Synthetic Polymer Waterproofing Membrane Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435081 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Synthetic Polymer Waterproofing Membrane Market Size

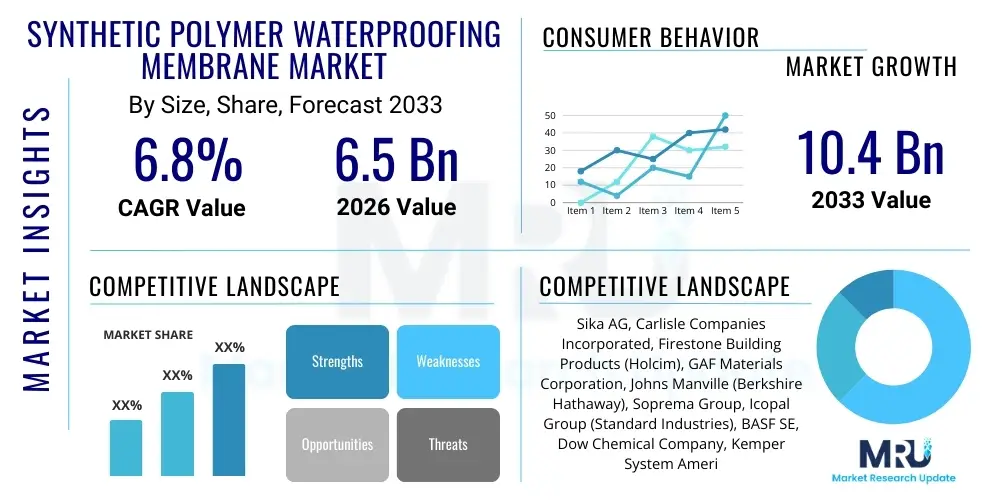

The Synthetic Polymer Waterproofing Membrane Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 10.4 Billion by the end of the forecast period in 2033.

Synthetic Polymer Waterproofing Membrane Market introduction

The Synthetic Polymer Waterproofing Membrane Market encompasses the production and utilization of advanced membrane materials derived from synthetic polymers such as EPDM (Ethylene Propylene Diene Monomer), PVC (Polyvinyl Chloride), TPO (Thermoplastic Polyolefin), and various modified polyurethanes. These membranes are crucial components in modern construction, providing superior barriers against water intrusion for critical infrastructure, commercial buildings, and residential developments. They offer enhanced durability, flexibility, and resistance to environmental factors like UV radiation, thermal expansion, and chemical degradation compared to traditional asphalt-based solutions, making them preferred choices for roofing, basement waterproofing, tunnel lining, and fluid containment structures.

Major applications driving the demand for these membranes include the rapid expansion of green roofing systems, which necessitate robust, root-resistant waterproofing layers, and the increasing complexity of infrastructure projects requiring highly reliable subterranean protection. The benefits conferred by synthetic polymer membranes, such as long service life (often exceeding 20 years), ease of installation (especially for TPO and PVC systems), and superior performance in highly demanding climates, solidify their position as essential materials in the global construction chemical industry. Furthermore, the push towards sustainable and energy-efficient building standards favors these lightweight and reflective membrane options, particularly in developed economies.

The market growth is primarily fueled by accelerated global urbanization, leading to high-volume commercial and residential construction, coupled with extensive renovation and repair activities focused on upgrading aging infrastructure worldwide. Stringent building codes and regulations mandating high-performance waterproofing systems, particularly in regions prone to heavy rainfall or seismic activity, further act as critical driving factors. Technological advancements focused on developing fire-resistant and environmentally benign polymer formulations, alongside improvements in welding and adhesion technologies, continue to enhance product appeal and market penetration across diverse geographical areas.

Synthetic Polymer Waterproofing Membrane Market Executive Summary

The Synthetic Polymer Waterproofing Membrane Market exhibits robust expansion driven by global infrastructure investment and a shift toward high-performance, sustainable building materials. Key business trends include the increasing dominance of TPO membranes due to their recyclability and energy efficiency, and strategic mergers and acquisitions among major manufacturers aimed at consolidating regional market shares and expanding specialized product portfolios, particularly in high-growth segments like liquid-applied waterproofing systems. Regional trends underscore Asia Pacific as the fastest-growing market, propelled by massive governmental investments in residential and infrastructural development, while mature markets in North America and Europe prioritize sophisticated, fire-rated, and aesthetically pleasing membranes for commercial retrofitting projects. Segment trends reveal sustained demand for EPDM in large-scale roofing applications requiring extreme weather resistance, while PVC membranes maintain a strong presence in regions demanding flexibility and resistance to puncture, particularly in below-grade structures and tunnels, showcasing a balanced and application-specific market evolution.

AI Impact Analysis on Synthetic Polymer Waterproofing Membrane Market

User queries regarding AI's influence in the Synthetic Polymer Waterproofing Membrane Market frequently center on themes of quality control, predictive maintenance, supply chain optimization, and the development of novel material formulations. Users are keenly interested in how AI can enhance the precision of membrane installation, specifically asking about AI-driven robotic application systems and real-time defect detection during manufacturing or field installation. Another major concern is utilizing machine learning algorithms to predict membrane performance and degradation rates based on environmental data (UV exposure, temperature fluctuations, and moisture levels), thereby offering customers proactive maintenance schedules. Furthermore, there is significant curiosity about how generative AI and computational chemistry could accelerate the R&D process for developing next-generation polymers with superior durability and environmental profiles, addressing the industry's continuous need for enhanced sustainability.

AI's primary impact involves streamlining operational efficiencies and enhancing product integrity across the value chain. In manufacturing, AI-powered vision systems are already employed to monitor membrane thickness, consistency, and identify microscopic flaws with greater accuracy than human inspection, significantly reducing waste and ensuring compliance with stringent standards. Logistically, machine learning models optimize inventory management for raw polymers and finished products, forecasting demand fluctuations based on construction cycles and seasonal patterns, thereby minimizing warehousing costs and mitigating supply chain disruptions. This integration of predictive analytics ensures that complex, multi-site construction projects receive customized membrane solutions precisely when needed, improving overall project timelines and reliability.

Looking forward, the role of AI is expected to transition from purely operational optimization to driving innovation in material science and application techniques. Specialized algorithms are being developed to simulate the long-term interaction of polymer compounds under extreme stress, allowing researchers to screen thousands of potential formulations virtually before physical synthesis. This accelerates the introduction of membranes that meet emerging environmental regulations (e.g., lower VOCs or higher recyclability). Moreover, integration of Building Information Modeling (BIM) with AI allows for highly customized waterproofing designs and automated quantification of required membrane materials, further optimizing resource utilization and minimizing on-site errors, thereby raising the overall quality standard of waterproofing installations globally.

- AI-powered vision systems enhance defect detection during membrane manufacturing, increasing product quality and reducing material waste.

- Predictive maintenance models utilize AI to forecast membrane degradation based on environmental data, leading to optimized replacement schedules.

- Machine learning algorithms optimize raw material sourcing and inventory management, improving supply chain resilience for synthetic polymers.

- Computational chemistry and generative AI accelerate the research and development of sustainable, high-performance polymer formulations.

- Integration of AI with robotic systems enables precision membrane installation on complex geometrical structures, minimizing labor errors.

- Predictive analytics supports dynamic pricing and demand forecasting based on global construction indices and macroeconomic indicators.

DRO & Impact Forces Of Synthetic Polymer Waterproofing Membrane Market

The Synthetic Polymer Waterproofing Membrane Market is governed by a robust interplay of Drivers (D), Restraints (R), Opportunities (O), and potent Impact Forces. Key drivers include stringent regulatory frameworks promoting high-performance building envelopes, accelerating urbanization coupled with massive public and private infrastructure spending, and the growing preference for durable, long-lasting roofing solutions over conventional materials. These drivers collectively ensure a high baseline demand for reliable synthetic waterproofing systems. However, the market faces restraints such as the volatility in raw material prices (particularly crude oil derivatives used in polymer synthesis), the presence of fragmented local markets dominated by non-standardized products, and the initial higher installation costs associated with certain high-end polymer systems compared to traditional methods. Addressing these cost and standardization challenges is crucial for broader market penetration.

Opportunities for growth are significant, particularly in emerging economies focusing on sustainable infrastructure and the renovation of existing structures. The rising adoption of green building technologies, especially vegetative roofs and rainwater harvesting systems, provides a strong niche for specialized root-resistant polymer membranes (such as FPO and high-grade PVC). Furthermore, technological advancements in developing liquid-applied synthetic polymers and hybrid systems that offer seamless application and faster curing times present considerable avenues for diversification. Manufacturers focusing on developing recyclable and low-VOC (Volatile Organic Compounds) products are positioned to capitalize on the increasing global emphasis on environmental accountability and health standards within the construction sector.

The primary impact forces shaping the market include rapidly evolving building codes requiring enhanced fire safety and energy efficiency (pushing demand toward TPO and specific EPDM formulations), intense competition from alternative waterproofing solutions like modified bitumen and crystalline admixtures, and macroeconomic factors such as interest rate fluctuations directly influencing construction activity levels. The market structure is also impacted by the technical expertise required for installation; the availability of skilled labor for specific synthetic membrane types (e.g., complex welding required for PVC and TPO) significantly influences regional market penetration rates. Successful firms must strategically navigate raw material price instability while consistently innovating to meet stricter performance criteria.

Segmentation Analysis

The Synthetic Polymer Waterproofing Membrane Market is extensively segmented based on the product type, end-use application, and geographical region, reflecting the diverse requirements across the global construction industry. Product segmentation typically differentiates between widely used materials like EPDM, PVC, TPO, and Polyurethane, each possessing unique properties regarding flexibility, UV resistance, and chemical compatibility, catering to specific environmental and structural demands. The application segment delineates consumption across roofing, wall and facade protection, civil engineering structures (tunnels and bridges), and waste management liners, with roofing and subterranean waterproofing accounting for the largest market shares due to high volume requirements in commercial and residential construction.

The detailed segmentation enables manufacturers to tailor their production, marketing, and distribution strategies to meet specialized regional needs. For instance, TPO membranes are highly demanded in regions prioritizing energy-efficient cool roofing systems (common in North America), while PVC retains dominance in underground applications requiring high resistance to aggressive groundwater (frequent in European civil projects). This granular view of the market assists stakeholders in identifying high-potential segments, such as the rapidly growing liquid-applied polyurethane segment, which offers ease of application and monolithic protection for complex architectural geometries, contrasting with traditional sheet membranes.

- By Product Type: EPDM, Polyvinyl Chloride (PVC), Thermoplastic Polyolefin (TPO), Polyurethane, Others (FPO, EVA)

- By Application: Roofing (Residential, Commercial, Industrial), Walls and Facades, Building Structures (Basements, Wet Areas), Civil Engineering (Tunnels, Bridges, Dams), Waste and Water Management (Ponds, Liners)

- By End-Use Sector: Residential Construction, Commercial Construction (Retail, Office, Hospitality), Industrial Construction, Infrastructure and Civil Engineering

Value Chain Analysis For Synthetic Polymer Waterproofing Membrane Market

The value chain for the Synthetic Polymer Waterproofing Membrane Market begins with upstream activities involving the sourcing and processing of raw materials, primarily petrochemical derivatives (like propylene, ethylene, and phthalates) necessary for synthesizing core polymers such as PVC, EPDM, and TPO. Key upstream participants include major chemical producers and polymer manufacturers who supply pellets and resins. Price volatility and stability in the petrochemical sector directly impact the profitability and pricing strategies of membrane producers. Efficiency in polymerization and compounding, which involves adding plasticizers, UV stabilizers, and fire retardants, determines the final quality and performance characteristics of the membrane.

Midstream activities involve the specialized manufacturing and processing of the polymer sheet membranes. This stage includes extrusion, calendering, and sometimes reinforced composite layering, converting raw polymer pellets into finished rolls of waterproofing material. Major membrane manufacturers focus on optimizing production scale, minimizing waste, and ensuring compliance with regional standards (e.g., ASTM, EN standards). Distribution channels then manage the flow of finished products to end-users. This involves a complex network of direct sales to large construction firms, indirect sales through specialized distributors and building material wholesalers, and increasingly, online procurement platforms for smaller contractors. Direct channels are crucial for large infrastructure projects requiring technical support.

Downstream activities center on application and installation, involving specialized waterproofing contractors and general construction companies. The quality of installation is paramount to the product's effectiveness, necessitating ongoing training and certification for applicators, particularly for welded systems like TPO and PVC. Aftermarket services, including long-term warranties, maintenance contracts, and repair services, complete the value chain, ensuring the membrane's service life is maximized. The influence of architects, engineers, and specifiers in the procurement process is significant, as they dictate the type and quality of membrane used in project designs, making indirect marketing and relationship building critical downstream strategies.

Synthetic Polymer Waterproofing Membrane Market Potential Customers

The primary customers for Synthetic Polymer Waterproofing Membranes span several sectors within the construction and civil engineering industries, driven by the need for robust protection against water damage and environmental degradation. Large general contractors and specialized roofing contractors constitute a significant customer base, procuring high volumes of membranes for new commercial, industrial, and residential projects, prioritizing materials that offer quick installation and long-term warranties. Infrastructure development authorities and civil engineering firms are critical buyers, especially for large-scale projects like highway tunnels, underground rail systems, municipal water reservoirs, and bridge decks, where failure is not an option and high-performance, chemical-resistant membranes (such as thick PVC or high-grade EPDM) are mandatory.

Institutional clients, including governmental bodies, healthcare facility owners, and educational campus administrators, are continuous consumers, typically requiring membranes for both new construction and extensive retrofitting projects aimed at extending the life of existing buildings. Furthermore, the burgeoning segment of green roof developers and urban planners represents a growing customer segment, specifically seeking root-resistant and sustainable TPO and FPO membranes that integrate effectively with complex landscaping features and drainage layers. These various customer groups require tailored products, ranging from large, seamless sheets for open roofs to pre-formed details for complex penetrations and corners, reflecting the customization demands inherent in the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 10.4 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sika AG, Carlisle Companies Incorporated, Firestone Building Products (Holcim), GAF Materials Corporation, Johns Manville (Berkshire Hathaway), Soprema Group, Icopal Group (Standard Industries), BASF SE, Dow Chemical Company, Kemper System America, Inc., Tremco Incorporated, Renolit SE, Axter SAS, Fosroc International Ltd., W. R. Meadows, Inc., GCP Applied Technologies, Polyglass U.S.A., Inc., Henry Company, Alchimica Building Chemicals, CETCO (Minerals Technologies). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Synthetic Polymer Waterproofing Membrane Market Key Technology Landscape

The Synthetic Polymer Waterproofing Membrane Market is characterized by continuous technological innovation focused on enhancing material performance, sustainability, and application efficiency. A critical technological trend is the development of advanced polymer blending and compounding techniques, particularly for TPO and FPO membranes, aimed at improving weldability, increasing flexibility in cold climates, and maximizing resistance to UV exposure and heat aging. Manufacturers are leveraging nanotechnology to incorporate specialized additives, such as carbon nanotubes or nano-silica, into the polymer matrix. These additions enhance tensile strength, puncture resistance, and long-term durability without significantly increasing the weight or thickness of the finished sheet, leading to high-performance lightweight systems.

Another significant technological advancement lies in the formulation of liquid-applied synthetic polymers, primarily polyurethanes and polyureas. These systems cure rapidly to form a monolithic, seamless membrane, which is highly advantageous for complex geometries, vertical surfaces, and areas with multiple penetrations where sheet membranes are prone to failure points. Recent innovations focus on hybrid polyurethane formulations that offer better moisture tolerance during application and rapid curing times, addressing historical challenges related to weather-dependent installation schedules. Furthermore, the integration of smart additives, such as color-changing indicators that signal proper curing or damage, is improving on-site quality assurance.

The application technology landscape is also evolving rapidly. Automated hot-air welding equipment for TPO and PVC is becoming standard, ensuring consistent and strong seam integrity, which is vital for system performance. Digitalization plays a role through the increased use of Building Information Modeling (BIM) to integrate waterproofing specifications directly into the construction design process, optimizing material usage and detailing complex junctions. The focus is increasingly shifting towards prefabrication, where membrane sheets are welded into larger panels off-site under controlled conditions, reducing on-site labor time and improving overall installation reliability for large-scale projects.

Regional Highlights

The global demand for synthetic polymer waterproofing membranes exhibits distinct regional consumption patterns dictated by climate, regulatory environment, and construction activity levels. Asia Pacific (APAC) stands out as the primary growth engine due to unprecedented urbanization rates in China, India, and Southeast Asian nations. Massive infrastructure projects, coupled with stringent new building codes aimed at durability and seismic resilience, fuel demand, particularly for PVC and high-grade EPDM used in tunnels, railways, and commercial roofing. Manufacturers are aggressively expanding production capacity within APAC to mitigate logistics costs and serve this escalating demand.

North America and Europe represent mature markets characterized by stable, high-value demand focused heavily on retrofitting and sustainability. In North America, TPO membranes dominate the commercial low-slope roofing sector due to mandates and incentives promoting energy-efficient cool roofs. European markets emphasize PVC and high-performance polyurethanes for below-grade applications and green roofing, driven by strict environmental regulations (e.g., REACH) and a strong focus on circular economy principles, leading to higher adoption of recyclable membrane solutions.

Latin America and the Middle East & Africa (MEA) are emerging markets experiencing strong investment in residential, commercial, and energy infrastructure. The MEA region, particularly the Gulf Cooperation Council (GCC) countries, demands highly UV- and heat-resistant membranes (such as modified TPO and specific polyurethanes) necessary for handling extreme desert climates. Latin America's market growth is supported by expanding housing projects and investments in civil works, though regulatory adoption of synthetic membranes still varies across countries.

- Asia Pacific (APAC): Highest growth region driven by urbanization, infrastructure development (e.g., transport, housing), and increasing adoption of modern construction practices in China and India.

- North America: Market maturity characterized by high replacement demand and dominance of energy-efficient TPO in commercial roofing, supported by energy standards (e.g., Title 24).

- Europe: Strong focus on sustainability, advanced liquid-applied systems, and specialized PVC/FPO membranes for environmental and subterranean engineering projects, influenced by strict EU regulations.

- Middle East & Africa (MEA): Growing market demanding highly durable, heat-resistant systems for large-scale commercial and residential complexes in extreme arid environments.

- Latin America: Developing market showing steady growth, primarily focused on basic residential and commercial roofing materials, with potential for high-end polyurethane systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Synthetic Polymer Waterproofing Membrane Market.- Sika AG

- Carlisle Companies Incorporated

- Firestone Building Products (Holcim)

- GAF Materials Corporation

- Johns Manville (Berkshire Hathaway)

- Soprema Group

- Icopal Group (Standard Industries)

- BASF SE

- Dow Chemical Company

- Kemper System America, Inc.

- Tremco Incorporated

- Renolit SE

- Axter SAS

- Fosroc International Ltd.

- W. R. Meadows, Inc.

- GCP Applied Technologies

- Polyglass U.S.A., Inc.

- Henry Company

- Alchimica Building Chemicals

- CETCO (Minerals Technologies)

Frequently Asked Questions

Analyze common user questions about the Synthetic Polymer Waterproofing Membrane market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between TPO, EPDM, and PVC membranes?

TPO (Thermoplastic Polyolefin) is known for its heat-welded seams, UV resistance, and energy efficiency, making it ideal for cool roofing. EPDM (Ethylene Propylene Diene Monomer) is a thermoset rubber celebrated for its durability, flexibility, and longevity in diverse climates. PVC (Polyvinyl Chloride) is highly resistant to chemicals, punctures, and fire, often preferred for below-grade applications and detailed structures.

Which synthetic polymer membrane offers the best performance for green roofing applications?

FPO (Flexible Polyolefin) and specialized PVC membranes are generally considered best for green roofing. They possess inherent or additive-enhanced resistance to root penetration, are chemically inert, and maintain structural integrity under continuous moisture and load, protecting the roof structure effectively from vegetation damage.

How does the sustainability profile of synthetic membranes compare to traditional bitumen systems?

Synthetic membranes, particularly TPO and certain PVC formulations, often have a superior long-term sustainability profile. TPO is fully recyclable, and EPDM boasts a very long service life, minimizing replacement waste. Many synthetic polymers contribute to energy savings through reflective surfaces, whereas traditional bitumen requires more energy-intensive installation and typically has shorter lifespan expectations.

What major factors are driving the growth of liquid-applied polyurethane waterproofing systems?

Liquid-applied polyurethane systems are growing due to their ability to form a seamless, monolithic layer, eliminating common failure points associated with sheet membrane seams. Their ease of application on complex or irregular geometries, rapid curing times, and flexibility make them highly attractive for renovation projects and detailed architectural structures.

What impact does raw material price volatility have on the synthetic polymer waterproofing market?

Raw material price volatility significantly affects profitability, as synthetic membranes rely on petrochemical derivatives. Price spikes in crude oil or key monomers (like ethylene and propylene) increase production costs, potentially leading to higher end-user prices or compressed margins for manufacturers, which can slow adoption in price-sensitive construction segments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager