predict the thermal, rheological, and mechanical properties of new wax formulations before physical synthesis.

- Enhanced quality control systems through computer vision and spectral analysis, ensuring compliance with strict purity standards (e.g., low oil content and controlled molecular weight).

- Optimization of global logistics and supply chain planning, using AI algorithms to forecast demand fluctuations across diverse end-use industries (adhesives, packaging, cosmetics).

DRO & Impact Forces Of Synthetic Paraffin Wax Market

The Synthetic Paraffin Wax Market dynamics are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and growth trajectory. The fundamental drivers include the rising demand for high-quality, high-performance industrial additives that offer superior thermal stability and lower volatility compared to traditional waxes, particularly in fast-growing sectors like packaging and specialized industrial coatings. Furthermore, stringent regulatory frameworks in North America and Europe regarding impurities in food-grade and personal care products mandate the use of ultra-pure synthetic waxes. These drivers are amplified by the availability of cost-effective natural gas feedstock in regions like North America and the Middle East, making the large-scale production of FT wax economically viable, thus solidifying its market position against crude oil derivatives.

However, significant restraints temper the market’s aggressive expansion. The most prominent challenge is the high initial capital expenditure required for establishing complex FT synthesis plants, which necessitates long-term investment cycles and high operational complexity, acting as a barrier to entry for smaller manufacturers. Furthermore, the volatility of natural gas and other petrochemical feedstock prices directly impacts the production cost of synthetic waxes, introducing pricing instability for end-users, especially those in highly price-sensitive industries like general packaging. The environmental perception of non-biodegradable synthetic polymers also poses a challenge, pushing researchers to seek more sustainable, bio-derived wax alternatives, potentially diverting investment from traditional synthesis methods.

Opportunities for growth are substantial and multifaceted. The increasing application scope in emerging fields, such as polymer modification for 3D printing filaments and specialized high-gloss architectural coatings, provides new revenue streams. Moreover, the refinement of catalyst technologies in the FT process promises higher selectivity towards specific chain lengths, allowing manufacturers to engineer tailor-made waxes for highly specialized applications with greater efficiency. The ongoing trend of regional market penetration, especially in untapped economies in Southeast Asia and Latin America, represents significant future growth potential. These forces combined suggest a market that, despite facing technological and investment hurdles, is poised for steady, specialized growth driven by continuous innovation and regulatory support for purity and consistency.

Segmentation Analysis

The Synthetic Paraffin Wax market is comprehensively segmented based on the synthesis method (Type), the specific industrial application, and the ultimate end-use industry. This segmentation is crucial as the performance characteristics of synthetic waxes, such as molecular weight, viscosity, and crystallinity, are highly dependent on the manufacturing process (FT vs. PE) and dictate their suitability for precise industrial requirements. Analyzing these segments helps in understanding the disparate demand drivers, competitive dynamics, and technological requirements across the market landscape, ranging from high-volume, cost-sensitive packaging applications to low-volume, high-specification medical device coatings. The dominance of FT wax is attributed to its highly crystalline structure, while PE wax commands a large share in lubricating and color additive roles.

- By Type

- Fischer-Tropsch (FT) Wax

- Polyethylene (PE) Wax

- Polypropylene (PP) Wax

- Chemically Modified Waxes

- By Application

- Adhesives (Hot-Melt Adhesives, Pressure-Sensitive Adhesives)

- Coatings & Inks (Powder Coatings, Liquid Coatings, Printing Inks)

- Plastics and Rubber Processing (Lubricants, Dispersants, Processing Aids)

- Polishes and Automotive Care

- Cosmetics & Personal Care (Creams, Lotions, Lipsticks)

- Packaging (Waxed Paper, Corrugated Boxes)

- Textiles

- Others (Candles, Insulation)

- By End-Use Industry

- Consumer Goods

- Construction and Infrastructure

- Automotive and Transportation

- Industrial Manufacturing

- Packaging Industry

- Chemical Processing

- By Region

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa (Saudi Arabia, UAE, South Africa, Rest of MEA)

Value Chain Analysis For Synthetic Paraffin Wax Market

The value chain for the Synthetic Paraffin Wax Market begins with the upstream procurement of fundamental raw materials, primarily natural gas (methane) or coal for the generation of synthesis gas (syngas) in the Fischer-Tropsch process, or naphtha and monomers (ethylene/propylene) for the production of PE/PP waxes. Key activities at this stage involve securing long-term supply contracts with petrochemical giants and natural gas distributors, requiring substantial logistical infrastructure and capital investment in gasification or cracking facilities. Given that feedstock costs constitute a significant portion of the total production cost, efficiency in syngas generation and purification is critical for maintaining cost competitiveness in the final product market. Integration backwards into feedstock production is a key strategy employed by major global players to mitigate supply risks and control input pricing volatility, ensuring consistent operational margins throughout the forecast period.

The core midstream activities involve the actual synthesis and refinement of the crude wax. For FT wax, this encompasses the catalytic reaction, followed by intricate refining processes such as hydrogenation, fractionation, and deoiling to achieve the required melting point range and purity levels, often tailored to specific client specifications (e.g., low viscosity for hot-melt adhesives or high hardness for polishes). Quality control at this stage is paramount, focusing on molecular weight distribution and contaminant levels, especially for food-grade and pharmaceutical applications. Manufacturers invest heavily in proprietary catalyst technology to enhance selectivity and yield, offering highly specialized wax grades that command premium pricing compared to commodity waxes, establishing technological superiority as a key differentiator.

Downstream distribution channels move the refined synthetic waxes to diverse end-use industries. Distribution often utilizes a combination of direct sales to large industrial customers (e.g., major coating manufacturers or adhesive formulators) and indirect distribution through a network of specialized chemical distributors and agents for reaching smaller enterprises and niche applications. Due to the high-volume nature of applications like road marking paints and large-scale plastics processing, efficient bulk liquid or solid handling (pellets, flakes) and storage logistics are essential. The involvement of experienced distributors is crucial for providing technical support and inventory management, ensuring just-in-time delivery to customers globally, particularly in fragmented regional markets like APAC where local sourcing and immediate availability are crucial competitive advantages for securing market share.

Synthetic Paraffin Wax Market Potential Customers

Potential customers for Synthetic Paraffin Wax span a wide array of industrial sectors that rely on high-performance additives for modifying rheology, improving surface finish, and enhancing durability or processability. The primary buyers are large chemical and formulation companies specializing in adhesives (e.g., packaging and non-woven diaper manufacturers who require fast-setting, thermally stable hot-melt adhesives). Another critical customer base is the plastics and rubber processing industry, including producers of PVC pipes, masterbatches, and extruded profiles, utilizing synthetic wax as an efficient external lubricant to reduce friction and minimize energy consumption during processing. The high purity of synthetic waxes also attracts the cosmetics and personal care sector, where major brands purchase these waxes as emollients and structural components for high-quality lipsticks, creams, and sunscreens, demanding stringent compliance with regulatory purity standards like FDA or REACH, making product certification a critical factor in vendor selection.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.1 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sasol Ltd., Royal Dutch Shell plc, Evonik Industries AG, Nippon Seiro Co., Ltd., Exxon Mobil Corporation, Nisseki Chemical Texas Inc., Honeywell International Inc., IGI Wax, Koster Keunen, BASF SE, Sinopec Corp., Chevron Phillips Chemical Company, Fushun Petrochemical Company, Petroleo Brasileiro S.A. (Petrobras), Repsol S.A., Dow Inc., AkzoNobel N.V., Micro Powders Inc., Trecora Resources, Sanyo Chemical Industries, Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Synthetic Paraffin Wax Market Key Technology Landscape

The technological landscape of the Synthetic Paraffin Wax Market is fundamentally dominated by the Fischer-Tropsch (FT) synthesis process, which converts syngas (a mixture of carbon monoxide and hydrogen derived from natural gas, coal, or biomass) into liquid hydrocarbons, including waxes. Continuous technological refinement focuses on optimizing the FT reactor design, primarily moving towards slurry phase reactors or fixed-bed reactors, to enhance heat transfer efficiency and maximize catalyst utilization and lifespan. The use of advanced cobalt-based or iron-based catalysts remains central, with ongoing research targeting highly selective catalysts that can reliably produce waxes within a narrow, desirable molecular weight range (C30+), which is critical for high-performance applications like high-pressure hot-melt adhesives and specialty polishes. Process innovation also emphasizes energy efficiency, particularly integrating waste heat recovery systems, crucial for reducing the operational costs associated with large-scale exothermic FT reactions, thereby improving the economic viability of new production capacity.

Beyond FT technology, the polymerization route, specifically the production of low molecular weight polyethylene (PE) waxes, represents another major technological pillar. PE wax is typically manufactured either through direct high-pressure polymerization or by thermal cracking of high molecular weight polyethylene polymers. Advances here are focused on metallocene catalysis, which offers precise control over the polymer structure, yielding waxes with extremely narrow polydispersity indices, translating into superior lubricating and dispersing properties required in masterbatches and PVC stabilizers. This high level of structural control allows manufacturers to engineer waxes specifically optimized for demanding applications, such as high-temperature processing environments or highly pigmented color concentrates, where consistency and low residue are non-negotiable performance attributes.

A crucial technological trend gaining momentum is the development of advanced purification and modification techniques. Post-synthesis processing involves complex fractional distillation, solvent crystallization, and hydrogenation to remove impurities, control oil content, and adjust the final melting point. Specialized modification technologies, such as oxidation (to create oxidized PE waxes for emulsion applications) or functionalization (for enhanced compatibility with polar polymers in coatings), are essential for expanding the functional scope of synthetic waxes into more challenging formulations. Furthermore, the burgeoning field of sustainable chemistry is exploring catalytic routes to produce synthetic waxes from biomass-derived syngas (Bio-FT), representing a long-term technological opportunity aimed at meeting the increasing global mandate for renewable chemical feedstocks and ensuring market resilience against fossil fuel price fluctuations.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market for synthetic paraffin wax, driven primarily by extensive infrastructure development, massive manufacturing activity in China, India, and Southeast Asian nations, and burgeoning packaging and automotive industries. The region benefits from lower operating costs and rapidly expanding local production capacity, particularly for PE wax used in masterbatches and processing aids. Demand is highly concentrated in adhesives and coatings, supported by favorable government policies promoting industrial output and urbanization.

- North America: North America is a mature market characterized by high consumption of specialized, high-ppurity synthetic waxes, especially FT wax, used in high-end personal care, food packaging (regulatory compliant waxes), and sophisticated industrial lubricants. The market is technologically advanced, with a strong emphasis on sustainability and product consistency. Abundant access to low-cost natural gas feedstock supports domestic FT wax production, reducing reliance on imports for specific grades and driving competitiveness in premium segments.

- Europe: The European market is defined by stringent regulatory environments (e.g., REACH), which strongly favor the use of pure, traceable synthetic waxes over mineral alternatives. Consumption is high in coatings, printing inks, and automotive applications, particularly focused on enhancing scratch resistance and abrasion protection. Innovation is concentrated on developing low-migration waxes for food contact materials and exploring bio-based synthetic alternatives to meet strict environmental targets set by the European Union.

- Latin America (LATAM): LATAM is an emerging market showing moderate growth, propelled by the expansion of the construction and consumer goods sectors, especially in Brazil and Mexico. Demand is concentrated in lower-to-mid range applications such as road markings, standard packaging adhesives, and polishes. Market growth is often volatile due to economic instability, but local producers are leveraging regional resource availability to meet increasing domestic consumption needs and reduce reliance on expensive imports.

- Middle East & Africa (MEA): MEA is witnessing significant growth, heavily reliant on substantial investment in petrochemical refining and diversification strategies, particularly in Saudi Arabia and the UAE. These regions benefit from readily available, cost-competitive oil and gas resources, facilitating the local synthesis of waxes. The demand is driven by local industrialization, including the growth of plastics manufacturing, construction chemicals, and specialized coatings, aiming to establish MEA as a major global exporter of bulk petrochemical derivatives and specialty chemicals.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Synthetic Paraffin Wax Market.- Sasol Ltd.

- Royal Dutch Shell plc

- Evonik Industries AG

- Nippon Seiro Co., Ltd.

- Exxon Mobil Corporation

- Nisseki Chemical Texas Inc.

- Honeywell International Inc.

- IGI Wax

- Koster Keunen

- BASF SE

- Sinopec Corp.

- Chevron Phillips Chemical Company

- Fushun Petrochemical Company

- Petroleo Brasileiro S.A. (Petrobras)

- Repsol S.A.

- Dow Inc.

- AkzoNobel N.V.

- Micro Powders Inc.

- Trecora Resources

- Sanyo Chemical Industries, Ltd.

- Clariant AG

- Mitsui Chemicals, Inc.

- OxyChem (Occidental Petroleum Corporation)

- The International Group, Inc. (IGI)

Frequently Asked Questions

Analyze common user questions about the Synthetic Paraffin Wax market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between synthetic paraffin wax and traditional petroleum wax?

Synthetic paraffin waxes, typically derived from the Fischer-Tropsch process, offer superior purity, higher consistency, controlled molecular weight distribution, and lower oil content compared to petroleum-derived waxes. This enhanced purity and consistency are vital for high-performance applications like food-grade packaging and specialized industrial coatings.

Which application segment drives the highest demand for synthetic paraffin wax?

The Adhesives segment, particularly Hot-Melt Adhesives (HMAs) used in packaging and non-woven fabric manufacturing, generates the highest demand. Synthetic waxes, especially FT waxes, provide the required fast setting speed, thermal stability, and low viscosity essential for efficient high-speed production lines.

How does the volatility of natural gas prices affect the market?

Natural gas is the primary feedstock for producing syngas, the input for Fischer-Tropsch (FT) wax synthesis. Therefore, volatility in natural gas prices directly impacts the production cost and pricing of FT wax, introducing market instability and affecting the competitive positioning of synthetic waxes against petroleum-based alternatives.

What role does the Asia Pacific region play in the global Synthetic Paraffin Wax Market?

Asia Pacific is the largest and fastest-growing regional market, driven by rapid industrialization, extensive construction activity, and expanding manufacturing sectors in countries like China and India. The region serves both as a major consumer, primarily in plastics and coatings, and an increasing hub for low-cost FT and PE wax manufacturing.

Are there sustainable or bio-based synthetic wax alternatives available?

Yes, research is actively exploring routes for producing bio-based synthetic waxes, often via the Bio-Fischer-Tropsch process using biomass-derived syngas. While currently niche, these sustainable alternatives are an emerging opportunity driven by stringent environmental regulations and the growing industrial preference for renewable chemical feedstocks.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager