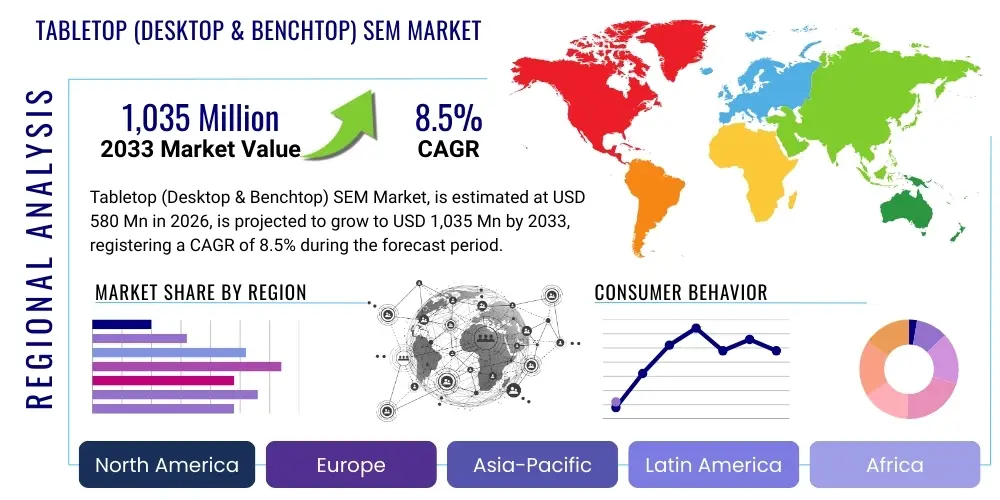

Tabletop (Desktop & Benchtop) SEM Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438125 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Tabletop (Desktop & Benchtop) SEM Market Size

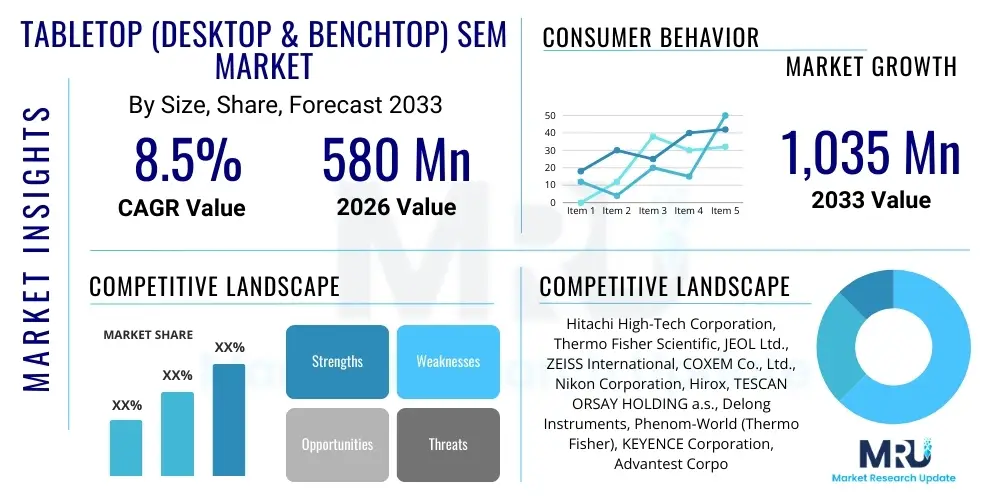

The Tabletop (Desktop & Benchtop) SEM Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $580 Million USD in 2026 and is projected to reach $1,035 Million USD by the end of the forecast period in 2033.

Tabletop (Desktop & Benchtop) SEM Market introduction

The Tabletop Scanning Electron Microscope (SEM) market encompasses compact, user-friendly electron microscopy systems designed for placement on standard laboratory benches or desktops, offering high-resolution imaging and elemental analysis capabilities. These instruments bridge the gap between traditional, large-scale floor-standing SEMs and optical microscopes, providing detailed surface morphology information, typically down to the nanometer scale. Their smaller footprint, simplified operation, and lower capital expenditure make them increasingly attractive across various sectors, enabling decentralized materials characterization and quality control processes closer to the point of fabrication or research.

The core product description involves advanced electron optics, vacuum systems, and digital imaging technology tailored for ease of use. Major applications span materials science research, particularly polymers, metals, and composites, forensic analysis requiring detailed trace evidence examination, and quality assurance in electronics manufacturing, including defect inspection of printed circuit boards (PCBs) and semiconductor components. Furthermore, the burgeoning demand in educational institutions for hands-on nanotechnological training significantly drives market adoption, positioning tabletop SEMs as essential tools for next-generation scientific development and industrial efficiency improvements.

Key benefits driving market adoption include significantly reduced operational complexity compared to conventional SEMs, minimal maintenance requirements, and rapid sample throughput. These factors, combined with continuous technological advancements enhancing resolution and incorporating energy-dispersive X-ray spectroscopy (EDS) modules for elemental mapping, solidify their role as essential analytical instruments. Driving factors primarily center on the accelerating pace of miniaturization in electronics, the stringent quality standards in advanced manufacturing sectors, and the global push for enhanced R&D capabilities in nanotechnology and biomedical engineering, necessitating affordable and accessible high-magnification imaging solutions.

Tabletop (Desktop & Benchtop) SEM Market Executive Summary

The global Tabletop SEM market exhibits robust growth fueled by the convergence of industrial quality control needs and academic accessibility mandates. Business trends indicate a strong focus on modular designs, integrated software interfaces optimized for non-expert users, and the incorporation of automated features, reducing the reliance on highly specialized technicians. Furthermore, strategic collaborations between microscopy manufacturers and specific vertical industry leaders, particularly in automotive and aerospace composite materials testing, are expanding the functional scope and market penetration of these compact systems. Competitive dynamics are intensifying, with key players emphasizing cost-performance ratio and global service support to capture emerging market share.

Regional trends highlight the Asia Pacific (APAC) as the dominant growth engine, attributed to massive investments in semiconductor fabrication, rapid industrialization, and substantial governmental funding allocated to advanced scientific research infrastructure in countries like China, South Korea, and Japan. North America and Europe maintain strong market shares, primarily driven by established research universities, high-value electronics R&D, and the robust pharmaceutical industry requiring precise particle analysis. However, emerging economies in Latin America and the Middle East & Africa are showing accelerating demand, capitalizing on the affordability and portability of tabletop systems to establish localized material testing capabilities.

Segment trends reveal that the Materials Science application segment consistently accounts for the largest share due to the ubiquitous need for microstructural characterization across almost every manufacturing discipline. Technologically, benchtop SEMs equipped with integrated EDS detectors are witnessing the fastest growth, as end-users increasingly require simultaneous elemental identification alongside morphological analysis, enhancing analytical efficiency. The Academic and Research Institutions segment remains a foundational consumer base, but the fastest growing end-user segment is the Industrial QC/QA sector, where decentralized, rapid inspection is critical for process optimization and fault analysis in high-volume production environments.

AI Impact Analysis on Tabletop (Desktop & Benchtop) SEM Market

User inquiries frequently revolve around how Artificial Intelligence (AI) and Machine Learning (ML) can enhance the efficiency and accessibility of Tabletop SEMs. Key themes include the potential for AI to automate complex image focusing and alignment procedures, the feasibility of using ML algorithms for rapid, standardized defect recognition and particle classification, and concerns regarding the integration cost and necessary data infrastructure. Users also seek clarity on whether AI integration will democratize the use of SEMs further, allowing routine quality control tasks to be performed reliably by personnel with minimal advanced training, thereby boosting throughput and reducing inter-operator variability. The overarching expectation is that AI will transform Tabletop SEMs from advanced visualization tools into intelligent, autonomous analytical systems.

- AI-driven automation of vacuum control and electron beam alignment, significantly reducing setup time and operator dependence.

- Machine Learning algorithms enabling rapid, unsupervised classification and quantification of defects, nanoparticles, and biological structures.

- Enhanced image processing and noise reduction via deep learning, improving signal-to-noise ratio and image clarity even at lower operating voltages.

- Predictive maintenance schedules for SEM components (e.g., filaments, pumps) based on operational telemetry analyzed by AI, minimizing unexpected downtime.

- Automated report generation and data interpretation, streamlining the workflow from image acquisition to actionable research findings or quality control reports.

- Integration of smart databases allowing users to compare acquired sample images against vast reference libraries using ML pattern recognition.

- Real-time adaptive imaging, where AI adjusts parameters (magnification, contrast) dynamically based on the observed sample characteristics to optimize data quality.

DRO & Impact Forces Of Tabletop (Desktop & Benchtop) SEM Market

The market dynamics for Tabletop SEMs are shaped by a complex interplay of growth drivers related to miniaturization and accessibility, coupled with restraints concerning resolution limitations and competitive pressures. Opportunities are largely dictated by emerging technological integrations, such as AI and enhanced spectroscopy, pushing the boundaries of what these compact devices can achieve. These forces, when aggregated, define the market's trajectory, emphasizing the shift towards high-throughput, decentralized analytical instrumentation. The primary impact force driving demand remains the compelling need for accessible nanometer-scale characterization across research and industrial quality control settings globally.

Key drivers include the expanding global nanotechnology sector and the critical demand for quality control in semiconductor and microelectronics industries, where sub-micron inspection is paramount. The relatively lower cost and ease of installation compared to traditional floor-standing SEMs make them highly appealing for smaller labs, universities, and factory floors that previously could not justify a large capital investment. However, market growth is restrained by the inherent limitations in maximum attainable resolution and magnification compared to high-end floor-standing systems, which restricts their adoption in highly specialized atomic-scale research. Furthermore, the reliance on high vacuum environments remains a procedural constraint for certain sensitive samples.

Significant opportunities lie in developing multi-modal benchtop instruments that seamlessly combine SEM imaging with Atomic Force Microscopy (AFM) or confocal microscopy, offering integrated characterization platforms. The rapidly increasing adoption of integrated EDS and WDS (Wavelength Dispersive Spectroscopy) capabilities in tabletop models presents a substantial revenue stream, satisfying the demand for simultaneous elemental analysis. Impact forces manifest as increased competitive pricing strategies among vendors, continuous innovation aimed at improving automation (GEO benefit), and the growing regulatory requirements across sectors like medical devices and pharmaceuticals demanding stringent particle and material verification, thereby accelerating the replacement cycle of older, less capable equipment.

Segmentation Analysis

The Tabletop (Desktop & Benchtop) SEM market is meticulously segmented based on the technological specifications of the instruments, their primary analytical application areas, and the varied end-user profiles that utilize these systems. Segmentation by type focuses on the vacuum environment capabilities, which directly impacts sample compatibility and imaging quality. Application-based segmentation highlights the major economic sectors driving demand, while end-user segmentation reveals the dominant purchasing power and specific requirements of academic, industrial, and government entities. This detailed segmentation aids stakeholders in targeting specific niches with tailored product offerings and strategic marketing campaigns.

- By Type

- High-Vacuum Tabletop SEM

- Low-Vacuum Tabletop SEM (VP-SEM)

- Variable Pressure Tabletop SEM

- By Detector/Integration

- Standard Imaging (SE/BSE)

- Integrated Energy Dispersive X-ray Spectroscopy (EDS)

- Integrated Wavelength Dispersive X-ray Spectroscopy (WDS)

- Cathodoluminescence (CL) Detectors

- By Application

- Materials Science and Engineering

- Electronics and Semiconductors

- Life Sciences and Biomedical (e.g., histology, pathology)

- Forensics and Security

- Pharmaceutical and Biotechnology (e.g., particle analysis)

- Geology and Mineralogy

- By End-User

- Academic Institutions and Universities

- Industrial Quality Control and Failure Analysis Labs

- Contract Research Organizations (CROs)

- Government and Defense Laboratories

Value Chain Analysis For Tabletop (Desktop & Benchtop) SEM Market

The value chain for Tabletop SEMs begins with complex upstream activities, primarily involving the sourcing and precision manufacturing of highly specialized components, including electron sources (like thermionic or field emission guns), high-precision electromagnetic lenses, vacuum pumping systems, and advanced detector technologies. Key suppliers of electron guns and high-resolution digital cameras wield significant influence over manufacturing costs and final product performance. Efficient supply chain management, particularly regarding rare materials used in specialized components, is crucial for maintaining competitive pricing and timely delivery, especially as the demand for high-performance compact systems increases.

The midstream involves the core activities of system integration, assembly, proprietary software development, and extensive quality assurance testing by the Original Equipment Manufacturers (OEMs). This stage is characterized by high intellectual property barriers related to electron optics design and automated control software. Distribution channels are varied but highly specialized. Direct sales are common for major academic or large industrial accounts, allowing OEMs to provide tailored technical consultation and installation support. Conversely, indirect distribution through regional distributors and value-added resellers (VARs) is essential for penetrating smaller markets and providing localized sales and first-line maintenance services globally.

Downstream analysis focuses on post-sales activities, including installation, calibration, operator training, maintenance, and consumables supply (e.g., filaments, vacuum pump oils). The recurring revenue stream from service contracts and spare parts is a vital component of the overall market structure. Potential customers, including academic researchers, industrial quality managers, and forensic analysts, rely heavily on robust technical support and fast maintenance response times to ensure minimal operational downtime, making high-quality post-sales service a significant differentiator and competitive advantage within the market ecosystem.

Tabletop (Desktop & Benchtop) SEM Market Potential Customers

Potential customers for Tabletop (Desktop & Benchtop) SEMs represent a diverse group spanning various professional and industrial sectors, all unified by the requirement for non-destructive, high-magnification surface characterization and elemental analysis. Primary end-users include research professors and graduate students in materials science and engineering departments who leverage these tools for rapid sample screening and fundamental research visualization. Industrial customers, particularly in electronics, automotive, and medical device manufacturing, utilize them primarily for crucial quality control, failure analysis, and reverse engineering processes directly on the production floor or adjacent laboratories. These industrial buyers prioritize speed, robustness, and ease of integration into existing quality assurance protocols, seeking to reduce production line bottlenecks.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $580 Million USD |

| Market Forecast in 2033 | $1,035 Million USD |

| Growth Rate | CAGR 8.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hitachi High-Tech Corporation, Thermo Fisher Scientific, JEOL Ltd., ZEISS International, COXEM Co., Ltd., Nikon Corporation, Hirox, TESCAN ORSAY HOLDING a.s., Delong Instruments, Phenom-World (Thermo Fisher), KEYENCE Corporation, Advantest Corporation, Gatan Inc. (Ametek), EMD Millipore, MicroXam, Focussed Photonics Inc., Semicaps, SEC Co., Ltd., Elionix Inc., Advantest Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tabletop (Desktop & Benchtop) SEM Market Key Technology Landscape

The technology landscape of the Tabletop SEM market is defined by continuous innovation aimed at enhancing resolution, simplifying operation, and expanding analytical capabilities within a compact form factor. The transition from traditional Tungsten (W) filaments to superior electron sources, particularly Cerium Hexaboride (CeB6) emitters, has significantly boosted image brightness and extended filament life, improving operational efficiency and data quality. This focus on optimizing the electron column is critical, as it directly addresses the inherent resolution trade-offs associated with smaller, less expensive instruments. Furthermore, advancements in digital signal processing (DSP) and noise reduction algorithms are essential, allowing these benchtop units to produce high-quality images comparable to older, full-sized models.

A crucial technological differentiator is the increasing integration of sophisticated analytical tools, primarily Energy Dispersive X-ray Spectroscopy (EDS). Modern Tabletop SEMs often feature Silicon Drift Detectors (SDD) for faster, more sensitive elemental analysis, sometimes even allowing simultaneous mapping alongside imaging. Software development plays an equally vital role; the use of automated features like auto-focus, auto-stigma, and navigational mapping software enables rapid sample orientation and reduces the technical expertise required by the operator. These user interface improvements are central to the democratization of electron microscopy, making the technology accessible to a broader user base outside of specialized central facilities.

Looking forward, the technology landscape is being shaped by connectivity and smart integration. Cloud connectivity for remote operation and data storage is becoming standard, facilitating collaborative research environments. Furthermore, the adoption of proprietary sample holders and motorized stages optimized for high-throughput analysis is speeding up industrial quality control applications. The development of low-voltage imaging optimization techniques is also key, allowing for the inspection of beam-sensitive and non-conductive samples without complex preparation (such as carbon or gold coating), broadening the applicability of tabletop systems across biology and polymer science.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by explosive expansion in the electronics and semiconductor manufacturing sectors, particularly in Taiwan, South Korea, and Mainland China. Government initiatives supporting local R&D and significant foreign direct investment into establishing advanced manufacturing hubs necessitate widespread adoption of decentralized QC tools like Tabletop SEMs. The rapid growth of tertiary education institutions further stimulates demand for accessible teaching and research microscopes.

- North America: This region holds a substantial market share, characterized by high-value research in nanotechnology, advanced materials, and biomedical engineering, particularly within the US. The market here is mature, focusing on high-end benchtop models with integrated analytical capabilities (EDS/WDS) and driven by strict regulatory requirements in aerospace and defense, mandating precise material verification and failure analysis.

- Europe: Europe represents a strong, stable market, sustained by robust automotive, pharmaceuticals, and academic research sectors, notably in Germany, the UK, and France. Emphasis is placed on automation and the integration of these devices into industrial production lines (Industry 4.0). Demand is supported by pan-European research programs that heavily fund materials characterization infrastructure across institutional networks.

- Latin America (LATAM): The LATAM region is emerging, with growth concentrated in industrial applications such as mining, petrochemicals, and basic manufacturing in Brazil and Mexico. The affordability and compact size of tabletop systems make them ideal for regions building foundational research and quality control capabilities, often replacing outdated optical microscopy techniques.

- Middle East & Africa (MEA): Growth in MEA is moderate but accelerating, primarily fueled by investments in diversified economic sectors, particularly materials testing related to oil and gas exploration, and rising government spending on educational infrastructure aimed at scientific capacity building in countries like Saudi Arabia and UAE.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tabletop (Desktop & Benchtop) SEM Market.- Hitachi High-Tech Corporation

- Thermo Fisher Scientific

- JEOL Ltd.

- ZEISS International

- COXEM Co., Ltd.

- Nikon Corporation

- Hirox

- TESCAN ORSAY HOLDING a.s.

- Delong Instruments

- Phenom-World (Now Thermo Fisher Scientific)

- KEYENCE Corporation

- Advantest Corporation

- Gatan Inc. (A subsidiary of Ametek)

- EMD Millipore

- MicroXam

- Focussed Photonics Inc.

- Semicaps

- SEC Co., Ltd.

- Elionix Inc.

- Advantest Corporation

Frequently Asked Questions

Analyze common user questions about the Tabletop (Desktop & Benchtop) SEM market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of a Tabletop SEM over a traditional Floor-Standing SEM?

The primary advantage is the significantly reduced footprint, lower purchase and operating costs, and enhanced ease of use, making them ideal for decentralized quality control (QC) applications, high-throughput analysis, and educational environments.

Are Tabletop SEMs capable of performing elemental analysis, and what technology is used?

Yes, most modern Tabletop SEMs are capable of elemental analysis, primarily through the integration of Energy Dispersive X-ray Spectroscopy (EDS) detectors, allowing users to identify and map the chemical composition of a sample simultaneously with high-resolution imaging.

In which industries is the adoption of Benchtop SEMs growing fastest?

Adoption is growing fastest in the Industrial Quality Control (QC) sector, particularly within microelectronics, semiconductor manufacturing, and advanced materials engineering, driven by the need for rapid, non-destructive failure analysis directly on the factory floor.

How does Artificial Intelligence (AI) influence the operational efficiency of Tabletop SEMs?

AI enhances operational efficiency by automating complex procedures such as focusing, alignment, and data interpretation, significantly reducing the required operator training and speeding up the time taken from sample loading to obtaining a definitive result or report.

What are the key technological advancements driving competitive differentiation in this market?

Key technological advancements include the deployment of high-brightness electron sources (e.g., CeB6), enhanced low-vacuum capabilities for sensitive samples, and highly optimized, integrated software packages that simplify operation and improve data reproducibility for industrial applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager