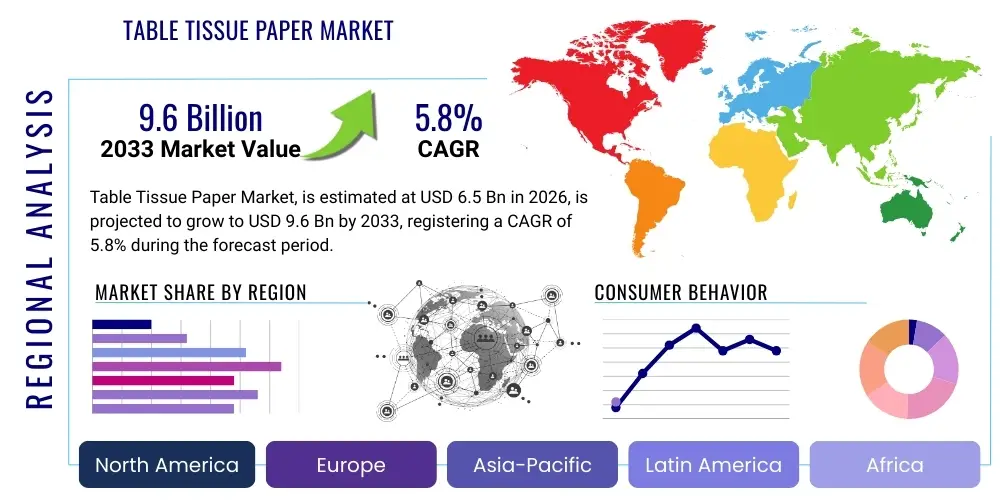

Table Tissue Paper Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435257 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Table Tissue Paper Market Size

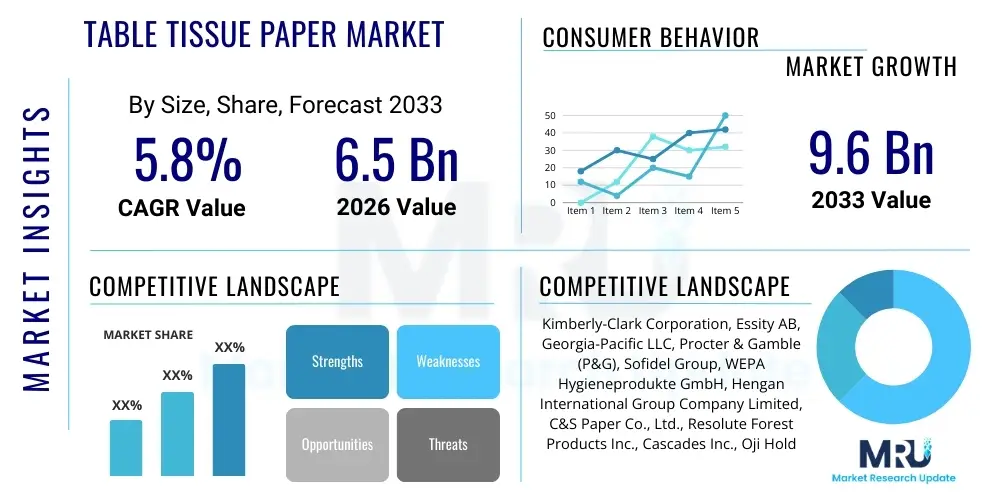

The Table Tissue Paper Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 6.5 billion in 2026 and is projected to reach USD 9.6 billion by the end of the forecast period in 2033.

Table Tissue Paper Market introduction

The Table Tissue Paper Market encompasses the global production and consumption of tissue paper products specifically designed for dining, wiping, and serving purposes in both commercial and residential settings. These products, often referred to as napkins or serviettes, are crucial components of hygiene and aesthetics in the food service industry, including restaurants, cafes, catering services, and hotels, collectively known as the HORECA sector. Table tissue papers are valued for their absorbency, softness, and disposable convenience, offering a hygienic alternative to cloth napkins, thereby catering directly to modern consumer demands for quick cleanup and sanitation.

The primary applications of table tissue paper span various environments, driven significantly by the rising global standards of hygiene and the expansion of the hospitality and tourism sectors. Products range from single-ply economical options used in fast-food establishments to premium, multi-ply, embossed, and decorative napkins utilized in fine dining or corporate events. The consistent growth in disposable income across emerging economies further fuels the residential segment, where consumers increasingly prefer high-quality, readily available tissue products for daily use and entertaining guests. Manufacturers are constantly innovating, focusing on aesthetics, material sourcing (virgin pulp vs. recycled fibers), and developing sustainable, biodegradable options to meet evolving environmental regulations and conscious consumer choices.

Driving factors for this market include rapid urbanization and corresponding lifestyle changes that favor convenience products, the burgeoning growth of the quick-service restaurant (QSR) sector globally, and stringent regulations concerning public health and sanitation, particularly after recent global health events that emphasized surface hygiene. The benefits of table tissue paper—cost-effectiveness, hygiene assurance, and ease of disposal—position it as an indispensable commodity. The market landscape is characterized by intense competition, with differentiation often achieved through branding, product quality (wet strength, softness), and environmental certifications.

Table Tissue Paper Market Executive Summary

The global Table Tissue Paper Market exhibits robust expansion, primarily steered by accelerating urbanization, heightened awareness regarding personal hygiene, and significant growth within the global HORECA sector. Business trends indicate a strong move toward sustainable sourcing, compelling major manufacturers to invest heavily in certifications such as the Forest Stewardship Council (FSC) and introducing products made from alternative fibers like bamboo or sugar cane bagasse. Operational strategies are increasingly focusing on vertical integration to manage volatile raw material costs, particularly fluctuations in pulp prices. Furthermore, e-commerce penetration is reshaping distribution channels, allowing smaller, specialized brands to access wider consumer bases, challenging traditional supermarket dominance and fostering direct-to-consumer relationships through subscription models.

Regional trends reveal that Asia Pacific (APAC) is poised for the most substantial growth, driven by massive population expansion, improving sanitation infrastructure, and rapidly increasing middle-class expenditure on away-from-home dining. North America and Europe maintain maturity, characterized by high per capita consumption rates and a demanding consumer base that prioritizes premiumization—seeking specialized, ultra-soft, and highly decorative products, alongside demanding verifiable sustainability credentials. Conversely, regions in Latin America and the Middle East and Africa (MEA) are emerging hotspots, propelled by tourism expansion and infrastructural development, leading to increased institutional consumption of disposable sanitary products.

Segment trends highlight the commercial segment (HORECA, healthcare, corporate offices) as the largest consumer base, due to high volume requirements and standardized purchasing practices. However, the residential segment is showing accelerated growth, particularly in premium napkin categories used for home entertaining and daily upscale needs. In terms of material, virgin pulp remains dominant owing to superior quality and softness, but the recycled and alternative fiber segments are growing at an accelerated pace, reflecting consumer willingness to pay a premium for eco-friendly alternatives. The market competition is fragmenting, with regional players specializing in specific product attributes (e.g., color, embossing) to differentiate themselves from global giants.

AI Impact Analysis on Table Tissue Paper Market

Common user questions regarding AI's influence on the Table Tissue Paper Market frequently center on efficiency gains in manufacturing, personalized consumption patterns, and optimizing complex supply chains. Users are keen to understand how AI-driven predictive maintenance can reduce costly downtime on high-speed converting machines, ensuring consistent product quality and minimizing waste. Furthermore, significant interest exists in utilizing AI for precise demand forecasting, especially concerning seasonal spikes (e.g., holidays) or regional specific events, which are crucial for inventory management given the bulk nature and low shelf life constraints of tissue products. Concerns often revolve around the initial investment cost for AI infrastructure and integrating these systems with legacy manufacturing execution systems (MES), alongside the perceived job displacement risk in logistics and quality control roles.

- AI-Powered Demand Forecasting: Utilizing machine learning algorithms to analyze historical sales data, seasonal variations, and external macroeconomic indicators (e.g., tourism rates, public health events) to predict tissue paper requirements with higher accuracy, minimizing overstocking and stock-outs.

- Optimized Production Scheduling: Implementing AI to manage the complex manufacturing process, optimizing roll changes, scheduling converting operations, and minimizing material waste based on real-time sensor data from paper machines.

- Predictive Maintenance: Deployment of IoT sensors and AI analysis on high-speed machinery (e.g., slitters, folders, embossers) to predict mechanical failures before they occur, drastically reducing unplanned downtime and maintenance costs.

- Automated Quality Control (AQC): Using computer vision and machine learning models to instantly detect defects (e.g., perforation issues, color inconsistencies, poor embossing quality) on the production line, ensuring only flawless products reach the packaging stage.

- Supply Chain and Logistics Optimization: Leveraging AI to model and refine logistics networks, determining optimal routes for distributing bulky finished goods, thereby reducing fuel consumption and transportation costs.

- Personalized Product Development: Analyzing consumer data and market feedback through AI to identify specific preferences for texture, ply count, and packaging design, accelerating the development of market-relevant, differentiated table tissue products.

- Sustainable Sourcing Management: Employing AI to track and verify the ethical and sustainable sourcing of raw materials, ensuring compliance with complex global certifications (e.g., FSC) and optimizing the procurement process for alternative fibers.

DRO & Impact Forces Of Table Tissue Paper Market

The market trajectory for table tissue paper is fundamentally shaped by a combination of robust growth drivers, significant operational restraints, and substantial opportunities arising from evolving consumer priorities and technological advancements. The primary driver remains the indispensable role of tissue products in maintaining basic hygiene, which is amplified by rapid global population growth and concentrated urbanization, particularly in high-growth regions like Asia and Latin America. However, this growth is significantly constrained by the high volatility and increasing cost of virgin wood pulp, a critical raw material, which directly impacts production margins and necessitates continuous price adjustments across the value chain. Moreover, the market faces intense scrutiny over environmental impact, turning the need for sustainable sourcing and packaging into both a regulatory challenge and a defining opportunity for product innovation and market leadership.

Operational restraints further include the energy-intensive nature of tissue production, leading to high operational expenditure and exposure to fluctuating utility prices, alongside regulatory pressures requiring reduced water usage and effluent management. The high capital expenditure required for setting up advanced, high-speed tissue converting facilities also poses a barrier to entry for smaller players. Conversely, the market is rich with opportunities centered on product diversification and premiumization. The opportunity to develop highly differentiated products—such as specialized anti-bacterial tissue papers, customizable napkin printing for corporate events, or tissues infused with biodegradable materials—allows companies to capture higher profit margins outside the commoditized standard white napkin segment. Investing in advanced, efficient converting technologies remains an essential impact force, driving down the unit cost of production and enhancing product consistency, thereby strengthening competitive positions against cost-effective regional manufacturers.

The impact forces within the Table Tissue Paper Market are primarily governed by shifts in consumer behavior towards sustainability and rapid developments in distribution efficiency. Increased consumer preference for eco-friendly, plastic-free packaging and products made from recycled or alternative fibers (like bamboo or wheat straw) compels manufacturers to overhaul their supply chains and production processes. This shift acts as a powerful lever, forcing industry-wide adoption of greener practices. Additionally, the proliferation of e-commerce and specialized B2B digital platforms accelerates market accessibility and distribution velocity, transforming how commercial buyers (HORECA) and residential consumers procure these bulky products, placing significant pressure on optimizing fulfillment logistics and minimizing shipping costs associated with low-density goods.

Segmentation Analysis

The Table Tissue Paper Market is comprehensively segmented based on material type, product type, end-user application, and distribution channel, providing a granular view of market dynamics and consumer preferences across various consumption categories. Understanding these segments is vital for manufacturers aiming to tailor their product offerings and marketing strategies to specific niches, such as targeting the premium aesthetic segment through embossed, multi-ply napkins, or focusing on high-volume, cost-sensitive procurement in the institutional sectors using recycled fiber products. The shift towards sustainability is critically influencing the Material Type segmentation, prompting innovation in non-wood fiber sources and bio-based packaging solutions, while the End-User segment reflects the differential growth rates between the resilient commercial sector and the increasingly sophisticated residential market.

- By Material Type:

- Virgin Wood Pulp

- Recycled Pulp

- Alternative Fibers (Bamboo, Sugarcane Bagasse, Hemp)

- By Product Type:

- Standard Napkins

- Dinner Napkins (Multi-ply, High quality)

- Cocktail Napkins

- Dispensable Napkins/Jumbo Rolls

- Custom Printed Napkins

- By End-User:

- Commercial/Institutional (HORECA, Corporate Offices, Healthcare Facilities)

- Residential

- By Distribution Channel:

- Offline (Supermarkets and Hypermarkets, Convenience Stores, Specialty Retailers)

- Online (E-commerce Platforms, Direct-to-Consumer Websites)

Value Chain Analysis For Table Tissue Paper Market

The value chain for the Table Tissue Paper Market begins with the upstream sourcing of raw materials, primarily wood pulp (softwood and hardwood) or alternative fibers, which are often subject to intense global commodity pricing pressures and require robust certification protocols, such as FSC or PEFC, to ensure sustainable harvesting. This stage involves complex logistics in transporting pulp from forestry operations or chemical plants to large-scale tissue paper manufacturing mills, where the pulp is processed, purified, and converted into large parent rolls using advanced paper machine technology involving forming, pressing, drying, and reeling. Efficiency at the manufacturing stage is paramount, as energy consumption and water management significantly affect final production costs, demanding continuous technological improvements in energy recovery and wastewater treatment.

The midstream process focuses on converting the jumbo parent rolls into consumer-ready products. This involves high-speed, precision machinery for slitting, embossing (to enhance bulk and softness), folding, and cutting the paper into final napkin dimensions. Branding, printing, and specialized treatments (like adding wet-strength chemicals) occur here, creating product differentiation crucial for market success. Downstream activities involve packaging and distribution. Packaging must be durable yet aesthetically pleasing, increasingly favoring environmentally friendly, plastic-free materials to meet retailer and consumer demands. The distribution channel is bifurcated: direct sales channels cater predominantly to high-volume institutional buyers (HORECA, catering services) through B2B contracts, providing bulk products and managed inventory solutions; while indirect channels leverage major retailers (supermarkets, hypermarkets) and the rapidly expanding e-commerce infrastructure to reach residential end-users.

Distribution efficiency determines profitability, especially for high-volume, low-margin tissue products. Direct distribution offers greater control over pricing and customer relationships with commercial clients, facilitating tailored supply arrangements. Indirect distribution, especially via online platforms, demands specialized fulfillment strategies to manage the high cubic volume and low weight of shipments, necessitating optimized warehousing and last-mile delivery solutions. The emergence of specialized wholesalers focused solely on the HORECA supply chain further simplifies procurement for commercial buyers. Ultimately, value capture is optimized by manufacturers who achieve high operational efficiency in conversion and maintain diverse, reliable relationships with both raw material suppliers (upstream) and vast retail networks (downstream).

Table Tissue Paper Market Potential Customers

The Table Tissue Paper Market serves a highly diverse customer base, categorized broadly into high-volume institutional buyers and routine residential consumers. Institutional buyers represent the largest volume segment, driven by mandatory hygiene requirements and high turnover rates inherent to their operations. Within this segment, the HORECA sector (Hotels, Restaurants, Cafes, and Catering services) is the cornerstone, requiring vast quantities of both standard and premium napkins for daily operations, often preferring custom-printed or proprietary dispenser systems to enhance branding and control usage. Healthcare facilities, including hospitals and clinics, also constitute significant buyers, prioritizing products with high sanitation standards and often requiring bulk dispensing solutions.

Corporate and educational institutions contribute substantially to demand, utilizing table tissue paper in cafeterias, meeting rooms, and high-traffic common areas, emphasizing functional, durable, and cost-effective solutions. The residential segment comprises individual households, which are the primary drivers for premiumization trends, seeking soft, aesthetically pleasing, and specialized tissue napkins for domestic use, entertaining, and daily cleaning. Retailers and wholesalers act as crucial intermediaries, purchasing bulk quantities from manufacturers and distributing them across various points of sale, thereby servicing both residential consumers and smaller independent commercial outlets that do not purchase directly from the factory.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 billion |

| Market Forecast in 2033 | USD 9.6 billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kimberly-Clark Corporation, Essity AB, Georgia-Pacific LLC, Procter & Gamble (P&G), Sofidel Group, WEPA Hygieneprodukte GmbH, Hengan International Group Company Limited, C&S Paper Co., Ltd., Resolute Forest Products Inc., Cascades Inc., Oji Holdings Corporation, Smurfit Kappa Group, Kruger Products L.P., Asia Pulp & Paper (APP), First Quality Enterprises Inc., Hygienic Products Industry Co. Ltd. (HPIC), Celtex SpA, Cartiera Lucia S.p.A., Unicorn Hygienics, Pindo Deli Pulp and Paper Mills. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Table Tissue Paper Market Key Technology Landscape

The manufacturing technology landscape for table tissue paper is characterized by continuous refinement aimed at increasing production speeds, enhancing product quality (softness and bulk), and drastically improving energy efficiency. Key technological advancements center around Through-Air Drying (TAD) processes, which utilize hot air rather than direct mechanical pressure to remove moisture. TAD technology significantly improves the softness and absorbency of the final product compared to conventional drying methods, allowing manufacturers to create ultra-premium, high-bulk napkins that command higher prices in the residential and luxury HORECA segments. However, TAD systems require substantial initial investment and high energy input, necessitating optimization through advanced heat recovery systems and process control software.

Another crucial area of innovation is in converting technology, involving high-speed slitting, folding, and packaging lines. Modern converting machines incorporate sophisticated automation and robotics to minimize material waste and maximize throughput, achieving speeds necessary to meet massive institutional demand. Embossing technology is also becoming more complex, utilizing precise engraving techniques to create intricate patterns that enhance product aesthetics and multilayer bonding, thereby improving structural integrity and liquid retention capabilities. Furthermore, the development of specialized chemicals, particularly those enhancing wet strength without compromising environmental biodegradability, remains a pivotal area of technological focus, critical for products intended for catering and moist food handling environments.

Digitalization and Industry 4.0 principles are increasingly integrated into the tissue paper manufacturing process. This involves the deployment of comprehensive sensor networks across the paper machine and converting lines to gather real-time data on moisture content, fiber alignment, and machine performance. Utilizing this data, manufacturers employ centralized Manufacturing Execution Systems (MES) to fine-tune operations, optimize supply synchronization (just-in-time material flow), and implement predictive maintenance schedules, drastically reducing operational variance and improving asset utilization. These technological implementations are essential for maintaining competitiveness in a commodity market where marginal cost advantages dictate profitability and sustained market share.

Regional Highlights

- Asia Pacific (APAC): APAC is the fastest-growing market, primarily fueled by expansive urbanization, the rapid development of modern retail infrastructure, and increasing disposable incomes leading to higher per capita consumption of disposable hygiene products. Countries like China and India exhibit explosive growth in the food service sector (QSRs, cloud kitchens), driving institutional demand. Furthermore, rising awareness of hygiene standards, particularly post-pandemic, reinforces the use of single-use table tissue over reusable options. The market here is sensitive to price, leading to high production volumes of standard, cost-effective products, but is quickly adopting premiumization, particularly in key metropolitan areas.

- North America: North America represents a mature, high-value market characterized by high consumer expenditure on premium, highly differentiated products. The regional focus is heavily skewed toward sustainability, demanding FSC-certified or recycled content and plastic-free packaging. The commercial segment is highly sophisticated, relying on optimized dispenser systems to minimize waste and enhance patron experience in institutional settings. Manufacturers in this region focus on technological innovation, brand loyalty, and providing superior softness and wet strength properties. The market growth is steady, driven mainly by product innovation rather than volume expansion.

- Europe: Europe is a highly regulated market where environmental standards dictate sourcing and manufacturing practices. The demand here is strongly influenced by green procurement policies, particularly within the public sector and large corporate buyers. Western European countries exhibit some of the highest per capita consumption rates globally, demanding premium quality and a significant shift toward alternative and non-wood fiber tissues (e.g., bamboo). Eastern Europe, while adopting western hygiene standards, offers greater growth potential due to lower current consumption rates and ongoing development in the HORECA and retail sectors.

- Latin America (LATAM): LATAM is an emerging market experiencing significant infrastructural investment and an expanding middle class. Market growth is spurred by increased tourism, leading to greater demand from hotels and resorts, and the expansion of international QSR chains. While cost-effectiveness remains a key purchasing criterion, particularly in economic segments, there is rising interest in value-added products and basic quality improvements. Market expansion is closely tied to economic stability and improving logistics networks across major nations like Brazil and Mexico.

- Middle East and Africa (MEA): The MEA region is witnessing robust demand, particularly in the Gulf Cooperation Council (GCC) countries, driven by mega-tourism projects, substantial investments in the hospitality sector, and high reliance on disposable products due to climatic conditions and strong hygiene culture. In Africa, urbanization and improving access to modern retail channels are driving baseline growth, though challenges persist related to distribution logistics and reliance on imported pulp. Local production capacity is slowly increasing, focusing primarily on meeting domestic institutional demand.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Table Tissue Paper Market.- Kimberly-Clark Corporation

- Essity AB

- Georgia-Pacific LLC

- Procter & Gamble (P&G)

- Sofidel Group

- WEPA Hygieneprodukte GmbH

- Hengan International Group Company Limited

- C&S Paper Co., Ltd.

- Resolute Forest Products Inc.

- Cascades Inc.

- Oji Holdings Corporation

- Smurfit Kappa Group

- Kruger Products L.P.

- Asia Pulp & Paper (APP)

- First Quality Enterprises Inc.

- Hygienic Products Industry Co. Ltd. (HPIC)

- Celtex SpA

- Cartiera Lucia S.p.A.

- Unicorn Hygienics

- Pindo Deli Pulp and Paper Mills

- Clearwater Paper Corporation

- Soundview Paper Company

- Industrias Fapesa S.A. de C.V.

- Renova - Fábrica de Papel do Almonda, S.A.

Frequently Asked Questions

Analyze common user questions about the Table Tissue Paper market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Table Tissue Paper Market?

The primary growth drivers are accelerated urbanization globally, which increases demand for convenience products; the rapid expansion of the HORECA (Hotel, Restaurant, Cafe) sector, particularly in emerging economies; and heightened public and commercial awareness regarding sanitation and disposable hygiene standards.

How significant is sustainability in purchasing decisions within the Table Tissue Paper Market?

Sustainability is highly significant, especially in North American and European markets. Commercial buyers and residential consumers increasingly prioritize products made from recycled fibers or certified alternative materials (like bamboo), demanding certifications such as FSC, and strongly preferring plastic-free, biodegradable packaging to reduce environmental impact.

Which segmentation category holds the largest market share in terms of volume?

The Commercial/Institutional segment holds the largest market share by volume. This is attributed to the high-volume, continuous requirements from sectors like food service, catering, healthcare facilities, and corporate offices, which rely on bulk purchasing and dispensing solutions for daily operations.

What role does e-commerce play in the distribution of table tissue paper?

E-commerce is a rapidly growing distribution channel, especially for the residential segment and smaller commercial buyers. It enables direct-to-consumer sales, supports subscription models for routine replenishment, and provides manufacturers with greater geographic reach, despite the logistical challenges associated with shipping low-density, bulky goods.

What is the main challenge faced by manufacturers regarding raw materials?

The main challenge is the high volatility and escalating cost of virgin wood pulp, which is the key raw material. Fluctuations in global pulp commodity markets and complex logistics directly pressure production margins, necessitating continuous research into cost-effective, high-quality alternative fibers to maintain profitability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager