T7 RNA Polymerase Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439605 | Date : Jan, 2026 | Pages : 243 | Region : Global | Publisher : MRU

T7 RNA Polymerase Market Size

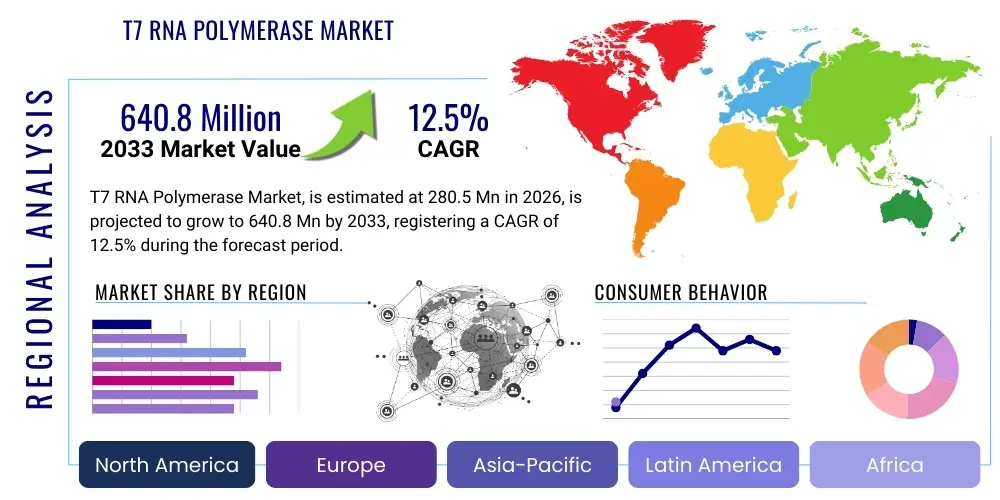

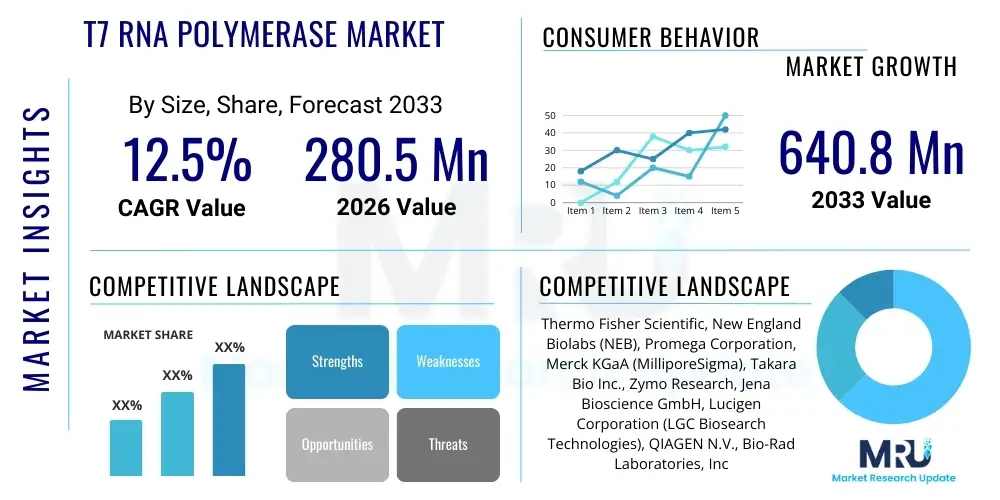

The T7 RNA Polymerase Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 280.5 Million in 2026 and is projected to reach USD 640.8 Million by the end of the forecast period in 2033.

T7 RNA Polymerase Market introduction

The T7 RNA Polymerase market is experiencing robust growth driven by its indispensable role in various molecular biology applications, particularly in gene expression systems. T7 RNA Polymerase is a highly processive, DNA-dependent RNA polymerase derived from the T7 bacteriophage, renowned for its exceptional specificity and efficiency in transcribing DNA templates downstream of a T7 promoter. Its unique characteristics, including high transcription rates and relative insensitivity to cellular inhibitors, make it a cornerstone enzyme for in vitro transcription (IVT) and recombinant protein production. This enzyme enables the rapid and abundant synthesis of RNA molecules, including messenger RNA (mRNA), transfer RNA (tRNA), ribosomal RNA (rRNA), and various non-coding RNAs, which are critical for diverse research and therapeutic endeavors.

Major applications of T7 RNA Polymerase span across several high-growth areas within the life sciences and biotechnology sectors. It is extensively utilized in the production of mRNA for vaccine and therapeutic development, where the ability to synthesize large quantities of high-quality mRNA is paramount. Furthermore, T7 RNA Polymerase is central to the expression of recombinant proteins in bacterial systems, facilitating the manufacture of enzymes, antibodies, and other biopharmaceuticals. Its utility extends to molecular diagnostics, where it drives the amplification of RNA targets, and in fundamental research for studying gene function, RNA structure, and regulatory mechanisms. The enzyme's straightforward mechanism and high yield offer significant benefits, simplifying experimental procedures and accelerating discovery processes.

Several driving factors are propelling the T7 RNA Polymerase market forward. The escalating global demand for mRNA-based vaccines and therapies, catalyzed by recent public health crises, has significantly boosted the need for efficient mRNA synthesis tools. Concurrently, the increasing investment in gene therapy and personalized medicine research, coupled with advancements in synthetic biology and bioinformatics, is expanding the applications of T7 RNA Polymerase. The enzyme's integration into automated high-throughput screening platforms and its role in developing novel diagnostic assays further underscore its market relevance. Continuous innovation in enzyme engineering to enhance stability, specificity, and yield also contributes to its growing adoption across academic, industrial, and clinical settings.

T7 RNA Polymerase Market Executive Summary

The T7 RNA Polymerase market is poised for significant expansion, fueled by dynamic business trends that emphasize accelerated biotechnological innovation and the commercialization of novel biotherapeutics. Key business trends include the strategic partnerships and collaborations between enzyme manufacturers and pharmaceutical companies aimed at streamlining the supply chain for mRNA production, especially in the context of vaccine development. There is also a notable trend towards developing customized T7 RNA Polymerase variants with improved characteristics, such as enhanced thermostability or modified substrate specificities, to meet specialized application requirements. Furthermore, the market is witnessing increasing investment in automated synthesis platforms that leverage T7 RNA Polymerase for high-throughput RNA production, driving efficiency and scalability in research and industrial applications.

Regionally, the market exhibits varied growth dynamics. North America, particularly the United States, maintains a dominant position due to its robust biotechnology and pharmaceutical infrastructure, substantial R&D investments, and the presence of numerous key market players and academic research institutions. Europe also represents a significant market, driven by strong governmental support for life sciences research and a growing focus on personalized medicine and advanced therapies. The Asia Pacific region is emerging as the fastest-growing market, primarily propelled by increasing healthcare expenditure, expanding biopharmaceutical manufacturing capabilities, and a surge in biotechnology research initiatives in countries like China, Japan, and India. These regions are actively investing in facilities and expertise to become global hubs for bioproduction and research, thereby escalating the demand for T7 RNA Polymerase.

Segment-wise, the market is seeing pronounced trends across its product, application, and end-user categories. In terms of product, recombinant T7 RNA Polymerase continues to hold the largest share, valued for its purity and consistent performance, while modified variants are gaining traction for niche applications requiring specific properties. The application segment is heavily influenced by the exponential growth in mRNA synthesis for vaccine and therapeutic development, which is becoming the leading driver. Gene expression studies and protein production also remain critical segments, albeit with a steady growth trajectory. From an end-user perspective, biotechnology and pharmaceutical companies are the primary revenue generators, driven by large-scale production requirements. However, academic and research institutions continue to be foundational consumers, contributing to market innovation and foundational research with T7 RNA Polymerase applications.

AI Impact Analysis on T7 RNA Polymerase Market

User inquiries regarding the impact of Artificial intelligence (AI) on the T7 RNA Polymerase market frequently revolve around its potential to revolutionize enzyme engineering, optimize experimental protocols, and accelerate drug discovery workflows. Common questions include how AI can enhance the design of T7 RNA Polymerase variants with improved catalytic efficiency or stability, whether AI can predict optimal reaction conditions for maximal RNA yield, and its role in integrating T7 RNA Polymerase-based synthesis into high-throughput automated systems. Users are also keen to understand if AI can contribute to the discovery of novel RNA targets for therapeutic intervention and how it might streamline the quality control and characterization of RNA products. The overarching expectation is that AI will introduce unprecedented levels of precision, speed, and cost-effectiveness in areas currently bottlenecked by traditional, labor-intensive approaches in T7 RNA Polymerase applications.

- AI-driven protein engineering for novel T7 RNA Polymerase variants with enhanced catalytic activity, specificity, and thermostability.

- Optimization of in vitro transcription reaction conditions (e.g., substrate concentrations, temperature, buffer composition) using machine learning algorithms.

- Automation and robotic integration of T7 RNA Polymerase-based RNA synthesis workflows, enabling high-throughput screening and production.

- Predictive modeling for RNA folding, stability, and degradation, improving the design of therapeutic mRNA.

- Enhanced quality control and characterization of synthesized RNA products through AI-powered analytics of spectroscopic or sequencing data.

- Accelerated discovery of novel RNA targets and therapeutic molecules by analyzing vast biological datasets, often leveraging T7 RNA Polymerase for validation.

- Development of smart laboratory systems that autonomously adapt T7 RNA Polymerase protocols based on real-time feedback and AI analysis.

- Streamlining supply chain and inventory management for T7 RNA Polymerase and related reagents through predictive analytics.

DRO & Impact Forces Of T7 RNA Polymerase Market

The T7 RNA Polymerase market is shaped by a complex interplay of drivers, restraints, and opportunities, collectively acting as impact forces that dictate its growth trajectory. Key drivers include the exponential growth in demand for mRNA vaccines and therapeutics, where T7 RNA Polymerase is the primary enzyme for large-scale RNA synthesis, proving critical during global health emergencies. Additionally, increasing investments in gene therapy and cell therapy research, coupled with advancements in synthetic biology and molecular diagnostics, create a continuous demand for efficient and reliable RNA production tools. The ease of use, high yield, and specificity of T7 RNA Polymerase further solidify its position as an indispensable reagent in both academic research and industrial applications. Furthermore, the rising adoption of high-throughput screening methods and automation in drug discovery and development amplifies the need for consistent and scalable RNA synthesis facilitated by this enzyme.

Despite significant growth, the market faces several restraints that could impede its expansion. The relatively high cost associated with the production and purification of high-quality, research-grade T7 RNA Polymerase and related reagents can be a barrier for smaller research institutions or developing economies. Furthermore, the inherent instability of RNA molecules, which are the products of T7 RNA Polymerase activity, requires careful handling and storage conditions, adding complexity and cost to research and manufacturing processes. Competition from alternative expression systems, though often less efficient for specific applications, also presents a challenge. Stringent regulatory guidelines, particularly for mRNA-based therapeutics and vaccines, can prolong product development cycles and increase compliance costs, indirectly impacting the demand for T7 RNA Polymerase as a key component in these processes.

Opportunities within the T7 RNA Polymerase market are substantial and diverse. The burgeoning field of personalized medicine, requiring patient-specific therapeutic RNA molecules, offers a long-term growth avenue for the enzyme. Expansion into emerging markets, particularly in Asia Pacific and Latin America, where biotechnological research and biopharmaceutical manufacturing are rapidly scaling up, presents significant commercial prospects. Ongoing research into modifying T7 RNA Polymerase to enhance its properties, such as improved fidelity, processivity, or altered promoter specificity, could open new application domains and improve existing ones. The development of novel diagnostic assays leveraging T7 RNA Polymerase for highly sensitive and specific detection of pathogens and biomarkers also represents a promising area of growth, as does its increasing integration into advanced synthetic biology platforms for creating complex biological systems and tools. These opportunities are expected to significantly mitigate the impact of existing restraints and propel market expansion.

Segmentation Analysis

The T7 RNA Polymerase market is comprehensively segmented to provide a detailed understanding of its diverse components and growth dynamics. This segmentation helps in identifying key market drivers, restraints, and opportunities across various product types, applications, and end-users, thereby offering critical insights for strategic decision-making. The granular analysis allows market players to tailor their product offerings and marketing strategies to specific customer needs and market niches, optimizing their competitive positioning. Understanding these segments is crucial for forecasting market trends and identifying areas ripe for innovation and investment within the broader biotechnology and life sciences landscape.

- By Product Type:

- Recombinant T7 RNA Polymerase

- Modified T7 RNA Polymerase

- Others (e.g., mutant enzymes, fusion proteins with T7 RP activity)

- By Application:

- In Vitro Transcription (IVT)

- Gene Expression & Protein Production

- mRNA Synthesis (for Vaccines & Therapeutics)

- RNA Vaccine Production

- Diagnostics

- Research & Development

- Synthetic Biology

- By End-User:

- Biotechnology & Pharmaceutical Companies

- Academic & Research Institutions

- Contract Research Organizations (CROs)

- Diagnostic Laboratories

- Government & Private Research Centers

- By Purity Grade:

- Research Grade

- GMP Grade (Good Manufacturing Practice)

- By Form:

- Liquid Form

- Lyophilized Form

- By Scale of Production:

- Laboratory Scale

- Pilot Scale

- Commercial Scale

Value Chain Analysis For T7 RNA Polymerase Market

The value chain for the T7 RNA Polymerase market encompasses several critical stages, from the initial research and development of the enzyme to its final distribution and end-use. Upstream activities primarily involve the genetic engineering and expression of T7 RNA Polymerase in host organisms, often bacterial strains like E. coli. This stage includes plasmid design, fermentation, cell lysis, and rigorous purification processes to ensure high purity and activity of the enzyme. Key players in this segment are typically specialized biotechnology companies and research institutions focused on enzyme discovery and optimization. The quality and efficiency of these upstream processes are paramount as they directly impact the performance and cost-effectiveness of the final product, influencing its adoption across various downstream applications.

Midstream activities in the value chain involve the formulation, packaging, and quality control of the purified T7 RNA Polymerase. Manufacturers combine the enzyme with appropriate buffers, stabilizers, and other reagents to create complete kits for in vitro transcription or gene expression. Extensive quality control testing, including activity assays, purity assessments, and functional validation in target applications, is crucial to ensure product consistency and reliability. This stage often includes the scaling up of production to meet commercial demand, adhering to stringent quality standards, especially for GMP-grade enzymes destined for therapeutic and diagnostic applications. The efficiency of these manufacturing processes directly affects the market's ability to supply high-quality reagents at competitive prices.

Downstream activities involve the distribution channel, which can be either direct or indirect, and the eventual consumption by end-users. Direct distribution typically involves manufacturers selling directly to large biotechnology and pharmaceutical companies or major research consortia, allowing for direct communication and customized solutions. Indirect channels utilize a network of distributors, wholesalers, and online marketplaces to reach a broader customer base, including academic institutions, smaller diagnostic labs, and individual researchers globally. The choice of distribution channel often depends on the customer segment, geographical reach, and the scale of demand. End-users then integrate T7 RNA Polymerase into their specific applications, such as mRNA vaccine production, gene expression studies, or molecular diagnostics, completing the value chain by deriving therapeutic or research value from the enzyme.

T7 RNA Polymerase Market Potential Customers

The primary potential customers and end-users of T7 RNA Polymerase are diverse, spanning across various sectors within the life sciences and healthcare industries, all driven by the need for efficient and specific RNA synthesis. Biotechnology companies constitute a major customer segment, leveraging T7 RNA Polymerase for the development and production of novel biopharmaceuticals, including recombinant proteins, therapeutic antibodies, and advanced gene-editing tools. Their demand is often for high-purity, sometimes GMP-grade, enzymes suitable for large-scale manufacturing and clinical applications. These companies are continuously innovating, requiring reliable and high-performance T7 RNA Polymerase to drive their research pipelines and commercial production efforts.

Pharmaceutical companies represent another significant customer base, particularly with the escalating focus on mRNA-based therapeutics and vaccines. These companies depend on T7 RNA Polymerase for the in vitro synthesis of large quantities of high-quality mRNA, which serves as the active ingredient in cutting-edge vaccines and various therapeutic modalities for diseases ranging from infectious diseases to cancer. The rigorous regulatory environment in pharmaceuticals necessitates T7 RNA Polymerase products that meet stringent quality and purity standards, often requiring comprehensive documentation and validation. The accelerated pace of drug discovery and development in this sector ensures a consistent and growing demand for this critical enzyme, vital for advancing their therapeutic platforms.

Academic and research institutions, including universities, government laboratories, and non-profit research organizations, form a foundational customer segment. These entities utilize T7 RNA Polymerase extensively for basic scientific research, such as gene function studies, RNA structure analysis, protein expression profiling, and developing new molecular biology tools. While their scale of purchase may be smaller than industrial players, their collective demand is substantial, and their research often leads to new applications and innovations that drive future market growth. Additionally, contract research organizations (CROs) and diagnostic laboratories are increasingly adopting T7 RNA Polymerase for their service offerings, including molecular diagnostics, custom RNA synthesis, and preclinical research, further broadening the customer landscape for this versatile enzyme.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 280.5 Million |

| Market Forecast in 2033 | USD 640.8 Million |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thermo Fisher Scientific, New England Biolabs (NEB), Promega Corporation, Merck KGaA (MilliporeSigma), Takara Bio Inc., Zymo Research, Jena Bioscience GmbH, Lucigen Corporation (LGC Biosearch Technologies), QIAGEN N.V., Bio-Rad Laboratories, Inc., Agilent Technologies, F. Hoffmann-La Roche AG, Enzo Life Sciences, Inc., TransGen Biotech, Sino Biological, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

T7 RNA Polymerase Market Key Technology Landscape

The T7 RNA Polymerase market is deeply intertwined with a dynamic technological landscape that continuously drives innovation and expands its utility. Advances in genetic engineering and recombinant DNA technology are fundamental, enabling the precise manipulation of the T7 RNA Polymerase gene to produce high-purity, high-activity enzymes in large quantities. These technologies also facilitate the development of modified T7 RNA Polymerase variants with enhanced characteristics, such as increased thermostability, altered substrate specificities, or improved processivity, which are crucial for specialized applications and overcoming existing limitations. Protein engineering techniques, including directed evolution and rational design, are actively employed to optimize the enzyme's performance for specific industrial or research requirements, pushing the boundaries of what T7 RNA Polymerase can achieve.

Synthetic biology platforms represent another crucial technological area influencing the T7 RNA Polymerase market. The ability to design and synthesize custom DNA templates with optimized T7 promoter sequences allows for highly efficient and controlled RNA production. This integration of gene synthesis and synthetic biology tools enables researchers and manufacturers to create complex RNA molecules or entire expression systems with unprecedented precision. Furthermore, the development of robust cell-free protein synthesis (CFPS) systems, which often rely on T7 RNA Polymerase for transcription, is a significant technological driver. These CFPS systems offer advantages in speed, versatility, and scalability for protein production, further increasing the demand for high-quality T7 RNA Polymerase as a key enzymatic component.

Automation and high-throughput screening technologies are revolutionizing the way T7 RNA Polymerase is utilized in research and industrial settings. Robotic liquid handling systems, integrated with microfluidics and miniaturized reaction formats, enable the parallel synthesis of hundreds or thousands of RNA constructs, accelerating drug discovery, functional genomics studies, and diagnostic assay development. These automated platforms increase efficiency, reduce manual labor, and minimize variability, making large-scale RNA production more feasible and cost-effective. Additionally, advanced analytical techniques, such as next-generation sequencing (NGS) and mass spectrometry, are employed for stringent quality control and characterization of RNA products, ensuring the integrity and functionality of T7 RNA Polymerase-derived materials. The synergistic application of these technologies collectively enhances the value and broadens the scope of the T7 RNA Polymerase market.

Regional Highlights

The global T7 RNA Polymerase market demonstrates significant regional variations in growth, adoption, and strategic initiatives, largely influenced by the concentration of biotechnology industries, research funding, and healthcare infrastructure. Each region presents unique market dynamics and opportunities for stakeholders.

- North America: This region holds the largest market share, driven by extensive R&D investments in biotechnology and pharmaceuticals, particularly in the United States. The presence of numerous key market players, leading academic institutions, and a robust regulatory framework supporting advanced therapies contributes to its dominance. High adoption rates of mRNA technology for vaccine and therapeutic development are particularly pronounced here.

- Europe: Europe represents a significant market, characterized by strong governmental support for life sciences research, substantial funding for gene therapy initiatives, and a growing focus on personalized medicine. Countries like Germany, the United Kingdom, and France are at the forefront of biotechnological innovation, leading to a steady demand for T7 RNA Polymerase in both academic and industrial applications.

- Asia Pacific (APAC): This region is projected to be the fastest-growing market due to rapid expansion of the biopharmaceutical sector, increasing healthcare expenditure, and rising government and private investments in biotechnology research. Countries such as China, Japan, India, and South Korea are emerging as key hubs for biomanufacturing and research, driven by a large patient pool and growing academic and industrial collaboration.

- Latin America: The market in Latin America is characterized by increasing government initiatives to improve healthcare infrastructure and a growing interest in biotechnology research. Brazil and Mexico are leading the region in terms of research activities and pharmaceutical manufacturing, contributing to the demand for T7 RNA Polymerase, albeit from a smaller base compared to developed regions.

- Middle East and Africa (MEA): The MEA market for T7 RNA Polymerase is in its nascent stage but shows potential for growth, primarily driven by increasing investments in healthcare infrastructure, improving research capabilities, and a rising focus on pharmaceutical development in some Gulf countries and South Africa. Strategic partnerships and technology transfer initiatives are key to unlocking its full market potential.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the T7 RNA Polymerase Market.- Thermo Fisher Scientific

- New England Biolabs (NEB)

- Promega Corporation

- Merck KGaA (MilliporeSigma)

- Takara Bio Inc.

- Zymo Research

- Jena Bioscience GmbH

- Lucigen Corporation (LGC Biosearch Technologies)

- QIAGEN N.V.

- Bio-Rad Laboratories, Inc.

- Agilent Technologies

- F. Hoffmann-La Roche AG

- Enzo Life Sciences, Inc.

- TransGen Biotech

- Sino Biological, Inc.

- Bioline (Meridian Bioscience)

- GenScript Biotech Corporation

- Lonza Group AG

- Takyon (A part of BioVision Inc.)

- Nippon Gene Co., Ltd.

Frequently Asked Questions

What is T7 RNA Polymerase and its primary function?

T7 RNA Polymerase is a highly specific DNA-dependent RNA polymerase from the T7 bacteriophage. Its primary function is to efficiently transcribe DNA templates containing a T7 promoter into RNA molecules, making it crucial for in vitro transcription, mRNA synthesis, and recombinant protein expression in various biological applications.

How is T7 RNA Polymerase utilized in mRNA vaccine production?

In mRNA vaccine production, T7 RNA Polymerase is essential for the large-scale, high-fidelity synthesis of messenger RNA (mRNA) from a linearized DNA plasmid template containing the target antigen sequence flanked by a T7 promoter. This in vitro transcription (IVT) process is a critical step in generating the active ingredient for mRNA vaccines.

What are the key advantages of using T7 RNA Polymerase in molecular biology?

Key advantages include its high transcription efficiency, excellent specificity for the T7 promoter, robust enzyme activity, and relative resistance to inhibitors, allowing for high yields of desired RNA. It simplifies gene expression systems and is widely adopted for its reliability and versatility in various research and industrial applications.

What challenges does the T7 RNA Polymerase market face?

The market faces challenges such as the relatively high cost of producing GMP-grade enzymes, the inherent instability of RNA products requiring careful handling, competition from alternative expression systems, and the need to navigate stringent regulatory hurdles for therapeutic applications, which can impact development timelines and costs.

Which regions are leading the adoption of T7 RNA Polymerase technology?

North America, particularly the United States, leads in T7 RNA Polymerase adoption due to its advanced biotechnology sector and significant R&D investments. Europe also shows strong adoption, while the Asia Pacific region is emerging rapidly as a key growth area, driven by expanding biopharmaceutical manufacturing and research capabilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager