Tactile Actuator Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433624 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Tactile Actuator Market Size

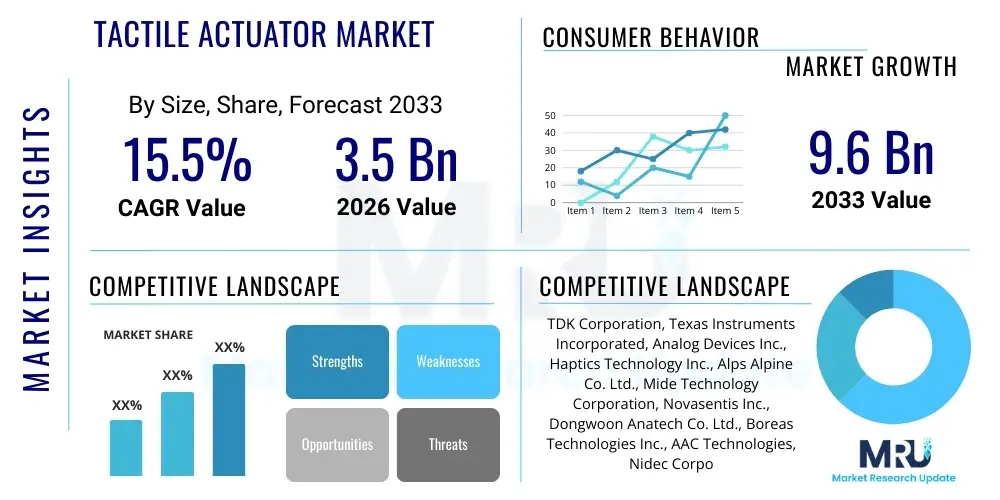

The Tactile Actuator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 9.6 Billion by the end of the forecast period in 2033.

Tactile Actuator Market introduction

The Tactile Actuator Market encompasses specialized devices engineered to create haptic feedback, simulating the sense of touch through vibrations, forces, or motions applied to the user. These actuators are crucial components in enhancing user experience by providing confirmation, alerts, and immersive interaction in digital environments. The fundamental principle involves converting electrical energy into mechanical movement, allowing electronic devices to communicate non-visually and non-auditorily with the user. Key product types dominating the market include Eccentric Rotating Mass (ERM) motors, known for their cost-effectiveness and broad application in basic alerts, and Linear Resonant Actuators (LRAs), favored for their superior responsiveness, localized feedback, and efficiency, especially in high-definition haptics required for premium devices.

Major applications of tactile actuators span across consumer electronics, including smartphones, smartwatches, and virtual reality (VR) headsets, where they deliver realistic and nuanced interactions, moving beyond simple buzz notifications. Furthermore, the automotive sector is increasingly integrating these actuators into dashboards, steering wheels, and seating systems for driver alerts (such as lane departure warnings) and intuitive control interfaces, thereby improving safety and reducing cognitive load. The medical field utilizes advanced tactile feedback for surgical robotics, prosthetic control, and rehabilitation devices, offering precise sensory information to operators and patients. The inherent benefits of tactile feedback—such as enhanced usability, improved safety through immediate non-visual alerts, and deep sensory immersion—are the primary drivers propelling this market expansion.

Driving factors for sustained growth include the miniaturization of high-performance actuators like Piezoelectric devices, which enable extremely high bandwidth and low power consumption suitable for next-generation wearables and AR/VR equipment. The increasing penetration of immersive technologies (Metaverse components, advanced gaming systems) and the regulatory push for enhanced safety features in vehicles, requiring reliable haptic warnings, further solidify the market trajectory. Moreover, continuous innovation in haptic control algorithms and the development of high-definition (HD) haptics are expanding the capabilities of these devices, making tactile interaction a necessity rather than a novelty across various high-value industries globally.

Tactile Actuator Market Executive Summary

The global Tactile Actuator Market is characterized by robust commercial growth driven primarily by the escalating demand for advanced human-machine interfaces (HMI) and the pervasive integration of haptics into smart devices. Business trends indicate a significant shift from traditional, low-fidelity ERM motors towards high-performance LRAs and Piezoelectric actuators, reflecting consumer willingness to pay a premium for enhanced sensory experiences. Strategic collaborations between haptic technology providers and original equipment manufacturers (OEMs) in the consumer electronics and automotive sectors are defining the competitive landscape, focusing on miniaturization, power efficiency, and the development of standardized haptic libraries. Investment is heavily concentrated in research and development aimed at creating actuators capable of rendering complex textures and localized effects, a critical capability for successful deployment in augmented and virtual reality ecosystems.

Regional trends highlight Asia Pacific (APAC) as the dominant and fastest-growing region, fueled by the massive manufacturing base for consumer electronics (smartphones and wearables) in countries like China, South Korea, and Japan, coupled with rapid technological adoption. North America and Europe maintain strong market shares, predominantly driven by sophisticated applications in automotive safety systems, high-end medical devices, and gaming. The stringent safety regulations in these Western markets mandate reliable haptic feedback systems, especially within Advanced Driver-Assistance Systems (ADAS), ensuring sustained demand. Emerging economies are also contributing to growth as disposable incomes rise and penetration rates of smart devices increase, although basic ERM technologies still hold a significant share in low-cost segments in these areas.

Segment trends underscore the supremacy of the Linear Resonant Actuator (LRA) segment by revenue, due to its favorable performance characteristics in premium mobile devices. However, Piezoelectric actuators are projected to demonstrate the highest Compound Annual Growth Rate (CAGR) due to their exceptional thinness, rapid response time, and potential for high-definition haptic feedback, positioning them favorably for next-generation portable devices and advanced medical tools. The Application segment is dominated by Consumer Electronics, but Automotive Haptics is emerging as the fastest-growing sector, driven by autonomous driving development and the replacement of physical buttons with haptic touch surfaces inside vehicle cabins. The shift towards non-vibratory haptics, such as force feedback and thermal haptics, represents a key area for future differentiation and market disruption.

AI Impact Analysis on Tactile Actuator Market

User queries regarding AI's influence on the Tactile Actuator Market primarily center on two critical areas: the use of AI to generate context-aware haptic feedback and the optimization of actuator performance parameters. Users frequently ask how machine learning (ML) algorithms can be employed to automatically design and sequence haptic effects that precisely match visual and auditory stimuli in real-time, moving away from pre-programmed libraries. Concerns also revolve around AI’s role in predicting maintenance needs for large-scale industrial haptic installations and optimizing power consumption dynamically based on application demands and user interaction patterns. The underlying expectation is that AI will transform haptics from a simple alerting mechanism into an intelligent, adaptive, and highly personalized sensory interface, especially crucial for immersive environments like VR/AR and complex, automated systems.

Artificial Intelligence significantly enhances the utility and sophistication of tactile actuators by enabling highly responsive, context-aware haptic rendering. AI algorithms, particularly deep learning models, analyze vast datasets of user interactions, environmental variables, and application states to dynamically generate tactile patterns that are more informative and natural than static feedback. For instance, in gaming or virtual reality, AI can interpret physics engines and user inputs simultaneously to deliver fine-tuned tactile sensations (e.g., simulating the precise feel of different terrains or the resistance of an object), thus elevating the level of immersion. This adaptive capability reduces user fatigue and maximizes the information conveyed through the sense of touch, making digital interfaces more intuitive and effective.

Furthermore, AI is instrumental in the design and manufacturing phases of tactile actuators. Generative AI and optimization algorithms are utilized to refine actuator structures, materials selection, and driving electronics to achieve better efficiency, smaller form factors, and higher bandwidth performance. Predictive maintenance enabled by ML ensures the longevity and reliability of haptic systems, particularly in critical applications such as surgical robotics or industrial automation, where actuator failure is unacceptable. By optimizing the control signals in real-time, AI maximizes the power efficiency of LRAs and Piezoelectric devices, a crucial factor for battery-dependent wearable and mobile technologies, thereby extending device life and improving overall system reliability.

- AI facilitates context-aware haptic rendering, generating real-time, personalized feedback based on user state and environment.

- Machine Learning models are used for optimizing power consumption in LRAs and Piezoelectric actuators in mobile devices.

- AI enhances immersive experiences by dynamically translating digital physics and interactions into nuanced tactile sensations for AR/VR.

- Predictive maintenance algorithms improve reliability and extend the operational lifespan of haptic systems in industrial and medical applications.

- Generative design techniques accelerate the development of miniaturized, high-performance actuators with optimized material compositions.

DRO & Impact Forces Of Tactile Actuator Market

The Tactile Actuator Market is positively influenced by key Drivers such as the proliferation of smart wearable devices, the rapid adoption of immersive VR/AR technologies necessitating realistic sensory feedback, and stringent regulatory requirements for enhanced safety HMI in the automotive sector. Restraints primarily involve the high cost and complexity associated with advanced high-definition actuators (like Piezoelectric technology), limitations in power efficiency, especially for continuous haptic feedback in battery-constrained devices, and the difficulty in standardizing complex haptic effects across diverse operating systems and hardware platforms. Significant Opportunities lie in the expansion into new verticals such as surgical robotics, rehabilitation devices, and enterprise applications requiring sophisticated remote control. The Impact Forces indicate a high degree of technological dependence, with innovation in material science and electronic control being central to market success, coupled with moderate competitive rivalry focused on patent portfolios and cost optimization for mass-market deployment.

Drivers

The foundational driver for the Tactile Actuator Market is the increasing consumer expectation for rich, multi-sensory digital interactions across all personal electronic devices. Consumers are no longer satisfied with simple, low-fidelity vibrations; they demand nuanced, localized feedback that significantly improves usability and entertainment value. This expectation pushes OEMs towards adopting higher-quality Linear Resonant Actuators (LRAs) and investing heavily in Piezoelectric solutions, which offer greater bandwidth and responsiveness essential for high-definition haptics. Simultaneously, the explosion in popularity of Virtual Reality (VR) and Augmented Reality (AR) headsets creates a captive market for highly sophisticated actuators capable of delivering true textural and force feedback, critical for achieving true presence within these simulated environments.

A second major driver stems from the automotive industry's pivot toward advanced driver assistance systems (ADAS) and autonomous vehicles. Haptic feedback integrated into steering wheels, pedals, and seats provides non-intrusive, immediate alerts regarding potential hazards, navigational cues, or system failures. This mechanism is proven to reduce reaction times compared to visual or auditory warnings alone, directly addressing regulatory and safety requirements. As vehicles incorporate more touch-sensitive surfaces to replace mechanical buttons, reliable and intuitive tactile feedback becomes mandatory for intuitive control and ensuring driver focus remains on the road, thereby accelerating the deployment of specialized haptic arrays in high-volume vehicle production.

Restraints

A primary restraint inhibiting broader market penetration is the trade-off between actuator performance and power consumption, particularly relevant for battery-operated devices like wearables and smartphones. High-fidelity haptic feedback often requires significant peak current draw, potentially reducing the overall battery life of portable electronics. While LRAs are more efficient than older ERMs, and Piezoelectric actuators are generally efficient for rapid, low-displacement pulses, delivering continuous or powerful feedback remains a power-intensive process. Device manufacturers are constrained by the need to balance robust haptic experiences with consumer demands for long battery life, often leading to compromises in haptic intensity or duration.

Furthermore, the high cost of implementing advanced high-definition haptic systems, especially those utilizing complex Piezoelectric or micro-fluidic technologies, poses a barrier to entry for mid-range and budget electronic products. Integrating these advanced systems requires complex driving electronics, sophisticated control algorithms, and precise calibration, increasing the overall bill of materials (BOM). The lack of standardized operating systems or comprehensive haptic libraries across different platforms also complicates development for content creators and application developers, who must often customize haptic patterns for specific hardware, fragmenting the software ecosystem and hindering mass adoption of truly universal haptic experiences.

Opportunities

The most significant opportunity lies in the professional and industrial application sectors. Precision haptics is increasingly vital in surgical robotics, where tactile feedback allows surgeons operating remotely to feel the tissue resistance, sutures, and forces exerted by robotic instruments, dramatically enhancing dexterity and safety. Similarly, in fields like remote sensing, inspection, and high-precision manufacturing, haptic interfaces offer operators control over distant machinery with enhanced physical awareness. These high-value applications are less sensitive to cost restraints and prioritize the precision and reliability offered by advanced tactile actuators, promising substantial revenue streams in the coming decade.

Another major opportunity involves the penetration of haptics into the rapidly developing field of digital health and rehabilitation. Tactile actuators embedded in therapeutic gloves, exoskeletons, and other medical devices can provide targeted sensory stimulation for neurological rehabilitation, gait correction, and pain management. The personalization potential, driven by sensor data and AI analysis, allows for customized therapeutic feedback, offering non-pharmacological interventions for various conditions. The expanding elderly population and increasing focus on preventative and rehabilitative care provide a fertile ground for market growth in this specialized segment, leveraging the actuator technology for medical efficacy rather than merely user experience.

Challenges

Key challenges include achieving universal standardization for high-definition haptic effects, ensuring that tactile experiences feel consistent and meaningful across diverse devices and brands. Technological integration challenges arise from the need to seamlessly embed actuators into flexible, thin, and often textile-based materials for wearable technology without compromising comfort or durability. Overcoming the acoustic noise generated by some actuator types, particularly LRAs and ERMs, is also essential, as unwanted noise diminishes the perceived quality of the tactile experience and limits deployment in quiet environments such as medical settings or luxury automotive interiors. Furthermore, the intellectual property landscape surrounding advanced haptics is heavily fragmented, leading to frequent patent disputes that can slow innovation and increase development costs.

Segmentation Analysis

The Tactile Actuator Market segmentation provides a granular view of the industry structure, divided primarily based on the technology type, the application in which they are deployed, and the end-user industry utilizing the final products. Technology segmentation is critical as it reflects the performance characteristics—such as bandwidth, size, power consumption, and price point—that determine suitability for specific devices. The market is witnessing a clear shift from mature technologies (ERM) to high-performance, compact solutions (LRA, Piezoelectric). Application analysis highlights the immense volume of the consumer electronics segment, contrasted with the high growth rate and value proposition of the specialized automotive and medical sectors, necessitating distinct product designs and certification pathways for each segment.

Segmentation by type reveals the dominance of Linear Resonant Actuators (LRAs), owing to their balance of compact size, quick response time, and energy efficiency, making them ideal for the high-volume smartphone market. Piezoelectric actuators, despite their higher cost, are gaining traction rapidly because they offer unparalleled precision and the ability to render complex, localized haptic effects, essential for next-generation interfaces. End-user classification confirms Consumer Electronics as the largest revenue contributor, but substantial long-term growth is projected from the Automotive sector due to mandated safety integrations and the growing transition towards haptic-enabled infotainment and control panels within modern vehicles. This dual focus on volume (Consumer Electronics) and value (Automotive/Healthcare) defines the strategic roadmap for market participants.

- By Type:

- Eccentric Rotating Mass (ERM) Actuators

- Linear Resonant Actuators (LRA)

- Piezoelectric Actuators (Piezos)

- Voice Coil Actuators (VCA)

- Electroactive Polymers (EAPs) and Other Advanced Actuators

- By Application:

- Mobile Devices (Smartphones, Tablets)

- Wearable Devices (Smartwatches, Fitness Trackers)

- Automotive Haptics (Infotainment Systems, ADAS Warnings, Controls)

- Medical Robotics and Devices (Surgical Systems, Prosthetics)

- Gaming Consoles and Accessories

- Industrial and Remote Sensing Systems

- Virtual Reality (VR) and Augmented Reality (AR) Equipment

- By End-User Industry:

- Consumer Electronics

- Automotive

- Healthcare and Medical

- Industrial and Enterprise

- Aerospace & Defense

- By Region:

- North America (NA)

- Europe (EU)

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Tactile Actuator Market

The value chain for the Tactile Actuator Market is highly specialized, beginning with the upstream segment focused on raw material suppliers, especially those providing specialized magnetic materials (for LRAs/ERMs), advanced ceramics (for Piezoelectric devices), and flexible polymer substrates. These suppliers are critical as material innovation directly translates into actuator performance metrics like size and efficiency. Following materials, the core manufacturing and integration phase involves specialized component fabrication, including micro-motor assembly, precision etching, and driver IC development. This phase requires significant intellectual property and advanced manufacturing capabilities, dominated by specialized haptics companies and semiconductor firms.

The midstream segment involves the distribution channel, which is typically bifurcated into direct sales to large Original Equipment Manufacturers (OEMs) and indirect sales through franchised distributors catering to smaller industrial customers and prototyping labs. Direct engagement is common for high-volume consumer electronics and automotive contracts, requiring long-term supply agreements and stringent quality control. Indirect channels often provide inventory, technical support, and logistical solutions, particularly in regions where manufacturers lack a direct presence. Strategic partnerships with specialized electronics distributors possessing technical expertise in motion control systems are essential for market penetration.

The downstream segment includes system integrators, software developers, and the final end-user markets. System integrators embed the actuators and their corresponding driver electronics into the final product design, optimizing mechanical coupling and structural resonance—a key factor for perceived haptic quality. Software developers create the haptic rendering libraries and algorithms, which often rely on patented technologies to produce advanced effects. The end-users, such as major smartphone brands (Apple, Samsung), automotive tier-1 suppliers (Bosch, Continental), and medical device manufacturers, wield significant bargaining power, driving demand for cost-effective customization and integrated solutions, thus completing the value chain loop.

Tactile Actuator Market Potential Customers

Potential customers for tactile actuators are diverse, spanning high-volume consumer goods producers to niche, high-value industrial and medical enterprises. The most significant buyers are global consumer electronics giants, including major smartphone, tablet, and wearable manufacturers, who integrate actuators into nearly every device to enhance feedback and interaction quality. These companies demand highly miniaturized, low-power, and cost-optimized LRAs and Piezoelectric actuators capable of delivering HD haptic effects, often requiring custom designs tailored to specific chassis architectures and industrial design requirements.

The second major category of buyers includes Tier 1 and Tier 2 automotive suppliers who purchase large volumes of robust, high-reliability LRAs and VCAs suitable for harsh in-vehicle environments. These customers require actuators that meet strict automotive quality standards (e.g., AEC-Q100 certification) for integration into advanced control panels, infotainment screens, and critical safety warning systems like collision avoidance and lane departure warnings. Reliability, longevity, and predictable performance under extreme temperatures are paramount considerations for these customers.

Furthermore, specialized segments such as medical device manufacturers, particularly those involved in surgical robotics (e.g., Intuitive Surgical competitors), and military/aerospace firms constitute important, albeit lower-volume, customers. These end-users demand ultra-high precision, low-latency actuators (often Piezoelectric or VCA-based) for force feedback mechanisms that simulate intricate physical interactions. Pricing is secondary to performance and certification requirements in these domains, driving demand for premium, custom-engineered tactile solutions that significantly enhance operational safety and efficacy for specialized professionals.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 9.6 Billion |

| Growth Rate | 15.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TDK Corporation, Texas Instruments Incorporated, Analog Devices Inc., Haptics Technology Inc., Alps Alpine Co. Ltd., Mide Technology Corporation, Novasentis Inc., Dongwoon Anatech Co. Ltd., Boreas Technologies Inc., AAC Technologies, Nidec Corporation, Johnson Electric Holdings Ltd., Immersion Corporation, Ultraleap (formerly Ultrahaptics), Precision Microdrives Ltd., CUI Devices, KEMET Corporation, Murata Manufacturing Co. Ltd., SMK Corporation, Kyocera Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tactile Actuator Market Key Technology Landscape

The technological landscape of the Tactile Actuator Market is rapidly evolving, driven by the demand for smaller, more powerful, and precise haptic feedback systems. The transition is moving swiftly away from electro-mechanical systems like Eccentric Rotating Mass (ERM) motors towards highly responsive technologies. Linear Resonant Actuators (LRAs) currently represent the technological sweet spot, utilizing a mass suspended by springs and driven by an AC voltage to produce clean, fast vibrations along a single axis. Technological advancements in LRA drivers now focus on improving rise and fall times and minimizing idle power consumption, making them the standard for modern smartphones and high-end wearables where spatial efficiency is crucial.

Piezoelectric technology is the emerging technological frontrunner, offering the highest bandwidth and the thinnest form factor available, making it suitable for rendering complex, high-definition haptic effects (HD Haptics). These actuators utilize the converse piezoelectric effect to generate extremely small, rapid displacements, ideal for simulating textures and fine localized sensations. The current research focuses on reducing the high operating voltage requirements of Piezoelectric materials and developing effective driver integrated circuits (ICs) that can manage complex waveform generation efficiently, particularly in power-sensitive applications like flexible displays and textile integration for smart clothing.

Further innovation is explored in non-traditional actuation methods, including Electroactive Polymers (EAPs) and micro-fluidic haptics. EAPs, often referred to as artificial muscles, offer large strain capabilities and potential compliance, holding promise for soft robotics and flexible wearable interfaces, though their commercialization still faces challenges related to longevity and control complexity. Voice Coil Actuators (VCAs), leveraging principles similar to speakers, are prominent in automotive and gaming applications where powerful, broadband force feedback is required, capitalizing on their reliability and high degree of linearity for accurate force replication in simulator controls and vehicular interfaces.

Regional Highlights

The global Tactile Actuator Market exhibits distinct regional dynamics shaped by manufacturing capacity, technology adoption rates, and regulatory environments.

- Asia Pacific (APAC): APAC is the largest market shareholder and is anticipated to maintain the highest growth trajectory. This dominance is intrinsically linked to the region’s massive manufacturing ecosystem for consumer electronics, especially smartphones, wearables, and gaming devices (China, South Korea, Japan). The early and rapid adoption of high-performance LRAs and the quick transition to Piezoelectric technology in flagship devices originating from this region fuel market expansion. Government initiatives promoting domestic high-tech manufacturing and the presence of major actuator suppliers contribute significantly to the regional growth profile.

- North America (NA): North America holds a substantial market share, primarily driven by high spending on advanced technologies, particularly in the automotive, aerospace, and high-end gaming and VR/AR sectors. The regional demand is characterized by a focus on premium, certified products, leading to a higher concentration of VCA and advanced Piezoelectric actuator deployment, particularly for force feedback systems in military training and specialized medical devices. The strong presence of leading technology innovators and software developers defining the VR/AR content landscape further solidifies its position.

- Europe: Europe is a mature market distinguished by strong regulatory mandates concerning automotive safety and industrial automation standards. This drives consistent demand for highly reliable haptic components used in ADAS, industrial control panels, and medical diagnostics equipment. Countries like Germany, known for precision engineering and automotive manufacturing, are key centers of haptic innovation and adoption. The market trend here focuses on quality, longevity, and seamless integration into established industrial systems, favoring certified LRAs and robust VCAs.

- Latin America (LATAM) and Middle East & Africa (MEA): These emerging markets represent significant long-term potential, primarily focusing on volume growth driven by increasing smartphone penetration and the nascent adoption of smart vehicle technology. While the current market tends to utilize more cost-effective ERM and standard LRA solutions for basic haptic feedback, infrastructure improvements and rising digital consumption rates suggest a future transition towards higher-fidelity actuators, albeit at a slower pace compared to APAC or NA.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tactile Actuator Market.- TDK Corporation

- Texas Instruments Incorporated

- Analog Devices Inc.

- Haptics Technology Inc.

- Alps Alpine Co. Ltd.

- Mide Technology Corporation

- Novasentis Inc.

- Dongwoon Anatech Co. Ltd.

- Boreas Technologies Inc.

- AAC Technologies

- Nidec Corporation

- Johnson Electric Holdings Ltd.

- Immersion Corporation

- Ultraleap (formerly Ultrahaptics)

- Precision Microdrives Ltd.

- CUI Devices

- KEMET Corporation

- Murata Manufacturing Co. Ltd.

- SMK Corporation

- Kyocera Corporation

Frequently Asked Questions

Analyze common user questions about the Tactile Actuator market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between LRA and Piezoelectric tactile actuators?

LRAs (Linear Resonant Actuators) are efficient and offer good responsiveness and clean vibration along one axis, making them standard for mobile alerts. Piezoelectric actuators are thinner, consume less standby power, and offer superior bandwidth necessary for high-definition (HD) haptics, allowing for highly localized and complex textural feedback, though they typically require a higher operating voltage.

Which end-user industry drives the highest growth rate for tactile actuators?

While Consumer Electronics holds the largest market share by volume, the Automotive Haptics segment is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This acceleration is driven by the mandatory inclusion of haptic feedback systems for driver safety (ADAS warnings) and the replacement of mechanical controls with haptic-enabled touch surfaces in modern vehicle cockpits.

How does high-definition (HD) haptics benefit the user experience in AR/VR?

HD haptics utilizes actuators with high bandwidth (like Piezo) to render subtle and localized feedback, which is crucial in AR/VR for creating a sense of physical realism. This allows users to accurately feel specific textures, resistance, and the subtle contours of virtual objects, dramatically increasing immersion and improving interaction precision compared to simple vibration alerts.

What are the main power efficiency challenges associated with tactile actuators in wearables?

The main challenge is balancing strong haptic performance with limited battery capacity. Delivering forceful or continuous tactile feedback requires significant peak power draw, especially for LRAs and VCAs. Manufacturers focus on using energy-efficient driver ICs and optimization algorithms to minimize power consumption during activation and standby periods, crucial for extending the battery life of wearables.

Are Electroactive Polymer (EAP) actuators ready for mass market commercialization?

EAP actuators are promising for future soft haptics due to their flexibility and large potential strain, ideal for smart textiles and compliant interfaces. However, they are not yet ready for high-volume mass commercialization due to ongoing technical challenges concerning their long-term durability, control complexity, and integration into existing electronic manufacturing processes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Tactile Actuator Market Size Report By Type (ERM Actuators, LRAS, Others), By Application (Mobile Terminal, Wearable Device, Automotive, Household Appliances, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Active Tactile Actuator Market Statistics 2025 Analysis By Application (Mobile Terminal (Smartphone/Tablet), Wearable Device, Automotive, Household Appliances), By Type (Eccentric Rotating Mass (ERM) Actuators, Linear Resonant Actuators (LRA)), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Passive Tactile Actuator Market Statistics 2025 Analysis By Application (Mobile Terminal (Smartphone/Tablet), Wearable Device, Automotive, Household Appliances), By Type (Eccentric Rotating Mass (ERM) Actuators, Linear Resonant Actuators (LRA)), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager