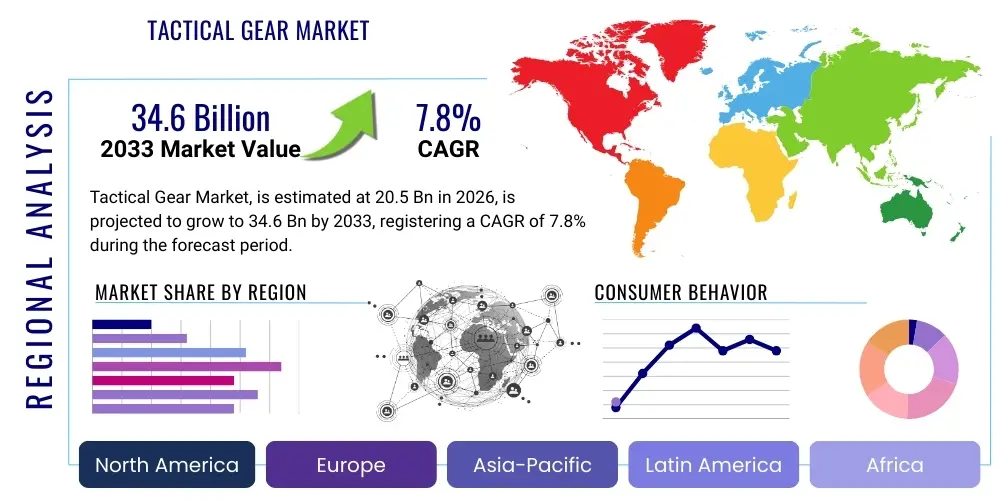

Tactical Gear Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440582 | Date : Jan, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Tactical Gear Market Size

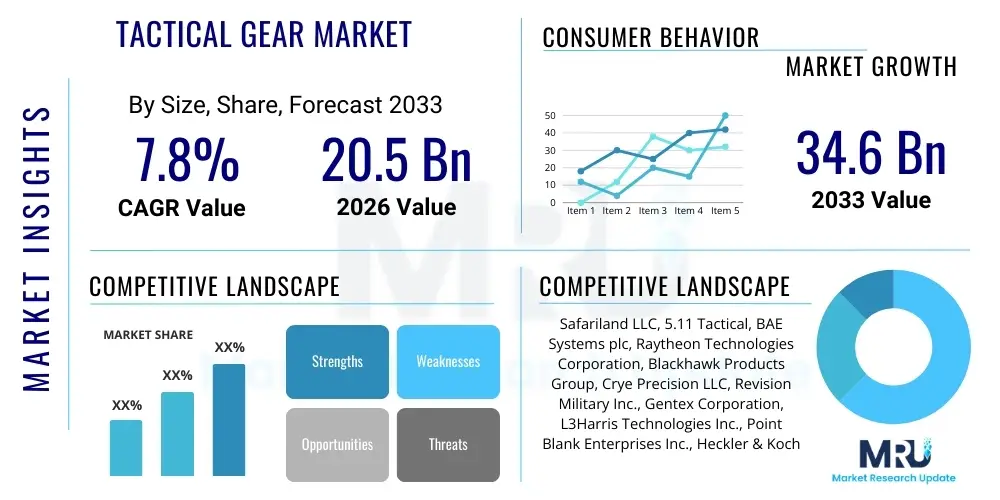

The Tactical Gear Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 20.5 Billion in 2026 and is projected to reach USD 34.6 Billion by the end of the forecast period in 2033.

Tactical Gear Market introduction

The tactical gear market encompasses a broad range of specialized equipment and apparel designed to enhance the safety, efficiency, and performance of individuals operating in demanding or hazardous environments. This includes products such as ballistic vests, helmets, specialized apparel, communication systems, optics, and load-bearing equipment. These products are primarily utilized by military personnel, law enforcement agencies, security contractors, and a growing segment of outdoor enthusiasts and hunters.

Major applications for tactical gear span combat operations, training exercises, tactical simulations, search and rescue missions, and personal protection. Beyond professional use, the market extends to civilian applications where robust and reliable gear is valued for outdoor activities, competitive shooting sports, and survival preparedness. The inherent benefits of tactical gear include enhanced protection against physical threats, improved situational awareness through advanced optics and communication, increased mobility and comfort due to ergonomic designs, and greater operational effectiveness.

Driving factors for the market's growth are multifaceted, including escalating global geopolitical tensions and conflicts, which necessitate increased defense spending and modernization efforts by national governments. The persistent threat of terrorism and internal security challenges further drives demand for advanced law enforcement and security solutions. Moreover, technological advancements in materials science, electronics, and communication are continually introducing more effective and lighter gear, while the rising popularity of outdoor adventure sports and competitive shooting among civilians also contributes significantly to market expansion.

Tactical Gear Market Executive Summary

The tactical gear market is currently experiencing dynamic shifts driven by evolving geopolitical landscapes, technological innovation, and changing end-user demands. Business trends indicate a strong move towards customization and modularity, allowing end-users to adapt their gear to specific mission requirements. There is also a notable increase in e-commerce penetration, making specialized gear more accessible to a global audience, alongside a continued emphasis on research and development to integrate advanced materials and smart technologies into products.

Regional trends reveal North America as a dominant market, primarily due to high defense expenditures, a robust law enforcement sector, and a large population of outdoor enthusiasts. Europe also maintains a significant market share, driven by military modernization programs and specialized forces requirements. However, the Asia Pacific region is emerging as a rapidly growing market, fueled by increasing defense budgets in countries like China and India, coupled with rising disposable incomes and expanding outdoor recreational activities. Latin America and the Middle East & Africa regions are also showing steady growth, often linked to internal security concerns and regional conflicts.

Segment trends highlight a strong demand for advanced personal protective equipment, including lightweight ballistic solutions and headgear, as a critical component of soldier modernization programs. The optics and communication devices segment is seeing significant innovation with the integration of night vision, thermal imaging, and secure, high-bandwidth communication systems. The load-bearing equipment segment is trending towards more ergonomic and efficient designs, while the increasing adoption of smart textiles and sensor-integrated gear points towards a future where tactical equipment offers real-time data and enhanced situational awareness.

AI Impact Analysis on Tactical Gear Market

User inquiries regarding AI's impact on the tactical gear market frequently revolve around how artificial intelligence can enhance real-time decision-making, improve soldier safety, and optimize operational efficiency. Key themes include the integration of AI into smart optics for threat detection and identification, the role of AI in predictive maintenance for equipment reliability, and the potential for AI-powered autonomous systems to support tactical operations. Concerns often surface regarding data privacy, the ethical implications of AI in combat, potential over-reliance on technology, and the cybersecurity risks associated with connected tactical systems.

- Enhanced Situational Awareness: AI-powered sensors and optics can process vast amounts of data to provide real-time environmental analysis, threat detection, and target identification, augmenting the user's perception.

- Predictive Maintenance and Logistics: AI algorithms can analyze usage patterns and sensor data from gear to predict potential equipment failures, optimizing maintenance schedules and supply chain management for spare parts.

- Training and Simulation: AI-driven virtual and augmented reality platforms offer realistic tactical training environments, allowing personnel to practice complex scenarios and adapt to evolving threats without physical risk.

- Autonomous Support Systems: AI can enable advanced robotics and drones to assist in reconnaissance, surveillance, and load carriage, reducing human exposure to danger and extending operational reach.

- Adaptive Personal Protective Equipment: Future tactical gear could utilize AI to dynamically adjust protection levels, thermal regulation, or camouflage based on real-time environmental and threat assessments.

- Improved Communication and Data Fusion: AI can filter noise, prioritize critical information, and fuse data from multiple sources (sensors, comms, databases) to present coherent intelligence to the user.

DRO & Impact Forces Of Tactical Gear Market

The tactical gear market is profoundly influenced by a complex interplay of drivers, restraints, opportunities, and external impact forces. Primary drivers include the continuous escalation of global geopolitical tensions, necessitating increased defense budgets and military modernization efforts across nations. The persistent threat of terrorism and insurgencies further compels law enforcement and security agencies to invest in advanced protective and operational gear. Additionally, technological advancements in materials science, miniaturization of electronics, and integration of smart features continually push the boundaries of what tactical gear can offer, creating demand for innovative products. The growing popularity of outdoor adventure sports and recreational shooting also contributes significantly to market expansion, bringing a civilian consumer base into the fold.

However, the market also faces notable restraints. The high cost associated with advanced tactical gear, particularly for specialized military and law enforcement applications, can be a significant barrier to adoption, especially for developing nations or smaller agencies with limited budgets. Strict government regulations and procurement processes, particularly concerning ballistic protection and export controls, introduce complexities and delays in market entry and product distribution. Supply chain disruptions, exacerbated by global events, can impact the availability of critical components and raw materials. Furthermore, the prevalence of counterfeit products poses a threat to legitimate manufacturers, undermining product quality and safety standards, and potentially eroding consumer trust.

Opportunities for growth are abundant within the market. The increasing demand for customized and modular gear allows manufacturers to cater to specific user requirements, enhancing versatility and operational effectiveness. The integration of "smart" technologies, such as IoT sensors, augmented reality overlays, and secure communication systems, represents a significant growth avenue. Expanding into emerging markets, particularly in Asia Pacific and parts of Latin America, offers new revenue streams as defense spending and civilian interest in outdoor activities rise. Developing specialized training solutions that incorporate advanced gear and simulation technologies also presents a promising niche. Examining the impact forces, the threat of new entrants remains moderate due to the capital intensity and regulatory hurdles. The bargaining power of buyers is moderate, as purchasers often seek high-quality, specialized solutions but have multiple vendors to choose from. The bargaining power of suppliers is also moderate, influenced by the availability of specialized raw materials and components. The threat of substitutes is low, as specialized tactical gear offers unique benefits for specific applications. The intensity of rivalry among existing competitors is high, characterized by continuous innovation, competitive pricing, and strategic partnerships.

Segmentation Analysis

The tactical gear market is comprehensively segmented to provide a detailed understanding of its diverse components and target audiences. This segmentation allows for precise market analysis, enabling manufacturers, distributors, and strategists to identify specific growth areas and tailor their offerings to distinct end-user needs. Key segments include various product types, end-user categories, and distribution channels, each with unique characteristics and market dynamics. Understanding these divisions is crucial for navigating the competitive landscape and capitalizing on emerging trends within the industry.

- By Product Type:

- Body Armor (e.g., ballistic vests, plate carriers)

- Headgear (e.g., helmets, balaclavas)

- Load-Bearing Equipment (e.g., backpacks, pouches, tactical belts)

- Optics (e.g., night vision devices, thermal imagers, scopes, binoculars)

- Communication Devices (e.g., tactical radios, headsets)

- Tactical Apparel (e.g., uniforms, gloves, footwear)

- Breaching Tools and Entry Devices

- Other Tactical Accessories (e.g., weapon lights, holsters, protective eyewear)

- By End-User:

- Military & Defense

- Law Enforcement & Security Forces

- Hunting & Shooting Sports

- Outdoor Enthusiasts & Survivalists

- Private Security Contractors

- Emergency Services (e.g., search & rescue)

- By Distribution Channel:

- Offline Channels (e.g., Specialty Stores, Retail Outlets, Government Contracts)

- Online Channels (e.g., E-commerce Websites, Company Websites)

Value Chain Analysis For Tactical Gear Market

The value chain for the tactical gear market commences with the upstream segment, which involves the sourcing and processing of raw materials. This includes specialized textiles like Cordura, Kevlar, and high-performance polymers, as well as metals, ceramics, and advanced electronic components for optics and communication devices. Key upstream players are material suppliers who provide these critical inputs, often requiring stringent quality controls and certifications given the end-use applications of the gear.

Moving downstream, the value chain encompasses manufacturing, assembly, and quality assurance processes, where raw materials are transformed into finished tactical products. This stage is dominated by manufacturers who often specialize in specific gear types, investing heavily in research and development to incorporate new materials and technologies. Following manufacturing, products move through distribution channels, which can be direct or indirect. Direct channels involve manufacturers selling directly to government agencies, military branches, or large security firms through established contracts and procurement processes. This often involves specialized sales teams and customized solutions.

Indirect channels involve a network of wholesalers, distributors, and retailers who make the products available to a broader range of customers, including smaller law enforcement agencies, private security contractors, and individual civilian consumers. Retail distribution includes brick-and-mortar specialty stores, sporting goods retailers, and increasingly, a significant presence through online e-commerce platforms. Both direct and indirect channels are critical for market penetration, with online platforms enabling global reach and direct channels facilitating large-scale, specialized procurements. The final stage involves end-users, whose feedback often informs future product development and innovation within the value chain.

Tactical Gear Market Potential Customers

The tactical gear market serves a diverse array of end-users and buyers, each with distinct requirements and purchasing behaviors. At the forefront are governmental entities, specifically military and defense organizations globally. These include national armies, navies, air forces, and special operations units, which consistently require advanced protective equipment, communication systems, and operational gear for combat, training, and peacekeeping missions. Their procurement processes are often characterized by large contracts, stringent specifications, and long lead times.

Another significant customer segment comprises law enforcement agencies, including local police departments, federal investigative bureaus, SWAT teams, border patrol, and correctional facilities. These organizations demand gear tailored for urban environments, crowd control, personal protection, and specialized tactical operations. Private security contractors and firms, operating in various capacities from executive protection to asset security in high-risk zones, also represent a substantial customer base, often mirroring military-grade requirements.

Beyond professional and governmental users, the civilian market forms a growing segment. This includes avid hunters, sport shooters, and participants in competitive shooting events who seek high-performance optics, durable apparel, and reliable load-bearing equipment. Outdoor enthusiasts, survivalists, and "preppers" also constitute a notable portion, purchasing gear for hiking, camping, bushcraft, and emergency preparedness. This segment values durability, functionality, and versatility, often seeking products that cross over from professional-grade to robust recreational use, driving demand for innovative and accessible tactical solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 20.5 Billion |

| Market Forecast in 2033 | USD 34.6 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Safariland LLC, 5.11 Tactical, BAE Systems plc, Raytheon Technologies Corporation, Blackhawk Products Group, Crye Precision LLC, Revision Military Inc., Gentex Corporation, L3Harris Technologies Inc., Point Blank Enterprises Inc., Heckler & Koch GmbH, Magpul Industries Corporation, Gerber Gear, Streamlight Inc., Peltor (3M), Ops-Core (Gentex), Avon Protection plc, Wilcox Industries Corp., Vertx, First Tactical. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tactical Gear Market Key Technology Landscape

The tactical gear market is profoundly shaped by continuous technological innovation, leading to products that offer enhanced protection, functionality, and user comfort. Advanced materials are at the forefront of this evolution, with a strong focus on lightweight yet highly durable composites such as Kevlar, Dyneema, carbon fiber, and ceramic plates for ballistic protection. These materials significantly reduce the weight burden on users while maintaining or improving protective capabilities. Furthermore, smart textiles with integrated sensors for physiological monitoring, environmental sensing, or dynamic camouflage are emerging, promising a new generation of adaptive apparel.

Miniaturization and integration of electronics play a crucial role, particularly in optics and communication devices. This includes the development of compact night vision and thermal imaging systems with improved clarity and longer battery life, as well as secure, high-bandwidth communication platforms that can seamlessly integrate with other tactical systems. Global Positioning System (GPS) and inertial navigation systems are becoming more precise and robust for navigation in challenging environments. The adoption of Internet of Things (IoT) technologies allows for interconnected gear that can share data in real-time, improving situational awareness and coordination among tactical teams.

Moreover, the integration of augmented reality (AR) and heads-up displays (HUDs) into headgear is transforming how information is presented to the user, providing critical data like maps, targeting information, and biometric feedback directly within the field of view. Power management systems are also advancing, with a focus on efficient power delivery for multiple devices and the development of portable, lightweight power sources. Modular design principles are becoming standard, enabling users to customize their gear configurations quickly and efficiently for various mission profiles, reflecting a broader trend towards flexible and adaptable solutions in the modern tactical landscape.

Regional Highlights

- North America: Dominates the market due to significant defense spending, robust law enforcement sectors, and a large consumer base engaged in hunting, shooting sports, and outdoor activities. The region benefits from a strong presence of key market players and a culture of innovation.

- Europe: A mature market driven by ongoing military modernization programs, counter-terrorism efforts, and demand from specialized law enforcement units. Countries like the UK, Germany, and France are key contributors, coupled with a growing outdoor recreation sector.

- Asia Pacific (APAC): The fastest-growing region, fueled by increasing defense budgets in countries such as China, India, and South Korea, coupled with rising internal security concerns and a burgeoning middle class with interest in adventure sports. Emerging markets offer substantial growth opportunities.

- Latin America: Experiences steady growth primarily due to persistent internal security challenges, combating organized crime, and modernizing police forces. Brazil and Mexico are notable markets, with demand focused on personal protective equipment and surveillance gear.

- Middle East and Africa (MEA): Growth is driven by geopolitical instability, regional conflicts, and increased defense spending to enhance national security and counter-terrorism capabilities. Demand is particularly high for advanced ballistic protection and surveillance technologies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tactical Gear Market.- Safariland LLC

- 5.11 Tactical

- BAE Systems plc

- Raytheon Technologies Corporation

- Blackhawk Products Group

- Crye Precision LLC

- Revision Military Inc.

- Gentex Corporation

- L3Harris Technologies Inc.

- Point Blank Enterprises Inc.

- Heckler & Koch GmbH

- Magpul Industries Corporation

- Gerber Gear

- Streamlight Inc.

- Peltor (3M)

- Ops-Core (Gentex)

- Avon Protection plc

- Wilcox Industries Corp.

- Vertx

- First Tactical

Frequently Asked Questions

What is the projected growth rate of the Tactical Gear Market?

The Tactical Gear Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033, reaching an estimated USD 34.6 Billion by 2033.

Which factors are primarily driving the Tactical Gear Market?

Key drivers include rising geopolitical tensions, increased defense spending, continuous technological advancements in materials and electronics, and the growing popularity of outdoor adventure sports and competitive shooting.

How is AI impacting the development of tactical gear?

AI is influencing tactical gear by enhancing situational awareness through smart optics, enabling predictive maintenance for equipment, optimizing training simulations, and facilitating the development of adaptive personal protective equipment and autonomous support systems.

Which region holds the largest share in the Tactical Gear Market?

North America currently holds the largest share in the Tactical Gear Market, driven by high defense budgets, a robust law enforcement sector, and significant civilian demand from outdoor enthusiasts and sport shooters.

What are the key product segments within the Tactical Gear Market?

The key product segments include Body Armor, Headgear, Load-Bearing Equipment, Optics, Communication Devices, Tactical Apparel, Breaching Tools, and various other tactical accessories.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager