Tablet Packaging Machines Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439281 | Date : Jan, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Tablet Packaging Machines Market Size

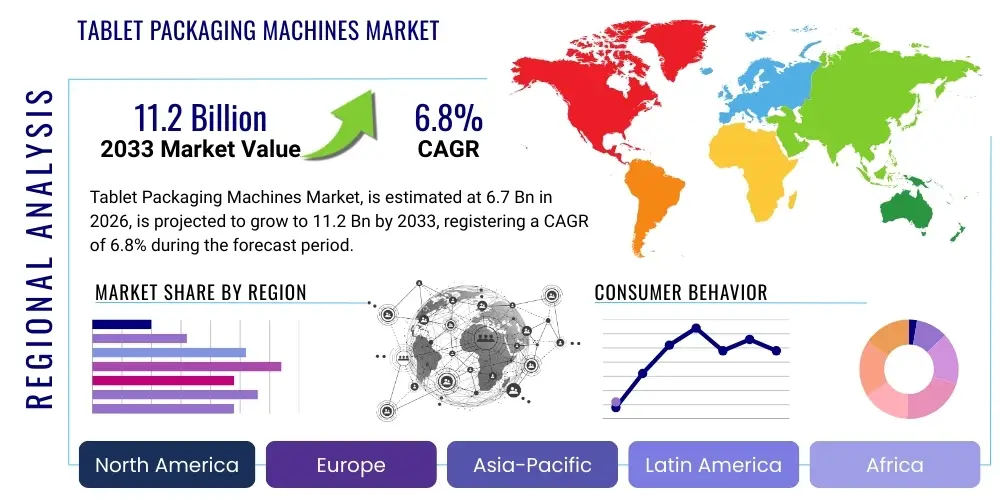

The Tablet Packaging Machines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 6.7 Billion in 2026 and is projected to reach USD 11.2 Billion by the end of the forecast period in 2033.

Tablet Packaging Machines Market introduction

The Tablet Packaging Machines Market encompasses a wide array of specialized equipment designed for the efficient and precise packaging of pharmaceutical, nutraceutical, and sometimes food-grade tablets and capsules. These machines are integral to ensuring product integrity, safety, and compliance with stringent regulatory standards across various industries. They perform critical functions such as counting, filling, sealing, blistering, strip packaging, and cartoning, often integrating advanced technologies for high-speed operation and reduced human intervention. The primary objective is to protect the product from environmental factors, extend shelf life, provide accurate dosage, and facilitate supply chain logistics.

Major applications of tablet packaging machines are predominantly found in the pharmaceutical and biotechnology sectors, where sterile and tamper-evident packaging is paramount. Nutraceutical companies also extensively utilize these machines for vitamins, supplements, and dietary aids, demanding high precision and output. Benefits of adopting advanced tablet packaging solutions include enhanced operational efficiency, significant reduction in manual labor costs, improved accuracy in counting and dosing, superior product protection, and adherence to global manufacturing practices (GMP) and regulatory mandates. The driving factors behind market growth include the escalating global demand for pharmaceutical products, the expansion of the nutraceutical industry, the increasing adoption of automation to boost productivity and reduce human error, and the continuous innovation in packaging materials and machine technologies that offer greater flexibility and speed.

Tablet Packaging Machines Market Executive Summary

The Tablet Packaging Machines Market is experiencing robust growth, driven by an accelerating demand for pharmaceutical and nutraceutical products globally, coupled with a pervasive push towards automation in manufacturing processes. Key business trends indicate a strong inclination towards integrated packaging lines that offer seamless transitions between various packaging stages, from tablet counting to final cartoning. Manufacturers are increasingly investing in modular and flexible systems capable of handling diverse tablet sizes and packaging formats, catering to an evolving product landscape and fluctuating batch requirements. Furthermore, a significant trend involves the development of machines with enhanced data connectivity and analytics capabilities, facilitating predictive maintenance and optimized operational performance, aligning with Industry 4.0 principles. The emphasis on sustainable packaging solutions is also shaping machine design, with demand for equipment that can process eco-friendly materials and minimize waste.

Regional trends reveal Asia Pacific as a primary growth engine, fueled by the expansion of its pharmaceutical manufacturing base, increasing healthcare expenditure, and a burgeoning nutraceutical market, particularly in countries like China and India. North America and Europe continue to be significant markets, characterized by high adoption rates of advanced, high-speed, and fully automated systems, driven by stringent regulatory environments and a focus on high-quality production. These regions are also at the forefront of technological innovation, including the integration of AI and machine learning for enhanced efficiency and quality control. Segment-wise, automatic tablet packaging machines dominate the market due to their superior speed, accuracy, and minimal labor requirements, making them ideal for large-scale production. The blistering and bottle filling segments are anticipated to maintain substantial market shares, reflecting widespread packaging preferences for solid dosage forms, with a growing emphasis on intelligent systems that offer greater flexibility and reduced changeover times.

AI Impact Analysis on Tablet Packaging Machines Market

Common user inquiries regarding AI's impact on the Tablet Packaging Machines Market frequently center on its potential to revolutionize operational efficiency, quality control, and predictive maintenance. Users are keenly interested in how AI can minimize errors, enhance throughput, and reduce downtime. There is also significant curiosity about AI's role in improving regulatory compliance through advanced data analytics and its ability to adapt to varying production demands. Concerns often include the initial investment costs, the complexity of integrating AI systems with existing machinery, and the need for a skilled workforce to manage and maintain these sophisticated systems. Expectations are high for AI to deliver unprecedented levels of precision, speed, and reliability in packaging operations, ultimately leading to significant cost savings and improved product safety and quality.

The integration of Artificial Intelligence (AI) is set to profoundly transform the tablet packaging machines market by introducing unparalleled levels of intelligence, automation, and adaptability. AI algorithms can process vast amounts of data generated during packaging operations, enabling real-time decision-making and continuous optimization. This includes self-correcting mechanisms for machine parameters, intelligent fault detection, and automated quality checks that go beyond human capabilities. The ability of AI to learn from historical data allows for the anticipation of maintenance needs, thereby reducing unexpected downtime and extending the lifespan of machinery. Furthermore, AI-powered vision systems can detect even minute defects in tablets or packaging materials with extreme accuracy, ensuring only flawless products reach the market, which is critical for patient safety and brand reputation.

Beyond process optimization, AI is also driving innovation in predictive analytics for supply chain management within the packaging ecosystem. By analyzing market demand, production schedules, and material availability, AI can help optimize inventory levels for packaging components, preventing shortages or overstocking. This predictive capability extends to machine performance, where AI can forecast component failures, allowing for proactive maintenance and reducing the likelihood of costly production halts. The technology facilitates greater customization and flexibility in packaging lines, enabling quicker changeovers for different product batches and packaging specifications, further enhancing market responsiveness. As regulatory demands continue to tighten, AI-driven data collection and reporting tools will become indispensable for ensuring compliance and maintaining comprehensive audit trails, solidifying its role as a pivotal technology for the future of tablet packaging.

- Enhanced predictive maintenance and fault diagnosis, minimizing unplanned downtime.

- Real-time quality control through AI-powered vision systems, detecting microscopic defects.

- Optimized machine parameters for increased efficiency, speed, and energy consumption.

- Automated batch changeovers and recipe management, improving flexibility and reducing human error.

- Advanced data analytics for regulatory compliance and comprehensive audit trails.

- Supply chain optimization for packaging materials based on predictive demand forecasting.

- Robotics integration for automated handling, loading, and unloading of tablets and packaging.

- Cognitive automation for self-learning and adaptive packaging processes.

DRO & Impact Forces Of Tablet Packaging Machines Market

The Tablet Packaging Machines Market is significantly influenced by a confluence of drivers, restraints, opportunities, and external impact forces. A primary driver is the continuous expansion of the global pharmaceutical and nutraceutical industries, fueled by an aging population, increasing prevalence of chronic diseases, and rising health consciousness, which directly translates into higher demand for tablets and capsules. The stringent regulatory environment, particularly in developed economies, mandates precise, secure, and compliant packaging, propelling manufacturers to invest in advanced, automated machinery that meets these rigorous standards. Furthermore, the pervasive trend towards industrial automation and the adoption of Industry 4.0 principles, including IoT and AI, incentivize the upgrade and acquisition of sophisticated packaging solutions to enhance efficiency, reduce labor costs, and minimize human error.

However, several restraints temper the market's growth. The high initial capital investment required for advanced tablet packaging machines can be a significant barrier, especially for small and medium-sized enterprises (SMEs) with limited budgets. The complexity of integrating these sophisticated machines into existing production lines and the need for a highly skilled workforce for operation and maintenance also pose challenges. Additionally, the fluctuating costs of raw materials, such as stainless steel for machine components and various plastic and foil packaging materials, can impact manufacturing costs and overall market pricing. The regulatory landscape, while a driver for quality, can also be a restraint due to evolving and diverse regional standards that necessitate complex machine designs and validation processes.

Opportunities for market growth primarily lie in emerging economies, particularly in Asia Pacific, Latin America, and the Middle East and Africa, where pharmaceutical manufacturing is rapidly expanding, and healthcare infrastructure is improving. These regions offer substantial untapped potential for new installations and technology upgrades. Innovations in sustainable packaging materials and machine designs that accommodate them present another significant opportunity, aligning with global environmental objectives and consumer preferences. Furthermore, the increasing demand for contract manufacturing and packaging services by pharmaceutical companies creates an avenue for specialized packaging solution providers. Impact forces include rapid technological advancements, leading to more efficient and flexible machines, global economic fluctuations affecting investment decisions, geopolitical events influencing supply chains, and public health crises that can either boost or disrupt demand for specific pharmaceutical products and their packaging requirements. The ongoing push for personalized medicine and smaller batch sizes also influences demand for highly flexible and adaptable packaging solutions.

Segmentation Analysis

The Tablet Packaging Machines Market is extensively segmented based on machine type, automation level, and end-use industry, providing a granular view of market dynamics and opportunities. This segmentation helps in understanding the diverse requirements of various stakeholders and the specific technological advancements driving each sub-segment. From highly specialized blistering machines to versatile bottle filling and capping systems, the market offers solutions tailored to different product forms, production scales, and regulatory needs. The level of automation, ranging from manual to fully automatic, dictates efficiency and capital expenditure, while end-use industries dictate specific compliance and throughput demands. Each segment experiences unique growth drivers and faces distinct challenges, making a comprehensive analysis crucial for market participants.

- By Machine Type

- Blister Packaging Machines

- Strip Packaging Machines

- Bottle Filling and Capping Machines

- Sachet/Pouch Packaging Machines

- Cartoning Machines

- Counting Machines

- De-blistering Machines

- Serialization and Track & Trace Systems

- Labelling Machines

- Case Packers and Palletizers

- By Automation Level

- Automatic Machines

- Semi-Automatic Machines

- Manual Machines

- By End-Use Industry

- Pharmaceutical & Biotechnology Industry

- Nutraceuticals Industry

- Contract Manufacturing Organizations (CMOs)

- Food & Beverage Industry (for certain tablet forms like candies, effervescent tablets)

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Tablet Packaging Machines Market

The value chain for the Tablet Packaging Machines Market begins with upstream activities involving the sourcing of raw materials and components, which include specialized metals like stainless steel, precision mechanical parts, electrical and electronic components, and advanced control systems. Key suppliers in this stage provide high-grade materials essential for manufacturing robust, hygienic, and long-lasting machinery. Research and development activities, which focus on innovation in machine design, automation capabilities, and compliance with evolving industry standards, also form a critical upstream component. Manufacturers then engage in the fabrication, assembly, and testing of the packaging machines, ensuring they meet performance specifications and quality benchmarks before they are ready for market.

Midstream in the value chain, the manufactured machines are distributed through various channels. This typically involves a combination of direct sales teams from major manufacturers who establish direct relationships with large pharmaceutical and nutraceutical companies, and a network of indirect distributors or agents who cater to smaller clients or specific regional markets. These distributors often provide localized sales support, installation services, and initial training. The sales process frequently involves extensive consultation to customize solutions to client-specific needs, considering factors such as production volume, tablet type, packaging format, and regulatory requirements.

Downstream activities primarily involve the end-users—pharmaceutical companies, nutraceutical manufacturers, and Contract Manufacturing Organizations (CMOs)—who integrate these machines into their production lines. Post-purchase, the value chain continues with critical support services, including installation, commissioning, operator training, maintenance, and technical support. Many manufacturers offer comprehensive service contracts, spare parts supply, and upgrade services to ensure the machines operate efficiently throughout their lifecycle. The feedback loop from end-users to manufacturers is crucial for continuous product improvement and adaptation to market demands, completing the circular nature of the value chain. Both direct and indirect distribution channels play vital roles, with direct channels fostering deeper client relationships and indirect channels providing broader market reach and local presence.

Tablet Packaging Machines Market Potential Customers

The primary potential customers for Tablet Packaging Machines are entities within the pharmaceutical and biotechnology sector. This includes large multinational pharmaceutical corporations that operate extensive manufacturing facilities, requiring high-speed, fully automated, and integrated packaging lines for various solid dosage forms. Additionally, numerous smaller and medium-sized pharmaceutical companies, including generic drug manufacturers, represent a substantial customer base, often seeking flexible and scalable solutions to meet their specific production volumes and product portfolios. These customers prioritize machines that ensure product integrity, sterility, and strict adherence to Good Manufacturing Practices (GMP) and other regulatory guidelines, as patient safety and regulatory compliance are paramount in this industry.

Another significant segment of potential customers is the nutraceutical industry, encompassing manufacturers of vitamins, dietary supplements, herbal remedies, and functional foods. With growing consumer awareness regarding health and wellness, the demand for nutraceutical products has surged, driving the need for efficient and precise tablet packaging machinery. These customers often require machines capable of handling a wide variety of tablet shapes and sizes, with an emphasis on accuracy in counting and packaging to ensure proper dosage and consumer trust. The packaging also needs to protect sensitive ingredients from degradation, requiring robust sealing and protective barrier solutions. They often seek machines that offer versatility to accommodate diverse product lines and rapid market introductions.

Contract Manufacturing Organizations (CMOs) and Contract Development and Manufacturing Organizations (CDMOs) form a rapidly growing customer segment. These companies provide manufacturing and packaging services to other pharmaceutical and nutraceutical firms, often handling multiple clients with diverse product specifications. Consequently, CMOs/CDMOs require highly adaptable, modular, and versatile tablet packaging machines that can be quickly reconfigured for different batch sizes, product types, and packaging formats. Their operational model demands equipment with minimal changeover times and high uptime, making them key purchasers of advanced, flexible, and automated packaging solutions. Furthermore, to a lesser extent, certain segments of the food and beverage industry that produce tablet-form candies, effervescent tablets, or soluble ingredients may also represent a niche customer base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.7 Billion |

| Market Forecast in 2033 | USD 11.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Uhlmann Pac-Systeme, IMA S.p.A., Syntegon Technology (formerly Bosch Packaging Technology), Marchesini Group S.p.A., Romaco Pharmatechnik GmbH, Accupack Engineering Pvt. Ltd., ACG Group, GEA Group AG, KÖRA-PACKMAT, CAM S.r.l., Sejong Pharmatech Co., Ltd., Shanghai Pharma Machinery Co., Ltd., Truking Technology Limited, Hoong-A Corporation, Dara Pharmaceutical Packaging, Krones AG, MULTIVAC, Optima packaging group GmbH, Fette Compacting GmbH, MG2 S.r.l. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tablet Packaging Machines Market Key Technology Landscape

The Tablet Packaging Machines Market is characterized by a dynamic and evolving technology landscape, primarily driven by the imperative for increased efficiency, precision, and compliance in pharmaceutical and nutraceutical packaging. A cornerstone technology is advanced automation, which includes robotic arms for precise handling and placement, and integrated control systems that orchestrate entire packaging lines from tablet feeding to final case packing. Programmable Logic Controllers (PLCs) and Human-Machine Interfaces (HMIs) are standard, enabling operators to manage complex processes with intuitive controls. Vision inspection systems, often leveraging high-resolution cameras and sophisticated image processing algorithms, are crucial for quality control, detecting defects, foreign particles, or incorrect tablet counts with unparalleled accuracy and speed, ensuring product integrity and patient safety.

Furthermore, the integration of Industry 4.0 technologies is profoundly shaping this landscape. The Internet of Things (IoT) enables machines to communicate with each other and with central monitoring systems, facilitating real-time data collection on performance metrics, energy consumption, and maintenance needs. This connectivity supports predictive maintenance strategies, where sensors and analytical software anticipate potential failures before they occur, significantly reducing unplanned downtime. Artificial Intelligence (AI) and Machine Learning (ML) algorithms are increasingly being embedded into these systems to optimize machine settings, perform intelligent fault diagnosis, and enhance decision-making processes for greater operational efficiency and throughput. These AI capabilities allow machines to learn from operational data and adapt to varying production conditions, making packaging lines more resilient and agile.

Serialization and Track & Trace technologies are another critical aspect, driven by stringent global regulations aimed at combating counterfeiting and enhancing supply chain transparency. These systems involve applying unique identifiers to individual tablet packages, cartons, and cases, allowing for complete traceability from manufacturing to distribution. Data management software, cloud computing, and secure networks are integral to implementing these serialization solutions effectively. Additionally, developments in flexible packaging technologies, such as thermoforming for blister packs and various sealing methods, continue to evolve, catering to diverse product requirements and sustainable material trends. The ongoing pursuit of modular designs and quick changeover mechanisms also represents a key technological focus, allowing manufacturers to rapidly adapt production lines to different product sizes and packaging formats, thereby maximizing asset utilization and reducing operational costs in a highly competitive market.

Regional Highlights

- North America: This region holds a significant share of the Tablet Packaging Machines Market, characterized by early adoption of advanced automation and a strong emphasis on regulatory compliance. The U.S. and Canada are major contributors, driven by a well-established pharmaceutical industry, high healthcare expenditure, and substantial R&D investments in new drug development. The demand here is for high-speed, highly automated, and sophisticated machines capable of serialization and comprehensive data management to meet FDA regulations.

- Europe: Europe represents another mature market with robust growth, particularly in countries like Germany, Italy, Switzerland, and France, which are home to leading pharmaceutical manufacturers and packaging machine innovators. The region is known for its stringent quality standards (EMA regulations) and a focus on precision engineering. There is a strong trend towards integrating smart factory concepts (Industry 4.0) into packaging lines, including AI-driven optimization and sustainable packaging solutions.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, propelled by the rapid expansion of the pharmaceutical and nutraceutical industries in countries such as China, India, Japan, and South Korea. Increasing healthcare access, rising disposable incomes, and the presence of a large generic drug manufacturing base fuel demand. The market here is characterized by a mix of high-volume automated lines and cost-effective semi-automatic solutions, with a growing shift towards advanced technologies and compliance with international standards.

- Latin America: Countries like Brazil, Mexico, and Argentina contribute to the growth of the Tablet Packaging Machines Market in Latin America. The region is witnessing increasing investments in healthcare infrastructure and local pharmaceutical manufacturing capabilities. While still developing, there is a growing demand for automated and semi-automated packaging solutions to improve efficiency and meet rising domestic and regional healthcare needs.

- Middle East & Africa (MEA): The MEA region is an emerging market with significant growth potential, particularly in countries like Saudi Arabia, UAE, and South Africa. Investments in pharmaceutical manufacturing and healthcare modernization, alongside efforts to reduce reliance on imported medicines, are driving the adoption of packaging machinery. The market is developing, with a focus on acquiring reliable and cost-effective solutions to establish and upgrade local production capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tablet Packaging Machines Market.- Uhlmann Pac-Systeme

- IMA S.p.A.

- Syntegon Technology (formerly Bosch Packaging Technology)

- Marchesini Group S.p.A.

- Romaco Pharmatechnik GmbH

- Accupack Engineering Pvt. Ltd.

- ACG Group

- GEA Group AG

- KÖRA-PACKMAT

- CAM S.r.l.

- Sejong Pharmatech Co., Ltd.

- Shanghai Pharma Machinery Co., Ltd.

- Truking Technology Limited

- Hoong-A Corporation

- Dara Pharmaceutical Packaging

- Krones AG

- MULTIVAC

- Optima packaging group GmbH

- Fette Compacting GmbH

- MG2 S.r.l.

Frequently Asked Questions

What is a Tablet Packaging Machine?

A Tablet Packaging Machine is specialized industrial equipment designed to automatically or semi-automatically package solid dosage forms such as tablets, capsules, and pills. These machines perform various functions including counting, filling, blistering, strip packaging, cartoning, and sealing, ensuring product protection, accuracy, and compliance with industry standards, primarily for pharmaceutical and nutraceutical products.

What are the primary types of Tablet Packaging Machines?

The primary types include Blister Packaging Machines, which seal tablets into pre-formed plastic cavities with a foil backing; Strip Packaging Machines, which encapsulate tablets individually in continuous strips; Bottle Filling and Capping Machines, for dispensing and sealing tablets in containers; and Cartoning Machines, which package blister packs or bottles into cardboard cartons for distribution.

Which industries are the main users of Tablet Packaging Machines?

The pharmaceutical and biotechnology industry is the largest end-user, requiring precise and compliant packaging for medications. The nutraceutical industry, producing vitamins and supplements, is another major consumer. Additionally, Contract Manufacturing Organizations (CMOs) that provide packaging services to these sectors are significant users of these machines.

How is AI impacting the Tablet Packaging Machines Market?

AI is transforming the market by enabling predictive maintenance, enhancing real-time quality control through advanced vision systems, optimizing machine parameters for increased efficiency, and automating complex tasks like batch changeovers. This leads to reduced downtime, improved product safety, and greater operational agility in packaging processes.

What factors are driving the growth of the Tablet Packaging Machines Market?

Key growth drivers include the increasing global demand for pharmaceutical and nutraceutical products, stringent regulatory requirements mandating secure and compliant packaging, the pervasive trend towards industrial automation to boost efficiency and reduce errors, and continuous technological advancements leading to more sophisticated and flexible packaging solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager