Table Tennis Balls Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433132 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Table Tennis Balls Market Size

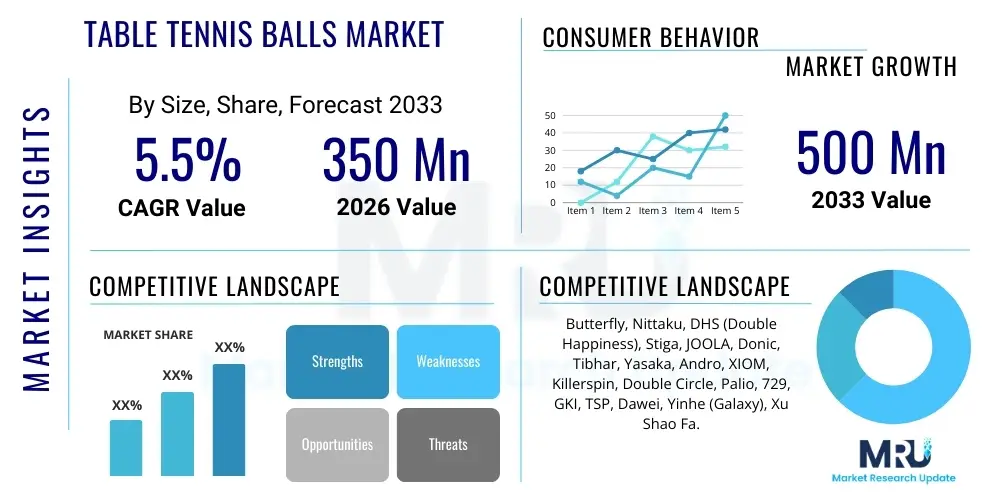

The Table Tennis Balls Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at USD 350 Million in 2026 and is projected to reach USD 500 Million by the end of the forecast period in 2033. This consistent growth trajectory is primarily driven by the expanding global participation in recreational and professional table tennis, coupled with critical shifts in material standards, notably the mandatory transition from traditional celluloid balls to non-celluloid (plastic/polymer 40+) materials. The market size reflects both the volume sales associated with mass consumption and the premium pricing commanded by high-specification, ITTF-approved competition balls, which are essential for tournament play and advanced training.

Table Tennis Balls Market introduction

The Table Tennis Balls Market encompasses the global production, distribution, and sale of spherical projectiles specifically designed for the sport of table tennis (Ping Pong). These balls are standardized globally, particularly since the 2014 rule change mandating the switch from celluloid to less flammable, more durable polymer balls, generally identified as '40+' balls. Key product categories include 1-star (recreational), 2-star (training), and 3-star (competition/ITTF approved) variants, differentiated primarily by sphericity, hardness, weight consistency, and rebound quality. Major applications span professional competitive events, amateur league play, training academies, and recreational use in homes, schools, and community centers. The fundamental benefits of this market include promoting physical activity, skill development, and providing standardized equipment necessary for the global execution of the sport.

Driving factors for market expansion include the increasing visibility of table tennis in major sporting events like the Olympics, aggressive marketing and sponsorship by international sporting goods brands, and the growing urbanization in developing economies, which often leads to increased participation in indoor sports. Furthermore, technological improvements in plastic molding and quality control (QC) processes have reduced manufacturing defects and enhanced the consistency of high-end balls, meeting the stringent demands of top-tier athletes. The shift to plastic balls, while initially facing resistance regarding bounce characteristics, has stabilized the market by offering better durability and safety standards, thus necessitating consistent replacement cycles for high-volume users like training centers.

The market environment is highly competitive, characterized by intense efforts from major Asian manufacturers who dominate production volumes, alongside niche European and American brands specializing in premium segment balls. Product differentiation often centers on spin retention, bounce stability, and longevity. The introduction of standardized quality metrics by the International Table Tennis Federation (ITTF) acts as a critical quality assurance benchmark, ensuring that products used in sanctioned events maintain rigorous specifications. Consumer purchasing decisions are often influenced by recommendations from coaches, player endorsement, and the durability required for their specific use case, ranging from casual play requiring minimal replacement to elite training requiring hundreds of balls weekly.

Table Tennis Balls Market Executive Summary

The Table Tennis Balls Market is experiencing robust growth fueled by the professionalization of the sport and mandatory material standardization. Current business trends indicate a strong focus on enhancing the durability and consistency of the new polymer 40+ balls, driving R&D investments among key manufacturers. Supply chain optimization, particularly in the sourcing of high-grade plastics and advanced molding techniques, is crucial for maintaining competitive pricing and quality. A significant operational trend involves manufacturers investing in automated inspection systems utilizing computer vision to ensure strict adherence to ITTF standards regarding diameter, weight, and rebound properties, minimizing rejection rates and guaranteeing consistency for 3-star balls.

Regionally, Asia Pacific (APAC), led by China, Japan, and South Korea, remains the dominant market both in terms of consumption and manufacturing output, reflecting the deep cultural significance and infrastructure for the sport in this area. North America and Europe show steady growth, primarily in the premium and recreational segments, spurred by rising disposable incomes and increasing interest in structured indoor sports. Emerging markets in Latin America and MEA present high growth opportunities, particularly as table tennis associations receive greater government and private funding to develop local talent and infrastructure, leading to increased demand for high-volume training balls.

Segment trends highlight the rapid adoption and dominance of the plastic 40+ ball category, effectively replacing celluloid. The 3-star segment, though smaller in volume, accounts for a disproportionately high share of revenue due to its premium pricing and brand loyalty associated with high-stakes competition. Distributionally, the online channel is witnessing the fastest expansion, offering consumers global access to specialized and niche brands, facilitated by direct-to-consumer (DTC) models adopted by key players. The amateur and training segment continues to drive bulk purchases, emphasizing the importance of cost-effective, durable 2-star balls for multi-ball practice and coaching.

AI Impact Analysis on Table Tennis Balls Market

Common user questions regarding AI's impact on the Table Tennis Balls Market primarily revolve around how advanced technology influences product quality, material innovation, and personalized consumer experiences. Users are concerned about whether AI-driven quality control systems can eliminate inconsistencies found in traditional manufacturing and whether machine learning algorithms are being used to synthesize next-generation polymer compounds that could further improve ball characteristics like spin retention and stability, potentially redefining competitive standards. There is also interest in how AI analyzes consumer purchasing patterns and playing styles to optimize inventory, predict demand for specific quality grades (1-star vs. 3-star), and potentially create highly personalized training feedback loops when balls are integrated with smart tables or robotic systems.

- AI-Powered Quality Control (QC): Implementation of machine learning algorithms in vision systems to inspect sphericity, weight tolerance, and surface consistency at extremely high speeds, ensuring near-perfect conformity for 3-star balls.

- Predictive Maintenance: Using AI to analyze machine performance in high-precision injection molding processes, predicting equipment failure and minimizing downtime, thereby optimizing production efficiency and consistency.

- Material Science Innovation: Application of computational chemistry and AI simulation tools to accelerate the discovery and testing of novel polymer blends for improved durability, bounce coefficient, and environmental sustainability (e.g., biodegradable plastics).

- Supply Chain Optimization: Utilizing AI and big data analytics to forecast regional demand fluctuations, optimize logistics, and manage raw material inventory, particularly sensitive polymer resins.

- Personalized Training Integration: Integration of sensor-enabled balls (future potential) or smart table systems utilizing AI to analyze ball trajectory, speed, and spin, offering personalized performance feedback to athletes and coaches.

- Market Trend Forecasting: AI analysis of social media trends, tournament data, and purchase history to accurately predict shifting consumer preferences regarding ball type (seamed vs. seamless) and brand popularity.

DRO & Impact Forces Of Table Tennis Balls Market

The Table Tennis Balls Market is fundamentally shaped by a dynamic interplay of Drivers, Restraints, and Opportunities, which collectively determine the overall Impact Forces. Key drivers include the mandatory standardization to polymer materials, requiring continuous replacement across all consumer segments, and the massive participation base in Asia Pacific, which drives volume sales. Restraints largely focus on regulatory hurdles, such as the initial high manufacturing cost and complexity associated with perfecting the new 40+ plastic balls, and the persistent issue of counterfeiting, which dilutes genuine market revenues. Opportunities lie heavily in the burgeoning amateur leagues globally, the adoption of sustainable manufacturing practices, and integrating balls with smart training technologies. These forces compel manufacturers to balance cost-efficiency with high-precision production standards.

The primary driving force remains the increasing globalization and professionalization of the sport. The International Table Tennis Federation (ITTF) plays a crucial role by mandating equipment changes and enforcing strict standards, which ensures consistent demand for high-quality, competition-grade balls. The rise in organized league play, coupled with aggressive marketing by sporting brands, expands the consumer base beyond traditional strongholds. Furthermore, the convenience of purchasing high-volume training balls through expanding e-commerce channels worldwide has lowered transactional barriers, contributing significantly to volume turnover.

Conversely, significant restraints hinder optimal market growth. The complexity of manufacturing polymer 40+ balls to achieve the exact specifications of older celluloid balls—particularly concerning spin and speed—requires highly sophisticated and expensive production lines, which limits the number of competitive manufacturers. Moreover, the environmental concern associated with plastic waste, despite efforts towards recyclable materials, remains a consumer and regulatory restraint. The dependency on a few key polymer suppliers also poses supply chain risks. Nonetheless, the opportunity to penetrate untapped regional markets (Africa, parts of Latin America) and capitalize on the growing focus on health and wellness as a driver for sports participation presents substantial avenues for long-term revenue expansion and market diversification.

The overall impact forces demonstrate a shift toward quality and sustainability over pure volume. The mandatory material change acted as a disruptive force, stabilizing the market around durable plastic balls and forcing manufacturers to innovate rapidly. This pressure has led to a highly differentiated product landscape where precision and consistency dictate pricing. Success is increasingly tied to the ability to minimize material waste while maximizing quality control effectiveness, ensuring that balls meet the demanding requirements of elite players who serve as crucial brand endorsers and validators of product quality.

Segmentation Analysis

The Table Tennis Balls Market is systematically segmented based on material composition, quality grade (star rating), end-user type, and distribution channel, providing a comprehensive view of market dynamics and consumer preferences across different tiers of the sport. Segmentation by material is critical, differentiating between the legacy Celluloid balls (largely phased out) and the contemporary Plastic/Polymer 40+ balls, which dominate the market. The quality grade segmentation is vital for pricing strategy and end-use application, with 3-star balls targeting professional tournaments and 1-star balls serving general recreational needs. This structured analysis allows manufacturers to precisely target their product development and marketing efforts to specific consumer groups, from elite athletes to casual home users, maximizing market penetration.

End-user segmentation clearly defines demand patterns: professional players and academies purchase premium, high-volume 3-star and 2-star balls frequently, driven by performance metrics. Conversely, recreational users are more price-sensitive and prioritize durability, driving demand for 1-star or generic 2-star options. The distribution channel segmentation reflects the modernization of the market, with traditional physical stores (specialty sports stores and large retailers) competing fiercely with fast-growing online platforms, which offer greater convenience, comprehensive product comparisons, and competitive pricing for bulk orders required by training centers.

The insights derived from segmentation analysis are crucial for strategic planning. For instance, companies focusing on the competitive segment must invest heavily in ITTF certification and brand endorsements, while those targeting the recreational segment must optimize supply chains for cost efficiency and mass distribution. Understanding the regional variation in segment dominance—Asia's high demand for training balls versus North America's growth in premium branded equipment—allows for tailored operational and marketing strategies, ensuring that products are optimally positioned within local market ecosystems and regulatory frameworks governing sports equipment standards.

- By Material:

- Celluloid (Legacy/Minimal Volume)

- Plastic/Polymer 40+ (Dominant)

- By Quality Grade (Star Rating):

- 1-Star (Recreational/Amateur)

- 2-Star (Training/Practice)

- 3-Star (Competition/ITTF Approved)

- By End-User:

- Professional Players and Federations

- Training Academies and Clubs

- Educational Institutions (Schools, Universities)

- Recreational/Home Use

- By Distribution Channel:

- Offline (Specialty Sports Stores, Hypermarkets, Department Stores)

- Online (E-commerce Platforms, Brand Websites)

Value Chain Analysis For Table Tennis Balls Market

The value chain for the Table Tennis Balls Market initiates with the upstream activities centered around raw material procurement, specifically the sourcing of high-grade plastic polymers (e.g., ABS or proprietary polypropylenes) that adhere to stringent quality and flammability standards. This stage involves complex negotiations with chemical manufacturers and material scientists to ensure the optimal resin formulation for rebound, sphericity, and durability. Upstream activities also include the design and maintenance of specialized, high-precision injection molding machinery and automated quality control systems, which are foundational for producing consistent 3-star balls. The concentration of expertise in polymer science and precision engineering heavily influences the competitive advantage at the manufacturing stage.

The midstream phase, involving manufacturing and assembly, is where the bulk of value addition occurs. This stage involves sophisticated processes such as injection molding, sanding, finishing, logo printing, and the critical step of rigorous testing for weight, diameter, and bounce consistency, often utilizing advanced computer vision systems. Major players like DHS, Nittaku, and Butterfly vertically integrate or maintain tight control over these processes to ensure batch consistency, a key differentiator in the premium segment. Downstream analysis focuses on distribution and final sales. Distribution channels are bifurcated into direct and indirect routes. Direct sales often involve manufacturers supplying large national federations or major training centers in bulk, ensuring competitive pricing and reliable supply. Indirect channels leverage wholesalers, distributors, specialized sports retailers, and increasingly, major e-commerce platforms to reach the global consumer base.

The choice of distribution channel significantly impacts market reach and cost structure. While specialty stores offer expert advice and immediate physical examination, online channels provide unparalleled global reach, efficiency for bulk orders (e.g., training centers buying thousands of 2-star balls), and detailed product reviews, shaping consumer trust. Effective logistics management is crucial in the downstream segment, especially for maintaining stock levels in geographically diverse markets like Europe and North America, where demand for branded premium products is high. The final segment of the value chain involves after-sales support and marketing efforts, including player endorsements and official ITTF partnerships, which are essential for reinforcing brand credibility and justifying the premium pricing of competition-grade equipment.

Table Tennis Balls Market Potential Customers

The potential customer base for the Table Tennis Balls Market is highly diverse, spanning the entire spectrum of participation, from professional athletes engaged in global tournaments to casual players using the equipment for light recreation. End-users can be broadly categorized into institutional buyers and individual consumers. Institutional buyers, such as national table tennis federations, professional clubs, and large training academies, represent the highest volume purchasers, consistently requiring large quantities of high-quality 2-star and 3-star balls for training, practice, and sanctioned matches. Their purchasing decisions are driven by durability, ITTF approval, and bulk pricing contracts, often favoring established global brands known for consistency.

The second major category involves educational institutions, including schools, colleges, and universities, which drive demand for moderately priced, durable 1-star and 2-star balls suitable for physical education classes and intramural leagues. This segment prioritizes robustness and cost-effectiveness over absolute spin performance. Retail consumers constitute the vast individual market, ranging from serious amateur league players who buy specific branded 3-star balls for personal practice to home users who seek inexpensive 1-star options for casual family play. This consumer group is highly influenced by online reviews, brand availability on major e-commerce sites, and price sensitivity, especially when purchasing multi-packs.

Furthermore, emerging potential customer segments include corporate wellness programs and fitness centers integrating table tennis into their recreational offerings. These entities require moderate volumes of reliable, durable balls. The consistent need for replacement, irrespective of the segment (due to wear, loss, or breakage), guarantees recurring revenue. Targeted marketing efforts must therefore be highly segmented: emphasizing precision and ITTF compliance for institutional buyers, while focusing on value and durability for mass recreational consumers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350 Million |

| Market Forecast in 2033 | USD 500 Million |

| Growth Rate | 5.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Butterfly, Nittaku, DHS (Double Happiness), Stiga, JOOLA, Donic, Tibhar, Yasaka, Andro, XIOM, Killerspin, Double Circle, Palio, 729, GKI, TSP, Dawei, Yinhe (Galaxy), Xu Shao Fa. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Table Tennis Balls Market Key Technology Landscape

The Table Tennis Balls Market, while seemingly low-tech, relies heavily on precision engineering and advanced material science, particularly since the mandatory global transition from flammable celluloid to the polymer 40+ standard. The key technological challenge lies in achieving perfect sphericity, consistent wall thickness, and optimal hardness in injection molded plastics to replicate the bounce and spin characteristics of the retired celluloid balls. Manufacturers invest significantly in proprietary polymer formulations, often incorporating additives to enhance durability and reduce friction, thereby ensuring maximum spin generation and minimizing material degradation during high-impact play. The development of seamless or highly consistent seamed plastic balls requires cutting-edge molding technology capable of extremely tight tolerances, moving the competitive edge from generic manufacturing to precision process control.

A critical component of the modern technology landscape is Quality Control (QC) automation. Due to the requirement for 3-star balls to meet ITTF specifications regarding diameter (40.0mm–40.6mm), weight (2.67g–2.77g), and rebound height, manufacturers utilize sophisticated computer vision and laser measurement systems. These systems can inspect thousands of balls per hour, automatically rejecting those that fail the tolerance test. This reliance on high-speed, non-contact measurement technology is essential for reducing waste and guaranteeing the consistency that premium brands promise to professional users. Furthermore, advancements in ultrasonic welding are used for seamed balls, ensuring the seam is nearly imperceptible and does not negatively affect the flight path or spin.

Looking ahead, the technological frontier includes the exploration of biodegradable or sustainable polymers to address environmental concerns associated with high-volume plastic consumption in training centers. Additionally, manufacturers are researching intelligent manufacturing processes leveraging IoT sensors embedded in molding equipment to provide real-time data on temperature, pressure, and cooling cycles, ensuring consistent production parameters across different batches and geographical locations. This integration of Industry 4.0 principles, particularly in highly controlled cleanroom environments, signifies the market's commitment to precision and repeatable quality crucial for maintaining competitive performance standards.

Regional Highlights

The global Table Tennis Balls Market exhibits significant regional variations in terms of demand, manufacturing concentration, and growth potential, primarily driven by cultural affinity for the sport and existing sports infrastructure.

- Asia Pacific (APAC): APAC is the global powerhouse, dominating both production and consumption. China is the largest manufacturer globally, housing key players like DHS and Double Circle, benefitting from established industrial infrastructure and control over polymer supply chains. Countries like Japan and South Korea also maintain high consumption rates due to strong national teams, organized league structures, and highly developed training academies. The region drives the highest volume sales, emphasizing both premium 3-star balls and high-volume, cost-effective training balls.

- Europe: Europe represents a mature market characterized by high consumption of premium and branded equipment, led by countries such as Germany, Sweden, and France. European brands like Stiga, JOOLA, and Donic command strong loyalty, often focusing on advanced polymer formulations and design aesthetics. Growth is steady, fueled by well-organized national leagues and the steady consumer willingness to invest in high-quality, durable equipment.

- North America: This region is characterized by steady, yet expanding, amateur and recreational participation. While historically smaller than APAC or Europe, North America is seeing rapid growth in organized club play and specialty retail demand. The market here is highly brand-conscious, with strong uptake via online channels, primarily focusing on imported premium 3-star balls and specialized training equipment. The U.S. and Canada are investing more in developing youth programs, promising future revenue streams.

- Latin America (LATAM): LATAM is an emerging market with significant growth potential, driven by rising economic stability and increasing investment in sports infrastructure, particularly in countries like Brazil and Argentina. Demand is currently concentrated in moderately priced 2-star balls, but the premium segment is poised for expansion as competitive standards improve and tournaments gain greater visibility.

- Middle East and Africa (MEA): This region is the smallest but offers high future growth prospects, contingent on government initiatives to promote sports and fitness. Current consumption is heavily skewed towards recreational use, but as international table tennis federations increase their presence and investment in local coaching and competitive infrastructure, demand for standardized, ITTF-approved balls is expected to accelerate significantly.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Table Tennis Balls Market.- Butterfly (Tamasu Co., Ltd.)

- Nittaku (Nippon Takkyu Co. Ltd.)

- DHS (Double Happiness)

- Stiga

- JOOLA

- Donic

- Tibhar

- Yasaka

- Andro

- XIOM

- Killerspin

- Double Circle

- Palio

- 729 (Friendship)

- GKI

- TSP

- Dawei

- Yinhe (Galaxy)

- Xu Shao Fa

Frequently Asked Questions

Analyze common user questions about the Table Tennis Balls market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between 3-star and 1-star table tennis balls?

3-star balls are the highest quality grade, certified by the ITTF for use in official competitions. They possess near-perfect sphericity, highly consistent weight, and predictable bounce. 1-star balls are designed for recreational or amateur use, offering lower consistency and durability, suitable for casual play where precision requirements are minimal.

Why did the Table Tennis Balls Market transition from celluloid to polymer 40+ materials?

The transition to polymer (plastic) 40+ balls was mandated primarily due to safety and environmental concerns. Celluloid is highly flammable and poses significant challenges during storage, transportation, and disposal. The polymer 40+ material is safer, more durable, and aligns with modern global safety standards, despite initial manufacturing difficulties in matching the performance characteristics of celluloid.

Which region dominates the global market for table tennis balls?

The Asia Pacific (APAC) region dominates the market in terms of both manufacturing output and consumption volume. This is attributed to the deep-rooted popularity of table tennis in countries like China, Japan, and South Korea, which drives massive demand across professional training and recreational segments.

How does the quality of the polymer ball impact spin performance?

High-quality 3-star polymer balls utilize proprietary plastic blends and precision finishing techniques that ensure a consistent surface texture and optimal hardness. This consistency is crucial for maximizing friction between the paddle rubber and the ball, allowing elite players to generate high levels of controlled spin necessary for competitive play.

Are seamless or seamed plastic balls better, and which is dominant in the market?

Both seamed and seamless plastic balls are used, with seamless balls often marketed for superior consistency and durability as they eliminate the potential failure point of a seam. However, seamed balls, perfected through advanced ultrasonic welding, are currently widely accepted and used in high-level competition, provided they adhere strictly to ITTF specifications for uniformity and weight distribution.

The Table Tennis Balls Market continues to be characterized by innovation in polymer science and manufacturing precision, driven by the highly demanding specifications set by the International Table Tennis Federation (ITTF) and the expanding global base of organized amateur and professional players. The market growth forecast is supported by consistent replacement demand, particularly from training institutions that cycle through high volumes of balls weekly. Investment in automated quality control systems remains critical for companies aiming to capture the lucrative 3-star competition segment. Furthermore, sustainability initiatives focusing on biodegradable plastics present a significant long-term growth avenue, aligning market practices with global ecological expectations.

Manufacturers are strategically optimizing their supply chains, often integrating AI and predictive analytics to manage complex inventory requirements across diverse distribution channels—ranging from specialized local retailers to vast global e-commerce platforms. The emphasis is shifting towards brand transparency regarding material composition and manufacturing origin, particularly among premium European and Japanese brands competing with high-volume Chinese producers. Success in this evolving landscape requires a dual focus: maintaining the absolute highest quality standards for competition-grade products while simultaneously driving down the cost base for high-volume training equipment to serve the mass market effectively.

The future trajectory of the market suggests further integration with smart sports technology. While currently focused on passive equipment, future advancements may see balls incorporating micro-sensors or advanced coatings compatible with augmented reality training systems, providing real-time data on trajectory and spin rate to athletes. This technological push will inevitably drive up average selling prices in the premium segment and create new opportunities for specialized IT service providers within the sports equipment ecosystem, thus cementing the market's long-term viability and evolution beyond a simple commodity product.

Regional dynamics will continue to be influenced heavily by government sports funding and the success of national table tennis teams, particularly in APAC, where brand loyalty is closely tied to national competitive performance. In North America and Europe, marketing efforts emphasizing health, wellness, and the accessibility of table tennis as a high-speed indoor sport will sustain growth. Continuous adherence to ITTF standards and preemptive adoption of sustainable materials will be the defining competitive factors influencing market share gains over the forecast period.

The competitive environment necessitates not just manufacturing prowess but also robust distribution networks capable of handling large-scale international logistics efficiently. Companies utilizing direct-to-consumer (DTC) models via sophisticated e-commerce platforms are gaining significant traction, bypassing traditional middlemen and allowing for immediate feedback loops regarding product performance and consumer satisfaction. This digitalization of the sales channel is a key modernizing force within the industry, requiring integrated inventory management and localized marketing content tailored to specific regional sporting cultures and buying habits. This allows for rapid market responsiveness to sudden shifts in competitive rules or material preferences.

The market also faces constant pressure from substitutes, although the unique requirements of table tennis limit the viability of alternative materials outside approved polymer blends. The challenge remains in educating the consumer base, particularly amateur players, on the distinct benefits of 2-star and 3-star balls compared to generic alternatives, justifying the higher price point based on performance consistency and durability. Strong brand narratives, often built around official sponsorships and endorsement by top players, are essential tools in converting price-sensitive consumers to quality-conscious buyers, ensuring that the premium segment maintains its substantial revenue contribution despite the higher unit cost of production.

Looking at the underlying material technology, research is ongoing into utilizing composite materials that could offer improved longevity and resilience against high-impact forces without compromising the required bounce coefficient. This research is driven by the demand from high-volume training centers that require balls to withstand hundreds of hours of repetitive use. The manufacturing process complexity, specifically relating to minimizing air bubbles and ensuring uniform internal structure, continues to define the barriers to entry for new players, reinforcing the dominance of established manufacturers who possess the necessary proprietary molding expertise and precision engineering assets.

Financial performance across the market is highly correlated with inventory management efficiency, given the relatively low profit margins per unit in the mass-market segment. Successful firms leverage global manufacturing footprints to minimize tariffs and optimize labor costs, while maintaining centralized R&D functions to safeguard proprietary material formulations and patented molding techniques. The interplay between cost optimization for 1-star and 2-star balls and premium pricing strategies for 3-star competition equipment defines the overall revenue structure of leading market participants. Future profitability hinges on the ability to efficiently scale production while continually meeting ever-tightening ITTF standards for consistency and performance.

The influence of major sporting events, such as the World Table Tennis Championships and the Olympic Games, cannot be overstated. These events serve as massive promotional platforms, not only increasing general interest in the sport but also showcasing the officially approved 3-star balls, leading to immediate spikes in consumer demand for those specific branded products. Manufacturers securing these official sponsorship rights gain immense competitive advantage and visibility, reinforcing their premium positioning and justifying higher price points compared to competitors lacking such high-profile endorsements.

The long-term health of the market is also dependent on the continued development of grassroots programs globally. Initiatives aimed at introducing table tennis in primary schools and community centers create a sustainable pipeline of future players, ensuring consistent demand for entry-level and training balls. Government investment in sports infrastructure, particularly in developing nations, directly translates into increased bulk purchasing by federations and academies, solidifying the market’s volume base and offsetting cyclical dips in competitive spending. Educational outreach and accessibility are therefore integral, long-term drivers for overall market stability and expansion.

The market faces inherent challenges related to the delicate balance required in production: the ball must be durable enough to last, yet sensitive enough to generate the complex spins demanded by professionals. This engineering constraint necessitates continuous material refinement. The polymer blends used must be resistant to cracking and deformation while maintaining the elasticity and hardness required for optimal rebound characteristics. This ongoing material science challenge ensures that R&D remains a critical expenditure for industry leaders, defining the technological arms race within the segment, particularly concerning proprietary 40+ ball formulations that claim superior performance metrics such as roundness retention and speed consistency over prolonged usage.

In summary, the Table Tennis Balls Market is transitioning from a traditional sports manufacturing sector to a highly technical domain driven by polymer precision, automated quality assurance, and sophisticated global logistics. The growth outlook remains positive, strongly underpinned by the mandatory material shift, professionalization of the sport, and the effective leveraging of digital sales channels to reach a wider, geographically dispersed consumer base.

The current market environment underscores the necessity for strategic differentiation. Companies cannot rely solely on price competition, especially in the premium segments. Instead, they must establish brand equity based on certified consistency, player trust, and reliability under tournament conditions. This involves stringent internal quality metrics that often exceed the minimum ITTF requirements. Furthermore, marketing must clearly articulate the performance advantages of their specific polymer formulation or manufacturing technique, ensuring that consumers understand the value proposition associated with the premium price tag. For instance, brands that successfully minimize the variations in weight and sphericity across a large batch of 3-star balls gain a significant edge among professional training centers.

E-commerce penetration is dramatically altering traditional sales landscapes. Online platforms not only facilitate bulk purchases for clubs but also allow niche and specialized brands to compete effectively against market behemoths without requiring extensive physical retail distribution networks. This digital shift compels all market players to invest in high-quality digital content, detailed product specifications, and efficient global warehousing capabilities. Managing returns and product inconsistencies becomes even more critical in the online environment, as negative reviews concerning poor quality can rapidly erode brand trust across international consumer bases. Consequently, logistics and customer service are becoming vital elements of the overall competitive strategy.

Finally, governmental and non-governmental sports bodies play a pivotal role in market expansion through infrastructure development and promotional campaigns. Sponsorships by governments to host international tournaments directly boost local consumption and introduce new demographics to the sport. The stability provided by standardized equipment rules (like the 40+ rule) reduces market fragmentation and allows manufacturers to focus their investments on long-term technological improvements rather than constant adaptations to regional rule variations. This regulated environment ensures market predictability, which is highly attractive for ongoing investment and sustained growth.

The core innovation trajectory will involve reducing the environmental impact of plastic production and developing balls that offer enhanced longevity without sacrificing performance characteristics. The future dominant player in the market will likely be the one who successfully commercializes a truly sustainable, high-performance ball that meets ITTF standards, addressing both the technical demands of elite athletes and the increasing ecological consciousness of the global consumer base, thereby achieving a competitive breakthrough in material science and brand positioning.

The detailed analysis confirms that the Table Tennis Balls Market is not static but rather highly responsive to regulatory changes, technological advancements in polymer science, and shifting global demographics in sports participation. The segmentation analysis underscores the importance of the 3-star segment in driving revenue and brand value, while the high-volume 2-star segment ensures operational scale. The regional dominance of APAC, coupled with the sophisticated demands of the European market, requires manufacturers to adopt a global strategy that balances mass production efficiency with localized premium positioning. The impact of digitalization and AI in quality assurance suggests a future defined by even tighter tolerances and greater product consistency, raising the bar for all participants in the value chain.

Investment decisions in the forecast period (2026-2033) should prioritize R&D into next-generation polymers and the expansion of automated production facilities capable of meeting ITTF specifications consistently. Strategic partnerships with key national federations and player endorsements will remain vital for marketing competitive equipment. Furthermore, companies must actively address supply chain vulnerabilities and the challenge of counterfeiting through enhanced security features and robust intellectual property defense mechanisms to safeguard their premium product integrity and market share gains.

Ultimately, the market's continued expansion relies on the dual commitment to upholding the high performance standards required by the professional circuit and making the sport accessible and appealing to the massive recreational base worldwide. By leveraging technological advancements and adhering to environmental sustainability principles, the Table Tennis Balls Market is positioned for stable and continuous growth throughout the forecast period, solidifying its role as a crucial segment within the global sporting goods industry.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager