Tablet Compression Tooling Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432981 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Tablet Compression Tooling Market Size

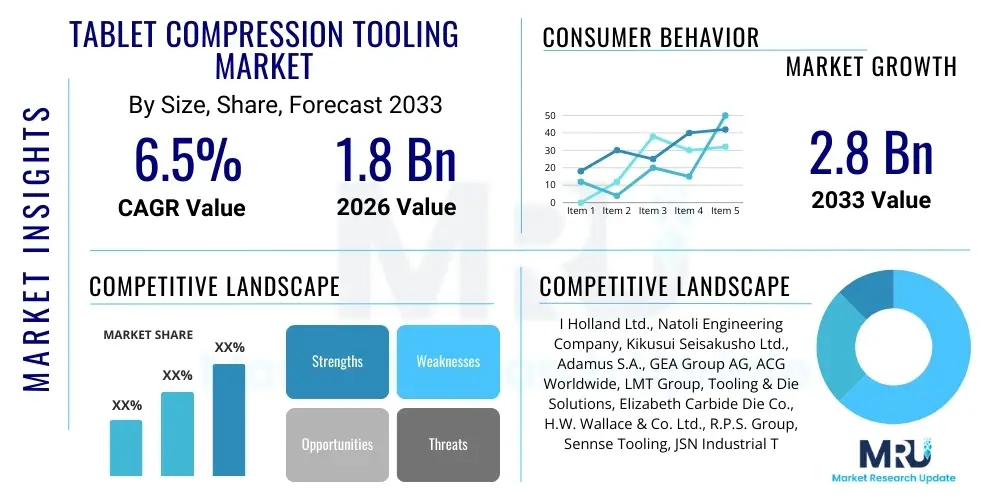

The Tablet Compression Tooling Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 2.8 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating global demand for oral solid dosage forms, particularly within the pharmaceutical and nutraceutical sectors, alongside continuous technological advancements aimed at enhancing tooling longevity and precision.

Tablet Compression Tooling Market introduction

The Tablet Compression Tooling Market encompasses the design, manufacturing, and supply of essential components—punches and dies—required for converting powdered or granulated material into consistently sized and shaped solid tablets. These specialized tools, often governed by international standards such as the TSM (Tablet Specification Manual) and the EU standard, are critical to the tablet manufacturing process, dictating the quality, weight, and dissolution characteristics of the final product. Precision engineering, material science, and anti-corrosion treatments are integral aspects of this market, ensuring optimal performance under high-speed compression cycles typical in modern pharmaceutical facilities. The core objective of high-quality tooling is to minimize downtime, reduce product defects, and maintain tight regulatory compliance.

Major applications for tablet compression tooling span across the ethical and generic pharmaceutical industry, where complex formulations and high-volume production are standard, and the burgeoning nutraceutical sector, which includes dietary supplements, vitamins, and herbal extracts. The functionality of the tooling extends beyond standard tablet shapes, including specialized multi-layer tablets, core-in-core designs, and shaped products that require intricate punch and die geometries. The increasing complexity of drug formulations, requiring customized tooling material like specialized stainless steels, carbide alloys, and advanced coatings (e.g., chromium nitride or titanium nitride), is a significant factor shaping market evolution.

The primary benefits derived from advanced compression tooling include enhanced tablet consistency, superior protection against wear and corrosion, and significant improvements in production efficiency and yield rates. Driving factors for market growth include the robust expansion of the global generic drug sector, increasing investments in continuous manufacturing technologies (which require highly durable tooling), rising public health awareness leading to higher consumption of supplements, and stringent regulatory requirements that necessitate the use of certified, high-precision tools to ensure patient safety and product efficacy. These dynamics collectively position the Tablet Compression Tooling market as a vital upstream component supporting the global pharmaceutical supply chain.

Tablet Compression Tooling Market Executive Summary

The Tablet Compression Tooling Market is characterized by robust growth anchored in the relentless expansion of the global pharmaceutical industry, particularly the high-volume production of affordable generic medicines. Current business trends indicate a strong pivot towards specialized coatings and materials science to extend tool lifespan and handle increasingly abrasive or challenging formulations, such as those used in specialized oncology or biopharmaceutical drugs. Strategic alliances between tooling manufacturers and tablet press original equipment manufacturers (OEMs) are becoming common, driving standardization and integrated solutions that minimize validation time for end-users. Furthermore, the push towards digitalization in manufacturing—often referred to as Pharma 4.0—is influencing tooling design, incorporating features for predictive maintenance and real-time wear monitoring.

Regional trends highlight the Asia Pacific (APAC) region, driven by countries like India and China, as the fastest-growing market due to massive generic drug production capacity expansion and increasing government support for domestic pharmaceutical manufacturing. North America and Europe, while mature, remain dominant in terms of demand for high-specification, premium tooling needed for patented and complex novel drug delivery systems. The focus in these developed regions is centered on tooling capable of handling highly potent active pharmaceutical ingredients (HPAPIs), requiring specialized containment and cleaning processes. Latin America and the Middle East & Africa (MEA) are experiencing moderate growth, spurred by local capacity building and increased investment in local pharmaceutical hubs.

Segmentation trends indicate that Standard Tooling (B-type and D-type) continues to hold the largest market share by volume due to its widespread application in common dosage forms. However, the Special Tooling segment (including multi-tip, shaped, and customized tooling) is exhibiting the fastest value-based growth, reflecting the industry's need for enhanced productivity and innovative product differentiation. By application, the Pharmaceutical sector overwhelmingly dominates the market, but the Nutraceutical segment is gaining traction rapidly, driven by consumer health trends. Manufacturers are increasingly differentiating based on service provision, offering extensive refurbishment programs and predictive diagnostics to maintain market competitiveness and customer loyalty.

AI Impact Analysis on Tablet Compression Tooling Market

Common user questions regarding AI’s impact on the Tablet Compression Tooling Market frequently center on themes such as predictive maintenance, optimization of tool design for complex formulations, and the role of AI in quality control during manufacturing. Users are primarily concerned with how AI can minimize tooling defects, predict failure points before catastrophic breakdown, and automate the intricate process of selecting the optimal coating or steel grade for a specific drug powder. The key expectation is that AI will move the industry from reactive maintenance and trial-and-error material selection to a highly proactive, data-driven approach, significantly reducing operational expenditure (OPEX) and maximizing equipment utilization time (OEE). This focus indicates a strong industry push towards integrating tooling data (wear rates, friction, temperature) into larger factory floor AI systems for comprehensive process optimization.

The implementation of AI algorithms in the Tablet Compression Tooling sector focuses heavily on data analytics derived from compression machine sensor arrays. AI models are trained on historical performance data, including tablet hardness variances, machine fault logs, specific tooling dimensions, and the physical characteristics of compressed powders (e.g., flowability, compressibility, lubricity). By processing this multimodal data, AI can accurately forecast the remaining useful life (RUL) of punch and die sets, thereby scheduling replacement or refurbishment precisely when needed. This shift from time-based maintenance to condition-based maintenance is crucial in high-throughput environments where unexpected tool failure can result in substantial financial losses and batch waste.

Furthermore, AI is beginning to influence the initial design phase through Generative Design Optimization (GDO). By feeding critical parameters—such as required compression force, desired tablet shape complexity, and the abrasive index of the formulation—into machine learning models, designers can rapidly explore thousands of feasible tooling geometries and material pairings that would be impossible or impractical to test manually. This accelerates the time-to-market for complex generic and specialized dosage forms, ensures better physical integrity of the tooling, and provides a significant competitive advantage to manufacturers adopting these smart design paradigms. AI thus acts as a catalyst for both operational efficiency and product innovation within the tooling ecosystem.

- AI-driven predictive maintenance forecasts tooling wear, reducing unscheduled downtime by up to 30%.

- Machine learning optimizes material selection (steel grade and coating) based on formulation abrasiveness and lubricity.

- Generative Design Optimization (GDO) accelerates the design of complex and custom punch and die profiles.

- Real-time monitoring using AI algorithms ensures immediate detection of minor tooling defects, preventing batch contamination.

- Improved root cause analysis for sticking, capping, and lamination issues by correlating process variables with tooling performance data.

DRO & Impact Forces Of Tablet Compression Tooling Market

The dynamics of the Tablet Compression Tooling Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO). The core driver is the robust expansion of the global pharmaceutical industry, particularly the high-volume production required by the generic drug sector, which necessitates continuous investment in durable and efficient tooling. Parallelly, the increasing prevalence of chronic diseases globally drives demand for diverse oral solid dosage forms, mandating specialized and high-precision tools. Technological innovation, such as the development of multi-tip tooling and advanced anti-stick/anti-wear coatings, serves as a significant growth catalyst by offering enhanced productivity and tool longevity, directly impacting the profitability of pharmaceutical manufacturers.

However, the market faces significant restraints. The high initial capital investment required for specialized tooling, particularly when moving into complex or highly potent drug manufacturing, can deter smaller or emerging market players. Moreover, the stringent regulatory environment imposed by bodies like the FDA and EMA demands continuous validation and adherence to strict specifications (like TSM and EU standards), increasing compliance costs for manufacturers. Counterfeit or low-quality tooling poses a persistent threat, undermining the integrity of the supply chain and potentially jeopardizing drug safety, thus requiring constant vigilance from reputable suppliers and end-users alike.

Opportunities for expansion lie predominantly in two areas: geographical penetration into high-growth emerging economies and technological advancement in materials science. The ongoing trend toward continuous manufacturing systems, which place extreme stress on tooling, creates a strong opportunity for premium, high-performance tooling solutions capable of operating reliably 24/7. Furthermore, the explosion in the nutraceutical and dietary supplement market demands specialized tooling for non-pharmaceutical, often abrasive, formulations. Tooling manufacturers who can effectively leverage IoT sensors for real-time performance tracking and offer comprehensive, data-driven refurbishment and technical support services are positioned for accelerated market share capture.

Segmentation Analysis

The Tablet Compression Tooling Market is comprehensively segmented based on Type, Application, Standard, and geographical Region, reflecting the diverse requirements and complexity inherent in global tablet manufacturing. The segmentation by Type, distinguishing between standard punches and dies (like B and D type) and specialized/custom tooling, is critical as it reflects the differing value propositions—volume efficiency versus handling complexity. Segmentation by Application highlights the crucial distinction between the stringent, high-volume pharmaceutical sector and the expanding, often abrasive, nutraceutical segment. Analyzing these segments provides strategic insights into investment areas, such as the growing demand for specialized tooling required for bi-layer or multi-layer tablets designed for complex drug release profiles, which commands higher pricing and requires greater precision in manufacturing.

The segmentation based on the physical Standard (TSM or EU) dictates regional market preference and compatibility with specific compression machines, acting as a crucial barrier to entry or facilitator for global suppliers. The majority of the global market adheres to one of these two recognized standards, ensuring interchangeability and consistency. Furthermore, segmentation by material and coating type (e.g., stainless steel, carbide, chromium-plated, ceramic) allows for granular analysis of material science trends driven by the need to combat issues like sticking, corrosion, and excessive wear caused by modern drug excipients. The overall segmentation structure reveals a market moving towards premium, customized solutions, while the foundation remains rooted in high-quality standard tooling for essential medicines.

- By Type:

- Standard Tooling (B-Type, D-Type)

- Special Tooling (Multi-Tip, Customized Shapes, Core Rods)

- By Standard:

- TSM (Tablet Specification Manual)

- EU Standard (European Standard)

- By Application:

- Pharmaceutical Industry (Generic Drugs, Ethical Drugs, OTC)

- Nutraceutical Industry (Dietary Supplements, Vitamins)

- Confectionery/Industrial Applications

- By Material & Coating:

- Stainless Steel Tooling

- Carbide Tooling

- Special Coatings (Chromium Nitride, Titanium Nitride, Ceramics)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Tablet Compression Tooling Market

The value chain for Tablet Compression Tooling starts with the Upstream Analysis, which is heavily reliant on the sourcing of high-grade specialized metals and alloys, primarily stainless steel (like 440C or high-carbon steel) and specialized materials such as tungsten carbide for abrasive applications. These raw materials must meet extremely tight specifications regarding purity and structural integrity, requiring specialized metallurgy suppliers. Key activities at this stage include precision machining (CNC turning, grinding), heat treatment processes to achieve the required hardness and wear resistance, and the application of surface coatings (PVD/CVD processes) which are vital for mitigating sticking and corrosion. Intellectual property related to proprietary heat treatments and coating formulas holds significant value at the upstream end.

The midstream phase involves the core manufacturing of punches and dies by specialized tooling houses, focusing on strict quality control and adherence to precise dimensional tolerances (often measured in microns). This stage also includes critical quality checks, such as profile inspection, surface roughness measurement, and compliance certification (TSM or EU). Distribution channels play a critical role; direct sales channels are heavily favored for complex or specialized tooling, as they allow tooling manufacturers to provide direct technical consultation, customized design services, and immediate after-sales support and refurbishment programs. Indirect channels, typically involving local distributors or agents, are more common for standard tooling replacement parts in emerging markets.

Downstream analysis focuses on the end-users: pharmaceutical manufacturers (large integrated firms, CMOs/CDMOs), and nutraceutical producers. The longevity and reliability of the tooling directly impact the operational efficiency and compliance of these downstream users. Customer value is defined by tool performance (e.g., resistance to wear and tear), low total cost of ownership (TCO) achieved through effective refurbishment services, and rapid turnaround times for custom tooling orders. The strong demand for continuous servicing and validation support makes the tooling market highly service-intensive, often creating long-term relationships between suppliers and major pharmaceutical clients, moving beyond a simple transactional model.

Tablet Compression Tooling Market Potential Customers

The primary consumers and end-users of Tablet Compression Tooling are overwhelmingly situated within the global solid oral dosage manufacturing sector. Pharmaceutical companies constitute the largest segment of potential customers, ranging from large multinational corporations (MNCs) that produce both branded and generic medicines, to mid-sized regional manufacturers and Contract Manufacturing Organizations (CMOs) or Contract Development and Manufacturing Organizations (CDMOs). These organizations require massive volumes of replacement tooling due to the constant wear and tear associated with high-speed tablet presses, and they also drive demand for custom tooling necessary for developing new, complex drug formulations, such as bi-layer or extended-release tablets.

A rapidly expanding customer base includes the Nutraceutical and Dietary Supplement manufacturers. While their regulatory oversight might be slightly less stringent than the pharmaceutical sector, these companies often work with highly abrasive materials (e.g., calcium, plant extracts) that necessitate tooling with superior wear-resistant coatings, driving demand for specialized, robust punch and die sets. As consumer awareness around health and wellness grows, the production volumes in this sector are escalating, creating sustained demand for reliable and cost-effective tooling solutions capable of handling diverse and difficult-to-compress formulations effectively.

Furthermore, academic research institutions and specialized compounding pharmacies represent smaller, yet technically demanding, customer segments. These entities require highly precise, often small-scale, custom tooling for formulation development and clinical trial batch production, prioritizing precision and material inertness over sheer volume capacity. The decision-making unit (DMU) within large pharmaceutical end-users typically includes the procurement department (focused on cost and contract management), the engineering department (focused on machine compatibility and maintenance), and the quality assurance/regulatory compliance team (focused on material certification and adherence to GMP standards).

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | I Holland Ltd., Natoli Engineering Company, Kikusui Seisakusho Ltd., Adamus S.A., GEA Group AG, ACG Worldwide, LMT Group, Tooling & Die Solutions, Elizabeth Carbide Die Co., H.W. Wallace & Co. Ltd., R.P.S. Group, Sennse Tooling, JSN Industrial Tools, Palamatic Process, GlobePharma Inc., Korsch AG, Fette Compacting, Cadmach Machinery, Kilian Tableting, STC Punch and Die Set. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tablet Compression Tooling Market Key Technology Landscape

The technology landscape of the Tablet Compression Tooling Market is dominated by advancements in materials science, precision machining, and surface engineering. The shift from traditional chrome plating to advanced physical vapor deposition (PVD) and chemical vapor deposition (CVD) coatings—such as Titanium Nitride (TiN), Chromium Nitride (CrN), and specialized ceramic coatings—is a critical technological trend. These advanced coatings offer superior hardness, significantly reduced friction, and enhanced resistance to sticking (adhesion of formulation material to the punch face), which is a common and costly problem in high-speed compression. The development of specialized steel grades, including high-vanadium stainless steel, is crucial for handling abrasive APIs and excipients, extending the operational life of the tooling even under high mechanical stress. The precision manufacturing tolerance achieved through modern Computer Numerical Control (CNC) grinding and polishing machines ensures that new tooling meets the micron-level accuracy required by regulatory guidelines.

Another significant technological advancement involves the integration of monitoring capabilities into the tooling itself, often referred to as smart tooling. Although still nascent, this includes the potential use of micro-sensors embedded within the punch body or tablet press turret, designed to measure parameters like temperature, compression force distribution, and micro-vibrations in real time. These data points are essential for facilitating AI-driven predictive maintenance and ensuring process analytical technology (PAT) compliance. Furthermore, the increasing adoption of multi-tip tooling technology allows a single punch station to compress multiple tablets simultaneously. While this necessitates highly precise alignment and greater complexity in tool geometry, it dramatically increases hourly output without requiring investment in additional presses, driving productivity gains in generic drug manufacturing.

The evolution of design software utilizing Finite Element Analysis (FEA) and computational modeling allows tooling manufacturers to simulate the compression process, stress distribution, and potential failure points before physical prototyping. This reduces the development cycle time for customized tooling and ensures optimal performance when dealing with challenging drug profiles (e.g., highly potent compounds or irregularly shaped tablets). Finally, innovative refurbishment technologies, including micro-welding techniques and advanced re-coating processes, extend the lifespan of expensive punch and die sets, offering a cost-effective alternative to complete replacement, thus influencing the total cost of ownership for end-users and solidifying the service component of the technology landscape.

Regional Highlights

Geographical analysis reveals stark contrasts in market maturity, regulatory focus, and growth trajectories across different regions, driven primarily by localized pharmaceutical production trends and healthcare expenditures. North America, led by the United States, represents a highly mature and premium market segment. This region is characterized by early adoption of complex tooling technologies, high demand for custom solutions related to novel drug delivery systems, and stringent adherence to TSM standards. Investment here is focused on tooling compatible with continuous manufacturing systems and handling of Highly Potent Active Pharmaceutical Ingredients (HPAPIs), necessitating superior containment and coating technologies. The presence of major pharmaceutical innovators ensures continuous demand for high-specification tooling replacement and development services.

Europe mirrors North America in its focus on quality and regulatory compliance (EU Standard prevalence), but the demand structure is slightly more balanced between branded and generic manufacturing centers, particularly in countries like Germany, Switzerland, and Italy. Eastern Europe, however, is a high-growth area as local pharmaceutical production capacity expands to serve growing regional markets. European tooling manufacturers are globally renowned for precision engineering and materials science expertise, often acting as technology leaders in advanced surface treatments and metallurgical advancements applied to punch and die fabrication. The unified regulatory framework across the European Union further facilitates the trade and standardized adoption of high-quality tooling.

Asia Pacific (APAC) is positioned as the primary engine for global market volume growth, driven chiefly by India and China—global powerhouses in generic drug manufacturing and APIs. This region exhibits massive demand for standard B and D type tooling due to high-volume production requirements. While cost-sensitivity is higher in APAC compared to Western markets, there is a growing trend among leading domestic manufacturers to invest in premium, high-durability tooling to meet stringent export standards (US FDA and EMA). Governmental initiatives supporting domestic pharmaceutical capacity, coupled with rising healthcare infrastructure development in Southeast Asia, guarantee accelerated expansion throughout the forecast period. Latin America and the Middle East & Africa (MEA) are emerging markets experiencing moderate, steady growth. These regions rely heavily on imports but are slowly developing localized manufacturing hubs, leading to initial demand for standard tooling and localized technical support services.

- North America: Dominant market for premium, custom, and HPAPI-compatible tooling; driven by stringent quality standards (FDA) and continuous manufacturing adoption.

- Europe: High demand for standardized, high-precision EU standard tooling; technological innovation focused on advanced coatings and material durability; strong refurbishment service market.

- Asia Pacific (APAC): Fastest growing region by volume; massive generic drug production in India and China; increasing investment in high-quality tooling to meet export compliance standards.

- Latin America (LATAM): Moderate growth driven by localized pharmaceutical market expansion; reliance on imported standard tooling; focus on cost-efficiency.

- Middle East & Africa (MEA): Nascent market development; growth tied to health spending initiatives and establishment of regional manufacturing centers; early stages of quality tooling adoption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tablet Compression Tooling Market.- I Holland Ltd.

- Natoli Engineering Company

- Kikusui Seisakusho Ltd.

- Adamus S.A.

- GEA Group AG (Specific tooling operations)

- ACG Worldwide

- LMT Group

- Tooling & Die Solutions

- Elizabeth Carbide Die Co.

- H.W. Wallace & Co. Ltd.

- R.P.S. Group

- Sennse Tooling

- JSN Industrial Tools

- Palamatic Process

- GlobePharma Inc.

- Korsch AG (Often partners with tooling suppliers)

- Fette Compacting (Often partners with tooling suppliers)

- Cadmach Machinery

- Kilian Tableting

- STC Punch and Die Set

Frequently Asked Questions

What are the primary factors driving the demand for advanced Tablet Compression Tooling coatings?

The primary drivers include the necessity to combat complex formulation challenges such as sticking, capping, and abrasive wear, particularly with modern excipients and highly potent drug compounds. Advanced coatings like Chromium Nitride (CrN) and specialized ceramics extend tool lifespan, significantly reduce maintenance downtime, and ensure regulatory compliance by maintaining consistent tablet quality and reducing cross-contamination risks, crucial for maximizing OEE in pharmaceutical manufacturing.

What is the difference between TSM and EU Standard Tablet Compression Tooling?

TSM (Tablet Specification Manual) and EU Standard are the two globally recognized dimensional specifications for punches and dies. TSM is predominantly used in North America, while the EU standard is widely adopted across Europe and many Asian countries. While both standards ensure consistency, they differ fundamentally in critical dimensions such as head thickness, overall length, and curvature profiles, meaning tooling is generally not interchangeable between presses designed for different standards.

How does multi-tip tooling impact pharmaceutical production efficiency and costs?

Multi-tip tooling significantly enhances production efficiency by allowing the simultaneous compression of multiple tablets (e.g., 4 to 8 tablets) at a single turret station, maximizing the output per rotation. This minimizes machine time and labor costs per tablet. While the initial investment for multi-tip tools is higher due to increased complexity and precision requirements, the improved throughput yields a dramatically lower total cost of ownership (TCO) in high-volume production environments like generic drug manufacturing.

Which market segment holds the greatest growth potential over the forecast period (2026-2033)?

The Special Tooling segment, encompassing multi-tip, customized, and bi-layer punches and dies, is projected to exhibit the highest value-based Compound Annual Growth Rate (CAGR). This growth is fueled by increasing pharmaceutical R&D activity requiring complex dosage forms and the sustained pressure on manufacturers to increase throughput without substantial capital expenditure on new tablet presses, making multi-tip solutions highly attractive and necessary.

What role does digitalization and IoT play in the future of Tablet Compression Tooling?

Digitalization enables the use of IoT sensors and embedded technology (Smart Tooling) to gather real-time data on tool performance, wear rate, and mechanical stress. This data feeds into AI-driven Predictive Maintenance programs, allowing manufacturers to schedule tool refurbishment or replacement precisely, minimizing unplanned stoppages, optimizing inventory management, and ensuring the tooling remains within critical performance parameters required for continuous, high-quality pharmaceutical manufacturing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager