Syringe Plunger Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433878 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Syringe Plunger Market Size

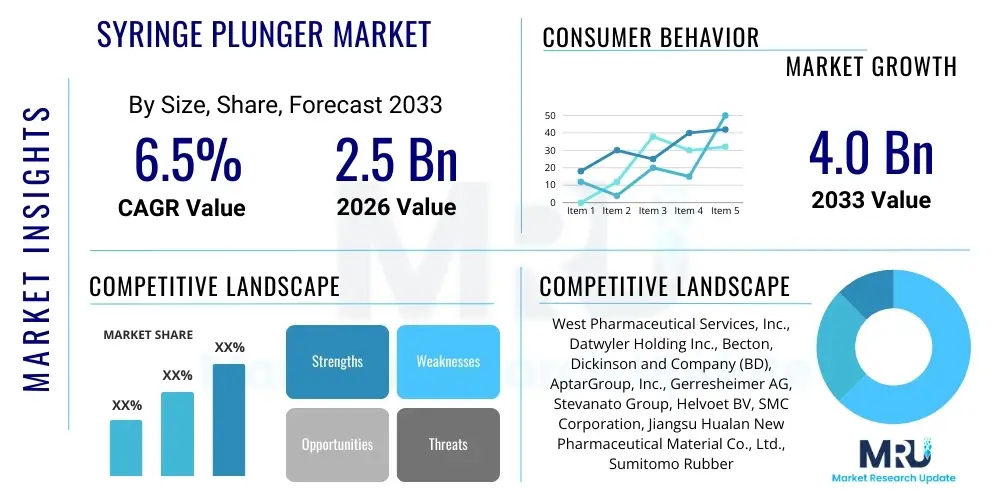

The Syringe Plunger Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 4.0 Billion by the end of the forecast period in 2033.

Syringe Plunger Market introduction

The Syringe Plunger Market encompasses the manufacturing and distribution of specialized components designed to create a seal and facilitate the controlled delivery or aspiration of fluids within a syringe barrel. Syringe plungers are critical elements, primarily manufactured from thermoplastic elastomers (TPE), rubber, or specialized polymeric materials, ensuring smooth movement, minimal friction, and robust chemical inertness compatible with a wide range of pharmaceutical compounds. Their primary function is to maintain sterility and prevent leakage while enabling precise dosage control, making them indispensable across various healthcare settings, from routine vaccinations to complex surgical procedures and drug compounding.

The core product description revolves around precision-engineered rubber stoppers or thermoplastic pistons that fit tightly inside the syringe body. These components must adhere to stringent international standards for biocompatibility and extractables/leachables testing, especially in pre-filled syringes where the plunger is in continuous contact with the drug product. Major applications include drug delivery systems, diagnostics, vaccination programs, and laboratory analysis. The benefit proposition is centered on improved patient safety through accurate dosing, enhanced sealing integrity for maintaining drug efficacy, and extended shelf life for pre-filled applications.

Driving factors propelling market expansion include the global increase in injectable drug usage, particularly biologics and biosimilars which often require specialized pre-filled delivery systems. Furthermore, the rising prevalence of chronic diseases necessitating frequent subcutaneous or intramuscular injections, coupled with increasing demand for self-administration devices, significantly stimulates the production of high-quality, low-friction syringe plungers. Technological advancements in molding techniques and material science, leading to superior sealing performance and reduced protein absorption, further cement the market's positive trajectory.

Syringe Plunger Market Executive Summary

The Syringe Plunger Market is currently experiencing robust growth driven by accelerating pharmaceutical production and the shift towards sophisticated pre-filled syringe (PFS) formats. Business trends highlight a strong emphasis on automation in manufacturing processes and the adoption of high-performance materials like cyclic olefin copolymer (COC) and advanced elastomer formulations to minimize particulate contamination and ensure drug compatibility. Suppliers are increasingly focused on vertical integration and offering comprehensive containment solutions rather than just components, responding to stringent regulatory requirements like those from the FDA and EMA. Regional trends show North America and Europe maintaining leadership due to advanced healthcare infrastructure and high adoption rates of premium drug delivery systems, while the Asia Pacific (APAC) region is poised for the fastest expansion, fueled by expanding domestic generic drug markets and government initiatives aimed at improving vaccination rates and primary care access.

Segment trends indicate that the rubber plunger segment, particularly bromobutyl and chlorobutyl rubber, dominates the market due to its established use and excellent sealing properties. However, the Thermoplastic Elastomer (TPE) segment is exhibiting the highest growth rate, primarily driven by TPE’s superior processing capabilities, lower costs in high-volume applications, and reduced risk of silicone oil dependency, which can impact certain sensitive drug formulations. Application-wise, the pre-filled syringes segment is the dominant revenue generator, reflecting the pharmaceutical industry's preference for unit-dose delivery systems that enhance convenience and reduce medication errors. Demand is also rising significantly in specialized applications, such as auto-injectors and pen injectors, which require custom-designed plungers optimized for high-force actuation and precise mechanical stability, further diversifying the product portfolio offered by key market players.

AI Impact Analysis on Syringe Plunger Market

User inquiries regarding AI's impact on the Syringe Plunger Market predominantly center on how Artificial Intelligence and Machine Learning (ML) can enhance manufacturing precision, streamline supply chain logistics, and revolutionize Quality Control (QC) processes to meet zero-defect standards required by the pharmaceutical industry. Key themes involve the automation of visual inspection systems using computer vision powered by AI for defect detection (e.g., surface imperfections, dimensional variances), the optimization of complex rubber molding parameters to reduce material waste, and the application of predictive analytics to forecast demand fluctuations and manage raw material inventory (e.g., specialized polymers and rubber compounds). Concerns often revolve around the initial high cost of integrating such advanced systems and the necessity for specialized personnel training, although the expectation remains that AI will ultimately drive down per-unit production costs while drastically improving component reliability and regulatory compliance.

- AI-driven visual inspection systems enhance defect detection sensitivity far beyond human capability, ensuring near-zero defect rates for plunger manufacturing.

- Machine learning algorithms optimize the rubber compounding and curing processes, predicting optimal injection pressures and temperatures to maintain precise dimensional stability.

- Predictive maintenance schedules for molding equipment are established using AI, minimizing unexpected downtime and maximizing operational efficiency.

- Natural Language Processing (NLP) aids in rapidly analyzing vast amounts of regulatory documentation (e.g., FDA guidance) to ensure proactive compliance updates in manufacturing protocols.

- AI-powered demand forecasting optimizes inventory levels for specialized raw materials (e.g., specialized butyl rubber, TPEs), reducing obsolescence and procurement costs.

- Robotics and AI coordination streamline automated assembly lines for integrating plungers into syringe barrels, increasing throughput and minimizing human contamination risks.

- Digital twins of manufacturing plants, managed by AI, allow for simulation and testing of new material formulations or process changes before physical implementation.

DRO & Impact Forces Of Syringe Plunger Market

The dynamics of the Syringe Plunger Market are intricately tied to global injectable drug volumes, stringent regulatory scrutiny, and advancements in polymer science. Drivers include the exponential increase in the adoption of pre-filled syringes across pharmaceutical sectors, driven by convenience and reduced dosage errors, coupled with a surging demand for specialized delivery systems used in managing chronic diseases such as diabetes and autoimmune disorders. Restraints primarily involve the critical challenge of material incompatibility, specifically the potential for extractables and leachables from the plunger material to interact negatively with sensitive drug formulations, necessitating expensive and time-consuming material validation processes. The stringent regulatory environment demanding zero tolerance for defects and contamination also acts as a constraint, placing immense pressure on manufacturers to maintain absolute quality control in high-volume production.

Opportunities in the market center on the development and commercialization of next-generation plunger materials, particularly advanced TPE and fluoropolymer technologies, that offer superior chemical resistance, lower friction coefficients without excessive siliconization, and enhanced barrier properties. Furthermore, the expansion of the biotech pipeline, focusing on high-viscosity drug products, opens up opportunities for plungers specifically engineered for high-force, precise actuation in auto-injectors. The primary impact forces shaping the market direction are technological innovation, regulatory mandates, and competitive rivalry. Technological innovation drives material breakthroughs and automation, while regulatory mandates set the non-negotiable standards for product safety and quality. Competitive rivalry focuses on achieving economies of scale and establishing robust global supply chains capable of handling stringent validation requirements, thereby differentiating market participants based on reliability and material expertise.

The market is fundamentally influenced by the increasing complexity of modern therapeutics, particularly novel vaccines and gene therapies, which require flawless containment solutions. This complexity elevates the importance of the plunger as a primary packaging component, moving it from a mere mechanical seal to a critical element of drug stability. Consequently, the high barrier to entry related to securing regulatory approval for new plunger designs and materials ensures that established manufacturers with proven track records of quality and compliance retain significant market influence, directing investment toward continuous process improvement and material validation studies.

Segmentation Analysis

The Syringe Plunger Market is extensively segmented based on material type, design type, application, and end-user, reflecting the diverse requirements across the healthcare and pharmaceutical industries. Material segmentation is crucial, differentiating between traditional elastomeric rubber formulations and newer thermoplastic alternatives, each offering specific benefits regarding chemical inertness, sealing capabilities, and cost efficiency. Design segmentation, focusing on single-piece vs. multi-component plungers, and the presence or absence of lubricity coatings (like silicone oil), impacts the plunger's suitability for high-speed automated filling and specific drug viscosities. Understanding these segments is vital for manufacturers to tailor production capabilities and for pharmaceutical companies to select the optimal component that minimizes drug interaction risks while ensuring reliable performance throughout the product's lifecycle.

- By Material Type:

- Rubber Plungers:

- Bromobutyl Rubber: Widely used for excellent gas barrier properties and chemical resistance; preferred for sensitive drug formulations.

- Chlorobutyl Rubber: Offers good heat resistance and lower permeability; commonly used in standard parenteral applications.

- Natural Rubber (Polyisoprene): Less common in pharmaceutical use due to extractables concerns, mainly utilized in non-critical general medical applications.

- Thermoplastic Elastomer (TPE) Plungers:

- Offer high purity, reduced propensity for interaction with sensitive biologics, and are easier to process with automated assembly.

- Gaining traction in pre-filled syringes due to reduced reliance on silicone oil lubrication and enhanced environmental sustainability in manufacturing.

- Other Materials (e.g., Silicone, Advanced Polymers): Utilized for highly specialized or experimental drug delivery systems requiring unique temperature or chemical stability.

- Rubber Plungers:

- By Syringe Type:

- Conventional Syringes (Disposable): High volume market segment, focused on cost-effectiveness and mass immunization programs.

- Pre-filled Syringes (PFS): Fastest growing segment; requires high-precision plungers verified for long-term drug stability and low extractables.

- Safety Syringes: Incorporate protective features; plungers must integrate seamlessly with safety mechanisms (e.g., retraction features).

- By Application:

- Drug Delivery Systems: Encompassing injectable therapeutics, vaccines, and high-viscosity biologics.

- Diagnostics and Laboratory Use: Plungers used in specimen collection, reconstitution, and precise fluid handling in clinical settings.

- Compounding and Mixing: Components used in specialized sterile environments for preparing custom medications.

- By End User:

- Pharmaceutical and Biotechnology Companies: Major consumers, utilizing plungers for large-scale production of injectable drugs and biologics.

- Hospitals and Clinics: Direct purchasers of syringes and associated components for immediate patient care and institutional use.

- Contract Manufacturing Organizations (CMOs): Significant purchasers who produce pre-filled systems on behalf of drug innovators, requiring diverse material and design specifications.

- Research Laboratories: Smaller volume consumers needing specialized, highly chemically inert components for research purposes.

Value Chain Analysis For Syringe Plunger Market

The value chain for the Syringe Plunger Market is characterized by highly specialized upstream material suppliers and stringent quality requirements throughout the manufacturing and distribution phases. The upstream segment involves the synthesis and refinement of primary raw materials, predominantly specialized butyl rubbers (bromobutyl and chlorobutyl) and medical-grade TPEs. These suppliers must adhere to strict quality control standards, ensuring consistency in chemical composition, vulcanization characteristics, and purity, as any variability directly impacts the performance and regulatory compliance of the final plunger product. Given the critical nature of these components, long-term relationships and comprehensive material validation studies between the material producers and plunger manufacturers are essential for risk mitigation and supply chain stability.

The manufacturing phase represents the core value addition, where raw materials undergo high-precision molding (e.g., injection molding, compression molding) and subsequent processing steps such as washing, siliconization (in many cases), and sterile packaging. Manufacturers invest heavily in automated, cleanroom facilities (ISO 7 or higher) and advanced quality inspection systems, often leveraging AI and computer vision, to achieve the near-zero defect rates demanded by pharmaceutical clients. The direct channel focuses on large-volume sales from plunger manufacturers to major pharmaceutical companies (OEMs) and Contract Manufacturing Organizations (CMOs) who integrate these components into their final drug products, requiring deep technical consultation and rigorous batch traceability documentation.

Downstream distribution channels serve both the primary pharmaceutical manufacturing sector and, indirectly, the healthcare providers. For pre-filled syringes, the plunger manufacturer's product is integrated into the final drug package by the pharma company and then distributed through established pharmaceutical distribution networks (indirect channel). For conventional disposable syringes, the distribution often moves through large medical device distributors and wholesalers to hospitals, clinics, and retail pharmacies. The efficiency and reliability of these distribution channels are paramount, particularly in ensuring the integrity of the sterile packaging and timely delivery to support high-volume, global immunization programs and therapeutic schedules. The shift towards direct-to-pharmaceutical company supply chains emphasizes technical support and customization over broad generalized distribution.

Syringe Plunger Market Potential Customers

The primary customers and end-users of syringe plungers are large pharmaceutical and biotechnology companies that utilize these components in the manufacture of injectable drug products, particularly those packaged in pre-filled syringes and auto-injectors. These customers demand highly specialized plungers that are compatible with complex biologic formulations, maintain long-term stability, and demonstrate minimal particulate burden. The selection process is exhaustive, involving extensive compatibility and extractables/leachables testing before final supplier qualification. A secondary but rapidly growing customer segment includes Contract Manufacturing Organizations (CMOs) and Contract Development and Manufacturing Organizations (CDMOs) which provide outsourced filling and packaging services to the broader pharmaceutical industry, requiring diverse inventories of plungers suitable for varied client needs.

Hospitals, clinics, and institutional healthcare providers represent the indirect customer base, consuming vast quantities of syringes for general medical procedures, vaccinations, and routine patient care. Although they purchase the complete syringe assembly, their demand profile dictates the volume and quality requirements fed back up the supply chain. Furthermore, government bodies and non-governmental organizations (NGOs) involved in public health and immunization programs, such as WHO and UNICEF, are significant purchasers, often prioritizing cost-effective, high-volume plungers suitable for mass-produced standard disposable syringes and essential medicines. The common denominator among all potential buyers is the non-negotiable requirement for sterility, dimensional accuracy, and material traceability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 4.0 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | West Pharmaceutical Services, Inc., Datwyler Holding Inc., Becton, Dickinson and Company (BD), AptarGroup, Inc., Gerresheimer AG, Stevanato Group, Helvoet BV, SMC Corporation, Jiangsu Hualan New Pharmaceutical Material Co., Ltd., Sumitomo Rubber Industries, Ltd., Schott AG, Tekni-Plex, Inc., Nolato AB, Tianjin Sinsega Medical Device Co., Ltd., Wuxi Medical Instrument Co., Ltd., SGD Pharma, Nemera, Fritz Gyger AG, Daikyo Seiko, Ltd., Baxter International Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Syringe Plunger Market Key Technology Landscape

The technological landscape of the Syringe Plunger Market is defined by advanced material science, precision molding, and sophisticated surface treatment techniques aimed at optimizing performance and minimizing drug interaction. A crucial area of innovation is the shift towards 'silicone-free' or reduced-silicone plungers, particularly TPE plungers, which mitigates concerns regarding silicone oil migration into sensitive protein-based drugs, leading to aggregation or stability issues. This technological advancement requires ultra-precise molding capabilities and the use of low-friction polymer compositions or alternative coatings (e.g., plasma treatment, hydrogel coatings) to ensure smooth plunger movement and reliable sealing without compromising drug integrity. The development of advanced halogenated butyl rubber formulations that offer superior chemical resistance and reduced extractables also remains a cornerstone of material technology.

Manufacturing technology emphasizes high-speed, fully automated production lines operating within stringent cleanroom environments. Automated visual inspection systems, increasingly integrated with AI for complex defect pattern recognition, have become standard, ensuring every component meets required dimensional tolerances and visual purity standards. Furthermore, the technology for plunger processing, including specialized washing and sterilization techniques (like gamma irradiation or E-beam sterilization), is continuously evolving to meet the regulatory demand for lower bioburden and particulate levels. Continuous real-time monitoring of manufacturing parameters using IoT sensors and data analytics ensures process stability and facilitates rapid identification of potential quality excursions, supporting the industry's zero-defect objective.

Innovation also focuses heavily on the design phase, particularly for plungers used in auto-injectors and high-viscosity drug applications. This involves utilizing Computer-Aided Engineering (CAE) and Finite Element Analysis (FEA) to model and predict the mechanical performance of the plunger under high force actuation, ensuring the component maintains structural integrity and provides consistent release kinetics. The key technological objective remains to produce a consistent, highly reliable, chemically inert seal that performs flawlessly across the syringe's functional range, whether for immediate use or over years of storage in a pre-filled system.

Regional Highlights

The global Syringe Plunger Market exhibits distinct regional dynamics influenced by healthcare spending, regulatory frameworks, and pharmaceutical manufacturing capacities.

- North America: Dominates the market in terms of revenue share, driven by a highly advanced healthcare system, substantial investment in biotechnology and R&D, and the early adoption of high-value pre-filled syringe systems. The stringent regulatory environment set by the FDA necessitates the use of premium, validated plunger components, favoring established global suppliers with proven quality track records. High prevalence of chronic diseases and robust drug pipeline innovation contribute to sustained demand, especially for specialized plungers used in biologics and personalized medicine.

- Europe: Represents the second-largest market, characterized by strong governmental support for universal healthcare and a significant presence of global pharmaceutical manufacturers (e.g., Germany, Switzerland). The European Medicines Agency (EMA) requires compliance with rigorous standards, similar to the FDA, promoting the use of high-quality bromobutyl and TPE plungers. The emphasis on advanced auto-injector and pen systems, particularly in diabetes and autoimmune treatment, drives innovation in plunger design and material coatings to ensure patient compliance and ease of use.

- Asia Pacific (APAC): Projected to register the highest CAGR during the forecast period. This growth is attributable to massive population bases, increasing healthcare expenditure, and the expansion of generic and biosimilar manufacturing hubs in countries like China and India. While the demand for cost-effective standard syringes remains high, there is a rapid shift towards local production of pre-filled systems, fueled by government initiatives to improve vaccination rates and modernize domestic pharmaceutical supply chains. Japan and South Korea lead the region in adopting advanced drug delivery technologies.

- Latin America (LATAM): Exhibits steady growth, primarily driven by expanding access to essential medicines and the ongoing efforts to improve healthcare infrastructure. The market heavily relies on imported plunger technologies, but local manufacturing is gradually increasing. Economic stability and governmental procurement patterns strongly influence the demand for both conventional and pre-filled syringe components.

- Middle East and Africa (MEA): Currently holds the smallest share but shows potential due to high healthcare investment in Gulf Cooperation Council (GCC) countries and increasing focus on addressing infectious and non-communicable diseases. The demand is often met through international sourcing, with quality requirements varying significantly across the sub-regions, favoring durable and reliably supplied components.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Syringe Plunger Market.- West Pharmaceutical Services, Inc.

- Datwyler Holding Inc.

- Becton, Dickinson and Company (BD)

- AptarGroup, Inc.

- Gerresheimer AG

- Stevanato Group

- Helvoet BV

- SMC Corporation

- Jiangsu Hualan New Pharmaceutical Material Co., Ltd.

- Sumitomo Rubber Industries, Ltd.

- Schott AG

- Tekni-Plex, Inc.

- Nolato AB

- Tianjin Sinsega Medical Device Co., Ltd.

- Wuxi Medical Instrument Co., Ltd.

- SGD Pharma

- Nemera

- Fritz Gyger AG

- Daikyo Seiko, Ltd.

- Baxter International Inc.

Frequently Asked Questions

Analyze common user questions about the Syringe Plunger market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary material requirements for syringe plungers in pre-filled syringes (PFS)?

The primary material requirements for PFS plungers include excellent chemical inertness, minimal extractables and leachables, and robust sealing integrity over the long term. Bromobutyl rubber and high-purity thermoplastic elastomers (TPEs) are preferred due to their low gas permeability and compatibility with sensitive biologic drug formulations, often necessitating rigorous testing for protein aggregation.

How does the presence of silicone oil affect plunger performance and drug stability?

Silicone oil is traditionally used to lubricate the plunger surface, reducing friction and ensuring smooth movement within the syringe barrel. However, in sensitive applications, particularly with protein-based biologics, silicone oil can potentially induce aggregation or particle formation, leading to a rising demand for silicone-free or reduced-silicone plungers utilizing advanced TPEs or alternative surface coatings.

Which market segment is expected to show the fastest growth rate?

The Thermoplastic Elastomer (TPE) Plunger segment is expected to exhibit the fastest growth. This is driven by TPE's advantages in manufacturing automation, reduced contamination risks, and their increasing use as an alternative to traditional rubber for sensitive drug products where interaction with vulcanization agents or silicone oil is a concern.

What role do regulatory bodies play in the Syringe Plunger Market?

Regulatory bodies such as the FDA and EMA play a critical role by imposing strict quality standards regarding material biocompatibility, extractables profiles, and manufacturing processes (cGMP compliance). Compliance ensures the plunger does not compromise the drug product's safety, efficacy, or stability, requiring extensive material validation and documentation from manufacturers.

What is the impact of auto-injectors on syringe plunger design?

Auto-injectors demand plungers designed for high-force actuation and precise dose delivery. The plungers must exhibit superior mechanical stability, consistent break-loose and glide forces, and high dimensional accuracy to ensure reliable function within the automated device mechanisms, often leading to the customization of plunger geometry and material formulation for specific auto-injector platforms.

Why is the Asia Pacific (APAC) region a key focus for market expansion?

APAC is a key focus due to rising healthcare expenditure, expanding access to healthcare services, and the rapid growth of local pharmaceutical manufacturing, particularly for generic and biosimilar drugs. Countries like China and India are aggressively increasing their domestic production capacity, driving immense volume demand for both conventional and increasingly complex pre-filled syringe plungers to meet local and global supply needs.

What are the main challenges related to extractables and leachables (E&L) in syringe plungers?

E&L challenges stem from potential chemical compounds migrating from the plunger material (e.g., residues from vulcanization or antioxidants) into the stored drug solution. This is a critical concern for patient safety and drug stability, necessitating specialized testing and the use of ultra-pure, validated pharmaceutical-grade elastomers and polymers to mitigate interaction risks.

How is AI specifically enhancing the manufacturing of syringe plungers?

AI is primarily used to optimize Quality Control (QC) through sophisticated computer vision systems for automated defect detection, achieving higher sensitivity than traditional methods. Furthermore, ML algorithms are used for predictive maintenance of complex molding machinery and optimizing material processing parameters to ensure consistent dimensional tolerances and reduced material waste.

What differentiates a conventional syringe plunger from a pre-filled syringe plunger?

The key differentiator is the longevity requirement. Conventional plungers are designed for immediate or short-term use. PFS plungers, however, act as primary packaging, requiring material purity and sealing reliability over the drug's entire shelf life (often 1-3 years), demanding far stricter E&L testing and material selection criteria to prevent drug degradation.

What are the environmental considerations impacting material choices in the plunger market?

Environmental concerns are driving interest in Thermoplastic Elastomers (TPEs) over traditional rubber, as TPEs are often easier to recycle and their manufacturing process generates less waste and fewer complex chemical byproducts compared to the vulcanization process required for butyl rubber, aligning with pharmaceutical companies' sustainability goals.

Explain the concept of 'break-loose' and 'glide' force related to syringe plungers.

Break-loose force is the initial force required to start the plunger moving from a static position within the barrel, which must be low enough for easy initiation. Glide force is the sustained force required to maintain movement. Both must be consistently low and predictable to ensure accurate and comfortable administration, especially in self-injection devices.

What impact does the increasing complexity of biologic drugs have on plunger technology?

Biologic drugs are highly sensitive to external factors, including container components. Their complexity drives demand for ultra-inert materials (like specialized TPE or fluoropolymers) and necessitates customized plunger designs to handle higher viscosities and prevent protein adsorption onto the component surface, safeguarding drug integrity and efficacy.

Are syringe plungers considered a primary or secondary packaging component?

In the context of pre-filled syringes (PFS), the plunger is considered a critical primary packaging component because it is in direct contact with the drug product and is essential for maintaining sterility, integrity, and stability throughout the product's shelf life. For conventional syringes filled just prior to use, it functions primarily as a delivery mechanism.

What is the significance of the shift toward advanced polymer materials like COC/COP in the market?

The significance lies in the use of Cyclic Olefin Copolymers (COC) or Polymers (COP) for the syringe barrel itself. When COC/COP barrels are used, the corresponding plungers must be highly compatible, often requiring optimized TPEs to achieve a perfect seal and minimize friction in a non-glass environment, supporting the move towards plastic-based PFS systems.

How does cleanroom manufacturing affect the cost structure of syringe plungers?

Cleanroom manufacturing (e.g., ISO Class 7 or higher) is mandatory to minimize particulate contamination and bioburden. This requirement significantly increases operational costs due to specialized air filtration, rigorous personnel protocols, advanced automation equipment, and continuous environmental monitoring, which is reflected in the final unit price of pharmaceutical-grade plungers.

What is driving the market consolidation among key syringe plunger manufacturers?

Market consolidation is driven by the need for vertical integration, allowing manufacturers to control the entire supply chain from raw material to final component processing. Furthermore, achieving the global economies of scale and securing the substantial investment required for advanced cleanroom technology and regulatory validation favors larger, established players capable of serving major global pharmaceutical clients.

Describe the supply chain vulnerability related to raw materials for rubber plungers.

The supply chain for rubber plungers relies on specialized petrochemical derivatives, specifically high-purity butyl rubber. Vulnerability arises from the limited number of qualified global suppliers for these medical-grade compounds, making the market susceptible to price volatility and supply disruptions caused by geopolitical events or large-scale industrial incidents.

In which application segment is dimensional accuracy most critical for the plunger?

Dimensional accuracy is most critical in high-precision, automated dosing applications, particularly in auto-injectors and specialized pen systems. Minute variations in plunger diameter or height can drastically impact the consistency of the administered dose, leading to either under- or over-dosing, necessitating tolerances measured in microns.

How does the demand for syringes in vaccination programs influence the market?

Mass vaccination programs, such as global COVID-19 or routine immunization efforts, generate enormous, sudden surges in demand for standard disposable syringes and their components, including plungers. This forces manufacturers to rapidly increase production capacity, often prioritizing high-volume, cost-effective rubber plunger designs to meet global public health needs quickly.

What is the future outlook for plunger surface treatment technology?

The future outlook points toward advanced non-silicone lubrication methods. This includes plasma surface treatment (creating a permanently slick, inert layer on the polymer) and the use of proprietary low-friction coatings that are chemically bonded to the material, ensuring long-term low glide force consistency without the extractable risks associated with free silicone oil.

How are advancements in 3D printing impacting the development cycle of syringe plungers?

While 3D printing is not used for mass production due to material limitations and speed, it is heavily utilized during the R&D phase. Rapid prototyping via 3D printing allows designers to quickly test new plunger geometries and fit-and-function concepts before committing to expensive tooling for injection or compression molding, significantly accelerating the design validation process.

What role do CMOs play in driving innovation in plunger selection?

Contract Manufacturing Organizations (CMOs) often handle diverse drug formulations from multiple pharmaceutical clients. This requires them to maintain expertise across a wide range of plunger materials and designs, prompting them to push suppliers for versatile, multi-purpose plungers that can be validated for use with various drug products, thereby indirectly driving standardization and quality refinement.

Why is traceability essential in the syringe plunger supply chain?

Traceability is essential for regulatory compliance and patient safety. Every batch of plungers must be traceable back to the specific raw material lot, processing conditions, and sterilization cycle. This allows for rapid isolation and recall of components in the event of a quality issue, preventing contaminated or defective batches from reaching patients.

What is the difference between bromobutyl and chlorobutyl rubber in plunger applications?

Both are halogenated butyl rubbers offering good barrier properties. Bromobutyl generally offers superior chemical stability and lower levels of extractables, making it the material of choice for highly sensitive biopharmaceuticals. Chlorobutyl is often utilized in more standard parenteral applications where chemical sensitivity is less pronounced, often balancing performance with cost-effectiveness.

How does the development of high-viscosity drugs challenge current plunger technology?

High-viscosity drugs (e.g., concentrated biologics) require significantly greater force to inject. This challenges the plunger by demanding higher structural integrity to prevent deformation under pressure, while still maintaining a low glide force to avoid patient discomfort, necessitating specialized, reinforced TPE or customized rubber compounds and robust auto-injector mechanisms.

What is the impact of safety syringes on the demand for plungers?

Safety syringes, designed to prevent needlestick injuries, often incorporate mechanisms that interact directly with the plunger (e.g., retraction features or lock mechanisms). This increases the complexity of the plunger design, requiring higher precision molding and customized features to ensure seamless integration and reliable operation of the safety function.

What major growth inhibitors are restraining the market?

Major inhibitors include the high capital expenditure required for establishing cleanroom manufacturing facilities, the lengthy and costly regulatory validation process required for new plunger materials, and the constant competitive pressure to reduce the per-unit cost of components while maintaining zero-defect quality standards for pharmaceutical use.

How is the move towards personalized medicine influencing syringe plunger design?

Personalized medicine often involves smaller batch sizes of highly potent or complex drug products. This necessitates flexible manufacturing capable of producing customized plungers optimized for specific, unique drug formulations, focusing less on mass volume and more on material exclusivity, low adsorption properties, and specialized container closure integrity.

Explain the significance of low friction coefficient in plunger material selection.

A low friction coefficient is vital because it determines the necessary force for injection (glide force). A lower, consistent friction minimizes patient pain and ensures reliable function in mechanical injection devices like auto-injectors. Materials and coatings are selected specifically to achieve the optimal balance between sealing force and smooth movement.

What are the typical quality assurance tests performed on syringe plungers?

Typical quality assurance tests include dimensional measurement (using optical or AI-based vision systems), functional testing (break-loose and glide force measurement), extractables and leachables analysis, particulate testing (counting visible and sub-visible particles), and container closure integrity (CCI) testing to ensure a hermetic seal is maintained.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager