Synthetic Tartaric Acid Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436398 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Synthetic Tartaric Acid Market Size

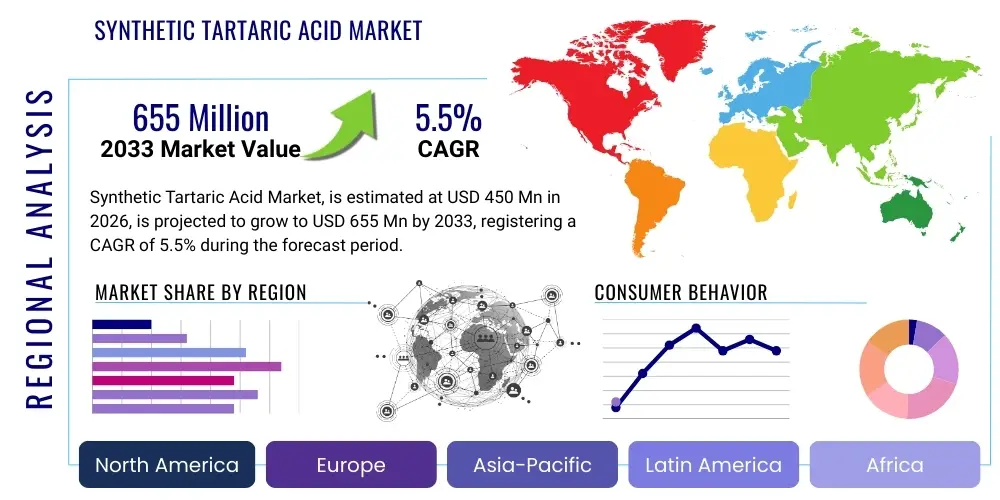

The Synthetic Tartaric Acid Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 655 Million by the end of the forecast period in 2033. This growth trajectory is significantly influenced by the escalating demand for acidulants and preservatives across the burgeoning global food and beverage industry, coupled with its critical utility in the pharmaceutical sector as an excipient and chiral resolving agent. The consistent demand from industrial applications, particularly in the construction and metal surface treatment sectors, further solidifies this market expansion.

Synthetic Tartaric Acid Market introduction

Synthetic Tartaric Acid, chemically known as 2,3-dihydroxybutanedioic acid, is an organic acid synthesized primarily from maleic anhydride, a petroleum derivative. It is a highly valued crystalline compound known for its strong acidity, excellent chelating properties, and high solubility. While naturally occurring L-(+)-Tartaric Acid is predominantly sourced as a byproduct of winemaking (tartrates), synthetic production methods allow for the creation of various stereoisomers, including the racemic DL-Tartaric Acid and the meso form, catering to specific industrial needs where consistent purity and large-scale supply are paramount. The synthetic route ensures stability in supply chains, mitigating the price volatility often associated with agricultural byproducts.

Major applications of synthetic tartaric acid span multiple high-growth industries. In the Food & Beverage sector, it functions as an essential acidulant, flavor enhancer, and preservative, commonly used in soft drinks, fruit juices, confectionery, and bakery products. Its role in achieving the desired tartness and inhibiting microbial growth is critical for product quality and shelf life. Furthermore, synthetic tartaric acid is indispensable in the pharmaceutical industry, where it is utilized in the preparation of effervescent salts, as an excipient to improve drug stability, and most importantly, as a highly effective chiral resolving agent necessary for separating enantiomers in complex drug synthesis processes.

The core benefits driving its adoption include superior cost-effectiveness compared to natural sources during periods of wine industry fluctuation, high chemical purity, and the ability to produce specific non-natural stereoisomers required for specialized chemical synthesis. Driving factors encompass the rapid expansion of processed food consumption globally, stringent quality control requirements in pharmaceuticals necessitating high-purity ingredients, and continuous technological advancements in catalytic synthetic processes that improve yield and reduce production costs, thereby bolstering the market's competitive edge against natural alternatives.

Synthetic Tartaric Acid Market Executive Summary

The Synthetic Tartaric Acid Market is characterized by robust business trends focusing on enhancing production efficiency, securing raw material supplies (primarily maleic anhydride), and diversifying end-use applications beyond traditional food and pharmaceutical sectors. Key manufacturers are investing heavily in improving catalytic processes, such as the use of specialized heterogeneous catalysts in the maleic anhydride oxidation and subsequent hydration steps, to achieve higher conversion rates and minimize environmental waste. The market structure remains moderately consolidated, with major chemical producers vying for dominance through strategic backward integration and long-term supply agreements with large FMCG and pharmaceutical conglomerates, ensuring stable revenue streams and predictability in demand forecasting.

Regional trends indicate that the Asia Pacific (APAC) region is poised for the fastest growth, primarily fueled by massive industrialization, rapid population growth, and the subsequent expansion of the processed food and pharmaceutical manufacturing bases in countries like China and India. North America and Europe, while mature markets, maintain high consumption rates due to stringent regulatory frameworks favoring high-purity synthetic grades in specialized pharmaceutical and cosmetic applications. The shift towards sustainable chemical production methods, driven by European Union regulations, is prompting innovation in bio-based synthetic routes, although the conventional petrochemical route still dominates the current landscape, setting the stage for future technological transitions.

Segment trends highlight the dominance of the Food & Beverage application segment in terms of volume, primarily utilizing DL-Tartaric Acid for bulk acidulation. However, the Pharmaceutical segment, demanding high-purity L-(+)-Tartaric Acid as a chiral resolution agent, contributes significantly to market value due to the premium pricing associated with excipient-grade chemicals. Furthermore, the Industrial Grade segment is witnessing increased utilization in specialized applications, such as in concrete retarders to control setting time in large-scale infrastructure projects, and in electroplating solutions, offering new avenues for market penetration outside core consumer-facing sectors.

AI Impact Analysis on Synthetic Tartaric Acid Market

User inquiries regarding AI's influence on the synthetic tartaric acid market often center on optimizing complex chemical synthesis pathways, predicting raw material price fluctuations (especially maleic anhydride), and enhancing quality control. Users are concerned about how AI-driven predictive maintenance will affect production downtime and whether machine learning algorithms can accelerate the discovery of more sustainable, non-petrochemical synthetic routes. The general expectation is that AI will primarily revolutionize upstream manufacturing processes, driving down operational expenditure (OPEX) and improving batch consistency, thereby directly impacting the competitiveness and pricing of synthetic tartaric acid relative to its natural counterpart.

- AI-driven optimization of catalytic reactors, improving synthesis yield and reducing energy consumption during the maleic anhydride conversion process.

- Predictive modeling of raw material (maleic anhydride and feedstocks) costs, enabling strategic procurement and hedging against price volatility.

- Enhanced quality control systems utilizing machine vision and deep learning to instantly detect impurities and ensure compliance with stringent Food and Pharma grade specifications.

- Accelerated discovery and screening of novel, environmentally friendly bio-catalysts or microbial fermentation pathways for sustainable tartaric acid production.

- Optimization of supply chain logistics and inventory management, minimizing storage costs and ensuring just-in-time delivery to major industrial end-users like beverage bottlers and pharmaceutical firms.

DRO & Impact Forces Of Synthetic Tartaric Acid Market

The market for synthetic tartaric acid is significantly shaped by a dynamic interplay of propelling drivers, market constraints, and emerging opportunities, all magnified by critical external impact forces. A primary driver is the pervasive and growing demand from the Food and Beverage industry, particularly in developing economies, where urbanization and shifts towards packaged and processed foods necessitate bulk supplies of reliable, cost-effective acidulants. Parallelly, the relentless global growth in pharmaceutical manufacturing, especially generic drug production, sustains high demand for high-purity synthetic tartaric acid as a crucial excipient and chiral resolving agent, vital for separating enantiomers in complex drug molecules.

However, the market faces inherent restraints, most notably the high price volatility and supply risk associated with the primary petrochemical feedstock, maleic anhydride. Being a derivative of crude oil products, geopolitical instability or fluctuations in global energy markets can directly impact production costs, challenging the competitive pricing of the synthetic product. Furthermore, the market faces steady competition from the natural L-(+)-Tartaric acid derived from the wine industry, which, although often less stable in supply, carries a 'natural' premium attractive to certain clean-label consumer segments, particularly in high-end food applications and nutraceuticals. Regulatory hurdles concerning the acceptance and labeling of synthetic food additives in some regions also pose moderate constraints on unfettered market growth.

Opportunities for expansion lie predominantly in technological innovation and diversification. The exploration and commercialization of bio-based routes for synthesizing tartaric acid, leveraging renewable raw materials such as glucose or glycerol, present a substantial opportunity to decouple production from petrochemical price volatility and appeal to the increasing demand for sustainable ingredients. Moreover, emerging industrial applications, such as its use as a potent biodegradable chelating agent in cleaning products and its increasing utility in the production of complex polymers and resins, offer promising avenues for volume growth, mitigating reliance solely on the mature F&B sector. The dominant impact forces shaping the market include stringent regulatory standards (Pharma and Food Safety agencies), technological advancements in catalysis, and overarching global sustainability initiatives demanding greener chemical manufacturing.

Segmentation Analysis

The Synthetic Tartaric Acid Market is meticulously segmented based on Type, Application, and Grade, reflecting the diverse end-user requirements and chemical specifications. The Type segmentation distinguishes between the various stereoisomers, crucially defining the product's function, particularly the racemic mixture (DL-Tartaric Acid) used widely in industrial settings and the enantiopure forms (L-(+)- or D-(-)-Tartaric Acid) required for specialized chiral chemistry. The Application segmentation dictates the volume consumption, with Food & Beverage dominating, while the Grade segmentation (Food, Pharma, Industrial) determines the necessary purity level, adhering to pharmacopeial standards (USP, EP, JP) for high-value applications.

- By Type: L-(+)-Tartaric Acid, D-(-)-Tartaric Acid, DL-Tartaric Acid (Racemic Mixture), Meso-Tartaric Acid

- By Application: Food & Beverage Industry (Acidulant, Preservative, Flavor Enhancer), Pharmaceutical Industry (Excipient, Chiral Resolving Agent), Cosmetics & Personal Care, Construction (Cement Retarder), Chemical Synthesis, Others (Metal Cleaning, Electroplating)

- By Grade: Food Grade (FCC), Pharmaceutical Grade (USP/EP/JP), Industrial Grade

Value Chain Analysis For Synthetic Tartaric Acid Market

The value chain for synthetic tartaric acid is primarily rooted in petrochemical feedstocks and extends through complex chemical processing to reach highly regulated end-use sectors. The upstream segment is dominated by petrochemical giants and chemical intermediates producers who supply the raw materials, chiefly maleic anhydride (MA). The stability and cost of MA procurement are the most critical determinants of the final product's cost structure. Producers of synthetic tartaric acid (the core manufacturing stage) focus on highly optimized, energy-intensive processes involving oxidation, hydration, and complex separation/purification steps, requiring specialized chemical engineering expertise and capital investment to ensure compliance with purity standards, particularly for pharmaceutical grades.

The downstream flow involves extensive distribution channels designed to manage specialized storage and delivery requirements. Direct channels are commonly used for large-volume contracts, such as supplying major multinational beverage corporations or bulk pharmaceutical manufacturers, where producers establish long-term relationships to guarantee consistent supply and technical support. This direct model allows for better quality control feedback and customized product specifications. Conversely, indirect channels rely heavily on specialized chemical distributors and regional agents who manage smaller volumes, provide localized inventory, and handle the last-mile delivery to smaller food processors, regional construction firms, and cosmetic formulators. These intermediaries are crucial for market penetration in fragmented geographical areas, providing essential logistical and credit services.

The efficiency of the distribution network is crucial, especially when dealing with the variable needs of different sectors; for instance, the construction sector demands high volumes of industrial grade quickly, while the pharmaceutical sector requires meticulous documentation and stringent handling protocols for pharmaceutical-grade material. Technological integration, such as sophisticated Enterprise Resource Planning (ERP) systems and blockchain traceability solutions, is increasingly being adopted throughout the value chain to enhance transparency, improve forecasting accuracy, and ensure regulatory compliance, thereby adding substantial value from raw material sourcing to final product delivery and confirming the integrity of the synthetic route.

Synthetic Tartaric Acid Market Potential Customers

The primary consumers and end-users of synthetic tartaric acid are large-scale industrial entities across multiple highly regulated sectors, requiring consistent purity and bulk supply. The largest segment of buyers resides within the Food and Beverage industry, including major bottling companies, juice producers, confectionery manufacturers, and specialized bakery ingredient suppliers who utilize the acid as an essential pH regulator, flavor intensifier, and preservative. These customers prioritize bulk capacity, competitive pricing, and certified Food Chemical Codex (FCC) grade quality, often relying on long-term contracts to stabilize their ingredient costs and supply chain risks associated with fluctuations in the natural wine-derived alternative.

Another crucial customer segment is the Pharmaceutical and Nutraceutical industry, which demands the highest purity levels, adhering strictly to pharmacopeial standards (USP, EP, JP). These buyers include large generic and branded drug manufacturers who need L-(+)-Tartaric Acid for use as an excipient in tablet formulations (e.g., effervescent tablets) or critically, as a chiral resolving agent in synthesizing complex therapeutic molecules. For this segment, traceability, regulatory documentation, and consistent enantiomeric purity are non-negotiable purchasing criteria, often justifying a significantly higher price point compared to industrial grades. Their purchasing decisions are heavily influenced by supplier credentials and audit compliance.

Furthermore, the Chemical and Construction industries represent substantial potential customers. Construction firms, particularly those involved in large-scale civil engineering projects, procure industrial-grade synthetic tartaric acid derivatives for use as concrete retarders, controlling the setting time of cement in hot climates or during long pours. Chemical synthesis companies purchase various stereoisomers for use as chelating agents, masking agents in metal surface treatments (electroplating), and as intermediates in the production of specialized resins, polymers, and highly technical cleaning solutions. These customers seek performance specifications, technical support, and reliable logistics, ensuring the synthetic acid performs consistently under demanding industrial conditions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 655 Million |

| Growth Rate | CAGR 5.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Changmao Biochemical Engineering Co. Ltd., Merck KGaA, Tártaros Gonzalo S.A., Shandong Jincheng Pharmaceutical Group Co. Ltd., Caviro Group (Natural and Synthetic), Sorbic International PLC, Junbu Group, Changzhou Yabang Chemical Co. Ltd., Sigma-Aldrich (Merck), Fuso Chemical Co. Ltd., ATPGroup, Lianyungang Jindun Chemical Co. Ltd., American Tartaric Products, Noah Technologies Corporation, Henan Hongda Chemical Co. Ltd., The Chemical Company, Vinichem BV, Richman Chemical Inc., Brenntag SE, Cargill, Incorporated. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Synthetic Tartaric Acid Market Key Technology Landscape

The technological landscape of synthetic tartaric acid production is predominantly defined by the efficiency and sustainability of the chemical processes used to convert petrochemical derivatives into the desired organic acid. The established and commercially dominant technology involves the catalytic oxidation of maleic anhydride (derived from n-butane or benzene) followed by complex hydration, purification, and resolution steps to separate the stereoisomers. Recent innovations focus heavily on improving the initial catalytic oxidation stage, utilizing advanced heterogeneous catalysts, often incorporating vanadium or similar transition metals, designed to operate at lower temperatures and pressures. This refinement is critical for improving yield, reducing energy consumption, and achieving a higher selectivity for the intermediate products required for subsequent conversion to the desired tartaric acid forms, particularly the racemic mixture, which is easier and cheaper to produce in bulk.

A key focus area in current technological research is the development of scalable methods for chiral resolution—the process of separating the desired L-(+)-Tartaric Acid from the racemic DL-Tartaric Acid mixture. Traditional methods relying on differential crystallization are energy-intensive and often result in yield losses. Emerging technologies are exploring the use of specialized enzymatic resolution techniques and advanced membrane separation processes. These innovative approaches promise higher purity L-(+)-Tartaric Acid, crucial for the high-value pharmaceutical sector, while potentially offering a more cost-effective and environmentally benign separation pathway compared to legacy methods, thereby enhancing the overall commercial viability of the synthetic product.

Looking forward, the most transformative technology involves the development and commercialization of bio-based synthesis routes. This landscape shift aims to utilize renewable carbon sources, such as sugar fermentation using engineered microbial strains (e.g., specific yeast or bacteria), to produce tartaric acid, effectively bypassing the reliance on fossil fuels. While still largely in the pilot or early commercialization stage, advancements in industrial biotechnology and metabolic engineering are rapidly making these 'green' routes viable. The adoption of these bio-based technologies is driven by consumer preference for sustainable ingredients, especially in Europe and North America, and will be critical for manufacturers seeking to secure long-term, price-stable raw material sourcing, fundamentally altering the existing manufacturing paradigm dependent on petrochemical feedstock vulnerability.

Regional Highlights

-

Asia Pacific (APAC):

The Asia Pacific region represents the fastest-growing market for synthetic tartaric acid globally, driven by massive consumption patterns emanating from its rapidly expanding industrial and consumer bases. Countries like China and India are central to this growth, characterized by significant investment in food processing, pharmaceutical manufacturing, and large-scale infrastructure projects. China, in particular, dominates both production and consumption, leveraging low-cost manufacturing capabilities and acting as a primary global exporter of both technical and food-grade tartaric acid. The rising middle class across Southeast Asia is fueling explosive growth in packaged food and beverage consumption, thereby amplifying the demand for acidulants and preservatives, making the region indispensable to global synthetic tartaric acid market dynamics.

Furthermore, the pharmaceutical sector in India (often referred to as the 'Pharmacy of the World') is a voracious consumer of L-(+)-Tartaric Acid, requiring high-purity synthetic variants for chiral resolution in the synthesis of generic active pharmaceutical ingredients (APIs). The sheer scale of demographic growth and urbanization across APAC dictates sustained high volume demand. Regulatory standards, while catching up to Western norms, are steadily becoming more rigorous, pushing local manufacturers towards higher-purity synthetic grades to meet export requirements and increasing domestic quality expectations in processed food.

-

North America:

North America is a mature but high-value market characterized by stringent quality control and high per-capita consumption of processed foods and beverages. Demand in the U.S. and Canada is stable, driven by the strong presence of major multinational food and soft drink companies that require reliable, large-volume supplies of food-grade synthetic acid. The region’s advanced pharmaceutical and biotechnology sectors are major consumers of high-purity L-(+)-Tartaric Acid, primarily for complex drug synthesis and as an excipient in specialized drug delivery systems, where purity standards (USP/FCC) must be exceptionally high.

A key factor influencing the North American market is the increasing consumer emphasis on 'natural' ingredients, which occasionally favors the natural wine-derived alternative. Consequently, synthetic producers in this region often focus on specific industrial and high-tech applications, such as advanced metal finishing, industrial cleaning compounds, and use in complex chemical reactions where the cost-effectiveness and consistency of the synthetic product provide a clear advantage over bio-based or natural sources. Furthermore, the regulatory environment is extremely rigorous, placing a premium on suppliers capable of complete transparency and traceability across the entire value chain.

-

Europe:

Europe holds a substantial share of the synthetic tartaric acid market, driven by its robust and highly regulated food and pharmaceutical manufacturing industries. Western European countries, including Germany, France, and Italy, maintain consistent demand for synthetic grades used extensively in confectionery, baking powders, and specialized chemical synthesis. However, the region presents a complex demand profile because it is also the traditional hub of natural L-(+)-Tartaric Acid production (derived from wine lees), creating intense competition between synthetic and natural sources, particularly in mid-range food applications.

The European market is increasingly influenced by the European Green Deal and related sustainability initiatives. This pressure is driving manufacturers to explore and invest in cleaner synthetic routes, including bio-based production methods utilizing local European agricultural waste or fermentation feedstocks. Demand for industrial-grade synthetic tartaric acid remains robust, particularly in the construction sector where it is utilized as a cement retarder for infrastructure projects, and in specialized industrial cleaning and metal treatment processes requiring effective chelating agents. Compliance with REACH regulations is a paramount concern for all synthetic chemical suppliers operating within the European Union.

-

Latin America (LATAM):

The Latin American market is exhibiting promising growth, particularly in Brazil and Mexico, due to rapid urbanization, expanding food processing capacities, and increased foreign direct investment in local manufacturing hubs. The growth in the packaged beverage sector, including fruit juices and soft drinks, heavily utilizes synthetic tartaric acid as a cost-effective acidulant to maintain flavor stability and extend shelf life under varied climatic conditions. This region relies significantly on imports, although local blending and formulation capacities are increasing.

Economic stability, though sometimes volatile, combined with a growing pharmaceutical market focused on meeting basic healthcare needs, ensures steady demand for excipient-grade synthetic tartaric acid. The region's inherent challenges include logistical complexities and regulatory fragmentation across individual countries, which suppliers must navigate carefully. The focus for synthetic manufacturers in LATAM is centered on offering competitive pricing and reliable logistical delivery to support the rapid scaling of local food and industrial operations.

-

Middle East and Africa (MEA):

The MEA market, while currently the smallest consumer, is witnessing substantial growth driven by diversification efforts away from oil economies, particularly in the GCC countries. Investment in food security, including local food processing and bottling plants, is increasing the consumption of synthetic tartaric acid for preservation and flavor enhancement. Infrastructure development across the region also fuels demand for industrial-grade materials, including cement retarders, ensuring market potential in the construction segment.

The consumption profile in the Middle East is characterized by high requirements for imported, high-quality ingredients, often sourced from established European and Asian manufacturers. Growth in the African continent, particularly in South Africa and Nigeria, is spurred by increasing packaged food consumption and nascent pharmaceutical production. Challenges include political instability in certain sub-regions and establishing efficient, cold-chain-compliant distribution networks, requiring specialized partnerships between global suppliers and local distributors to successfully penetrate these complex markets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Synthetic Tartaric Acid Market.- Changmao Biochemical Engineering Co. Ltd.

- Merck KGaA

- Tártaros Gonzalo S.A.

- Shandong Jincheng Pharmaceutical Group Co. Ltd.

- Caviro Group (Natural and Synthetic)

- Sorbic International PLC

- Junbu Group

- Changzhou Yabang Chemical Co. Ltd.

- Sigma-Aldrich (Merck)

- Fuso Chemical Co. Ltd.

- ATPGroup

- Lianyungang Jindun Chemical Co. Ltd.

- American Tartaric Products

- Noah Technologies Corporation

- Henan Hongda Chemical Co. Ltd.

- The Chemical Company

- Vinichem BV

- Richman Chemical Inc.

- Brenntag SE

- Cargill, Incorporated.

Frequently Asked Questions

Analyze common user questions about the Synthetic Tartaric Acid market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between synthetic and natural tartaric acid?

The primary difference lies in the source and the stereoisomer composition. Natural tartaric acid (L-(+)-Tartaric Acid) is a byproduct of winemaking, while synthetic tartaric acid is manufactured chemically, often yielding the racemic mixture (DL-Tartaric Acid) and is derived from petrochemical feedstocks like maleic anhydride. Synthetic production ensures consistent, large-scale supply and cost stability, crucial for industrial applications.

Which application segment drives the highest volume demand for synthetic tartaric acid?

The Food & Beverage industry application segment, utilizing synthetic tartaric acid primarily as an acidulant, flavor enhancer, and preservative in soft drinks, juices, and confectionery, accounts for the highest volume demand globally due to the pervasive expansion of processed food consumption worldwide.

What are the main feedstock raw materials used in synthetic tartaric acid manufacturing?

The main feedstock raw material for producing synthetic tartaric acid through conventional chemical synthesis is maleic anhydride (MA). MA is typically derived from the oxidation of petrochemical sources such as n-butane or benzene. Price volatility of these raw materials significantly impacts the final cost of the synthetic product.

How does regulatory compliance impact the synthetic tartaric acid market?

Regulatory compliance is critical, particularly for pharmaceutical (USP/EP/JP) and food grade (FCC) applications. Stringent regulations mandate high purity, detailed batch traceability, and adherence to manufacturing practices (GMP/cGMP), creating high barriers to entry and favoring established manufacturers with robust quality management systems.

What technological innovations are shaping the future production of synthetic tartaric acid?

Future production is being shaped by advancements in green chemistry, specifically the development of bio-based synthesis routes utilizing microbial fermentation of renewable feedstocks (like glucose) to produce tartaric acid, offering a sustainable alternative to the current reliance on petrochemical-derived maleic anhydride.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager